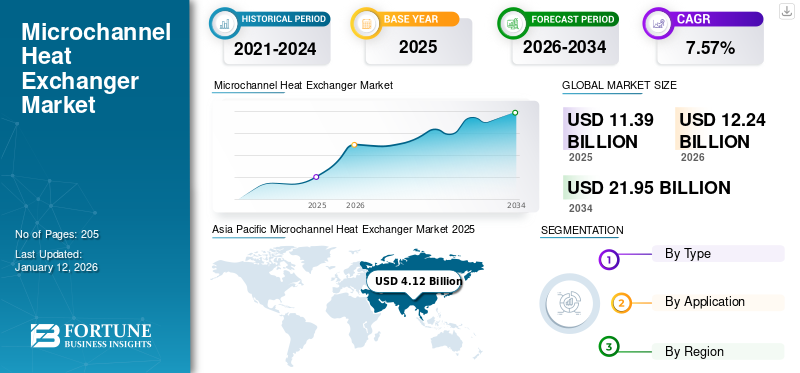

Microchannel Heat Exchanger Market Size, Share & Industry Analysis, By Type (Evaporator, Condenser, and Water Coil), and By Application (HVAC {Air Conditioning, Heat Pump, Heat Pump Water Heater, Others} Automotive, Refrigeration, and Others), and Regional Forecast, 2026-2034

Microchannel Heat Exchanger Market Size

The global microchannel heat exchanger market size was valued at USD 11.39 billion in 2025. The market is projected to grow from USD 12.24 billion in 2026 to USD 21.95 billion by 2034, exhibiting a CAGR of 7.57% during the forecast period. Asia Pacific dominated the global market with a share of 36.20% in 2025.

Microchannel heat exchangers are compact devices with high performance and are designed for multiple applications in the industry. It helps to transfer heat to heat pumps, HVAC systems, automotive vehicles, and others efficiently. The complex network of small channels enhances heat exchange capabilities with power generating technology, making them ideal for challenging environments, such as humid and hot climate conditions. One of the major driving factors is the increasing production of conventional vehicles, where the microchannel heat exchanger is an important part of the whole assembly of vehicles.

The COVID-19 pandemic negatively impacted various industrial operations due to breaks in the company's activities, operations, transportation, and the shortage of raw materials. The supply chain faced issues due to the scarcity of raw materials and finished products, which led to shortages in global markets for commodities, logistics, and labor, as well as input cost inflation.

Microchannel Heat Exchanger Market Trends

Growing Focus on Zero-Emission Regulations to Drive Market Expansion

The global shift toward energy efficiency and a sustainable future, propelled by zero-emission regulation, has created fresh opportunities in the market. These exchangers play a crucial role in the transition by offering a highly efficient solution for heat management in various applications, such as automotive, HVAC, heat pumps, refrigeration systems, and others.

For instance, on November 21, 2023, the Department of Environmental Protection (DEP) and the Murphy administration accepted zero-emission vehicle standards to improve air quality, fight climate change, and promote clean vehicle choices.

Moreover, the cumulative adaptation of the zero-emission goals by the private sector is also creating opportunities for heat exchangers in the market as several applications are trying to change the current market scenario.

Download Free sample to learn more about this report.

Microchannel Heat Exchanger Market Growth Factors

Increasing Sales and Production of Conventional Vehicles Drive Market Growth

All classes of vehicles, such as two-wheelers, three-wheelers, light commercial vehicles, passenger cars, buses, trucks, tractors, heavy commercial vehicles, and others, are manufactured globally with essential components of heat exchangers. Most of these classes require exchangers to control the heat of particular vehicles. The heat exchanger cannot be easily replaced with other devices as it is made for a particular use. Hence, the rising applications globally, such as vehicle production, are increasing demand for these exchangers, driving the microchannel heat exchanger market growth.

The automobile industry is one of the most flourishing industries in the market. The rising developments and new products are creating demand for the equipment that is essential for cars. Microchannel is also one of the equipment that is driven by the rising car production in the market.

For instance, as per the data of Economic and Market Report Europe, in 2022, demand in China was amplified by 7.6% YoY to 21.7 million cars sold, as the removal of government enticements by the end of 2022 has carried forward demand. Similarly, North American car manufacturing rose by 10.3% in 2022 to 10.4 million units, mainly driven by strong demand in the U.S. market.

Exponential Advancements in the HVAC Sector are Boosting the Heat Exchanger Market Growth

The heating, ventilation and air conditioning (HVAC) technology offers environmental comfort via thermal manipulation (heating and air conditioning) and is an essential product as rising global warming is hitting high temperatures in several regions. The HVAC system consists of a microchannel heat exchanger component, which helps to deliver smooth performance in any environmental condition. Additionally, the recent advancements in the HVAC sector are boosting the demand for heat exchangers in the market.

