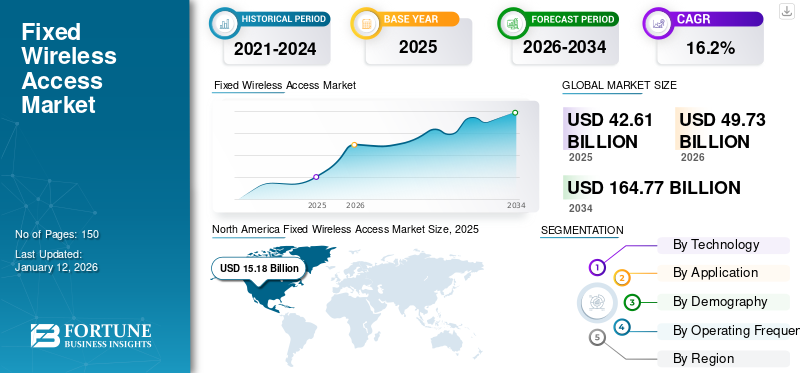

Fixed Wireless Access Market Size, Share & Industry Analysis, By Technology (5G and 4G), By Application (Commercial, Residential, and Industrial), By Demography (Urban, Semi-urban, and Rural), By Operating Frequency (Sub-6 GHz and Above 6 GHz), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global fixed wireless access market size was valued at USD 42.61 billion in 2025. The market is projected to grow from USD 49.73 billion in 2026 to USD 164.77 billion by 2034, exhibiting a CAGR of 16.2% during the forecast period.

The key market players including Verizon, AT&T, and T-Mobile are expanding their 5G and LTE-based fixed wireless offerings. Additionally, smaller ISPs and regional players also play a crucial role in offering competitive, localized wireless broadband solutions.North America dominated the global fixed wireless access market with a market share of 35.6% in 2025.

The Fixed Wireless Access (FWA) market refers to the industry that provides broadband internet services through wireless technology to residential, commercial, and industrial customers. This market includes deploying, operating, and managing FWA infrastructure, which connects users to the internet without needing physical cables or fiber optics. The driving factors include the growing demand for high speed internet in rural and semi-urban areas, advancements in 5G and LTE technologies, and the cost-effective nature of wireless infrastructure compared to traditional wired broadband. For instance,

- A Bank of America report projects that 5G-based FWA services could reach USD 59 billion annually.

Additionally, FWA provides a flexible and scalable solution for rapidly expanding high speed internet connectivity in regions with limited fiber deployment.

The COVID-19 pandemic accelerated the demand for reliable internet connectivity as remote work, online education, and digital services became essential. This increased reliance on broadband highlighted traditional infrastructure limitations, boosting the adoption of FWA as a flexible and rapid solution for expanding broadband coverage in underserved areas.

MARKET DYNAMICS

Market Trends

Increasing adoption of 5G technology to Fuel Market Growth

5G technology offers faster speeds, lower latency, and greater capacity to support more connected devices. It is an ideal solution to deliver high speed internet in urban and rural areas where traditional broadband infrastructure is costly or complex. 5G FWA can provide gigabit-level connections, making it a strong competitor to fiber and cable broadband, especially in regions with lower population density. Furthermore, 5G's enhanced network capacity and ability to implement network slicing enable providers to customize service levels and offer flexible pricing, improving service quality and reliability. As telecom operators continue to expand 5G coverage, FWA is becoming a key broadband solution for customers. For instance,

- In June 2024, Claro Colombia launched its 5G home internet service, which offers 160GB of data, including the modem.

Download Free sample to learn more about this report.

Market Drivers

Growing Demand for Broadband in Underserved and Rural Areas Drives Market Expansion

The increasing demand for broadband in underserved and rural areas is boosting market growth. For instance,

- The Economic Survey 2022-23 highlighted that internet penetration in rural India grew by 200% from 2015 to 2021, outpacing the 158% growth seen in urban areas.

