On-Orbit Services Market Size, Share, and COVID-19 Impact Analysis, By Orbit (GEO, MEO, and LEO), By End User (Government & Defense and Commercial), By Service (Inspection, Refuel, Repair, Upgrade, and Other), By Frequency (Short, Medium, and Long), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

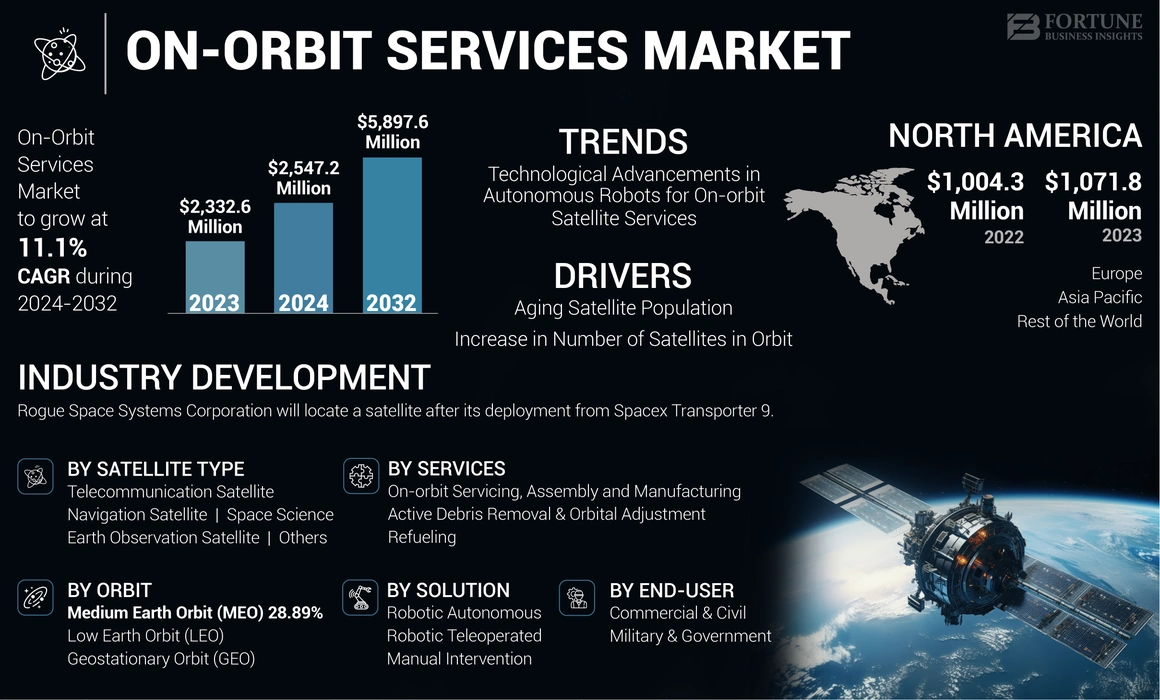

The global on-orbit services market size was valued at USD 2,332.6 million in 2023 and is projected to grow from USD 2,547.2 million in 2024 reach USD 5,897.6 million in 2032, exhibiting a CAGR of 11.1% during the forecast period. North America dominated the on-orbit services market with a market share of 45.95% in 2023.

On-orbit services is the term used to describe the observation or modification of a satellite by another spacecraft, also known as the service vehicle, following its initial launch. It covers repairing spacecraft, assembling space stations, to 3D printing in space. On-Orbit Servicing (OOS) includes a collection of new technologies that give users access to satellites after they have been launched. OOS has the potential to change space logistics and resilience completely. For instance, a change in how satellites are designed, launched, and operated will result from the ability to upgrade sensors or add capabilities every few years, navigate without remorse, and examine and repair satellites.

The COVID-19 pandemic disrupted the supply chains and operations of companies in the on-orbit services market. Lockdowns, travel restrictions, and workforce availability issues delayed hardware assembly, delivery, and access to facilities. For instance, the NASA Space Launch System (SLS) program reported over USD 360 million in COVID-19 pandemic cost impacts due to schedule adjustments, compression, and facility shutdowns. International partners of NASA projects such as NISAR also experienced delays ranging from 2 weeks to 4 months.

GLOBAL ON-ORBIT SERVICES MARKET OVERVIEW

Market Size & Forecast

- 2023 Market Size: USD 2,332.6 million

- 2024 Market Size: USD 2,547.2 million

- 2032 Forecast Market Size: USD 5,897.6 million

- CAGR: 11.1% from 2024–2032

Market Share

- North America dominated the on-orbit services market with a 45.95% share in 2023, owing to the presence of major commercial players, advanced satellite servicing infrastructure, and active government support.

- By service type, the life extension segment held the largest market share in 2023 due to increasing demand to prolong operational satellite missions cost-effectively.

Key Country Highlights

- United States: Leading the market with key players like Northrop Grumman and Orbit Fab; strong government and defense sector contracts fuel growth.

- China: Rapid advancements in satellite servicing technology with growing military and commercial space ambitions.

- Russia: Despite sanctions, continued investment in satellite servicing for national security and defense capabilities.

- India: ISRO’s initiatives and increased private sector participation support emerging on-orbit servicing capacity.

- Japan: Actively investing in debris removal and satellite refueling technologies.

- France: Collaborations under the European Space Agency foster innovation in life extension and de-orbiting systems.

- UK: Investment in in-orbit servicing startups like Astroscale boosts role in debris mitigation and satellite repair.

On-Orbit Services Market Trends

Technological Advancements in Autonomous Robots for On-orbit Satellite Services to Drive Market Growth

Robotic servicing spacecraft equipped with advanced computer vision, manipulation, and autonomous control systems are being developed to perform tasks such as refueling, repairs, upgrades, and relocation of satellites in orbit without direct human control. Autonomous robots are being used in several key ways for on-orbit satellite servicing. North America witnessed on-orbit services market growth from USD 1004.3 Million in 2022 to USD 1071.8 Million in 2023.

Autonomous capture of free-flying satellites: Robotic servicing spacecraft equipped with advanced computer vision and control systems can autonomously capture and grapple free-flying client satellites without direct human control. This was demonstrated by the Orbital Express mission.

Autonomous on-orbit repairs and upgrades: These robotic systems can perform tasks such as refueling, component replacement, and other repairs and upgrades on satellites in orbit, extending their operational lifetimes.

Autonomous on-orbit assembly and manufacturing: Emerging technologies are enabling in-space manufacturing and assembly of satellite components and structures directly in orbit, reducing the need for pre-assembled satellites.

Download Free sample to learn more about this report.

On-Orbit Services Market Growth Factors

Aging Satellite Population Driving On-Orbit Services Market Growth

The aging satellite population is a major driver of the on-orbit services industry growth. Many satellites in orbit are approaching the end of their operational lives and require maintenance or replacement to continue functioning. Satellites are typically designed to operate for a fixed period, after which they may experience technical problems or degradation in performance.

The demand for on-orbit satellite services such as life extension, servicing, and repair is increasing due to the aging satellite population. These services can help extend the lifespan of existing satellites, reducing the need for costly launches of new satellites from Earth. Satellites that are reaching the end of their operational lives can be refueled or repaired in orbit rather than replaced.

On-orbit satellite servicing can also help address technical issues that arise during a satellite's operational life, such as failures or degradation due to exposure to harsh space environments. This can help ensure that satellite-based services remain operational and reliable.

Increased Number of Satellites in Orbit to Drive Market Growth

The number of active satellites in Earth's orbit has grown significantly in recent years, increasing the need for on-orbit services. As of the end of 2022, an estimated 6,718 active satellites were orbiting the planet, up from around 4,852 at the end of 2021. This rapid growth has been driven largely by the deployment of large satellite constellations such as SpaceX's Starlink, which aims to provide global broadband internet access. As satellites age or encounter issues, on-orbit servicing can help extend their operational lifetimes and avoid the need for costly and risky deorbit and replacement. It can also help mitigate the growing problem of space debris by enabling active debris removal. Several companies and organizations are now developing on-orbit servicing technologies and business models to meet this growing need. For example, Northrop Grumman's MEV-1 and MEV-2 spacecraft have demonstrated the ability to dock with and extend the life of commercial communications satellites in geostationary orbit. As the number of satellites continues to grow, especially in low Earth orbit, where the majority of active satellites now reside, the importance of on-orbit servicing will only increase. It will be critical for ensuring the long-term sustainability of the space environment and enabling the realization of the full potential of satellite technologies.

RESTRAINING FACTORS

Technological Complexities are Anticipated to Hamper Market Growth

The technology essential for providing on-orbit satellite services is in a perpetual state of evolution, requiring companies to make substantial investments in research and development to remain competitive. This poses a formidable barrier to entry for new entrants into the market. Precisely locating and docking with a target satellite in orbit is extremely difficult, as the satellite may be tumbling or is in unexpected orientation. Advanced sensors, guidance, and control systems are required to accomplish this safely. Much of the servicing process needs to be automated, as communication latency makes real-time teleoperation from Earth impractical. Robust autonomous decision-making and fault tolerance are critical.

On-Orbit Services Market Segmentation Analysis

By End-user Analysis

Investments in the On-Orbit Servicing Is Enabling Segment Growth for Military & Government Segment

Among the end user, the market is segmented into commercial & civil and military & government.

