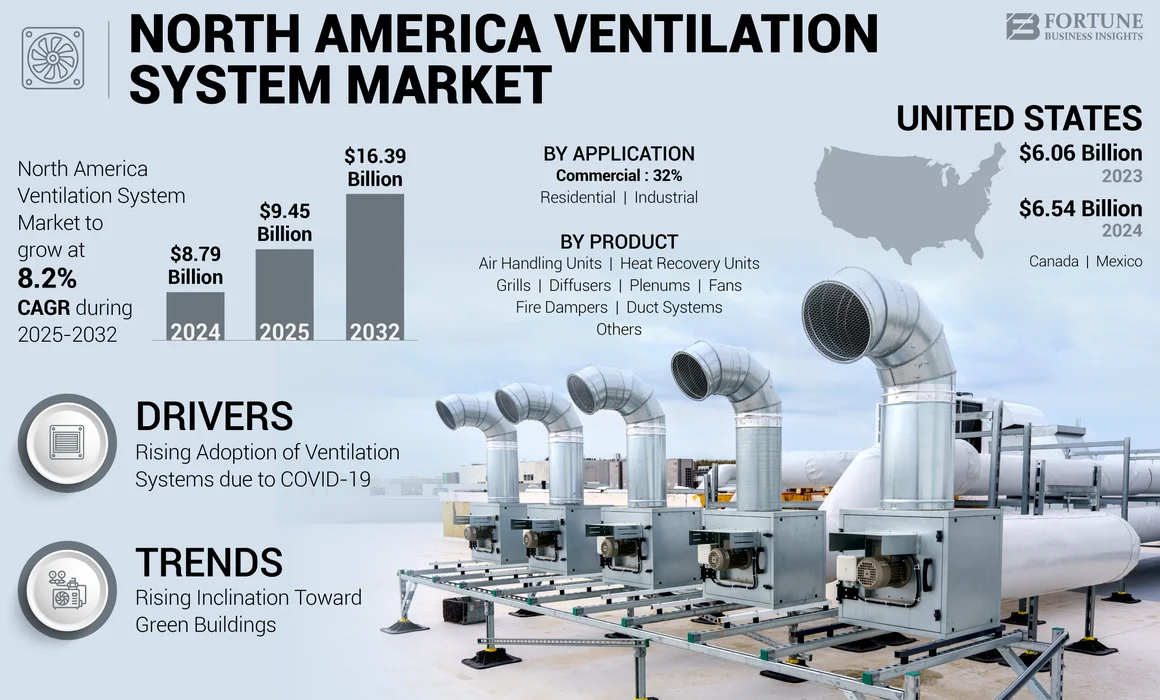

North America Ventilation System Market Size, Share & COVID-19 Impact Analysis, By Product (Grill, Diffuser, Plenum, Fan, Fire Damper, Duct Systems, Air Handling Units (AHU), Heat Recovery Unit (HRV), and Others), By Application (Commercial, Residential, and Industrial), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The North America ventilation system market size was USD 8.79 billion in 2024. The market is projected to grow from USD 9.45 billion in 2025 to USD 16.39 billion by 2032, exhibiting a CAGR of 8.2% during the forecast period.

Ventilation systems control and circulate indoor air by displacing and diluting pollutants. They improve the Indoor Air Quality (IAQ), which enhances the indoor climate through an exchange of indoor and outdoor air. Ventilation to improve the indoor air quality plays a crucial role in controlling the thermal comfort when weather conditions change. It is installed in residential, commercial, and industrial areas.

Recent improvements in evaporative cooling and fan technology are fueling the demand for innovative ventilation systems over conventional ones. Technological advancements integrated into ventilators improve their usability, efficiency, and effectiveness. Leading manufacturers are upgrading energy recovery ventilators, air filters, and other products with programmable controls and advanced technologies to create streamlined operations. These technological advancements are expected to boost the North America ventilation system market growth.

COVID-19 IMPACT

COVID-19 Hampered Business Operations, Causing Market Uncertainty and Volatility

This industry in North America was slightly impacted by the COVID-19 pandemic during the first quarter of 2020. The reason behind it is that certain ventilation and air conditioning activities were halted as there was a severe lack of workforce. COVID-19 also caused changes in human behavior and hobbies. Consumers got more influenced by the increase in air changes, outdoor air intakes, and exhaust air intakes, and the adoption of air filters grew owing to precautions taken against the COVID-19 virus.

Additionally, due to changes in climate and growing public concerns over air quality and energy efficiency, there was a strong demand for climate control systems, such as HVAC machines for reducing energy consumption in North American countries. Moreover, various governments were planning to fund the installation of HVAC systems in residential, commercial, and industrial areas.

For instance, in December 2020, the U.S. government offered funds worth around USD 82 billion for installing ventilation and air quality systems in primary as well as secondary schools.

North America Ventilation System Market Trends

Rising Demand for Green Buildings to Boost Market Growth

The trend of zero-energy buildings in the construction sector is rising at a notable pace, which is anticipated to boost the ventilation system market growth. The concept of sustainable buildings is supported by several governments including 26 countries in ‘Energy in Building and Communities’. They are introducing several programs to promote the construction of eco-friendly buildings and formulating policies regarding carbon emissions for commercial and residential purposes.

The building owners are also emphasizing on the construction of eco-friendly buildings as there is a strong connection between financial incentives and zero-energy buildings. Therefore, owners of commercial buildings are installing supportive ventilation solutions on a large scale after realizing the significance of having fresh indoor air. Emerging as well as developed nations are increasing their focus on eco-friendly building programs, which will help them increase awareness about the importance of having high indoor air quality.

Download Free sample to learn more about this report.

North America Ventilation System Market Growth Factors

Rising Adoption of Ventilation Technologies due to COVID-19 Fueled Market Progress

Ventilation continues to be a top concern - a key prevention strategy for maintaining healthy environments and reducing the likelihood of spreading disease.

Moreover, in the wake of the COVID-19 pandemic, several institutions were heavily investing in improving their ventilation solutions across the commercial and residential sectors. They were also recommending a layered approach to reduce exposure to COVID-19. This is owing to the rising awareness of the importance of a healthy indoor air quality.

Indoor Air Quality or IAQ awareness increased among people due to the COVID-19 outbreak as proper ventilation could decrease the risk of air-transmitted diseases by reducing the number of airborne virus particles. Healthcare is one of the major end-users in this market. Ventilation units must be well maintained to halt the spread of airborne pathogens throughout healthcare facilities.

RESTRAINING FACTORS

High Maintenance & Operating Costs and Skilled Labor Shortage to Hamper Market Progress

Conventional ventilation systems remove the issue of space congestion. Many futuristic residential and commercial spaces, which are quite airtight and compact, decrease the overall internal pressure by forcing the air out of the space. This factor can create problems while deploying traditional ventilators that need positive force to eliminate combustion outside the room. This problem can be solved by ensuring that these systems are sent for regular maintenance. However, analyzing the machines and detecting and solving the problem is a complex and time-consuming process. Skilled technicians are required to perform these activities. These factors often increase the cost of operating and maintaining ventilation machines. The key companies keep developing new technologies to overcome different operating and maintenance challenges.

Furthermore, the HVAC sector is facing a severe shortage of skilled technicians. The existing workforce has already become eligible for retirement within the next 10 years. This issue has raised the problem of workforce shortage. These factors might restrain the region’s market share.

North America Ventilation System Market Segmentation Analysis

By Product Analysis

Air Handling Units to Gain Major Traction Due to High Demand in Residential and Commercial Spaces

Based on product, the market is divided into grills, diffusers, plenums, fans, fire dampers, duct systems, Air Handling Units (AHU), Heat Recovery Units (HRV), and others (air filters).

The Air Handling Units (AHU) segment might hold the largest North America ventilation system market share. This is due to a rise in the demand for these units for commercial and residential spaces as they offer energy-efficiency and attractive features. Moreover, the use of these systems is expected to grow significantly in oil & gas and other related areas due to the expansion of residential and commercial sectors.

The fan, Heat Recovery Unit (HRU), and duct system segments will grow significantly during the forecast period owing to their high demand across all sectors. Improving the productivity of data centers and raising the average spending on them are driving the need for fans across data centers to maintain an ambient indoor temperature and boost the indoor air quality.

Grills, diffusers, plenums, and fire damper segments will grow at a decent rate during the forecast period. This is due to the rising demand for ventilation systems in industrial and commercial sectors due to features, such as energy efficiency, durability, and ease in installing the machine.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Commercial Sector to Exhibit Highest Growth Due to Wide Utilization Ventilation Solutions in Workplaces

Based on application, the market is divided into residential, commercial, and industrial.

The commercial application segment may record the highest CAGR during the forecast period. This is because airports, hotels & restaurants, private workplaces, educational institutions, and other commercial spaces are using ventilation systems to offer an ambient working environment that can improve work efficiency.

Furthermore, the residential application segment might record a steady CAGR during the forecast timeframe. This segment’s steady growth is due to factors, such as the growing construction of residential spaces, rising income level of end-users, and supportive government initiatives to boost spending on activities related to residential construction.

