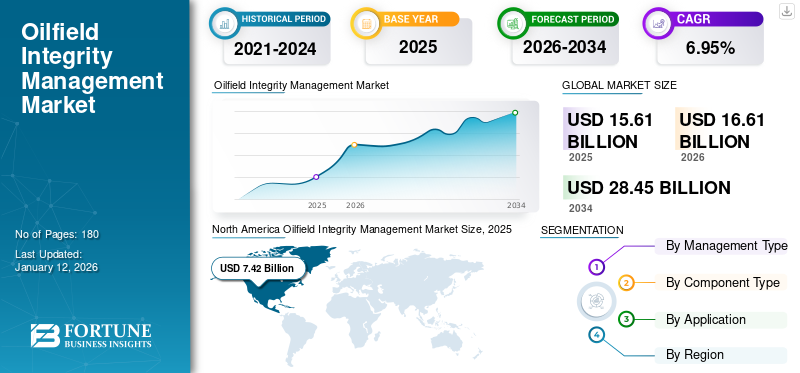

Oilfield Integrity Management Market Size, Share & Industry Analysis, By Management Type (Monitoring System, Data Management, Corrosion Management, Planning, and Predictive Maintenance & Inspection), By Component Type (Hardware, Software, and Services), By Application (Onshore and Offshore), and By Regional Forecast, 2026-2034

Oilfield Integrity Management Market Size and Future Outlook

The global oilfield integrity management market size was valued at USD 15.61 billion in 2025 and is projected to grow from USD 16.61 billion in 2026 to USD 28.45 billion by 2034, exhibiting a CAGR of 6.95% during the forecast period. North America dominated the global market with a share of 47.51% in 2025.

Oilfield integrity management services help track the performance of assets, carry out inspections, and improve the reliability of equipment, plant safety, and profitability. It encompasses a wide range of innovations, such as fleet management and predictive maintenance inspection. These innovations directly result from the maturing of enabling technology market segments such as big data analytics, low-cost sensors, and cloud computing.

Baker Hughes Company is one of the major players in the global market. The company delivers several oil field management services globally for multiple applications. The company’s wide product and service portfolio provides safer, cleaner, and more efficient solutions for industries.

MARKET DYNAMICS

MARKET DRIVERS

Growing Onshore Projects is Expected to Boost Market Expansion

Emerging economies in many regions are focusing on the expansion of the onshore projects. This is owing to multiple factors such as cost effectiveness and easy maintenance. In addition, onshore oil and gas projects allow for rapid deployment with lower infrastructure investments. It's making them a more reachable and striking option for clean energy development, considering the growing demand for renewable energy sources such as wind and solar to combat climate change.

Rising Focus on Digitization in the Oil Sector for Automation and Process Optimization will Propel Market Growth

Fluctuating oil prices, the increasing demand for oil, and the high costs of exploration and production activities are some of the factors that are affecting the profitability of the companies. Therefore, several companies are adopting oilfield integrity management services to reduce cost operational risks and improve asset availability to tackle such situations.

The oilfield integrity management tools help the companies to develop new techniques resulting in greater efficiency, less unplanned downtime, less operational risk, better yields, and increased flexibility of production. Additionally, it ensures the safety of employees, mostly isolated workers, by giving them access to the information they require. Thus, the introduction of digital trends has helped in optimizing the upstream process and making effective decisions. This factor is anticipated to drive the global market during the forecast period. The oil and gas sector faces several challenges, such as low oil prices, schedule overruns, and climate change. In addition, the structure and the design of plants are aging. Digital transformation and process automation help overcome these challenges and benefit the company.

MARKET RESTRAINTS

Volatility in Oil Prices is Anticipated to Hamper Market Growth

The oil price is subjected to demand and supply of oil, which fluctuates considerably. According to the U.S. Energy Information Administration (EIA) Short-Term Energy Outlook, the cost of crude oil settled at USD 40.93 per barrel in October 2020, a decrease of USD 4.65/b from September 1, 2020. Significant growth in alternative energy generation technology such as solar, wind, and hydro would reduce the dependency on oil & gas, which is likely to affect the oilfield services industry, including the directional drilling services market. Hence, volatility in oil prices and growth in alternative energy generation technologies restrain market growth during the forecasted period.

Download Free sample to learn more about this report.

MARKET OPPORTUNITIES

Rising Focus on Digitization in the Oil Sector for Automation and Process Optimization to Augment Market Growth

The oil & gas sector is widely engaged in converting its old business models into a new one with smarter operations to increase industry players' focus on remote monitoring of oilfields. Remote monitoring reduces the need for human intervention, decreasing the overall cost and chances of manual errors. It assists operators in monitoring real-time data, thereby improving an oilfield's overall productivity and reliability. According to World Oil, oil demand is expected to increase by 1.2 mb/d annually by 2025. Mainly, South East Asian countries such as India and Indonesia are expected to account for around 30% of the global oil demand by 2025.

