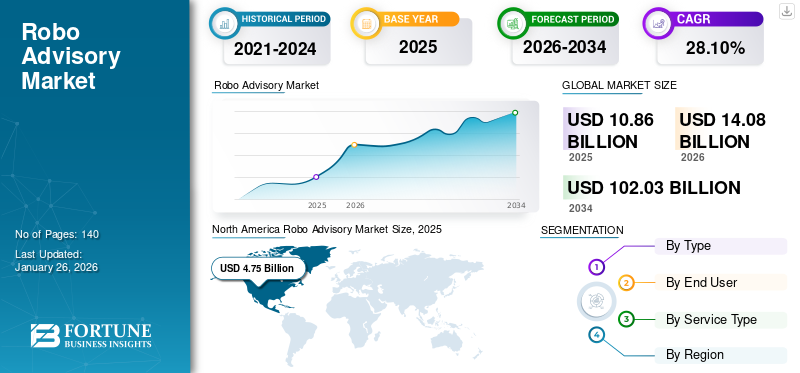

Robo Advisory Market Size, Share & Industry Analysis, By Type (Pure Robo-Advisors and Hybrid Robo-Advisors), By End User (Retail Investors, High-Net-Worth Individuals, and SMEs and Corporate Clients), By Service Type (Direct Plan-based/Goal-based and Comprehensive Wealth Advisory), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global robo advisory market size was valued at USD 10.86 billion in 2025 and is projected to grow from USD 14.08 billion in 2026 to USD 102.03 billion by 2034 exhibiting a CAGR of 28.10% during the forecast period. North America dominated the global market with a share of 4.75% in 2025.

The robo advisory market players provide a platform that offers automated financial services for end users. The market is evolving at an accelerated pace, driven by technological advancements, increasing investments in the financial sector, and market-related engagements, such as launch of new and improved solutions and relevant partnerships & acquisitions.

To add to this, companies are also investing in solutions that help educate kids about their finances, spending limits, and savings goals. For instance,

- April 2023: Acorns completed the acquisition of a digital banking firm, GoHenry, with the objective of enlightening kids about money. The acquired company provides a spending card for kids aged 6 to 18, which is linked to a money management software. The tool allows their parents to track transactions and set spending limits or savings goals.

Moreover, the increasing inclination of end users toward adopting an ESG investing strategy is bolstering the market growth. In recent years, the increasing popularity of hybrid robo-advisory services among high-net-worth individuals has positively impacted the market. The market has also witnessed an increase in the presence of companies that provide direct plan-based/goal-based services across the globe.

The COVID-19 pandemic had a positive impact on the market, recording an increase of 13% in accounts during this period. Market players, such as The Vanguard Group saw an increase of 14% in its Assets under Management (AUM). As per industry experts, the market is expected to grow at an accelerated pace during the forecast period owing to the increasing demand for hybrid robo-advisory services.

IMPACT OF GENERATIVE AI

Incorporating Generative AI Expertise into Robo Advisory Solutions to Help End Users Obtain Personalized Investment Advice

Generative AI has created a significant impact on the market. Recently, several financial leaders have reported incorporating gen AI capabilities for developing solutions that provide investment advice. For instance,

- May 2023: JPMorgan Chase introduced a software service similar to ChatGPT that provides investment advice using a disruptive form of artificial intelligence.

The traditionally available chatbots in financial sectors only provide straightforward services. They lack explanations related to investing and financial concepts. Thus, incorporating generative AI capabilities would be path-breaking for market players.

Moreover, using generative AI capabilities, robo advisors can use previous market trends and potential risks to offer better and customized investment advice for clients. In addition, SEI recently highlighted the emergence of generative robo advisors, which are capable of providing more personalized investment advice.

Thus, as the AI industry progresses, the market is expected to profit immensely in the coming years.

