Luxury Car Market Size, Share & Industry Analysis, By Vehicle Type (SUV, Sedan/Hatchback, Sports/Super Luxury Cars), By Propulsion (Electric/Hybrid, ICE), By Component (Drivetrain, Interior, Body, Electronics, and Chassis), and Regional Forecast, 2025 – 2032

KEY MARKET INSIGHTS

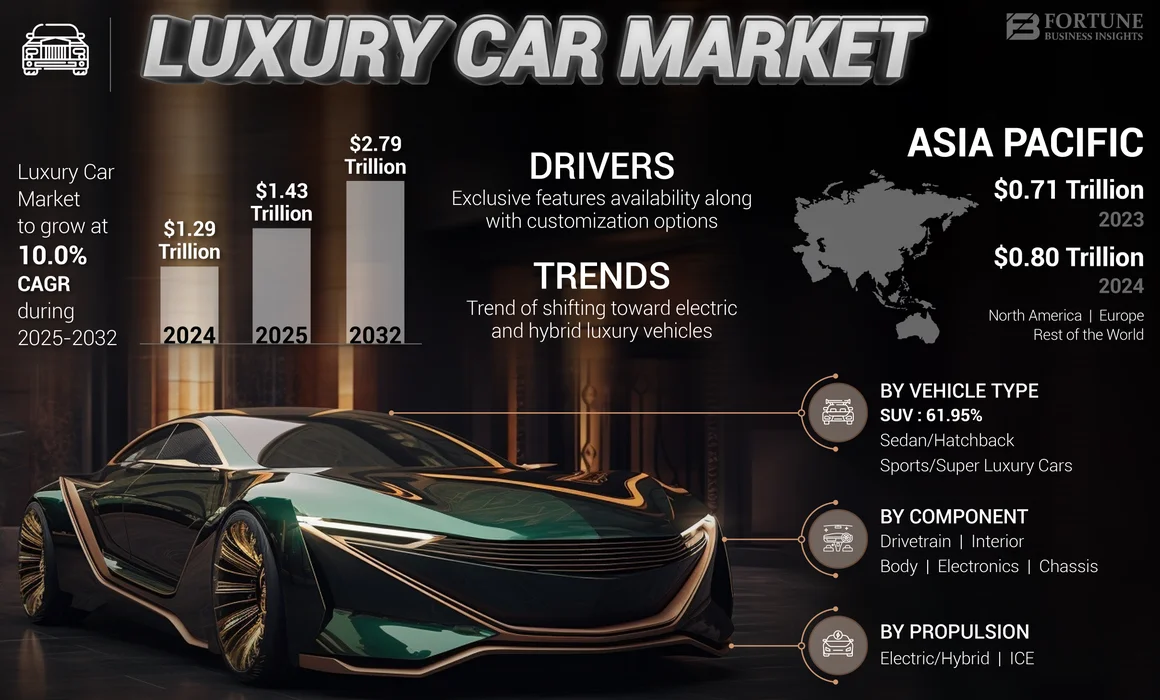

The global luxury car market size was valued at USD 1.29 trillion in 2024 and is projected to grow from USD 1.43 trillion in 2025 to USD 2.79 trillion by 2032, exhibiting a CAGR of 10.0% during the forecast period. Asia Pacific dominated the global market with a share of 62.02% in 2024.

Luxury cars are vehicles that prioritize advanced technology, exceptional performance, and high-quality materials provided with passenger and driver comfort. These types of cars are designed to provide a superior driving experience, equipped with cutting-edge features and amenities, and cater to the demand for comfort and luxury along with performance required for an affluent buyer. These cars optimally boast elegant and sleek exteriors, and luxurious interiors, adorned with premium materials such as fine leather and wood trim provided with high-end finishes.

The current trend for the luxury cars segment is that automobile manufacturers focus on electric and hybrid technologies to cater to the rising demand for environmentally friendly vehicles, fueling the market. However, luxury vehicles often have powerful engines in large sizes, which consume more fuel. This creates a restraint in the market. Although technological advancement in the automotive industry caters to fuel efficiency and connectivity technology drives the market over the forecast period.

The COVID-19 pandemic led to a drop in consumer confidence in discretionary spending, which decreased demand for luxury vehicles. Economic uncertainties, provided with job losses and financial constraints, affected the purchasing power of potential buyers. This resulted in people postponing buying luxury vehicles during the pandemic. Furthermore, the automotive industry faced production delays causing limited availability of luxury vehicle models.

Luxury Car Market Trends

Trend of Shifting Toward Electric and Hybrid Luxury Vehicles Thrives Market Growth

One of the major luxury car market trends is manufacturers shifting toward electric and hybrid vehicles. Luxury vehicle manufacturers are actively focusing on expanding their electric vehicle portfolios. They are developing all-electric models or hybrid variants of their existing models to cater to the demand for environment-friendly transportation. This trend aligns with the goal of reducing carbon emissions and transitioning toward cleaner energy sources.

Luxury brands are also constantly developing high-performance vehicles, which are further aimed to be integrated with electric luxury vehicles. In March 2023, Mercedes-Benz tested the launch of its ultra-luxury brands’ vehicle, the Mercedes-Maybach EQS SUV. In April 2023, Mercedes-Benz planned to launch four electric vehicles in the next eight to twelve months. With this initiative, the company aims to accelerate its electric mobility drive, with around 25% of its vehicle sales being EVs by 2027.

Download Free sample to learn more about this report.

Luxury Car Market Growth Factors

Exclusive Features Availability along with Customization Options Drives the Market

Luxury vehicle brands are renowned for their commitment to engineering excellence, superior performance, and meticulous craftsmanship. Affluent consumers appreciate the precision engineering, advanced technologies, and high-quality materials used in luxury vehicles. The endurance of exceptional performance, refined driving experience, and luxurious interiors surge the demand for these types of cars in the market.

Further, luxury vehicle manufacturers provide a wide range of exclusive features and customization options. They offer technologies from bespoke interiors and premium audio systems. ADAS, to unique paint finishes, according to buyers' or consumers’ needs and requirements. Thus the availability of exclusive features along with customization options thrives the luxury car market growth.

For instance, in October 2023, Lucid launched the Lucid Air Pure RWD, completing the Air model lineup. The Air Pure features a driving range of 410 miles, an elegant design, and is priced at USD 77,400. The standard features in the vehicle include Apple CarPlay, a 34-inch curved Glass Cockpit display, heated front seats, nighttime illumination from Lucid's patented Micro Lens Array LED headlights, the DreamDrive constellation of advanced driver assistance systems (ADAS), and the Lucid UX digital environment.

In October 2022, Cadillac launched an all-electric ultra-luxury SUV, which comprises several features. The vehicle includes adaptive air suspension, active rear steering, magnetic ride control 4.0, advanced AWD, active roll control, active rear spoiler, ride-focused tires, and 5-link front & rear suspension.

RESTRAINING FACTORS

Economic Downturn and Uncertainty Hinders the Market Development

Luxury vehicles are high-priced products, so their demand is sensitive to economic fluctuations. During economic downturns, consumer confidence and spending power often decrease. Affluent consumers may postpone or reduce their purchases of high-end cars as they prioritize essential expenses or become more cautious with their discretionary spending.

While these types of restraints exist, the employment of new strategies from manufacturers mitigates the impact on the market. The manufacturers invest in innovations to offer diverse product portfolios to adapt to the changing consumer preferences and sustain the market, which will further fuel market growth.

Luxury Car Market Segmentation Analysis

By Vehicle Type Analysis

Various Advanced Feature of SUVs Helped Segment to Lead Market Share

Based on vehicle type, the market is classified into sedan/hatchback, SUV, and sports/super luxury cars.

SUVs led the vehicle type segment with a major market share in 2024. Sport Utility Vehicles (SUVs) offer spacious interiors, ample cargo capacity, and versatile seating arrangements, attracting consumers who have practicality and functionality. Luxury SUVs combine luxury features and practicality, allowing owners to enjoy a premium driving experience while accommodating their lifestyle needs. This propels the growth of the luxury SUVs segment. In March 2023, Porsche planned to launch a luxury electric SUV to tap the growing luxury vehicle demand in the U.S. and China.

Sedans/hatchbacks offer practically ample cargo space and passenger seating capacity. Buyers prioritizing functionality and everyday usability often choose luxury sedans and hatchbacks over other body types in the luxury vehicle market.

The sports/super luxury cars segment growth is attributed to the exceptional performance, cutting-edge technologies, and unique design of these types of vehicles. They offer high-speed acceleration with precise handling and advanced features that cater to consumers seeking luxury and extraordinary driving experience. In August 2023, Lucid unveiled its luxury electric super-sports sedan, the Lucid Air Sapphire. This luxury car is fully electric, achieving 0 to 60 mph in 1.89 secs, 0 to 100 mph in 3.84 secs, and a quarter mile in around 8.95 secs, having a top speed of 205 mph. It features three motors, four driving modes, carbon-ceramic brakes, an aerodynamic package, sports seats, track-tuned suspension, and others. The estimated driving range is 427 miles.

To know how our report can help streamline your business, Speak to Analyst

By Propulsion Analysis

Advanced Features in Electric Vehicles Boost the Segment Development

Based on propulsion, the market is bifurcated into electric/hybrid and ICE.

Electric/hybrid luxury vehicles are equipped with advanced technologies, such as high-capacity batteries, regenerative braking systems, and others, that provide smooth acceleration and quiet operation. This augments the demand for luxury electric cars in the market. In April 2023, Mercedes-Benz launched four new luxury electric vehicles EV in India. The company expects to acquire 25% of India’s total electric vehicle sales by 2027.

On the other hand, ICE-based luxury vehicles offer a wide range of customization, allowing buyers to tailor their vehicles to their specific preferences, from engine specifications to exterior design features. This fueled the market growth of internal combustion engines of ICE-based luxury vehicles.

By Component Analysis

Drivetrain Segment to Dominate due to Rapid Improvement in Connectivity Technologies

Based on component, the market is considered into drivetrain, interior, body, electronics, and chassis.

