Photonic Integrated Circuit Market Size, Share & Industry Analysis, By Application (Telecommunications, Data Center, Biomedical, Quantum Computing, and Others), By Integration Type (Monolithic, Hybrid, and Module), By Component (Lasers, MUX/DEMUX, Modulators, Optical Amplifiers, Detectors, Attenuators, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

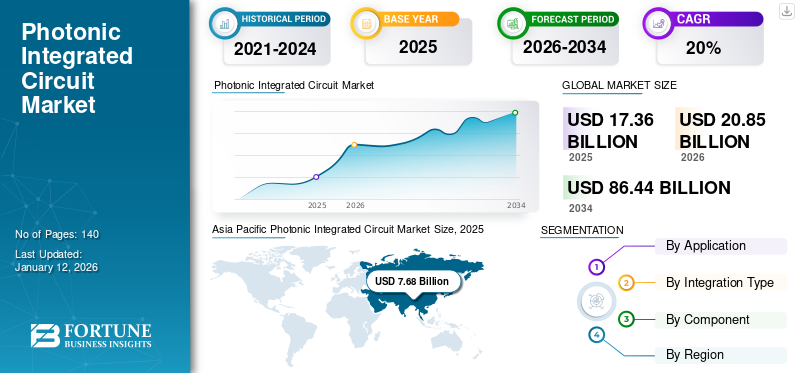

The global photonic integrated circuit market size was valued at USD 17.36 billion in 2025. The market is projected to grow from USD 20.85 billion in 2026 to USD 86.44 billion by 2034, exhibiting a CAGR of 20.80% during the forecast period. Asia Pacific dominated the global photonic integrated circuit market with a share of 44.30% in 2025.

A photonic integrated circuit (PIC) consists of two or more photonic components arranged on a microchip to create a working circuit and is also called a photonic chip. Photonic components make use of photons, rather than electrons, as their energy source.

Photonic integrated circuit market growth is expected to be driven by the growing need for faster data transmission rates, especially in telecommunications and data centers. The expansion of 5G networks and the upcoming shift to 6G necessitate the incorporation of photonics to manage unprecedented data volumes and communication speeds, further driving the adoption of PICs. Additionally, the use of cutting-edge technologies such as quantum computing and communication relies significantly on PICs to manipulate individual photons, enabling significant advancements in these fields. Thus, these factors are increasing the photonic integrated circuit market share.

The COVID-19 pandemic had a mixed impact on the photonic integrated circuit market. While it caused challenges such as supply chain disruptions, it also accelerated the demand for digital communication and the adoption of advanced technologies such as PICs. As industries adapt to the post-pandemic landscape, the long-term outlook for the PIC market remains positive, driven by ongoing investments in telecommunications infrastructure and digital transformation initiatives.

IMPACT OF GENERATIVE AI

Advanced-Technical Capabilities of Generative AI for Photonic Integrated Circuit Fueled Market Growth

Photonics is a key enabling technology for generative AI, providing the computing power, low latency, interconnects, energy efficiency, and acceleration needed for the next wave of AI development. The integration of photonics is expected to be a crucial part of the infrastructure powering large language models and other generative AI applications in the future.

Photonic integrated circuits can reduce the power consumption of AI hardware accelerators compared to digital electronic solutions. Data movement dominates power usage, and photonics can move data more efficiently.

Photonic Integrated Circuit Market Trends

Integration of AI with Photonic Integrated Circuits is a Key Trend

The collaboration between AI and photonics spans across various domains, with photonics using the AI capabilities by facilitating high-speed AI networks and enabling a new category of information processing machines (IPMs). The integration of photonic circuits with AI and machine learning algorithms is an emerging trend that can enhance the adaptability and performance of optical networks. Machine learning, in particular, can be utilized to automate the optimization of parameters for improved performance and yield in the design and production process of PIC.

AI algorithms can be incorporated into PIC for optical computing applications, leveraging the inherent parallelism in optics for faster and more efficient processing by utilizing light signals to execute specific computation tasks. Furthermore, a phPIC not only delivers heightened performance but also offers a path to improved energy efficiency, while supporting miniaturization to minimize power consumption.

Download Free sample to learn more about this report.

Photonic Integrated Circuit Market Growth Factors

Growing Applications in Telecommunications and Data Centers is Aiding Market Growth

PICs are extensively used in telecommunication companies and data centers due to the increasing demand for higher transfer speeds, which traditional ICs cannot support. The growth of high-capacity networks and 5G technology has further accelerated the need for speed. The emergence and widespread acceptance of passive components and transceivers have established the role of PIC technologies in the telecommunications sector, while the focus of 5G development has primarily been on wireless and radio technology.

Photonics and fiber optics play a vital role in transmitting signals to and from the new generation of base stations. Many manufacturers leverage the high level of innovation to develop cost-effective hybrid PIC hardware tailored to specific requirements. Furthermore, the rising number of cloud applications is rapidly amplifying the traffic that data centers need to manage. Based on the Uptime Institute's survey of the data center industry, the majority of operators utilize a combination of approaches for data center operations. The survey revealed that with IT workloads distributed across different facilities and services, approximately one-third of workloads transitioned to cloud, colocation, hosting, and Software-as-a-Service (SaaS) providers.

