Nutraceuticals Market Size, Share & Industry Analysis, By Product Type (Dietary Supplements, Functional Foods, and Functional Beverages), Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail, and Others) and Regional Forecast, 2026-2034

Nutraceuticals Market Size and Future Outlook

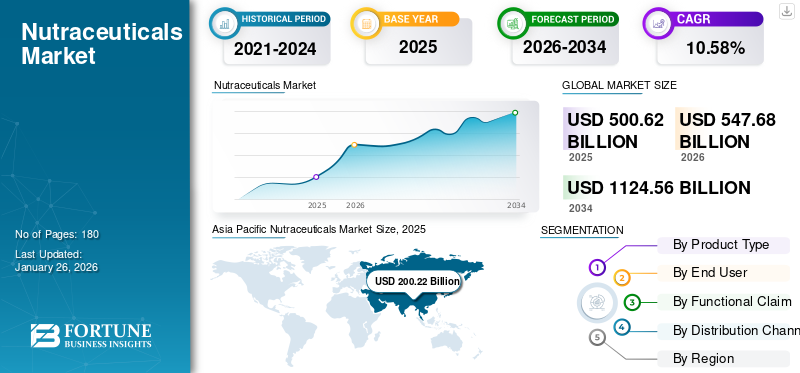

The global nutraceuticals market size was valued at USD 500.62 billion in 2025 and is projected to grow from USD 547.68 billion in 2026 to USD 1,124.56 billion by 2034, exhibiting a CAGR of 10.58% during the forecast period. Asia Pacific dominated the nutraceuticals market with a market share of 39.99% in 2025.

Nutraceuticals are steadily gaining traction across the globe as consumers become increasingly aware of their vast health advantages. The recognition of these products' capability to prevent or delay various health conditions has fueled their growing demand. Moreover, individuals are gravitating toward natural and alternative approaches to maintaining health and wellness, further boosting their popularity.

Rising health consciousness among consumers drives product sales, presenting businesses with significant opportunities to innovate and expand their offerings. This trend is expected to propel market growth over the forecast period. Additionally, companies are enhancing their strategies by digitizing supply chains, partnering with celebrities for promotions, and fortifying their e-commerce platforms, which are likely to influence the market in the coming years.

Global Nutraceuticals Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 500.62 billion

- 2026 Market Size: USD 547.68 billion

- 2034 Forecast Market Size: USD 1,124.56 billion

- CAGR: 10.58% from 2026–2034

Market Share:

- Asia Pacific dominated the nutraceuticals market with a market share of 39.99% in 2025, supported by rising population, disposable income, and health awareness. Increasing consumer preference for functional foods and beverages is fueling growth across countries like China, India, and Southeast Asia.

- By product type, functional beverages held the largest share in 2024 due to growing demand for low-calorie, health-enhancing drinks. Lifestyle users represented the largest end-user segment owing to rising preventive healthcare spending. Supermarkets/hypermarkets led distribution due to high consumer reliance on physical retail for food and wellness products.

Key Country Highlights:

- United States: High demand for dietary supplements and functional beverages; obesity management and healthy aging trends are boosting consumption.

- China: Rising awareness of gut health and probiotics, with 70% population acknowledging health benefits as per CFIC survey.

- India: Government launched eight nutraceutical products under Pradhan Mantri Bhartiya Janaushadhi Pariyojana to boost immunity.

- Japan: Cultural emphasis on preventive health supports consistent dietary supplement consumption.

- Brazil: Increased consumer interest in protein-rich and functional products fueling demand.

- Saudi Arabia: Growth driven by rising income and shift toward western-style preventive healthcare.

- South Africa: Demand growing due to increased interest in immune-boosting and functional wellness products.

NUTRACEUTICALS MARKET TRENDS

Personalization of Nutrition is a Prominent Trend Propelling Growth

The personalized nutrition market is anticipated to witness exponential growth in the upcoming years. Such robust growth potential is expected to witness the benefit of the market, especially those with evidence-based health benefits and clean-labeled traits. The sustainable growth of this market pivots on personalized offerings such as the one-size-fits-all concept. Also, consumers are showing greater willingness for such customized offerings which include supplements, diet, and exercise. Further, nutritional supplements are likely to emerge as a crucial intervention in the prognostic and proactive health concept. The factors mentioned above are anticipated to support the steady global nutraceuticals market growth.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increasing Popularity of Nutrient-Enriched Diets to Facilitate the Market Growth

The improvement in healthcare opportunities, decrease in death rates, and consumer willingness to spend on health and wellness have led to an increase in the regional population. This has provided the necessary impetus to the sector's growth globally. The shifting preferences of consumers toward functional foods and beverages have also contributed to improved sales performance.

Consumers exhibit a greater willingness to opt for a concentrated nutrition source, and dietary supplements have answered this call effectively and conveniently. During the global pandemic, the realization of its significance in aiding immune and physical health has increased exponentially, which will favor the global market growth in the forthcoming years. For instance, in September 2020, the Indian government launched eight nutraceutical products under the Pradhan Mantri Bhartiya Janaushadhi Pariyojana scheme. The newly launched nutraceutical products will help improve users' immunity systems.

Rising Expenditure on Technological Advancements to Drive Market Growth

The high investment in research and development activities positively impacts a manufacturer's production technology and its quality. The nutraceutical industry has rapidly evolved in the past few years to respond to this growing demand for health-benefiting products. This is manifested in the exponential increase of the nutraceutical launches in functional beverages and dietary supplements categories. The rampant use of antibiotics in the form of over-the-counter medicines has negatively impacted our health. There are incidences of infections caused by antibiotic-resistant pathogens. This calls for the development of nutraceutical products that provide a microbiota of great diversity that will enable enhanced immunity and overall well-being.

Market Restraints

High Regulatory Stringent Laws Associated with Products to Impede Market Growth

Despite the higher demand for the product, there are certain factors restraining the market growth. One among them is the highly stringent and complex regulatory structure for the commercialization of nutraceutical products. The global markets exhibit limited harmonized provisions on the composition of these products. The upper limits and conditions of use for other botanicals, botanical preparations, and bioactive substances are yet to be harmonized. The different opinions among several government bodies on the type of ingredients to be allowed and what quantity further challenge the harmonization aspect.

Market Opportunities

Consumers Opting for Preventive Healthcare to Fuel Up New Opportunities for Market Growth

The rise in healthcare costs is leading more consumers to use food supplements as a proactive measure to reduce long-term medical expenses. The shift toward preventive healthcare has increased the demand for ingredients that support general health and wellness rather than just treating specific conditions. This could include vitamins, minerals, and others. Thus, there is a huge potential area of growth for nutraceutical manufacturers to address emerging areas of preventive healthcare, such as gut health, cognitive function, and stress management.

Market Challenges

Lack of Stringent Quality Control Measures to Impact Product Quality

Unlike pharmaceutical products, which are subject to strict regulations, safety requirements, and quality standards, limited regulations and standardization have been established for nutraceutical products. The lack of well-defined quality control standards poses a great challenge for the manufacturers as it can lead to product quality variations, which in turn causes a deterioration of consumer's trust in the products.

IMPACT of COVID-19

The COVID-19 pandemic heavily and positively affected the market across the globe. There have been reports of a massive increase in demand for products that claim to enhance health and immunity. The circulation of advice from doctors globally to incorporate functional foods and dietary supplements in daily life to aid the immune system greatly contributes to the high adoption of these types of products.

The industry’s growth is primarily driven by increased consumer awareness about the benefits of consumption of health supplements, growing consciousness about preventive healthcare measures, and a rising population of affluent and health-conscious consumers. The rapid spread of COVID-19 globally encourages people to shift toward products that support their immune health and adopt preventive healthcare measures that significantly boost product sales. Since the onset of the pandemic globally, panic buying of dietary supplements, functional foods, and beverages by consumers contributed to the exponential growth in the product's sales in retail distribution channels.