For instance, on November 1, 2023, Mitsubishi Electric established an aluminum vertical flat tube (VFT) heat exchanger design that can provide over 40% increase in heat pump air conditioner performance. The new VFT heat exchanger is combined with small-diameter flat tubes, arranged vertically, and a high-performance refrigerant distributor with a double-tube structure that can distribute refrigerant with over 20% smaller internal volume than conservative aluminum horizontal flat tube (HFT) heat exchangers; this new VFT heat exchanger allows for reduced refrigerant charges.

RESTRAINING FACTORS

Complex Design of Microchannel Heat Exchanger Increases the Cost of Manufacturing Hampering Market Growth

Microchannel heat exchangers necessitate an accurate yet suitable design to enhance device performance, which increases production expenses. According to industry data, the cost of the exchangers is approximately 20% to 30% higher than conventional heat exchangers due to their complex design. This involves an increase in attributes to specialized materials such as aluminum. In addition, tight tolerance and advanced welding or bounding processes are involved in constructing this compact heat exchanger unit.

In May 2023, The Department of Energy (DOE) delivered USD 40 million to advance new approaches to data center cooling. This involves several pieces of equipment, including a microchannel heat exchanger, which is expensive to manufacture as per the requirement. Again, rising raw material prices are creating a negative impact on the market, as this factor adds valuable importance to several applications.

Microchannel Heat Exchanger Market Segmentation Analysis

By Type Analysis

Condenser Dominates Due to its High Efficiency and Power Performance

Based on type, the market is segmented into evaporator, condenser, and water coil.

The condenser segment held a larger share in 2024 owing to the rapidly increasing demand for condensers across the globe, owing to their high efficiency and power performance. In addition, it helps to increase efficiency in applications by 20% to 40%.

For instance, on September 25, 2023, Spirax Sarco, the worldwide forerunner in steam system engineering and management, has long drawn out its product line to comprise the new Exhaust Vapor Condenser (EVC). The Spirax Sarco EVC is a consistent, innovative heat exchanger that utilizes flash steam from release and exhaust vent pipework to process water or pre-heat make-up.

The evaporator segment is the fastest-growing segment in the market with a share of 25.14% in 2026, driven by its application in devices. An evaporator is a heat exchanger that adapts the serviceable or latent heat of one fluid into the latent heat of vaporization of another. This makes it applicable to most heating and cooling devices.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

HVAC Segment is dominating the global market due to the Increasing Use of Applications

Based on application, the market is segmented as HVAC, automotive, refrigeration, and others. The HVAC is sub-segmented into air conditioning, heat pump, heat pump water heater, and others.

The HVAC segment is accounting for 46.70% market share in 2026, driven by the rising applications in the commercial and residential areas. Additionally, the driving factor for the HVAC segment is the increasing development and innovation of the devices, making it one of the fastest-growing applications. HVAC systems are estimated to lead the market during the forecast period owing to the rising use of cooling and heating to keep residential areas warm.

For instance, in 2020, the U.S. transferred 1.4 million new vehicles and 108,754 medium and trucks (worth a combined cost of over USD 52 billion) to over 200 markets around the globe, with added exports of automotive parts valued at USD 66.7 billion.

Automotive is one of the fastest growing segments in the global market, driven by the essential application of vehicles to exchange heat. In addition, the microchannel heat exchanger is more effective for performance enhancement than a conventional fin and tube heat exchanger. This makes it ideal for vehicle applications.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Microchannel Heat Exchanger Market 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 4.12 billion in 2025 and USD 4.46 billion in 2026. The rising demand for HVAC systems and commercial vehicles is one of the major growth drivers for the market. China, Japan, and India are largely adopting this exchanger technology owing to its high efficiency and long service life advantages in hot climate conditions.

China dominates the microchannel heat exchanger market with rapid urbanization and more shifting into cities. This has surged the demand for comfortable and energy-efficient products such as HVAC systems. It also has ambitious targets to enhance energy efficiency and reduce carbon emissions. For instance, on August 1st, 2022, as per the refrigeration industry data, the China Refrigeration Expo was anticipated to have seven major characteristics and three highlighted value expectations. In this Expo, well-known brands gathered together, and new devices and technologies emerged one after another. The Japan market is projected to reach USD 0.65 billion by 2026, the China market is projected to reach USD 1.69 billion by 2026, and the India market is projected to reach USD 1.02 billion by 2026.

