Foot Orthotic Insoles Market Size, Share & Industry Analysis, By Type (Prefabricated and Customized), By Material (Thermoplastics, Ethyl-vinyl Acetate (EVA), Foam, Composite Carbon Fiber, and Others), By Application (Medical, Sports & Athletics, and Personal), By Age Group (Adults and Pediatrics), By Distribution Channel (Hospital Pharmacies, Retail Stores, and Online Stores), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

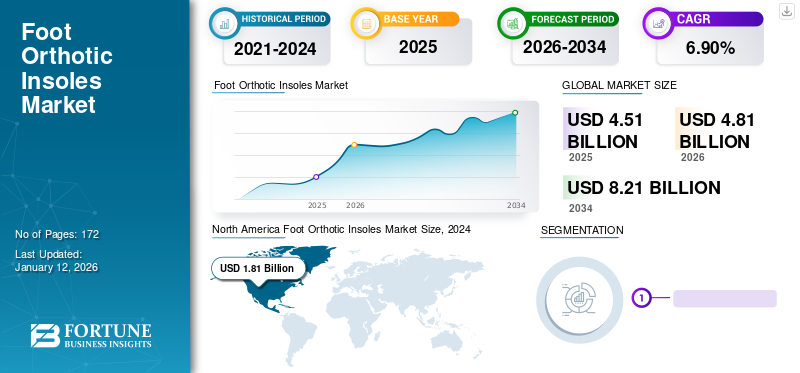

The global foot orthotic insoles market size was valued at USD 4.51 billion in 2025. The market is projected to grow from USD 4.81 billion in 2026 to USD 8.21 billion by 2034, exhibiting a CAGR of 6.90% during the forecast period. North America dominated the foot orthotic insoles market with a market share of 42.90% in 2025. Moreover, the foot orthotic insoles market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 2.71 billion by 2032, driven by increasing adoption of advanced tools such as 3D printers, 3D scanners, and rising demand for orthotics care.

Foot orthotic insoles are medical devices that physicians prescribe to reduce pain and treat foot ailments. The increase in the prevalence of chronic disorders, such as diabetes, is leading to diabetic foot ulcers and an increase in cases of other foot ailments, driving the global foot orthotic insoles market growth.

Significant technological advancements in the orthotics market and robust clinical studies proving the efficacy of insoles in various ailments favor the market growth. For instance, in October 2022, SUPERFEET WORLDWIDE, LLC, a Ferndale-based company, announced the launch of two different types of removable insoles specifically designed for snowboarders and skiers. Similarly, in October 2021, a team of researchers from the University of Queensland in Australia developed an innovative insole technology. This product operates via a mobile app and is aimed to help individuals with nerve damage maintain their balance. Such research initiatives are further expected to drive product demand during the forecast period.

The cancellation of orthotic appointments exerted a negative impact on the global market in 2020. Major players operating in the market witnessed a drop in revenues for their orthotic business segments during the 2020 pandemic. However, the market witnessed a resurgence in terms of sales figures for orthotic insoles in 2021. In addition, orthotic clinics with digital technologies such as 3D scanners and digital imaging sustained their business during the pandemic. Despite some supply chain issues in 2022, the market is anticipated to gain a normal growth rate during the forecast period.

Global Foot Orthotic Insoles Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 4.51 billion

- 2026 Market Size: USD 4.81 billion

- 2034 Forecast Market Size: USD 8.21 billion

- CAGR: 6.90% from 2026–2034

Market Share:

- North America dominated the foot orthotic insoles market with a 42.90% share in 2025, driven by the rising adoption of advanced technologies such as 3D printers and scanners, and increasing demand for orthotics care in medical practices.

- By type, customized insoles are expected to retain their largest market share owing to growing patient preference for personalized solutions and enhanced clinical outcomes facilitated by technological advancements like 3D foot scanners and molding clay techniques.

