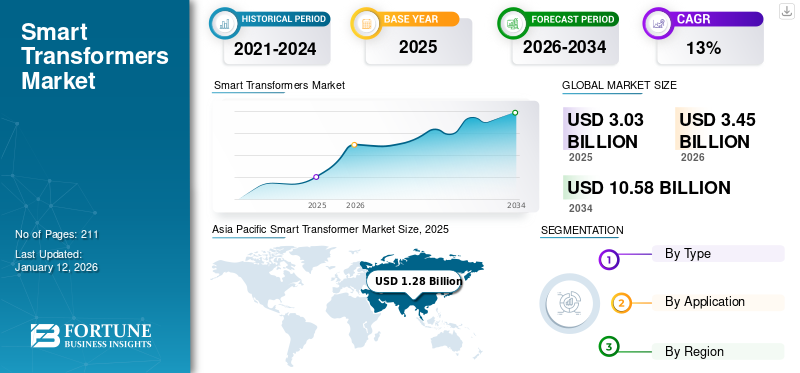

Smart Transformer Market Size, Share & Industry Analysis, By Type (Power Transformer, Distribution Transformer, Specialty Transformer, Instrument Transformer), By Application (Smart Grid, Traction Locomotive, Electric Vehicle Infrastructure, Others), and Regional Forecast, 2026-2034

Smart Transformers Market Size

The global smart transformer market size was valued at USD 3.03 billion in 2025 and is projected to be worth USD 3.45 billion in 2026 and reach USD 10.58 billion by 2034, exhibiting a CAGR of 15.04% during the forecast period. Asia Pacific dominated the global market with a share of 42.04% in 2025.

The global impact of COVID-19 has been unprecedented and staggering, with witnessing a lower-than-anticipated demand across all regions amid the pandemic. For instance, India’s total demand for grid electricity declined 25% between March and April in 2020 compared to demand in the same period in 2019. The decline in demand has resulted in significant variation in electricity consumption and distribution, which further has disturbed the optimization of production schedules and challenges in power balance due to uncertainties from both the demand-side and generation sides.

A smart transformer is a device that can be placed between the power grid and external systems like homes, businesses to provide a buffer. These devices are equipped with advanced features and functionality to support the power grid. . The smart transformer market growth is majorly driven by the production of alternative energy worldwide, digitalization of power utilities, and huge investment in smart grids and energy systems.

These kinds of transformers are widely adopted to regulate the voltage and maintain contact with the smart grid such that it allows remote administration in the power system. The growth of the market is driven by increasing investment in developing and strengthening the smart grid and the growing trend for adopting digitalization in the power industry. Additionally, renewable energy solutions such as solar systems are also connected to the primary power grid and altering its operations. The increasing focus on renewable power generation and integration of energy mix, emerges the need for intelligent monitoring and voltage regulation, thereby propelling the global market growth in the projected period.

Smart Transformer Market Trends

Smart Grid Continues to Play a Key Role in Adopting Smart Transformer

The development of smart grids will provide various advantages such as energy-saving through reducing consumption, reducing balancing cost, leveling the peak demand, accuracy in the electric bill, and other benefits. That makes the power transmission through the grid system more flexible and creates more opportunities for enhanced grid modernization and smart grids for both utilities and customers. Organizations such as European Union (EU) and U.S. models are increasing their adoption of smart grids primarily due to environmental concerns and desire for a reliable and improved energy grid. Smart transformers, as the new generation of power transformers, can monitor and analyze the electrical grid in real-time, actively managing and optimizing its performance. By detecting potential issues or anomalies before they escalate, smart transformers help prevent widespread blackouts and disruptions, significantly enhancing the overall resilience of the grid.

The smart grid's preferable characteristics comprise transmission and distribution architecture that resist intentional attacks or natural hazards. Other factors which enhance reliability include the use of transformers. The application of transformers in the power grid would enable the smart grid to work more efficiently and reliably by regulating the voltage at the end-user, resulting from improving the efficiency of the grid. For instance, on March 25, 2021, Hitachi ABB Power Grid, a global technology leader has partnered up with Nanyang Technological University, Singapore (NTU Singapore) for a government lead smart grid project, which is a part of the Singapore Government Energy 2.0 initiative to shape and transform the grid system. The two organizations will advance the developments in solid-state transforms to support power systems transformation for a more flexible system and to facilitate the integration of renewable energy sources. Hence, the adoption of the product in the smart grid is trending the demand to leverage the effectiveness of the transmission system at a wider pace.

Download Free sample to learn more about this report.

Smart Transformer Market Growth Factors

Growing Digitalization in Power Sector Will Drive Market

The power industry is at the edge of transforming from centralized, conventional, and security threats to distributed energy mix generation and advancement in control systems. Digitalization plays a crucial role in the power industry, including control systems, sensors, industrial software, transformer, Industrial Internet of Things (IIoT) technologies, and others. Digitalization has also been integrated with equipment and devices, which helps improve system efficiency, such as transformer, an integral part of the smart grid, which works independently to regulate the voltage and allow remote administration in the system.

According to Infosys, the energy and utilities sectors will produce USD 1.3 trillion and USD 299 billion in value through digital transformation by 2025. To continue the competition, the energy and utilities sectors must undertake digital transformation in operations, customer service, finance, and other areas.

This provides digitalized control and advanced features such as a digital platform to access online, Wi-Fi, Ethernet or cellular options, optimization of asset performance, cybersecurity, and other features that make the transformer play a managerial role in the electric distribution grid. Increased digitalization in the power system has helped control real and reactive power, improve the power quality, limit fault current, and reduce energy consumption. For instance, In February 2021, Enel Infrastructure and Network division has deployed ABB’s TXpert Ecosystem. This product is equipped with data-driven capabilities and analytics, which helps measure the aging of the transformer and contributes to the reliability of the electrical grid. Hence, a broad spectrum of advantages for integrating digitalization into the power industry drives the demand for smart transformers in the global market.

Growing Investments in Alternative Energy Smart Grids to Boost Market Growth

The growing usage of fossil fuels poses a potential hazard to the global and regional environment owing to their emission of carbon dioxide (CO2) into the atmosphere. The GCC countries have some of the highest CO2 emission rates worldwide. Therefore, many countries invest in alternative fuels and energy efficiency and are developing untapped resources, especially shale gas. Alternative fuels are much safer and cleaner than fossil fuels and can improve the environment by reducing air pollutants. The government across the world is also promoting the usage of alternative fuels and enacting several policies. HENCEFORTH, the growing non-linear equipment that supports the renewable energy system increases the risk of grid instability, which creates a threat of electrical grid failure and the risk of damage to the electric equipment required in the renewable energy system. Therefore smart transformers are required to maintain the grid frequency by regulating the voltage.

Smart grid and smart metering technology are rapidly becoming an important focus for the future of the electricity sector. As energy innovation becomes a priority, certain topics are circulating in the industry. By using advanced technology to monitor & control the flow of electricity, smart grids ensure more efficient, reliable, and sustainable energy distribution.

Smart grid had evolved the power industry to a new transition from static one-way management to dynamic two-way management. It plays a crucial role in optimizing and monitoring the power consumption from the demand side, which helps to save energy and increase efficiency—substantial investments from utilities, government initiatives, and grid strengthening projects from various funding organizations. For instance, in 2021, Northern Powergrid, an electrical distribution company, invested USD 15.86 million in its digital transformation project. The project supports the enhancement of remote network management of the company.

RESTRAINING FACTORS

High Initial Cost Hindering the Installation of Smart Transformers

The major restraint in installing smart transformers is their high equipment cost, owing to many enterprises' reluctance to implement. However, these transformers provide reliability, harmonics elimination, and power factor improvement, which is critical in making the overall energy system efficient, productive, and cost-effective. Furthermore, smart transformers' adoption is also declining due to their ability to withstand extreme weather conditions. The traditional transformers can handle situations like lightning strikes, frequent overheating, and surges with failure. But, transformers have significantly less forgiving due to small transistors and little thermal inertia, which results in regular heat up, limiting its widespread adoption. Moreover, the technological advancement in the transformer is upgrading day-by-day, which makes the end-user spending higher. The integration of advanced technology and redundancy of all the power grid components, such as sensor technologies, monitoring, diagnostics, and cloud computing and analytics, makes it more expensive with the limited improvements for reliable power systems are considered.

Smart Transformer Market Segmentation Analysis

By Type Analysis

Expansion of Residential Sector within Distribution Segment, Dominates Market during Forecast Period

Based on the type, this market is segmented into power transformers, distribution transformers, specialty transformers, and instrument transformers. The distribution type segment is estimated to hold the largest market position in 2026 with a market share of 40.29%, as it has been widely used to regulate and optimize the voltage power supply and facilitate the energy need. Distribution transformers are less efficient when compare to power transformers as they are subject to load fluctuation and the chances of failure are higher.

These Transformers are used in large commercial facilities to utilize and distribute energy more effectively, resulting in more efficiency, reducing the cost and power consumption, and going greener. The distribution type transformer helps reduce the cost and helps to provide feedback and information about the power supply.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Smart Grid Applications to Lead Market, Accounting for Maximum Share

This market is segmented into the smart grid, traction locomotive, electric vehicle infrastructure, and others based on application. The smart grid application is estimated to dominate the smart transformer market share of 69.57% in 2026, as it is most commonly used in power systems. The growing focus on renewable energy is expected to propel the demand for smart grid technologies across the energy sector. These devices manage the distribution and flow of energy in smart grids, which ensures the stable growth of smart grid applications.

In traction locomotive, the transformer provides a significant weight reduction and also helps in improving efficiency, reducing electromagnetic compatibility (EMC) and audible emissions.

REGIONAL INSIGHTS

The market has been analyzed across five key regions which are North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

Asia Pacific Smart Transformer Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the major region in the global market. Countries in the Asia Pacific are strategically focused on improving grid stability and investing in intelligent grid projects. Therefore, using a transformer in the smart grid increases the power quality and grid stability. For instance, China Southern Power Grid plans to invest USD 105 billion in grid network construction during 2021-25. Hence, growing intelligent grid investments and government initiatives boost the regional market. The Japan market is projected to reach USD 0.13 billion by 2026, the China market is projected to reach USD 0.56 billion by 2026, and the India market is projected to reach USD 0.2 billion by 2026.

Europe is expected to hold the second-largest position in the global market during the forecast period. Growing digitalization in the power industry and increasing demand for strengthening the grid drive the market demand. Countries in Europe are focusing on extension, refurbishment, and replacement of aging grid infrastructure, which would help to improve the power quality, monitoring, and energy saving in the grid. The UK market is projected to reach USD 0.1 billion by 2026, while the German market is projected to reach USD 0.23 billion by 2026.

North America is also estimated to hold a significant share in the market during the projected period. As per our market research analysis, North America is expected to witness a healthy market growth. The U.S. market is projected to reach USD 0.53 billion by 2026, in North America, owing to the significant increase in investments from utilities to upgrade the existing grid infrastructure. For instance, according to the EIA report 2018, investment in transmission infrastructure in the U.S. peaked at USD 35 billion in 2016. Hence, increasing investments and growing demand for grids led to the market's growth. The Smart Transformers Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.15 billion by 2032.

The Middle East & Africa continuously focuses on renewable power generation and energy mix power generation, which emerges the need for the grid and intelligent equipment. For instance, according to the Middle East Solar Industry Association, energy investment in the Middle East & North Africa region would increase to USD 1 trillion in the forecast period of 2019-2023. Hence, growing investment in the grid, renewable power generation, and government initiatives for grid modernization will lead to the wider adoption of transformers in the power grid. This, in turn, is accelerating the demand for transformers in the regional market.

