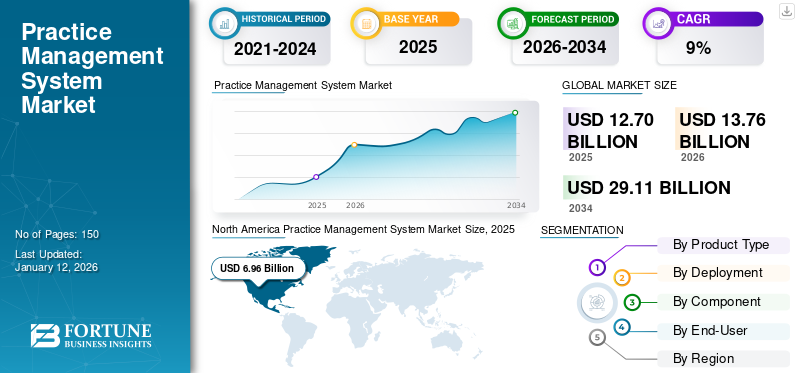

Practice Management System Market Size, Share & Industry Analysis, By Product Type (Integrated and Stand-alone), By Deployment (Cloud-based and On-premise), By Component (Software and Services), By End-User (Hospitals, Physician Offices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global practice management system market size was valued at USD 12.7 billion in 2025. The global practice management system market size is projected to grow from USD 13.76 billion in 2026 to USD 29.11 billion by 2034, exhibiting a CAGR of 9.82%. North America dominated the practice management system market with a market share of 54.83% in 2025.

Practice management system software streamlines administrative tasks in healthcare, enhancing efficiency and organization. It handles scheduling, billing, and patient records, optimizing workflows for medical professionals. This technology improves patient care by reducing paperwork, minimizing errors, and providing a centralized system for managing the daily operations of medical practices.

The rapid transition of the healthcare industry from manual medical records to Electronic Health Records (EHR) has transformed the record-keeping aspect in recent years. The advantages and features of these systems are enabling healthcare providers to improve efficiency within their practices at comparatively lower costs, leading to the rising adoption of these systems for multiple specialties.

Moreover, the growing geriatric population and rising healthcare access are leading to the increased need for patients’ data integration with practice management software. The integration of patient data, including medical history, treatment plans, and other clinical data, helps in generating comprehensive, integrated treatment plans and provides better patient outcomes. Furthermore, technological advancements in products further drive market growth. Augmented Reality (AR) and Virtual Reality (VR) are technologies that are used in the healthcare field to improve patient care. These technologies can be used in primary care clinics, operating rooms, emergency rooms, and dental offices.

- For instance, as per the data published by iFour Technolab Pvt. Ltd. in September 2022, Augmented Reality (AR) and Virtual Reality (VR) are assisting healthcare industries in a variety of ways to give the finest treatment and care possible. These technologies have proved to be efficient in the fields of medical education, surgery planning, and patient rehabilitation.

The COVID-19 pandemic had a positive effect on the overall practice management system market growth. Since there is a large patient pool suffering from COVID-19 infection, these healthcare solutions played an important role in smoothening the flow of patients during the treatment process. To meet the rapidly growing utilization and demand for these products, industry players implemented various strategies, such as the development and launch of new products, in turn capturing untapped market revenues.

- For instance, in March 2020, Innovaccer, Inc. launched its COVID-19 Management System. This solution is intended to facilitate the provision of immediate assistance to patients through remote assessments, virtual care, education, automated outreach, and guidance to government agencies and healthcare organizations.

Global Practice Management System Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 12.7 billion

- 2026 Market Size: USD 13.76 billion

- 2034 Forecast Market Size: USD 29.11 billion

- CAGR: 9.82% from 2026–2034

Market Share:

- Region: North America dominated the market with a 54.83% share in 2025. This is due to a well-established healthcare IT infrastructure, high digital literacy rates, significant government investment in digitalization, and high adoption rates among physicians.

- By Product Type: The integrated systems segment held the largest market share in 2024. These systems are favored because they offer comprehensive solutions that improve productivity and patient management by combining features like EHR, patient engagement, billing systems, and e-prescribing into a single platform.

Key Country Highlights:

- Japan: The market is expanding due to the rapidly growing adoption of practice management systems among healthcare professionals, contributing to the high growth forecast for the Asia Pacific region.

- United States: Growth is driven by strong government support for healthcare IT, high adoption rates among physicians, and major strategic partnerships, such as those between HCA Healthcare and Google Cloud, to integrate generative AI into hospital systems.

