Identity and Access Management Market Size, Share & Industry Analysis, By Component (Access Provisioning, Directory Services, Single Sign-On, Password Management, Multifactor Authentication, Audit, Compliance, & Governance, and Others), By Type (Customer IAM and Workforce IAM), By Deployment (Cloud and On-Premise), By Enterprise Type (Small & Medium Enterprises (SMEs) and Large Enterprises), By Vertical (BFSI, IT and Telecom, Retail and Consumer Goods, Government, Energy and Utilities, Education, Manufacturing, Healthcare and Life Sciences, and Others), and Regional Forecast, 2026-2034

IAM Market Analysis

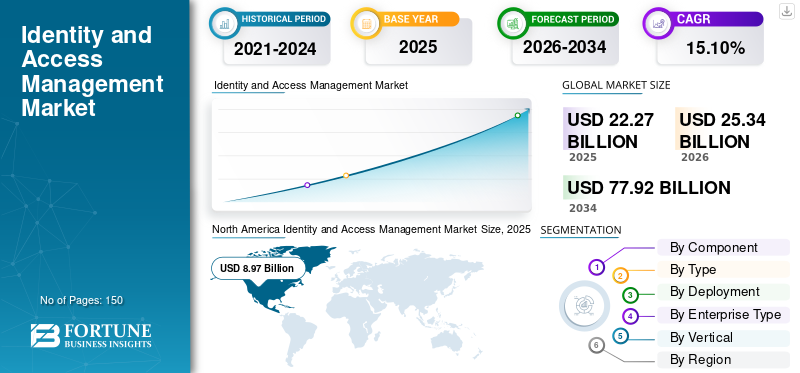

The global identity and access management market size was valued at USD 22.27 billion in 2025. The market is projected to grow from USD 25.34 billion in 2026 to USD 77.92 billion by 2034, exhibiting a CAGR of 15.10% during the forecast period. North America dominated the global market with a share of 40.30% in 2025.

The demand for identity and access management solutions is gaining traction due to rising regulatory compliances and security concerns. Additionally, growing cloud adoption is one of the major factors responsible for the growth of the market. The integration of advanced technologies such as Blockchain and artificial intelligence into IAM solutions is expected to boost the growth of the market in the coming years. Small and medium-sized enterprises are adopting IAM solutions to comply with regulatory requirements that are anticipated to fuel the growth of the market. Additionally, the increasing instances of scams and cybercriminal acts are pushing companies to adopt IAM systems due to the swift move toward cloud computing and the development of new technologies.

Enterprises are focusing on increasing funding to accelerate product demand and growth in the market. For instance,

- In October 2023, Aembit, a Workload identity and access management startup, raised USD 16.6 million in seed funding from CrowdStrike Falcon Fund. Through this partnership, the company aimed to deliver its Zero Trust strategy by assessing workloads' identities and health before permitting access to sensitive data resources.

The COVID-19 pandemic impacted business operations across the globe. Owing to the pandemic, organizations adopted remote work culture practices and cloud technology to mitigate the impact on business operations. However, the rising adoption of cloud and remote work increased data protection and privacy concerns for many organizations. Additionally, the economic disruptions caused by the COVID-19 pandemic led to a rise in cybercrimes and identity frauds, which boosted the adoption of IAM solutions amid the pandemic.

IMPACT of GENERATIVE AI

Gen AI Integrated IAM Solutions Enhance the Authentication and User Verification Process to Secure the Organizations Data

The emergence of generative artificial intelligence (AI) is set to transform the field of Identity and Access Management (IAM) within the rapidly evolving terrain of cybersecurity and data safeguarding. By enhancing the functionalities of IAM systems, generative AI presents a potential solution for companies grappling with the challenge of securing confidential information while preserving seamless user interactions. Integrated Gen AI with IAM solutions helps to strengthen the authentication and user verification processes to reduce unauthorized access attempts.

- For instance, in January 2024, Tuebora launched “Ask Tuebora,” a generative AI-based tool for identity and access management that streamlines tasks and enhances operational productivity.

As businesses worldwide increasingly prioritize the security of sensitive data, IAM is considered a critical component for ensuring appropriate access management.

Identity and Access Management Market Trends

Adoption of Blockchain Technology in Identity Management to Tackle Authentication and Authorization Issues

Blockchain-based identity and access management (IAM) services have potential to shift the conventional IAM approaches. Nowadays, web services and application are increasingly consist of decentralized applications and distributed networks. Hence, deployment models are consistently evolving, with technology innovation forces to shift on-premise deployments to the cloud.

