Protonic Ceramic Fuel Cell Market Size, Share & COVID-19 Impact Analysis, By Application (Transportation and Off-grid Power) and Regional Forecast, 2025–2032

Protonic Ceramic Fuel Cell Market Size

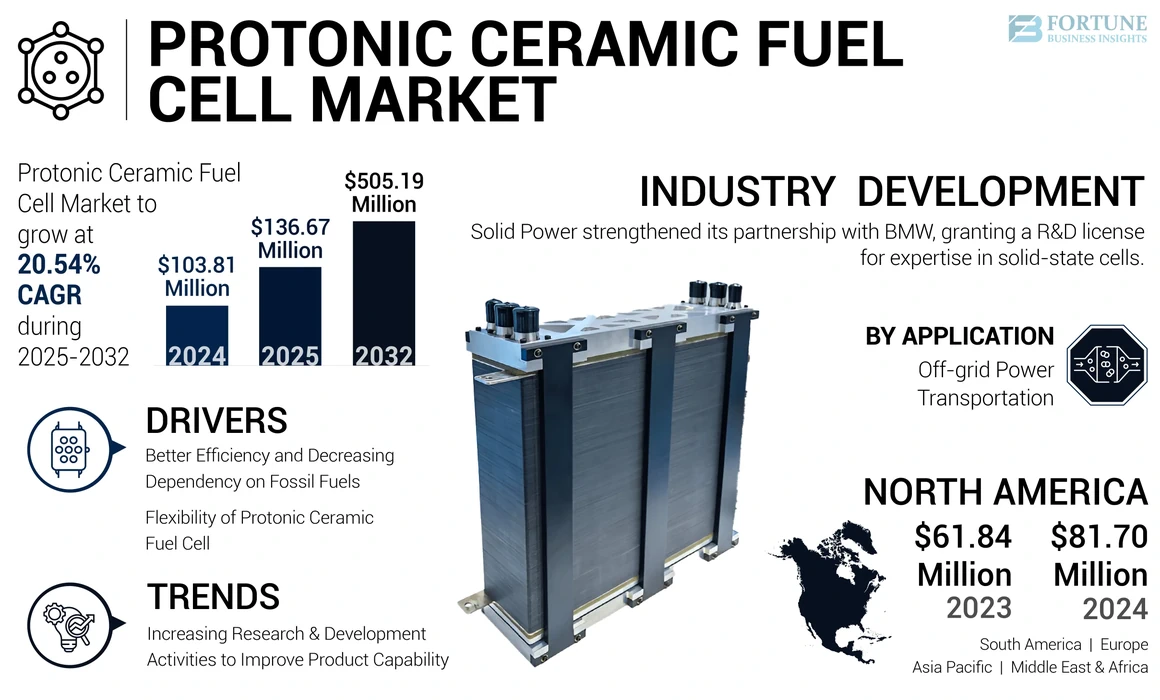

The global protonic ceramic fuel cell market size was valued at USD 103.81 million in 2024. The market is projected to grow from USD 136.67 million in 2025 to USD 505.19 million by 2032, exhibiting a CAGR of 20.54% during the forecast period. North America dominated the protonic ceramic fuel cell industry with a market share of 78.70% in 2024.

A protonic ceramic fuel cell operates at high temperatures, using a proton-conducting ceramic electrolyte. It's a type of solid oxide fuel cell, part of a broader range of fuel cells. This technology is based on ceramic materials for the electrolyte, and it finds immediate applications in various scenarios, especially in developing countries. It provides decentralized solutions for critical systems, powers equipment during emergencies, and enhances energy access in remote areas. Hydrogen and fuel cell technologies have made significant strides in terms of efficiency, durability, reliability, and cost reduction. Protonic ceramic fuel cells can operate reversibly, storing renewable energy by employing water electrolysis to produce hydrogen, which can later be converted back into electricity. The market is experiencing growth due to the increased interest in clean and sustainable energy solutions.

COVID-19 IMPACT

Rapid Spread of COVID-19 Led Market to a Substantial Slowdown

The global spread of COVID-19 impacted almost every country at various stages. Measures taken during the pandemic considerably reduced electricity demand in various industries, leading to changes in power mix. Lockdown measures have significantly reduced electricity demand in industry affecting in turn the power mix. Decrease in electricity demand has raised the share of renewables in electricity supply, as their output is largely unaffected by demand. Demand fell for all other sources of other electricity sources, including coal, gas, and nuclear power also declined during the pandemic.

Many research institutions and companies involved in protonic ceramic fuel cell development had to halt or limit their research and development activities during the pandemic. This interruption in R&D efforts could have slowed down the pace of innovation and the introduction of new and improved PCFC technologies. Globally, numerous establishments across diverse sectors, including the power sector, ceased or reduced capital expenditures. In addition, disruptions in the supply chains for the power sector led to a slowdown in the manufacturing of various power sector equipment.

Protonic Ceramic Fuel Cell Market Trends

Increasing Research and Development Activities to Improve Product Capability Drives Market Growth

Protonic ceramic fuel cells (PCFCs) have great potential for higher energy conversion efficiency than conventional devices. Hong Kong University of Technology experts have produced an innovative iron-based cathode material to achieve record-breaking performance for PCFCs. This represents a significant advancement in the growth and commercialization of this capable renewable energy technology.