In many remote or low-density regions, deploying traditional broadband infrastructure, such as fiber-optic cables, is often costly and logistically challenging. FWA offers a more cost-effective solution, utilizing wireless technology to deliver high-speed internet without the need for physical cabling. Additionally, the need for reliable internet has surged due to the increasing reliance on digital services for education, healthcare, and remote work. Governments are prioritizing policies and funding to extend broadband coverage to underserved and rural areas. Moreover, telecom operators are investing in 5G and LTE technologies to meet the growing demand for reliable connectivity in remote locations, fueling the growth of the 5G FWA market globally.

Market Restraints

Higher Deployment Costs and Competition from Fiber-optic Broadband Providers May Hamper Market Growth

Limited coverage and signal interference in densely populated urban areas negatively impact the market for FWA. The quality and reliability of wireless connections can be affected by physical obstructions, weather conditions, and interference from other wireless signals, leading to inconsistent performance. Additionally, the capacity to support high user demand can be constrained in areas with insufficient network infrastructure. High deployment costs for network equipment and spectrum licensing can also be barriers for service providers in regions with limited market potential. Furthermore, competition from fiber-optic and cable broadband services can hinder the fixed wireless access market growth.

Market Opportunities

Increasing Demand for Smart Cities and IoT Applications Creates Significant Opportunities for Market Expansion

Cities globally are implementing smart technologies to improve transportation, energy efficiency, healthcare, and public safety. For instance,

- Abu Dhabi has maintained its position as the smartest city in MENA and achieved a global ranking of 13th in the 2023 Smart City Index by the International Institute for Management Development (IMD). This recognition reflects the city's advanced infrastructure and significant investment in FWA, which is crucial for its high-speed wireless connectivity.

These advancements mandate high-speed, reliable, and scalable internet connectivity. FWA enables quicker deployment and greater flexibility than traditional wired solutions. Moreover, IoT applications can benefit from FWA's capabilities alongside the ongoing rollout of 5G networks. The technology supports the functioning of smart cities by enabling seamless connectivity between smart devices, sensors, and city systems. This surge in demand for interconnected urban solutions will fuel the fixed wireless access market share during the forecasted period.

SEGMENTATION

By Technology Analysis

Need for Reliable and Cost-effective Solutions Fuels 4G Segment Growth

Based on technology, the market is divided into 5G and 4G.

4G dominates the market due to its widespread availability, established infrastructure, and sufficient speeds for many broadband applications. It offers reliable and cost-effective solutions for urban and rural areas, making it a practical choice for providers aiming to deliver high-speed internet without requiring extensive fiber deployment.

5G is expected to grow at the highest CAGR in the market due to its superior speed, low latency, and high capacity, which enable gigabit-level broadband services. As 5G networks expand, they will offer a more reliable and scalable solution for delivering high-speed internet in areas where traditional wired infrastructure is limited or costly to deploy. The segment gained 22% of the market share in 2024.

By Application Analysis

Growing Demand for High-speed Connectivity Leads to the Dominance the Residential Segment

By application, the market is categorized into commercial, residential, and industrial.

The residential segment holds the highest share of the market due to the growing demand for high-speed internet in homes, driven by remote work, online education, and entertainment. FWA offers a cost-effective and quick-to-deploy solution in rural or underserved areas, making it an attractive choice for residential broadband services. This segment is expected to attain 71.73% of the market share in 2026, registering a considerable CAGR of 15.94% during the forecast period (2025-2032).

The industrial sector is expected to witness the highest CAGR in the market due to the increasing adoption of IoT, automation, and smart manufacturing technologies. FWA provides reliable, high-speed connectivity that supports real-time data transmission and remote monitoring. It is ideal for industries seeking to enhance operational efficiency and productivity in areas with limited wired infrastructure.

To know how our report can help streamline your business, Speak to Analyst

By Demography Analysis

Higher Demand for Efficient Internet Services Drives Urban Areas Segment Growth

By demography, the market is trifurcated into urban, semi-urban, and rural.

Urban areas dominate the market due to their higher population density and greater demand for reliable, high-speed internet services. FWA provides a cost-effective solution for urban telecom operators to quickly deploy broadband without the need for extensive underground wiring, meeting the needs of residential and business customers. This segment is foreseen to gain 48.15% of the market share in 2026, recording a substantial CAGR of 15.87% during the forecast period (2025-2032).