MARKET CHALLENGES

Fluctuations in Prices of Oil and Gas can Create New Challenges

The prices of oil and gas are always a concern for many countries. This is due to the direct link between oil and gas projects and their applications all over the globe. Oil is an important energy source used in almost all sectors. Additionally, fluctuations in its price directly affect production costs for goods and services, including consumer spending on transportation. All these factors ultimately affect economic growth, influencing inflation and employment levels across the world. This can be stabilized by the development of fair trade between the two countries. In addition, reduced dependency on fossil fuels can relieve the market challenge.

OILFIELD INTEGRITY MANAGEMENT MARKET TRENDS

Awareness Regarding Data Management & Services to Drive Market Positively

Oil & gas management services are growing rapidly due to the global demand for oil and gas. Additionally, rising applications that depend upon crude oil, such as the petroleum and automotive industries, are boosting the demand for oil and gas. Hence, it faultlessly manages all the activities related to oil and gas operation data management and continuing servicing. The growing advancement in technology is also playing a crucial role in the oil & gas sector, influencing the oilfield integrity management market growth.

Impact of COVID-19

The ongoing outbreak of the COVID-19 pandemic impacted the oil industry significantly across the globe. Various oil companies worldwide had to shut down their manufacturing facilities and services as countries were approaching a lockdown strategy to deal with the pandemic. As per the International Energy Agency, oil demand decreased by 29 million barrels per day (bpd) in April 2020 and 23.1 million bpd in the second quarter of 2020.

SEGMENTATION ANALYSIS

By Management Type

Monitoring System Segment Accounted for the Largest Share of the Market owing to Demand for Real Time Data Monitoring

Based on the management type, the global market is classified into a monitoring system, data management, corrosion management, planning, and predictive maintenance & inspection.

The monitoring system segment accounted for the majority market share by 43.94% in 2026. The monitoring system segment comprises machinery and equipment such as wireless sensors, analyzers, flow meters, smart well systems, SCADA systems, and DCS systems. The consistent rise in the share is owing to the advancement in technology that delivers real-time data upon which to act.

To know how our report can help streamline your business, Speak to Analyst

By Component Type

Hardware Segment Held the Highest Share due to Technological Advancements

Based on component type, the market is characterized by hardware, software, and services.

The hardware segment accounted for the highest share of the global oilfield integrity management market, owing to the adoption of digital technologies for collecting significant volumes of data. Hardware is responsible for communication, data transfer, and surveillance in both onshore and offshore fields. Hence, the hardware segment is expected to significant growth over forecast period. The hardware segment is expected to dominate the market share of 47.01% in 2026.

The software segment is anticipated to exhibit a CAGR of 8.95% during the forecast period.

By Application

Onshore Segment is Expected to be Largest Contributor during Forecast Period due to Increasing Offshore Drilling Operations

Based on the application, the global market is classified into onshore and offshore.

The onshore segment accounted for the highest market share in 2024, and it is anticipated to maintain its attractiveness during the forecast period as onshore wells are widely drilled across the world, with more oil & gas production potential from regions such as the Middle East, North America, and Asia Pacific. Furthermore, the cost incurred in onshore oilfield activities is less than in offshore applications. The onshore segment is expected to dominate the market share of 77.49% in 2026.

Offshore segment is anticipated to exhibit a CAGR of 8.30% during the forecast period.

OILFIELD INTEGRITY MANAGEMENT MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Rising Demand for Oil Production to Boost Market Growth

North America holds the largest oilfield integrity management market share globally. North America has about 3.3 million km of pipeline, and about 2,996 active production platforms exist on the U.S. Outer Continental Shelf. In turn, this factor is expected to augment the growth of the market during the forecast period. In addition, the new U.S. president recently shifted focus to fossil fuels to reduce dependence on other countries. This factor must be taken into consideration for growth in the service field. The regional market value in 2025 was USD 7.42 billion, and in 2026, the market value led the region by USD 7.84 billion.

North America Oilfield Integrity Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

U.S.

Availability of Management and Service-based Companies in the U.S. to facilitate market growth

The U.S. is the dominating country in the North American region. This is owing to the availability of the major players in the country. Top oilfield integrity management providers such as Schlumberger, Ltd., Halliburton, and Baker Hughes Company, who continuously invest in developing innovative solutions for various segments of the oil & gas industry, can make a huge difference in the market. The U.S. market size is expected to hit USD 6.46 billion in 2026.

Europe

Europe is Fastest-growing Region Driven by Industrial Expansion

Europe's oilfield integrity management market size is growing globally. This growth stems from the growing demand for fuel-based machinery in the industrial sector. Moreover, rapid hydrogen production in countries such as Norway, Russia, and the U.K. is also one of the major factors for Russia to focus on integrity management. Russia holds the majority of the oil production share all over the globe, after Saudi Arabia. Europe's growth is considerable and can dominate in the upcoming decades. The market size in U.K. is expected to hit USD 0.0955 billion in 2026, and the Germany market is projected to reach USD 0.11 billion by 2026. Russia is likely to stand at USD 0.11 billion and Norway is projected to reach USD 0.15 billion in 2025.

