Office Furniture Market Size, Share & Industry Analysis, By Product Type (Office Chair, Office Tables, Storage Furniture, and Others), By Material (Wood, Steel, and Others), By Distribution Channel (Online and Offline), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

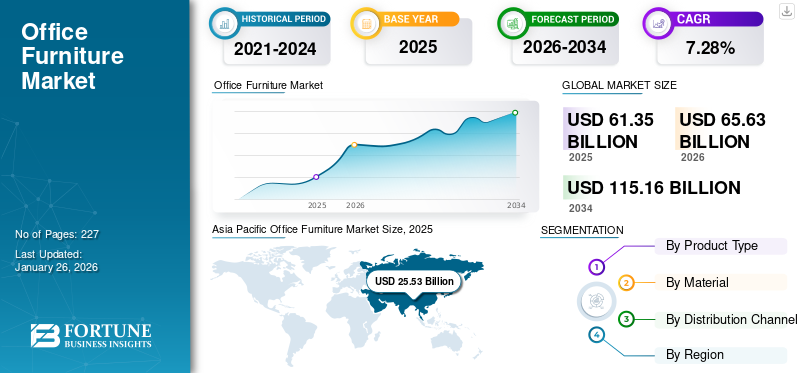

The global office furniture market size was valued at USD 61.35 billion in 2025 and It is projected to grow from USD 65.63 billion in 2026 to USD 115.16 billion by 2034, exhibiting a CAGR of 7.28% during the forecast period. Asia Pacific dominated the office furniture market with a market share of 41.62% in 2025. Moreover, the office furniture market in the U.S. is expected to grow significantly, reaching USD 15.44 billion by 2032. The demand for ergonomic and modern workspace solutions is a key growth driver.

The global COVID-19 pandemic has been unprecedented and staggering, with office furniture experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels. Based on our analysis, the global office furniture market exhibited a decline of -19.21% in 2020 as compared to 2019.

Workplaces or business spaces consider furniture as their centerpiece objects, such as a chair, tables, and others, that are moveable and used to support various human activities at the workplace. Furniture settings at commercial spaces such as corporate spaces, business establishments, co-working spaces, and others are essential to set the right environment and ambiance of the workplace to be safe, relaxing, and comfortable for all employees. In addition, furniture plays a vital role in the productivity of employees.

The office furniture industry comprises various large and small pieces of equipment that contribute to the ambiance and atmosphere of the organization. The products with the highest demand are office chairs, tables, and storage units. They can be manufactured with wood, steel, and others based on the design and requirements. The products can be brought through online and offline sales channels per the consumer's requirement of quantity and feasibility.

Workspaces throughout the years have changed their designs from cubicles to more modern and interactive workplaces based on the evolving demand from consumers. The consumers are various companies and modern-day startups, believing the company’s culture, values, and vision are reflected through its interiors. The market has seen a paradigm shift in designs, sales channels, and consumer demands over the last few years, owing to technological advancements among market players and consumer base.

Due to the COVID-19 pandemic, the government took various actions such as lockdowns, the closing of borders, and other suspensions of non-essential business operations to combat the spread of COVID-19. These restrictions and regulations further resulted in causing significant disruption in the manufacturing, supply chain, and other operations during 2021. In addition, many companies, such as IT service providers, were required to work from home for an extended period, which significantly impacted global demand for storage units, tables, and others, resulting in a decline in revenue generation.

Global Office Furniture Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 61.35 billion

- 2026 Market Size: USD 65.63 billion

- 2034 Forecast Market Size: USD 115.16 billion

- CAGR: 7.28% from 2026–2034

Market Share:

- Asia Pacific dominated the office furniture market with a 41.62% share in 2025, driven by rising office rentals, expanding IT sectors, flexible office space demand, and startup growth.

- By product type, office chairs hold the highest market share, fueled by rising demand for ergonomic and modular designs, while office tables are expected to account for 23.93% of the market in 2024 due to increased adoption of height-adjustable and ergonomic models.

Key Country Highlights:

- United States: Expected to reach USD 15.44 billion by 2032, driven by increased commercial real estate activity, co-working space expansion, and ICT investment.

- India: Surge in startups and urban development fueling demand for affordable and modular workspace furniture.

