Industrial Furnace Market Size, Share & Industry Analysis, By Application (Metallurgy, Foundry, Metal Molding, and Others (Heat Treatment)), By Furnace Type (Electric furnaces, Gas or Fuel furnaces, Induction furnace, Vacuum Furnace, and Others (Muffle Furnace)), By End Users (Metals & Mining, Energy & Power, Oil & Chemicals, Transportation, and Others (Food Processing)), and Regional Forecast, 2026 – 2034

Industrial Furnace Market Size

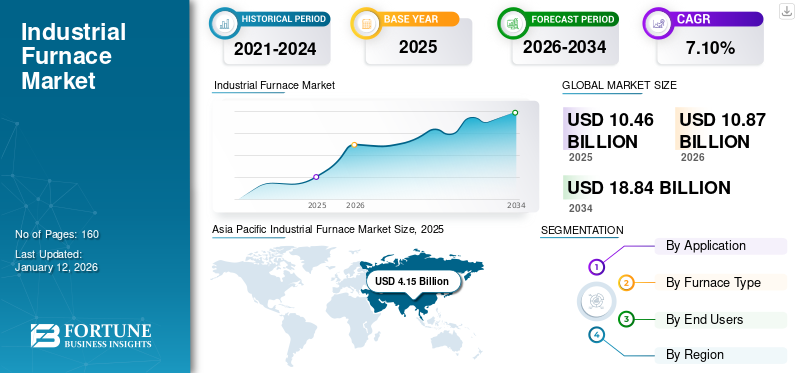

The global industrial furnace market size was valued at USD 10.46 billion in 2025. The market is projected to grow from USD 10.87 billion in 2026 to USD 18.84 billion by 2034, exhibiting a CAGR of 7.10% during the forecast period. Asia Pacific dominated the global market with a share of 39.70% in 2025.

Industrial furnaces are specialized heating units designed for various industrial processes as they are capable of providing high temperatures during manufacturing. These furnaces endure highly efficient heat conditions that can perform industrial operations proficiently. Operating industrial furnaces offer a diverse array of configurations and types that are customized to consumer needs and applications.

Global Industrial Furnace Market Overview

Market Size:

- 2025 Value: USD 10.46 billion

- 2026 Value: USD 10.87 billion

- 2034 Forecast Value: USD 18.84 billion

- CAGR: 7.10% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific with 39.70% market share in 2025

- Furnace Type Leader: Electric furnaces are projected to lead due to IIoT integration and energy efficiency

- Application Leader: Foundry segment dominates, driven by high throughput needs and simplified configuration

- End-User Leader: Metals & mining sector leads with extensive furnace use in steel and metal production

Industry Trends:

- Adoption of compact, vacuum-based furnaces in foundries for energy savings and space efficiency

- Rapid replacement of blast and fuel-based systems with electric arc and induction furnaces

- Strong integration of Industry 4.0 technologies like IIoT in furnace systems

- Expanding demand for stainless steel and ceramic applications in consumer and industrial sectors

Driving Factors:

- Rising global focus on carbon neutrality and demand for energy-efficient machinery

- Increased furnace adoption in electric arc, steel, aluminum, and specialty metal processing

- Technological advancements enabling faster heating cycles and easier system upgrades

- Government support and industrial investment in Asia Pacific fueling new manufacturing capacity

Global demand for modern engineering equipment and materials has raised the demand for non-corrosive and conductive materials such as steel and copper. These materials require high melting temperatures to convert from their raw form to useful entities. Primarily, the furnaces are used for industrial operations such as metal melting, forging, heat treatment, food processing, and others. The heating furnaces provide adequate temperature for melting, molding, and forging the metals into desired shapes and products. Thus, the growing use of stainless steel and the need for energy-efficient and carbon-neutral furnaces is bolstering the market demand.

The manufacturing industry faced a huge decline in investments for the second quarter of 2020 during the COVID-19 pandemic. The End Users of the heating furnace observed a huge drop in sales that hit the businesses of furnace manufacturers globally. Furthermore, the disturbed supply of the products to the foremost locations of users has been impacted by the high freight costs and import taxes that hit hard the businesses of industrial furnaces for the impact period. However, post-pandemic, a rise in sales has been observed due to the adoption of electric arc and induction furnaces.

Industrial Furnace Market Trends

Budding Trend of Compact Furnaces in Foundries to Boost Market Opportunities

The metal and mining industry is focusing on sustainable vacuum furnaces that help deliver more detailed engineering products and occupy less space and energy. Also, the global push toward sustainable and lesser emission industrial practices helps to switch to vacuum chamber furnaces. Adequate heating temperature and minimal greenhouse gas emission help in adopting the budding trend of compact furnaces in the foundry that offer quick heating and increased operational capabilities.

- For instance, in FY 2023, Carbolite Gero, a compact sustainable solution manufacturer, launched its compact front and loading furnaces specialized for the annealing process.

Download Free sample to learn more about this report.

