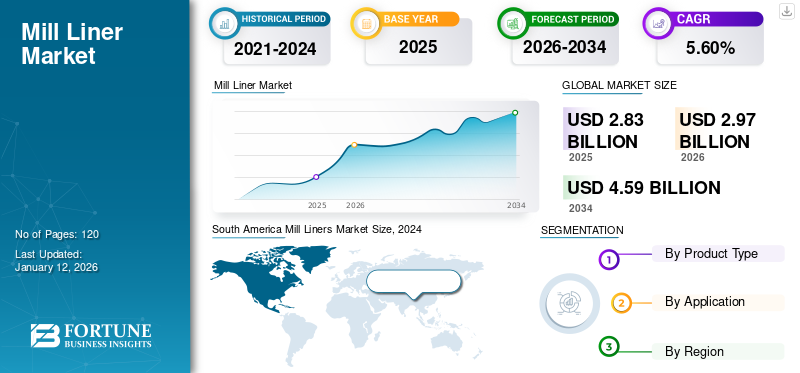

Mill Liners Market Size, Share & Industry Analysis, By Product Type (Metallic Mill Liners, Rubber Mill Liners, Poly-Met (Composite) Mill Liners, and Orebed Mill Liners), By Application (Metal, Mining & Mineral, Cement, Power, Oil and Gas, Heavy Equipment, and Others), and Regional Forecast, 2026-2034

Mill Liners Market Size

The global mill liners market size was valued at USD 2.83 billion in 2025 and is projected to grow from USD 2.97 billion in 2026 to USD 4.59 billion by 2034, exhibiting a CAGR of 5.60% during the forecast period. South America dominated the global market with a share of 34.32% in 2024.

Mill Liners are crucial components applicable in grinding machines to shield them from wear and tear and make grinding machines more durable for end-users. These liners aid in protecting the grinding mills and enhance the process by boosting the machine's efficiency.

Grinding machines find extensive application across diverse sectors, including mining, metal, cement, power, and oil and gas industries, considerably spurring the market growth. Furthermore, rapid urbanization and infrastructure development across developing nations and growing populations are further surging the growth of the cement and oil and gas industries, boosting the installation of grinding machines and ultimately creating a huge positive impact on the market share.

Strong demand for minerals across process and manufacturing industries are all spurring the mining activities in different geographical regions. According to World Mining Data 2022, China solely contributed to the production of 31 different commodities, including ferrous metals and industrial minerals, catering to one-fourth of the total mining production in 2020. Supportive government policies, increasing capital expenditure, and efficient and durable product launches by key players in the market are a few of the prominent factors propelling market growth across industries.

However, the COVID-19 pandemic negatively hindered the market. It halted production activities across manufacturing facilities except for sectors such as power and oil and gas, creating a lenient effect on the market in 2020. Post-pandemic, as the temporary lockdowns and restrictions were released, the market gained its position and is anticipated to show steady market growth over the forecast period.

End-users are consistently demanding high-performing and energy-efficient liners in order to reduce operating costs, directing significant investment in research and development activities. For instance, Metso expanded its mill lining portfolio by introducing Skega Life, which is sustainable and high-performance with up to 25% longer wear life.

Mill Liners Market Trends

High-Performance and Sustainable Mill Liners are Gaining Market Traction

Specific application-based liners are generating strong demand across geographies, thereby forcing manufacturers to develop high-performance liners for end-users. Lightweight and sustainable liners provide additional benefits, such as safety and additional uptime, which enhances productivity for end-users. Manufacturers are focusing on developing liners that are easy to install and provide enhanced performance, further generating strong demand across industries. For instance, FLSmidth launched PulpMax™ Composite Mill Liners in 2019 with ball mill liners for all minerals’ processing applications carrying additional features, such as lightweight and reduced downtime.

Download Free sample to learn more about this report.

Mill Liners Market Growth Factors

Rising Demand for Mining and Metal Application to Boost the Market Growth

Applications of grinding machines across the metal and mining industry are experiencing strong growth owing to industrial facility expansion and replacement activities. Reduced quality of minerals is further increasing the sales of grinding mills, demanding highly reliable and efficient liners that play a crucial role in extracting minerals. Increasing demand for metal and metal products across geographies is further spurring the market growth.

