Ultrasonic Flow Meter Market Size, Share & Industry Analysis, By Type (Spool Piece, Insertion, Clamp-On, and Others), By Number of Paths (3-Path Transit Time, 4-Path Transit Time, 5-Path Transit Time, and 6 or More Path Transit Time), By Technology (Transit Time -Single/Dual Path, Transit Time –Multipath, Doppler, and Hybrid), By Industry (Natural Gas, Non-Petroleum Liquid, Petroleum Liquid, Power Generation, Pharmaceuticals, Chemical, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

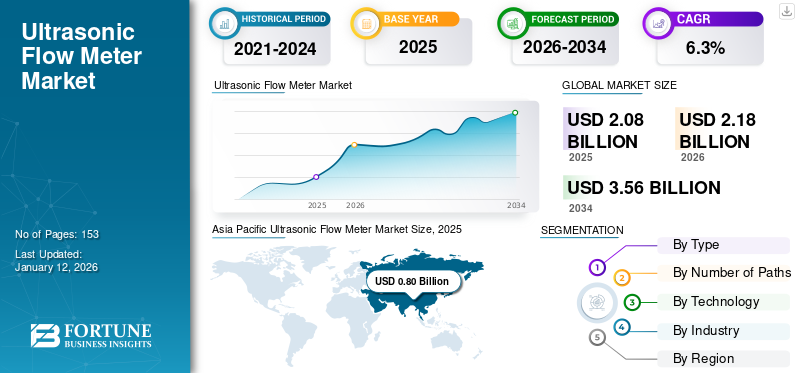

The global ultrasonic flow meter market size was valued at USD 2.08 billion in 2025. The market is projected to grow from USD 2.18 billion in 2026 to USD 3.56 billion by 2034, exhibiting a CAGR of 6.3% during the forecast period. Asia Pacific dominated the ultrasonic flow meter market with a share of 38.6% in 2025.

An ultrasonic flow meter is a device used to measure the flow rate of a fluid, typically liquids, by utilizing ultrasonic waves. Unlike traditional flow meters that rely on mechanical parts or physical barriers to measure flow, these meters operate by sending ultrasonic pulses through the fluid and measuring the time it takes for the pulses to travel upstream and downstream.

These type of meters are known for their non-invasive nature, high accuracy, wide range of applications, and minimal pressure drop. They are commonly used in industries, such as water 7 wastewater management, oil & gas, chemical processing, and HVAC (heating, ventilation, and air conditioning) systems.

They find numerous applications across various industries due to their versatility, accuracy, and non-invasive nature. They are extensively used in water treatment plants, sewage treatment facilities, and distribution networks to measure the flow of water and wastewater. They help in monitoring water usage, detecting leaks, and ensuring efficient operation of the systems.

Global Ultrasonic Flow Meter Market Overview

Market Size:

- 2025 Value: USD 2.08 billion

- 2026 Value: USD 2.18 billion

- 2034 Forecast Value: USD 3.56 billion

- CAGR: 6.3% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific held the largest share in 2025 with 38.6%, driven by industrial expansion and infrastructure development.

- Type Segment Leader: Clamp-on ultrasonic flow meters dominate due to easy installation and cost-efficiency.

- Technology Leader: Transit-time ultrasonic meters lead the market owing to high accuracy and broad application.

- End-User Leader: The natural gas sector remains the largest end-user due to the need for accurate and reliable flow measurement in pipelines and custody transfer.

Industry Trends:

- Increasing adoption of digital signal processing for enhanced accuracy and reduced noise.

- Rising use of IoT-enabled flow meters for remote monitoring and real-time data access.

- Surge in popularity of clamp-on units for retrofitting and minimizing downtime.

- Integration with smart infrastructure and utility management systems.

Driving Factors:

- Growing need for precision in flow measurement across oil & gas, water, and wastewater industries.

- Environmental and regulatory mandates supporting accurate monitoring solutions.

- Advancements in sensor technology and diagnostics enhancing overall system performance.

- Rising industrial automation and investments in smart manufacturing.

In the oil & gas sector, these meters are employed for measuring the flow of crude oil, refined products, natural gas, and various chemicals used in processing. They are crucial for custody transfer applications, pipeline monitoring, and optimizing production processes. These flow meters are employed in power plants to measure the flow of cooling water, fuel, and other fluids used in the energy generation process. They assist in monitoring equipment efficiency, detecting leaks, and ensuring continuous operation of critical systems.

During the COVID-19 pandemic, ultrasonic flow meters found their applications primarily in the healthcare sector and related industries. They were used in manufacturing various medical equipment, such as ventilators and respiratory devices. They helped ensure accurate measurement and control of airflow and gas volumes critical for patient care. These meters contributed to enhancing the safety protocols and improving the healthcare infrastructure resilience during the COVID-19 pandemic. This was particularly in areas where precise airflow and gas measurement were critical for patient management and infection control.

Ultrasonic Flow Meter Market Trends

Rapid Technological Advancements to Augment Market Growth

In the last few years, ultrasonic flow meters have undergone a rapid transformation. In the 1980s, the first multipath ultrasonic flowmeters for measuring gases were introduced in the market. However, the major improvement in ultrasonic flow measurement came in the last decade, which has witnessed a digital signal processing breakthrough. Digital signal processing advancements have enhanced noise filtering, resulting in improved accuracy and efficiency in flow metering. This improvement will contribute to the rising adoption of these meters across various sectors.

While transit time technology dominates the market on the account of continued improvements in precision and processing capabilities, doppler technology is important for applications involving dirty or aerated fluids. The rapid advancement in transit time technology is widening its scope, making it favorable for a broader range of applications. Moreover, the integration of Internet of Things (IoT) technology enables users to monitor and measure the amount of water passing through the pipe, improving convenience and efficiency. Some companies have introduced IoT ultrasonic water flowmeters for IoT-based remote monitoring of water flow.

Download Free sample to learn more about this report.

Ultrasonic Flow Meter Market Growth Factors

Rising Importance of Operational Excellence and Measurement Accuracy in Oil & Gas Sector to Drive Market Growth

The oil & gas sector is one of the most capital-intensive sectors worldwide. Due to increased regulation, decreased output, growing cyber security issues, and shortage of pipeline capacity, it has experienced rising operational costs in recent years. Oil & gas operational efficiency is often achieved by using advanced technologies. In addition to lowering operational costs, these solutions can boost security, decrease waste, increase productivity, and offer numerous other advantages to businesses in the oil & gas sector. According to the "2024 Oil and Gas Industry Outlook" report by the industry expert, more than one-third of surveyed O&G executives noted operational efficiency and lowering direct emissions as key metrics for evaluating the energy transition progress.

The ability of ultrasonic flow meters to precisely monitor and examine various flow dynamics can contribute to enhanced operational efficiency. The non-intrusive design of clamp-on meters and their compatibility with various pipe materials further improve their versatility and appeal in the oil & gas sector. Hydrocarbon liquids, including crude oils and refined products, have both high economic worth and a hazardous nature. An accurate flow measurement device is essential for both custody transfer and leak detection monitoring applications, which is contributing toward ultrasonic flow meter market growth.

RESTRAINING FACTORS

Higher Upfront Cost to Impede Market Growth

Ultrasonic flowmeters are comparatively costlier than many of the other flowmeter options available as the acoustic parts are quite expensive. The upfront cost of buying and installing these flowmeters may pose an issue to price-sensitive customers. Slurry flows and highly contaminated fluids may prevent ultrasonic waves from passing through the fluid, making it impossible for the meter to measure the flow accurately. Even though these meters are not invasive, correct installation is still necessary to guarantee precise results.

To get the best performance, variables, such as pipe size and material need to be taken into account. The temperature range of ultrasonic flowmeters is low. It can only measure a fluid whose temperature is less than 200℃. In conclusion, ultrasonic flow meters offer several benefits for flow measurement, such as non-invasiveness, high accuracy, and low maintenance costs. However, the right installation and awareness of temperature and pressure limits are necessary to ensure optimum performance and high accuracy.

Ultrasonic Flow Meter Market Segmentation Analysis

By Type Analysis

Clamp-On Type to Grow at Highest CAGR Owing to Ease of Installation and Versatility

By type, the market is classified into spool piece, insertion, clamp-on, and others.

The clamp-on type segment will witness the highest growth in terms of market share and CAGR during the forecast period. These are non-intrusive meters that can be clamped onto the exterior of a pipe to measure flow using either transit-time or Doppler techniques. They are ideal for temporary measurements, retrofitting, or applications where penetrating the pipe is not feasible. They are also growing in popularity due to their ease of installation and versatility. The segment is likey to attain 42.66% of the market share in 2026.

Moreover, the insertion type segment is also witnessing major growth owing to specific design configuration used for measuring the flow rate of liquids flowing through a pipe. Insertion type ultrasonic flow meters are generally more cost-effective compared to the full-bore or inline versions. This affordability makes them attractive for applications where budget constraints are a concern. The segment is anticipated to grow with a considerable CAGR of 5.80% during the forecast period (2025-2032).

To know how our report can help streamline your business, Speak to Analyst

By Number of Paths Analysis

4-Path Transit Time to Lead Market Due to Its Utlization in Complex Industrial Applications

By number of paths, the market is categorized into 3-path transit time, 4-path transit time, 5-path transit time, and 6 or more path transit time.