The industrial sector is anticipated to register a considerable demand for precise air conditioners, air handlers, range hood products, fresh air systems, and other products. These systems are being deployed in several sectors, such as chemical & pharmaceutical, food & beverage, oil & gas, and other industries.

REGIONAL INSIGHTS

The report's scope comprises three major countries: U.S., Canada, and Mexico.

The U.S. may record a consistent rate of growth in the coming years as there is a strong demand for systems that supervise the indoor air quality of residential spaces. The country has harsh climatic conditions, such as hurricanes, hailstorms, heavy snowfall, and others, which can greatly impact the indoor air quality of residential spaces. Moreover, growing investments in residential construction projects will also improve the demand for these machines to provide a healthy and safe indoor environment.

Canada and Mexico will grow at a decent rate during the forecast period. In Canada, the market is driven by factors, such as increasing awareness about indoor air quality, energy efficiency requirements, and rising construction & renovation activities. Residential, commercial, and industrial sectors are contributing to the expansion of this market. In Mexico, the market is influenced by factors, such as rapid urbanization, growing industrialization, and government initiatives to improve energy efficiency. The demand for ventilation systems is particularly strong in commercial, manufacturing, and healthcare sectors.

KEY INDUSTRY PLAYERS

Key Companies to Expand Business Operations by Using Reliable Corporate Growth Strategies

The COVID-19 pandemic was instrumental in boosting the market’s growth as key market players, such as Greenheck Fan Corporation, Johnson Controls, Honeywell International Inc., and many others, are now focusing on improving their ventilation systems. They are decentralizing their production processes by establishing facilities in many regions. This will help them cut the transportation, shipping, and third-party warehouse charges.

Key companies are developing and introducing novel products and solutions. They are investing heavily in establishing robust R&D facilities and raising their yearly expenditure on R&D. They are also implementing long-term marketing strategies to promote their offerings and boost their brand name in the global marketplace. The strong reputation can make the products more reliable and help vendors increase the price of their products slightly.

List of Top North America Ventilation System Companies:

- CaptiveAire Systems (U.S.)

- Greenheck Fan Corporation (Japan)

- Trane Technologies plc (Ireland)

- Carrier (U.S.)

- Twin City Fan & Blower (U.S.)

- DAIKIN INDUSTRIES, Ltd. (U.S.)

- Systemair AB (Sweden)

- Lennox International Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Johnson Controls (Ireland)

- Nortek Air Solutions, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2024: Systemair AB acquired SagiCofim S.P.A., an Italian based supplier of filtration and air distribution, its air distribution products to strengthen Systemair's product portfolio.

- May 2021: Johnson Controls completed the acquisition of Silent-Aire for around USD 0.8 billion. Silent-Aire is a leading producer of modular critical infrastructure and hyperscale data center cooling solutions.

- May 2021: Carrier launched Revit configurator to customize air conditioning system drawings. With the integration of Revit, customers can save the time needed to configure the system.

- April 2021: Greenheck introduced RV-10, a new model that would be included in its rooftop ventilation unit range for 100% outside air and partial recirculation solutions.

- March 2021: Lennox International Inc. introduced ‘PureAir S and PureAir Air Purification Systems.’ With this, the company showed its commitment to delivering complete-home purification solutions for perfect air amidst the COVID-19 pandemic.

REPORT COVERAGE

The market report offers a detailed analysis of numerous factors affecting the North American market. These include opportunities, growth drivers, threats, key industry developments, and restraints. It further helps analyze, bifurcate, and define the market based on different segments, such as products and applications. It examines several strategies, such as product innovations, mergers, alliances, joint ventures, and acquisitions adopted by key players to gain a competitive edge in the market and attract high revenue during the forecast period.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.2% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

By Application

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the size of the market was valued at USD 8.79 billion in 2024.

The market is projected to reach USD 16.39 billion by 2032.

The market will record a CAGR of 8.2% over the forecast period of 2025-2032.

The U.S. market is expected to witness the highest growth rate, with a revenue generation of USD 6.54 billion in 2024 due to rising living standards and the modernization of residential and commercial buildings.

The Air Handling Units (AHU) segment is expected to lead the market during the forecast period.

Rising adoption of ventilation systems due to the COVID-19 pandemic is driving the market growth.

Johnson Controls, Greenheck Fan Corporation, and Honeywell International Inc. are the top players in the market.

The commercial application segment is expected to lead the market during the forecast period.

The market currently exhibits the trend of green buildings.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us