Optical Interconnect Market Size, Share & Industry Analysis, By Product Type (Cable Assemblies, Connectors, Optical Transceivers, Silicon Photonics, Optical Engines), By Interconnect Level (Metro and Long-haul Optical Interconnect, Board-to-Board & Rack-Level Optical Interconnect, and Chip and Board-Level Optical Interconnect), By Fiber Mode (Single-mode & Multimode), By Data Rates (Less than 10 Gbps, 10-50 Gbps and More than 100 Gbps), By Distance (Less than 10 Km & More than 100 Km), By Application (Data Communication, Telecommunications, and Defense), & Regional Forecast, 2026–2034

Optical Interconnect Market Overview

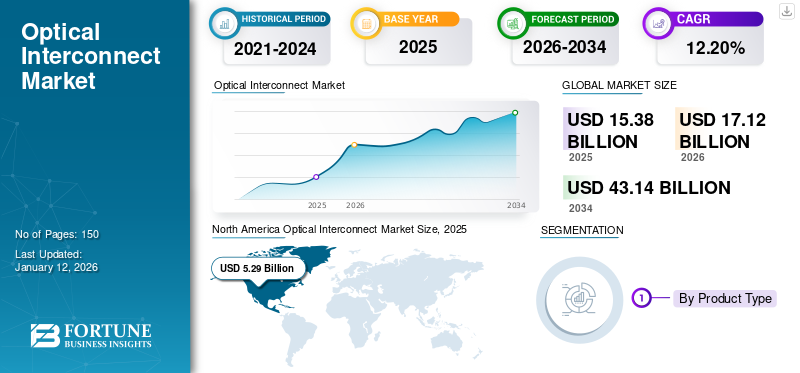

The global optical interconnect market size is valued at USD 15.38 billion in 2025 and is projected to grow from USD 17.12 billion in 2026 to USD 43.14 billion by 2034, exhibiting a CAGR of 12.20% during the forecast period. North America dominated the optical interconnect market with a market share of 34.40% in 2025.

Optical interconnect technology refers to the use of optical (light-based) signals, typically via fiber optics or photonic devices, to transmit data between different components or chips instead of relying on traditional electrical signals carried by copper wiring. These interconnects offer several advantages, such as higher bandwidth, faster data transfer speeds, lower latency, and reduced power consumption, especially over long distances, compared to electrical interconnects. As the demand for higher data rates and energy-efficient solutions increases, they are becoming increasingly important in high-performance computing, data centers, and Integrated Circuits (ICs).

Download Free sample to learn more about this report.

The global optical interconnect market is poised to depict significant growth driven by the increasing demand for higher data transfer rates, energy efficiency, and scalability in several applications. Key players in the market include Coherent Corp. (U.S.), Fujitsu Limited. (Japan), and Amphenol Communication Solutions (U.S.), with products such as Amphenol's QSFP DD and Amphenol's BarKlip BK600 modules. In the future, the optical interconnect market is anticipated to witness technological innovations focused on enhancing durability and efficiency in extreme conditions.

IMPACT OF GENERATIVE AI

Accelerated Adoption of Generative AI Workloads in Data Centers to Boost Market Demand

The rapid advancement of generative AI technologies is significantly increasing the demand for data center infrastructure. Training and deploying sophisticated AI models require substantial computational resources, leading to surge in data center capacity and power consumption. As these models become more complex and widely adopted across various industries, the need for fast, high-capacity data centers surge. Optical interconnects, with their ability to provide high bandwidth and low latency, are crucial to meet the data transmission needs of generative AI workloads.

OPTICAL INTERCONNECT MARKET TRENDS

Rising Demand for Increased Bandwidth Capacity in Optical Interconnect

The primary trend influencing the optical interconnect market is the growing demand for advanced bandwidth. The exponential growth in data traffic has compelled data centers to adopt advanced optical interconnect solutions to support edge computing and faster data processing. The rising deployment of hyper-scale data centers across the globe also escalates market growth. Moreover, companies such as Amazon Web Services, Inc., Microsoft, and Google Inc. are cloud service providers implementing higher data rate optical interconnects in their data centers. The emerging trends of wireless communication, smart gaming, and driverless vehicles are anticipated to increase data traffic across data center networks, leading to an augmented demand for interconnects and an accelerating market.