- China: Robust office expansion and a large manufacturing base position China as a key supplier and consumer.

- Germany: Demand driven by workplace modernization, premium designs, and sustainability in office setups.

- Canada & Mexico: Rapid urbanization and growth in commercial real estate boost demand for desks, chairs, and smart furniture.

- UK & Europe: Increased employment, rising demand for flexible workspaces, and expansion of retail outlets like IKEA enhance market growth.

Office Furniture Market Trends:

Growing Trend of Co-working Spaces to Fuel Growth of the Office Furniture Market

Co-working spaces are where people or groups assemble in neutral spaces and work independently on different projects. Amenities and equipment, such as WiFi, printers, and conference rooms, are similar to a private workspace to provide the same comfort to the individuals working. The flexibility offered by co-working spaces, such as no long-term lease, attracts a significant crowd of startups, freelancers, and others.

Co-working spaces have seen massive growth in the last few years owing to a significant rise in the startup ecosystem and growing number of freelancers around the globe, which significantly increased the dynamics of furniture design. The open office and informal co-working spaces are creating informal workplace culture, thus influencing consumers' demands. There is a wide variety of co-working spaces such as open workspaces, industry-specific, and venture/incubators.

- Asia Pacific witnessed office furniture market growth from USD 25.53 Billion in 2025 to USD 27.54 Billion in 2026.

Download Free sample to learn more about this report.

Office Furniture Market Growth Factors:

Significant Growth in ICT Industry Drives the Office Furniture Market Growth

The ICT industry has been contributing significantly to the economy of many countries globally. The ICT industry requires an adequate amount of infrastructural development as it is essential for its operation to obtain optimal performance and provide essential services. It includes two components, IT application, engineering, and services offered through electronic means. Thus, governments have been investing in developing infrastructure and attracting MNCs and startups in the country.

For instance, in June 2022, the Singapore government announced its plan to spend USD 3.8 billion on the ICT industry. Furthermore, ICT companies have been expanding their reach in different regions with multiple office launches, resulting in a rise in spending on furniture and equipment. For instance, as per the annual report of Cognizant, the company's furniture and equipment were valued at USD 772 million, which was USD 761 million in 2020.

RESTRAINING FACTORS:

Volatility in Cost Incurred by Manufacturers Hinders Market Growth

Various raw materials such as steel, plastics, foam, aluminum, wood, particleboard, and others are procured by the manufacturers from the source network, which is spread globally. The cost incurred while procuring these raw materials depends on several factors such as fuel, freight, energy, labor, and other input costs. Thus, raw material procurement costs are highly volatile as changes in trade barriers, tariffs, large currency moments, and others have a significant influence.

For instance, as per Steel case Q1 report of 2022, in the U.S., the foam supply chain was disrupted due to severe weather events and the availability of foam saw a negative impact.

Thus, significant increases in input costs make it difficult for manufacturers to offset increased prices owing to the existing contractual commitments with customers. Therefore, a negative impact on gross margins is observed due to significant increases in these costs, further restraining the market growth.

Office Furniture Market Segmentation Analysis:

By Product Type Analysis

- The Office table segment is expected to hold a 23.93% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

Ergonomic and Modular Development of Office Chairs will Further Fuel Market Growth

By product type, the market is segmented into office chair, table, storage furniture, and others. The office chair segment has the highest market with a share of 49.99% in 2026, in the industry owing to the higher dependency of an individual on comfortable seating equipment. Furthermore, there has been a rise in technologically driven developments in the office chair segment to bring more ergonomic and modular office chairs into the market. The growing investments by market players in technological-driven products will further fuel the market growth.

For instance, in September 2020, X-Chair launched a new ergonomic office chair X-HMT. The X-HMT is a heat and massage chair targeted toward the body’s core.

Office tables are used to keep a laptop or desktop with essential documents while an individual is working. Tables are continuously used in workplaces and provide comfort and convenience while working. The rising innovations for ergonomic tables have contributed to market growth and demand for tables. Furthermore, the availability of height-adjustable office tables made from different materials such as wood, fiber, steel, and others will further bring more growth opportunities in the market. Storage units are used to further store important materials or equipment that may be frequently required at a workplace. Storage units come in various types such as individual, shared, and others. Furthermore, the others segment includes workstations and accessories used while working.

