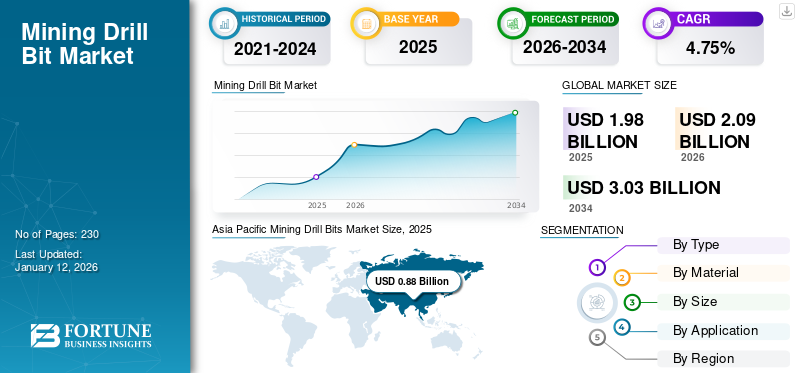

Mining Drill Bits Market Size, Share & COVID-19 Impact Analysis, By Type (Rotary Bit, DTH Hammer Bit, Others), By Material (PDC Diamond, Tungsten Carbide, Steel, Others), By Size (Below 8’’, 8’’-11”, Above 11”), By Application (Surface Mining, Underground Mining), and Regional Forecast, 2026-2034

Mining Drill Bits Market Size

The global mining drill bits market size was valued at USD 1.98 billion in 2025 and is projected to grow from USD 2.09 billion in 2026 to USD 3.03 billion by 2034, exhibiting a CAGR of 4.75% during the forecast period. Asia Pacific dominated the global market with a share of 44.47% in 2025. The Mining drill bit market in the U.S. is projected to grow significantly, reaching an estimated value of USD 353.41 million by 2032.

A mining drill bit is a tool used to drill or dig a hole in stone or other earth's surface. Mining drill bits come in many sizes and shapes and materials used to dig differently on various types of surfaces. The remarkable development of mining activities globally has increased the demand for mining equipment. The revolution in all fields requiring raw materials depends on mining. Growth in the construction, electronics, telecommunications, automotive, and manufacturing sectors increased the demand for mined materials, further propelling the demand for mining drill bits. As mining is an economically important activity in many parts of the world, it drives the mining industry and technological developments in mining drill bits.

COVID-19 IMPACT

Disruption in Mining Production and Exploration Impacted Market Growth

The global impact of COVID-19 was unprecedented and staggering, with mining activities experiencing negative demand shocks across all regions during the pandemic. Based on our analysis, the global market posted a decline of -18.6% in 2020 compared to 2019. However, as the pandemic subsided, the market has shown a rapid recovery with the CAGR experiencing a sudden rise due to the demand and growth of the market, returning to pre-pandemic levels. The COVID-19 pandemic had a disastrous effect on all sectors including trade which suffered significant damage due to the strict rules, such as nationwide closures, implemented to limit virus’s spread. Consequently, the virus outbreak changed the demand for mining drill bits. Given the mining industry’s heavy reliance on this market, the significant downturn faced by the mining industry has impacted the investment in mining exploration and production activities. As a result, the demand for drilling activities has been directly affected, leading to a reduced need for mining equipment, including mining drill bits.

Mining Drill Bits Market Trends

Download Free sample to learn more about this report.

Increasing Requirement for Commodities to Enhance Demand for Mining Equipment

The growing industrial landscape supported by population explosion and energy needs due to automation and digitalization has increased the demand for raw materials. Increased urbanization and industrialization have increased the demand for oil, gas, metals, agricultural fertilizers, and others that are highly dependent on mining.

The construction industry is experiencing significant growth globally, especially in China, the U.S., and India. The Global Construction Perspectives and Oxford Economics report indicates that average global construction growth is expected to increase by 3.9% annually. This industry depends on mining for its raw materials. The massive expansion of this industry is expected to propel the mining drill bits market growth.

According to an October 2021 World Bank Commodities Market Outlook report, the energy prices increased by 16% in the third quarter of 2021. In addition, demand for metals, precious metals, and natural gas increased by leaps and bounds over the year. This is expected to enhance the growth of mining activities globally, propelling the market's growth.

Rapidly Rising Coal and High Gas Prices Enhancing the Market Growth

The rapid growth in the demand for coal due to the boom in energy requirements has increased the demand for mining drilling equipment. According to the International Energy Agency (IEA), China's coal-fired power plant fleet accounts for one-third of the world's total capacity. Coal mining is expected to increase by 4% in 2021 in China.

Higher natural gas prices around the world in the wake of the global energy crisis have led to increased dependence on coal for power generation. In China, the world's largest coal consumer, a summer heatwave, and drought led to a surge in coal-fired power generation, although strict COVID-19 restrictions slowed demand. According to a new IEA report, global coal use is set to rise by 1.2% in 2022, surpassing 8 billion tonnes in a single year for the first time and eclipsing the previous record set in 2013.

Mining Drill Bits Market Growth Factors

Adequate Government Support to Enhance Mining Activities will Support the Market

Mining activities are important for the economic development of various national governments. The mining industry is a significant source of income for many countries in the Asia Pacific and the Middle East. As part of new government initiatives, the Australian resources sector will be de-risked and encouraged to explore and discover minerals, particularly in underexplored areas. Discoveries in frontier regions will increase knowledge of Australia’s geology and resources and drive the market of mining drill bits. According to a 2021 report by the Mineral Council of Australia, mining generates USD 270 billion in export revenue. It further contributes to USD 39 billion in government fees and taxes and supports 1.1 million jobs. The Government of Australia announced the Junior Mineral Exploration Incentive and continued funding for Geoscience Australia's Exploring for the Future program. These incentives and programs are expected to promote the mining industry in the country.

According to China's 2003 Mineral Resources Policy, the country has 10 energy-related mineral reserves, 54 metallic and 91 non-metallic mineral reserves. Heavy industries play an important role in China's economic development. In 2020, Saudi Arabia passed a new mining law to boost foreign investment in its mining sector to diversify its economy from crude oil and fuels. This is anticipated to strengthen the mineral mining market, further propelling the market growth.

Rapidly Rising Requirement of Coal for Electricity Production will Boost the Adoption of Drill Bits

According to the IEA's July 2022 press release, global coal demand is supported by rising natural gas prices, intensifying the shift from gas to coal in many countries, and economic growth in India. Coal demand in India has been strong since the start of 2022 and is expected to grow by 7% for the full year as the country's economy expands and electricity use expands. In China, coal demand is estimated to have fallen by 3% in the first half of 2022 as further COVID-19 shutdowns in some cities have slowed economic growth, but an expected increase in the second half is expected to bring coal consumption to its peak at the same levels as last year.

Although a majority of countries are reducing their carbon emissions and planning reductions in the use of coal, coal remains the majority source used for power generation in many countries, including India. According to BP statistics, in 2021, coal consumption in Asia Pacific will account for 80% of global coal consumption. According to the U.S. Energy Information Administration, coal production in the U.S. will be 588 million short tons in 2021. However, electricity generation from coal has not increased significantly in the country. Rising demand for coal is expected to boost mining activities, propelling the market growth.

RESTRAINING FACTORS

Increasing Environmental Conscience of Mining Activities to Hinder Market Growth

Mining is considered harmful to the environment. It can mark natural landscapes permanently. It can harm wildlife and habitat and can cause air and groundwater pollution.

According to the NPL Abandoned Mine Land Sites and Cleanup Leads published by the U.S. Environment Protection Act, 78 mine sites in the U.S. are so toxic that they have been declared federal superfund sites. Major downsides to mining include acid mine drainage, cyanide, mercury leaks into waterways, and air and water quality permit violations.

Mining Drill Bits Market Segmentation Analysis:

By Type Analysis

High Versatility of Rotary Bit to Boost the Segment Growth

The market by type is broadly categorized into rotary bit, DTH hammer bit, and others. Rotary bit segment is further classified into fixed cutter bits and roller cone bits. The Surface Mining segment is projected to dominate the market with a share of 57.48% in 2026.

Rotary bits have various applications and can be used for various rock formations. Tapered steel roller bits are typically used to drill softer formations, while tungsten carbide inserts are used to drill hard rock formations. Fixed bits are generally used for drilling at different depths.

These bits are used for drilling holes through various rock formations using down-the-hole hammers. DTH hammer bits have a spline drive to spin the bit in the ground. With increase in exploration activities, these bits are increasingly in demand. The others segment represents the less-used wing, chisel, anchor, button, and cross bits.

By Material Analysis

High Strength of PDC Diamond Bits to Bolster Segment Growth

The market by material is broadly categorized into tungsten carbide, PDC diamond, steel, and others.

A PDC diamond bit can cut various materials due to its superior strength. Since they are artificial, they are relatively cheap. They are in high demand due to their hardness, toughness, and heat stability. With a Moh's hardness of 8.5 to 9, tungsten carbide is extremely tough and hard. Their capability to fit small diameters in hard rock formations drives the tungsten carbide bits market. Milled-tooth steel bits are generally used for soft rock formations. The others segment accounts for materials such as stable diamonds, surface set diamonds, and matrix.

By Size Analysis

To know how our report can help streamline your business, Speak to Analyst

High Utilization of the 8 to 11 inches Segment to Dominate Market

Based on size, the market is divided into below 8“, 8”– 11”, and above 11”. Generally, smaller drill bits are used for exploration drilling activities. Drill bits are even as small as 1mm. The 8”– 11” segment is the most widely used bit size for production drilling owing to various applications and increase in exploration activities. Larger bits are generally used for production drilling at greater depths. Drill bits of different sizes, materials, and types are analyzed to drill specific rock formations.

By Application Analysis

Surface Mining Activities to Augment Segment Growth

The market by application is broadly categorized into underground mining and surface mining. Surface mining is typically used to extract sand, gravel, crushed stone, phosphates, coal, copper, iron, and aluminum. This type of mining is mainly used due to its ease of use. Therefore, mining drill bits are widely used in surface mining. Gold, iron, zinc, tin, lead, and crude oil ores are mined underground.

REGIONAL INSIGHTS

Asia Pacific Mining Drill Bits Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The global market has been analyzed across major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 0.88 billion in 2025 and USD 0.94 billion in 2026. Asia Pacific has the largest mining drill bits market share due to the region's large reserves of minerals and metals. Growth in coal-fired power generation and using raw materials in industries drive the demand for mining drill bits across Asia Pacific. According to the Census and Economic Information Center (CEIC) report on coal production, China extracted 3,902 MT in December 2020. China is the largest coal producer in the world. According to World Mining Data 2021, China accounted for 4,324,215,796 MT of mineral production in 2019, the highest in the world. Rising investment in mining activities in the region is massively propelling the market.

The Middle East & Africa is a notable region with oil and gas extraction. The GCC countries such as Saudi Arabia, United Arab Emirates, Qatar, Bahrain, Kuwait, and Oman in the Middle East are the largest oil producers in the world and are called OPEC countries. Their crude oil and gas extraction propels the demand for mining drill bits in the region. The region's major markets are Iran, South Africa, Iraq, and Nigeria. In November 2021, Nigeria's Mining and Steel Development Industry proposed to offer a three-year tax break to investors in the mining sector. These government incentives in the region are driving the growth of the market.

Europe

The European mining industry is fundamental to the economic development of the region. Europe is home to large reserves of minerals, crude oil, and gas. The region has many offshore crude oil and gas extraction facilities. Russia, Kazakhstan, and the U.K. are a few countries responsible for the prosperity of the mining sector, which is driving the drill bits market.

The U.S. in North America is the world's leading mining country in production, ranked sixth globally. The country is among the top ten producing minerals such as copper, gold, silver, zinc, and iron ore. However, several essential materials for the processing industry are imported, especially lithium, platinum, zinc, cobalt, and rare earth elements.

Latin America holds potential growth opportunities for the mining industry due to new mining investment projects in the region. The future scope of drill bits for mining in Latin America is huge and is expected to strengthen the market over the forecast period. In 2021, the San Gabriel gold and silver mining project in Peru witnessed an investment of USD 2.56 billion. The Los Filos mine in Mexico, Pascua-Lama in Chile and Argentina, and Yanacocha Sulfides in Peru are other major upcoming mining projects.

KEY INDUSTRY PLAYERS

Majority Players to Lead with Various Technological Advancements

The market has several players focused on providing the drill bits. The market players are developing various technological advancements such as drill bit designs that enhance performance characteristics, strength, and versatility. A majority of players in the market focus on rotary drill bits. A growing market for commodities and energy will create profitable opportunities for mining companies as the mining industry grows.

LIST OF TOP MINING DRILL BITS COMPANIES:

- Universal Drilling Technique, LLC (Ukraine)

- MICON Drilling GmbH (Germany)

- Caterpillar Inc. (U.S.)

- Brunner and Lay Inc. (U.S.)

- Changsha Heijingang Industrial Co. Ltd. (China)

- Epiroc AB (Sweden)

- Mitsubishi Materials Corporation (Japan)

- Robit Plc (Finland)

- Rockmore International (U.S.)

- Sandvik AB (Sweden)

- Western Drilling Tools (Canada)

- Xiamen Prodrill Equipment Co., Ltd. (China)

- Boart Longyear (U.S.)

- Glinik Drilling Tools (Poland)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 – Epiroc launched DTH drill bits designed to improve productivity while ensuring a better safe-work environment for operators. It claims up to 20% longer service. Additionally, the DTH drill bit has three shapes to choose from to tackle different drilling needs and rock types, Epiroc Trubbnos, spherical, and ballistic buttons.

- September 2021 – As part of its Heavy Duty drill bit line for production mining and quarrying, Sandvik AB introduced a new range of top-hammer drill bits. The design is created to improve life, lower costs per meter, and enhance safety and accuracy.

- September 2021 – Epiroc AB developed an automatic bit changer to change the bits of the Pit Viper 270 and 290 series drill rigs. The automatic bit changer can change rotary tri-cone bits with a button. This is a faster, more efficient, and safer way to change drill bits.

- May 2021 - Universal Drilling Technique LLC partnered with Nadrahidroburmash LLC. The company offers products manufactured at their facilities - Drilling equipment, Borehole breakdown elimination tools, spare parts for drilling pumps, and other equipment such as drill string drifts, pressure-tested valves, and others.

- June 2021 - Sandvik signed an agreement to acquire Tricon Drilling Solutions Pty. Ltd., a privately-held supplier of rock tools to the mining industry based in Perth, Australia. Tricon will operate as an independent, stand-alone business unit within the Rock Tools division of Sandvik Mining and Rock Solutions. Tricon's product offering includes rotary bits, DTH (Down-The-Hole) hammers, and bits and complete rotary and DTH drill strings.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The global market research report highlights regional and country-level analysis to offer a better understanding to the user. Furthermore, the report provides insights into the latest market trends and market analysis of technologies deployed rapidly globally. It further highlights some drivers and restraints, helping the reader gain in-depth knowledge about the industry.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.75% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Material, By Size, By Application, and By Region |

|

By Type

|

|

|

By Material

|

|

|

By Size

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.98 billion in 2025 and is projected to reach USD 3.03 billion by 2034.

In 2025, the Asia Pacific market was valued at USD 0.88 billion.

The market will likely grow at a CAGR of 4.75%, exhibiting substantial growth during the forecast period (2026-2034).

Surface mining is expected to maintain its dominant application segment in the forecast period.

Sandvik AB and Caterpillar Inc. are some of the key players operating across the industry.

Asia Pacific dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us