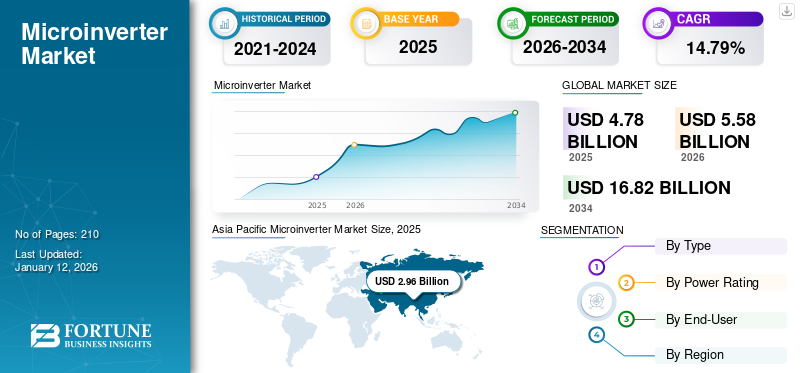

Microinverter Market Size, Share & Industry Analysis, By Type (Single Phase and Three Phase), By Power Rating (Below 250 W, Between 250 to 500 W, and Above 500 W), By End-User (Residential, Commercial, and Industrial and Electric Utility), and Regional Forecast, 2026-2034

Microinverter Market Size

The global microinverter market size was valued at USD 4.78 billion in 2025. It is projected to grow from USD 5.58 billion in 2026 to USD 16.82 billion by 2034, exhibiting a CAGR of 14.79% during the forecast period. Asia Pacific dominated the global market with a share of 61.88% in 2025.

Microinverters are small, compact devices that convert direct current (DC) electricity generated by individual solar panels into alternating current (AC) electricity, which can be utilized in home appliances or fed into the electrical grid. Continuous improvements in technology have enhanced their reliability, efficiency, and cost-effectiveness, making them a more attractive option for a wider range of applications. These factors increase the market share.

These products can optimize the power output of each solar panel, leading to higher overall system efficiency compared to traditional string inverters, which are limited by the performance of the lowest-performing panel in the string. They are less affected by shading and can work efficiently with panels installed at different orientations, maximizing energy harvest. There is an increasing trend of installing solar panels in residential and commercial buildings. These products are particularly attractive for these installations due to their modularity and ease of expansion. Thus, all these factors are expected to boost market growth.

The initial lockdowns and restrictions amid the COVID-19 pandemic led to temporary shutdowns of manufacturing facilities and delays in production. This affected the availability of the product and other solar components. Restrictions on transportation and logistics slowed down the shipment of raw materials and finished products, causing delays in project timelines. Many solar installation projects were delayed or put on hold due to lockdowns, social distancing measures, and labor shortages. This led to a temporary decrease in demand for the product.

Microinverter Market Trends

New Product Launches and Advancements in Microinverter Technology to Drive Market Growth

Companies are continually developing new microinverter models with higher efficiency ratings, allowing for better conversion of DC to AC power and maximizing energy output from solar panels. Newer products can handle higher power outputs, making them suitable for modern high-wattage solar panels, which improves overall system performance. Advanced products can seamlessly integrate with smart batteries, enabling homeowners and businesses to store excess energy for later use, thus enhancing energy independence. Modern products are designed to be compatible with smart grid technologies, enabling better coordination with utility providers and participation in demand response programs.

In March 2024, Enphase Energy, Inc., a global energy technology company and world leader in microinverter-based solar and battery systems, announced that it has begun shipping the IQ8P 480W AC peak microinverters for residential and commercial applications in Thailand and the Philippines to support newer high-capacity solar modules.

Download Free sample to learn more about this report.

Microinverter Market Growth Factors

Increasing Utilization of Products in Residential Settings and Commercial Buildings to Boost Market Growth

These products operate at lower voltages than string inverters, reducing the risk of electrical fires and making them safer for residential installations. Technological advancements have made these inverters offer greater durability and longer warranties, providing homeowners with reliable long-term performance. Microinverters’ modularity allows for easy installation and scalability. Homeowners can start with a small system and expand it over time without significant redesign or additional inverter capacity.

Maximizing energy production is crucial for commercial buildings. These inverters ensure that each panel operates at its peak efficiency, significantly boosting the overall energy yield of the solar installation. Vendors are developing products with higher power handling capacities to accommodate larger solar panels used in commercial installations. These high-capacity products can manage more power per panel, making them suitable for commercial projects. For instance, in November 2023, Enphase Energy, Inc., a global energy technology company and world leader in microinverter-based solar and battery systems, announced its new IQ8 Commercial microinverter along with the IQ8P-3P microinverter for small commercial solar applications market in North America.

