Human Milk Oligosaccharides Market Size, Share & Industry Analysis, By Type (2’FL, 3’FL, 3’SL, 6’SL, and LNT), By Structure (Neutral Fucosylated HMOs, Neutral HMOs, and Sialylated HMOs), By Application (Infant Nutrition, Functional Food and Beverages, Food Supplements, and Pharmaceuticals), and Regional Forecast, 2026-2034

Human Milk Oligosaccharides Market Size and Future Outlook

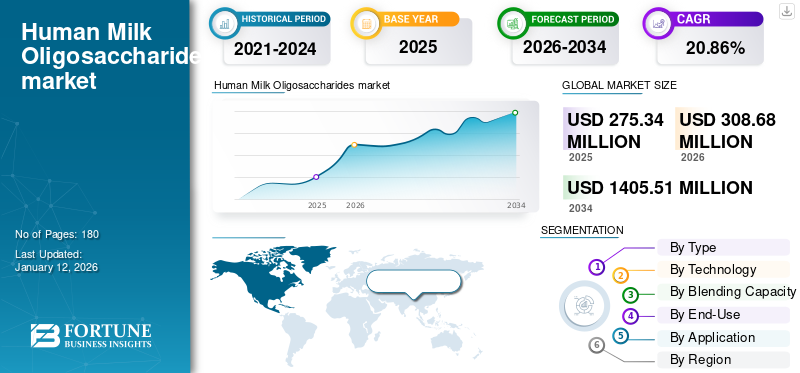

The global human milk oligosaccharides market size was valued at USD 275.34 million in 2025. The market is projected to grow from USD 308.68 million in 2026 to USD 1405.51 million by 2034, exhibiting a CAGR of 20.86% during the forecast period. North America dominated the human milk oligosaccharides market with a market share of 46.86% in 2025.

Human Milk Oligosaccharides (HMOs) are compounds that are derived primarily from mammals and that support infant health and development. They are found naturally in human breast milk and play a pivotal role in providing necessary nutrition and boosting the global market growth. These compounds have been found to have several health benefits, which include improved immunity, boosting healthy gut microbiome growth, and protection against pathogens. Thus, major infant nutrition companies, such as Abbott Nutrition, Nestle S.A., and others, incorporate HMOs in their products to improve product functionality and, in turn, boost global market growth.

Global Human Milk Oligosaccharides Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 275.34 million

- 2026 Market Size: USD 308.68 million

- 2034 Forecast Market Size: USD 1405.51 million

- CAGR: 20.86% from 2026–2034

Market Share:

- North America dominated the human milk oligosaccharides market with a 46.86% share in 2025, driven by strong research activities, high adoption of novel ingredients, and growing demand for functional infant nutrition products.

- By type, 2’-Fucosyllactose (2’FL) held the largest market share in 2024 due to its extensive industrial application, robust scientific backing, and role in promoting gut health and immune system development in infants.

Key Country Highlights:

- United States: Major investments in novel food technology and strategic partnerships between academia and industry support market growth, especially in functional food and infant nutrition.

- Canada: Pioneered early HMO-based infant formulas; supportive regulatory environment enhances product innovation.

- China: Early-stage adoption of HMOs in infant nutrition, with rising fertility rates and growing disposable income fueling future market expansion.

- India & Southeast Asia: High fertility rates and increasing awareness of infant nutrition are driving demand for premium ingredients like HMOs.

- Germany & France: Strong regulations and classification of HMOs as novel foods promote safety and quality, boosting their use in dietary supplements and infant formulas.

- Brazil & Argentina: Market still in early development; regulatory approvals by companies such as BASF and Chr. Hansen are opening pathways for growth.

Human Milk Oligosaccharides Market Trends

New Source Identification and Advanced Technology Usage for Manufacturing to Support Improved Applications

There is a growing advancement in the adoption of advanced technologies for the production of such ingredients. Multiple approaches are used for the production of these compounds, which include advanced technologies for the production, identification of new sources for production, and scaling up of the production of such compounds. Such technological advancements are expected to boost production and support market growth.

- As per a study published in Nature Food Journal 2024, a team of scientists at the University of California discovered a method to produce HMOs from genetically engineered plants. The team was able to develop 3 HMOs from a single plant source successfully.