- According to recent studies, the upcoming IAM deployments will be based on a flexible shared infrastructure to support multiple independent code and platform integrations.

The emergence of blockchain technology facilitates secure and transparent identity management platforms to protect personal and organizational identities from cyberattacks and fraudulent activities. By leveraging the benefits of identity authentication and secure access provided by Blockchain integrated IAM systems, governments and organizations are investing in these solutions.

In addition, blockchain-based IAM systems assist in reducing the cost and operational risks by eliminating intermediaries, data and replicated identity repositories. Such rising adoption of blockchain technology is expected to foster the demand for such systems in the coming years.

Download Free sample to learn more about this report.

Identity and Access Management Market Growth Factors

Growing Security Concern among Organizations to Boost Market Growth

Rising cybercrimes and fraudulent activities owing to the rapid adoption of cloud and similar emerging technologies across organizations have pushed organizations to incorporate IAM systems.

IAM solution providers are expected to construct expertise to control the security concerns for public cloud services such as, Azure, AWS, Google Cloud, and others. IAM systems leverages identity analytics and intelligence to monitor unusual activities from user account. It enables the identification of policy violations, deletion of idle accounts, and removal of inappropriate access privileges. Such rising identity and security concerns across enterprises are anticipated to fuel market growth.

Increasing Awareness of Regulatory Compliance to Drive Market Growth

In today's data-driven world, companies incorporate identity and access management solutions to identify fraudulent activities and mitigate cyberattacks, ensuring data privacy and security. IAM systems also help organizations fulfill compliance requirements. For instance, organizations with IAM solutions can prove that they have appropriate measures in place to mitigate the risk of a data breach or misuse while auditing.

IAM solutions also help to meet specific criteria associated with various regulations, including the Gramm-Leach-Bliley Act (GBLA), Sarbanes-Oxley (SOX), Family Educational Rights and Privacy Act of 1974 (FERPA). Other regulations include the Payment Card Industry Data Security Standard (PCI), Health Insurance Portability and Accountability Act (HIPAA), General Data Protection Regulation (GDPR), and North-American Electric Reliability Corporation (NERC).

Such compliance requirements and corporate governance concerns are expected to boost this market.

Moreover, leading companies require IAM technology for various purposes:

- Defending customer privacy preferences across hosting models, partners, and locations

- Seamless mobile customer support experience that builds trust

- Managing customer identity across channels

- Providing secure access to sensitive data

- Using identity data to boost customer relationships

RESTRAINING FACTORS

Risk Associated with Identity and Access Management to Hamper Market Growth

Failure to securely store data such as authentication credentials and personal information in a centralized place may result in digital identity fraud and data breaching. Emerging BYOD policy among enterprises has made IAM Systems more complex.

A lack of skilled professionals may impact the adoption of IAM solutions. While cloud-based IAM systems are rapidly being adopted by enterprises due to their numerous benefits, they also presents security and privacy issues such as data breaches, hacked interfaces, credential protection, DoS attacks, etc., of stored data. Such activities are expected to hinder the identity and access management market growth.

Identity and Access Management Market Segmentation Analysis

By Component Analysis

Access Provisioning Segment Dominated due to Need for Minimizing Risk Associated With Data Breach Activities

Based on component, the market is segmented into access provisioning, directory services, single sign-on, password management, advanced authentication, multifactor authentication, audit, compliance, and governance, and others (access management and authorization, verification).

The access provisioning segment held the largest identity and access management market share of 30.06% in 2026 owing to its vast functionalities, which are used to mitigate security and regulatory compliance and enhance the productivity of business operations. They mainly minimize the risk of unauthorized access and data breaches.

- For instance, the identity management provider, OneLogin, provides multi-role single sign-on and multi-account access management for Amazon Web Services (AWS). The solution automates user provisioning, which improves the productivity of AWS administrators.

The single sign-on (SSO) segment is expected to grow with the highest CAGR during the forecast period. SSO helps to reduce data breach cases and aims to simplify the user identity verification process present across different systems. This factor leads to the growth of the SSO segment over the forecast period.

For instance, IBM Corporation single sign-on offers one-click access with a single set of credentials to cloud, on-premise and mobile applications.

By Type Analysis

Workforce IAM Segment Dominates due to Rise in Adoption of Workforce IAM Solution

By type, the market is divided into customer IAM and workforce IAM.