Advancements in Energy Storage Solutions to Surge Market Growth

Modern products are being designed to integrate seamlessly with advanced energy storage systems. This compatibility ensures that solar energy can be stored efficiently and used when needed, enhancing the overall utility of solar installations. Some products now come with built-in energy storage capabilities, acting as an inverter and a battery charger. This dual functionality simplifies the system design and reduces costs.

Businesses are adopting integrated solar and storage solutions to ensure continuity of operations during power outages, manage energy costs, and meet sustainability goals. In April 2024, Enphase Energy, Inc., a global energy technology company and the world's leading supplier of microinverter-based solar and battery systems, announced a new strategic relationship with Octopus Energy Group, a global energy and technology company. The parties will focus on introducing Enphase IQ8 microinverters and IQ Battery 5P in the U.K. Octopus Energy retail customers in the U.K. can now integrate Enphase home solar and battery systems into their energy plans to unlock affordable residential energy rates.

RESTRAINING FACTORS

High Initial Costs Compared to Traditional String Inverters May Restrain Market Growth

Higher initial costs are a significant barrier for homeowners sensitive to upfront expenses, even if products offer long-term benefits like higher energy yield and better monitoring. Higher initial costs can make financing more challenging, as loan amounts or lease payments might be higher, deterring some potential buyers. Businesses with tight capital expenditure budgets prefer the lower initial cost of string inverters, even though the total cost of ownership might favor the product due to efficiency and maintenance benefits.

Large-scale solar projects are highly cost-sensitive, and the higher initial cost of products can be a significant disadvantage. Utility companies often prioritize minimizing upfront costs to achieve the lowest possible cost per watt installed.

Microinverter Market Segmentation Analysis

By Type Analysis

Ongoing Advancements in Microinverter Technology to Impel the Three Phase Segment Growth

Based on type, the global market is segmented into single phase and three phase.

The three-phase segment is projected to dominate the market with a share of 61.60% in 2026. Ongoing advancements in microinverter technology, including inverter efficiency improvements and advanced monitoring capabilities, enhance the appeal of three-phase products for commercial and industrial applications. As businesses and industries globally prioritize sustainability and renewable energy goals, the demand for larger-scale solar installations is growing. Three-phase products meet this demand by offering robust solutions that cater to higher power requirements.

The single phase segment is the second dominant segment in the market. Due to their compatibility with single-phase household electrical systems, single-phase products are widely preferred for residential rooftop solar installations.

By Power Rating Analysis

Growing Usage of Products With Above 500 W Power Rating in the Commercial and Utility Scale Applications to Spur Segment Expansion

By power rating, the global market is segmented into below 250 W, between 250 to 500 W, and above 500 W.

The above 500 W power rating segment is expected to lead the market, accounting for 41.70% of the total market share in 2026. Recent advancements in solar panel technology have led to the development of panels with higher wattage ratings, often exceeding 500 watts per panel. The adoption of high-wattage panels and corresponding products is particularly prevalent in commercial and utility-scale solar installations.

The second dominating segment in the market is between 250 to 500 W. Solar panels in this range are commonly used in residential rooftops due to their manageable size and power output. This segment also caters to small businesses, schools, and other small commercial entities looking to install solar PV systems to offset their electricity costs.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Residential Segment Leads Driven by Product’s Ability To Optimize Energy Production And Maintenance Capabilities

By end-user, the global market is segmented into residential, commercial, and industrial and electric utility.

The residential segment is anticipated to hold a significant market share of 48.31% in 2026. The segment is growing rapidly because the product can optimize energy production, enhance monitoring and maintenance capabilities, improve safety and durability, offer scalability and flexibility, and benefit from market dynamics such as cost reductions and government incentives.

The second dominating segment in the market is commercial. The commercial segment is expected to grow as more businesses, institutions, and organizations recognize solar energy's financial, environmental, and operational benefits.

REGIONAL INSIGHTS

Asia Pacific Microinverter Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific is estimated to have all the dominant microinverter market share during the study period. Many countries in the Asia Pacific region have implemented supportive policies and incentives to promote renewable energy adoption, including solar power. Government initiatives such as feed-in tariffs, subsidies, and tax incentives encourage businesses and homeowners to invest in solar PV systems, boosting the demand for the product. The Japan market is projected to reach USD 0.32 billion by 2026, the China market is projected to reach USD 2.25 billion by 2026, and the India market is projected to reach USD 0.4 billion by 2026.

