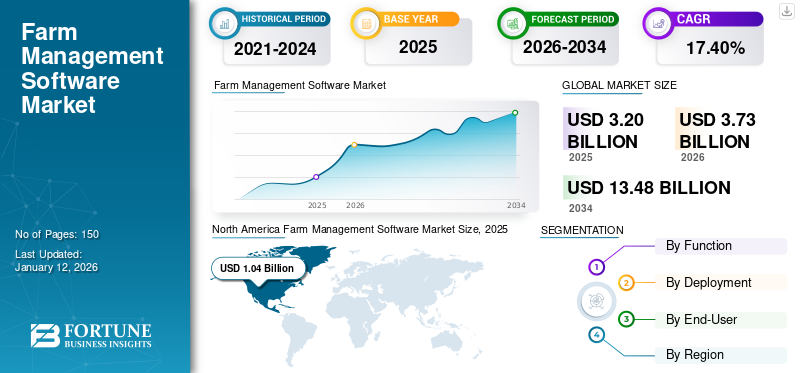

Farm Management Software Market Size, Share & Industry Analysis, By Function (Livestock Tracking and Monitoring, Smart Logistics and Warehousing, Precision Farming, Remote Crop and Soil Monitoring, and Others), By Deployment (Cloud & SaaS and On-Premises), By End-User (Farmers, Accountants, Advisors, and Agriculture Consultants, Agri Banks, Government Institutions, Agribusiness Companies, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global farm management software market size was valued at USD 3.20 billion in 2025. and is projected to be worth USD 3.73 billion in 2026 and reach USD 13.48 billion by 2034, exhibiting a CAGR of 17.40% during the forecast period. North America dominated the global farm management software market with a share of 32.40% in 2025.

Farm management software streamlines work schedules, makes it easier to monitor all agricultural activities, and automates data collection and storage. With access to analysis of specific crops, environmental conditions, and financial situations, the software helps farmers increase their agricultural output and profit margins. Solutions are essential to maximize the efficiency of management processes in medium and large commercial operations. It provides agricultural marketing, budgeting, and financial management tools, including agricultural planning, procurement, and accounting programs. Additionally, it supports farms in their production and operations by centralizing, managing, and optimizing them.

In the COVID-19 pandemic era, with social distancing measures and lockdowns in place, farmers sought digital solutions to manage their operations remotely. This led to a surge in the adoption of farm management software to maintain productivity and streamline operations. Software providers accelerated the feature development to support remote monitoring, data analytics, and automated processes. This included integrating IoT devices for real-time data collection and analysis. Overall, the pandemic accelerated the digital transformation in agriculture, highlighting the importance of technology in ensuring farm operations' resilience and sustainability.

IMPACT OF GENERATIVE-AI

Artificial Intelligence Continues to Demonstrate Benefits for Farming Sector

Farm management software using Gen-AI technology can track accurate data to optimize farming operations. Machine learning and general monitoring of large amounts of agricultural data will improve profitability by intelligently using data points to increase productivity and quality of results. It has been tested in Andhra Pradesh, India, and increased agricultural productivity by up to 30%, without increasing capital costs.

Fertilizers and pesticides will be used more efficiently, reducing environmental impacts and increasing financial costs due to overuse. With the help of Gen-AI, pests and diseases can be easily identified, ensuring high crop yield. AI-interpreted data on rainfall, soil, temperature, and other climatic factors can provide farmers with better information to help them make effective farm management decisions and maximize their profits.

Farm Management Software Market Trends

Increased Adoption of Sustainable Agricultural Practices to Drive Market Growth

There is an increasing emphasis on sustainability and environmental management in agriculture due to the enormous nature of the industry and its resulting impacts. For instance, According to WWF, agriculture employs more than a billion individuals and produces more than USD 1.30 trillion worth of food each year, covering about 50% of the Earth's livable land and providing habitat and food for many different species.

This has led to the growing demand for agriculture management solutions that support regenerative agriculture practices, carbon sequestration initiatives, and soil health management. Farmers are seeking software tools that help them monitor and minimize their environmental impact while improving long-term profitability and productivity. Additionally, concerns about climate change and the environment will increase the adoption of sustainable agricultural practices supported by advanced software solutions. This will shape the market outlook in the coming years.

Download Free sample to learn more about this report.