Robo Advisory Market Trends

Increasing Inclination of End Users Toward ESG Investing Will Accelerate Market Growth

The market is experiencing several trends, such as increasing demand for hybrid robo advisors and inclination of end users toward ESG investing. ESG investing refers to investments in businesses that strive to make a sustainable future. This type of investing strategy allows the end users to align their investment plans with personal ethics. In addition, ESG offers heavy returns on their investment.

As per a recent survey by Morgan Stanley, over 77% of investors across the globe are preferring sustainable investing. Besides, over 57% reported that their inclination toward sustainable investing has grown in the last two years, while 54% expected that, in the coming years, they will increase their sustainable investing efforts. The major factors driving the popularity of this type of investment are climate science findings and the performance of sustainable investments. The survey was conducted in October 2023, and respondents were reported to be over 2,802 across the globe.

This factor is pushing market players to incorporate ESG criteria in their solutions, which will further accelerate the global robo advisory market growth.

Download Free sample to learn more about this report.

Robo Advisory Market Growth Factors

Evolving Consumer Preferences in Implementing Investment Strategies Will Ensure Market Growth

Several digitalization and automation technologies have greatly impacted the finance industry. Among these, the most prominent technology is the robo advisors that provide tailored portfolio management and investment advice using data analysis and algorithms.

The key driving factors of the market include increasing demand for automated investment advisors, integration of new-age technologies in robo advisory platforms, and ease of use & cost-effectiveness of robo-advisory solutions. In addition, the main factor that is accelerating the market growth is the changing consumer preferences. As per the Schwab Modern Wealth Survey published in 2024, older generations have showcased a higher rate of participation in the investing department. On the other hand, the younger generations are beginning to invest more in the coming years. The chart below highlights the responses from American respondents who are currently implementing investing strategies for achieving their financial goals.

As per the above chart, over 28% of Americans prefer robo advisor investing strategy in 2024. The highest percentage (41%) is recorded among millennials, followed by gen Z with 40% that prefer robo advisor investing strategy in 2024. The chart also represents that although 56% of Americans currently opt for the buy-and-hold investing strategy, the population is also showcasing increasing inclination toward strategies, such as direct indexing (32%), fractional share investing (37%), automated or robo-advisor investing (28%), thematic investing (25%), and socially responsible investing (31%).

Thus, increasing technological advancements, rising focus on automated investment strategies, growing demand for robo-advisory platforms, and evolving consumer preferences are driving the market growth.

RESTRAINING FACTORS

Data Privacy Concerns to Negatively Impact Adoption of Robo Advisory Solutions

Although the market is gaining traction, several challenges remain evident that can hamper the market growth. These include inaccuracy of algorithm-driven results, data privacy concerns, and cyber threats. As robo advisors have critical information about end users, it becomes crucial to protect this information.

Furthermore, as per industry experts, trust in automated financial services is the most significant factor for bolstering their adoption. There have been doubts regarding the accuracy of algorithms that provide automated investment advice. There are also concerns regarding the accurate consideration of current market trends and potential risks.

To cope with these concerns, market players are investing in new-age technologies to improve the efficiency of robo advisory solutions.

Robo Advisory Market Segmentation Analysis

By Type Analysis

Popularity of Hybrid Robo Advisors Increased among High-Net-Worth-Individuals Due to Their Versatility

By type, the market is categorized into pure robo-advisors and hybrid robo-advisors.

The hybrid robo-advisors segment is projected to account for 56.53% of the total market share in 2026, increasing inclination of the population toward hybrid robo advisory services, and rising demand for tailored investment advice. According to a recent study by industry experts, the majority of investors have showcased interest in hybrid robo advisors. In addition, this type of robo-advisory service attracts high-net-worth individuals as they prefer the combination of technology and human recommendation for their financial requirements. Moreover, according to Refinitiv, financial advisors who integrated digital technologies experienced a 77% increase in their retention of clients. This finding indicates a healthy growth of the segment in the future.

