FinTech Market Size, Share & Industry Analysis, By Technology (AI, Blockchain, RPA, and Others), By Application (Fraud Monitoring, KYC Verification, and Compliance & Regulatory Support), By End Use (Banks, Financial Institutions, Insurance Companies, and Others), and Regional Forecast, 2026–2034

FinTech Market Analysis

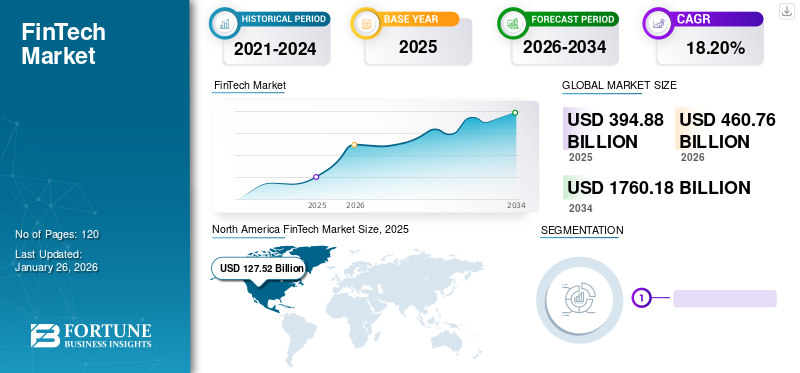

The global fintech market was valued at USD 394.88 billion in 2025. The market is projected to be worth USD 460.76 billion in 2026 and reach USD 1,760.18 billion by 2034, exhibiting a CAGR of 18.20% during the forecast period. North America dominated the global market with a share of 32.30% in 2025.

FinTech companies provide various financial technology services, tools, or solutions to other businesses (B2B) as a service. These services are typically delivered over the cloud, allowing other companies to integrate and use financial technology capabilities without developing these technologies in-house. Moreover, financial technology providers offer a wide range of financial services and technology solutions, including payment processing, Peer To Peer (P2P) lending platforms, fraud detection, blockchain technology, and more solutions. In the scope of work, we have included solutions provided by players such as Rapyd Financial Network Ltd., Unicorn Payment Ltd., Stripe, Inc., Mastercard, Fiserv, Inc., and others.

The advent of open banking and the use of Application Programming Interfaces (APIs) enables collaboration between fintech companies and traditional financial institutions. This partnership provides fintech companies with the opportunity to leverage traditional banks' data and infrastructure to deliver value-added services, develop innovative solutions, and improve customer experience.

The pandemic accelerated the digital transformation of financial services. As businesses and consumers increasingly turned to online and mobile banking, there was a growing demand for financial technology platforms. In addition, financial technology companies offering payment and transaction processing services experienced a surge in demand as e-commerce, contactless payments, and digital wallets became more prevalent during the pandemic.

FinTech Market Trends

Adoption of AI and ML Technology in Financial Technology Plays an Important Role to Propel Market Growth

Financial technology providers are incorporating AI and machine learning to enhance fraud detection, customer service, credit scoring, and personalization of financial services. Integration of AI in the solution enables faster, smarter, and more intuitive financial interactions. In addition, this technology plays an important role in meeting customer demands with high satisfaction. With increased digital financial transactions, there is a growing emphasis on cybersecurity. Financial technology companies are developing advanced security measures to protect financial data and transactions. Moreover, demand for real-time payments is on the rise as financial technology service providers are delivering solutions that enable instant, cross-border, and secure transactions. The above-mentioned factors contribute to market growth.

Download Free sample to learn more about this report.

FinTech Market Growth Factors

Adoption of Cloud Computing Technology in FinTech Services Optimizes Operations, Fueling the Market Growth

Cloud computing offers fintech service providers the ability to scale their infrastructure and services according to demand. This is essential for accommodating fluctuations in user activity and transaction volumes. Cloud services offer a pay-as-you-go model, allowing financial technology companies to manage costs effectively. They can scale resources up or down as needed, reducing the need for upfront infrastructure investments. Moreover, cloud technology offers flexibility, enabling financial technology service provider to develop, deploy, and iterate on their solutions rapidly. This agility is crucial in a fast-paced industry where innovation is key. Thus, the growing adoption of cloud computing in financial technology is expected to drive market growth.

