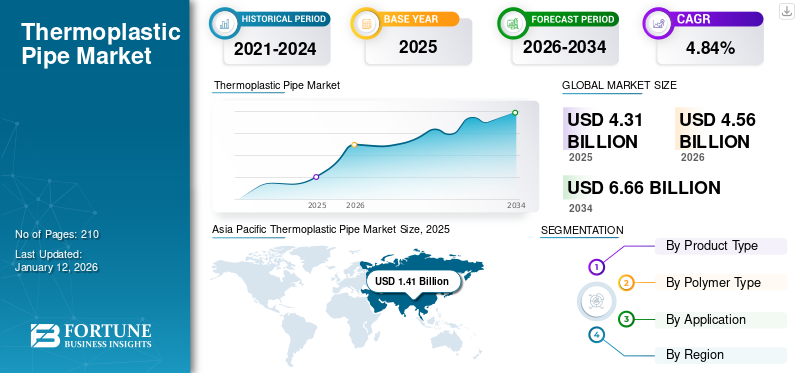

Thermoplastic Pipe Market Size, Share & Industry Analysis, By Product Type (Reinforced Thermoplastic Pipe (RTP) and Thermoplastic Composite Pipe (TCP)), By Polymer Type (Polyethylene (PE) Pipe, Poly Vinyl Chloride (PVC) Pipe, Polypropylene Pipe (PP), Polyvinylidene Fluoride (PVDF), and Others), By Application (Oil & Gas, Water & Wastewater, Mining & Dredging, and Utilities & Renewables), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global thermoplastic pipe market size was valued at USD 4.31 billion in 2025. It is projected to be worth USD 4.56 billion in 2026 and reach USD 6.66 billion by 2034, exhibiting a CAGR of 4.84% during the forecast period. Asia Pacific dominated the thermoplastic pipe market with a market share of 32.65% in 2025.

Thermoplastic pipes do not corrode such as steel or iron, especially in harsh environments (chemicals, saltwater, and wastewater). This makes them ideal for oil and gas, municipal water, and chemical industries. They are much lighter than metal pipes, making transportation, handling, and installation easier and more cost-effective, resulting in lower labor and equipment costs.

Increased exploration of offshore and deepwater oil and gas has boosted the use of thermoplastic composite pipes. These pipes are flexible and corrosion-resistant, perfect for flowlines and subsea operations.

Many countries are replacing aging water and sewer systems with these pipes due to their long service life (50-100 years). A growing urban population is increasing the demand for water supply and sanitation pipelines. Baker Hughes, Georg Fischer, and Sasol are the major players in the market due to their strong product portfolio, global presence, and continuous investments in research and development. The market share is growing as industries and governments are increasingly choosing them over traditional materials such as steel and concrete.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Onshore & Offshore Production Activities Fuels Market Growth

Thermoplastic pipes offer several potential benefits, due to which their usage is increasing in onshore & offshore production activities. Its properties, such as wear and corrosion resistance, high stiffness, and strength concerning variations in temperature and deformation due to stress, make it highly effective for several underwater applications. Although steel is widely used in the oil and gas industry manufacturing, thermoplastic composites are of huge importance for offshore production activities such as chemical injection pipes and risers.

In August 2023, Strohm successfully installed and commissioned its inaugural deep-water/high-pressure Thermoplastic Composite Pipe (TCP) Jumper in South America for ExxonMobil Guyana at the Liza field. It is now operational. The Jumper, made with innovative carbon fiber and polyamide12 components, facilitates Water Alternating Gas (WAG) injection. It was installed at depths exceeding 1,700 meters for ExxonMobil, following its subsea landing and leak testing.

Increasing Demand for Gas Distribution to Boost Market Growth

The reinforced pipe is essential in combining high-performing materials with high-strength reinforcements to create a spoolable high-pressure pipeline system. Such construction is well-suited to various applications, mainly gas distribution. The key usage of reinforced thermoplastic pipes for gas gathering, water disposal, and water injection generates huge demand, further impacting the global market growth. Increasing the use of such pipes for gas distribution also creates growth opportunities in the forecast period.

In February 2025, McDermott successfully completed the transportation, installation, and commissioning tasks for the Kikeh subsea gas lift project, which was granted by PTTEP Sabah Oil Limited (PTTEP) in early 2024. The company’s Kuala Lumpur (KL) team carried out this undertaking at water depths of around 1,400 meters, adhering to an expedited timeline.

MARKET RESTRAINTS

High Cost Associated with Thermoplastic Composite Pipes Impedes Market Growth

Thermoplastic pipes developed with engineering thermoplastic grades such as Polyethene (PE) and Polyvinyl Chloride (PVC) are immensely used due to their cost-effectiveness and outstanding chemical resistance characteristics. However, due to their high cost, higher grades of thermoplastics, consisting of Polyether Ether Ketone (PEEK), are used in limited applications in seals and wirelines. Although the pipes offer good abrasion resistance, reduced emission of smoke and toxic gases, and low flammability, the high raw material and fabrication costs limit their usage, further hampering the thermoplastic pipe market growth.

MARKET OPPORTUNITIES

Rising Oil & Gas Exploration and Production Activities for Deep and Ultra-Deepwater Offer Growth Opportunities

There is a rapid rise in the production of deep & ultra-deepwater oil & gas exploration activities as the reserves in shallow waters are becoming dry. In the oil and gas exploration and production industry, deepwater is generally considered water depth greater than 1,000 feet, and ultra-deepwater is greater than 5,000 feet. Bringing the fluids through such deep waters to the main surface poses key challenges for good operators. Moreover, the temperature and pressure ratings are very high in deep and ultra-deep water. The high pressure and currents also drag the pipes through deep water.

In January 2021, Baker Hughes introduced its latest Onshore Composite Flexible Pipe, aimed at tackling the issues of corrosion and the expense associated with traditional steel piping in the energy, oil, and gas, and industrial fields. This flexible and lightweight Reinforced Thermoplastic Pipe (RTP) provides a more cost-effective and environmentally friendly option compared to the resource-heavy onshore steel pipes, enhancing the essential framework of flowline and oil and gas pipeline systems.

MARKET CHALLENGES

Limited Awareness and Expertise to Restrain Market Growth

The growth of the market is restrained by the limited awareness and technical expertise among end-users and installers. Many industries, especially in developing regions, are still accustomed to traditional piping materials such as steel, copper, or concrete. As a result, they are hesitant to adopt thermoplastics, despite their advantages such as corrosion resistance, flexibility, and lightweight nature.

Additionally, the lack of trained professionals for the proper design, handling, and installation of pipe systems leads to performance issues or project delays, further deterring potential adopters. This knowledge gap also impacts decision making at the procurement stage, where engineers or contractors avoid using unfamiliar materials.

THERMOPLASTIC PIPE MARKET TRENDS

Infrastructure and Urbanization Boom to Drive Market Growth

The rapid pace of urbanization and infrastructure development, particularly in emerging economies, is significantly boosting the demand for the product. As cities expand and new residential, commercial, and industrial zones are built, there is a growing need for efficient water supply, sewage, gas distribution, and drainage systems, all of which rely heavily on durable and corrosion resistant piping.

Thermoplastic pipes, such as PVC, PE, and PP, are increasingly preferred over traditional materials due to their corrosion resistance, lightweight and easy installation, low maintenance costs, and long operational life.

IMPACT OF TARIFFS

The upcoming tariffs on plastic imports and petrochemical raw materials in 2025 are expected to raise expenses, disturb supply chains, and require manufacturers in the plastics sector to make strategic adjustments.

Tariffs on Imported Plastic Resins

Numerous manufacturers in the U.S. depend on imported polyethylene, polypropylene, and polyvinyl chloride to enhance local production. The recently implemented tariffs consist of:

- A 10% duty on plastic resin imports from China

- A 15% duty on petrochemical feedstocks originating from the Middle East.

As a result, companies obtaining raw materials from abroad will experience a prompt rise in expenses, encouraging them to focus on domestic sourcing or seek other suppliers.

