Oat Milk Market Size, Share & Industry Analysis, By Nature (Organic and Conventional), By Packaging Type (Cartons and Bottles), By Flavor (Flavored and Non-Flavored), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

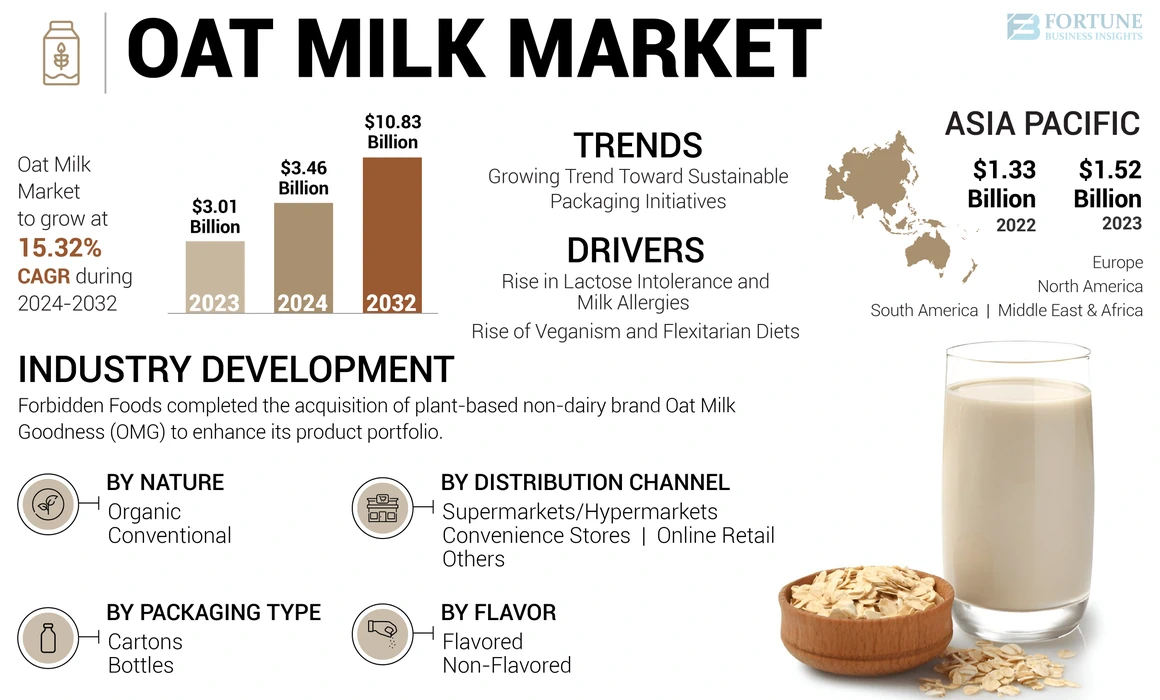

The global oat milk market size was valued at USD 3.01 billion in 2023. The market is projected to grow from USD 3.46 billion in 2024 to USD 10.83 billion by 2032, exhibiting a CAGR of 15.32% during the forecast period. Asia Pacific dominated the oat milk market with a market share of 50.5% in 2023.

Moreover, the U.S. oat milk market is projected to reach USD 2.01 billion by 2032, driven by the demand for plant-based dairy alternatives.

The key players in the market are leveraging product innovation, sustainability, and strategic partnerships to enhance their market presence amid rising consumer demand for plant-based alternatives. Each player is tailoring their approach to meet specific consumer preferences while navigating the competitive landscape effectively.

Oat milk is defined as a plant-based milk alternative made primarily from oats and water, often supplemented with added vitamins and minerals. It serves as a lactose-free, nut-free, and dairy-free option, appealing to consumers with dietary restrictions or preferences for non-dairy products. The market is experiencing robust growth due to increasing consumer awareness of health benefits, rising dairy milk allergies and lactose intolerance rates, and a growing preference for plant-based diets. The market is projected to expand significantly over the coming years, driven by innovations in product offerings and an increasing presence in retail environments.