List of Key Companies in Smart Transformer Market

ABB Focuses on Developing New Products and Upgrading Existing Devices to Strengthen its Product Portfolio

The global market is fragmented and has witnessed high competition from several regional and global participants. ABB is currently one of the world's largest power services companies, and through its advanced services, it continues to dominate the global market. The company continues to focus on providing world-class services to its customers worldwide.

- On January 19, 2021, Hitachi ABB partnered with Vietnam to expand its local manufacturing of transformers. This enables Hitachi ABB to strengthen its electrical network and integrate more renewable energy.

- In July 2020, ABB completed 80% of its Power Grid business to Hitachi. This enables ABB to focus on key market trends and customer needs in electrification, automated manufacturing, digital solutions transportation, industry, and product sustainability.

Additionally, other key players include Schneider Electric, Siemens, Eaton, Mitsubishi Electric Corporation, and GE Power, among others. Key companies across the industry are continuously striving to introduce a highly efficient portfolio with environmental effects and easy integration features.

LIST OF KEY COMPANIES PROFILED:

- ABB (Switzerland)

- Schneider Electric (France)

- Siemens (Germany)

- Mitsubishi Electric Corporation (Japan)

- Eaton (Ireland)

- Alstom (France)

- GE Power (U.S.)

- Powerstar (England)

- CG Power and Industrial Solutions Limited (India)

- Ormazabal (Spain)

- SPX Transformer Solutions Inc. (U.S.)

- Triad Magnetics (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 - The Jammu and Kashmir Power Development Department (JKPDD) planned to install smart meters in over 40,000 Distribution Transformers (DTs) in Kashmir. JKPDD Principal Secretary H Rajesh Prasad announced, "The department will install smart meters in all over 40,000 DTs operating in the Kashmir region so that we have a complete chain from feed meter to DT meter to consumer meter."

- July 2022- Enel Grids announced the development of a new low-carbon transformer that uses natural esters to reduce its carbon footprint. The transformer was established in a joint venture between the electricity distribution network operator and Hitachi Energy, which develops technologies and solutions for companies in the utility, industrial, and infrastructure sectors.

- April 2021 - GE’s Renewable Energy Grid Solution and Hitachi ABB Power Grids signed a landmark agreement to reduce the environmental impact in the electrical transmission industry. The agreement includes complementary share intellectual property of power technologies and accelerating efficient insulation and switching gas in high-voltage equipment.

- October 2020 - Schneider Electric launched EcoStruxure Power and Process, which integrates the engineering design, operations, maintenance and optimizes the decision-making process. The launch of EcoStruxure has enabled various industries to cut down the traditional barriers between power systems and process control systems and enter a new era of digital efficiency.

- February 2020 - On February 25, 2020, Eaton Corporation has completed its acquisition of Power Distribution Inc. (PDI), a leading supplier of mission-critical power distribution, static switching, power monitoring equipment, and services for data centers, industrial, and commercial customers. The company is headquartered in Richmond, Virginia, and is reported within the Electrical Americas business segment with sales of USD 125 million in 2019. The acquisition will enable Eaton Corporation to build power management technologies and services and improve the quality of life and environment.

REPORT COVERAGE

The global smart transformer market research report presents a comprehensive industry assessment by offering valuable insights, facts, industry-related information, and historical data. To formulate the market research report, several methodologies and approaches have been adopted to make meaningful assumptions and views. Furthermore, the report covers a detailed market analysis and information per market segment, including type, applications, and regions, helping our readers get a comprehensive overview of the global industry.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.04% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 3.03 billion in 2025 and is projected to surpass USD 10.58 billion by 2034.

Asia Pacific dominated the market in terms of share in 2025.

Registering a CAGR of 15.04%, the market will exhibit a decent growth rate during the forecast period (2026-2034).

By type, the distribution transformer segment is anticipated to hold a significant share and dominate the forecast period.

Growing digitalization in the power industry and significant growth in developing and strengthening the smart grid, coupled with growth in renewable power generation, are the major factors fueling the demand for the smart transformer market.

ABB, Schneider Electric, Siemens, Eaton, Alstom, and GE Power are among the top players in the smart transformer market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us