Higher Production Costs and Pricing Challenges

Due to rising costs of raw materials, producers must determine their approach to price changes. Take on the costs: This may cut into profits but assist in staying competitive, and transfer costs to consumers. This may result in losing clients if rivals offer cheaper options, seek different suppliers, acquire materials from regions without tariffs, or boost the usage of recycled resources.

SEGMENTATION ANALYSIS

By Product Type

High Durability and Corrosion Resistant Factor to Drive Reinforced Thermoplastic Pipe Segment’s Growth

Based on product type, the market is segmented as reinforced thermoplastic pipe (RTP) and thermoplastic composite pipe (TCP).

The reinforced thermoplastic pipe (RTP) holds the largest thermoplastic pipe market share of 59.91% in 2026 and is expected to dominate over the forecast period. These pipes are more durable and corrosion-resistant than steel ones and can easily withstand CO2 and salt corrosion. They are highly accepted as an important substitute for conventional metallic offshore pipes owing to their distinctive benefits, such as a higher stiffness-to-weight ratio, enriched fatigue resistance, and better corrosion resistance.

In May 2024, Westlake Pipe and Fittings, a sector of Westlake Corporation, established a new plant for molecular-oriented Polyvinyl Chloride (PVCO) pipes at its production facility located in Wichita Falls, Texas. This expansion is a noteworthy achievement in Westlake's dedication to progress, innovation, and generating employment in the area.

Thermoplastic composite pipe (TCP) is the second dominating segment in the market, due to its superior strength-to-weight ratio, corrosion resistance, and suitability for high-pressure applications in industries such as oil and gas and offshore operations.

By Polymer Type

Versatility and Wide Range of Applications to Drive Polyethylene Segment’s Growth

Based on the polymer type, the market is segmented as Polyethylene (PE) Pipe, Poly Vinyl Chloride (PVC) Pipe, Polypropylene Pipe (PP), Polyvinylidene Fluoride (PVDF), and others.

Polyethylene (PE) pipes dominate the market share of 39.92% in 2026, as their crosslinked structure improves the toughness and temperature resistance of the material. A polyethylene pipe designed to transport drinking water can be installed underground or above ground. In both cases, its installation is much more affordable than traditional materials (steel and cast iron) as it requires less work and specific equipment.

Poly Vinyl Chloride (PVC) pipe can be easily processed into rigid or flexible forms, making it suitable for a broad spectrum of uses such as construction, medical, automotive, and consumer goods.

By Application

To know how our report can help streamline your business, Speak to Analyst

Massive Investment in Oil & Gas Industry Propelled Segment Growth

Based on application, the market is segmented as oil & gas, water & wastewater, mining & dredging, and utilities & renewables.

The oil & gas segment held the leading share of 44.46% in 2026, owing to the massive rise in investments in the sector and the increasing usage of thermoplastic pipes. The increasing demand for oil is driving market growth. The growing gas consumption generates demand for installing thermoplastic pipes, integral to gas distribution. It results in faster growth of the oil & gas application segment in the global market.

In contrast to metal pipes, thermoplastic pipes (e.g., PVC, HDPE, CPVC) do not corrode or rust. This makes them ideal for water distribution and sewage systems, especially in chemically aggressive environments.

Water and wastewater is the second-dominating segment. The segment is growing due to increasing infrastructure development and growing emphasis on sustainable water management.

THERMOPLASTIC PIPE MARKET REGIONAL OUTLOOK

The market has been studied regionally across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Thermoplastic Pipe Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Expansion of Water & Wastewater and Oil & Gas Industries to Drive Market Growth in Asia Pacific

Asia Pacific dominated the market with a valuation of USD 1.41 billion in 2025 and USD 1.5 billion in 2026. Asia Pacific is the dominating region of the market. The wide application of these pipes in several industries, such as water & wastewater, oil & gas, utilities & renewables, and construction & infrastructure, is bolstering the growth of this market. Moreover, the rising development activities and the economic expansion in most Asian Pacific countries will fuel the market growth in the region. The Japan market is projected to reach USD 0.33 billion by 2026, the China market is projected to reach USD 0.59 billion by 2026, and the India market is projected to reach USD 0.22 billion by 2026.