Farm Management Software Market Growth Factors

Rising Implementation of ML and AI for Real-Time Farm Data Management to Propel Market Growth

The market is expanding due to increasing agricultural activity and the need for real-time decision-making data. Precision agriculture, fish farming, livestock monitoring, and advanced greenhouse techniques are some of the agricultural applications where Artificial Intelligence (AI) and Machine Learning (ML) are quickly gaining a foothold. They manage data exchange between equipment and people to simplify the farm management process. The main objective of the agricultural management framework is to understand the environment by analyzing data generated by various agricultural management tools, including Global Positioning Systems (GPS), satellite imagery, and field sensors. Since management decisions in agriculture rely on analyzing real-time data from agricultural operations, data management is critical. Artificial intelligence and machine learning have become more prevalent, allowing real-time data access and simplifying data management tasks, such as planning, purchasing, harvesting, feeding, marketing, and inventory control.

RESTRAINING FACTORS

Limited Technical Expertise and Advanced Infrastructure to Hamper Market Growth

Some farmers have difficulty understanding how to use farm management software, manage farm data, and use it in decision-making, which can hinder market expansion. Real-time data analysis of various agricultural activities uses this software to increase farmers’ profits and reduce their losses. Using this software also requires technical expertise in farm management. To use this software efficiently, the farmer or producer must clearly understand the process. Many governments and market participants are educating farmers on effectively using these systems to minimize their losses. Most farmers today are still hesitant to use this software due to the various complexities involved and the need for advanced infrastructure.

Farm Management Software Market Segmentation Analysis

By Function Analysis

Increased Implementation by Companies to Help Precision Farming Dominate Market

Based on function, the market is segmented into livestock tracking and monitoring, smart logistics and warehousing, precision farming, remote crop and soil monitoring, and others (greenhouse automation).

The precision farming segment held the highest market with a share of 21.53% in 2026 and is expected to record the highest CAGR during the forecast period owing to the increased implementation of precision farming technologies by companies to increase their profitability. For instance,

In January 2023, John Deere announced that eight companies were participating in its Startup Collaborator 2023 program, supporting the design of precision technology for its equipment. This initiative resulted in fruitful collaborations, such as with Bear Flag Robotics, which was later acquired by Deere in 2021 to develop autonomous tractors.

The U.S. is at the forefront of implementing precision technologies in agricultural engineering. For instance,

According to a report by the U.S. Department of Agriculture, the average farm size in the country was 441 acres in 2017 and increased to 445 acres in 2021.

Larger farms are more likely to adopt smarter agricultural software. With average farm sizes rising in the U.S. and agricultural labor shortages becoming common, large-scale farmers are well placed to use agricultural software to gain data-driven insights and optimize crop productivity.

By Deployment Analysis

Adoption of Cloud-based Agricultural Technique Increased Due to Reduction in Costs

Based on deployment, the market is segmented into cloud & SaaS and on-premises.

The cloud segment held the major farm management software market with a share of 72.31% in 2026 and will record the highest growth rate during the forecast period. Many experts believe that cloud-based solutions can reduce costs associated with purchasing and managing servers, paying for software license backups, and maintaining security. The key factors driving the segment’s growth are increasing demand for real-time data management using cloud computing, government support to promote the adoption of modern agricultural techniques, and increased use of agricultural software to maintain farm efficiency. For instance,

According to Cropin company, cloud-based agri-tech solutions are finding revolutionary agricultural lending and insurance applications by providing essential farm insights.

The above factors will contribute to the cloud-based farm management software market growth.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Farmers Increased Use of Farm Management Software Owing to Need for Maintaining Farm Productivity

Based on end-user, the market is segmented into farmers, accountants, advisors, and agriculture consultants, agri banks, government institutions, agribusiness companies, and others (NGOs and site operators).

The farmers segment held the highest market share contributing 30.56% globally in 2026. Farm management software helps farmers make agronomic decisions that minimize yield losses under adverse conditions and improve yield quality and quantity under optimal conditions. This software allows farmers to manage resources, such as water, fertilizers, and pesticides more effectively, leading to cost savings and environmental sustainability. By leveraging these benefits, farmers can improve their profitability and farm productivity.

The agribusiness companies segment is expected to register the highest CAGR during the forecast period. Innovations in IoT and data analytics have enhanced the capabilities of FMS, making it more appealing and beneficial to agribusinesses. Agribusiness companies are investing heavily in developing and acquiring FMS to expand their offerings and remain competitive. For instance,

- In May 2024, Cooperative Ventures declared an investment in Traction Ag, Inc., a provider of agricultural accounting technology offering solutions to farmers across the U.S. A joint venture between two leading agricultural cooperatives, GROWMARK and CHS, Cooperative Ventures is focused on the rising mutually beneficial business relationships between cooperative partners and startups. Traction Ag’s USD 10 million Series A funding round was led by Cooperative Ventures, with participation from Plymouth Development and existing investors.

REGIONAL INSIGHTS

Geographically, the market is divided into five key regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America

North America Farm Management Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2025, accounting for a major market share of USD 1.04 billion. The regional market analysis includes the U.S., Canada, and Mexico. Larger farms and better farmer awareness in rich countries will lead to the faster adoption of modern technologies compared to other countries. As a result, the largest market for FMS solutions is in North America. For example, companies, such as Deere & Company provide software to operate tractors and other agricultural machinery, thereby allowing farmers to practice precision farming. The U.S. has been a leader in integrating precision technologies into agricultural operations. The presence of several large farms, significant technological advances, and high software adoption rates are factors contributing to the region's growth. The U.S. market is projected to reach USD 0.56 billion by 2026.

Asia Pacific

Asia Pacific is expected to record the fastest CAGR from 2025 to 2032. Most countries in this region depend on agriculture for their livelihood, and the demand for agricultural management is expected to increase. India is the most populous of these countries and most of its citizens depend on agriculture. Due to rapid population growth and the need to meet the growing demand for agricultural products, farmers are adopting FMS and other modern farming methods in the fields of precision agriculture, monitoring livestock, and aquaculture farms. The Japan market is projected to reach USD 0.22 billion by 2026, the China market is projected to reach USD 0.22 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

Europe

Europe has captured the second-largest share of the global market. Advanced IT infrastructure and rapid adoption of modern technologies will contribute to the European market’s growth. The region's favorable environment promotes innovation, facilitates effective farm management solutions, and supports technological advancements in agriculture. The UK market is projected to reach USD 0.27 billion by 2026, while the Germany market is projected to reach USD 0.23 billion by 2026.

South America and Middle East & Africa

South America and the Middle East & Africa have become increasingly popular in the global market. The adoption of advanced technologies, such as cloud computing and AI and rising awareness about advanced farm technologies is rising at a tremendous rate in these regions.

KEY INDUSTRY PLAYERS

Key Players to Emphasize On Advanced Farm Management Software to Strengthen Their Market Positions

Prominent players, such as Trimble, Inc., Agrivi, and Granular are expected to dominate the market. These players are focused on offering farm management software options to cater to the advanced farming technology requirements. Similarly, they are adopting various strategies, such as partnerships and investments to continue their dominance in the coming years.

List of Top Farm Management Software Companies:

- Agrivi (England)

- Trimble, Inc. (U.S.)

- Raven Industries, Inc. (U.S.)

- Topcon (Japan)

- AgJunction LLC (U.S.)

- Agworld Pty Ltd (U.S.)

- Farmers Edge Inc (Canada)

- Climate LLC (U.S.)

- Granular, Inc. (U.S.)

- Conservis (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Syngenta Spain launch advanced digital agriculture platform Cropwise, available to their technicians and all producers. This new tool combines advanced digital solutions to provide producers with a complete agricultural management system, sustainably optimizing the profitability and productivity of operations.

- March 2024: The governments of India, Ecuador, Laos, Kenya, Uruguay, the Philippines, and Vietnam jointly launched a USD 379 million initiative to control pollution caused by using plastics and pesticides in agriculture.

- March 2024: Bayer launched a pilot project of its Gen AI expert system aimed at advanced farmers and agronomists. The company uses proprietary agronomic data to guide its Large Language Model (LLM) with years of in-house data, insights from the number of trials in its extensive testing network, and the centuries of accumulated experience of Bayer’s agronomists worldwide.

- July 2023: Bushel, an independently operated software technology company that creates digital solutions tailored to the agricultural supply chain, launched an addition to its product line, Bushel Farm. This is a feature that automatically imports grain into the farm.

- December 2022: Traction Ag Inc. has partnered with CropZilla, a data-driven machinery management software. Through this partnership, users will benefit from a simplified accounting process to optimize their equipment fleet and gain insight into their productivity, costs, and equipment replacement needs.

REPORT COVERAGE

The study on the market includes prominent areas to help the user get a better knowledge of the industry. Furthermore, the research provides insights into the most recent market trends and an analysis of technologies that are being adopted quickly across the world. It also emphasizes some of the growth-stimulating factors and restrictions, allowing the reader to obtain a thorough understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 17.40% from 2026 to 2034 |

|

Segmentation |

By Function

By Deployment

By End User

By Region

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 13.48 billion by 2034.

In 2025, the market value stood at USD 3.2 billion.

The market is projected to record a CAGR of 17.40% during the forecast period of 2026-2034.

By end-user, the farmers segment is likely to lead the market.

Rising implementation of machine learning and artificial intelligence for real-time farm data management will propel the market growth.

Trimble, Inc., Agrivi, Granular, and Topcon are the top players in the market.

North America dominated the global farm management software market with a share of 32.40% in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us