Rural areas are expected to grow at the highest CAGR in the market due to the increasing need for affordable and accessible broadband in underserved regions. FWA offers a cost-effective and quick deployment solution to provide high-speed internet where traditional wired infrastructure is difficult or expensive to establish, thereby helping to bridge the digital divide in rural communities.

By Operating Frequency Analysis

Need for Ideal Signal Penetration in Urban and Rural Areas to Drive Segment Growth

The market is bifurcated by operating frequency into sub-6 GHz and above 6GHz.

Sub-6 GHz holds the highest share in the market as it offers a balance between comprehensive coverage and reliable performance, making it ideal for both urban and rural deployments. Its lower frequency provides better signal penetration and a more extended range than higher frequency bands such as mmWave, making it more suitable for large-scale, cost-effective broadband access. This segment is likely to hold 72.87% of the market share in 2026, exhibiting a significant CAGR of 15.96% during the forecast period (2025-2032).

Above 6 GHz is expected to grow at the highest CAGR in the market due to its higher speeds and greater capacity, particularly with the advent of 5G technologies. These higher frequencies, such as mmWave, enable ultra-fast internet connections and support dense, high-demand environments, making them ideal for urban areas and advanced use cases such as smart cities and IoT applications.

For instance,

- In February 2024, Nokia launched a 5G outdoor FWA receiver to improve broadband coverage in urban, suburban, and rural areas. This receiver enables operators to use a cost-effective mmWave spectrum for reliable, high-speed wireless broadband in locations where fiber deployment is complex.

FIXED WIRELESS ACCESSMARKET REGIONAL OUTLOOK

In terms of region, the market is categorized into Europe, North America, the Asia Pacific, South America, and the Middle East & Africa.

North America

North America Fixed Wireless Access Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 15.18 billion in 2025 and USD 17.85 billion in 2026. North America dominates the market due to its advanced telecommunications infrastructure, high demand for reliable broadband, and substantial investments in 5G and wireless technologies. The region's widespread urbanization and government initiatives to improve broadband access in underserved areas further drive the adoption of FWA as a key solution for expanding internet coverage. For instance,

- In August 2024, Cambium Networks and Cal.net launched a 6 GHz fixed wireless access (FWA) network for outdoor use of the 6 GHz spectrum. This solution aimed to provide reliable, high-speed internet to underserved communities in Central Valley and rural Northern California.

The U.S. leads the North American market due to its robust telecommunications infrastructure and high consumer demand for broadband. Major service providers such as Verizon, T-Mobile, and AT&T, have invested in 5G and millimeter-wave technologies to expand FWA coverage and provide high-speed internet to underserved rural areas. The U.S. market is likely to reach USD 10.42 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is the third largest market expected to hold USD 11.93 billion in 2026. Asia Pacific is expected to grow at the highest CAGR in the market due to rapid urbanization, increasing demand for high-speed internet, and the expansion of 5G networks across the region. The Chinese market is predicted to hit USD 3.46 billion in 2026. For instance,

- In August 2024, Nokia expanded its R&D presence in India by launching its largest global facility for fixed networks in Chennai. This new lab would serve as a significant hub for Nokia, supporting its commitment to developing advanced technologies to bridge the digital divide.

The need for cost-effective broadband solutions in rural and remote areas further accelerates FWA adoption in this diverse and fast-growing market. Indian market is expected to be valued at USD 1.90 billion in 2025, while Japan is set to be worth USD 2.31 billion in the same year.

Europe

Europe is poised to hold the second largest market share valued at USD 13.15 billion in 2026, exhibiting a significant CAGR of 16.44% during the forecast period (2025-2032). Europe holds the second-highest share in the market due to its ongoing efforts to enhance broadband connectivity across urban and rural areas. The U.K. market is anticipated to reach USD 3.21 billion in 2026. Government initiatives, such as the EU’s Digital Agenda and increasing adoption of 5G technology drives the demand for FWA as a cost-effective solution to bridge the digital divide and meet growing connectivity needs. Germany is predicted to reach USD 2.77 billion in 2026, while France is foreseen to gain USD 2.08 billion in the same year.