IMPACT OF COVID-19

The COVID-19 pandemic had a significant impact on the market. The rise in remote work, e-commerce, online education, and telemedicine highlighted the need for robust and high-speed networking infrastructure. This accelerated the investment in optical communication technologies to upgrade networks and data centers. In this context, optical interconnects gained traction due to their ability to improve network performance. The pandemic prompted companies to accelerate digital transformation initiatives. As businesses and consumers shifted online, data centers, cloud providers, and networking equipment manufacturers recorded an increase in the demand for high-speed, energy-efficient interconnects to meet the rising traffic and performance needs. Optical interconnects offered the scalability and efficiency required for the growing data demand.

MARKET DYNAMICS

Market Drivers

Increasing Demand for Communication Bandwidth in Cloud Computing, AI, and HPC to Drive Market Demand

The rapid growth of cloud computing, Artificial Intelligence (AI), and high-performance computing drives the demand for communication bandwidth. Optical interconnects, which use light to transmit data between components in computing systems, are becoming essential in meeting the growing need for high-speed, low-latency, and energy-efficient data transmission. Cloud computing involves a vast network of data centers handling enormous amounts of data storage, processing, and exchange. Optical interconnects are crucial for high-speed, high-capacity data transmission within and between data centers and end-users. As cloud service providers such as Amazon, Microsoft, and Google continue to scale their operations, the demand for interconnects grows to support high-bandwidth data exchanges across networks. These factors drive the optical interconnect market growth.

Market Restraints

Slow Commercialization of Optical Interconnection-Related Technologies May Hamper Market Growth

Optical interconnects require specialized materials, precision engineering, and advanced manufacturing processes that are more expensive than traditional copper-based interconnects. The high initial investment in R&D and manufacturing activities limits the ability of companies to bring these technologies to the market at competitive prices. The adoption rate of the product is anticipated to remain slow until the costs come down through economies of scale and technological advancements.

In addition, technical challenges such as signal conversion, packaging, thermal management, and ensuring reliability at a large scale delay the commercialization of optical interconnects. Efficiently converting optical signals to electrical signals and vice versa while maintaining performance levels remains a technical hurdle hindering optical interconnect market growth.

Market Opportunities

Rise in Deployment of Data Centers among Several Organizations to Boost Market Demand

There has been a significant increase in data center budget allocation at the global level. The optical interconnect market is anticipated to grow due to the increasing deployment of data centers. Most governments and companies rely on data centers to provide business value that is more significant than their cost. Data analytics and cloud computing have increased investments in large data centers, potentially contributing to the implementation of optical interconnection and favoring industry expansion.

SEGMENTATION ANALYSIS

By Product Type

Rise in Data Center Traffic Boosts Higher Adoption of Optical Transceivers

On the basis of product type, the optical interconnect market is categorized into cable assemblies, connectors, optical transceivers, silicon photonics, optical engines, PIC-based interconnects, and free space optics, fibers and waveguides.

The optical transceivers segment holds the largest optical interconnect market share in 2026 by 23.87%. This is driven by the exponential growth in data traffic from big data, cloud computing, and IoT technologies, which demand high-speed data transmission solutions. The development of data centers and the rollout of 5G networks have further supported the adoption of optical transceivers, which provide essential bandwidth and speed. Technological advancements, such as development of high-capacity transceivers, have improved reliability and performance, leading to broader adoption.

The cable assemblies segment is anticipated to grow at the highest CAGR during the forecast period due to the rapid expansion of data centers, which require consistent and high-performance interconnect solutions. The growing demand for high-speed connectivity in applications such as cloud computing, IoT, and big data analytics drives the need for advanced cable assemblies that sustain higher data rates and data integrity over long distances. The deployment of 5G networks imposes optical interconnect solutions, with cable assemblies playing a crucial role in connecting 5G infrastructure components.

By Interconnect Level

Mounting Adoption of Metro and Long Haul Interconnects to Expand Telecom Networks

On the basis of interconnect level, the optical interconnect market is categorized into metro and long-haul optical interconnect, board-to-board and rack-level optical interconnect, and chip and board-level optical interconnect.