Government agencies such as NASA, DARPA, and the European Space Agency are investing in on-orbit servicing demonstrations and helping to de-risk the technologies, which is catalyzing commercial activities in this area. Therefore, the military & government segment accounted for a substantial market share in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

Commercial & civil space accounted for the dominating market share in 2023 and is anticipated to grow significantly during the forecast period. The users want more flexibility to update, maintain, and reconfigure their spacecraft on-orbit rather than relying on the traditional model of launching fully integrated, single-purpose satellites. Developments in robotics, autonomy, rendezvous and proximity operations, and other critical capabilities are making on-orbit servicing more feasible and reliable. As the on-orbit servicing options expands and the technology matures, the business case for these services is becoming more compelling, especially for life extension, refueling, and payload upgrades.

By Orbit Analysis

Growing Number of Small Communication Satellites Propelled LEO Segment Growth

Based on orbit, the market is segmented into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO).

The low earth orbit segment dominated the global on-orbit services market in 2023. There has been a significant increase in the deployment of small satellites, especially in LEO, driven by the growth of commercial space companies and the demand for communication, Earth observation, and other space-based services. The rise in small satellite deployments is contributing to the growth of the LEO segment in the on-orbit satellite servicing market, as these satellites often require servicing, maintenance, and upgrades during their operational lifetimes.

- The Medium Earth Orbit (MEO) segment is expected to hold a 28.89% share in 2023.

The geostationary orbit segment is estimated to grow significantly in the forecast period. This segment accounted a significant market share in base year 2023 and is anticipated to grow at the fastest CAGR. Many satellites in geostationary orbit are nearing the end of their design life and will require servicing to extend their operational lifetime. As these satellites age, the demand for on-orbit servicing in GEO increases.

To know how our report can help streamline your business, Speak to Analyst

By Satellite Type Analysis

Growing Scientific Research Implications in Space Science is Expected To Boost Segment Growth for Earth Observation Satellite

Among the satellite type, the market is studied across telecommunication satellite, navigation satellite, Earth observation satellite, space science, and others.

The earth observation satellite segment dominated the global on-orbit services market in 2023. The segment is anticipated to be a moderate growing segment during the forecast period. The growing deployment of satellites for communication, Earth observation, navigation, and other purposes is fueling the need for on-orbit servicing. Many of these satellites have limited or no servicing capabilities, making them prone to malfunctions over time.

Space science is estimated to be the fastest growing segment in the forecast period. Space science satellites are critical for providing continuous scientific data and observations. On-orbit servicing can help keep these satellites operational for longer, ensuring uninterrupted data collection and scientific research. Space science satellites represent significant investments and are often highly valuable assets. On-orbit servicing can help protect these investments by maintaining the satellites and avoiding the need for costly replacement launches.

By Services Analysis

Refueling of Satellites to Propel Refueling Segment Growth

Among the services, the market is segmented into on-orbit servicing, assembly and manufacturing, active debris removal & orbital adjustment, and refueling.

The refueling segment dominated the global on-orbit services market in 2023 and is anticipated to be the fastest-growing segment during the forecast period. Refueling of satellites prepared for in-orbit refueling are designed to be refueled, reducing the complexity and cost of servicing. This enables satellites to launch with less onboard fuel, allowing more mass for revenue-generating payloads.

The on-orbit servicing, assembly and manufacturing segment accounted for a significant market share in the base year 2023. These services can provide cost savings in comparison to launching new replacement satellites, as they avoid the expense of new launch vehicles and spacecraft.

The OSAM market is seeing growing demand driven by the need to extend the life of aging satellites, mitigate space debris, enable larger and more complex space systems, provide cost savings, and leverage technological advancements in robotics and manufacturing.

By Solution Analysis

Robotic Teleoperation Being Used as a Core Technology to Propel Segment Growth

Among the solution, the market is segmented into robotic autonomous, robotic teleoperated, and manual intervention.

Robotic teleoperated dominated the global on-orbit services market in 2023 and is anticipated to grow significantly during the forecast period. Teleoperation systems can integrate autonomous control and virtual fixtures to guide the operator and increase precision, especially for tasks requiring tight tolerances. Virtual fixtures provide haptic guidance to the operator to help align the robot end-effector precisely with the target. Teleoperation with force feedback allows the human operator to feel the forces and interactions at the remote robot, enabling dexterous manipulation and precise control. The force feedback increases the transparency of the system and allows the operator to execute tasks requiring high precision.

The robotic autonomous segment accounted for a significant market share in 2023 and is anticipated to grow at the fastest CAGR in the forthcoming years. Visual Perception for Non-Cooperative Targets: Advances in visual perception technologies, such as ellipse detection and structured light vision systems, enable robots to autonomously identify and interact with non-cooperative satellite targets.