Segmentation Analysis

By Product Type

Increasing Health Consciousness Boosted Demand for Functional Beverages

The market is classified into dietary supplements, functional foods, and functional beverages, based on the product type.

Beverages are projected to account for 42.06% of the total market share in 2026. The segment is flourishing at an impeccable pace, accredited to the increasing number of health-conscious consumers switching from sugary drinks to drinks that are low in calories & sugar and offer functional benefits. The increasing health consciousness among buyers has supported the sales of functional beverages. Drinks, such as soft drinks, colas, and sodas have been replaced with functional beverages. Moreover, the rising focus of prominent brands on the launch of low and no-sugar functional foods will help to maintain their market prominence. Among functional beverages, fortified and functional energy drinks account for the highest market share owing to the increased product availability in the market. Such products help to address micronutrient deficiencies and also act as an efficient means to enhance the diet.

Functional foods is another prominent category in the market and such products have several health benefits, which include anemia prevention, addressing dietary deficiencies, and improving bone health.

Dietary supplements account for the third major category in the sector. Companies operating in the dietary supplements segment are embarking on the expansion of their facility to fulfill the rising demand for health-benefiting products. For instance, Sabinsa Corporation, an American functional & nutraceutical producer, opened its production plant in Hasan, Karnataka, India. The company invested nearly USD 18 million to construct this facility and planned to produce 88 tons of active nutraceutical ingredients.

By End User

Lifestyle Users Account for the Highest Market Share Owing to Increased Spending on Preventative Healthcare Products

Based on end user, the market is segmented into lifestyle users, athletes, geriatric users, fitness enthusiasts, and others.

Lifestyle users are expected to represent 28.01% of the market share by end users. Such users are aware of the need to maintain a balanced and healthy lifestyle and hence spend a significant proportion of their spending on preventative healthcare products. Hence, the spending of such a category of consumers on such products is high.

The geriatric population accounts for the second major category of users of such products. Such prole is susceptible to a higher risk of nutrient deficiency and other health disorders, which lead to increased consumption of such products to improve general well-being and prevent disease.

Athletes account for another major category of end users of such products. Food supplements, functional food, and beverages help to enhance the athlete's performance, improve recovery, and promote general well-being.

Fitness enthusiast is another prominent user of such products. Gymgoers and other consumers who are passionate about health and wellness are purchasing protein, vitamins, mineral fortified, and other products to improve their speed, endurance, and muscle mass and enhance their physical appearance.

By Functional Claim

High/Added Fiber Accounts for the Highest Market Share Due to Several Health Benefits Associated with Such Products

Based on functional claim, the market is segmented into high/added fiber, vitamin/mineral fortified, brain health, bone health/added calcium, weight management, cardiovascular health, skin/hair/nails, added protein, and others.

High/added fiber products are anticipated to hold a 26.78% market share by functional claim. Such products are popular among consumers as they support blood sugar regulation, support digestive health, and improve gut health. Among different ailments, gastrointestinal disease is one of the major ailments that affect consumers globally, and hence, such products are popular among consumers across the globe. For instance, as per data published by the Global Burden of Disease Study, in 2019, there were 7.29 billion gastrointestinal diseases in the global market.

The added protein segment is expected to register the fastest growth during the forecast period. The consumer favors protein products as they are essential for overall health and growth. Hence, functional food, beverages, and dietary supplements fortified with protein are growing in popularity among consumers globally.

By Distribution Channel

Supermarkets/Hypermarkets Segment to lead Due to Higher Consumer Reliance to Purchase Several Food Products

Based on the distribution channel, the global market has been categorized into hypermarkets/supermarkets, convenience stores, online retail, and others.