Industrial Furnace Market Growth Factors

Growing Demand for Energy Efficient Electric Furnaces is Changing Dynamics of Manufacturing

Globally changing market conditions and increased focus on carbon neutrality are bolstering energy-efficient machinery equipment. Rising demand for energy-efficient heating furnaces due to increased focus on following sustainable practices in manufacturing. Also, the need for adequate and continuous heat supply in modern manufacturing solutions is bolstering the demand for electric furnaces. These industrial furnaces endure maximum heating temperatures with low electricity consumption, which is growing the demand for efficient industrial furnaces in overseas markets during the forecast period.

- For instance, in July 2023, Tenova, a global sustainable solution provider, completed a long-term contract with ORI Martin to replace the electric arc furnace.

RESTRAINING FACTORS

Strict Emission Norms and Stringent Regulation to Hamper Market Growth

Global environmental regulations have changed the demand for gas or fuel furnaces owing to the rising effect of harmful greenhouse gas emissions from industrial furnaces that have hampered the market demand for the short term. Furthermore, changing emissions norms and the need for efficient furnaces owing to high operational capabilities and strict regulations to cut down carbon emissions have reduced the demand for blast furnaces. However, technological advancements and efficient electric furnaces help sustain and grow the market.

Industrial Furnace Market Segmentation Analysis

By Application Analysis

Competent Functionalities of the Furnace Increases its Applications across Foundry

Heating furnaces have diverse applications, such as metallurgy, foundry, metal molding, and others (heat treatment).

Among these applications, foundry units dominate in terms of application with various industrial processes such as annealing, melting, drying, and other methods. The adoption across industries owing to less complicated configurations allows operators to work easily. Also, these features increase production efficiency by reducing heating time by half compared to any other fuel furnace, which enhances its further application in the metallurgy industry. The foundary segment is projected to dominate the market with a share of 39.01% in 2026.

Furthermore, the increasing use of metal products that offer a larger life cycle and rising demand for ceramic products among consumers in the home décor and tiling industry have been expanding the application of furnaces in metal molding and heat treatment.

By Furnace Type Analysis

Dominance of IIoT and Easy Upgradation to Bolster the Electric Furnace Demand

Furnaces across the industry have broadened into electric furnaces, gas or fuel furnaces, induction furnaces, vacuum furnaces, and others (muffle furnaces).

Changing carbon emission regulations has given a huge response to the adoption of electric arc furnaces. Electric furnaces are set to dominate the industrial furnace type segment owing to their easy-to-upgrade capability. Further, the addition of technologies such as Industry 4.0 and the industrial Internet of Things (IIoT) that minimize operational complications has extended the potential of electric arc furnaces in the long term. The gas or fuel furnaces segment is expected to lead the market, contributing 39.47% globally in 2026.

Further, induction furnaces are observed to follow stable growth owing to the growing adoption of specialized metal manufacturing applications such as steel.

- For instance, in October 2022, Andritz, an international technology group, acknowledged an order from Tatmetal, a leading steel manufacturer. The scope includes supplying a galvanizing furnace for their new hot-rolled and cold-rolled coating line.

Additionally, prominent growth of gas or fuel furnaces and other furnaces in India, South Africa, and other developing countries. The growth supporting factors such as limited infrastructure availability and minimal capital for upgradation help generate revenue during the forecast period.

By End Users Analysis

Growing Metal & Steel Manufacturing in Metal and Mining to Dominate End Users's Adoption

The furnace has prime adoption by prominent End Users: metal & mining, energy & power, oil & chemicals, transportation, and others (food processing).

Metal & mining is set to dominate the End Users segment with diverse applications in raw material pre-processing and frequent heat requirements for uniform temperature control in the metal products production. The metals & mining segment will account for 40.39% market share in 2026.

Furthermore, significant growth of energy & power owing to the prominent demand for furnaces in the coal pre-processing plants in power plants to increase calorific values helps grow revenue in the long term.

Also, oil & chemicals and other (food processing) are observed to grow steadily with increased demand for furnaces in heating and stirring operations among End Users. Moreover, the stable demand for furnaces for automotive parts manufacturing is growing the business globally. Thus, the demand for iron and steel among End Users is observed to grow prominently with the rise in capital expenditure and adoption, which will increase the industrial furnace market share during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Globally, industrial furnaces are the prime industrial equipment that generate revenue and provide cost-saving opportunities. The market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Industrial Furnace Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is set to dominate in terms of the adoption of industrial furnaces globally, and it is the epicenter for the manufacturing of steel and other specialized metals. Also, highly populated countries with skilled workforces, such as China, India, and Japan, are prominent markets that drive revenue for manufacturers. These countries hold a major market share in the global market owing to high domestic manufacturing and consumption of steel products. The Japan market is forecast to reach USD 0.80 billion by 2026, the China market is set to reach USD 2.04 billion by 2026, and the India market is likely to reach USD 0.58 billion by 2026.

China is estimated to hold the largest share and dominate the Asia Pacific market, with huge potential for upgradation as the majority of heating furnaces are operating on fuel. The upgradation to the electric furnace or another furnace from blast furnaces is a major revenue driver for furnace manufacturers. Additionally, India is observed to grow progressively with government initiatives and plans to boost domestic manufacturing and promote the ease of doing business. Also, Japan and other Asia Pacific regions are observed to grow steadily, with the majority of investments focusing on using less carbon emitting furnaces, which is driving industrial furnace market growth in the long term.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is set to grow progressively owing to the latest innovation and growth in demand for smart and efficient heating furnaces that are capable of providing adequate heat with minimal electricity consumption. Also, the U.S., which needs or produces steel to fulfill its domestic needs, is seeking an advanced furnace that can accommodate less space and provide quick heat for manufacturing operations. Moreover, the use of heating furnaces in food processing industries across Mexico and Canada is observed to comprehend stable growth. The U.S. market is estimated to reach USD 0.81 billion by 2026.

Europe

Europe is set to grow steadily with geo-political tensions and strict carbon emission norms in Germany, the U.K., Italy, France, and Russia. Demand for furnaces in the metal and mining industry is slow. The German manufacturing sector is observed to have a bolstered demand for industrial furnaces in the long term. However, the dominance of tool and automotive parts manufacturing across Italy, France, and the U.K. will drive growth in the long term. The UK market is expected to reach USD 0.60 billion by 2026, while the Germany market is anticipated to reach USD 0.71 billion by 2026.

The Middle East & Africa is estimated to grow at a stable pace owing to the manufacturing of steel and pipe in the region. Also, Africa, which has abundant natural resources, supports the growth of metal manufacturing in the long term.

Key Industry Players

Strengthen Portfolio and Push Towards Sustainable Goals to Lift EAF Demand in the Long Term

Key players operating in the market have blended the product mix very well, which has supplemented the End Users demand for less carbon-emitting furnaces. The majority of players in the market have strengthened their product portfolio with an efficient Electric Arc Furnace (EAF) that is optimized to save the operational cost of the stakeholders and get a Return on Investments (ROI) in a minimal period, as are the key performer indexes (KPIs) for manufacturers of industrial furnaces. These positive improvements by major players are estimated to drive the market size in the forthcoming period.

- For instance, In March 2023, Tenova, a leading sustainable engineering solution supplier, bagged an order for the advanced EAF equipped with an electromagnetic stirrer that will increase production capacity to 950,000 tons from the single furnace.

List of Top Industrial Furnace Companies:

- Andritz ag (Austria)

- Danieli (Italy)

- Tenova (Italy)

- Carbolite Gero (U.K.)

- Daido Steel Co. Ltd. (Japan)

- ULVAC Inc. (Japan)

- DOWA Thermotech Co. Ltd (Japan)

- SMS Group GmbH (Germany)

- Abbott Furnace Inc. (U.S.)

- Surface Combustion Inc. (U.S.)

- The Grieve Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: SMS Group modernizes the Calaca steel mill of SteelAsia Manufacturing Corp., Philippines' leading steel producer. The modernization of EAF will increase plant output by 20% by utilizing 100% renewable energies.

- December 2022: Tenova has completed the installation and commissioning of the Twin Chamber Melting Furnace (TCF) for aluminium recycling. Tenova can optimize the production of TCF furnaces at E-max billets in Kerkrade, Netherlands.

- November 2022: Tenova, a leading furnace manufacturer, has installed its state-of-the-art Walking Beam Furnace (WBF) for ThyssenKrupp at Europe’s biggest steel plant in Duisburg. The plant has a capacity of five million metric tons and mainly serves European automotive giants.

- November 2022: Can-Eng Furnaces International Limited, an engineering solution provider, has received a contract to commission a Continuous Quench (CQ) and Temper furnace system for a prominent North American manufacturer of mining and material handling products.

- April 2022: Furnace Juko Co., Ltd., a prominent Japanese furnace manufacturer, has developed a new technology for hardening that offers rapid air cooling. The company’s new T7 heat treatment furnace, which was developed for aluminum die-cast products, is equipped with elevated-type rapid air coolers that prevent hardening delays.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application, Furnace Type, End Users, and Region |

|

Segmentation |

By Application

By Furnace Type

By End Users

By Region

|

Frequently Asked Questions

The market is projected to reach USD 18.84 billion by 2034.

In 2025, the market was valued at USD 10.46 billion.

The market is projected to grow at a CAGR of 7.10% during the forecast period.

The electric furnace segment is expected to lead the market.

The growing demand for energy-efficient electric furnaces is changing the dynamics of manufacturing, which are the key factors driving market growth.

Andrit, Danieli, Tenova, Carbolite Gero, Daido Steel Co. Ltd., ULVAC Inc., DOWA Thermotech Co. Ltd, SMS Group GmbH, Abbott Furnace Inc., Surface Combustion Inc., The Grieve Corporation are the top players in the market.

Asia Pacific is expected to hold the highest market with a share of 39.70% in 2025.

By application, the foundry segment is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us