RESTRAINING FACTORS

High Initial Costs and Complex Design of Photonic Integrated Circuits to Hinder Market Expansion

The development and fabrication of PICs require specialized equipment and processes, leading to significant initial investment costs. This financial barrier can deter startups and smaller companies, limiting competition and innovation in the market. Moreover, the design and manufacturing processes for PICs are complex, necessitating precise alignment of optical components. This complexity can result in longer development times and increased resource allocation, which may slow down product rollout and market penetration. These factors act as a barrier to the expansion photonic integrated circuit market growth.

Photonic Integrated Circuit Market Segmentation Analysis

By Application Analysis

Telecommunication Segment Dominated due to Demand for High-Speed Data Communication

Based on application, the market is segmented into telecommunications, data center, biomedical, quantum computing, and others.

In terms of market share, the telecommunication segment dominated the market with a share of 29.74% in 2026. The increasing need for high-speed data transfer in telecommunications networks is a significant driver for the adoption of PICs. These circuits enable efficient data transmission over long distances using optical fibers, which is essential for modern communication systems. Moreover, the rollout of 5G technology is a major catalyst for the PIC market. 5G networks require advanced optical communication solutions to handle increased data traffic and lower latency. PICs are crucial in meeting these demands, providing the necessary bandwidth and data rates to support next-generation wireless communication.

The biomedical segment is anticipated to register the highest CAGR during the forecast period. The integration of PICs into medical imaging, bio-sensing, and telemedicine applications highlights their importance in advancing healthcare technology. As the demand for efficient and precise diagnostic tools continues to rise, the role of PICs in biomedicine is expected to expand further, contributing to the overall growth of the PIC market.

By Integration Type Analysis

Monolithic Segment Dominated Owing to Advanced Monolithic Integration in Photonic Integrated Circuits

Based on integration type, the market is segmented into monolithic, hybrid, and module.

In terms of market share, the monolithic segment dominated the market contributing 39.81% globally in 2026. The integration type combines all optical components, such as lasers and detectors, on a single semiconductor substrate. Monolithic integration provides several benefits, including small size, high performance, and cost efficiency. PICs created through monolithic integration can deliver exceptional levels of integration and efficiency, making them well-suited for critical applications such as data centers, telecommunications networks, and optical sensing devices.

The hybrid segment is anticipated to register the highest CAGR during the forecast period. Hybrid Integrated PIC (Photonic Integrated Circuit) joins photonic and electronic components on one chip, combining optical functions such as detectors, lasers, and modulators with electronic circuitry to enable continuous data processing and communication. This integration boosts efficiency, reliability, and speed in sensing, high-speed optical communication, and quantum information processing applications. PICs utilize light's distinct properties, Hybrid Integrated PICs addresses the constraints of traditional electronic circuits and enable advanced technologies across various industries in the field of photonics.

By Component Analysis

To know how our report can help streamline your business, Speak to Analyst

Lasers Segment Dominated the Market Due to the Increased Demand for Faster Data Transmission

Based on component, the market is categorized into lasers, MUX/DEMUX, modulators, optical amplifiers, detectors, and attenuators.

In terms of market share in 2026, the lasers segment dominated the market with a share of 27.34%. Laser devices are essential elements in PICs and play a crucial role in a wide range of industries. They are vital components in optical communication systems, where PICs are extremely important. The increasing demand for faster data transmission, particularly in 5G networks, data centers, and long-haul fiber optics, is pushing the need for more efficient and smaller lasers within PICs. Additionally, lasers are utilized in diverse sensing applications such as LiDAR for environmental monitoring, autonomous vehicles, and industrial processes. As these technologies progress, the incorporation of lasers into PICs becomes increasingly critical for accuracy and dependability.

The modulators segment is expected to grow at the highest CAGR during the forecast period owing to its important role in the manipulation of optical signals. The PIC market is driven significantly by the growing need for high-speed data communication, leading to increased demand for advanced modulators.

REGIONAL INSIGHTS

Based on geography, the market is fragmented into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific Photonic Integrated Circuit Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 7.68 billion in 2025 and USD 9.23 billion in 2026.. This region, including China, has become a major market due to the growth of the electronics and telecom industries, along with the rapid transfer of semiconductor production facilities to Southeast Asian countries. China has seen rapid advancements in PIC technologies over the past decade, with over nine significant PIC projects being launched in the country. Multiple material technologies and platforms have been developed for a wide range of applications, focusing on broadband communication such as optical and wireless networks, optical interconnects, and coherent optical communication.

The Japan market is projected to reach USD 2.09 billion by 2026, the China market is projected to reach USD 3.25 billion by 2026, and the India market is projected to reach USD 1.28 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe is estimated to grow at the highest growth rate during the forecast period. The European Commission, the EU's executive branch, has made long-term investments in photonic integrated circuit technology. These investments encompass cutting-edge support for basic research, the development of proof-of-concept devices and software, and, more recently, the establishment of pilot line manufacturing. As a result, there is now a thriving ecosystem for PICs in the Europe, offering the potential to unlock the capabilities of PIC technologies and bring benefits to the local population across various economic and social aspects. Furthermore, there have been several other programs launched to progress PIC development in Europe. For instance, InPulse program aims to provide companies with innovative concepts, but lacking PIC manufacturing facilities, the opportunity to utilize most state0f0the-art production technology for PICs based on indium phosphide.The UK market is projected to reach USD 0.84 billion by 2026, while the Germany market is projected to reach USD 0.78 billion by 2026.

North America is expected to register the second-highest growth rate during the forecast period. The demand for PIC technology in North America is fueled by data centers and fiber optic communication WAN applications. The need to transfer data at high speeds is growing due to the rise in cloud computing traffic, and the rapid emergence of the Internet of photonics is likely to result in a thriving IC industry throughout the region. According to Cloudscene, the U.S. has the highest number of data centers globally, totaling nearly 2,700, which accounts for almost 33% of the world's data centers. Furthermore, service providers must meet the increasing demand for network capacity as mobile, video, and cloud services become increasingly essential. It is anticipated that companies will build their optical networks using PICs, which could have a positive impact on market growth. The U.S. market is projected to reach USD 3.96 billion by 2026.

The Middle East & Africa is expected to register a significant growth rate in the market during the forecast period. The increasing need for high-speed internet, data analysis, and upcoming technologies such as 5G and quantum computing drives the use of PICs. Additionally, government programs and funding for infrastructure development, support the growth of optical communication networks, leading to a demand for more effective and advanced PIC solutions in the region.

South America is poised for significant growth during the forecast period due to the expansion of urbanization and energy and power infrastructure.

KEY INDUSTRY PLAYERS

Market Players Use Merger and Acquisition Strategies to Expand Their Business Reach

Major industry players operating in the market are providing advanced PICs by providing higher electron mobility, greater design flexibility, and unique properties in their product portfolio. These companies prioritize acquiring small and local firms to expand their business reach. Moreover, mergers & acquisitions, leading investments, and strategic partnerships contribute to an increase in demand for products.

List of Top Photonic Integrated Circuit Companies:

- Infinera Corporation (U.S.)

- Intel Corporation (U.S.)

- Lumentum Operations LLC (U.S.)

- Ciena Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Broadcom (U.S.)

- POET Technologies (Canada)

- EMCORE Corporation (U.S.)

- Coherent Corporation (U.S.)

- STMicroelectronics (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Foxconn Interconnect Technology, a player in interconnect solutions for communication structure and other fast-growing markets, selected POET Technologies Inc.'s optical engines, such as 800G optical transceiver modules and Silicon PIC for its 1.6T.

- March 2024: Infinera introduced ICE-D, a fresh range of high-speed intra-data center optics utilizing monolithic InP photonic integrated circuit technology. This product aimed to significantly reduce the power and cost required per bit while offering intra-data center connectivity at speeds exceeding 1.6 Tb/s. This advancement empowered data center operators to efficiently manage the continuous expansion in bandwidth requirements.

- March 2024: MaxLinear and Jabil have announced that a family of 800G silicon photonics-based optical transceiver modules is now ready for production. These modules were designed to support the AI/ML revolution and are targeted at data center, metro, and wireless transport networks. Jabil is a global company known for its expertise in design, manufacturing, and supply chain solutions.

- August 2022: Lumentum Holdings Inc. finalized its acquisition of NeoPhotonics Corporation, a developer of lasers and optoelectronic solutions. The acquisition strengthened the company’s position to capitalize on the growing opportunities arising from the digital transformation of work and life. This transformation is causing continuous growth in the required capacity and efficiency of cloud and network infrastructure.

- June 2022: Intel Labs made a significant development in its research on integrated photonics, which represents the edge in enhancing communication bandwidth between computing silicon across networks and in data centers. The latest research showcases developments in multiwavelength integrated optics, such as eight-wavelength distributed feedback laser array incorporated on a wafer based on silicon. This array delivers exceptional wavelength spacing uniformity of ± 6.5% and output power uniformity of +/-0.25 decibel, surpassing industry specifications.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, leading applications, integration types, and components. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

By Integration Type

By Component

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 86.44 billion by 2034.

In 2025, the market value stood at USD 17.36 billion.

The market is projected to grow at a CAGR of 20.80% during the forecast period.

By component, the lasers segment led the market in 2025.

Growing applications in telecommunications and data centers is a key factor aiding market growth.

Infinera Corporation, Intel Corporation, Lumentum Operations LLC, Ciena Corporation, Cisco Systems, Inc., Broadcom, POET Technologies, EMCORE Corporation, Coherent Corporation, and STMicroelectronics are the top companies in the global market.

In 2025, Asia Pacific held the largest market share.

Europe is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us