- China: The market is fueled by the rapidly increasing adoption of these systems by healthcare professionals as the country continues to modernize its healthcare infrastructure and workflows.

- Europe: The market is driven by government initiatives to digitalize healthcare systems across the continent, such as the E.U.'s focus on EHR interoperability, and efforts by local companies to achieve key certifications, enhancing product trust and adoption.

Practice Management System Market Trends

Integration of New Technologies with Electronic Health Records Identified as One of the Significant Practice Management System Market Trends

In recent years, healthcare systems have often operated in isolated silos, making it difficult to share patient information across different organizations and providers. However, interoperability helps in bridging these gaps by enabling seamless data exchange and communication between various EHR systems. For instance, as per the data published by RevenueXL Inc. in April 2023, interoperability is one of the most significant trends in the future of PMS platforms. Interoperable platforms allow healthcare providers to access comprehensive patient records in real-time, regardless of the provider or healthcare setting.

Furthermore, many hospitals and healthcare facilities are using Artificial Intelligence (AI) and machine learning to conduct analyses, gather information, and draw conclusions. Integrating practice management systems with telehealth platforms, robotic process automation, and big data management helps medical organizations provide remote care and improve clinical workflows.

Download Free sample to learn more about this report.

Practice Management System Market Growth Factors

Government Initiatives for Digitization of the Healthcare System by Providing Incentives to Boost Market Growth

One of the factors responsible for driving the practice management system growth is the initiatives undertaken by government bodies to boost the digitalization of the healthcare system. For a transition in the healthcare system, governments from various countries are spending a considerable amount of money to train health information technology workers and establish regional extension centers to provide technical and other advice. In addition, the launch of incentive programs that encourage hospitals and providers to adopt Electronic Health Records systems (EHR) is also increasing, in turn supplementing the global practice management system market growth.

- For instance, according to data published by Healthcare IT in June 2023, the European Union (EU) is involved in digitalizing healthcare systems across the continent. Initiatives range from Enhancing Electronic Health Record (EHR) interoperability to more comprehensive digital tools and services for patients.

Furthermore, promoting interoperability (formerly the Medicare and Medicaid EHR Incentive Programs) was developed to encourage eligible professionals and critical access hospitals to adopt, implement, upgrade, and demonstrate meaningful usage of certified electronic health record technology (CEHRT). Additionally, government authorities focus on bringing EHR to the administrative division of a country.

- For instance, as per the data published by CBC/Radio-Canada in February 2023, the government of Nova Scotia signed a USD 365.0 million contract to bring electronic healthcare records to the province.

High Return on Investments and Improvement in Revenue Cycle Management Process to Propel Market Growth

An integrated practice management system allows organizations with complex organizational structures to have seamless coordination amongst various departments and locations. Implementation of such systems in areas such as scheduling, staffing, claims processing, patient engagement, billing, and inventory management results in increasing the potential Return On Investment (ROI). These systems provide a significant return on investment by streamlining all aspects of practice workflow, from online appointment booking to patient recalls, while enabling administration staff to collect payments and process online claims with ease.

For instance, according to data provided by Ambula Health in January 2023, practice management system is essential for healthcare providers looking to streamline their revenue cycle management process. By implementing this software, healthcare providers are improving their revenue cycle management process in several ways, such as better data management, increased efficiency, and improved patient satisfaction. Thus, owing to the benefits offered by this software, the market is expected to witness higher adoption in the coming years, driving overall market growth.

RESTRAINING FACTORS

Increasing Incidences of Cyber Attacks Leading to Data Privacy Risks to Limit Market Growth

Healthcare systems, including hospitals and specialty clinics, use digital platforms to store sensitive patient information. However, the rising number of cyber-attacks and other data breaching activities are leading to a concern about data security and privacy among healthcare providers and patients. Due to the increasing number of patients suffering from chronic diseases, these cyberattacks target medical records and patient data, putting the safety and privacy of patients at risk, leading to either data loss or manipulation. The loss of data creates substantial financial and trust issues for healthcare settings, leading to loss of customer base, delay in treatment, and repetition of the whole consultation procedure. Also, the manipulation of patients' data leads to the delivery of inaccurate treatment.

- For instance, as per the data published by TechCrunch in May 2023, NextGen Healthcare, a U.S.-based provider of Electronic Health Records (EHR) software, confessed that hackers breached its systems and stole the personal data of more than 1.0 million patients, including approximately 4,000 Maine residents.

