Heat Treating Market Size, Share & Industry Analysis, By Process (Carburizing, Nitriding, Hardening & Tempering, Annealing, and Others), By Material (Steel, Cast Iron, and Others), By Equipment (Fuel-fired Furnaces, Electrically Heated Furnaces, and Others), By End-User (Automotive, Aerospace, Metalworking, Machine, Construction, Energy, and Others), and Regional Forecast, 2026-2034

Heat Treating Market Size

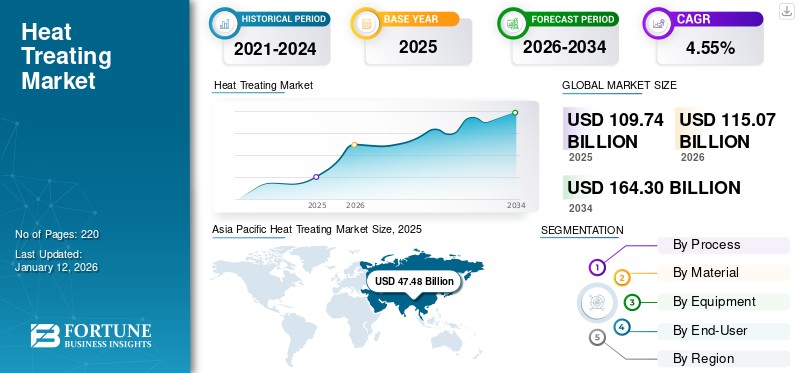

The global heat treating market size was valued at USD 109.74 billion in 2025. The market is projected to be worth USD 115.07 billion in 2026 and reach USD 164.3 billion by 2034, exhibiting a CAGR of 4.55% during the forecast period. Asia Pacific dominated the global market with a share of 43.26% in 2025.

Heat treating refers to the treatments applied to metallic materials to improve their mechanical properties, such as durability, corrosion, wear resistance, rigidity, etc., thereby increasing the value of the material. The process is carried out in specific controlled atmosphere furnaces, fluidized beds and salt baths, vacuum, and induction/flame surface-hardening machines. The heat treatment process is applied to the inputs required and used by almost every sector, mainly to form and add proper mechanical properties to the finished products. Metals such as iron, steel, stainless steel, structural steel, aluminum, and copper are used most for heat treatment. Approximately 80% of the heat treatment processes are applied to steel products.

Global Heat Treating Market Overview

Market Size:

- 2025 Value: USD 109.74 billion

- 2026 Forecast: USD 115.07 billion

- 2034 Forecast Value: USD 164.3 billion, with a CAGR of 4.55% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific held approximately 43.26% of the market in 2025, driven by automotive, aerospace, and manufacturing sector growth.

- Fastest-Growing Region: Asia Pacific remains the fastest-growing region, supported by industrial expansion, infrastructure projects, and high demand from end-use industries.

- End-User Leader: The automotive segment led the market in 2024, fueled by lightweight vehicle production and rising electric vehicle (EV) adoption.

Industry Trends:

- Renewable Energy-Driven Expansion: Growing applications in offshore wind, solar, and turbine manufacturing boost heat-treating demand.

- Electric Vehicle & Automotive Innovation: Increased EV production and lightweighting strategies drive the need for advanced heat treatment.

- Focus on Materials Engineering: Steel dominates as the primary material, accounting for about 80% of usage, with hardening and tempering being key processes.

Driving Factors:

- Rising automotive sales and EV adoption increase demand for treated metal components.

- Expansion of aerospace and construction equipment industries requires high-performance metal parts.

- Infrastructure and industrial growth in Asia Pacific accelerates market demand.

- Growing need for component durability, wear resistance, and mechanical performance enhances heat-treating applications.

- Regulatory and environmental standards push for modernization of furnaces and sustainable heat-treatment processes.

The outbreak of the COVID-19 pandemic had a negative impact on the global heat treating market. The shutdown of various industries due to supply chain disruptions and shutdowns led to economic collapse in several countries. In 2020, the shrinkage of global construction, machine construction, and the automobile industry negatively affected the market. The market for construction materials dropped to USD 5.86 trillion, a 5.8% drop compared to previous years. The heat treating market experienced shrinkage in developed and developing countries, thereby impacting the global market.

Heat Treating Market Trends

Growing Renewable Energy Sector to Create Opportunities for Market Growth

Heat treatment plays a crucial role in the energy sector, primarily in manufacturing components such as turbines, boilers, and electric systems. These components require precise heat treatment to ensure optimal performance, efficiency, and longevity. For instance, heat treatment is employed in hydroelectric power plants manufacturing turbines and associated components, such as runner blades, shafts, and bearings. Processes, such as surface hardening and stress relieving enhance these components' wear resistance, fatigue strength, and dimensional stability, thereby contributing to the efficient operation of such plants.

Moreover, offshore renewable energy projects, such as offshore wind and solar installations, require robust and durable components to withstand harsh marine environments. Heat treatment is essential in manufacturing critical components, such as turbine blades, tower sections, and foundation structures/solar piles. The increasing demand for renewable energy solutions is driving market expansion on a global scale. Heat treatment companies may be able to enter new markets or expand their operations to serve renewable energy projects worldwide. This could involve partnerships with renewable energy developers, manufacturers, and contractors to provide tailored heat treatment solutions for their specific needs.

Download Free sample to learn more about this report.

Heat Treating Market Growth Factors

Rising Automobile Sales Drives Demand for Heat-Treating

The automotive industry is one of the most utilized and emerging sectors today, where many different materials are manufactured. A modern automobile that is profoundly manufactured using a heat-treating process with components made of aluminum is observed to be much lighter than the components and the parts made of steel, which directly enhances and improves the fuel consumption efficiency of the automobile.

Increasing demand for energy-efficient products and new generations of electric vehicles creates demand for this market. The automotive industry has been witnessing increasing sales of efficient and electronic vehicles. Much of this can be credited to growing regulations, net-zero initiatives, and the ever-increasing number of EVs available to consumers. Automobiles require heat-treated metals for thermal proofing and crash-proofing, which ensures the safety of drivers throughout the changing weather. Moreover, heat treatment helps build the vehicle brand's credibility, driving the global heat treating market.

Global auto sales recorded strong growth in 2024. According to IEA estimates, global car sales expanded at a robust rate of 10.8% year-on-year growth. Car sales recorded a double-digit growth rate in all three major geographical markets, rising +12.4% in the United States, +11.0% in China, and +13.7% in Europe, comprising the EU, UK, and EFTA markets. Moreover, China is at the forefront, with 60% of global electric car sales in 2022. U.S. and Europe, the second and third largest markets, witnessed strong growth, with sales increasing by 15% and 55% in 2022, respectively. Such factors are increasing the demand for heat treatment in the market.

Ambitious policy programs in major countries, such as the Fit for 55 package in the EU and the Inflation Reduction Act in the U.S., are expected to increase market share for electric vehicles further this decade and over the forecast period. By 2030, the average share of electric vehicles in total sales across the EU, China, and the U.S. is set to rise to around 60%.

Increasing Demand for Various Industrial Equipment and Modern Machines Augments Demand for Heat Treating Processes

Industrialization is mainly based on the ownership of production and product technologies. Accordingly, heat treatment drives technological processes in several medium and high-technology industries, primarily the machine industry, white appliances, energy equipment, healthcare equipment, rail systems, shipbuilding, electrical appliances, electronics, and others. The heat treatment market applies heat treatment to metal, composite, and ceramic material inputs used by the abovementioned industries, among others. This treatment makes almost all industries as crucial as other manufacturing equipment and machines. Thus, it performs a critical function in the development and industrialization of different sectors.

Numerous progress in the heat treatment industry resulted in more robust, long-lasting, smooth-surfaced, easy-to-shape, flexible, and durable inputs. Therefore, heat treatment industries and production technologies are available in all industrialized countries, and the heat treatment industry is a precondition of industrialization. For instance, in 2024, to engage the rapidly increasing interest in compact track loaders (CTLs) in North America, Dana is expanding its annual production of Spicer Torque-Hub track drives by almost three times its previous production at the manufacturing hub in Lafayette. Spicer Torque-Hub drives for CTLs offer an output torque from 5,000 to 17,000 Nm, with increased productivity and maximized motor displacements in a compact package.

RESTRAINING FACTORS

Stringent Environmental Regulations on Fuel-Based Furnaces Hampers Market Growth

Heat treatment is a capital-intensive and energy-intensive market since it uses industrial and large-scale furnaces and equipment with high operating costs. As a result, the heat treatment market is a deciding factor in the cost-effectiveness and competitive strength of several industries, such as automobile, aerospace, construction, machine construction, and others. The commercial heat treating process is capital, labor, and energy-intensive, as the primary input of the heat treatment industry is energy, which accounts for a sizable portion of production costs.

Moreover, the commercial heat treatment market has a high level of environmental impact, which requires a high level of environmental sensitivity regulations. The environmental effects of heat treatment are categorized under water and energy consumption, use of chemicals, and waste output. For this reason, the heat treatment industry is positioned to be subject to the regulations set forth by the EU Green Deal. Generally, heat treatment generates substances that are more likely to be toxic compared to their ordinary waste components. Harmful toxins include dioxins, furans, and dangerous gases, such as mercury and cadmium. Small and medium-scale players have become obsolete using outdated technology and various procedures. Thus, all these factors are restraining the market growth. Worldwide attention has been emphasized on environmental issues, and global warming has been the central theme of the recent international summits. Utilizing low-energy efficiency machines harms the environment and lowers the overall effectiveness of business operations in different industrial sectors. Thus, these factors are hampering the market.

Heat Treating Market Segmentation Analysis

By Process Analysis

Hardening & Tempering to Lead the Market Owing to Its Wide Application Base In Several Sectors, including EVs

The market is segmented based on process: carburizing, nitriding, hardening & tempering, annealing, and others.

The hardening & tempering segment dominates the market owing to its wide application base, contributing 24.68% globally in 2026. The growing automobile industry and explicitly increasing demand for electric vehicles in the automotive sector. Moreover, the increasing infrastructural development in the railway sector is expected to impact the segment growth positively.

The carburizing process of hardening is a heat treatment method used for low-carbon steel parts, high alloy gears, and steel-bearing components. As machinery and equipment evolve, bearings are increasingly needed to withstand harsh operating conditions, higher loads, and prolonged use. Carburized steel for bearings addresses this demand, contributing to improved efficiency and reduced maintenance costs, thus increasing the demand for this segment.

The annealing heat treating segment is estimated to grow over the forecast period. Key variables driving the industry include an increase in the demand for different annealing forms, such as soft annealing stress relieving, within the automotive, semiconductors, and construction industries.

By Material Analysis

Steel is One of the Most Consumed Metals in the World, Subsequently Leading the Heat Treatment Market

Based on material, the market is segmented into steel, cast iron, and others.

The steel segment dominates with the market share of 83.51% in 2026 and is expected to witness the highest growth rate owing to its high tensile strength and lightweight properties. Steel is the most important, multi functional, and adaptable to material available with low production costs. The increasing use of steel in numerous end-user sectors, machining applications, and consumption is increasing in several emerging economies, thereby supporting their industrial development.

Cast iron is an alloy of iron that contains over 2-4% carbon, along with different amounts of silicon and manganese and traces of impurities, such as sulfur and phosphorus. It manufactures internal combustion engine cylinder blocks, flywheels, gearbox cases, manifolds, and disk brake rotors in railways and other sectors. Due to the increasing need for improved and modern rail connectivity, governments globally are investing in improving rail infrastructure projects.

The other segment comprises aluminum, copper alloys, nickel alloys, brass, titanium alloys, and other metals. Aluminum is also a vital market segment since it primarily produces automotive and aerospace components. It possesses several unique properties that make it versatile and sought after by most industries.

By Equipment Analysis

Increasing Adoption of Efficient and Sustainable Products Drives Dominance of Electrically Heated Furnaces in the Market

The market is segmented based on equipment: fuel-fired furnaces, electrically heated furnaces, and others.

The electrically heated furnace segment dominates the market share of 50.6% in 2026, followed by fuel-fired furnaces. Electrically heated furnaces led the industry due to their high operational efficiency and higher environmental sustainability than conventional fuel-fired systems. Rapidly increasing demand for environmentally friendly technology is expected to propel the industry growth of electrically heated furnaces over the next few years.

Fuel-fired furnaces are used in industrial applications to generate heat or steam for direct use in methods and for operating other equipment such as steam turbines. The fuel-fired furnaces are gaining preference due to their low cost compared to electrically heated furnaces. However, unstable fuel prices and greenhouse gas emissions have restrained the growth of conventional fuel-fired furnaces.

Other equipment segments include induction furnaces, plasma-heated furnaces, and others. Key factors driving the industry include energy efficiency, ease of cleaning, and a fast and well-controlled melting process.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Leading Market Share of the Automotive Segment to Be Driven by Increase in Lightweight and Heavy Vehicle Production

Based on end-user, the market is classified into automotive, aerospace, metalworking, machine, construction, energy, and others.

The automotive segment accounted for a leading market share owing to the rapidly increasing production of lightweight and other heavy vehicles globally, accounting for 28.09% market share in 2026. The automotive industry uses heat treatment to manufacture gear, wheel bearings, shafts, rings, and bushings. Moreover, it is significant for maintaining the structural integrity of modern cars and vehicles such as electric vehicles. These factors are driving the demand for heat treatment in the automotive sector.

Aerospace is the next dominating segment and the fastest-growing industry. In the aerospace industry, heat treatment is a critical process to improve the mechanical properties of metal parts, such as strength, hardness, and wear resistance. Heat treatment in this industry is often performed in vacuum furnaces or furnaces that use controlled atmospheres to prevent the oxidation or contamination of the metal. This factor makes aerospace the fastest-growing segment in the heat treating market.

Metalworking, construction, and energy are also critical segments of the market, as steel structures are widely used in the metallurgical production of beams, columns, and grills for construction and other requirements.

