North America Hybrid Cable Market Size, Share & COVID-19 Impact Analysis, By Cable Type (Fiber Optics Cables, Coaxial Cables, Copper Cables, and Others), By Transmission Type (AC Power and DC Power), By Application (Onshore and Offshore) By End-use Industry (Telecommunication, Power Transmission, Oil & Gas, Railways, Medical, and Others) and Country Forecast, 2025-2032

North America Hybrid Cable Market Size

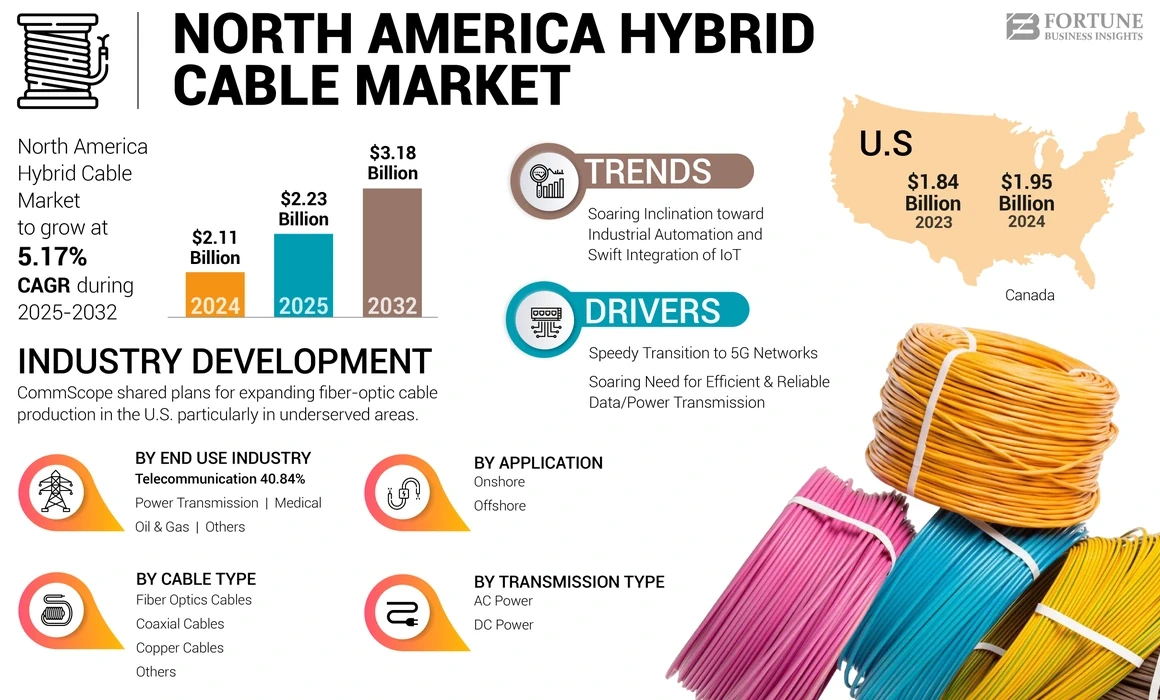

The North America hybrid cable market size was valued at USD 2.11 billion in 2024. The market is projected to grow from USD 2.23 billion in 2025 to USD 3.18 billion by 2032, exhibiting a CAGR of 5.17% during the forecast period.

Hybrid cable combines multiple cables, such as optic fiber and copper, within a single physical structure. It is designed to carry different signals simultaneously, such as electrical and network signals. The hybrid cable is used in various industrial applications such as telecommunication, power generation, industrial automation, medical, and others. The growing need for reliable and efficient data and energy transmission is expanding the application base for these cables. Their ability to handle increasing data consumption, enable simultaneous data and power transmission, integrate into existing infrastructure, and withstand demanding environments make them versatile solutions. Hybrid cable consists of multiple insulated conductors for carrying electrical signals and one or more optical fibers for transmitting light-based signals. The electrical conductors may be used for power transmission, data communication, or control signals, while the optical fibers are used for high-speed data transmission over long distances.

COVID-19 IMPACT

Supply Chain Disruptions amid COVID-19 Pandemic Affected Market Growth

Every country recorded diverse stages of the pandemic. China, the U.S., and Germany adopted early containment and implemented additional measures to combat the virus. Some countries faced the severe impact of COVID-19 as the infection spread vigorously and urgently built surge capacity in their health systems. The impact of COVID-19 on the North America hybrid cable market is moderate, as it hampered consumption in many end-use industries due to supply chain disruption of raw materials and hindrance in activities due to social distancing norms. Industries using these cables, such as telecommunications and energy, experienced a lower demand during the pandemic. The COVID-19 pandemic forced many companies and individuals to adopt remote work practices. This shift reduced demand for these cables used in office network infrastructure as companies downsized operations or moved to remote installations. The pandemic highlighted the importance of healthcare infrastructure, including medical equipment and devices. As a result, demand for hybrid cables increased for medical devices such as patient monitoring systems, ventilators and diagnostic devices.