Middle East & Africa (MEA) and South America

South America is the fourth largest market anticipated to be valued at USD 3.60 billion in 2025. South America, the Middle East & Africa are expected to grow at an average rate in the market due to the gradual expansion of telecommunications infrastructure and increasing demand for affordable broadband. While these regions face challenges, such as varying levels of economic development and regulatory barriers, FWA providers offer a scalable and cost-effective solution to improve connectivity in underserved areas. The GCC market is likely to stand at USD 0.82 billion in 2025.

- In March 2024, Omsor, South Africa's Fixed Wireless Access and Private Networks provider, launched a 5G FWA solution to offer business-class broadband for SMEs and a cost-effective redundancy solution for enterprises.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Launch New Products to Strengthen Market Positioning

Players are launching new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement through strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. These strategic product launches help companies maintain and grow their market share in a rapidly evolving industry.

List of Companies Studied:

- Verizon (U.S.)

- T‑Mobile USA, Inc. (U.S.)

- AT&T Intellectual Property (U.S.)

- Nokia (Finland)

- ZTE Corporation (China)

- Vodafone Limited (U.K.)

- BT Group plc (U.K.)

- Telefónica Germany GmbH & Co. OHG (Germany)

- Reliance Jio (India)

- Samsung (South Korea)

- Mavenir (U.S.)

- Digi International Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Zyxel (Taiwan)

- Quectel (China)

- Cambium Networks, Ltd. (U.S.)

- Airgain (U.S.)

- Vantiva (France)

KEY INDUSTRY DEVELOPMENTS:

- December 2024- HFCL launched its 5G fixed wireless access customer premises equipment (CPE), designed to address last-mile connectivity and deliver fiber-like speeds via wireless 5G networks.

- October 2024- Spirent Communications launched 5G FWA testing services, which include live network benchmarking and 5G/Wi-Fi gateway testing. These solutions help service providers and device manufacturers optimize quality of experience (QoE).

- August 2024- Inseego Corp. launched the Wavemaker 5G indoor router, its first 5G FWA indoor router certified for all major U.S. carrier networks. This FX3110 router offers fast 5G connectivity, robust security, and seamless remote management, making it an easy-to-deploy solution for various sectors.

- July 2024- Nokia introduced a 5G FWA indoor Wi-Fi 7 gateway and outdoor receiver, expanding its FWA portfolio. These solutions are designed for the North American market and support a wide range of 5G and 4G bands, including Citizens Broadband Radio Service (CBRS).

- July 2024- Nokia unveiled additional products in its fixed broadband portfolio, including a 5G Fixed Wireless Access outdoor receiver, an indoor gateway with Wi-Fi 7, and the Broadband Easy Connect product for fiber home connectivity. These FWA solutions address connectivity gaps in North America, supporting various 4G and 5G bands, including Citizens Broadband Radio Service (CBRS).

- February 2024- Nokia launched a 5G outdoor fixed wireless access receiver to improve broadband coverage in urban, suburban, and rural areas. This receiver enables operators to use a cost-effective mmWave spectrum for reliable, high-speed wireless broadband in locations where fiber deployment is complex.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investments in the market are significantly transforming its growth by enabling faster network expansion, technology upgrades, and broader service coverage. Telecom operators and governments are increasingly investing in 5G and LTE technologies, which enhance FWA's ability to deliver high-speed, reliable broadband services. Additionally, the growing demand for digital services and connectivity drives investments in FWA, helping to bridge the digital divide and improve internet access for businesses and households. For instance,

- In May 2024, DZS acquired NetComm Wireless, enhancing its broadband and cloud software solutions with NetComm's FWA, Home Broadband, Fiber Extension, and IoT products. This acquisition strengthened DZS' broadband portfolio and expanded its customer base across multiple regions.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years. The market segmentation is mentioned below:

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 16.2% from 2026 to 2034 |

|

|

Segmentation |

By Technology

By Application

By Demography

By Operating Frequency

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

The market is projected to reach USD 164.77 Billion by 2034.

In 2025, the market size stood at USD 42.61 Billion.

The market is projected to grow at a CAGR of 16.2% during the forecast period.

By application, the residential segment is leading the market.

The growing demand for broadband in underserved and rural areas is driving market growth.

Verizon, T Mobile USA, Inc., AT&T Intellectual Property, and Nokia are the top players in the market.

North America holds the highest market share.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us