In the coming years, the pure robo advisors segment is expected to record the highest CAGR primarily due to their cost effectiveness. As per industry experts, it has been observed that the number of young-generation investors is rising across the globe. This generation prefers digital platforms that provide investment advice conveniently and effectively. Owing to these reasons, the segment is expected to gain more traction during the forecast period.

By End User Analysis

High-Net-Worth Individuals Dominated Market Due to Need for Tailor-Made Robo Advisory Services

By end user, the market is divided into retail investors, high-net-worth individuals, and SMEs & corporate clients.

High-net-worth individuals are expected to represent 44.82% of the end-user market share in 2026. Several market players provide tailored services for high-net-worth clients. These players include The Vanguard Group, Inc., Betterment, and others. Personalized services, insights based on algorithms, data analysis, and efficiency encourage HNWI to adopt more robo advisors. Such services help these individuals make more informed business decisions.

The retail investors segment is expected to record the highest CAGR during the forecast period. The pandemic bolstered the segment’s growth as people were forced to stay at home, which gave rise to more accounts. Moreover, the effect of this lasted in the post-pandemic years as well as retail investors became more aware of tailor-made robo-advisory solutions. This increasing awareness is expected to attract more customers in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Service Type Analysis

Direct Plan-Based/Goal-Based Services Gained Maximum Traction Owing to Lower Fee Structure

By service type, the market is bifurcated into direct plan-based/goal-based services and comprehensive wealth advisory services.

The direct plan-based/goal-based service type segment is anticipated to account for 59.38% of the market share in 2026. Direct plan-based/goal-based advisors cater to customers that are looking for a lower fee structure and maximum revenue returns. Market players that offer goal-based robo-advisory services focus on the end users’ specific financial goals. These services are more popular as end users stay aligned with their financial goals and also benefit from personalized financial investment advice. Direct plan-based/goal-based services are majorly popular among retail investors.

In the coming years, the comprehensive wealth advisory services segment is expected to rise substantially owing to the expansion of economies, rising income, and need for effective robo advisory modules.

REGIONAL INSIGHTS

Geographically, the market is studied across the following key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Robo Advisory Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America held the highest global market share. Factors, such as a large presence of market leaders, including Betterment and Wealthfront Corporation, increasing popularity of robo-advisory software among the population, and recent developments in the market will cement the region’s dominance. In addition, several companies are catering to the rising demand for automated investing solutions across the region. The U.S. market is projected to reach USD 4.54 billion by 2026.

For instance,

- February 2023: Santander Bank NA announced its strategic partnership with SigFig to integrate digital tools that will transform the client investment experience. With the help of this partnership, the company developed the Santander PathFinder, a new automated investment management tool. The new tool helps customers effectively save for their retirement or work toward their long-term financial goals.

Furthermore, the European market ranks second in terms of generating revenue for the global market. The region has been experiencing rising demand for robo advisory platforms in recent years. Besides, countries, such as the U.K., Germany, and France have showcased consistent growth in the robo-advisory services market. Moreover, the presence of major financial institutions and innovative fintech firms will further boost the regional market’s growth.

Asia Pacific

In the coming years, Asia Pacific is expected to record the highest CAGR owing to the higher demand for robo advisory services from developing economies, such as China and India. Moreover, the increasing inclination of end users toward adopting automated investment services is driving the regional market growth rate. Factors, such as the growing middle-class population, increasing tech-savvy interests, and accelerated digitalization are expected to drive the regional market share in the coming years. The Japan market is projected to reach USD 0.76 billion by 2026, the China market is projected to reach USD 0.92 billion by 2026, and the India market is projected to reach USD 0.51 billion by 2026.

The MEA and South America captured the lowest shares of the global robo advisory market in 2023. Lack of awareness and appropriate infrastructure and economic factors are hindering the regional market growth. However, gradually developing interest among end users and investments in financial institutions are promising a healthy growth rate for these regions during the forecast period.