Supermarkets and hypermarkets are forecast to account for 43.05% of the total market share by distribution channel and is expected to showcase considerable growth during the forecast period. This is due to factors, such as the stores being key distributors of the product on account of higher consumer reliance to purchase several food products & healthy foods and drinks.

The online retail marketplace becomes a digital platform for consumers and merchants without warehousing the products. These marketplaces do offer shipment, delivery, and several easy payment options to their consumers. Several factors, such as low product prices, discounts, shopping convenience, free shipping, and extensive product range, are anticipated to support the steady growth of the online retail segment.

To know how our report can help streamline your business, Speak to Analyst

NUTRACEUTICALS MARKET REGIONAL OUTLOOK

The global market segmentation includes regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Nutraceuticals Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific stood at USD 182.67 billion in 2024. Asia Pacific is expected to dominate the global market. This is due to the rising population, increasing disposable income, and improving living standards in the region. The increasing awareness regarding health-improving foods is also likely to act as a key driving factor for market growth. Presently, The Japan market is projected to reach USD 48.65 billion by 2026, the China market is projected to reach USD 80.31 billion by 2026, and the India market is projected to reach USD 37.50 billion by 2026.

The increasing popularity of functional foods and beverages within several countries of Asia Pacific has supported the regional market growth. For instance, in June 2020, the China Food Information Center (CFIC) published a survey report that concluded that 70% of China's population acknowledged that probiotics offer health benefits. Hence, the growing popularity of probiotics among consumers to improve gut health, which ultimately prevents various chronic health conditions, can further propel the market growth.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is projected to hold the second-largest share of the market. The significant growth is attributed to the increasing consumer awareness of the health benefits of these types of products and their nutritional benefits for potential disease prevention and health enhancement. Functional foods and beverage products can help improve health, reduce healthcare costs, and support economic development. The growth of these products is mainly driven by the continuously growing demand for energy drinks, fortified dairy products, functional beverages, and dietary supplements. However, country-specific regulations and health claim substantiation are challenges that the key markets continue to face. The U.S. market is projected to reach USD 94.17 billion by 2026.

In the U.S., consumers are seeking out supplements and healthy foods that can help manage obesity and promote overall well-being. For instance, according to the National Health and Nutrition Examination Survey 2022, nationally in the U.S., 41.9% of adults have obesity. Moreover, the aging population in the country is further fueling the demand for supplements that can support healthy aging, such as those targeting bones, joints, and others.

Europe:

The market in Europe is primarily driven by the rising consumer inclination toward preventive healthcare measures. The increasing aging population in the region has significantly contributed to the growing demand for such products, especially dietary supplements. The regional key players are embarking on new product development to increase their presence in this market. The UK market is projected to reach USD 24.42 billion by 2026, while the Germany market is projected to reach USD 21.81 billion by 2026.

South America:

The market in South America is at the infancy stage and currently accounts for a small fraction i.e. approx. 12% of the total world market turnover. However, the region has lots of potential and it can grow at a healthier pace in the forthcoming years. This industry is evolving at a considerable pace, with conditions set for tremendous growth in the upcoming years.

Middle East & Africa:

The growth in the shift toward preventive therapies, rising family income, satisfactory pricing environment growth in the pharma retail chain, and rise in healthcare spending are primarily responsible for the growing market of these products in the Middle East & Africa. Moreover, the growing investments by key international market players in the regional market are predicted to drive the growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies Focus on Product Launches to Strengthen Their Positions

The global market is moderately consolidated with a few prominent players, such as Herbalife Nutrition Ltd, Archer Daniels Midland Company, Abbott, and Amway. The increasing popularity of health-benefiting products and the rising demand for functional beverages have significantly led to a surge in demand for such products. Companies, such as Archer Daniels Midland Company, Herbalife, and Amway are embarking on new product launches and expansion of product portfolios to broaden their presence.