The surging demand for oil & gas has raised the demand for Reinforced Thermoplastic Pipe (RTP) as oil, gas, and hydrocarbon transportation that includes flowlines, domestic pipelines, transportation pipelines, and many others need a special material to withstand extreme temperatures. RTP is made of high-strength materials, has chemical compatibility and ultra-low permeability, and is therefore a reliable solution for transporting and distributing chemicals and refined fuels, further fueling the growth of the market in Asia Pacific.

China

Continuous Rise in Demand for Gas Production Enhances Market Growth in China

The continuous rise in demand for gas production will also enhance the market growth in the Asia Pacific region. For instance, according to the Gas Exporting Countries Forum, the region's gas demand is anticipated to grow by 78%, from 910 billion cubic meters in 2021 to 1,620 billion cubic meters by 2050. China will account for 48% of Asia Pacific's increasing gas usage between 2021 to 2050.

The demand for natural gas in China is anticipated to reach 700 billion cubic meters by 2050 from 360 billion cubic meters in 2021 due to rapid urbanization, economic expansion, infrastructural development, and coal-to-gas conversions. In June 2024, Rollepaal, a prominent worldwide provider of pipe extrusion solutions, is excited to reveal the start of a special collaboration in India with Sintex, part of the internationally acknowledged Welspun World group. Through the signing of this deal, Sintex is preparing to enter a new phase in the production of PVCO pipes in India, utilizing the highly advanced technology already recognized for PVCO products.

North America

Rising Demand for Reinforced Thermoplastic Pipes to Drive Regional Market Growth

The North American market is experiencing steady growth. The reinforced thermoplastic pipe segment contributes to regional development. Additional service costs associated with the maintenance of pipelines can be eliminated by using thermoplastic pipes, which results in an increasing demand. Furthermore, the rising demand for high-temperature and pressure-reinforced thermoplastic pipes in water and wastewater applications is also projected to create profitable opportunities for market growth in the region. The U.S. market is projected to reach USD 1.03 billion by 2026.

In October 2024, Soleno Inc., located in Quebec, launched its initial manufacturing facility in Saratoga Springs, New York, where it created pipes crafted from recycled high-density polyethylene. This includes a new range of products featuring diameters reaching 136 inches, utilizing advanced spiral-wound pipe technology.

U.S.

Increasing Production of Oil & Gas Contributes to Market Growth in U.S.

The market in the U.S. is growing due to the increasing demand from the oil and gas, water management, and chemical industries, driven by the need for corrosion-resistant, lightweight, and cost-effective piping solutions.

For instance, according to the U.S. Energy Information Administration (EIA), natural gas production (dry gas) reached the highest record of 34.15 trillion cubic feet (Tcf) or 93.57 billion cubic ft/day (Bcf/day) in 2021.

Europe

Growing Offshore Applications to Surge European Market Growth

Thermoplastic composites are emerging as a greater alternative to steel in Europe, in the oil & gas sector. They are widely utilized in offshore applications such as chemical injection pipelines and risers. Its features, such as wear and corrosion resistance, improved stiffness, and strength in response to temperature differences and stress deformation, make it ideal for underwater applications. The UK market is projected to reach USD 0.16 billion by 2026, while the Germany market is projected to reach USD 0.21 billion by 2026.

European oil and gas also contribute to the market’s growth. For instance, according to the statistics by Eurostat, the EU energy mix in 2020 consisted of 34.5% of oil and petroleum products, 23.7% of natural gas, 17.4% of renewables, 12.7% of nuclear energy, and 10.5% of solid fossil fuels.

Latin America

Power Generation from Renewable Sources to Soar Market Growth in Latin America

The market in Latin America is experiencing significant growth. The oil & gas industry is helping in driving the growth of this market as the consumption of natural fuel is increasing. Countries are laying pipeline systems to import it from other countries as they are unable to meet the demands. According to the Economic Commission for Latin America (ECLA), the consumption of natural gas in Mexico has grown in recent years, mainly due to its use in electricity generation. Further, to meet the growing demand, the country has to import almost 70% of the country's total consumption. They are also used to offer cable protection.