LATEST TRENDS

Rising Inclination Toward Industrial Automation and Swift Integration of the Internet of Things (IoT) to Promote Market Growth

The market is experiencing rising progress due to increasing industrial automation trends and the integration of the Internet of Things (IoT). Industrial sectors are embracing automation to improve efficiency and productivity, while the IoT is revolutionizing connectivity and data exchange. Hybrid cables enable whole and reliable communication between devices and systems.

Industrial automation is witnessing rapid adoption across various sectors to enhance operational efficiency, reduce costs, and improve productivity. As industries implement advanced automation technologies such as robotics, machine learning, and artificial intelligence, the demand for reliable and efficient connectivity increases. Hybrid cables provide a robust communication infrastructure by integrating fiber optics for high-speed data transmission and copper conductors for power delivery. This enables continuous connectivity between automated systems, enabling real-time data exchange and control. These cables offer scalability and future-proofing for industrial automation and IoT systems. These cables can be easily integrated into existing infrastructure, allowing for flexible network expansions and upgrades. As industries evolve and adopt new technologies, hybrid cables provide the flexibility to adapt to changing connectivity requirements. This scalability and future-proofing attribute of hybrid cables contribute to their growing adoption in industrial automation and IoT applications.

The need for reliable connectivity, high bandwidth, speed requirements, and the durability and reliability of these cables in industrial environments make them a critical component of modern industrial infrastructure. As industries embrace automation and IoT technologies, the demand for these cables will continue to rise, fostering market growth and facilitating seamless communication and data exchange in industrial settings.

Download Free sample to learn more about this report.

DRIVING FACTORS

Speedy Transition to 5G Networks to Stimulate Demand for Hybrid Cables

The rapid adoption of the 5G network in North America will likely favor the development of the telecommunication industry and drive the demand for these cables. 5G technology offers high speed, low latency, and increased bandwidth, enabling various applications and services. Hybrid cable combines fiber optics and copper conductors as a feasible solution to meet the structure demand of the 5G network.

Hybrid cable offers several advantages in the 5G network transmission. It meets the need for high speed and bandwidth. With the large growth in data consumption, copper-based wires have less potential to fulfill the requirement. The hybrid cable supports high-speed data transmission over long distances, ensuring smooth application in 5G networks.

The Federal Communications Commission is describing the outdated regulations to boost the wired backbone of 5G networks and digital capabilities in the U.S. The Commission announced that in October 2020, the 5G Fund for Rural America will provide up to USD 9 billion in Universal Service Fund support for carriers to provide advanced 5G wireless services in rural America (including up to USD 680 million for use in tribal areas). The fund also provides at least USD 1 billion for operations that facilitate the needs of correct agriculture.

Growing Need for Reliable & Efficient Data/Power Transmission to Widen the Application Base of Hybrid Cables

The power transmission industry plays a crucial role in driving the growth of the market. This is attributed to the increasing number of power projects governments initiate in response to the rising demand for electricity. The World Nuclear Association has passed the statement in October 2022 that the U.S. will experience a significant surge in electricity demand, reaching 5,000 TWh annually by 2030. This growth is driven by U.S. nuclear reactors' previous 807 billion kilo-watt-hour production. Consequently, the government has announced plans to construct two additional reactors, with completion scheduled for the end of the previous year.

In the digital era, the consumption of data is continuously increasing. Bandwidth demand is rising as more data-intensive applications and technologies, such as streaming services, are increasing. These cables enable these demands by providing high-speed data transmission. They can efficiently transport large amounts of data over long distances, enabling reliable connectivity across various industries. These cables provide flexibility in harsh environments. Copper wires are known for their durability and ability to withstand harsh conditions, including high temperatures. Hybrid cables have the feature to deliver reliable performance in tough environments, making them suitable for industrial use indoors and in installations.

The growing need for reliable and efficient data and power transmission is expanding the application base for these cables. Their ability to address increases in data consumption, enable simultaneous data and power transmission, integrate with existing infrastructure, and withstand challenging environments makes them versatile solutions. These cables find applications across industries such as telecommunications, power, oil & gas, and smart cities.

RESTRAINING FACTORS

Time Consuming and Complex Cable Installation Process for Long Distances to Restrain Market Growth

Hybrid cables, which combine power and communication capabilities in a single cable, have become increasingly popular due to their capability to transmit large amounts of data over long distances. However, the growth of the market has been restrained by the time-consuming and complex cable installation process, particularly over longer distances.