By Material Analysis

Higher Durability, Easy Maintenance, and Elegant Designs of Wood will Further Boost Market Growth

Wood has traditionally been chosen for furniture manufacturing by the players operating in the market due to its high durability and strength. Wood will Further Boost Market Growth with a share of 61.30% in 2026. Wooden furniture further adds a more elegant look to the workstation. Furthermore, the changing workspace and its requirements can be ideally addressed through wood. In addition, consumers are more inclined toward sustainable products, and manufacturers prefer carbon-efficient manufacturing processes to attract the growing prevalence of sustainable consumers. The product requirements in the market are more customized, and higher feasibility for customization by wood further contributes to market growth.

For instance, in May 2022, Benchmark, in collaboration with AHEC, launched a new wooden office furniture collection during Clerkenwell Design Week 2022 at St James’ Crypt. The collection is called the Victoria collection.

Steel is known for its sturdy nature and safety. It is the least reactive metal, thus further nullifying the chances of shock as wires and cables surround the maximum area at a workplace. Furthermore, steel is environment-friendly, allowing manufacturers to meet Sustainable Development Goals (SDG). Steel also has a higher resistance to dents than other metals, making it an ideal choice for office furniture. In addition, the growing innovations in sustainable chairs, tables, and other products and to further improve the sturdiness and safety of various equipment used at workplaces, corporates, and others with the use of steel will further drive the market growth.

Others include glass, aluminum, and plastic. Plastic is known for its durability and various types, such as PVC and polypropylene, are used for manufacturing products in the market. The qualities such as no rusting, no effects of termites, and others make them a desired choice of individuals. Moreover, manufacturers' launch of new fiber chairs with recycled plastic significantly impacts the demand. For instance, in February 2022, Muuto, a Danish furniture brand, launched the recycled version of its Fiber Chair designed by Copenhagen studio Iskos-Berlin.

By Distribution Channel Analysis

Convenience Provided by Offline Sales Channel Further Contributes to Market Growth

By distribution channel, the market is divided into online and offline. The offline segment holds a higher market with a share of 78.95% in 2026, owing to various factors, such as the convenience of verifying the product and its quality. The offline channel comprises hypermarkets/supermarkets, specialty stores, and others. Individuals usually prefer specialty stores as multiple products are placed in these stores for display. Specialty stores typically cover a large area and offer various products at a single location. The furniture used in an organization is usually a considerable investment, and thus customers prefer the products to be verified before purchase.

For instance, in September 2022, Evok, a furniture and furnishing brand, announced its plan to launch 15 new stores in India in FY 2022-2023.

Products are usually customized based on the workspace, individual requirements, parks and commercial zones. Thus, offline channels offer the convenience of understanding the need and whether the products fit accordingly. Therefore, the comfort provided in quality assurance, customization, and others boosts offline channel sales.

Online channels have recently seen most technological advancements such as AI, AR, and others. Market players have been investing in the launch of technologically driven online sales channels. For instance, in September 2021, Jerome's Furniture announced the launch of augmented reality powered by Marxent 3D Cloud powers called WebAR.

REGIONAL INSIGHTS:

Asia Pacific

Asia Pacific Office Furniture Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the global office furniture market owing to rising demand for office rentals, IT sectors, flexible office spaces and growing startups. Asia Pacific dominated the global market in 2025, with a market size of USD 25.53 billion. Furthermore, the rise in office expansion and the provision of world-class office infrastructure to employees are the key factors boosting the demand for office furniture products. The Japan office furniture market is projected to reach USD 3.38 billion by 2026, the China office furniture market is projected to reach USD 10.22 billion by 2026, and the India office furniture market is projected to reach USD 6.37 billion by 2026.

North America

North America is expected to grow with a significant CAGR owing to factors such as growing commercial real estate, ICT spending, and the rising number of startups in this region contribute to the rise in corporate offices, and thus have significantly impacted market growth. In addition, the U.S. is considered the world's leading innovation center, bringing more opportunities for new companies to start their operations and new branches. The rise in the number of co-working spaces and new branch launches in the country is a significant contributor to market development. For instance, according to the U.S. Census Bureau, a part of the U.S. Department of Commerce, from September 2022, 425,741 applications were placed for business formation, which is a 1% increase compared to August 2022. This rapid growth has a significant impact on market growth. The U.S. office furniture market is projected to reach USD 10.59 billion by 2026.