The workforce IAM segment holds the largest market share of 53.63% in 2026 over the forecast period. This is due to the increased adoption of workforce identity and access management (IAM) solutions among enterprises, which accelerate workforce efficiency and provide secure authentication for accessing sensitive organizational data.

- For instance, in October 2023, ManageEngine, an enterprise IT management division of Zoho Corporation, unveiled a cloud-based identity management platform named “Identity360” at ManageEngine’s User Conference in Dallas, Texas. This platform helps to address and resolve the identity and access management (IAM) challenges arising within organizational workforces.

Furthermore, the demand for customer identity and access management (CIAM) solutions will grow at the highest CAGR over the forecast period owing to the increasing demand for CIAM solutions to manage customer identities and provide secure access to online services.

By Deployment Analysis

Cloud Segment to Lead due to Rising Adoption of Cloud

Based on deployment, the market is bifurcated into the cloud and on-premise.

Cloud-based IAM solutions are expected to grow with the highest CAGR during the forecast period. This is due to the increased adoption of cloud IAM solutions, which use a centralized trust model to provide enterprise security.

- For instance, in February 2023, Procyon launched a new cloud-based privilege access management (PAM) solution for organizations with multi-cloud environments to improve and streamline business identity and access management operations.

The on-premise segment held the largest market share of 52.36% in 2026 and is likely to show moderate growth over the forecast period. The higher implementation and maintenance cost, the need for regular troubleshooting updates, and the need for high-level expertise to monitor an on-premise IAM solution generate challenges for a company’s resources. These factors increase the software's operating expenses over the period, resulting in lower demand for on-premise software compared to cloud-based IAM solution.

By Enterprise Type Analysis

Large Enterprise Segment to Lead due to Rising Adoption of IAM Solution

Based on enterprise type, the market is segmented into small & medium enterprises (SMEs) and large enterprises.

The large enterprise segment is expected to hold the largest market share during the forecast period. Large enterprises are making substantial investments in advanced technology solutions to ensure advanced identity protection for customers. They also provide comprehensive products across different categories and industries, making them potential customers for IAM solutions.

Meanwhile, small and medium-sized enterprises (SMEs) are projected to grow with the highest market share of 51.48% in 2026, due to the increasing adoption of IAM solutions by SMEs across different industries to provide password less multi-factor authentication (MFA) to secure the organization's data from cyber-attacks. As SMEs seek to reduce identity theft and phishing attempts, the demand for IAM solutions will increase over the forecast period.

By Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Adoption of IAM Solutions Across the Healthcare Sector to Foster the Market Growth

As per vertical, the global market has been segmented into BFSI, IT and telecom, retail and consumer goods, government, energy and utilities, education, manufacturing, healthcare and life sciences, and others.

The healthcare and life-science segment is expected to show the highest growth owing to the rising adoption of these type of solutions. It is due to rising digitalization across healthcare such as telemedicine, EMR, and e-health applications, which creates a large number of identities. Securing these identities and patient-sensitive data while meeting regulatory compliances such as Health Insurance Portability and Accountability Act (HIPAA) and Electronic Prescribing for Controlled Substances (EPCS), is expected to fuel demand for IAM systems across the sector.

The BFSI sector held the largest market share in 2023. This is due to rising adoption of online payments, e-wallets, and digital/retail banking, which is expected to boost the adoption of these type of solutions across the BFSI sector. These solutions help ensure that the right access is granted to the right people, manage risks, and comply with security regulations.

Other verticals, such as government, manufacturing, retail and consumer packaged goods, education, I.T. & telecom, and energy & utilities, are also projected to grow at a substantial rate during the forecast period. These sectors aim to deliver better data identity and data management experiences for customers worldwide.

REGIONAL INSIGHTS

By geography, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America

North America Identity and Access Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 8.97 billion in 2025 and USD 10.18 billion in 2026. The growth in this region is owing to the adoption of remote work, cloud technology, and increasing cyberattacks. Additionally, the market growth is driven by the presence of key companies such as Amazon Web Services Inc., Akamai Technologies, H.P. Development Company L.P., Microsoft Corporation, Oracle Corporation, IBM Corporation, and others in the region. The players in this region are focused on investing in emerging technologies and partnerships to enhance the capabilities of IAM solutions. The U.S. market is projected to reach USD 5.776 billion by 2026.

- For instance, in September 2023, CyberArk collaborated with Accenture to provide privileged access management solutions to clients present across the world. Through this partnership, the companies enable zero trust security at an enterprise scale via advanced IAM solutions.