For instance, in March 2019, Herbalife Nutrition Ltd. launched a new plant-based protein-rich supplement, Protein Drink Mix Select and Formula 1 Select Meal Replacement Shake. Similarly, in June 2019, Archer Daniels Midland Company introduced a new line of vegan DHA/EPA blends with Qualitas Health, a leader in algae cultivation, manufacturing algae-based, vegan, and sustainable products.

Major Players in the Nutraceuticals Market

To know how our report can help streamline your business, Speak to Analyst

Herbalife Nutrition Ltd., Archer Daniels Midland Company, Glanbia Plc, and others are some of the largest players in the market. The global market is semi-fragmented, with the top 5 players accounting for around 45% of the global nutraceuticals market share.

LIST OF KEY NUTRACEUTICALS COMPANIES PROFILED:

- Herbalife Nutrition Ltd. (U.S.)

- Archer Daniels Midland Company (U.S.)

- General Mills (U.S.)

- PepsiCo Inc. (U.S.)

- BASF SE (Germany)

- Abbott (U.S.)

- Amway (U.S.)

- Glanbia Plc. (Ireland)

- Danone S.A. (France)

- Nestle S.A. (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Zingavita, an Indian startup company specializing in manufacturing nutraceuticals and supplement products, raised approximately USD 1.2 million in its pre-series A round funding.

- May 2023: Kirin Holdings Company Limited, a Japanese beer & beverages manufacturer, partnered with an American breakfast product manufacturer, Kellogg’s Company, to introduce a new product portfolio, Kellogg’s All-Bran, in Japan. The new product contains a blend of L. lactis strain Plasma (postbiotic) and fermented dietary fiber and helps to support users' immune health.

- April 2023: Fonterra, a New Zealand dairy giant, launched functional beverage products under its Anchor and Fernleaf brands to meet increasing ready-to-drink beverages across South East Asia. The company collaborated with the convenience store chain 7-Eleven to sell its functional dairy beverages Actif-Fiber and Anchor-Beaute.

- February 2021: Israeli functional gummy supplement manufacturer TopGum Industries Ltd. announced to expand its operations in the U.S. by establishing a new subsidiary TopGum, Inc., in New Jersey. The company aims to expand its production capacity and marketing activities of functional gummy bears in North America and Europe.

- January 2021: The manufacturer of premium instant coffee, Alpine Start Inc., announced the launch of its functional beverages, With Benefits, with the help of the American public benefit company Kickstarter. The new fortified beverages are loaded with vitamins, minerals, and MCTs, made using clean-label, natural ingredients for boosting immunity and focus.

Investment Analysis and Opportunities

The nutraceuticals market report provides comprehensive investment analysis and opportunities aimed at providing investors and business leaders with actionable insights. The global market trends overview report highlights the various opportunities that have the potential for investments, including new product launches, technological advancements, mergers & acquisitions, and geographic expansions.

REPORT COVERAGE

The global nutraceuticals market report includes qualitative and quantitative insights into the industry. It also offers a detailed analysis of the market size and growth rate for all possible segments. The report presents numerous key insights, such as an overview of related markets, competitive landscape, recent industry developments such as base expansion, the regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

|

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By End User

By Functional Claim

By Distribution Channel

By Geography

Rest of Middle East & Africa (By Distribution Channel)

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 500.62 billion in 2025 and is predicted to reach USD 1,124.56 billion by 2034.

The market will exhibit a promising CAGR of 10.58% during the forecast period.

Based on the product type, the functional beverages segment leads the market.

The increasing demand for nutraceuticals to prevent lifestyle-related health conditions is the key factor driving the market growth.

Abbott, Amway, Danone S.A., and Nestle S.A. are a few of the leading players in the market.

Asia Pacific dominated the market in terms of share in 2025.

Based on the distribution channel, the hypermarkets and supermarkets segment holds a major share of the global market.

The shift toward personalization of products is the key market trend.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us