Fuel cells, designed to harness the chemical energy of hydrogen or supplementary fuels to generate electricity in a clean and efficient energy source, have been intensively developed worldwide to tackle energy shortages and climate change. A novel technology known as PCFCs has been developed in this field based on proton-conducting ceramic electrolytes. In addition, these cells offer advantages such as high efficiency, low pollutant emissions, and adaptability to various gases such as methane, biogas, and ammonia.

They are generally used for decentralized power generation, such as off-grid power generation. PCFCs activate at high temperatures, typically above 500°C, allowing for better thermodynamic efficiency than lower-temperature fuel cells. Due to their high efficiency, PCFCs are suitable for power generation in combined heat and power systems, where waste heat and cogeneration systems can contribute to heating other industrial processes.

Download Free sample to learn more about this report.

Protonic Ceramic Fuel Cell Market Growth Factors

Better Efficiency and Decreasing Dependency on Fossil Fuels to Drive Market Growth

Society's reliance on burning fossil fuels for energy poses an urgent challenge in mitigating climate change and transitioning to a carbon neutral and sustainable energy economy. Hydrogen energy supply is expected to play an important role as an energy carrier in a sustainable and clean future economy, converting its chemical energy into electrical energy through fuel cells.

In the fuel cell industry, protonic ceramic fuel cells have the potential and are more efficient to upgrade from conventional fuel cells such as Solid Oxide Fuel Cells (SOFC). This is predominantly due to their capacity to operate efficiently at low and intermediate temperatures and their quality of nonfuel dilution at the anode during operation. Improved efficiency and inclination toward adopting clean energy is expected to surge the demand for protonic ceramic-based fuel cells during the forecast period.

Significant investments and ongoing initiatives by major companies have substantially increased the market size. For instance, Adaptive Energy (AE), a Solid Oxide Fuel Cell (SOFC) developer and manufacturer, focuses on providing reliable, robust, and cost-effective SOFC products in the 100-350W power output range. The company aims to leverage military-grade tubular ceramic fuel cell technology, combining it with recent advancements in these fuel cell materials and manufacturing from the Colorado School of Mines. This effort is aimed to create a portable, propane-powered, intermediate-temperature, and 300We+ fuel-cell stack for remote-power or off-grid applications.

Flexibility of Protonic Ceramic Fuel Cell to Drive the Market Growth

PCFCs can generate clean and efficient energy to power various applications. Fuel cells use the chemical energy of hydrogen or other fuels to generate electricity cleanly and efficiently, driving their acceptance as a clean energy source. PCFCs generally operate in an intermediate temperature range between 400–800⁰C, giving them the advantage of higher mobility and lower activation energy of protons. The operation at the intermediate level results in fuel flexibility. Further, their ability to operate on uncomplicated hydrocarbons is often preferred, providing widespread use with hydrogen as fuel.

Furthermore, the PCFCs can also be used in different fuel sources, which act as one of the critical parameters for the improved performance of protonic ceramic-based fuel cells.

The Colorado School of Mines demonstrated a relatively new class of fuel cells that has the long-term durability and flexibility needed to become a viable commercial alternative to existing fuel cell technologies. Researchers tested 11 different fuels: hydrogen, methane, CNG (with and without hydrogen sulfide), propane, n-butane, i-butane, isooctane, methanol, ethanol, and ammonia. The tests demonstrated excellent performance and exceptional durability across fuel types over thousands of operating hours. This breakthrough positions PCFCs as critical components with high durability and flexibility. This is likely to drive increased adoption of protonic ceramic-based fuel cells in off-grid locations, including remote locations, areas, and emergency power generators in natural disasters and more.

RESTRAINING FACTORS

Availability of Alternative Efficient Fuel Cell to Limit Market Growth

Alternative fuel cell technologies such as proton exchange membrane fuel cells and solid oxide fuel cells have been extensively researched, developed, and commercialized over an extended period compared to protonic ceramic fuel cells. These alternative technologies have a successful application track record and widespread market acceptance across various end-use industries. The availability of available fuel cell technologies often corresponds to supporting infrastructure. For instance, in some regions, the hydrogen infrastructure required for PCFC is more developed than that required for PCFC involving high-temperature fuel processing.

The lack of necessary infrastructure can pose challenges for PCFC in competing effectively and limits their market growth. Infrastructure availability and its compatibility with existing systems play a crucial role in limiting the uptake of protonic ceramic type of fuel cells. PCFC with their requirement for additional infrastructure investments and modifications to existing systems may deter potential users. Moreover, PCFC requires a higher temperature to operate, which limits their suitability for specific applications or requires additional thermal management systems. The availability of alternative fuel cell technologies better suited to specific application requirements may limit the market growth opportunities.

Protonic Ceramic Fuel Cell Market Segmentation Analysis

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Off-grid Power Dominates the Market owing to PCFC’S High Durability and Efficiency

Based on application, the global market is segmented into transportation and off-grid power. The off-grid power segment dominates the protonic ceramic fuel market. There are various off-grid deployments, including power distribution and supply substituting fossil fuels, resulting in zero-carbon emissions, thereby positively impacting the off-grid power segment.