The metro and long-haul optical interconnect segment holds the largest optical interconnect market share in 2024, due to the ability of these solutions to transmit data over long distances with minimal signal degradation. These interfaces cover over 1000 kilometers, while metro interfaces typically operate within a 100-600 kilometer range. This makes them ideal for connecting distant data centers or extending telecom networks across cities or countries and accelerates the growth of the segment. The metro and long-haul optical interconnect segment is expected to hold 41.92% of the optical interconnect market share in 2025.

The chip and board-level optical interconnect segment is expected to grow at the highest CAGR of 15.74% during the forecast period. This is essential for applications requiring the rapid transmission of large volumes of data, such as AI, machine learning, data center operations, and HPC. Optical signals can transmit data at terabit-scale rates, enabling greater data throughput in a smaller footprint.

By Fiber Mode

Single-mode Fibers Receive Amplified Demand Owing to its Higher Bandwidth

On the basis of fiber mode, the market is categorized into single-mode and multimode.

The single-mode fiber segment holds the largest market share in 2024, supported by higher bandwidths. These fibers can transfer data over long distances without significant signal loss or degradation, making it ideal for long-haul telecommunications. In addition, the fibers have minimal modal dispersion, allowing one light mode to propagate, resulting in more precise signals over long distances. This is crucial for high-speed data transmission and boosts the growth of the market. The single-mode fiber segment is anticipated to capture 56.12% of the optical interconnect market share in 2026.

The multimode fiber segment is expected to grow at the highest CAGR of 15.00% during the forecast period. Multimode fiber tends to be less expensive than single-mode fiber in terms of the fiber itself and associated components, such as transceivers. This makes it an attractive option for many organizations. Moreover, this fiber has a larger core diameter, making it easier to handle and install. The larger core also simplifies the termination process, reducing labor costs and installation time, driving segment growth.

By Data Rates

Increasing Adoption of Solutions with 50-100 Gbps Data Rates Due to Enhanced Performance

On the basis of data rates, the market is categorized into less than 10 Gbps, 10-50 Gbps, 50-100 Gbps, and more than 100 Gbps.

The 50-100 Gbps segment holds the largest market share in 2024. These data rates help improve the overall performance of networks by reducing latency and increasing throughput, enabling faster data transfers and more efficient network operation. As businesses grow and data demands increase, 50-100 Gbps interconnects provide a scalable solution that can easily adapt to future needs without requiring a complete network overhaul. The 50-100 Gbps segment is likely to attain 41.49% of the optical interconnect market share in 2026.

The 10-50 Gbps segment is expected to grow at the highest CAGR of 15.91% during the forecast period. The data rates help balance performance and cost, making them more affordable for organizations seeking to upgrade their network infrastructure without a substantial financial investment. Therefore, for a wide range of applications such as video conferencing, cloud services, and other systems, 10-50 Gbps provides adequate bandwidth, allowing for smooth and efficient data transfer.

By Distance

Optical Fibers Covering Distance Less than 10 km Dominates Owing to its Deployment Among Several Applications

Based on distance, the market is categorized into less than 10 km, 11-100 km, and more than 100 km.

The less than 10 km segment held the largest global optical interconnect market share in 2024. Short-distance interconnects can support high data rates, often exceeding 10 Gbps, which is essential for applications requiring fast data transfer, such as video streaming, cloud computing, and real-time data processing. Moreover, short-distance optical fibers are typically less expensive to install compared to long-haul systems. The infrastructure needed, such as cables, connectors, and associated hardware, is more economical. The less than 10 km segment is anticipated to capture 54.88% in 2025 and exhibiting to record CAGR of 14.88% during the forecast period.

The more than 100 km segment is expected to grow at the highest CAGR during the forecast period. Long-distance optical interconnects can span vast geographical areas, enabling communication between remote locations, such as between cities or across countries. The solutions are essential for telecommunications and wide area networks (WANs).

By Application

Implementation of Data Communication Applications Among Several Organizations to Propel the Market Growth

To know how our report can help streamline your business, Speak to Analyst

On the basis of application, the optical interconnect market is categorized into data communication, telecommunications, and military & defense.

The data communication segment holds the largest market share and is expected to continue its dominance over the forecast period. Optical interconnects can easily scale to accommodate growing data demands. Organizations can upgrade bandwidth and capacity without the need for extensive infrastructure changes. Interconnects can transfer data over long distances without substantial signal loss or degradation, which makes them appropriate for wide-area networks and intercity connectivity. Data communication segment is likely to hold 59.31% of the market share in 2025 and exhibiting a CAGR of 14.32% during the forecast period.