- Similarly, in August 2020, a U.S.-based biotechnology firm, Conagen, developed a novel and proprietary process to produce non-GMO HMOs at a commercial scale.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Growing Demand for Premium Ingredients in Infant Nutrition Products to Support Market Growth

Several clinical studies have been conducted to assess the impact of human milk oligosaccharides on infants. It has been found to promote gut health, support anti-microbial and antiviral activities in the body, reduce the risk of disease, and promote brain development. As parents continue to prioritize nutrition and the healthy growth of their children, there is increased spending on products that are scientifically proven to help the growth. Hence, demand for such compounds for manufacturing a wide range of infant nutrition products is expected to increase in the future.

- For instance, in November 20202, Abbott Nutrition launched an infant formula which is made of 2'-Fucosyllactose Oligosaccharide. It was one of the first infant nutrition formulas that was made of such an ingredient that was launched in Canada.

Growing Strategic Alliances to Boost R&D Expenditure to Escalate Market growth

As the market is still evolving, manufacturers are investing in expanding their research and development activities to expand their capabilities. This includes developing strategic alliances with related manufacturers, which enables them to share resources and leverage mutual strength to build a strong platform for product innovation. This increased collaboration between companies supports product innovation and boosts new product development, and in turn, drive the global human milk oligosaccharides market growth.

Market Restraints

Complex Manufacturing Process and High Material Costs to Limit Market Growth

The raw materials and the production process are the major factors that include the overall cost of production of these compounds. The price of raw materials, such as lactose, which is used or production, varies significantly, and hence, the increase in cost of raw materials leads to high prices of the products. Additionally, the complex nature and structure of such compounds make the isolation and synthesis of such products difficult, leading to challenges in large-scale production and impacting the overall production and availability.

Market Opportunities

Increased Spending on Healthy Premium Products Offers Immense Opportunities for Innovation and Expansion

Globally, the demand for premium ingredients in infant formula products is increasing rapidly. Bioactive ingredients, which include HMOs, have been clinically proven to provide health benefits. In emerging economies with high disposable income, such as China, India, Brazil, and others, the demand for premium ingredients in infant formulas is expected to increase further in the future. The parents are specifically inclined to spend more on products that are effective and appealing to the kids. This creates an opportunity for the manufacturers to develop premium ingredients that find application in infant nutrition and account for HMOs in infant formula as well as other industries. Growing awareness of human milk oligosaccharide among consumers and infant formula manufacturers is expected to play a pivotal role in market growth.

Market Challenges

Slow and Stringent Regulatory Approvals Hinder Market Growth

Slow and stringent regulatory approvals related to these compounds impede the pace at which new products are produced, marketed, and launched in the market. The U.S. and Europe have developed regulatory guidelines related to such ingredients. However, in the rest of the world, limited research and development on such ingredients is taking place comparatively. Hence, limited regulations have been established in other countries, due to which assessment of the quality and standards of the ingredients used in the final products is difficult.

Impact of COVID-19

The COVID-19 pandemic had a positive impact on the growth of the market due to the increased demand for premium and healthy products among consumers. As health consciousness among consumers increased, the demand for dietary supplements and concern among consumers about infant nutrition increased significantly. As clinical studies related to such compounds have exhibited several health benefits, especially among infants, the demand for such beneficial ingredients increased significantly, leading to rapid growth during the period and also after the post-pandemic period.

SEGMENTATION ANALYSIS

By Type

2’FL Accounts for the Highest Market Share Owing to Its Increased Industrial Application

Based on type, the market is segmented into 2’FL, 3’FL, 3’SL, 6’SL, and LNT.

2’FL accounted for the highest market share by 67% in 2024, as it is one of the most well-researched and widely used types in the production of infant nutrition and dietary supplement products. It helps and promotes the growth of good bacteria in the baby’s stomach leading to improved digestion and healthy growth.

Apart from this, LNT is another prominent type used for the production of infant nutrition products.

Other types, such as 3’FL, 3’SL, and 6’SL, are the least researched types of compounds. However, as there is continuous research in the field, the use of such types is expected to grow in the future.

To know how our report can help streamline your business, Speak to Analyst

By Structure

Neutral Fucosylated HMOs Segment Accounts for the Largest Market Share as It Is the Most Abundant Structure Available in the Market

Based on structure, the market is segmented into Neutral Fucosylated HMOs, Neutral HMOs, and Sialylated HMOs.

