Mooring Ropes Market Size, Share & Industry Analysis, By Material Type (Nylon, Polyester, Polypropylene, High Modulus Polyethylene, Others), By No. of Strands (Up to 4 Strands, 4 to 10 Strands, Above 10 Strands), By End-user (Marine, Oil & Gas, Others), and Regional Forecast, 2026-2034

Mooring Ropes Market Size

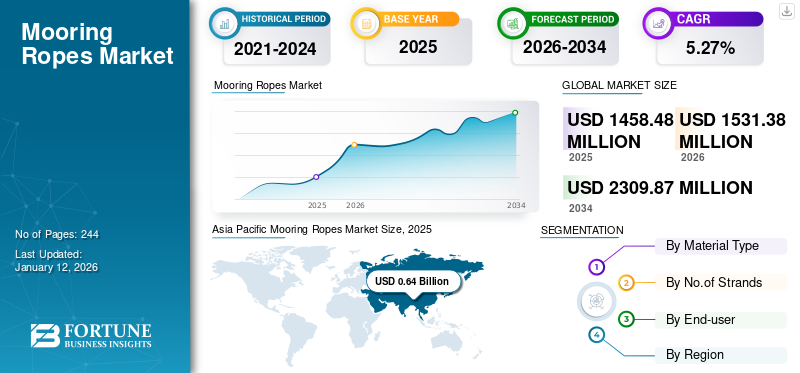

The global mooring ropes market size was valued at USD 1.46 billion in 2025 and is projected to grow from USD 1.53 billion in 2026 to USD 2.31 billion by 2034, exhibiting a CAGR of 5.27% during the forecast period. Asia Pacific dominated the mooring ropes industry with a market share of 43.70% 2025. The Mooring ropes market in the U.S. is projected to grow significantly, reaching an estimated value of USD 211.48 million by 2032

A mooring rope is a manila rope made from synthetic materials, such as nylon and used extensively in the marine industry. It is made of different materials with specific characteristics, which makes it ideal or unfavorable for a variety of applications found on a vessel. A mooring rope is chosen based on the strength, elasticity, and chafe-resistance properties of the material, which is used in varied applications.

These ropes are widely used for ship launching, marine salvage, and heavy transportation these days; the most popular application of these ropes is to launch a ship. The use of airbags helps eliminate the use of tows and tugs as launching and landing instruments. These ropes use synthetic rubber as reinforcement layers and must adhere to stringent quality control standards. They comprise three major parts, namely, airbag body, airbag mouths, and airbag heads. These ropes are considered a more powerful and advanced tool for many marine projects, which include disembarking ships, heavy transportation, and re-floating salvage.

The COVID-19 pandemic severely impacted many energy sectors around the world. The impact on the oil & gas sector and maritime trade was more pronounced than on other sectors due to continued geopolitical uncertainty and trade tensions. Furthermore, the rapid increase in the number of new infections affected maritime trade and oil tanker operations across many countries. Moreover, the nationwide lockdowns forced parts manufacturing factories to suspend their operations partially or completely.

Mooring Ropes Market Trends

Wide Usage of Synthetic Material in Modern Mooring Ropes to Augment Market Growth

The mooring rope market is undergoing major changes due to the maritime sector's growing demands and changing requirements for sustainability, efficiency, and safety. Recent advances have shown a growing trend of using advanced materials, such as synthetic fibers with high durability and strength, for marine safety. Furthermore, environmentally friendly solutions and creative designs are becoming increasingly important, reinforcing the market's resolve to comply with strict regulations while reducing negative environmental impacts.

High-performance plastics, such as polyester and HMPE (High Modulus Polyethene), are expected to replace regular steel ropes. HMPE-based ropes are lightweight, easier to handle, and offer high-strength with a longer lifespan. These ropes are expected to be favored by the marine industry for their increased operational efficiency and reduced maintenance costs, thus creating lucrative opportunities for the market to grow.