Additionally, the advent of open banking and the use of application programming interfaces (APIs) enables collaboration between fintech companies and traditional financial institutions. This partnership provides fintech companies with the opportunity to leverage traditional banks' data and infrastructure to deliver value-added services, develop innovative solutions, and improve customer experience. These growth opportunities, driven by technological advancements, changes in consumer behaviour, and regulatory developments, make the fintech market a dynamic and promising sector with significant expansion potential.

RESTRAINING FACTORS

Issues Related to Data Privacy and Security Concerns May Hamper Market Growth

FinTech companies often collect and process personal and financial data. Ensuring data privacy and compliance with data protection regulations such as GDPR can be challenging. In addition, financial technology service providers handle sensitive financial data, making them attractive targets for cyber-attacks. Security breaches can have significant financial and reputational consequences.

Moreover, building trust with customers is vital in the financial sector. These companies may face scepticism from customers who are used to traditional financial institutions. These factors are anticipated to restrict the market growth in the coming years.

FinTech Market Segmentation Analysis

By Technology Analysis

Rising Demand for High Security and Transparency Offered by the Blockchain Technology to Propel the Segment Growth

Based on technology, the market is classified into AI, blockchain, RPA, and others (cryptography, biometrics, and others).

The blockchain segment is projected to dominate the market with a share of 38.40% in 2026. Blockchain provides a highly secure and immutable ledger, making it extremely difficult for unauthorized parties to alter or tamper with transaction data. This enhances security in financial transactions, reducing the risk of fraud and data breaches. In addition, transactions recorded on a blockchain are transparent and can be audited in real-time by all relevant parties. This transparency builds trust among participants and regulators.

The artificial intelligence (AI) segment is poised to grow at the highest CAGR during the forecast period. AI-powered chatbots and virtual assistants provide instant and efficient customer support, improving the overall customer experience. In addition, AI can quickly identify and flag potentially fraudulent activities, reducing the risk of financial fraud, which is expected to help the market growth in the upcoming years.

By Application Analysis

Increasing Need for Real-time Monitoring of Financial Transactions to Reduce Fraudulent Activities to Augment Fraud Monitoring Segment Growth

By application, the market is segregated into fraud monitoring, KYC verification, and compliance & regulatory support.

The fraud monitoring segment is projected to dominate the market with a share of 45.28% in 2026. FinTech solutions offer real-time monitoring of financial transactions, allowing for the immediate detection of suspicious activities or anomalies. These services use advanced analytics and machine learning algorithms to identify patterns and trends associated with fraudulent activities, enhancing the accuracy of fraud detection. Owing to these features, the segment is anticipated to continue its dominance during the forecast period.

The KYC verification segment is predicted to grow at the highest CAGR during the forecast period. FinTech solutions automate KYC processes, reducing the need for manual verification and paperwork, which can be time-consuming and error-prone. These services validate customer-provided information against various data sources, ensuring the accuracy and authenticity of the information.

By End-Use Analysis

To know how our report can help streamline your business, Speak to Analyst

The surge in Demand for Digital Payments to Propel the Adoption of Financial Technology Solutions in Banks

By end use, the market is segmented into banks, financial institutions, insurance companies, and others.

The banks segment is projected to dominate the market with a share of 36.90% in 2026, as banks can onboard new customers quickly and smoothly, reducing the time and effort required for account setup. Furthermore, market players are significantly integrating with financial technology-enabled banks to offer modern digital payment solutions, including mobile wallets and contactless payment, which contributes to the segment's growth.

The financial institutions segment is poised to expand at the highest CAGR during the forecast period as financial technology services offer data analytics and insights, helping financial institutions make data-driven decisions and improve services. These institutions can tailor these services to meet their specific needs and adapt to evolving market demands.

REGIONAL INSIGHTS

Based on region, the market has been analyzed across five major regions, namely South America, North America, the Middle East and Africa, Europe, and the Asia Pacific.