Neutral Fucosylated HMOs, which include 2’FL, 3’FL, and LNT, account for the highest market share in 2024, and the market is expected to grow in the future. Neutral Fucosylated HMOs is projected to register a considerable CAGR of 18.18% during the forecast period. Among these structural types, 2′-FL accounts for the most abundant available types used in different industries. These products are helpful in supporting immune system development, strengthening gut barriers in babies, promoting healthy microbiota in babies, and regulating their nervous system development.

Sialylated HMOs account for one of the prominent structures of products available in the market. Such products help to promote gut health and improve immunity in babies. There is ongoing research on such structural compounds, and their availability in the market is expected to increase in the future.

Neutral HMOs is expected to display 14% of the market share in 2025 in the global market.

By Application

Infant Nutrition Accounts for the Highest Market Share Due to the Wide Usage of HMOs in Infant Formula Products

Based on application, the market is segmented into infant nutrition, functional food and beverages, food supplements, and pharmaceuticals.

Infant nutrition application is likely to account for the highest market share by 82% in 2025. These products play a crucial role in providing the essential nutrition required by babies during their growth and supporting brain development and nutritional requirements. With the rise in disposable income, parents are spending on high-quality food products, which helps to support their child’s development. Hence, the demand for such products in this application area is expected to increase in the future as well.

In recent years, the demand for health products that provide preventative healthcare has increased significantly. These also include products that support gut health and improve the functioning of the digestive system, and the popularity of such products has increased significantly. They are known for their gut-strengthening nutrients and are therefore used for the production of such dietary supplements. Hence, the growth in the demand for dietary supplements also plays a positive role in influencing the demand for such products as ingredients for production.

Another major application area of such products is functional foods and beverages. Prebiotic food and beverage products containing such compounds are growing in prominence in the market. Food and beverages that support gastrointestinal health are thus, using these compounds as one of the crucial ingredients for improving and enhancing their food quality.

Food supplements segment is anticipated to register a CAGR of 17.21% during the forecast period.

Human Milk Oligosaccharides Market Regional Outlook

Geographically, the global market report covers analysis across North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America accounts for the highest market share, amounting to USD 144.66 million in the global market in 2026. Significant research is being conducted in the region, which is contributing to new product development and market launches. Several academic institutions are collaborating with major infant formula and functional food manufacturers to adopt innovative ingredients and develop products that are healthy and support the overall growth of the body.

In the U.S., the demand for novel food products is growing rapidly. The U.S. market is anticipated to reach USD 112.59 million in 2026. With the growth in the demand for functional food and beverages, the demand for novel ingredients to manufacture such products is increasing rapidly. Investment in new technologies, compounded with government funding that supports innovation, is playing a pivotal role in supporting the country’s market growth.

Europe

The Europe region is the second-largest market and anticipated to hit USD 82.36 million in 2026, exhibiting a CAGR of 17.55% during the forecast period. In Europe, HMO-based food products are considered novel food products, and hence, specific regulations have been developed in the region to maintain food safety and quality. The use of such ingredients helps to enhance nutrition sustainability and improve food security. The usage of this ingredient for manufacturing infant nutrition products, dietary supplements, and functional food products has increased rapidly in recent years in the region. The U.K. market size is expected to hit USD 18.37 million in 2026, along with Germany projecting to hit USD 20.46 million in 2026 and France to attain USD 13.64 million in 2025.

Asia Pacific

Asia Pacific is the third largest market and is projected to reach USD 63.84 million in 2026 and accounts as one of the most promising areas, and the demand for such ingredients is expected to increase significantly in the future. Apart from North America and Europe, scientific studies related to such compounds are growing at a rapid pace in China. In China, the adoption of HMOs in infant nutrition is at an early stage of development. Companies are applying for regulatory approvals for their products through government approval agencies. Moreover, in several South Asian and Southeast Asian countries, the fertility rate is high and is expected to increase further in the future. With the rise in disposable income in countries such as India, Indonesia, and other emerging economies, the demand for nutritious and healthy food products, including the demand for HMOs in infant formula, is expected to increase significantly. The market in China is expected to hit USD 28.05 million in 2026, along with India projecting to hit USD 6.73 million and Japan to attain USD 13.00 million in 2026.