All the above-mentioned factors are anticipated to limit the market growth for practice management system up to a certain extent.

Practice Management System Market Segmentation Analysis

By Product Type Analysis

Highest Adoption of Integrated Systems Resulted in Dominance of the Integrated Segment

On the basis of product type, the market is categorized into integrated and stand-alone systems.

The integrated segment accounted for the highest global practice management system market share in 2024, owing to the several benefits offered, such as improved productivity, efficient patient management, and others. These solutions include EHR, e-prescription, patient engagement, and billing systems. The Integrated segment is projected to dominate the market with a share of 73.42% in 2026.

On the other hand, the stand-alone system segment is anticipated to witness considerable growth over the study period. This can be attributed to the fact that these systems focus mainly on functions associated with administrative and billing, particularly scheduling.

By Deployment Analysis

Cloud-Based Segment Led the Market Due to Technological Advancements in the Products

On the basis of deployment, the market is segmented into cloud-based and on-premise.

The cloud-based segment captured the largest market share in 2024. Factors contributing to this include easy accessibility of data through the web, automation of daily medical tasks, and others. Additionally, the lower installation cost of these systems, along with the reduced need for in-house maintenance, also supports the dominance of the segment. The Cloud-based segment is projected to dominate the market with a share of 75.5% in 2026.

On the other hand, the on-premise segment accounted for a comparatively lesser share of the market in 2024. The need for streamlined workflow, efficient management of patient records, and treatment planning and administrative tasks are some of the factors driving the segment's growth.

To know how our report can help streamline your business, Speak to Analyst

By Component Analysis

High Demand for Software Responsible for Dominance of the Segment in 2024

On the basis of component, the market is categorized into software and services.

The software segment held the dominating position in the market in 2024. This is attributed to the launch of advanced products aimed at easing medical practice management. Moreover, the recent outbreak of COVID-19 also supplemented the segment growth to manage healthcare services effectively. The Software segment is expected to lead the market, contributing 82.37% globally in 2026.

- For instance, in April 2023, eClinicalWorks announced advancements in its cloud technology with AI for keeping usability, security, and patient safety on top priority. This advancement can improve user experience and empower healthcare professionals to deliver the utmost quality of care.

- Similarly, in April 2023, Healthcare technology startup Suno launched AI-powered practice management software for audiology practices. This new software is designed to help hearing healthcare providers streamline their operations.

By End-User Analysis

Hospital Segment Dominated Owing to High Demand for PMS in Healthcare Settings

On the basis of end-user, the market is categorized into hospitals, physician offices, and others.

The hospital segment led the market in 2024 owing to the higher number of patient admissions leading to the growing demand for these solutions in hospital settings. These facilities adopt PMS solutions to manage administrative work along with other related medical tasks effectively. The Hospitals segment will account for 59.55% market share in 2026.

- For instance, Heartbeat Medical, a medical practice management software company stated that its software is being used by more than 35 healthcare providers and leading hospitals in Germany.

On the other hand, physician offices segment is expected to grow at a significant rate due to the increasing number of physicians across the globe. For instance, as per the data given by the American Medical Association, in 2020, around 49.1% of the total patient care physicians worked in physician offices.

REGIONAL INSIGHTS

Based on region, the market for practice management system is studied across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Practice Management System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the largest share of the global market in 2025, with a revenue of USD 6.96 billion. The region is anticipated to dominate the market throughout the forecast period. The dominance of the region is attributed to factors such as well-established healthcare IT infrastructure, high adoption among physicians, and high digital literacy rates. The U.S. market is expected to reach USD 7.02 billion by 2026.

- For instance, according to an article published in the Healthcare IT News in November 2023, the current U.S. government proposed a considerable increase in the healthcare IT budget in FY 2024, with an aim to improve and defend critical infrastructure. Such expansionary movements in healthcare IT infrastructure are anticipated to bolster the adoption of practice management system.

Moreover, increasing strategic collaborations between operating players in the region further supports market growth.

- For instance, in August 2023, HCA Healthcare and Google Cloud signed a partnership agreement for the use of generative AI technology in hospitals.

Europe

On the other hand, Europe held the second-largest share of the global market. A favorable growth environment, coupled with increasing efforts by different governments to improve the quality of care, has driven the European market growth. Additionally, recent product launches and company initiatives in the region also supplement the regional growth. The UK market is anticipated to reach USD 0.46 billion by 2026, while the Germany market is estimated to reach USD 0.59 billion by 2026.