REGIONAL INSIGHTS

The global market is segmented into regions such as North America, Europe, Asia Pacific, and the Rest of the World.

North America On-Orbit Services Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the largest on-orbit services market share and was valued USD 1,071.8 million in 2023 and is likely to remain dominant throughout the forecast period. This region's growth is due to the presence of a large number of OEMs, driven by both new and modernization programs by the government. The commercial on-orbit satellite servicing market in North America is rapidly evolving, providing a range of valuable capabilities to commercial satellite operators. These services include in-orbit refueling, repairs, upgrades, and maintenance for satellites. Leading companies such as SpaceLogistics (U.S.) and Astroscale (Japan) are actively involved in this market, developing advanced technologies to ensure safe and efficient servicing of satellites in orbit.

The market in Asia Pacific held a significant market share in the base year and is estimated to be the fastest-growing region in the forecast period. Japan is maintaining its position as a key contributor to the on-orbit satellite servicing market. Japan's leadership in space technology and commitment to innovation have propelled its growth in this market. Chinese companies are capitalizing on government initiatives, technological advancements, and a rapidly expanding space infrastructure to offer competitive domestic and international servicing solutions.

KEY INDUSTRY PLAYERS

Key Market Players Adapt Strategies to Ensure Market Survival by Expanding Service Portfolio

The on-orbit services market is relatively fragmented with key players operating in this industry. It is observed that key players are focusing on offering different services and solutions.

The top five players in the industry are Airbus S.A.S, Thales Alenia, Lockheed Martin Corporation, Orbit Fab, and Astroscale. As the market grows, competition is expected to intensify among players such as Maxar, Astroscale, Airbus, and Thales Alenia Space.

List of Top On-Orbit Services Companies:

- Airbus S.A.S (Netherlands)

- Thales Alenia Space (Thales) (France)

- Lockheed Martin Corporation (U.S.)

- Orbit Fab (U.S.)

- Astroscales (Japan)

- Clear Space SA (Switzerland)

- Obruta Space Solutions Corp. (Canada)

- D-Orbit SpA (Italy)

- Maxar Technologies (U.S.)

- Eta Space (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2024 - Thales Alenia Space, a joint venture between Thales and Leonardo, signed a first-phase contract worth €25m (USD 26.09 Million) with the European Space Agency (ESA) to demonstrate a complete cargo delivery service to and from space stations in low-Earth orbit by 2028. Thales Alenia Space will co-found the development of this LEO Cargo Return Service.

- December 2023 - Rogue Space Systems Corporation, a provider of space situational awareness and satellite servicing solutions, will locate a satellite after its deployment from Spacex Transporter 9. The mission will involve establishing communication and undertaking operations for the customer’s satellite.

- August 2022 - Orion Space Solutions announced that it was selected by the U.S. Space Force to develop three small satellites for a demonstration of on-orbit services in geostationary Earth orbit. The USD 44.5 million contract is for the Tetra-5 mission, a project intended to help the Space Force figure out how to take advantage of commercial technologies to inspect objects in space and to service geostationary satellites 22,000 miles above Earth that perform critical missions and are expensive to replace.

- June 2022 - Isar Aerospace announced that it entered into a firm launch services agreement with space infrastructure pioneer D-Orbit. The company’s launch vehicle, Spectrum, which is developed for small and medium satellites and satellite constellations, will launch D-Orbit’s ION Satellite Carrier as a primary customer to a Sun-synchronous orbit from its launch site in Andøya, Norway, with a launch term starting in 2023.

- November 2020 – MDA announced that it signed multiple contracts with Maxar Technologies to provide advanced space robotics technologies for the Space Infrastructure Dexterous Robot (SPIDER), a technology demonstration on NASA’s On‑orbit Servicing, Assembly, and Manufacturing 1 (OSAM-1) mission.

REPORT COVERAGE

The report provides detailed information on the competitive market landscape and focuses on leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the above factors, it contains several factors that have contributed to the sizing of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 11.1% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Services

|

|

By Satellite Type

|

|

|

By Orbit

|

|

|

By End User

|

|

|

By Solution

|

|

|

By Region

|

Frequently Asked Questions

The global on-orbit services market was valued at USD 2,332.6 million in 2023 and is projected to record a valuation of USD 5,897.6 million in 2032.

The global market is projected to grow at a CAGR of 11.1% during the forecast period.

The Low Earth Orbit (LEO) segment dominated the market in 2023.

The top five players in the industry are Airbus S.A.S, Thales Alenia (Thales), Lockheed Martin Corporation, Orbit Fab, and Astroscale are the leading players in the global market.

North America topped the market in terms of market share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us