Asia Pacific

Asia Pacific is Dominating Market Due to Growth in Oil Applications

Asia Pacific is projected to hit USD 1.91 billion in 2025 as the third-largest market. The region is expected to witness significant growth in coming years driven by rapid expansion in the industrial segment. Countries such as China and India are more focused on fulfilling the energy demand owing to the expansion of the industrial sector. Moreover, automotive is one of the major sectors that consume petrol and diesel as a daily consumer requirement. For instance, in July 2024, according to Rystad Energy, offshore gas production in Southeast Asia is composed of unlocking a USD 100 billion latent, determined by planned final investment decisions (FIDs) that are predicted to materialize by 2028. The market in China is expected to reach USD 0.36 billion in 2026. India is likely to accumulate USD 0.92 billion by the year 2026, whereas Indonesia is projecting to hit USD 0.20 billion in 2025.

Latin America

Industrial Expansion in Region to Contribute to Market Development

Latin American countries are actively participating in the oilfield integrity management market. The region is projected to be the fourth-largest market with USD 1.61 billion in 2025. This is owing to the expansion of the industrial sector and high returns on investments, especially in power generation and other industrial applications. The region has sought to improve its energy-efficient product in recent years. This is owing to the growing demand for energy in industrial spaces. Brazil and Mexico play an important role in fulfilling the energy demand in Latin America.

Middle East & Africa

Wide Scope in Oil and Gas Rigs to Boost Market Growth

The Middle East & Africa is anticipated to account for the second-highest market size of USD 3.54 billion in 2025. The region is the second-fastest growing market for global oilfield integrity management market with a CAGR of 8.62% during the forecast period, as the region consists of major oil & gas producing countries such as Saudi Arabia, the UAE, Kuwait, Iraq, and Iran, which have some of the largest petroleum reserves in the world. These countries export most of their production to neighboring Asian countries such as China and India, which have high energy demand. Furthermore, the growth of the market in the Middle East & Africa is due to the increasing focus on a number of drilling activities and the inspection and monitoring systems required to optimize production from mature fields. Saudi Arabian market size is estimated to hit USD 1.03 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Rapid Technological Advancements are Positively Impacting the Market Growth

The global market is highly fragmented, with key players and some medium-scale regional players delivering a wider focus on oil & gas management services. Players are increasingly required to demonstrate their technological advancements, helping countries regulate requirements and making it easier for them to boost the efficiency of applications.

For instance, in July 2024, Saudi Arabia invested USD 100 billion to position itself as a major player in data analytics, artificial intelligence, and advanced technology.

List of Key Oilfield Integrity Management Companies Profiled:

- Baker Hughes Company (U.S.)

- Schlumberger Limited (U.S.)

- Halliburton (UAE)

- John Wood Group PLC (U.K.)

- Aker Solutions (Norway)

- SGS SA (Switzerland)

- Oceaneering International, Inc. (U.S.)

- TechnipFMC plc (U.K.)

- Emerson Electric Co. (U.S.)

- Saipem (Italy)

- Weatherford (U.S.)

- National Oilwell Varco (U.S.)

KEY INDUSTRY DEVELOPMENTS:

June 2024: Baker Hughes recently launched the assembly of hydrogen measurement gas, flow, and moisture sensor technologies. It will deliver advanced levels of accuracy, dependability, and durability across a wide range of applications.

September 2023: Kirloskar Oil Engines introduced CPCB IV+ obedient gensets for viable power solutions. It will enable gensets to deliver real-time insights, prognostic maintenance, and remote monitoring capabilities, ensuring operational efficiency.

April 2023: C3 AI – a leading provider of AI Software, proclaimed the introduction of the C3 Generative AI Product Suite that embeds progressive transformer models with C3 AI’s pre-built AI applications. It will help across business functions and processes, including oil & gas, utilities, CRM, ESG, and aerospace.

April 2022: Neste –an oil refining and marketing company, positively concludes its first dispensation run with pyrolysis oil from castoff tires. Pyrolysis oil derived from castoff tires was treated into high-quality raw material for chemicals and plastics at Neste’s refinery in Porvoo, Finland.

February 2020: Halliburton Company launched SPIDRlive Self-Powered Intelligent Data Retriever, an unconventional well testing and fracture interaction monitoring technology that acquires real-time well data without the need for intervention to reduce costs and improve fracture understanding for greater recovery.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service process, competitive landscape, and leading source of the engine. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.95% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Management Type, By Component Type, By Application, and By Region |

|

Segmentation |

By Management Type

|

|

By Component Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 15.61 billion in 2025.

The market is likely to grow at a CAGR of 6.95% during the forecast period.

Based on application, the onshore segment leads the market due to technological advancements in offshore fields.

The North American market size stood at USD 7.42 billion in 2025.

The growth of onshore projects is expected to boost industrial services, driving market growth.

Some of the top players in the market are Baker Hughes Company, Schlumberger Limited, and Halliburton.

The global market size is expected to reach USD 28.45 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us