Telecommunications is the second leading segment of the market as they can easily scale optical interconnects to accommodate the growing data demand. Adding capacity through wavelength-division multiplexing allows multiple channels to be transmitted over a single fiber. Furthermore, these interconnects can work with existing telecommunications infrastructure, allowing for seamless integration and upgrades without major disruptions to service, favoring industry growth.

OPTICAL INTERCONNECT MARKET REGIONAL OUTLOOK

From the regional ground, the market has been analyzed across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America Optical Interconnect Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the highest market share in 2024, valuiowing to its technological advancements, decreasing costs of optical components, and increased demand for faster and more efficient data transmission systems. The rollout of 5G networks across the region has accelerated the need for faster and more efficient data transmission technologies. Optical interconnects enhance network performance, reducing latency and providing higher capacity for back haul and front haul networks.

To know how our report can help streamline your business, Speak to Analyst

The U.S. optical interconnect market is likely to hit USD 3.65 billion in 2026. The U.S. records an accelerated product adoption as the demand for high-speed, energy-efficient data transmission continues to rise. The country is a hub for innovation in optical networking technologies. Continued R&D efforts are lowering costs and improving the performance of optical interconnect components, including transceivers, photonic integrated circuits, and silicon photonics. These advancements are making it easier for companies to adopt optical technologies.

- With U.S. carriers such as AT&T and Verizon heavily investing in 5G infrastructure, optical interconnects are becoming indispensable for upgrading network capacity and performance.

Asia Pacific

Asia Pacific to be anticipated the second-largest optical interconnect market with USD 5.05 billion in 2026, recording the second-largest CAGR of 29.00% during the forecast period. Technological advancements and the increasing demand for high-speed data transmission across several vital industries drive the region’s market growth. The region is experiencing massive growth in cloud computing, fueled by major global and local players such as Alibaba, Tencent, Google, and Amazon. These companies are expanding their data centers to handle massive data traffic and ensure high-speed, low-latency communication between servers and storage systems.

Moreover, China, South Korea, and Japan are leading the region in deploying 5G networks. As 5G adoption increases, there is a parallel demand for advanced optical solutions to handle the surge in mobile data and IoT applications. The market in China is estimated to be USD 1.58 billion in 2026.

India’s market size is foreseen to be valued at USD 0.76 billion and Japan’s likely to be USD 1.30 billion in 2026.

Europe

Europe is set to expand with a value of USD 2.76 billion in 2026, as the third-largest optical interconnect market. In Europe, the market is set for steady growth, supported by several factors. The regional growth is driven by an increase in data center development, especially in the Netherlands, Germany, the U.K., and Ireland, which are data center hubs. Major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are expanding their European data center footprints. These facilities rely heavily on optical interconnects to handle large-scale data processing with minimal latency and higher energy efficiency than traditional copper-based interconnects. The market in U.K. is estimated to be USD 3.65 billion in 2026.

The Germany’s optical interconnect market size is foreseen to be valued at USD 0.68 billion and France’s likely to be USD 0.29 billion in 2025.

Middle East and Africa South America

The Middle East & Africa and South America markets are still emerging but show significant potential. Many countries in the Middle East & Africa are investing in cloud computing, data centers, and 5G infrastructure. Optical interconnects help ensure low-latency and high-bandwidth connections between these facilities' servers, storage systems, and networking equipment. Additionally, the UAE and Saudi Arabia are investing in smart cities, 5G, and IT infrastructure, which increases product demand. The Middle East & Africa market is expected to accumulate USD 2.05 billion in 2026, as the fourth-largest regional market. The GCC is likely to hit USD 0.63 billion in 2025.

Similarly, South America is expected to grow at a moderate rate owing to the rising adoption of 5G deployment, data center expansion, and government initiatives to improve internet access. However, the market growth may be constrained by economic challenges and limited technological infrastructure in the region.

KEY INDUSTRY PLAYERS

Prominent Companies Focus on Partnerships and Acquisitions to Expand their Operations

Leading companies in the market are launching specialized solutions to increase their global presence. To cement their market position, they are collaborating strategically and acquiring domestic businesses in various regions. Additionally, companies are also focused on designing novel solutions and effective marketing strategies to increase market share. The increasing demand for optical interconnects is expected to create lucrative opportunities for market players.