The below figure represents the findings from a survey of 300 respondents across the globe conducted by Economist Impact. Over 23% of respondents reported that robo-advisors/automated wealth management services are the non-traditional entrants that will be the biggest competitors for banks in the coming years. A similar belief was shared among Europeans (28%), North Americans (27%), Latin Americans (16%), Asia Pacific respondents (18%), and Middle Easterners & Africans (22%).

Europe

The UK market is projected to reach USD 0.95 billion by 2026, while the Germany market is projected to reach USD 0.79 billion by 2026.

KEY INDUSTRY PLAYERS

Lower Fees, Customized Pricing, and Relevant Partnerships to Help Market Players Drive Revenue Growth

The robo advisory ecosystem includes serval market players, such as service providers (Betterment and Wealthfront Corporation) and software providers. (SigFig and AdvisorEngine) The market players are adopting several business strategies to get ahead of their competitors. They are keen on lowering their fees and customizing their pricing for the services they offer. Moreover, they are continuously investing in new-age technologies, such as AI and Machine Learning (ML) to integrate them into their existing solutions and enhance customer experience. The small-scale market players are aiming at securing funds to develop innovative robo advisors and expand their geographical reach and team member count. Besides, the market players are also investing in business strategies, such as acquiring and partnering with relevant businesses, which include traditional banking service providers and small-scale robo advisors.

List of Top Robo Advisory Companies

- Betterment (U.S.)

- Wealthfront Corporation (U.S.)

- SigFig (U.S.)

- The Vanguard Group, Inc. (U.S.)

- Charles Schwab Corporation (U.S.)

- Social Finance, Inc. (U.S.)

- Acorns Grow Incorporated (U.S.)

- AdvisorEngine (U.S)

- Scalable Capital GmbH (Germany)

- StashAway (Singapore)

KEY INDUSTRY DEVELOPMENTS

- May 2024: Canada-based Manulife introduced a robo-advisory service that is focused on the mandatory provident fund ecosystem in Hong Kong. The company partnered with AutoML Capital and Syfe for the new digital portal, which will aim to “educate and encourage proactive review and management of MPF investments.”

- March 2024: Apex Fintech Solutions Inc. acquired AdvisorArch to strengthen its RIA Custody & Execution Platform with a collection of digital advice solutions. These tools will allow wealth management companies to enhance their customer experiences at scale.

- December 2023: Scalable Capital secured over USD 65 million in equity, which will help it expand its business across Europe. The countries in which the company is already active and aims to expand further are Austria, Germany, France, Italy, the Netherlands, and Spain.

- May 2023: Ritholtz Wealth Management introduced an automated digital advice platform, Good Advice Automated Wealth Management. The new launch provides customers with guidelines for their complete investment process, which includes financial planning and asset management. The platform charges a maximum fee of 0.50% of assets under management and requires a minimum bank balance of USD 15,000.

- January 2023: The Charles Schwab Corporation completed the acquisition of The Family Wealth Alliance, which serves family wealth companies that have ultra-high net worth end users. With this, both companies are expected to offer thought leadership resources and technologies focused on ultra-high-net-worth clients.

REPORT COVERAGE

The report offers its readers an elaborative analysis of the market, focusing on major factors, such as key market players, their service offerings, and leading use cases. In addition, it provides insights related to all macro and micro economic factors that impact the market growth. The impact of robo-advisory on wealth management and the overall financial sector is also covered in this market report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 28.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By End User

By Service Type

By Region

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 102.03 billion by 2034.

In 2025, the market was valued at USD 10.86 billion.

The market is projected to register a CAGR of 28.10% during the forecast period.

The high-net-worth individuals segment led the market in 2025.

Evolving consumer preferences while implementing investment strategies are driving the market growth.

Betterment, Wealthfront Corporation, SigFig, The Vanguard Group, Inc., Charles Schwab Corporation, Social Finance, Inc., Acorns Grow Incorporated, AdvisorEngine, Scalable Capital GmbH, and StashAway are the top players in the market.

North America held the highest market share in 2025.

By end user, the retail investors segment is expected to record the highest CAGR during the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us