The rapid urbanization in Canada and the rising commercial real estate industry in Mexico further contribute to the demand for tables, chairs, and other products in the North America region. The increasing number of corporate offices by multinationals and startups in Canada also surges the demand in the region. Furthermore, the launch of new co-working spaces in Canada further contributes to the rise in demand for intelligently designed furniture and the creation of informal workplaces.

Europe

Europe region is projected to grow with a significant CAGR owing to a rise in employment rate and an increase in demand for commercial spaces, which are the factors driving the growth of the market. The rising development of retail outlets, along with an increase in internet connectivity and growing consumption of smartphones in the region, will further increase the customer reach and thereby increase the sales of office furniture products. For instance, in January 2024, IKEA announced the launch of more central, small-sized stores in the U.K. The launch will help improve the physical retail availability of office furniture products in the country. The UK office furniture market is projected to reach USD 2.88 billion by 2026, while the Germany office furniture market is projected to reach USD 3.67 billion by 2026.

List of Key Companies in Office Furniture Market:

Key Players Strongly Focus on Product Innovation and New Product Launches

Key office furniture players in this industry focus on innovations and product developments tailored to customer requirements and sustainability. The manufacturers are launching new products and stores to cater to the growing demand. Furthermore, new product innovations such as ergonomic designs and smart furniture have increased competition. The manufacturers are also collaborating with designers to develop a comprehensive product portfolio per market trends. For instance, in June 2022, MillerKnoll, Inc. collaborated with Studio 7.5 to introduce its new office chair collection, inspired by Eames and called Zeph Chair. The design is implemented to reduce the gap between the mid-century designs and today's ergonomics of office chairs.

List of Top Office Furniture Companies:

- Steelcase Inc. (U.S)

- MillerKnoll, Inc (U. S.)

- Nilkamal Ltd. (India)

- Kimball International Inc. (U.S)

- Haworth Inc. (U.S.)

- HNI Corporation (U.S)

- Krueger International, Inc. (U. S.)

- Humanscale (U.S.)

- Global Furniture Group (U.S.)

- Vitra International AG. (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- In September 2022, Steelcase Inc. announced the launch of its new ergonomic chair called Steelcase Karman, which is designed to respond to the body’s movement and provide comfort naturally and is manufactured with new proprietary mesh textile and ultra-light-flexible frame.

- In May 2022, Steelcase Inc. signed a definitive agreement to acquire Halcon. Halcon is a Minnesota-based designer and manufacturer of wood furniture for the workplace. The acquisition is to leverage the current Steelcase wood products portfolio.

- In February 2022, Godrej and Boyce, a flagship company of Godrej, announced the launch of Move Up, an ergonomic office table through its business Godrej Interior for individuals with a home office.

- In August 2021, BoConcept launched its 6th store in India on the completion of five years in the Indian market.

- In June 2020, Cor, a German furniture company, launched a new line of office furniture ideal for working from home.

REPORT COVERAGE

The research report analyzes the market in-depth and highlights crucial aspects such as prominent companies, competitive landscape, product types, materials, and distribution channels. Besides this, the reports provide insights into the market trends and highlight significant office furniture industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 7.28% from 2026 to 2034 |

|

Segmentation |

By Product Type

By Material

By Distribution Channel

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the worldwide market size was USD 65.63 billion in 2025 and is anticipated to reach USD 115.16 billion by 2034.

Ascending at a CAGR of 7.28%, the global market will exhibit steady growth over the forecast period (2026-2034)

By product type, the office chair segment is expected to dominate the market throughout the forecast period (2026-2034).

The rapid growth in the ICT industry and commercial real estate will be driving the market growth in the forecast period (2025-2032).

Steelcase Inc., MillerKnoll, Inc., HNI Corporation, Haworth Inc., Kimball International Inc., and Nilkamal Ltd. are the leading companies worldwide.

Asia Pacific dominated the global market in 2025.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us