World mining production has grown by 53% in the past two decades, according to World Mining data for 2022, as a result of rising demand for minerals growth, the introduction of new policies, and uniformly mobilizing funds complying with carbon emission standards. All these factors are largely contributing to the growth of energy-efficient and sustainable machines and equipment in mining activities, such as grinding mills. For instance, Argentina’s Lithium sector attracted about USD 1.5 Billion in capital investment in 2022, according to the Cámara Argentina de Empresarios Mineros.

RESTRAINING FACTORS

Varying Raw Material Prices to Hinder Market Growth

Advancements in materials technology and design techniques are demanding highly durable mill shells and linings across industries such as the mining, power, and oil and gas sectors. The rising cost of rubber compounds and other superior alternative materials are further increasing overall costs for the end users, which might limit the growth of the market across regions. Moreover, the replacement of milling machines and their components further enhances the operating cost limiting the mill liners market growth across the regions.

Mill Liners Market Segmentation Analysis

By Product Type Analysis

Diverse Industry Applications to drive the Metallic Mill Liners Segment Growth

Based on the product type, the market is categorized into metallic, rubber, poly-met (composite), and orebed mill liners.

The metallic segment dominated the market in 2026, accounting for 30.64% of the total market share. Metallic mill liners are designed in order to enhance efficiency, reduce replacement time, and ensure safe installation to optimize mill performance. They are largely used in diverse sectors, such as mining, mineral processing, construction, power generation, and recycling.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Government Initiatives and Investment for Mining Projects are Propelling Market Growth

Based on Application, the market is classified as metal, mining & mineral, cement, power, oil and gas, heavy equipment, and others (Rail and Textile).

The metal, mining & mineral segment catered to the highest market revenue share in 2026, accounting for 50.17% of the total market share. The growing demand for minerals that are aggressively being used in varied applications, including electric vehicles, solar panels, and other innovative technologies, is propelling the demand for mining activities across regions. According to the International Energy Agency, the demand for nickel rose by 40% between the years 2017 and 2022, in response to which investment in mineral development grew by 30% in 2022. Clean energy transitions and increasing demand for minerals are showing positive impacts on the mining sites across regions, influencing the growth of liners across the mining sector. Metal, mining & minerals will hold more than one-third of the market revenue share in 2024.

The cement segment to witness significant growth in the market due to the increasing government projects, infrastructure development, and rising investment in the construction sector. Rising demand for uniform particles with high-efficiency grinding machines is a prominent factor generating strong market growth across the cement industry.

Mill Liners play a crucial role across sectors, such as power generation and oil & gas, ensuring reduced wear and tear on the equipment along with enhanced grinding efficiency, generating strong market growth across diverse geographies.

REGIONAL INSIGHTS

Based on geography, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

South America Mill Liners Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

The South American region has been a primary contributor to the mill liners market share, surpassing other regions and accounting for about 40% of the total market revenue share. These liners meets the industry standards and regulatory requirements across different sectors simplify procurement decisions and ensure compliance with safety, quality, and environmental regulations, promoting integration through harmonization of specifications and practices. Subsequently, environmentally friendly mill liner materials and designs that reduce energy consumption, emissions, and waste generation appeal to industries with sustainability goals, encouraging integration across sectors committed to responsible resource management.

Increasing globalization and market dynamics create opportunities for mill liner suppliers to expand their customer base across different regions and industries, fostering integration through diversification and market penetration strategies. Mining sites in the region are investing in modernization initiatives to improve efficiency, productivity, and safety. Upgrading equipment is part of these efforts to enhance operational performance.

South America's mining sector, including coal, iron ore, gold, and other minerals, is showcasing strong growth prospects to meet the industrial and economic needs. Establishing long-term partnerships between mill liner suppliers and diverse industries fosters trust, collaboration, and mutual understanding, facilitating integration by promoting continuity, reliability, and shared goals. Most manufacturers have extensively tried to understand the exact requirements of consumers operating in different industries and have tried to develop products that will complement their operations.