North America FinTech Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is leading the fintech market share globally. North America dominated the global market in 2025, with a market size of USD 127.52 billion. North America, particularly Silicon Valley, is a global centre for fintech innovation. Financial technology leverages this environment to drive continuous innovation in financial services. The growing need for customization, regulatory compliance, cross-selling opportunities, and FinTech industry trends are some of the key factors driving market growth in the region. The U.S. market is projected to reach USD 99.82 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

The Asia Pacific market is anticipated to grow at the highest CAGR during the forecast period. FinTech services expand access to financial products and services, particularly in underserved and unbanked areas of the Asia Pacific region. Many countries in the region, such as China, South Korea, Japan, and India, are mobile-first markets, and financial technology services cater to the high mobile penetration, making financial services more accessible. As per the survey, the Asia Pacific is anticipated to overtake the U.S. and become the world’s largest market by 2032. All these factors are expected to support the regional market growth during the forecast period. The Japan market is projected to reach USD 26.53 billion by 2026, the China market is projected to reach USD 30.86 billion by 2026, and the India market is projected to reach USD 26.58 billion by 2026.

Europe has a robust regulatory environment, and financial technology service providers often offer built-in regulatory technology (RegTech) features, ensuring compliance with complex financial regulations. The U.K. got ahead of other countries in the region in terms of investment in financial technology solutions. FinTech solutions provide data analytics and insights, helping financial institutions tailor their offerings to meet the unique needs of customers in different European countries. The UK market is projected to reach USD 17.51 billion by 2026, while the Germany market is projected to reach USD 15.97 billion by 2026.

Financial technology can bridge the gap between unbanked and underbanked populations in many parts of the Middle East & Africa, offering access to essential financial services. Many countries in the region have high mobile penetration rates, making financial technology solutions that cater to mobile users highly accessible.

In South America, financial technology facilitates cross-border payments, reducing remittance costs and supporting international trade and financial transactions in a region with significant cross-border activities. These factors play a vital role in the prominent growth of the market in the region.

List of Key Companies in FinTech Market

Companies Are Emphasizing Merger & Acquisition Strategies for the Expansion of Their Operations Globally

Key companies are emphasizing the expansion of their geographical boundaries globally by introducing industry-specific solutions. These companies are strategically acquiring and collaborating with local players to capture a strong regional hold. Moreover, key players in the market are introducing new products to attract new customers and retain their customer base. In addition, consistent investments in research and product development are thriving in the global financial technology market. Thus, through the deployment of such corporate strategies, companies sustain their competitiveness in the market.

List of Key Companies Profiled:

- Rapyd Financial Network Ltd. (U.K.)

- Unicorn Payment Ltd. (China)

- Stripe, Inc. (Ireland)

- Mastercard (U.S.)

- Finastra (U.K.)

- Fiserv, Inc. (U.S.)

- Block Inc. (Square) (U.S.)

- Adyen (Netherlands)

- Plaid Inc. (U.S.)

- Neo Mena Technologies Ltd. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 – FIS launched the FIS Fintech Hangout Series, an initiative to promote and connect fintech startups, FIS professionals, financial institutions, investors, and participants in the FIS Fintech Accelerator Program. In this series, the company share best practices and highlights the great work of participating fintech companies.

- September 2023 – Finastra launched compliance-as-a-service, an end-to-end solution for banks operating in the U.S. and Europe. This solution was launched on Microsoft Azure for instant bank payment.

- June 2023 – Adyen, a financial technology platform provider, launched payout services for businesses. This will enable customers to payout funds in the preferred method by removing third parties and unwanted delays in the fund transfer process.

- May 2023 – Rapyd engaged in a new strategic partnership with Belvo, a Latin America-based Open Finance data and payment platform. This partnership will enable businesses in the region to provide uninterrupted open finance experiences to their customers.

- April 2023 – Square introduced Tap to Pay on Android for merchants across Canada. This technology enables businesses to accept contactless credit card payments quickly and securely at no additional cost.

- March 2023 – Stripe, the U.S. financial technology company, raised USD 6.5 billion in funding at a valuation of USD 50 billion. The company previously secured USD 600 million in funding in March 2021.

REPORT COVERAGE

An Infographic Representation of FinTech Market

To get information on various segments, share your queries with us

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.20% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Technology

By Application

By End Use

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 1,760.18 billion by 2034.

In 2025, the market stood at USD 394.88 billion.

The market is projected to grow at a CAGR of 18.20% during the forecast period.

By end use, the banks segment captured the maximum share in 2026

The adoption of cloud computing technology in fintech services optimizes operations, which is driving the market growth.

Rapyd Financial Network Ltd., Unicorn Payment Ltd., Stripe, Inc., Mastercard, and Fiserv, Inc. are the top players in the market.

North America has the largest share in the market.

By end use, the financial institutions segment is expected to grow at the highest CAGR during the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic