Fiber Laser Market Size, Share & Industry Analysis, By Type (Continuous Wave Fiber Lasers, Pulsed Fiber Lasers, Quasi-Continuous Wave Fiber Lasers, and Mode-Locked Fiber Lasers), By Power Output (Low Power (Up to 100W), Medium Power (100W-2kW), and High Power (Above 2kW)), By Application (Medical & Aesthetic, Instruments & Sensors, Aerospace, Defense, and Military, Materials Processing, Communications & Optical Storage, Entertainment, Displays, & Printing, and Others), and Regional Forecast, 2026-2034

FIBER LASER MARKET OVERVIEW AND FUTURE OUTLOOK

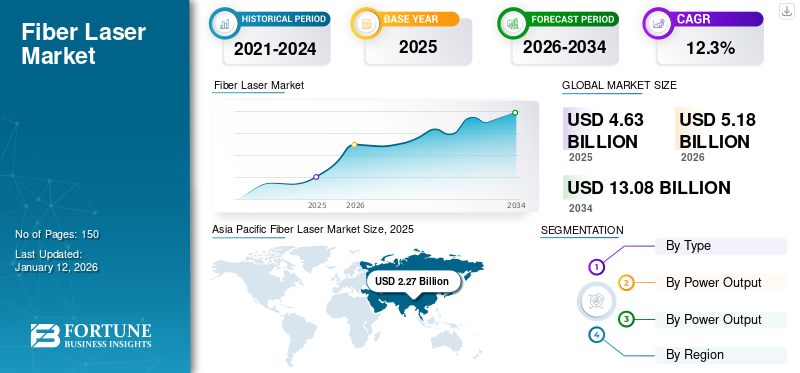

The global fiber laser market size was valued at USD 4.63 billion in 2025. The market is projected to grow from USD 5.18 billion in 2026 to USD 13.08 billion by 2034, exhibiting a CAGR of 12.3% during the forecast period. Asia Pacific dominated the market with a share of 49.0% in 2025.

A fiber laser is a solid-state laser where an optical fiber is the active gain medium that is doped with rare earth elements, such as ytterbium, erbium, or neodymium. These lasers are known for their high beam quality, efficiency, and reliability, making them suitable for various applications. These applications include materials processing (cutting, welding, and marking), medical treatments, telecommunications, spectroscopy, and defense. Moreover, their ability to deliver high precision and minimal maintenance requirements make them ideal for industrial and research purposes.

The market is witnessing rapid growth, driven by the increasing adoption of these lasers in industries, such as automotive, electronics, and aerospace for precision manufacturing. Key players in the market include IPG Photonics, Coherent, Raycus, and Trumpf, among others. Fiber lasers offered by them include IPG's YLR-Series and Coherent's HighLight series. Additionally, the market is expected to expand due to technological advancements and a shift toward automation, with an emphasis on sustainability and higher efficiency in laser-based processes. For instance,

- July 2024: TRUMPF and SiMa.ai partnered to integrate AI chips into laser systems for enhanced welding, cutting, and 3D printing. The AI-driven technology aimed to improve manufacturing efficiency, particularly in electric vehicle production, by enabling real-time quality monitoring.

The COVID-19 pandemic initially disrupted the global market due to supply chain issues and a decline in industrial activities. However, recovery began as manufacturing resumed, particularly in sectors, such as automotive and electronics, which require precise laser processing. Also, the push for digitalization and automation accelerated during the pandemic, boosting the demand for laser technologies in various industries as businesses sought more efficient and contactless production methods.

MARKET DYNAMICS

Market Drivers

Increasing Demand for Efficient and Precise Material Processing Solutions to Boost Adoption of Fiber Lasers

The primary driver of the global market is the increasing demand for efficient and precise material processing solutions across industries, such as automotive, electronics, and aerospace. Moreover, the automotive sector's shift to electric vehicles is another driving factor as the production of these vehicles requires lightweight materials and high-precision cutting for battery components and structural parts. This has increased the need for advanced laser processing techniques that offer enhanced speed and accuracy. For instance,

- September 2023: IPG Photonics introduced a dual-beam laser with 3 kW single-mode core power at The Battery Show, offering spatter-free battery welding at double the speed of lower power options. The laser's dual-beam design enhances weld quality by stabilizing the weld pool and minimizing defects. The innovation aids in the continued growth of welding and cleaning applications driven by e-mobility.

Market Restraints

Limited Adoption Among SMEs and Availability of Alternative Technologies Can Hinder Market Growth

The market faces challenges related to the high initial investment costs and complexity of laser systems, which may limit their adoption among small and medium-sized enterprises.

Additionally, the availability of alternative technologies, such as CO2 and diode lasers, which offer competitive pricing for certain applications, can hinder the market's growth. Also, the market’s expansion can be affected by stringent regulations concerning laser safety standards.

Market Opportunities

Growing Adoption of Fiber Lasers in Solar Panel Manufacturing to Fuel Market Growth

A specific opportunity in the global market is the increasing adoption of lasers in solar panel manufacturing, where precision cutting and minimal thermal damage are crucial for optimizing energy efficiency. This trend aligns with the growing emphasis on renewable energy sources, driving the demand for laser-based solutions in the clean energy sector. Also, the shift to green manufacturing and sustainable production offers significant opportunities to drive the global fiber laser market growth. For instance,

- April 2024: Research from Jolywood and the University of South Wales stated that a laser-assisted firing process enhances the reliability of TOPCon solar cells by improving contact quality and corrosion resistance while lowering production costs. The new process, which is already in high-volume production, utilizes a low-temperature technique to enhance power efficiency and reduce sodium chloride-induced degradation.

FIBER LASER MARKET TRENDS

Shift Toward High-Power Lasers for Industrial Applications to Drive Market Growth

The global market is experiencing a shift toward high-power lasers for industrial applications, driven by the demand for faster processing speeds and their ability to cut thicker materials. Moreover, a specific trend is the growing popularity of ultrafast lasers, which offer high precision and minimal thermal damage, making them suitable for micro-processing applications in electronics and medical device manufacturing. This trend supports advancements in miniaturization and high-precision machining. For instance,

- August 2024: BWT unveiled a 200kW ultra-high-power industrial laser in Tianjin, making advancements in the laser technology. This innovation cemented China’s leadership in high-power laser applications, thereby enhancing manufacturing capabilities for sectors, such as aerospace and shipbuilding.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Continuous Wave Fiber Lasers Lead Due to their Widespread Use in Industrial Applications

Based on type, the market is divided into continuous wave fiber lasers, pulsed fiber lasers, quasi-continuous wave fiber lasers, and mode-locked fiber lasers.

The continuous wave fiber laser segment held the highest market share by 50.15% in 2026 due to its widespread use in industrial applications, such as cutting, welding, and surface treatment. These lasers offer consistent power output, making them ideal for processes that require continuous energy delivery for efficient and precise material processing, particularly in the automotive and metal fabrication industries. For instance,

- August 2024: Coherent introduced high-efficiency continuous wave lasers designed for 800G and 1.6T silicon photonics transceivers, offering 15% improved power efficiency. These innovations aim to meet the increasing data demands in AI-driven data centers.

The pulsed fiber laser segment is anticipated to experience the highest CAGR due to its growing use in precision marking, engraving, and micro-machining applications. These lasers provide short bursts of energy, causing minimal heat impact and offering higher precision. This is essential in fields, such as medical device manufacturing, electronics, and semiconductor fabrication.

By Power Output

Ability to Cut and Weld Thick Materials in Heavy Industries to Create Demand for High-Power Output Lasers

Based on power output, the market is divided into low power (up to 100W), medium power (100W-2kW), and high power (Above 2kW).

The high power laser segment dominates the market due to its ability to cut and weld thick materials in heavy industries, such as automotive and shipbuilding. Their high power output enables rapid processing speeds, thereby increasing productivity in industrial applications where thick materials and deep cutting are required. The high power laser segment is likely to hold 49.96% of the market share in 2026.

The medium power segment is expected to record the highest CAGR of 14.86% as lasers of this power output strike a balance between precision and power. This makes them versatile for a wide range of applications, including sheet metal cutting, medical device manufacturing, and precision welding. Additionally, the rising adoption of these lasers in small and medium-sized manufacturing firms is contributing to the segment's growth. For instance,

- May 2024: IPG Photonics launched the LightWELD 2000 XR, a handheld laser welder and cleaner with 2 kilowatts of power, enhancing welding speeds and capability for thicker materials. It also comprises advanced cleaning modes and a smaller laser spot for precision.

By Application

Demand for Precision and Efficiency in Manufacturing Processes Drove Product Adoption in Materials Processing

Based on application, the market is divided into medical & aesthetic, instruments & sensors, aerospace, defense, and military, materials processing, communications & optical storage, entertainment, displays, & printing, and others.

The materials processing segment accounted for the largest fiber laser market share. Materials processing is the largest application segment due to the widespread use of such lasers in cutting, welding, engraving, and marking processes in various industries, including automotive, aerospace, and electronics. The demand for precision and efficiency in manufacturing processes will drive the adoption of these lasers for materials processing, where high-quality output is critical. The materials processing is augmented to capture 36.65% of the market share. For instance,

- November 2023: IPG Photonics and Miller Electric partnered to promote the handheld laser welding technology. Their collaboration aimed to combine fiber laser expertise and traditional welding knowledge to deliver precise, efficient solutions designed for modern welding needs.

The instruments and sensors segment is estimated to project the highest CAGR of 15.95% during the forecast period, due to the growing use of these lasers in advanced sensing applications, including spectroscopy and environmental monitoring. These lasers offer high precision and sensitivity, making them suitable for developing innovative sensor technologies used in research, medical diagnostics, and industrial monitoring.

To know how our report can help streamline your business, Speak to Analyst

FIBER LASER MARKET REGIONAL OUTLOOK

On the regional ground, the market is studied across Asia Pacific, North America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific

Asia Pacific Fiber Laser Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest market value of USD 2.60 billion in 2026, and in 2025, the region’s market stood at USD 2.27 billion, and is expected to continue its dominance during the forecast period. The regional market’s growth is propelled by rapid industrialization, particularly in China, Japan, and South Korea. Also, the expanding automotive, electronics, and semiconductor industries in the region, along with rising investments in advanced manufacturing technologies, are key factors driving the market. The market in China is estimated to be USD 0.91 billion in 2026.

The Japan market size is foreseen to be valued at USD 0.59 billion and India is likely to be USD 0.36 billion in 2026.

The market in China is expected to continue on its growth path, supported by the country's dominant manufacturing sector and government initiatives promoting industrial automation and technological upgrades. The demand for high-power lasers for cutting and welding in heavy industries will further fuel the market’s expansion in the country. For instance,

- October 2024: At FABTECH 2024, HSG Laser unveiled its expansion plans for the U.S. market, introducing three new automation solutions aimed at boosting the productivity of fabrication processes. The company also enhanced its customer service network to better support American manufacturers with advanced technologies and localized service.

To know how our report can help streamline your business, Speak to Analyst

North America

North America to be anticipated the second-largest market with USD 0.91 billion in 2025, recording the second-largest CAGR of 19.7% during the forecast period. The market in North America is expected to grow steadily, driven by advancements in manufacturing technologies and increased automation in industries, such as automotive, aerospace, and defense. Moreover, the region's focus on high precision in production processes, coupled with investments in research and development, will support the regional market’s growth. The U.S. market size is estimated to be USD 0.74 billion in 2026. For instance,

- October 2024: nLIGHT launched n finite and ProcessGUARD technologies, which optimize laser cutting for thick metals and integrate advanced process monitoring technologies. The products debuted at FABTECH 2024 in Orlando.

Europe

Europe region is to be anticipated the third-largest market with USD 0.96 billion in 2026. Europe's market is characterized by a strong manufacturing base, especially in Germany and Italy, which are known for their industrial laser applications. The region's focus on sustainable manufacturing and energy efficiency, along with the adoption of advanced laser technology in the automotive and aerospace sectors, is expected to fuel the market’s growth. For instance,

- June 2023: Frankfurt Laser Company partnered with ALTER TECHNOLOGY UK to provide customized laser diode solutions, thereby enhancing flexibility in packaging and reducing lead times. This collaboration focused on a standardized approach, offering reliable modules with various performance specifications.

The market in U.K. is estimated to be USD 0.74 billion in 2026. The Germany’s market size is foreseen to be valued at USD 0.19 billion in 2026 and France’s likely to be USD 0.11 billion in 2025.

Middle East & Africa (MEA) and South America

The Middle East & Africa region is to be anticipated the fourth-largest market with USD 0.24 billion in 2026. The market is experiencing moderate growth, driven by increasing industrial activities and infrastructural development in the region. Moreover, investments in sectors, such as oil & gas, construction, and mining can boost the demand for these lasers to be used in cutting, welding, and marking applications. The GCC market size is estimated to be USD 0.08 billion in 2025. For instance,

- July 2023: WIOCC partnered with Laser Light to enhance connectivity across Africa, focusing on integrating Laser Light's satellite and fiber technologies. This collaboration aimed to improve service delivery and network resilience for operators and enterprises across the continent.