Growing Use of Smart Mooring Ropes to Digitalize and Improve Mooring Safety Onboard Vessels to Create Market Growth Opportunities

Another emerging trend is the use of the Internet of Things and the mooring ropes becoming data-driven. The growing utilization of the Internet of Things (IoT) is due to its ability to bring earlier isolated objects online. Data collected by IoT sensors is monitored and fed back to the design of algorithms, based on which the response is generated in other connected objects at a distance. Smart ropes with sensors that track tension, fatigue, and environmental variables are researched, and such projects are in progress in many countries. These ropes are capable of transmitting data in real-time to a control center on land, thus enabling preventive maintenance and early detection of potential damage and ensuring the safety of personnel and vessels. By 2025, shipping organizations plan to invest USD 2.5 million in IoT-based solutions, achieving cost savings of about 14%.

In the future, global cooperation on decarbonization will mandate the adoption of new technologies through large-scale investments, economic incentives, and favorable policies. This scenario will also see the large-scale deployment of automated solutions, smart technologies, fuel & system efficiency, and higher levels of data sharing.

Download Free sample to learn more about this report.

Mooring Ropes Market Growth Factors

Increasing Maritime Trade and Investment to Drive Demand for Mooring Ropes

The marine industry plays a crucial role in a country's economy. Maritime transport is an integral part of international logistics and accounts for nearly 80-90% of the total volume of global trade. This adds around USD 380 billion every year to the world economy through freight rates. Therefore, enhancements in international seaborne trading and maritime transport are shaping the macroeconomic factors worldwide.

The demand for mooring ropes has increased significantly due to the expansion of world trade and the increase in the amount of cargo transported by ships. The need for safe and high-quality ropes in ports is paramount, and the use of such ropes is being promoted. The role of these ropes in protecting maritime assets, preventing collisions, and promoting efficient port operations underlines their importance in the maritime sector. As the maritime industry experiences technological advancements and changes in the regulatory environment, the mooring rope market is adapting to meet the stringent safety and performance standards due to the increasing maritime trade activities.

The marine industry generates employment and other economic activity in both the shipping industry and ports, which stimulates economic growth, specifically for several coastal and island countries. In addition to that, coast guards of different countries use ships to guard and secure their territorial waters and international trade routes. This sector has brought together multiple parties in the international supply chain with increased investment for enhancing global maritime trade.

In April 2019, the European Commission launched the ‘BlueInvest’ investment platform with the aim of fostering innovation, investment, and sustainable growth in the blue economy. It provides support to innovative SMEs and start-ups active in the blue economy sectors through its online community, investment readiness assistance, matchmaking, investor outreach & engagement, academy, project pipeline, and the BlueInvest Fund. By mid-2022, BlueInvest raised investment over USD 105.15 million, and the total expected amount of capital mobilized along with private investment amounted to USD 315.46 million.

Increasing Offshore Oil and Gas Exploration Activities to Create Demand for Mooring Ropes

By value technology and geopolitical status, the offshore oil & gas sector is the most important in the contemporary blue economy. Companies continue to expand their areas of operations, with “Exploration and Production” (E&P) in ever more extreme and hostile areas. Oil and gas products and by-products have wide applicability in day-to-day lives as they are used as raw materials for pharmaceuticals, chemicals, plastics, lubricants, waxes, tars, synthetic clothes, rubbers, paints, or photographic films.

In spite of initiatives to switch to new energy technologies, such as renewable sources of energy, the use of fossil fuels continues to dominate the energy supply and this dominance is projected to continue in the coming years. Successful offshore operators have developed technologies, infrastructure, and operational skills of enormous value to the blue growth sectors. Expansion of offshore oil and gas activities demands reliable and robust mooring systems. The development of new oil and gas reserves, especially in deep-sea and ultra-deep-sea regions, is increasing the demand for advanced these ropes. This factor is responsible for propelling the mooring ropes market growth.

For instance, based on the 2021 estimates from Platt's Analytics, the U.S. Gulf oil production was at 1.769 million barrels per day, increasing by 125,000 barrels per day to reach 2 million barrels per day by the end of 2022. The continued development of deep sea hydrocarbons offers significant potential for oil and gas producers, equipment suppliers, and service providers along the value chain. Investors are exploring and unlocking potential at record-breaking ocean depths (currently 3,500 meters) and distances from the shore (up to 650 kilometers).

RESTRAINING FACTORS

Fluctuations in Raw Material Prices for Manufacturing Mooring Ropes to Restrain Market Development

Mooring lines are made from a variety of synthetic fibers, such as nylon, polyester, and polypropylene. Fluctuations in the price of any fiber can have a negative impact on the quality of the mooring line.

Although the supply is increasing due to increased demand, the price of these ropes has not fallen in recent years. The cost of raw materials is expected to continue to rise and is unlikely to be offset by efficiency gains through innovation. Therefore, the rising cost of raw materials and energy is one of the main reasons for the market’s low profit margins, although they have improved slightly. Additionally, the lack of penetration of mooring lines in potential end-use industries is hampering the mooring lines market forecast.

The demand for mooring ropes has increased significantly due to the expansion of world trade and the increase in the amount of cargo being transported by ships. The need for safe mooring in ports is paramount, and the use of high-quality ropes is being promoted. Moreover, stringent safety and quality regulations created by the International Maritime Organization and respective governments have increased the production cost of these ropes. Complying with these standards can be difficult for some rope manufacturers, especially small and medium-sized businesses, thereby restricting the market’s growth.

Mooring Ropes Market Segmentation Analysis

By Material Type Analysis

Existing and Increasing Application of Nylon Ropes Boosts Material Demand

Based on material type, the market is segmented into nylon, polyester, polypropylene, high-modulus polyethene, and others.

The nylon segment dominates the mooring ropes market share owing to its wide range of applications in the marine & fishing industry. Nylon rope offers high strength and flexibility suitable for several applications in different industries since it is considered the strongest rope fiber when compared with polypropylene, polyethene, and organic fibers. Moreover, nylon shows good resistance to UV radiation, mildew, rot, and chemical exposure and can withstand high-temperature environments, which makes it the most preferred material in the marine sector. The nylon segment is expected to account for 41.27% of the market in 2026.

Polyester ropes are stronger and more abrasion-resistant than nylon ropes. Polyester has a low stretch factor and higher resistance to petroleum based products, bleaches and solvents, making it preferable for marine applications after nylon ropes.

To know how our report can help streamline your business, Speak to Analyst

By No. of Strands Analysis

4 to 10-strand Ropes to Gain Notable Traction Due to Their High Mechanical Strength and Bending Capability

Based on no. of strands, the market is segmented into up to 4 strands, 4 to 10 strands, and above ten strands.

The 4 to 10-strand segment is expected to drive the market due to its superior mechanical strength, higher stretch resistance, and bending capability. Also, it is one of the most preferred type of rope due to its low cost and high durability. These ropes are specifically designed for mooring lines, headlines, breast lines, or other applications that require strong, lightweight, and easy-to-handle & connect ropes with safety in mind. In 2026, the 4 to 10 strands segment is projected to lead the market with a 40.28% share.

Above 10 strands mooring ropes are comparatively stronger than steel due to their high strength-to-weight ratio, low stretch and easy handling. Moreover, these ropes are safer, with less recoil force than steel ropes and are 15 times more resistant to abrasion or damage than regular carbon steel mooring ropes.

By End-user Analysis

Marine Industry to be Major End-user Due to Product’s Wide Usage in Various Applications

Based on end-user, the market is segmented into marine, oil & gas, construction, and others.

The marine segment is expected to hold the largest share of the market owing to wide applications of these ropes, such as inland shipping, anchor ropes, mooring lines, and other marine applications. In offshore applications, these ropes offer improved efficiency, reduced operating costs, and high safety, making them a key consideration for the maritime industry. The marine segment is poised to account for 64.68% of the market share in 2026.

Oil & gas sector is the next dominating segment, where mooring ropes are utilized within the onshore and offshore to position oil generation and capacity offices. They are moreover utilized by cranes and heavy lifting equipment amid establishment exercises to lift and raise heavy equipment and oil and gas platform facilities.

REGIONAL INSIGHTS

The mooring ropes market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Mooring Ropes Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the market, followed by Europe and then North America. Growing maritime trade and offshore exploration activities in countries like China, India, and Southeast Asia are the major factors driving the demand for mooring ropes in the region. In addition, the expansion of ports and terminals necessitates reliable mooring systems, and the adoption of cost-effective synthetic ropes over traditional steel cables in various marine applications is also driving the demand for the market. The Japan market is forecast to reach USD 0.41 billion by 2026, the China market is set to reach USD 0.37 billion by 2026, and the India market is likely to reach USD 0.12 billion by 2026.

North America

The increasing influence of mooring ropes in North America is driven by the rising offshore oil and gas sector, especially in regions like the Gulf of Mexico. Increasing oil and gas activities have resulted in the adoption of advanced synthetic fibers due to their durability and resistance to harsh marine environments, which is positively driving the demand for mooring ropes in the North American market. The U.S. market is estimated to reach USD 0.15 billion by 2026.

Europe

In Europe, rapid expansion in offshore wind farms is driving demand for mooring ropes for floating turbines. Busy shipping lanes in the North Sea and Baltic Sea require robust mooring solutions, and the EU government is increasingly emphasizing sustainable materials and recycling practices that influence market trends. The UK market is expected to reach USD 0.94 billion by 2026, while the Germany market is anticipated to reach USD 0.107 billion by 2026.

Rest of The World

In Latin America, investments in ports and coastal developments and increasing focus on sustainable practices impacting material choices and product specifications in the region are driving the demand for this product. The market for mooring ropes in the area is expected to increase over the forecast period, thus the region offers growth opportunities for the market.

KEY INDUSTRY PLAYERS

Prominent Companies are focused on Developing Advanced Technologies to strengthen their Position

A significant portion of the market is fragmented with the growing presence of both large and small players. Some players are working on advanced technologies and activities to strengthen their market position. Additionally, they are focusing on improving their transportation services to withstand harsher conditions and meet specific global requirements. The companies are actively investing in research and development activities to develop advanced mooring ropes and to expand their product portfolios. Moreover, many major players have entered strategic partnerships and collaborations to strengthen their market presence and cater to the diverse needs of the maritime industry.

LIST OF TOP MOORING ROPES COMPANIES:

- WireCo WorldGroup (U.S.)

- Courtland Limited (U.S.)

- Katradis Marine Ropes Industry S.A (Greece)

- Dynamic Ropes (Denmark)

- Marlow Ropes Ltd. (U.K.)

- Folch Ropes S.A. (Spain)

- Teufelberger (Austria)

- LIROS GmbH (Germany)

- Van Beelen Group (Netherlands)

- Jimmy Green Marine (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – KATRADIS partnered with Freight Marine, a leading shipping and logistics company in South Africa, and opened a stock point in Port Elizabeth, South Africa. This alliance is set to improve the distribution and ensure timely delivery of an extensive range of mooring ropes, towing lines, and specialized ropes in the country.

- February 2023 – Marlow launched its first sustainably manufactured Fast Rope using recycled-based content (BCF rPA). The new specification has developed a strong, firm rope with less elongation while maintaining the existing popular properties of the Marlow Fast Rope construction. Its special feature is that oil and general spillage do not affect the speed of new launches as Marlow’s Fast Ropes absorb liquid.

- October 2022 – KATRADIS SA opened its first retail store named Cavo Yachting in Akti Themistokleous 14 in Zea Marina, Piraeus. The store supplies anodes, ropes, and cleansing & maintenance equipment for the yachting sector and a full range of products that fulfill all related needs.

- January 2022 – Bridon-Bekaert Ropes Group (BBRG) signed a Memorandum of Understanding (MoU) with Gazelle Wind Power to deliver advanced mooring lines for Gazelles’ first dynamic mooring system. BBRG will be responsible for supplying mooring lines for the initial 2MW pilot project at the Oceanic Platform of the Canary Islands.

- October 2020 – WireCo World Group announced that it had moved its Houston stock point to Lankhorst Ropes. The new site will be serviced by WireCo World Group’s partner Precision Tension Solutions, enabling Lankhorst to enhance its customer service further to varied mooring rope users along the southern coast of the U.S.

REPORT COVERAGE

The research report highlights leading regions across the world to better understand the market and its leading players. Furthermore, it provides insights into the latest market trends and analyzes technologies that have been deployed at a rapid pace at a global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.27% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material Type

|

|

By No. of Strands

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 1.46 billion in 2025 and is projected to reach USD 2.31 billion by 2034.

The market is expected to exhibit a CAGR of 5.27% during the forecast period of 2026-2034.

By material type, the nylon segment leads and accounts for a considerable share of the market.

WireCo WorldGroup, Katradis Marine Ropes Industry S.A., and Teufelberger are among the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us