Cable installation is a highly complex and slow process requiring specialized equipment and skilled personnel. The installation involves multiple stages, including cable laying, jointing, and termination, each requiring careful planning and execution. This process can take several months for longer distances, leading to delays in project timelines and increased costs. Companies are progressively investing in new technologies and innovative solutions to overcome these challenges and accelerate the growth of the market.

For example, in August 2021, the Prysmian Group recently announced the delivery of the unique battery-hybrid cable laying vessel Leonardo da Vinci, designed to improve the efficiency and speed of cable installation significantly. The vessel features new generation cable technology armored with lighter materials, maximum speed slightly above 16 knots, and bollard pull over 180 tons, which enable faster and more efficient cable installation. Furthermore, the vessel has a DP3 positioning and seakeeping system, ensuring maximum stability during cable-laying operations.

SEGMENTATION

By Cable Type Analysis

Growing High-Speed Network to Propel the Demand for Fiber Optic Cables

Based on cable type, the market is segmented into fiber optics cables, coaxial cables, and copper cables.

The fiber optics cable segment is dominating the market in North America. Fiber optic cables offer much higher bandwidth and faster data transfer rates than copper cables. With the increasing demand for high-speed internet, streaming services, and data-intensive applications, fiber optic cables provide superior performance and meet the requirements of modern technology.

Copper cables are generally less expensive than fiber optic cables, making them a more budget-friendly option, especially for short-distance applications or installations with lower bandwidth requirements. With the increase in renewable technology development in North America, the market can grow due to its multipurpose application.

By Transmission Type Analysis

Due to its Higher Efficiency DC Transmission Segment to Gain Highest Market Share

Based on transmission type, the market consists of two segments: AC power and DC power.

The Direct Current power segment dominates the North America’s market as DC (Direct Current) power transmission offers higher efficiency than AC (Alternating Current) over long distances. DC cables have lower resistance losses, making them more efficient for transmitting electricity over large-scale transmission networks. DC power is entirely made up of active power, meaning that there are almost no losses due to the capacitance of wires when DC power travels long distances. In fact, high voltage AC transmission systems have losses of 7% to 15% with aboveground transmission. This increased efficiency is driving the growth of the DC power transmission type segment in the market. The need for grid interconnections and power infrastructure expansion is contributing to the growth of the DC power transmission type segment.

AC power transmission holds the second largest market share for North America hybrid cables market and transmits electricity over long distances. The existing power infrastructure, including transformers and AC transmission lines, is predominantly designed for AC power transmission. As a result, AC cables continue to be widely used and form the second type of cable in the market.

By Application Analysis

Optimum Location of Offshore Projects for Harnessing Renewable Energy to Propel Offshore Segment Growth

Based on application, the market is split into onshore and offshore segments.

The offshore application segment is the dominating segment for renewable wind energy and the oil & gas industry. Offshore locations provide access to strong and consistent wind and tidal resources, making them ideal for harnessing renewable energy. These projects require specialized hybrid cables that withstand harsh marine environments and transmit electricity long distances. Cables play a vital role in powering offshore drilling platforms, subsea production systems, and underwater communication networks in these operations.

The onshore application segment is developing in this market. Onshore applications typically refer to projects and installations on land, such as buildings, power plants, and industrial facilities. The growing demand for infrastructure development, especially in emerging economies, drives the need for cables for onshore applications. With rapid urbanization, industrialization, and population growth, modernizing power grids with smart grid technologies requires advanced communication and control systems, necessitating hybrid cables.

By End-Use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Developing 5G Speed & Network Speed to Drive the Telecommunication Segment Growth

Based on end-use industry, the market is classified into telecommunication, power transmission, oil & gas, railways, medical, and others.

The telecommunication segment holds the major market share in North America. The fiber optic cables are used in the region's 5G and high network speed. With the ability to transfer power and data simultaneously, the North America hybrid cable is growing and expected to flourish in more demand in the forecast period.

Power transmission is the second fastest-growing end-use industry segment in this market. The power transmission industry relies on a robust electrical grid infrastructure to distribute electricity efficiently across long distances. This factor is set to drive the segment growth.

COUNTRY INSIGHTS

U.S. Market to Dominate due to Rising preference for Smart Grid Development

Internet usage in North America has grown considerably over the years. The telecom industry in the region has witnessed significant growth recently. Owing to the growth of the telecom industry, this market is expected to gain traction in the region during the hybrid cable market forecast period in North America The U.S. held a dominant market share in 2024 as the U.S. has been investing heavily in the development of the 5G telecommunication sector and smart grid power supply. This has led to an increased demand for hybrid cables for operation in the U.S. and Canada.

The market is extremely fragmented, with many players distributing a wide range of products and services across the value chain in North America. Numerous companies operate in the region to meet the end-use industry's specific demands, mostly in telecommunication and power generation. This market is growing due to the increasing demand for high-speed and reliable connectivity across various industries. This type of cable is used in various industrial applications such as telecommunication, power generation, industrial automation, medical, and others.