Off-grid power refers to the generation and use of power in areas unconnected to the traditional power grid, including remote locations, rural areas, or network access applications. Efficiency is critical in off-grid applications where resources can be limited or expensive.

REGIONAL INSIGHTS

This market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

North America Protonic Ceramic Fuel Cell Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

North America holds the largest market share globally and being a developed region, it has various research institutes. The U.S. Department of Energy Hydrogen Association has invested in research and development of fuel cells to improve their efficiency, durability, and affordability. These investments are made through federal agencies such as the Department of Energy. General Motors uses the fuel cell moment with green hydrogen. The Department of Energy describes its hydrogen program as part of its clean energy portfolio.

Europe holds the second largest protonic ceramic fuel cell market share, as European regions are developing hydrogen as an energy and fuel cell source, offering an excellent alternative to depleting natural gas and oil resources. Fossil fuels are becoming scarcer and more expensive and also contribute to climate-damaging CO2 emissions. Hydrogen can be stored in liquid and gaseous forms, allowing for controlled energy release. Unlike fossil fuels, hydrogen is a clean energy solution that generates no polluting pollutants or climate-damaging emissions.

Key Industry Players

Enormous Benefits and Applications Associated with Protonic Ceramic Fuel Cells to Drive Market Growth

Companies are currently pursuing the development of new protonic ceramic fuel cells. The government has supported fuel cell research development through various funding programs, grants, and initiatives. The hydrogen and fuel cell technologies office is addressing the development of applications that use hydrogen instead of today's fuels and technologies that provide modern energy services. The fuel cell's energy directly converts chemical energy into electricity, with pure water and potentially useful heat as by-products. Various players in the market are focusing on reducing CO2 emissions by introducing fuel-cell vehicles. For instance, in 2021, G.M. launched hydrogen-powered flight collaboration with Hydrotec and aerospace company Liebnerr. G.M. also works with Navistar on truck fuel cells and with Wabtec on locomotives. Moreover, it uses Hydrotec modules as mobile charging stations for battery electric vehicles. The produced hydrogen is consumed and utilized across various industries for refining petroleum, treating metals, producing fertilizer, and processing foods.

List of Top Protonic Ceramic Fuel Cell Companies:

- Bosch (Germany)

- Edge Autonomy (U.S.)

- SolydEra Group (Italy)

- Ceramic Powder Technology AS (Norway)

- Superior Technical Ceramics (U.S.)

- Nexceris, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Bosch announced to start volume production of its fuel-cell power module, spanning the entire hydrogen value chain. This emerging technology was poised for manufacturing and application. With a target to generate roughly 7.85 billion USD in sales by 2030 through hydrogen technology, Bosch took the lead as the first company to produce these systems in China and Germany.

- December 2022: Solid Power announced that it had strengthened its partnership with the BMW Group, extending their joint development agreement. Solid Power granted the BMW Group a research and development license for Solid Power's design and manufacturing expertise in solid-state cells.

- November 2022: Nexceris, LLC provided an update on the cost-effective manufacturing of high-temperature electrolysis stack at the DOE Hydrogen event during the 2022 Annual Merit Review and Peer Evaluation Meeting. The goal was to enable the manufacture of high-temperature electrolytic stacks for USD 100 per kW, a crucial requirement to meet the DOE's Earth Shot goal of producing Hydrogen for USD 1 per kilogram.

- October 2022: Bosch initiated a pilot project with HUB Security to integrate SOFC technology into holistic data center solutions, specializing in cyber security, secure IT hardware, and secure data center solutions. Bosch could supply the SOFC technology as a ready-to-use, plug-and-play system, with an output of 100 kW, which was flexibly scaling up to the megawatt range.

- August 2022: Edge Autonomy acquired Adaptive Energy, a leading solid oxide fuel cell technology manufacturer. Adaptive Energy is the foremost provider of SOFC for low-wattage energy, with federal agencies and commercial customers deploying its innovative solutions in the military, critical infrastructure, and transportation end markets. Adaptive Energy's lightweight, energy-dense SOFCs were seamlessly integrated into Edge Autonomy's UAV platforms as a key technology for over a decade.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, products/services, and applications. Besides, the report offers insights into the market trends and highlights key industry developments and analysis of the protonic fuel cell. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope and Segmentation

Request for Customization to gain extensive market insights.

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 20.54% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application and By Region |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights, the market size was USD 103.81 million in 2024.

The market is likely to grow at a CAGR of 20.54% over the forecast period (2025-2032).

By application, the off-grid power segment dominates the protonic ceramic fuel market.

The market size of North America stood at USD 81.70 million in 2024.

Notable advancements in emerging proton-conducting electrolyte materials, improvements in mechanical strength and durability are essential for efficient applications in fuel cell technologies which drives market growth.

Some of the top players in the market are Bosch, Nexceris LLC, Adaptive Energy, and Superior Technical Ceramics.

The global market size is expected to reach USD 505.19 million by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us