Europe

Europe is growing rapidly, driven by multiple factors. The U.K. is one of the dominating markets driven by the rising demand from the automotive sector. Car manufacturers are driving the demand for these exchangers. After the U.K., Germany and Europe are also showing a solid position in the market. For instance, on October 27, 2023, As per the data of Driving Mobility for Europe, new commercial vehicle registration stats are out, where vans +14.3%, trucks +23%, and buses +18.5% displayed strong growth for the first three quarters of 2023. The UK market is projected to reach USD 0.73 billion by 2026, while the Germany market is projected to reach USD 0.92 billion by 2026.

North American

The U.S. and Canada are the major contributors to the North American microchannel heat exchanger market due to the rising applications, such as HVAC systems and the automotive sector. The U.S. has one of the largest automotive markets in the world and is expected to dominate the market due to growing demand from the automotive sector. In addition, the trend of continuous innovation might drive the demand for these exchangers in vehicles.

For instance, as per the data of Select USA, which is the International Trade Administration, U.S. light vehicle sales were over 14.5 million units. The U.S. is the world’s second-largest market for vehicle sales and manufacture. Autos Drive America (ADA) reports that international automakers produced USD 5 million vehicles in the U.S. in 2020. The U.S. market is projected to reach USD 2.2 billion by 2026.

Latin America

Latin America is one of the world’s major emerging economies, which includes economies such as Brazil and Mexico. Brazil also dominates one of the most prominent automotive markets worldwide. Aiding a population of over 212 million, the Latin American nation ranks as the 6th largest car market globally. As the application is growing in the country, the microchannel heat exchanger is also increasing rapidly.

For instance, On November 8th, 2023, The Associacao Nacional dos Fabricantes de Veiculos Automores (ANFAVEA) proclaimed that Brazilian vehicle production in October 2023 were 199,758. On a positive note, the country is trying to reach a high point where the levels of vehicle manufacturing in some areas of Brazil are almost back to the levels of previous years.

KEY INDUSTRY PLAYERS

Key Players Focus on Investments in Long-Duration Microchannel Heat Exchanger Systems to Boost Market Expansion

The market is concentrated due to investments by leading market players, which are Danfoss SA, Norsk Hydro, Sanhua International, Kaltra, Modine Manufacturing Company, and others. Danfoss SA has 31% of sales generated from the climate solution business segment, which accounted for USD 572 million in FY22. The growing demand for refrigeration and the automotive industry has increased the company’s investments in the market.

- For instance, in January 2021, Danfoss changed its set structure to combine the heating and cooling segments into Danfoss Climate Solutions. With the new Climate Solutions segment, Danfoss will increase its focus on the green agenda in attractive global markets.

LIST OF TOP MICROCHANNEL HEAT EXCHANGER COMPANIES:

- Danfoss Group (Denmark)

- Sanhua International Europe S.L (Spain)

- Modine Manufacturing Company (U.S.)

- EVAPCO (U.S.)

- Climetal S.L (Spain)

- Kaltra Innovativtechnik GmbH (Germany)

- Hanon Systems (Republic of Korea)

- API Heat Transfer (U.S.)

- Goldstone HVACR Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: Kaltra reduced the manufacturing time by 30% for microchannel heat exchangers due to the completion of the production facilities, which included the installation of two new CAB furnaces and large indexing grids.

- October 2023: Chart Industries, a manufacturer of highly engineered equipment, has assimilates braised aluminum heat exchangers in LNG facility. In addition, Chart’s integrated mid-scale LNG solution attains total plant liquefaction capacity over multiple identical trains.

- April 2023 Danfoss expanded the Z-design range of microchannel heat exchangers with the launch of the C262L-EZD, which is a dual-circuit evaporator ideal for roll-on coolers. These durable and reliable units increase the capacity of the product range with a cooling capacity that now covers up to 300 kW in one circuit and up to 800 kW in two circuits.

- October 2023: Sanhua International Europe S.L launched Braze Plate Heat Exchangers – BPHE to provide higher heat transfer efficiency and lower pressure drops. The company has obtained EU PED certification BPHEs work with fluid groups 1 and group 2, including water, ethylene glycol solution, common HCFC, HFC, and HC, as well as HFO refrigerants such as R410A, R32, R454B, R290, R134a, R404A, R507, R448A, R449A, R1234yf, R1234ze and R452A.

- March 2022: A new brazed plate exchanger called Alfa Laval AC65 was presented by Alfa Laval, who has a strong presence in the Latin America region. The new product is aimed to meet the growing demand for next-generation heat exchangers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.57% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was valued at USD 12.24 billion in 2026.

The global market is projected to grow at a CAGR of 7.57% over the forecast period.

Asia Pacific dominated the global market with a share of 36.20% in 2025.

Based on application, the HVAC segment holds a dominating share of the overall market.

The global market size is estimated to reach USD 21.95 billion by 2034.

Rising demand for HVAC systems is propelling the market growth.

Danfoss Group, Modine Manufacturing Company, and Hanon Systems are the top players actively operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us