REGIONAL INSIGHTS

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Heat Treating Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the major share of the market in 2024, owing to the rapid-paced industrialization and urbanization in the region. Heat-treating services are primarily driven by rapidly growing automotive, aerospace, and construction industries across key emerging economies such as India, China, and Indonesia. The Japan market is forecast to reach USD 2.39 billion by 2026, the China market is set to reach USD 36.92 billion by 2026, and the India market is likely to reach USD 5.25 billion by 2026.

North American

The rising automotive and aerospace industries across the region will likely drive the North American market. The aerospace sector in the region is expected to witness the highest growth due to the rising manufacturing of aircraft parts and systems in the U.S. & Canada. The U.S.'s automotive, aerospace, and defense industries continue to be the driving sectors in the heat treatment industry. In addition, the U.S. has created international standards, such as NADCAP in the aviation, space, and defense industries. It has been leading the world markets by revising and implementing these standards in the heat-treating market. The U.S. market is expected to reach USD 21.86 billion by 2026.

Europe

In Europe, the heat treatment industry is mainly led by countries such as Germany and the U.K., which pioneered setting industrial standards within the EU. Germany also leads the way in harmonization with the Green Deal regulation of the European Union, and in this context, it is making greener production in the heat treatment market. The UK market is estimated to reach USD 6.21 billion by 2026, and the Germany market is anticipated to reach USD 8.5 billion by 2026.

Others

Due to increasing government expenditure on key infrastructure projects, the rapidly growing construction industry in Latin America and the Middle East & Africa is expected to drive demand in the sector over the forecast period.

KEY INDUSTRY PLAYERS

Major Market Players Takes the Lead with Their Broad Service Portfolio

The global heat treating market is highly competitive and fragmented. Key players compete with companies that manufacture, distribute, and market furnaces and related products/services. Companies are focusing on expanding their markets to gain higher market shares. Bodycote has been among the major players in the heat treating market for decades and has developed a broad range of services for different types of applications. The company has expertise and proprietary specialist technologies to serve across the manufacturing supply chain. The company has a strong presence in the European market and is engaged in expanding its operations across the globe.

List of Top Heat Treating Companies:

- Bluewater Thermal Solutions (U.S.)

- SECO/WARWICK (Poland)

- Nabertherm GmbH (Germany)

- Bodycote Heat Treatments Ltd. (U.K.)

- American Metal Treating Inc. (U.S.)

- East-Lind Heat Treat Inc. (U.S.)

- General Metal Heat Treating, Inc. (U.S.)

- Shanghai Heat Treatment Co. Ltd. (China)

- Unitherm Engineers Limited (India)

- Solar Atmosphere Inc. (U.S.)

- Ajax Tocco International Ltd. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023- YALMAN KNIVES, a Turkish manufacturer of knives and rolls, ordered a Vector vacuum furnace for hardening and tempering tool steel. This vacuum furnace is equipped with a heating chamber of size 600x600x900 mm for effective heat treating of large packages of shredding knives at Yalman Knives. This order meets all the requirements of the YALMAN KNIVES for the heat treatment of spare parts.

- July 2023- Aalberts Surface Technologies announced the expansion of its austempering capabilities and capacity in Canton, Ohio, and Ft. Smith, Ark. Three atmosphere-to-salt furnaces will be added to the existing facility in Canton, allowing Aalberts to better serve customers in that region.

- September 2022- SECO/WARWICK Group signed an agreement with GreenIron H2 AB (Swedish company) for furnaces for fossil-free metal production from residuals, ore, and waste recycling. These furnaces ordered by GreenIron will be used to recycle oxidized metals without emissions, and each furnace can reduce emissions by 56.000 metric tons/yr.

- July 2021- Aalberts N.V. signed an agreement to acquire 100% Premier Thermal Solutions LLC shares based in Michigan, USA. After the acquisition, Aalberts N.V. will be able to expand its geographical footprint and enhance growth prospects throughout the North American market since PT operates in nine locations across the industrial Midwest in Michigan, Wisconsin, Indiana, and Ohio.

- May 2021- Aalberts Surface Technologies expanded its facility in Dzierżoniów, Poland, by 2,800 square meters, adding a new sealed quench furnace. The new furnace has a working height of 1200 mm, which will allow the facility to process more parts vertically.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as major market players, product/service types, and leading end-users of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.55% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Process, By Material, By Equipment, By End-User, and By Region |

|

Segmentation |

By Process

|

|

By Material

|

|

|

By Equipment

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 109.74 billion in 2025.

The market is likely to record a CAGR of 4.55% during the forecast period.

The automotive segment is expected to lead the market due to the development of heat treatment globally.

The market size of Asia Pacific stood at USD 47.48 billion in 2025.

Rising automobile sales is the key factor driving the demand for the heat treating process.

Some of the top players in the market are Bluewater Thermal Solutions, SECO/WARWICK, and Bodycote Heat Treatments Ltd.

The global market size is expected to record a valuation of USD 164.3 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us