The market in South America is projected to expand as industrialization progresses, particularly in Brazil and Argentina. Also, growth in sectors, such as automotive and agriculture equipment manufacturing, along with a gradual shift toward more efficient production processes, will drive the demand for these lasers. For instance,

- November 2023: Transcelestial partnered with Generagua to introduce wireless laser communications across Mexico, aiming to enhance connectivity for mobile network operators, ISPs, and government agencies. This innovative solution seeks to overcome infrastructure challenges by providing high-speed, secure internet access while acting as a backup during disasters.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Partnerships and Collaborations to Boost Market Presence of Key Players

The key players in the market are entering strategic partnerships and collaborating with other significant market leaders to expand their portfolio and provide enhanced products to fulfill their customers’ requirements. Also, through collaborations, the companies are gaining expertise and expanding their business by reaching a larger customer base.

List of Fiber Laser Companies Profiled:

- IPG Photonics (U.S.)

- Coherent, Inc. (U.S.)

- TRUMPF (Germany)

- nLIGHT, Inc. (U.S.)

- Fujikura Ltd. (Japan)

- Lumentum Holdings (U.S.)

- GSI Group, Inc. (U.S.)

- Calmar Laser (U.S.)

- Rofin-Sinar Technologies, Inc. (Germany)

- Wuhan Raycus Fiber Laser Technologies Co., Ltd. (China)

- Maxphotonics Co., Ltd. (China)

- TOPTICA Photonics (Germany)

- Keopsys (France)

- Hypertherm (U.S.)

- JENOPTIK AG (Germany)

- Newport Corporation (U.S.)

- Han's Laser Technology Industry Group Co., Ltd. (China)

- LIMO GmbH (Germany)

- AdValue Photonics (U.S.)

- NKT Photonics (Denmark)

- Optromix (Russia)

- Laserline GmbH (Germany)

- Amonics Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: nLIGHT launched two new laser technologies, Automatic Parameter Tuning (APT) and WELDForm, aimed at enhancing battery manufacturing quality. These innovations were showcased at The Battery Show North America.

- September 2024: Bodor launched an upgraded M Series laser cutting machine featuring Dual Process Parallel Processing, allowing simultaneous tube cutting and loading/unloading to enhance productivity. This innovative system and its four-chuck design offer five cutting modes, targeting various tube weights and lengths while ensuring zero waste material cutting.

- June 2024: nLight partnered with EOS to enhance additive manufacturing by integrating nLight's programmable lasers into EOS's systems. This collaboration aimed to improve productivity and printing speeds in metal 3D printing.

- March 2024: Frankfurt Laser Company launched a new range of high-power fiber-coupled laser diodes featuring 9XXnm wavelengths optimized for laser pump applications. These lasers offer power levels from 100W to 1kW and are available in ultra-compact packages, suitable for various applications.

- January 2023: OFS introduced its 150 W Raman Laser Module at Photonics West 2023, designed for high-brightness laser applications, including LiDAR and medical uses. This module enhances Raman laser’s performance for pumping solid-state lasers and amplifiers.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investment in the global market is focused on advancing laser technology, increasing energy efficiency, and expanding application areas. Moreover, venture capital and government funding are directed toward R&D to enhance laser performance and develop cost-effective solutions.

Companies worldwide are indulging in strategic acquisitions and partnerships to drive investments aimed at expanding market reach and accelerating the development of new laser-based products. Also, the rising trend of green manufacturing will further encourage investments in eco-friendly laser technologies. For instance,

- January 2024: Bystronic launched the ByCut Eco, a high-power laser cutting machine designed for efficient production with high stability and quality. It features a cutting width of up to 6 meters and advanced technology for precise cutting of various materials.

- October 2024: Michael Muller was awarded the inaugural Valentin Gapontsev Prize for developing powerful ultrafast lasers, achieving a record power of 10.4 kW. This USD 20,000 prize shall support his innovative research with applications in nanotechnology, biomedical research, and environmental monitoring.

REPORT COVERAGE

The report provides an overview of the market’s competitive landscape and focuses on key aspects, such as key players, segments, product types, and leading applications. Besides, it offers insights into the market trends, regional analysis, and product launches and highlights key industry developments. In addition to the factors mentioned above, the market report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 12.3% from 2026 to 2034 |

|

|

Segmentation |

By Type, Power Output, Application, and Region |

|

|

Segmentation |

By Type

By Power Output

By Application

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 13.08 billion by 2034.

In 2026, the market size was valued at USD 5.18 billion.

The market is projected to record a CAGR of 12.3% during the forecast period.

The continuous wave fiber lasers segment is leading the market.

The increasing demand for efficient and precise material processing solutions will create sustained demand for these lasers.

IPG Photonics (U.S.), Coherent, Inc. (U.S.), TRUMPF (Germany), nLIGHT, Inc. (U.S.), and Fujikura Ltd. are the top players in the market.

Asia Pacific dominated the market with a share of 49.0% in 2026.

Asia Pacific is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us