OAT MILK MARKET Overview & Key Metrics

Market Size & Forecast:

- 2023 Market Size: USD 3.01 billion

- 2024 Market Size: USD 3.46 billion

- 2032 Forecast Market Size: USD 10.83 billion

- CAGR: 15.32% from 2024–2032

Market Share:

- Asia Pacific dominated the oat milk market with a 50.5% share in 2023, driven by increasing adoption of plant-based diets, growing awareness of lactose intolerance, and cultural shifts in countries such as China, India, Japan, and South Korea.

- The U.S. oat milk market is projected to reach USD 2.01 billion by 2032, supported by rising demand for plant-based dairy alternatives and the presence of leading oat milk brands across retail and e-commerce channels.

Key Country Highlights:

- United States: Rising health awareness and strong retail presence of major brands such as Oatly, Planet Oat, and Califia Farms are driving significant market growth.

- China: Growing vegan and flexitarian populations, combined with influence from Western dietary trends, are contributing to the expanding demand for oat milk.

- India: Increasing demand for dairy-free alternatives and the rise in health-conscious consumers are boosting the adoption of oat milk across urban populations.

- United Kingdom: Surge in veganism and lactose intolerance, along with government campaigns promoting sustainable diets, are accelerating market growth.

- Brazil: Changing dietary preferences among the middle class and improved product availability across retail channels are supporting steady market expansion.

- Saudi Arabia: Launch of locally produced oat milk and shifting consumer habits influenced by urbanization and expat communities are driving demand.

Oat Milk Market Trends

Growing Trend Toward Sustainable Packaging Initiatives to Fuel Market Growth

Increasing awareness of environmental issues has led consumers to prefer products that utilize sustainable packaging. Oat milk brands are responding by adopting recyclable and biodegradable materials, aligning with consumer values, and enhancing brand loyalty. For instance, in August 2024, Milkadamia, an Australian company, introduced sustainable packaging innovation with flat-pack organic oat milk. The new packaging uses a proprietary 2D-printing process to create oat milk sheets. This approach reduces packaging waste by 94% and transportation weight by 85%, minimizing the carbon footprint associated with shipping. Such innovations appeal to environmentally conscious consumers and set new industry standards. Asia Pacific witnessed a growth from USD 1.33 Billion in 2022 to USD 1.52 Billion in 2023.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic heightened awareness around health and nutrition, prompting consumers to seek out products that support immune health and overall well-being. Oat milk, known for its nutritional benefits, became a favored alternative as people wanted to eliminate carbohydrates and sugars from their diets in favor of more nourishing options. A significant shift toward plant-based diets was observed during this period, driven by rising veganism and flexitarian lifestyles. Consumers increasingly sought dairy alternatives due to lactose intolerance, allergies, and a general preference for lower-cholesterol options. The COVID-19 pandemic acted as a catalyst for the global oat milk market growth, driven by increased health consciousness and sustainability concerns among consumers.

Market Dynamics

Market Drivers

Rise in Lactose Intolerance and Milk Allergies to Foster Product Demand

A substantial portion of the population, particularly in regions such as North America, is lactose intolerant. According to Boston’s Children’s Hospital, around 30 to 50 million of the American population is lactose intolerant. This growing demographic is seeking non-dairy options that provide a taste and texture similar to cow's milk. Oat milk is emerging as a preferred choice for consumers with dietary restrictions due to its allergen-friendly profile. It is free from common allergens, such as lactose, soy, and nuts, making it suitable for individuals with allergies or sensitivities. This characteristic broadens its appeal and market reach.

Rise of Veganism and Flexitarian Diets to Contribute to Increased Demand for Product

The rise in awareness regarding animal welfare and the environmental impact of dairy farming has led many consumers to seek sustainable alternatives. Oat milk is considered more environmentally friendly, with a significantly lower carbon footprint compared to cow's milk. This sustainability aspect resonates with the values of flexitarian, vegan, and plant-based consumers. As more consumers adopt vegan and flexitarian lifestyles, there is a growing preference for plant-based alternatives to dairy products. Oat milk has emerged as a popular choice in the plant-based milk market due to its creamy texture and mild flavor, making it suitable for various culinary applications, including coffee, smoothies, and baking.