The 4-path transit time segment is leading the market, capturing the major share and recording a notable CAGR. The segment’s growth is owing to utilization of 4-path transit time in oil & gas pipelines, chemical processing, and more complex industrial applications where higher accuracy is essential. This transit time is growing in industries, such as oil & gas and chemicals where precise flow measurement is crucial for operational efficiency and safety. It employs four ultrasonic paths for flow measurement and offers higher accuracy compared to 3-path meters, making it suitable for more demanding applications. The segment is likely to acquire 38.07% of the market share in 2026.

Moreover, adoption of 5-path transit time is across high-stakes industries, such as oil & gas custody transfer, power generation, and large-scale industrial operations is resulting in steady growth of the market. Also, it helps in providing superior accuracy and is used for demanding applications.

The 3-path transit time segment is poised to register a substantial CAGR of 5.80% during the forecast period (2025-2032).

By Technology Analysis

Transit Time-Single/Dual Path Holds Highest Market Share Due to Its Suitable Accuracy For Various Applications

By technology, the market is divided into transit time-single/dual path, transit time-multipath, and doppler & hybrid.

The transit time-single/dual path segment is gaining major traction and dominating the ultrasonic flow meter market share. This technology utilizes one or two ultrasonic paths to measure the flow rate by determining the time difference between upstream and downstream signal transmissions. In addition, it further provides basic-to-moderate accuracy suitable for applications where extremely high precision is not critical.

It is commonly used in water & wastewater management, residential & commercial HVAC systems, and simple industrial processes. It is also widely used due to its lower cost and ease of installation, thereby representing a significant portion of the market. The segment is projected to hold 40.37% of the market share in 2026.

The Doppler segment is foreseen to grow with a considerable CAGR of 5.90% during the forecast period (2025-2032).

By Industry Analysis

Natural Gas to Lead Market Due to Its Regulatory Standards For Measurement Accuracy

By industry, the market is divided into natural gas, non-petroleum liquid, petroleum liquid, power generation, pharmaceuticals, chemical, and others.

Ultrasonic flow meters are extensively used in natural gas industry for measuring flow rates in pipelines, distribution networks, and custody transfer. They have higher accuracy which is essential due to the high-value and regulatory requirements of natural gas transactions. Furthermore, this segment represents a significant portion of the market due to the critical need for precise flow measurement in gas distribution and transfer. The market is being driven by the increasing natural gas production & consumption, stringent regulatory standards for measurement & accuracy, and need for efficient pipeline operations. The natural gas segment captured 27.98% of the market share in 2026.

Ultrasonic flow meters are also being utilized in the petroleum liquid industry for measuring the flow of crude oil, refined products, and liquid hydrocarbons in pipelines, refineries, and terminals. However, the petroleum liquid segment is expected to havea moderate growth rate over the forecast period.

REGIONAL INSIGHTS

The report's scope comprises five major regions - North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Ultrasonic Flow Meter Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 0.80 billion in 2025 and USD 0.85 billion in 2026. Asia Pacific is experiencing robust growth in the global market due to rapid industrialization, urbanization, and infrastructure development in various countries across the region. Industries, such as oil & gas, water & wastewater management, power generation, chemicals, and manufacturing are significant users of ultrasonic flow meters in the region. China is poised to reach USD 0.32 billion in 2026. The expanding industrial base and increasing demand for accurate flow measurement solutions will drive the adoption of these meters in diverse applications. With growing concerns over water scarcity and pollution, countries across the region are investing in advanced water management solutions, including ultrasonic flow meters, for monitoring and managing water resources effectively. India is foreseen to grow with a value of USD 0.17 billion in 2026, while Japan is expected to hold USD 0.14 billion in the same year.

North America

North America is the second leading region anticipated to be valued at USD 0.63 billion in 2026, registering a CAGR of 5.70% during the forecast period (2025-2032). North America is one of the leading regions in the adoption and utilization of ultrasonic flow meters due to its advanced industrial infrastructure and stringent regulatory environment. The market in North America is substantial and continues to grow, driven by technological advancements and the need for efficient flow measurement solutions. Regulatory bodies, such as the Environmental Protection Agency (EPA) enforce strict standards for environmental protection and industrial emissions. Compliance with these regulations necessitates accurate flow measurement, boosting the demand for these flow meters. The U.S. market is anticipated to hold USD 0.52 billion in 2026.