Middle East & Africa

Huge Presence of Oil & Gas Industry to Augment Product Demand in Middle East & Africa

The Middle East & African region is expected to experience moderate growth. Oil & gas is the dominating industry and the primary cause driving the development of the market in this region. The reinforced thermoplastic pipes are corrosion-resistant, more durable than the traditional ones, and contribute to the longer lifespan of the entire pipeline system without adding extra cost. Furthermore, the spoolability of RTPs reduces installation time and requires less workforce for installation due to their flexible properties. All these factors contribute to the growth of the market in the Middle East & African region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players are Focusing on Introducing Advanced Products to Gain a Market Advantage

The global market is mostly fragmented, with key players operating in the industry. Globally, Baker Hughes is dominating the market. In November 2024, Energy technology firm Baker Hughes declared the introduction of its new PythonPipe portfolio, which represents the most recent advancement in Reinforced Thermoplastic Pipe (RTP) technology that allows for quicker installation, decreased time to initial production, and minimized lifecycle emissions.

List of Key Thermoplastic Pipe Companies Profiled

- Wienerberger (Austria)

- Baker Hughes (U.S.)

- Advanced Drainage Systems, Inc. (U.S.)

- Georg Fischer (Switzerland)

- National Oilwell Varco (NOV) (U.S.)

- Magma Global (U.K.)

- KWH Group (Finland)

- Exxon Mobil (U.S.)

- Sasol (South Africa)

- Sibur (Russia)

- Uponor (Finland)

- Simtech (U.S.)

- Topolo (China)

KEY INDUSTRY DEVELOPMENTS

- May 2025- Advanced Drainage Systems, Inc. acquired River Valley Pipe LLC, which is a privately held pipe manufacturing company based in the Midwest of the U.S. This acquisition is a part of its strategic priority to increase the company's market-leading position through acquisitions in its core stormwater and agriculture drainage markets in the important agricultural states of Illinois and Iowa.

- March 2025 – Georg Fischer displayed critical fluid handling solutions in the semiconductor industry at SEMICON China 2025 at Shanghai New International Expo Centre, China. These solutions include durable thermoplastic piping systems and services such as planning, engineering, support, and prefabrication.

- March 2025, NOV’s Subsea Production Systems (SPS) division entered into a Pre-commercial Agreement (ETEC) with Petrobras, representing a significant achievement in advancing a cutting-edge solution for flexible pipes intended for high CO₂ deepwater uses.

- November 2023 – Magma Global and Element renewed their strategic partnership to extend m-pipe capabilities. The aim is to qualify the system for new operating environments with advancements in thermoplastic composite technologies, specifically for the energy sector, through testing and validation.

- December 2020- Aramco and Baker Hughes announced the establishment of Novel, a Joint Venture (JV) that is equally owned at 50/50 to create and market a wide array of non-metallic products for various uses in the energy industry. Novel’s new facility is in the process of being constructed at King Salman Energy Park (SPARK), located in Saudi Arabia’s Eastern Province.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key market players are actively investing in strategic initiatives such as technological advancements, product innovation, and geographic expansion to strengthen their position in the market.

- In December 2022- Strohm, the globe's first and major producer of Thermoplastic Composite Pipe (TCP), finished the largest funding round in the company’s 15-year history by obtaining a USD 17 million investment, setting the firm on a quick global development trajectory in the low carbon energy sector.

REPORT COVERAGE

The global thermoplastic pipe market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations offering thermoplastic pipe. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.84% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Polymer Type

|

|

|

By Applications

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 4.31 billion in 2025.

The market is likely to grow at a CAGR of 4.84% over the forecast period (2026-2034).

By application, the oil and gas segment led the market.

The market size of Asia Pacific stood at USD 1.41 billion in 2025.

Augmenting demand for thermoplastic pipes in onshore & offshore production activities drives the market growth.

Wienerberger, Baker Hughes, KWH Group, and others are some of the market's top players.

The global market size is expected to reach USD 6.66 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us