Market Restraint

Perception as Niche Product and Limited Knowledge to Limit Market Growth

Oat milk is sometimes viewed as a niche product rather than a mainstream dairy alternative. This perception can hinder its acceptance among broader consumer demographics, making it difficult for manufacturers to scale operations effectively. Despite its benefits, a significant portion of the consumer base still lacks awareness of its nutritional advantages. Effective marketing and educational initiatives are necessary to promote oat milk as a viable alternative to dairy products.

Market Opportunities

Growing Focus on Product Innovation to Ensure Success for Market in Foreseeable Future

The market is experiencing rapid growth, significantly fueled by a strong focus on product innovation. This trend is driven by evolving consumer preferences, health consciousness, and a shift toward sustainable and versatile food options. Companies are increasingly fortifying oat milk with vitamins and minerals to meet health-conscious consumers' needs. For instance, in September 2022, Elmhurst 1925, a plant-based food and beverage company, launched its reformulated unsweetened oat milk to offer better benefits for its mindful-minded consumers. The new product has increased nutritional benefits, including more fiber, potassium, whole grains, calcium, and healthy fat.

Market Challenge

Rising Costs of Ingredients and Construction and Expansion Costs to Pose Challenge for Market Growth

The costs of raw materials, particularly oats, have surged due to supply constraints and inflation. This has forced companies to increase prices for consumers, potentially dampening demand. Efforts to scale production capacity amid rising construction costs and supply chain delays can strain financial resources, impacting profitability.

Segmentation Analysis

By Nature Analysis

Conventional Method’s Cost-Effectiveness and Widespread Availability Drive Segment Growth

On the basis of nature, the market has been divided into organic and conventional.

The conventional segment is expected to lead the global oat milk market share during the forecast period. Conventional oat milk is typically more affordable than organic alternatives. This price advantage makes it accessible to a broader consumer base, contributing significantly to its market share. The cost-effectiveness is further enhanced by efficient production methods and economies of scale achieved by major manufacturers. Moreover, conventional oat milk enjoys high penetration in retail channels, including supermarkets and cafes, making it readily available to consumers. This extensive distribution network facilitates easy access, thereby increasing its consumption among health-conscious and environmentally aware consumers.

The organic oat milk segment is expected to experience significant growth during the forecast period. Consumers are increasingly prioritizing health and wellness, leading to an increasing demand for organic products. Organic oat milk is perceived as a healthier alternative, free from synthetic pesticides and additives, which appeals to health-conscious individuals seeking nutritious options. The higher concentrations of antioxidants and minerals in organic oat milk compared to conventional varieties also attract consumers seeking enhanced nutritional benefits.

To know how our report can help streamline your business, Speak to Analyst

By Packaging Analysis

Extended Shelf Life and Cost-Effectiveness of Carton Packaging Backs its Growth

Based on the packaging, the market has been segregated into cartons and bottles.

The carton segment is projected to dominate the market during the forecast period. Cartons, particularly those made from paperboard, such as Tetra Pak, are widely regarded as environmentally friendly. Moreover, carton packaging effectively preserves the freshness and quality of oat milk. The aseptic packaging process used in cartons allows for longer shelf life without the need for preservatives, making it an attractive option for both manufacturers and consumers. The production process for carton packaging is often more cost-effective compared to other packaging types, such as glass bottles. This affordability can translate to lower prices for consumers while maintaining profit margins for manufacturers.

The bottles segment is likely to grow significantly in the forecast period. Bottled products are often associated with premium quality. Consumers may perceive bottled oat milk as fresher or more artisanal compared to other packaging types, which can influence purchasing decisions. Unique bottle shapes and designs further enhance brand identity and attract consumers' attention on store shelves.

By Flavor Analysis

Versatility and Consumer Preference for Simplicity to Fuels Non-Flavored Segment’s Growth

In terms of flavor, the market has been integrated into flavored and non-flavored.

The non-flavored segment holds the major share of the global market. It is highly versatile, making it suitable for various culinary applications, including coffee, smoothies, and cooking. Its neutral taste allows it to blend seamlessly into different recipes without overpowering other flavors. Many consumers prefer straightforward, uncomplicated products without additional flavors or sweeteners. This trend toward minimalism in food choices has bolstered the popularity of plain oat milk, which is often viewed as a cleaner option.