Government-led infrastructure projects and construction activities in Chile require significant quantities of cement and minerals, boosting the demand for mill liners in cement factories and mining operations supplying these sectors. Investing in premium liners may involve higher upfront costs but offers long-term benefits in terms of extended equipment lifespan, reduced maintenance downtime, and overall cost savings, making it an attractive option for global consumers. According to the Chilean Copper Commission (COCHILCO), projects worth about USD 24.6 billion are under execution for the period 2022-2026. Chile is experiencing economic growth, driving the demand for automation across industries. This growth fuels the need for mill liners to support increased production capacities.

To know how our report can help streamline your business, Speak to Analyst

Followed by South America, Asia Pacific is the second largest revenue shareholder in the market. There is a growing emphasis on sustainability and environmentally friendly practices across industries. Manufacturers are adopting mill liners that are designed for longer life cycles, reduced energy consumption, and improved recycling capabilities. Sustainability considerations can influence purchasing decisions and positively impact companies offering eco-friendly mill liner solutions. The manufacturers in the region are the pioneers in investing and deployment of innovative solutions in the technology sector. Continuous innovation in materials and design can enhance their performance, durability, and efficiency.

Rising safety standards, initiatives by government associations, supportive policies, and increasing investment are all estimated to support the market demand for mill liner across the North American countries.

Europe witnessing substantial infrastructure development projects, including construction, transportation, and energy sectors owing to the increasing demands for mining operations which are closely tied to the overall industrial growth in a region. This can drive the demand for mill linear products used in various machinery and equipment for these projects.

The crucial geographical location of the region and considering current political demography of the international trade, the Middle East & Africa region is becoming an integral part of the global supply chains. The integration of the industries into the global market can lead to increased demand for mill linear products to meet international standards and specifications.

List of Key Companies in Mill Liners Market

New Product Launches and Merger Strategies to Generate Robust Opportunities for the Market Participants

Key players in the market are making huge investments in research and development activities and expanding their product portfolio through regions for end-users. Several market players are collaborating and acquiring domestic companies to develop innovative products for end-users across diverse industries. Metso Corporation, FLSmidth, and Tega Industries are a few of the top players in the market striving to penetrate across geographies by expanding their product portfolios and manufacturing facilities for diverse end-users.

For example, Metso Outotec expanded its grinding mill lines boosting the demand for mill liners for wide range of applications.

- In 2021, Metso Outotec introduced its Premier and Select horizontal grinding mill product lines for varied industry applications which would spur the demand for mill liners across sectors

LIST OF KEY COMPANIES PROFILED

- The Weir Group (Scotland)

- Metso Corporation (Finland)

- FLSmidth (Denmark)

- Magotteaux (Belgium)

- Eriez Manufacturing (U.S.)

- Multotec (South Africa)

- Trelleborg AB (Sweden)

- Tega Industries (India)

- Polycorp (U.S.)

- Bradken Pty Ltd. (Australia)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Metso Corporation expanded its product portfolio of mill lining by introducing rubber-based mill liner, Skega Life that offers up to 25% longer durability and wear life enabling sustainability, and safety for operators.

- August 2023: Multotec expanded its manufacturing facility with new press installations for mill liners in Spartan, South Africa. The manufacturing capacity is expected to meet the increasing mill liner demand.

- June 2023: FLSmidth acquired Morse Rubber in June 2023 to strengthen its rubber based product offerings, such as enhanced molding capabilities for rubber and composite mill liners and stronger aftersales service to its customers.

- January 2023: Bradken expanded its product and service portfolio by acquiring Linings organization, which specifically deals in manufacturing of composite mill liners for mining sectors.

- October 2022: Metso Outotec launched recycling service for worn mill liners across Europe. The service offering aims at recycling and creating value for industrial end users across the region.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2022 to 2032 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATRIBUTE |

DETAILS |

|

Study Period |

2021– 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 5.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market reached at USD 2.83 billion in 2025.

The market will reach USD 4.59 Billion in 2034 according to Fortune Business Insights’ Analysis.

Growing at a CAGR of 5.60%, the market will exhibit strong growth during the forecast period.

High Demand from mining, metal and minerals industry.

The top companies in the market are Metso Corporation, Bradken Pty Ltd., Tega Industries, and FL Smidth.

South America leads the market.

Poly-Met (Composite) Mill Liners segment is projected to hold the highest CAGR.

Metal, Mining, and Minerals to lead the market.

Durable, sustainable and high-performance mill liners to generate strong market opportunities.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us