Europe

European countries have been leading the way in promoting renewable energy sources, including solar power. Robust regulatory frameworks, feed-in tariffs, and subsidies encourage investments in solar PV systems, driving the demand for the product. Europe's significant position in the microinverter market growth is expected to strengthen further as the region advances its renewable energy agenda. Ongoing technological advancements, supportive policies, increasing consumer awareness, and competitive market dynamics are poised to drive the continued adoption of products across diverse applications. The UK market is projected to reach USD 0.11 billion by 2026, while the Germany market is projected to reach USD 0.35 billion by 2026.

North America

North America has a robust residential solar market, driven by increasing awareness of renewable energy benefits, favourable regulatory policies at state and federal levels, and declining solar PV system costs. These products are preferred in residential applications for their ability to optimize energy production and accommodate varying roof orientations and shading conditions. The U.S. market is projected to reach USD 0.49 billion by 2026.

KEY INDUSTRY PLAYERS

Companies are Focusing on Collaborations with Vendors to Deploy Latest Technological Advancements

As microinverter technology evolves, vendors bring specialized expertise in power electronics, semiconductor materials, and control systems. Collaborating with vendors allows companies to swiftly and effectively integrate the latest technological advancements into their microinverter products. The collaboration enhances after-sales support capabilities, including technical assistance, warranty services, and maintenance. This contributes to overall customer satisfaction and loyalty, which is crucial to sustaining market growth. Several key players dominate the global market, contributing to its growth through innovation, quality products, and an extensive distribution network.

In March 2024, Enphase Energy, Inc., a global energy technology company and the world's leading manufacturer of microinverter-based solar and battery systems, and Semper Solaris, a leading home solar and battery installer in the U.S., announced an expanded strategic partnership focused on deployment of Enphase's IQ8 and IQ Battery 5P Microinverters. Semper Solaris also uses Solargrafia, Enphase's cloud-based engineering, proposal, and permitting software platform.

List of Top Microinverter Companies:

- Enphase Energy (U.S.)

- Altenergy Power Systems, Inc. (China)

- Hoymiles (China)

- Deye Inverter (China)

- Chilicon Power, LLC (U.S.)

- AEconversion GmbH & Co. KG. (Germany)

- Envertech (China)

- Zhejiang Benyi New Energy Co, Ltd. (China)

- Solar Panel Plus (U.S.)

- CyboEnergy (U.S.)

- Sparq Systems (Canada)

- Sungrow (China)

- HiQ Solar (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2024- Hoymiles launched a new 5000-watt microinverter designed for industrial, commercial, and large residential projects. Hoymiles guarantees that the new microinverter will not need to be replaced for 25 years.

- February 2024- Sparq Systems Inc. announced the execution of a manufacturing and supply agreement with Jio Things Limited, a major Indian technology company and a subsidiary of India's leading digital services provider Jio Platforms Limited (JPL). This collaboration described in the agreement includes joint efforts to develop, manufacture, and distribute microinverters globally in India and integrate Sparq's advanced microinverter technology with Jio Things solutions worldwide.

- November 2023- Enphase Energy, Inc., a global energy technology company and the leading microinverter-based solar and battery system manufacturer announced that it has begun shipping IQ8P 480W AC microinverters in Mexico to support newer high-power solar modules. IQ8 microinverters are designed to maximize energy production and can handle continuous 14-amp DC power, supporting more efficient solar modules with greater energy storage.

- October 2023- Havells India Limited, a fast-moving electrical goods (FMEG) company, announced the launch of a dual-mode microinverter (DMMI) backed by four U.S. patents. The company claims this innovation could transform the solar industry by addressing key limitations associated with traditional and microinverters.

- October 2023- Growatt, a provider of distributed energy solutions, launched its first product in the microinverter category, the NEO 2000M-X. Microinverters are mainly designed for small residential rooftops or balconies and have attracted increasing interest. The Growatt microinverter series' NEO 2000M-X, with built-in RandD features, highlights better system performance and productivity with 2kW full power, four MPP tracking, and 96.5% maximum efficiency.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, products, and product technology. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 14.79% from 2026-2034 |

|

Unit |

Value (USD Billion) |

| Segmentation |

By Type

|

|

By Power Rating

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 4.78 billion in 2025.

The market is likely to grow at a CAGR of 14.79% over the forecast period.

The global market size is expected to reach USD 16.82 billion by 2032.

By power rating, the above 500 W segment leads the market.

The market size of Asia Pacific was USD 2.96 billion in 2025.

The increasing utilization of products in residential settings and commercial buildings is set to drive market growth.

Some of the top players in the market are Enphase, Hoymiles, Deye Inverter, HiQ Solar, Sungrow.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us