List of Key Optical Interconnect Companies Profiled:

- Broadcom (U.S.)

- II-VI Incorporated (U.S.)

- Lumentum Operations LLC (U.S.)

- Molex, LLC (U.S.)

- InnoLight Technology Ltd. (China)

- NVIDIA Corporation (U.S.)

- Amphenol Corporation (U.S.)

- Coherent Corp. (U.S.)

- Fujitsu Limited (Japan)

- ZHONGJI INNOLIGHT RESERVED (China)

- TE Connectivity (Switzerland)

- Smiths Interconnect (U.K.)

- Juniper Networks, Inc. (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- Cailabs (France)

- Infinera Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Marvell, Lumentum, and Coherent announced the demonstration of 800G ZR/ZR+ optical modules over transmission links up to 500km. The partnership demonstrates that pluggable modules can meet future challenges, offering cost-effective, space-efficient, and power-efficient solutions.

- May 2024: Amphenol Corporation acquired Carlisle’s Carlisle Interconnect Technologies (CIT). The acquisition would increase Amphenol’s products for vastly engineered harsh environment interconnect solutions and allow customers to deliver complete technology posing for their clientele in the defense, commercial air, and industrial markets.

- March 2024: Broadcom Inc. launched its industry’s first 51.2 Terabits per Sec (Tbps) Co-Packaged Optics (CPO) Ethernet switch for its clients. The product launch enables the optical interconnect to activate at 70% lower power consumption and allocates an 8x improvement in silicon area efficiency interconnected to pluggable transceiver solutions.

- October 2023: Lumentum Holdings Inc. acquired Cloud Light to quicken data center rapidity and scalability. The partnership would deliver immediate customer value with a more comprehensive product and technology range, enabling clients to effectively manage AI workloads' escalating compute and interconnect necessities.

- March 2022: Ayar Labs and Lumentum collaborated to supply external light sources for Co-packaged Optical Interconnect solutions. These light sources power Ayar Labs’ optical I/O solutions to deliver higher energy efficiency, bandwidth, and expectancy aids for networking and computing completed current short-reach copper links.

- February 2021: Marvel and Fujitsu collaborated to distribute the new OCTEON Fusion baseband processor for their 5G New Radio (NR) base station contributions. The partnership would provide a flexible and scalable platform for leveraging technology through multiple product contributions.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market is focused on research & development activities to develop more advanced, efficient, and cost-effective solutions. Companies are increasingly collaborating with small organizations, providing opportunities for merger and acquisition strategies. New developments in photonics, silicon photonics, and integrated optics are reducing costs and increasing the performance of optical interconnects. Companies developing silicon photonics technology, such as Intel and Cisco, are leading the charge in high-speed, low power optical solutions. Investment in firms working on this technology can yield significant returns as adoption scales.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers an insight into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, Interconnect Level, Fiber Mode, Data Rates, Distance, Application, and Region |

|

Segmentation |

By Product Type

By Interconnect Level

By Fiber Mode

By Data Rates

By Distance

By Application

By Region

|

|

Companies Profiled in the Report |

Broadcom (U.S.), II-VI Incorporated (U.S.), Lumentum Operations LLC (U.S.), Molex, LLC (U.S.), InnoLight Technology Ltd. (China), NVIDIA Corporation (U.S.), Amphenol Corporation (U.S.), Coherent Corp. (U.S.), Fujitsu Limited (Japan), ZHONGJI INNOLIGHT RESERVED (China), TE Connectivity (Switzerland), Smiths Interconnect (U.K.) |

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 43.14 billion by 2034.

In 2025, the market value stands at USD 15.38 billion.

The market is projected to grow at a CAGR of 12.20% during the forecast period.

By interconnect level, the metro and long-haul optical interconnect segment is the leading segment.

The increasing demand for communication bandwidth in cloud computing, AI, and HPC across the globe are the key factors driving market growth.

Broadcom, Amphenol Communication Solutions, Coherent Corp., Fujitsu Limited, ZHONGJI INNOLIGHT RESERVED, Lumentum Operations LLC, Molex, NVIDIA Corporation, TE Connectivity, and Smiths Interconnect are the top players in the market.

North America holds the highest market share.

By application, the telecom network is expected to grow with a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us