Key Country Highlights:

- United States: Growth is supported by the rapid adoption of digital technologies in orthotic clinics and a surge in podiatric procedures addressing chronic foot ailments.

- Europe: Favorable reimbursement policies and increasing government initiatives to promote foot care awareness are key drivers for market expansion.

- China: Rising geriatric population and increased focus on customized orthotic solutions are fostering market growth.

- Japan: Technological innovations and a strong demand for effective foot pain management solutions are enhancing the adoption of orthotic insoles.

Foot Orthotic Insoles Market Trends

Increased Strategic Initiatives by Prominent Players to Drive Growth Trajectory

The need for foot orthotic insoles is expected to increase over the forecast period owing to the increasing prevalence of foot ailments among the population worldwide. This has led prominent players to increase their portfolios and expand their business through mergers and acquisitions. Companies are involved in strategic initiatives to develop innovative technologies such as high frequency and shock absorbing materials. Furthermore, market players are slowly transitioning toward providing customized support to their customers based on their problems and helping them achieve a better quality of life. For instance, in January 2021, Thuasne announced that they completed the acquisition of an U.S. based company Knit-Rite, LLC, a manufacturer of textiles for the medical markets and its Therafirm division. The acquisition has helped the company to open up new markets for their products. Such acquisitions are anticipated to strongly contribute to the growth prospects of the market over the forecast period.

Download Free sample to learn more about this report.

Foot Orthotic Insoles Market Growth Factors

Escalating Prevalence of Chronic Foot Ailments with Favorable Policies Pertaining to Reimbursement to Impel Market Growth

According to studies, foot pain affects 87% of the general population globally. Around one-third of older adults suffer from foot pain, aching feet, or stiffness, according to data published by AGS Health in Aging Foundation in 2023. This pain can be caused by various medical conditions such as diabetic foot ulcers, plantar fasciitis, bursitis, and arthritis. Thus, foot orthotic insoles are prescribed by physicians to treat these conditions. As per NCBI, in 2021, the annual prevalence of diabetic foot ulcers across the globe is between 9.1 to 26.1 million. It is further estimated that approximately 20% to 25% of the population with diabetes mellitus will develop diabetic foot ulcer. The magnitude and incidence of diabetic foot ulcers are increasing rapidly worldwide since the increased incidence of diabetes reached an epidemic level. Hence, these aforementioned factors are crucial growth drivers for the global market.

Predominantly, the sedentary middle-aged and older adults are affected by plantar heel pain, and it is estimated that around 8.0% of all injuries are related to running. Hence, the growing incidence of the disorder will reflect a positive growth trajectory for the market. According to the American Academy of Orthopaedic Surgeons (AAOS), in 2020, around two million people in the U.S. are treated with plantar fasciitis each year.

The surge in demand for customized orthotic insoles and a favorable reimbursement policy, is a significant driver for the market. The reimbursement of prosthetic and orthotic devices is applied when a registered physician provides consultation. Reimbursement includes an applicable fee, design, materials, measurements, fabrications, testing, fitting, and device training. Reimbursement also covers the repair & replacement of prosthetic and orthotic devices. Thus, the aforementioned factors are the prominent drivers for the global market.

Technological Advancements in Foot Orthotic Insoles to Augment Market Growth

One of the key factors poised to drive the market growth is the technological advancements in foot orthotic insoles. Globally, it has been reported that people suffer from debilitating foot pain, which makes it difficult for them to accomplish daily activities such as walking or climbing stairs. Therefore, manufacturers are focusing on the large-scale manufacturing and commercialization of technologically advanced foot orthotic insoles for their customers, which will ease their problems. Recently, the orthotic foot industry has witnessed various technological changes, which will drive the market in the future. For instance, in April 2021, Covestro and GeBioM mbH, based in Münster, expanded their orthopedic footwear cooperation to support custom insoles production using 3D printing. Stratasys Direct gives millions of new patients’ access to life-changing orthotics, offering much-needed improvements in mobility and pain relief. The use of advanced technology for 3D printed foot insoles enables the creation of complex geometries and includes varying features within a single device.

Furthermore, 3D printing techniques provided significant opportunities to improve the functional abilities and traditional manufacturing processes for custom-foot orthotics, and thus is considered a massive technological advancement in this market. For instance, it has been observed that each HP Multi Jet 3D printer can produce up to 21,000 foot-orthotic pairs every year. This indicates that every HP Multi Jet 3D printer installed will save approximately 40 tons of material waste per year vs. traditional CNC polypropylene milling. Moreover, substantial involvement of researchers in the development of advanced products will further supplement the market growth. For instance, in March 2023, Swiss researchers developed an insole that is manufactured using 3D printing technology and contains sensors. These sensors offer a precise measurement of the pressure of the foot on the sole. Therefore, the incorporation of such novel technology is expected to impel industry expansion.

RESTRAINING FACTORS

High Costs of Custom Insoles with Limited Penetration Rate in Emerging Countries to Impede Market Growth

Despite a strong need for effective orthotic insoles, one of the most important limiting factors that restrain this market growth is the limited penetration rate of these products in the emerging regions. The demand for foot orthotics insoles in Lower-Middle-Income Countries (LMIC) is limited due to lack of service capacity and funding shortage, inhibiting the market expansion. Furthermore, clinical providers in LMICs do not have enough product options to meet customer needs. They do not allow flexible ordering from players in the regional market, which, as witnessed, is a result of a weak supply channel.

Moreover, the high cost of custom orthotic insoles is one of the major restraints contributing to the market growth. For instance, according to Podiatry Today, the typical cost of prescription custom foot orthotics ordered through a doctor ranges from USD 400 – USD 600. The overall cost of treatment varies from one doctor to the other doctor. Most podiatrists do not quote an actual fee; instead, they quote a price for an entire treatment program. The factors mentioned above may hinder the market growth to some extent.

Foot Orthotic Insoles Market Segmentation Analysis

By Type Analysis

Strong Demand for Customized Insoles to Lead to Segment Dominance in 2025-2032

Based on type, the market is segmented into prefabricated and customized. The customized segment led the market accounting for 63.20% market share in 2026. The segment dominated due to the rise in patients' preference for customized foot orthotic insoles as it matches comfort specifications. Furthermore, most orthotists also prescribe customized foot insoles to help in better clinical outcomes. Technological advancements, such as molding clay and 3D foot scanners, have made it easier for manufacturers to provide customized foot insoles for their customers, propelling segmental growth.

However, the prefabricated segment is anticipated to register a comparatively lower CAGR during the forecast period. Furthermore, rise in awareness of the product benefits and the increasing geriatric population led to an increase in the global foot orthotic insoles market share. The surge in prevalence of arthritis and plantar fasciitis is likely to augment the segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Material Analysis

Ethyl-vinyl Acetate (EVA) Segment to Dominate the Market Owing to its Easy Availability

Based on material, the market is segmented into foam, thermoplastics, composite carbon fiber, ethyl-vinyl acetate (EVA), and others. The ethyl-vinyl acetate (EVA) segment accounts for the maximum market share. The dominance can be attributed to the easy availability of EVA and a comparatively lower price than foam-based foot insoles. In addition, advantages offered by this material, such as improved comfort due to its lightweight and flexible nature will further support its high usage.

The thermoplastics segment is the second largest segment of this market. The rising adoption of thermoplastic material for the production of these products significantly reduces plantar pressure. Hence, the material of thermoplastics is the choice for manufacturers due to its enhanced benefits. The rise in adoption of these products for sports and athletic activities has escalated the shock-absorbing insoles material demand. Furthermore, foam-based foot orthotic insoles, including polyethylene foams insoles are gradually gaining much traction as they offer excellent shock absorption, favoring the foam segment's expansion.

The composite carbon fiber segment holds a small share of the market. Athletes mostly use these orthotic insoles as the material claims to store the energy and direct it toward the ground, increasing the speed while improving the energy efficiency. Thus, this helps an athlete propel in any direction. This is one of the reasons for manufacturers to use this material for the production of orthotic insoles.

By Application Analysis

Strong Prescriptions of Orthotics by Medical Professionals to Propel Segmental Expansion

Based on application, the market is segmented into medical, sports & athletics, and personal. The medical The segment dominated the market accounting for 46.15% market share in 2026. A growing number of clinical evidence that indicates foot orthotic insoles' efficacy in reducing pain of various diseases and disorders is the primary reason for the prominent share of the medical segment. For instance, according to Rehabilitation, an article published in the Archives of Physical Medicine Journal, prescription shoe orthotics significantly improved back pain and dysfunction.

Many studies indicating the effectiveness of foot orthotic are expected to favor its adoption for medical purposes. The sports & athletics segment holds the second largest share and is expected to grow, reflecting a robust CAGR during the forecast period. The increasing usage of shock-absorbing foot insoles to prevent injuries during sports and vigorous physical activities is expected to fuel the market growth. People have become more conscious of healthy lifestyles that involve physical activities such as running, walking, and sports. Over-the-counter products can be easily attached to footwear. Many manufacturers are offering footwear solutions with non-removable foot insoles, which is poised to increase in the global market for sports & athletics.

By Age Group Analysis

Strong Adult Patient Populace to Propel Segmental Share in 2024

Based on age group, the market is segmented into adults and pediatrics. The adults segment is projected to dominate the market with a share of 83.16% in 2026. The rise in prevalence of diabetes, arthritis, chronic pain, and common problems associated with old age is the major reason contributing to the product adoption among adults across the globe. For example, according to the Osteoarthritis Action Alliance, in 2021, globally, there will be an estimated 242 million people suffering from symptomatic and activity-limiting osteoarthritis. Thus, the increasing prevalence of arthritis and foot & ankle pain is likely to surge the demand for foot insoles amongst the rising geriatric adult population.

However, rise in the number of cases of congenital foot deformities and increase in the number of foot insoles specially designed for pediatrics, such as Formthotics, are expected to provide an impetus to the growth of the pediatric segment.

By Distribution Channel Analysis

Strong Volumes of Orthotic Insoles Attributed to Hospital Pharmacies to Impel Segmental Growth

Based on distribution channel, the market is segmented into hospital pharmacies, retail stores, and online stores. The hospital pharmacies segment dominates the market in 2024 and is anticipated to depict lucrative growth throughout the analysis period. The growth can be attributed to favorable health reimbursements for prescribed products. Furthermore, increasing awareness and demand for customized products is a key reason attributable to the growth of hospital pharmacies.

The retail stores segment accounts for the second-largest share. Major players in this market are expanding their global footprint by launching new retail stores across the globe, thus allowing the expansion of the retail stores segment. The online stores segment is expected to exhibit positive growth owing to the rapid adoption of over-the-counter orthotics and increasing usage of e-commerce portals.

REGIONAL INSIGHTS

Based on region, the global market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

North America Foot Orthotic Insoles Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America was valued at USD 0.85 billion in 2026 and is estimated to hold a dominant share in the global market during the study period. North America presently dominates the global market due to rapid adoption of 3D printers to produce customized orthotic insoles. Furthermore, rise in the number of podiatric procedures and increase in the number of podiatrist and orthotist are driving the regional growth. The U.S. market is projected to reach USD 1.66 billion by 2026.

The Europe market is poised to be the second-largest market. The growth is being driven by favorable reimbursement policies and increasing efforts by the governments to increase awareness among people about foot care. For instance, the BMJ Open journal published a cross-sectional survey of orthotic services; around USD 36.2 million were spent in the U.K. from 2015 to 2016 on orthotic products. Thus, increasing expenditure on orthotic services and products is likely to favor the market growth in Europe. The UK market is projected to reach USD 0.32 billion by 2026, while the Germany market is projected to reach USD 0.37 billion by 2026.