The flavored segment is expected to grow significantly in the forecast period. It often combines indulgent flavors with health benefits, attracting consumers who seek both taste and nutrition. The demand for healthier alternatives to traditional dairy products is driving interest in flavored options that are lower in calories and free from lactose. As manufacturers continue to cater to evolving tastes and preferences, the demand for flavored oat milk is expected to rise significantly in the coming years.

By Distribution Channel Analysis

Widespread Accessibility and Product Variety to Enlarge Supermarkets/Hypermarkets Growth

In terms of distribution channel, the market has been integrated into supermarkets/hypermarkets, convenience stores, online retail, and others.

The supermarket/hypermarket segment is anticipated to capture the foremost share of the overall market. These are the most frequented locations for grocery shopping, providing consumers with easy access to a variety of oat milk brands and products. This convenience is a significant factor for their dominance. These distribution channels offer an extensive assortment of both national and international oat milk brands, catering to diverse consumer preferences regarding taste and price. The ability to discover new varieties and compare labels enhances the shopping experience.

The online retail segment is predicted to account for a significant share in the coming years. The market is characterized by high fragmentation and low customer loyalty, which encourages consumers to experiment with different brands and products available online. This trend is expected to boost online sales further as consumers seek new options. The COVID-19 pandemic accelerated the shift toward online retail channels as consumers sought safe and convenient ways to shop. This shift has solidified e-commerce as a vital channel for purchasing oat milk and other plant-based alternatives.

Oat Milk Market Regional Outlook

Asia Pacific

Asia Pacific Oat Milk Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2023, Asia Pacific attained the major share of 50.61% of the overall oat milk market. Emerging markets in the region, such as China and India, present vast growth potential for the market. A major driver is the increasing adoption of flexitarian and vegan lifestyles. Consumers are becoming more health-conscious, seeking alternatives to dairy products due to concerns about lactose intolerance and cow's milk allergies. This trend is particularly evident in East Asia, where the demand for dairy substitutes is rising. Cultural changes and the influence of Western dietary habits are leading to a greater acceptance of plant-based diets in South Korea and Japan. The increasing number of vegan festivals and initiatives reflects this shift, further promoting the consumption of oat milk.

North America

North America is expected to grow significantly in the global market. Increasing awareness about health and nutrition is driving consumers toward plant-based alternatives. Oat milk is recognized for its lower fat content, absence of cholesterol, and high fiber levels, making it an attractive option for those seeking healthier dietary choices. Furthermore, the presence of key manufacturers in the U.S. market is highly significant, contributing to its rapid growth and overall market dynamics. Leading companies such as Oatly Group AB, Planet Oat, Califia Farms, Danone SA, and Ripple Foods dominate the market. The presence of major manufacturers facilitates the widespread availability of oat milk across various distribution channels, particularly supermarkets and online platforms.

Europe

The market in Europe is experiencing significant growth, driven by a variety of factors that reflect changing consumer preferences and broader oat milk market trends. The number of individuals identifying as vegan has surged, particularly in the U.K., Germany, and Spain, further driving demand for plant-based food and beverages, including oat milk. Moreover, the growing prevalence of lactose intolerance in the region is significantly fueling the demand for plant-based beverages. According to the National Library of Medicine, about 5 to 15% of people in Europe are lactose-intolerant.

Oat milk is recognized for its health benefits, including high fiber content and a rich concentration of branched amino acids. It is a nutritious alternative that supports proper growth without causing insulin spikes. As consumers become more health-conscious, they are increasingly opting for oat milk as a healthier choice compared to traditional dairy products.

South America

In South America, Brazil holds the largest share of the market, driven by a rising middle class and changing consumer preferences toward healthier food options. The expansion of retail options, including online shopping and supermarkets, has made oat milk more accessible to consumers across South America. This increased availability encourages trial and repeat purchases. Although veganism is not as widespread in South America compared to other regions, there is a growing trend toward plant-based diets, especially among younger consumers and urban populations.

Middle East & Africa

In South Africa and Saudi Arabia, there is a noticeable shift in dietary habits influenced by expatriate populations and changing lifestyles. These shifts contribute to increased demand for diverse food products, including plant-based options such as oat milk. Manufacturers are actively innovating within the oat milk category by introducing flavored options and organic variants, catering to diverse consumer preferences, and enhancing market appeal. For instance, in May 2022, Saudia Dairy and Foodstuff Company (SADAFCO), a Saudi Arabian-based dairy company, launched SAUDIA Oat Milk, the Kingdom’s first locally produced oat-based milk.