Rest of the World

The rest of the world is the fourth-largest region and expected to hit USD 16.25 million in 2025. The market in South America and the Middle East is still in the early stages of growth, and the demand for such novel ingredients is expected to increase in the future. In countries such as Brazil, Argentina, and others, several major manufacturers such as BASF SE, Chr. Hansen A/S has applied to the regulatory bodies of respective countries to receive approval and expand their market presence. Such initiatives will continue to increase further in the future for untapped markets and thus create enormous opportunities for organic growth in new markets for the manufacturers.

COMPETITIVE LANDSCAPE

Key Industry Players

Investments in Research and Development and Strategic Alliance Formation to Support Market Growth

The global market is a semi-consolidated market where multinational companies are investing in research and development to develop new products and launch new products. Manufacturing companies are embarking on the research and development of new sources and methods of production, which enables them to expand their product range. Another major strategy adopted by the companies includes partnerships and collaborations with related companies to improve their production capability and support market growth. Companies such as Prolacta Bioscience conduct clinical studies to assess the efficacy of their products, and successful studies of their compounds help to build consumer trust in their products.

To know how our report can help streamline your business, Speak to Analyst

DSM, BASF SE, Chr. Hansen A/S, part of Novonesis, FrieslandCampina, and International Flavors and Fragrances Inc. are some of the largest players in the market. The global market is moderately consolidated, with the top 5 players accounting for around 55% of the global human milk oligosaccharides market share.

List of Key Companies Profiled:

- Koninklijke DSM N.V. (Netherlands)

- BASF SE (Germany)

- Hansen A/S (Denmark)

- International Flavors and Fragrances Inc. (U.S.)

- KYOWA HAKKO BIO CO., LTD. (Japan)

- Dextra Laboratories (U.K.)

- Inboise N.V. (U.S.)

- ELICITYL S.A (France)

- Abbott Laboratories (U.S.)

- FrieslandCampina (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Nestle announced the launch of Human Milk Oligosaccharides-based infant milk products in the Chinese market. The product was launched under the “Wyeth Illume” brand.

- November 2023: Wyeth Nutrition launched an HMO growing-up infant formula, which was added to two HMOs in China as a part of its Illumina brand.

- November 2021: Abbott Nutrition launched HMO-based infant formula products under the brand name Similac 360 Total Care. This product is made of five HMOs and provides nutrition for a baby’s healthy growth and development.

- September 2020: Chr. Hansen Holding A/S acquired Jennewein Biotechnologie GmbH (“Jennewein”), one of the leading players involved in the production of Human Milk Oligosaccharides (“HMO”). This acquisition helped the company expand its product portfolio in the microbial and fermentation technology platforms.

- May 2019: BASF SE partnered with Glycosyn to develop and commercialize human milk oligosaccharides that can be used for the production of dietary supplements, functional nutrition, and medical food products.

Investment Analysis and Opportunities

The market report provides comprehensive investment analysis and opportunities aimed at providing investors and business leaders with actionable insights. The global market overview report highlights the various opportunities that have the potential for investments, including new product launches, technological advancements, mergers & acquisitions, and geographic expansions.

REPORT COVERAGE

The market report analyzes the market in-depth and highlights crucial aspects such as global human milk oligosaccharides market trends, prominent companies, HMO market trends, and applications. Besides this, the market statistics report also provides insights into the market trends and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.86% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Type

|

|

By Structure

|

|

|

By Application

|

|

|

By Region North America (by Type, by Structure, By Application and by country) · U.S. (By Application) · Canada (By Application) · Mexico (By Application) Europe (by Type, by Structure, By Application and by country) · U.K. (By Application) · Germany (By Application) · France (By Application) · Spain (By Application) · Italy (By Application) · Rest of Europe (By Application) Asia Pacific (by Type, by Structure, By Application and by country) · China (By Application) · India (By Application) · Japan (By Application) · Australia (By Application) · Rest of Asia Pacific (By Application) Rest of the World (by Type, by Structure, By Application and by country) · Brazil (By Application) · Argentina (By Application) · Israel (By Application) · Saudi Arabia (By Application) · Other Countries (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the worldwide market was USD 308.68 million in 2026 and is anticipated to reach USD 1405.51 million by 2034.

At a CAGR of 20.86%, the global market will exhibit steady growth over the forecast period.

By type, the 2’FL segment leads the market.

Growing demand for premium ingredients in infant nutrition products to support market growth.

DSM, BASF SE, Chr. Hansen A/S, part of Novonesis are the leading companies in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us