The Asia Pacific market is set to depict remarkable growth over the forecast period due to increase in geriatric population. It is one of the important reasons for the adoption of these products. The rest of the world holds a comparatively lesser share in the market. However, it is expected to witness significant growth due to improvement of healthcare expenditure and rising awareness amongst the people of developing countries in these regions. The Japan market is projected to reach USD 0.33 billion by 2026, the China market is projected to reach USD 0.22 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

List of Key Companies in Foot Orthotic Insoles Market

Robust Portfolio of Hanger Inc. and Implus LLC to Aid these Companies to Market Dominance

The global market is highly fragmented in the competition landscape due to various national and international players. However, a few companies, such as Hanger Inc., Implus LLC, and Footbalance Systems Ltd., hold a leading position due to their strong brand presence, large customer base, and strong network with healthcare professionals, and diversified product offerings. For example, Implus LLC has over 80,000 retail outlets across the globe. Thus, a vast distribution network of the company is expected to strengthen the company’s position and increase its market revenue.

Other vital players, such as Thuasne, Foot Science International, and Aetrex Worldwide Inc., are gradually establishing a market position in the global market due to their strategic collaborations and product offerings to expand their operations. Furthermore, Superfeet Worldwide, Bauerfeind AG, and Tynor Orthotics Pvt. Ltd are new to the global market, which are slowly gaining a competitive edge owing to the adoption of modern technologies and securing funds from investors to expand their production capabilities.

LIST OF KEY COMPANIES PROFILED:

- Implus Footcare LLC (U.S.)

- Hanger Inc. (U.S.)

- Aetrex Worldwide, Inc. (U.S.)

- Footbalance System Ltd. (Finland)

- Tynor (India)

- Digital Orthotics Laboratories Australia Pty Ltd. (Australia)

- Thuasne (France)

- Foot Science International (New Zealand)

- OttoBock (Germany)

- Superfeet Worldwide, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2022: Hanger, Inc. announced the completion of its previously announced transaction on 21st July, 2022 to be acquired by Patient Square Capital, a healthcare investment firm.

- February 2022: Foot Solutions, Inc. announced the acquisition of Florida-based retailer Happy Feet Plus, Inc. The acquisition marks the merger of two major retail forces in specialty footwear.

- February 2022: A new DOLA iPhone scanning feature through which customers can scan, prescribe, and order orthotics using iPhone was launched by Digital Orthotics Laboratories Australia Pty Ltd.

- November 2021: Spenco, the brand under Implus Footcare LLC launched Propel and Propel + Carbon insoles that are designed to supercharge running shoes with the latest running technology.

- June 2021: Aetrex announced the launch of Albert 3DFit, a 3D fit technology scanner to revolutionize the retail industry.

REPORT COVERAGE

The research report provides qualitative and quantitative insights on the global market and a detailed analysis of market size & growth rate for all possible segments. Along with this, the report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are the technological advancements, key industry developments, pricing analysis by key players, and key start-ups with funding overview.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.90% from 2025-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Application

|

|

|

By Age Group

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 4.22 billion in 2025 and is projected to reach USD 7.16 billion by 2034.

In 2025, the North American market value stood at USD 4.51 billion.

The market is expected to exhibit a CAGR of 6.90% during the forecast period of 2026-2034.

By type, the customized segment is set to lead the market.

The increasing prevalence of chronic foot ailments, strong focus on clinical studies proving the efficacy of these products in various ailments, and technological advancements in the global market are driving the market growth.

Hanger Inc. and Implus LLC are some of the major players in the global market.

North America dominated the market in 2025.

New product launches, increasing need for personal comfort for foot pain, and the prevalence of foot ailments across the globe are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us