Europe

Europe is the third largest market expected to be worth USD 0.43 billion in 2026. Moreover, the European market is significant and growing steadily, driven by factors, such as industrial automation, infrastructure development, and environmental regulations. Technological advancements, such as the integration of these flow meter with IoT platforms and digitalization trends are driving market growth by enhancing its functionality and data analysis capabilities. The U.K. market continues to expand, projected to reach a market value of USD 0.09 billion in 2026. These meters find applications in various industry verticals in Europe, including oil & gas, water & wastewater management, power generation, chemicals, pharmaceuticals, HVAC, and food & beverage processing. Germany is expected to hit USD 0.12 billion in 2026, while France is esrimated to gain USD 0.06 billion in 2025.

The Middle East & Africa

The Middle East & Africa is the fourth largest market set to reach USD 0.17 billion in 2026. Furthermore, in the Middle East & Africa (MEA), ultrasonic flow meters play a significant role in various industries, driven by factors, such as rapid industrialization, infrastructure development, and the growing demand for accurate flow measurement solutions. The region is home to some of the world's largest oil and gas reserves, making it a key player in the global energy market. These meters are extensively used in the oil & gas industry in the region for custody transfer measurement, pipeline monitoring, and production optimization. In Africa, countries, such as South Africa, Nigeria, and Kenya are witnessing increasing demand for these flow meter services, particularly in sectors, such as commercial real estate, healthcare, and government facilities. The GCC market is expected to acquire USD 0.09 billion in 2025.

South America

These flow meters play a significant role in the South American market across various industries, providing accurate and reliable flow measurement solutions. With the region being home to significant oil and gas reserves, particularly in countries, such as Brazil and Venezuela, the demand for these meters is driven by the need for accurate measurement of hydrocarbon flows. These meters offer advantages, such as high accuracy, reliability, and versatility, making them well-suited for the demanding conditions encountered in the oil & gas sector in South America.

KEY INDUSTRY PLAYERS

Major Players to Adopt Several Market Penetration Approaches to Sustain Their Position

The ultrasonic flow meter market consists of prominent players, such as Emerson Electric Co., Baker Hughes Company (Panametrics), Fuji Electric Co., Ltd., ifm electronic gmbh, Aichi Tokei Denki Co., Ltd., Siemens AG, KROHNE GROUP, Endress+Hauser Group Services AG , Badger Meter, Inc., Danfoss, and others. These major players are adopting several market penetration approaches and strategies to sustain their position through collaborations, mergers & acquisitions, partnerships, creation of new production processes, establishment of new joint ventures, innovating existing or developing new products for their product line-up, and many others. These strategies will help them expand their customer base in the existing and untouched markets in all regions.

List of Top Ultrasonic Flow Meter Companies

- Baker Hughes Company (U.S.)

- Siemens AG (Germany)

- Emerson Electric Co. (U.S.)

- Fuji Electric Co., Ltd. (Japan)

- KROHNE Group (Germany)

- Endress+Hauser Group Services AG (Switzerland)

- Badger Meter, Inc. (U.S.)

- Danfoss (Denmark)

- ifm electronic gmbh (Germany)

- Aichi Tokei Denki Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- March 2024 - Siemens upgraded and expanded its SITRANS FC Coriolis Mass Flowmeter portfolio to significantly enhance its offerings and capabilities.

- March 2024 - Emerson introduced the RosemountTM 9195 Wedge Flowmeter, a fully integrated solution consisting of the wedge's primary sensor, supporting components, and a choice of Rosemount pressure transmitters.

- February 2024 - KROHNE introduced a compact, high performance flow computer for volumetric flow calculation and heat quantity measurement of liquids and gases, including saturated steam and superheated steam, with the OPTIBAR FC 1000.

- November 2023 - Baker Hughes launched the latest generation of reinforced thermoplastic pipes, PythonPipeTM, which allows quicker installation, shorter first production time, and lower lifecycle emissions.

- August 2023 - Fuji Electric launched a new flow meter for liquids in small pipes, the New S-flow Ultrasonic Flow Meter integrated with a clampon ultrasonic flowmeter.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.3% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Number of Paths, By Technology, By Industry, and By Region |

|

Segmentation |

By Type

By Number of Paths

By Technology

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach a valuation of USD 3.56 billion by 2034.

In 2025, the market was valued at USD 2.08 billion.

The market is projected to record a CAGR of 6.3% during the forecast period.

The clamp-on type is leading the market in terms of share.

Rising importance of operational excellence and measurement accuracy in the oil & gas sector is expected to drive the market growth.

Baker Hughes Company, Siemens AG, Emerson Electric Co., Fuji Electric Co., Ltd., KROHNE Group, Endress+Hauser Group Services AG, Badger Meter, Inc., Danfoss, ifm electronic gmbh, and Aichi Tokei Denki Co., Ltd. are some of the top market players.

Asia Pacific generated the maximum revenue in 2025.

The natural gas industry is expected to record the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us