Competitive Landscape

Key Market Players

The competitive landscape of the market offers insights into various competitors. This includes an overview of each company, their financial performance, revenue generation, market potential, investments in research and development, new initiatives, strengths and weaknesses, product and brand portfolios, product launches, mergers and acquisitions, and their applications. The data provided focuses specifically on the companies' engagement within the market.

Major Players in Oat Milk Market

To know how our report can help streamline your business, Speak to Analyst

Oatly Group AB, Chobani, LLC., Danone SA, HP Hood LLC. , and Campbell Soup Company are some of the major players in the market. The global market is moderately consolidated, with the top 5 players accounting for ~49% of the market share.

List of Key Oat Milk Companies Profiled

- HP Hood LLC. (U.S.)

- Danone S.A. (France)

- Chobani, LLC. (U.S.)

- Campbell Soup Company (U.S.)

- Oatly Group AB (Sweden)

- Califia Farms (U.S.)

- Hain Celestial Group, Inc. (U.S.)

- Smile Foods (U.S.)

- Boring (New Zealand)

- Earth's Own Food Company (Canada)

Key Industry Developments

- September 2024 – Forbidden Foods, an Australian-owned and managed company, completed the acquisition of plant-based non-dairy brand Oat Milk Goodness (OMG). The acquisition allows Forbidden Foods to enhance its product portfolio by integrating OMG's offerings, which include oat milk and flavored milk products.

- September 2024 – f'real, one of the leading providers of blended beverage machines specializing in food service, C-store, C&U, and QSR industries, launched choco choco chip oat shake. The new product is a limited-edition chocolatey frozen blend of plant-based oat milk and chocolate chips.

- February 2024 – Oatly Group AB, one of the largest oat drink companies, expanded its North American product line with the launch of its Oatmilk Creamers. The new product is available in four flavors, including mocha, caramel, vanilla, and sweet & creamy.

- January 2024 – Oatly Group AB launched two new beverage innovations in the U.S. The new products included unsweetened oat milk and super basic oat milk.

- June 2022 – Vegano Foods Inc., a food service company, completed the acquisition of SMPL Oats, an upstart oat milk brand. This move marks a significant step in Vegano’s growth strategy. The acquisition strengthens Vegano's product offerings and also positions the company favorably within the competitive landscape of plant-based beverages.

Investment Analysis and Opportunities

Increasing Brand Investment and Collaboration with Different Stakeholders to Provide Market Opportunity

The market is experiencing significant growth driven by increasing consumer demand for plant-based alternatives and the rising trend of veganism. To capitalize on this opportunity, brands are focusing on enhancing their investments and collaborating with various stakeholders. Market players are increasing production capabilities to meet the rising demand, particularly in markets such as North America and Europe, where consumer interest in plant-based products is high. For instance, in July 2024, SunOpta, a manufacturer of plant-based foods and beverages, invested USD 26 million in order to expand its production facility in Modesto, California. The expansion would allow the company to increase its annual oat milk production capacity by more than 60%.

Report Coverage

The report analyzes the market in-depth and highlights crucial aspects such as prominent companies, regional market, segmentation, competitive landscape, product types, distribution channels, and application. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 15.32% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Nature

By Packaging Type

By Flavor

By Distribution Channel

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the worldwide market size was USD 3.46 billion in 2024 and is anticipated to record a valuation of USD 10.83 billion by 2032.

Fortune Business Insights says that the global market value stood at USD 3.01 billion in 2023.

The global market is projected to grow at a significant CAGR of 15.32% during the forecast period of 2024-2032.

By nature, the conventional segment is predicted to dominate the market during the forecast period of 2024-2032.

A rise in lactose intolerance and milk allergies among consumers is likely to drive the demand in the market.

Oatly Group AB, Chobani, LLC., Danone SA, HP Hood LLC. , Campbell Soup Company, and others are some of the leading players globally.

Asia Pacific dominated the global market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us