The U.S. possesses a strong R&D infrastructure with significant investments in research and innovation. This enables companies to continually develop and improve hybrid cable technologies, giving them a competitive edge in the market. This has led to an increased demand for hybrid cables in the country. The U.S. possesses a strong R&D infrastructure with significant investments in research and innovation. This enables companies to continually develop and improve hybrid cable technologies, giving them a competitive edge in the market.

The U.S. has witnessed significant investment and development in the cable industry. With the increased consumption of digital networks and data-intensive applications, there is a growing need for high-speed data transmission networks. Hybrid cable cannot use fiber optic and copper wire to provide the bandwidth and speed to meet this requirement. The demand for high-speed data transmission, IoT integration, and infrastructure development in North America will likely favor the market and expected overall cable market growth.

KEY INDUSTRY PLAYERS

Manufacturing Companies Collaborate with Network Providers to Enhance Market Growth

Companies are focusing on product development technology. Collaborating with key players, including network providers, system integrators, and end-users, allows industry players to access new markets and enhance their market share. Strategic partnerships and alliances provide companies with a broader customer base and improved market reach.

In August 2021, Prysmian Group announced an investment of about USD 85 million in major equipment and technology upgrades at plants in North America, enabling the company to match the growing production requirements for telecom customers. Most of these investments and upgrades are for the Prysmian Group Claremont, N.C. facility to increase the production of optical products. The Claremont facility is expected to grow to 620 employees in the next 18 months, adding around 70 new jobs.

List of Top North America Hybrid Cable Companies:

- Nexans (France)

- Prysmian Group (Italy)

- CommScope (U.S.)

- BELDEN INC. (U.S.)

- Hexatronic Group (Sweden)

- HUBER+SUHNER (Switzerland)

- New England Wire Technology (U.S.)

- Galaxy Wire & Cable, Inc. (U.S.)

- Eupen Cable (U.S.)

- SCHUNK SE & Co.KG (Germany)

KEY INDUSTRY DEVELOPMENTS:

- March 2023 - Prysmian secured a USD 120 million loan from the Italian investment bank Cassa Depositi e Prestiti (CDP) to invest in research & development for network promotion. The loan will support R&D plans focused on implementing advanced technologies and subsidize firming up digitalization processes while cutting emissions to facilitate the energy transition. The financed initiative is part of a higher project including four areas: research & materials, nanotechnology, sustainable materials, and low-voltage power grids for the telecommunication sector.

- March 2023 - Hexatronic completed the previous broadcast acquisition of Rochester Cable, one of the foremost designers and manufacturers of tough environment electro-optical cables in the U.S., from TE Connectivity Corporation for an enterprise. The contract elaborates on Hexatronic’s offering of fiber optic submarine communication cables to contain dynamic working cables that transmit electrical signals and power. Product trades are mostly in the U.S., Asia Pacific & Europe, and the Middle East & Africa regions.

- March 2023 - Belden introduced the industry's first UL-certified hybrid cable for Class 4 circuits: Fault-Managed Power System (FMPS) hybrid cable. These cables are designed to safely transmit power at higher levels and over longer distances than previous power-limited circuits that were limited to 100W. UL qualifies FMPS hybrid cables for Class 4 compliance. Their copper/fiber construction carries power and data over long distances in a single cable run, saving installation time and reducing complexity.

- March 2023 - CommScope shared plans to expand its fiber-optic cable production in the U.S. to accelerate broadband deployment nationwide, particularly in underserved areas. This expansion will increase fiber-optic cable output employment opportunities and bolster supply chain production in the U.S. CommScope is introducing a new HeliARC fiber optic cable designed for rural deployments. The company would invest USD 47 million in the U.S. to expand fiber optic cable production focused on rural applications.

- January 2022 - Nexans received its first order and signed the contract to produce approximately 110 km of high-voltage submarine cables for South Fork Wind, a joint venture between Orsted and Eversource. These include three-phase 138 kV high-voltage other-current subsea cables (HVAC) for export combined with two fiber optic cables carrying 132 MW of power.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and the growing market shares for different segments and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.17% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Cable Type

|

|

By Transmission Type

|

|

|

By Application

|

|

|

By End-Use Industry

|

|

|

By Country

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the North America market size was USD 2.11 billion in 2024.

The North America market is projected to grow at a CAGR of 5.17% over the forecast period.

The market size of the U.S. stood at USD 1.95 billion in 2024.

Based on application, offshore applications hold the dominating share in the market.

The North America market size is expected to reach USD 3.18 billion by 2032.

Hybrid cables support high-speed data transmission across the power transmission sector, which is a key factor driving market growth.

The top players in the market are Hexatronic Group, New England Wire Technology, Galaxy Wire & Cable, Inc., and Prysmian Group, which are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us