Europe

Europe is anticipated to grow significantly owing to the security and regulatory compliance concerns in countries such as Germany, Italy, Spain, and others. The requirements of general data protection regulation (GDPR) across the European Union drive the demand for identity and access management solutions in this region. Rising small and medium-sized enterprises also boosts the demand for IAM solutions to comply with regulations in this region. The UK market is projected to reach USD 1.34 billion by 2026, and the Germany market is projected to reach USD 1.333 billion by 2026.

- For instance, in May 2024, Helasoft GmbH partnered with Atricore to deliver developed modern IAM services. They leverage identity orchestration technology with IAM cloud migration solutions to provide reliable software solutions to customers in European countries such as Germany and France.

Middle East & Africa

The growing digital transformation across the Middle East & Africa is expected to boost the demand for IAM solutions. Furthermore, governments of various countries such as Saudi Arabia, Egypt, and Jordan started implementing data protection laws, which creates market opportunities in the coming years.

Asia Pacific

Asia Pacific is anticipated to grow with the highest CAGR during the forecast period. The major players in Asia Pacific are investing in advanced solutions to prevent cyberattacks and identity frauds; this drives the growth of this market in this region. The Japan market is projected to reach USD 1.156 billion by 2026, the China market is projected to reach USD 1.574 billion by 2026, and the India market is projected to reach USD 1.136 billion by 2026.

South America

South America is expected to witness moderate growth due to rising cybercrimes, advancement of technology, and implementation of data privacy and protection laws in this region.

KEY INDUSTRY PLAYERS

Key Players Are Focused on Strengthening Their Market Position with Continuous Developments

Players are investing in advanced technologies to improve the capabilities of IAM solutions. Additionally, the prominent players are involved in various acquisition, partnerships, collaborations, and mergers to expand their market presence.

- January 2024: ForgeRock, a U.S.-based identity and access management software company, announced a merger with Ping Identity, an identity security platform provider, to make a significant evolution in the identity and access management market.

List of Top Identity and Access Management Companies:

- Amazon Web Services Inc. (U.S.)

- Akamai Technologies (U.S.)

- H.P. Development Company L.P. (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- IBM Corporation (U.S.)

- Fortinet, Inc. (U.S.)

- ForgeRock (U.S.)

- Thales Group (France)

- Evidian (France)

- HID Global Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: CyberArk launched CyberArk Identity Security Platform services to fulfill the data sovereignty needs of customers present across the UAE. These services aimed to fulfill the identity security goals of large companies and state-owned organizations in sectors such as telecommunications, financial services, energy sectors, along with cloud-native businesses.

- June 2023: Ekco, a secure cloud solution provider, earned Microsoft's Identity & Access Management Specialization, highlighting the company's expertise and customer success in deploying Microsoft Identity workloads with Azure AD.

- July 2022: Thales Group, IAM provider, announced the acquisition of 'OneWelcome,' a European Customer Identity and Access Management (CIAM) company for approximately USD 104.9 million. The company's digital identity lifecycle management capabilities would complement Thales's identity services.

- May 2022: Microsoft Corporation announced the launch of 'Entra,' a product family of identity and access management solutions. It includes Azure AD, Decentralized Identity, and Cloud Infrastructure Entitlement Management (CIEM).

- April 2022: Microsoft Corporation announced their eighth 'Content+Cloud' Microsoft Advanced Specialisation in Identity and Access Management, making it one of 19 Microsoft partners in the U.K. to achieve this recognition.

REPORT COVERAGE

The study on the market includes prominent areas globally to gain enhanced knowledge of the industry verticals. Moreover, the research offers insights into the most recent endeavors and industry developments and an analysis of high-tech solutions being adopted promptly worldwide. It also highlights some of the growth-stimulating limitations and elements, allowing the reader to obtain a comprehensive understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.10% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Component

By Type

By Deployment

By Enterprise Type

By Vertical

By Region

|

Frequently Asked Questions

The market is projected to reach USD 77.92 billion by 2034.

In 2025, the market stood at USD 22.27 billion.

The market is projected to grow at a CAGR of 15.10% in the forecast period.

Healthcare and life sciences is likely to grow with highest CAGR over the forecast period.

Increasing awareness of regulatory compliance is a key factor driving market growth.

Amazon Web Services Inc., Akamai Technologies, H.P. Development Company L.P., Microsoft Corporation, Oracle Corporation, IBM Corporation, and Fortinet, Inc. are the top players in the market

North America dominated the global market with a share of 40.30% in 2025.

Asia Pacific is expected to grow with the highest CAGR over the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us