- For instance, in April 2023, Closed Loop Medicine in the U.K. successfully achieved ISO 13485:2016 certification for its digital therapeutic platform. The company has been recognized as one of Europe's top 200 medical technology companies.

Asia Pacific

Asia Pacific is projected to witness the fastest CAGR over the forecast period. It is expected to record the highest CAGR during the forecast period. Key factors responsible for this high growth include the rapidly growing adoption of practice management system among healthcare professionals in China, India, and Japan. The Japan market is forecasted to reach USD 0.57 billion by 2026, the China market is set to reach USD 0.73 billion by 2026, and the India market is likely to reach USD 0.43 billion by 2026.

Rest of The World

Furthermore, Latin America and the Middle East & Africa are expected to witness comparatively lower growth owing to poorly developed healthcare IT infrastructure. However, gradual penetration of these solutions in these regions would boost market growth in the near future.

List of Key Companies in Practice Management System Market

Henry Schein Inc., and Athenahealth to Lead Market Growth with Strong Product Offerings

The market space for practice management system is moderately competitive, with the presence of several well-established and emerging players in the market. Henry Schein Inc., Veradigm LLC, Athenahealth Inc., and GE Healthcare are among the major players operating in the market. These players are focusing on strengthening their market presence through various strategic initiatives such as collaboration, partnerships, new product launches, and others.

- For instance, in May 2023, athenahealth, Inc., announced a partnership with LCH Health and Community Services to deliver a unified experience for its patients and providers. As a part of this partnership, both companies have implemented athenaOne, athenahealth’s integrated medical billing, cloud-based Electronic Health Record (EHR), and patient engagement solution.

Furthermore, other prominent players, such as Epic Systems Corporation, CareCloud, Inc., Cerner Corporation, and others, are also adopting several growth strategies such as collaborations, partnerships, and new product launches, in turn contributing to the growing competition in the market.

- For instance, in April 2023, Microsoft Corp. and Epic announced the extension of their strategic partnership to develop and integrate generative AI into healthcare.

LIST OF KEY COMPANIES PROFILED:

- Henry Schein, Inc. (U.S.)

- Veradigm LLC (U.S.)

- Athenahealth, Inc. (U.S.)

- Epic Systems Corporation (U.S.)

- CareCloud, Inc. (U.S.)

- Cerner Corporation (U.S.)

- MCKESSON CORPORATION (U.S.)

- General Electric Company (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2023 – Renaissance Physicians Partners (RPP), a physician-led organization, announced a partnership with Florence Health to manage RPP-owned practices.

- October 2023 – GE HealthCare collaborated with University Hospitals to implement enterprise digital solutions to help improve patient care and optimize processes.

- June 2023 – BoomerangFX, Inc. announced a partnership with DrFirst to offer a medication management platform for clients to maximize clinical workflows and patient engagement.

- April 2023 – Henry Schein, Inc. acquired Biotech Dental S.A.S., a provider of dental implants, clear aligners, and innovative digital dental software.

- December 2022 – Henry Schein, Inc. announced a partnership with VideaHealth to introduce Dentrix Detect AI.

REPORT COVERAGE

An Infographic Representation of Practice Management System Market

To get information on various segments, share your queries with us

The practice management system market research report provides an in-depth analysis of the industry. It focuses on market segments, such as product type, deployment, component, and distribution channel. Besides this, it offers the current market analysis in relation to the current market dynamics, the impact of COVID-19, and latest market trends. Additionally, the report consists of several factors that have contributed to the market’s growth. The market analysis also provides the competitive landscape of the market along the key company profiles.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.82% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Deployment

|

|

|

By Component

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 12.7 billion in 2025 and is projected to reach USD 29.11 billion by 2034.

In 2024, the market value stood at USD 6.96 billion.

The market will exhibit a steady CAGR of 9.82% during the forecast period of 2026-2034.

By product type, the integrated system segment led the market.

The increasing need for streamlined workflow, efficient management of patient records, and technological advancements in software solutions are the key factors driving the market growth.

Henry Schein, Inc., Veradigm LLC, Athenahealth, and Epic Systems Corporation are some of the major players in the market.

North America captured the largest share of 54.83% the market in 2025.

Surge in the demand for effective management of medical practices and need for reduction in healthcare cost are expected to drive the adoption of these systems.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic