Automotive Air Suspension Market Size, Share & Industry Analysis, By Component (Air Spring/Airbag, Compressor, Tank, and Others), By Type (Electronic and Non-electronic), By Propulsion (ICE and EV), By Vehicle Type (PC & Vans and Buses & Trucks), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

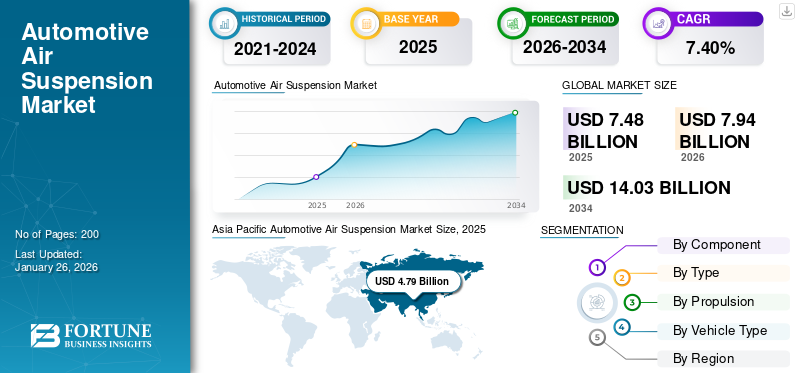

The global automotive air suspension market size was valued at USD 7.48 billion in 2025. The market is projected to grow from USD 7.94 billion in 2026 to USD 14.03 billion by 2034, exhibiting a CAGR of 7.40% during the forecast period. Asia Pacific dominated the global market with a share of 64.03% in 2025. Additionally, the automotive air suspension market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.45 Billion By 2032.

Air suspension, also known as air ride suspension or pneumatic suspension, is a type of vehicle suspension system that uses air as the spring medium instead of conventional metal springs. As a replacement for metal coil springs or leaf springs, air suspension systems use air-filled bellows or airbags, often made of reinforced rubber or other flexible materials. A compressor is used to pump air into air springs, inflating them and adjusting the suspension’s firmness or ride height. Air suspension systems still include other traditional components, such as shock absorbers, bushings, and control arms, to control and dampen the suspension movement.

Download Free sample to learn more about this report.

Global Automotive Air Suspension Market Overview:

Market Size:

- 2025 Value: USD 7.48 billion

- 2026 Value: USD 7.94 billion

- 2034 Forecast Value: USD 14.03 billion, with a CAGR of 7.40% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific held the largest market share at 64.03% in 2025, driven by rising demand for electric vehicles, favorable government policies, and infrastructure development.

- Fastest-Growing Region: Middle East & Africa is expected to grow rapidly, supported by increasing demand for luxury vehicles and electric mobility.

- Vehicle Type Leader: Buses & Trucks led the market in 2023, due to regulatory requirements and enhanced driver/passenger comfort needs.

Industry Trends:

- Smart Suspension Integration: Air suspension systems are increasingly integrated with adaptive damping, electronic stability control, and active body control technologies.

- Material Innovation: Use of advanced materials like Thermoplastic Polyurethane (TPU) and fiber-reinforced composites to improve durability and performance.

- Predictive Capabilities: Adoption of AI algorithms and machine learning for predictive suspension control to enhance ride comfort.

- Driving Factors:

- Luxury Vehicle Demand: Rising disposable incomes and consumer preference for premium comfort features drive adoption of air suspension systems in luxury cars.

- Electric Vehicle (EV) Adoption: Need for load balancing and ride optimization in EVs contributes to increased installation of air suspension systems.

Automotive air suspension market growth will be driven by superior operational characteristics over the next few years. One of the main advantages of air suspension is the ability to adjust the vehicle’s ride height. By increasing or decreasing the air pressure in the air springs, the ride height can be adjusted as needed. Automotive air suspension systems generally provide a smoother and more comfortable ride than traditional steel springs. They can absorb road imperfections and vibrations, resulting in a more luxurious and compliant ride quality.

Automotive air suspension systems can automatically adjust the air pressure in the air springs to compensate for varying loads, such as passengers or cargo. This helps maintain a consistent ride height and improve stability, even when the vehicle’s distribution changes. Adjusting the firmness of air springs and air suspension can minimize body roll during cornering, resulting in improved handling and stability. Automotive air suspension systems can support higher loads than traditional suspension systems by increasing the air pressure in the air springs, making them suitable for heavy-duty applications.

The automotive industry faced widespread production shutdowns and supply chain disruptions due to lockdowns imposed during the COVID-19 pandemic. This led to a decrease in demand for automotive air suspension systems. The air suspension market relies on various components, such as air springs, compressors, and sensors. Disruptions in the supply chain affected the availability of these components, impacting the production and supply of automotive air suspension systems.

Automotive Air Suspension Market Trends

Technological Developments Will Bolster the Automotive Air Suspension Market Growth

Some advanced automotive air suspension systems integrate ride control functions with other vehicle systems, such as adaptive damping, active roll control, and electronic stability control. This integration allows for coordinated adjustments and optimized performance, enhancing overall vehicle dynamics and stability. Air suspension with active body control technology combines air suspension with active body control systems, which use sensors and actuators to counteract body movements and vibrations. This can result in improved ride comfort, reduced body roll, and enhanced handling, particularly in demanding driving conditions.

Automotive air suspension system manufacturers are exploring the use of new materials, such as Thermoplastic Polyurethane (TPU) and fiber-reinforced composites for air springs. These materials offer improved durability, resistance to environmental factors, and better performance compared to traditional rubber air springs. Few manufacturers are implementing predictive algorithms and machine learning techniques to anticipate road conditions and adjust the suspension accordingly, providing a smoother and more comfortable ride.

Automotive Air Suspension Market Growth Factors

Rising Demand for Luxury Vehicles to Drive Market Growth

Luxury and premium vehicles are associated with superior comfort, advanced features, and a more refined driving experience. Air suspension systems offer a plush and comfortable ride by effectively absorbing road imperfections and minimizing vibrations. This enhanced ride comfort is a key selling point for luxury and premium vehicle buyers who prioritize a refined driving experience. Many luxury vehicles feature air suspension systems that allow the ride height to be adjusted based on driving conditions or personal preferences. This capability contributes to improved aerodynamics, better handling, and increased ground clearance when needed.

In addition, to improve ride comfort, air suspension systems can enhance handling and performance by reducing body roll during cornering and providing adjustable ride firmness settings, appealing to luxury vehicle buyers seeking a more dynamic driving experience. As disposable incomes rise, there is an increasing demand for luxury vehicles. Automakers are responding by offering more advanced features, such as air suspension systems, to cater to the expectations and preferences of this growing customer base.

RESTRAINING FACTORS

High Costs and Maintenance Requirements to Hinder Market Growth

Air suspension systems are more expensive than conventional coil springs or leaf spring suspension systems. The additional components, such as air springs, compressors, sensors, and electronic control units, contribute to higher manufacturing and maintenance costs, which can be a deterrent for some automakers and consumers, especially in the mass-market vehicle segments.

Air suspension systems are more complicated than traditional suspension systems, with multiple components and intricate air line routing. This complexity leads to higher maintenance costs and potential reliability issues if not properly maintained. Regular inspections, airline checks, and component replacements may be required, adding to the overall ownership costs.

Automotive Air Suspension Market Segmentation Analysis

By Component Analysis

Superior Load Levelling Capabilities and Improved Ride Quality Propel the Demand for Air Springs/Airbags

By component, the market is segmented into air spring/airbag, compressor, tank, and others.

Air spring segment will dominate the market during the forecast period with a share of 50.36% in 2026. Air springs serve as the primary spring element in an air suspension system, providing the necessary suspension travel and absorbing the forces generated by the vehicle’s weight and road inputs. One of the critical advantages of air springs is their ability to adjust the air pressure to compensate for varying loads automatically. This load-leveling feature ensures that the vehicle maintains a consistent ride height and improved stability, even when carrying different loads or passengers.

The compressor segment will grow at a steady pace during the forecast period. The compressor is used for supplying compressed air to the air springs, which is the primary medium that provides the suspension’s spring action. Without the compressor, the air springs would not be able to maintain the required air pressure to support the vehicle’s weight and absorb road inputs. Modern air suspension systems often use high-speed or high-output compressors that can quickly inflate or deflate air springs.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Electronic Segment Lead the Market Due to Automatic and Real-Time Adjustments

The market is split into electronic and non-electronic within the type segment.

Electronically Controlled Air Suspension (ECAS) leads and is an advanced type of air suspension system that uses electronic control units and sensors to adjust the air pressure in air springs automatically. This system provides improved ride quality and handling across a wide range of scenarios. Moreover, it offers enhanced load-leveling capabilities and better stability when carrying varying loads. These systems are generally found in luxury and high-performance vehicles.

The non-electronic air suspension segment is expected to dominate the majority of the market during the forecast period, contributing 85.32% globally in 2026. Non-electronic air suspension systems, also known as manually controlled or analog air suspension systems, are more traditional and more straightforward implementations of air suspension technology compared to Electronically Controlled Air Suspension (ECAS) systems. These systems are commonly found in trucks, buses, and trailers owing to their excellent load-leveling capabilities and adjustable ride height.

By Propulsion Analysis

Superior Weight Distribution Management Propels the Electric Vehicle Segment Growth

The market is divided into ICE and EV within the propulsion segment.

Electric vehicle segment is expected to dominate by the end of the forecast period, accounting for 68.13% market share in 2026. The use of air suspension systems in EVs (electric vehicles) is gaining traction. Electric vehicles have a different weight distribution compared to conventional ICE vehicles due to the placement of heavy battery packs. Air suspension systems can help compensate for this weight distribution by adjusting the air pressure, ensuring proper load balancing, and optimal handling characteristics. These systems can interface with ADAS features, such as adaptive cruise control and lane-keeping assistance, by adjusting the vehicle’s ride height and leveling based on sensor inputs, improving the performance of these systems.

Air suspension systems are used in a few ICE (internal combustion engine) vehicles, particularly in heavy duty vehicles. These systems provide a smoother and more comfortable ride by absorbing road imperfections and vibrations better than traditional steel springs. Airbags can adjust their stiffness based on the vehicle’s load and driving conditions.

By Vehicle Type Analysis

Improved Driver Comfort and Regulatory Requirements Will Drive Market Growth within Buses & Trucks

The market is categorized into PC & vans and buses & trucks within the vehicle type segment.

Buses & trucks will dominate the market growth within the forecast period, with a share of 50.49% in 2026. The use of air suspension systems in buses & trucks has been increasing in recent years due to several advantages these offer over traditional suspensions. One of the key advantages of air suspension is to adjust the vehicle’s ride height based on the load. This is crucial for trucks and buses, which often carry varying loads. Many buses equipped with air suspension have a kneeling feature that allows the vehicle to lower its ride height when stopped, making it simpler for passengers to board and exit the bus. The positive outlook of commercial vehicle sales will augment the segment’s growth in the future.

Few luxury cars allow drivers to customize the air suspension settings according to their preferences, such as a comfort or sport mode. These systems have become increasingly popular in luxury cars, including Mercedes-Benz, Audi, BMW, and Lexus, among others. As the technology continues to improve and become cheaper, it may see broader adoption in non-luxury car segments as well.

REGIONAL INSIGHTS

Geographically, the market is divided into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific Automotive Air Suspension Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific captured the largest automotive air suspension market share. The interest in electric vehicles has been on the rise in Asia Pacific in recent years, driven by various factors, such as government policies and technological advancements. Several countries in the region have implemented multiple incentives and policies to encourage the adoption of electric vehicles. These include subsidies, tax rebates, and strict emission regulations, making EVs more affordable and attractive to consumers. Governments and corporations in Asia Pacific are investing in the development of charging infrastructure, which is crucial for the adoption of EVs, thereby leading to market growth. The Japan market is projected to reach USD 0.75 billion by 2026, the China market is projected to reach USD 3.61 billion by 2026, and the India market is projected to reach USD 0.41 billion by 2026.

Europe will capture considerable market share during the forecast period. Europe has traditionally been a strong market for luxury vehicles, and the demand remains high in the region. Europe has a large and affluent customer base with a significant proportion of high-net-worth individuals. Moreover, it is home to several well-established and globally renowned luxury car brands, such as Mercedes-Benz, BMW, Audi, and Jaguar. These brands have a strong presence and loyal customer base, boosting the demand for luxury cars. The UK market is projected to reach USD 0.13 billion by 2026, while the Germany market is projected to reach USD 0.36 billion by 2026.

North America will grow at a steady rate over the next few years owing to high demand for buses & trucks. The demand for buses and trucks has been steadily increasing in North America, driven by various factors, such as economic growth, infrastructure development, and the rise of e-commerce & logistics industries. The growth of e-commerce has considerably increased the demand for delivery trucks and logistics services. The U.S. market is projected to reach USD 0.72 billion by 2026.

The Middle East & Africa will grow at a rapid pace during the forecast period. The high demand for luxury cars, coupled with the advent of technology, will drive the growth of air suspension in the future. Moreover, the favorable trends associated with electric vehicles will support the industry's growth over the next few years.

List of Key Companies in Automotive Air Suspension Market

Technological Advancements Will Play Key Role in Competitive Landscape

The automotive air suspension market is composed of several key players with large customer bases. These players are adopting various strategies, such as product differentiation & development, high investment in research & development activities, and expansion of sales and distribution networks to gain competitive advantages. Moreover, these players are collaborating with automotive OEMs to integrate technological advancements, which will help provide them with a strong foothold in the market.

LIST OF KEY COMPANIES PROFILED:

- ZF Friedrichshafen AG (Germany)

- Continental AG (Germany)

- ThyssenKrupp AG (Germany)

- SAF Holland (Germany)

- Hendrickson International (U.S.)

- Firestone Industrial Products Company, LLC (U.S.)

- Vibracoustic SE (Germany)

- HL Mando Corporation (South Korea)

- Hitachi Astemo Ltd. (Japan)

- AccuAir Control Systems, L.L.C. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2021 – Continental AG announced that it will supply air suspensions and compressors to independent workshops as original parts.

- September 2021 – Continental AG expanded its product portfolio in the automotive spare parts category with the launch of air suspension dampers, compressors, and thermostats.

- April 2021 – SAF Holland unveiled the CBX AeroBeam Fixed Frame Air Suspension System. This will aid in saving an additional 62 pounds per axle by specifying an optional super lightweight disc brake wheel end package.

- July 2020 – SAF Holland announced that it won a contract to supply the rear drive air suspensions for the new VW Electric Truck in Brazil.

- March 2019 – ZF Friedrichshafen AG signed a definitive agreement to acquire WABCO for USD 7 billion. This acquisition will help the company to provide added value to commercial vehicle customers.

REPORT COVERAGE

The automotive air suspension market research report provides a detailed analysis of the industry and focuses on key aspects such as leading companies, product types, end-users, design, and technology. Besides this, the report offers in-depth analysis and insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.40% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Type

By Propulsion

By Vehicle Type

By Geography

|

Frequently Asked Questions

Fortune Business Insights says the global market size was valued at USD 7.48 billion in 2025 and is projected to reach USD 14.03 billion by 2034.

The market is expected to grow at a CAGR of 7.40% during the forecast period (2026-2034).

Favorable trends associated with e-commerce are expected to drive global market growth.

Asia Pacific led the global market in 2025 and is estimated to exhibit solid growth over the forecast period.

The EV or electric vehicle is the leading segment of the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us