The demand for high-performance drivetrains, which deliver exceptional power, acceleration, and dynamic handling characteristics in luxury vehicles, actuates the dominance of the segment in the market.

The growth of the electronics segment in the market is attributed to the advancement in connectivity and digital services, ADAS technology, autonomous driving technology, and integration of IoT in luxury vehicles, propelling the segmental growth. In February 2023, Mercedes-Benz partnered with Google to develop branded navigation using new in-car geospatial data and navigation capabilities from the Google Maps Platform.

The interior, body, and chassis segments are anticipated to meet the requirements of comfort, ergonomics, safety, styling, and design in a luxury vehicle, which creates its brand image and prestige. These factors drive the manufacturers to innovate and develop new technologies related to the segment, which fuels the market growth.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific Luxury Car Market Size, 2024 (USD Trillion)

To get more information on the regional analysis of this market, Download Free sample

North America, particularly in the U.S., has relatively high disposable income and a decent number of ultra-high net worth individuals. This creates a significant consumer base with the financial means to purchase luxury brand vehicles which fuels the market growth in the region.

The Europe market is primarily driven by the presence of prestigious automotive brands such as BMW, Mercedes-Benz, Audi, and Rolls-Royce, which contribute to the strong demand for luxury segment cars. Thus driving the market growth in the region.

Asia Pacific held the leading luxury car market share in 2024. The development is attributed to the rapid economic growth in the region, leading to increasing disposable income and thus creating demand for the luxury segment cars in the region. In January 2022, Lamborghini, a super luxury segment car manufacturer, recorded its sales in 2021 in India, which was 69 units. The Company witnessed a growth of 86% in the country, which fuels the market growth of luxury vehicles in the Asia Pacific region.

The rest of the world includes the Middle East & Africa and Latin America. The demand for the luxury segment in automobiles in these regions is due to the government and business demand, purchasing luxury vehicles for their fleets. Moreover, increasing tourism in the region with high-value vehicle demand thrives the demand for the market in the region.

Key Industry Players

Companies are Emphasizing the Building Unique Selling Propositions to Attract More Customers

The major players in this market have each of its unique selling propositions and strategies to differentiate themselves. The key players in the market compete in terms of design, performance, technology, brand reputation, customer service, and pricing. Some of the leading players in the market are Mercedes-Benz, BMW, Audi, Lexus, and others.

List of Top Luxury Car Companies

- Mercedes-Benz (Germany)

- Audi (Germany)

- BMW (Germany)

- Lexus (Japan)

- Porsche (Germany)

- Jaguar Land Rover (U.K.)

- Cadillac (U.S.)

- Maserati (Italy)

- Volvo (Germany)

- Genesis (South Korea)

KEY INDUSTRY DEVELOPMENTS

- November 2023 - Lotus Technology Inc., a leading luxury electric vehicle manufacturer, signed agreements worth USD 870 million within private investment in public equity (PIPE) funding. The funding is procured for the completion of its planned business combination with the (LCAA) L Catterton Asia Acquisition Corp.

June 2023 - Aston Martin signed a partnership with the Lucid Group, a leading electric vehicle technologies company. The deal aims at accelerating the high-performance electrification of vehicle strategy for long-term growth. Through this partnership, Aston Martin aimed at developing a battery electric vehicle (BEV) using the powertrain and battery technology offered by Lucid. - April 2023 – Lucid Air has been recognized as the luxury vehicle of the year. Known for its long EV range, the luxury electric car won the award at the 2023 New York International Auto Show, chosen from the entry list of 16 luxury vehicles.

- May 2023 – Aston Martin revealed the limited edition version of DBX707, which is named the AMR23 Edition. The supercar is provided with a 697-horsepower exterior design stirred by its Formula One car.

- May 2023 – Mercedes-Benz achieved the leading position in luxury vehicle sales in India. The brand’s BMW 3 Series was recorded as the best-selling car, and the E-Class LWB was the top-selling vehicle of Mercedes-Benz.

- July 2021 – Bugatti, Rimac, and Porsche formed a joint venture, Bugatti Rimac. Through the Joint Venture, the companies will focus on shifting toward electric vehicle technology.

- January 2023 – Tesla paced up to the leading position in the U.S. automotive market. The brand’s vehicles have dominated the luxury segment in sales volume in the U.S. market.

REPORT COVERAGE

The report provides a detailed analysis of the global market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.0% from 2025 to 2032 |

|

Unit |

Value (USD Trillion) Volume (Units) |

|

Segmentation |

By Vehicle Type

|

|

By Propulsion

|

|

|

By Component

|

|

|

By Geography

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 1.29 trillion in 2024.

The market is likely to develop at a CAGR of 10.0% over the forecast period (2025-2032).

The market size in Asia Pacific stood at USD 0.80 trillion in 2024.

Exclusive feature availability, along with customization options, drives the market.

Some of the top players in the market are Mercedes-Benz, BMW, and Audi.

Asia Pacific led the market in 2024.

Economic downturns, uncertainty, and the high cost of these cars hinder market development.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us