Rotary-Wing Unmanned Aerial Vehicle (UAV) Market Size, Share, Industry Analysis & Russia-Ukraine War Impact Analysis, By Rotary-Wing Class (C0 to C6), By Control Method (Autonomous & Remotely Piloted), By Solution (Aerostructures & Mechanism, Securing System, Operating Software, Tethering Cord), By Application (Perimeter Security & Border Management, Combat & Combat Support Missions, Situational Awareness), By End User (Government & Defense, Energy, Power, Oil & Gas, Construction & Mining, Agriculture, Forestry etc.), & Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

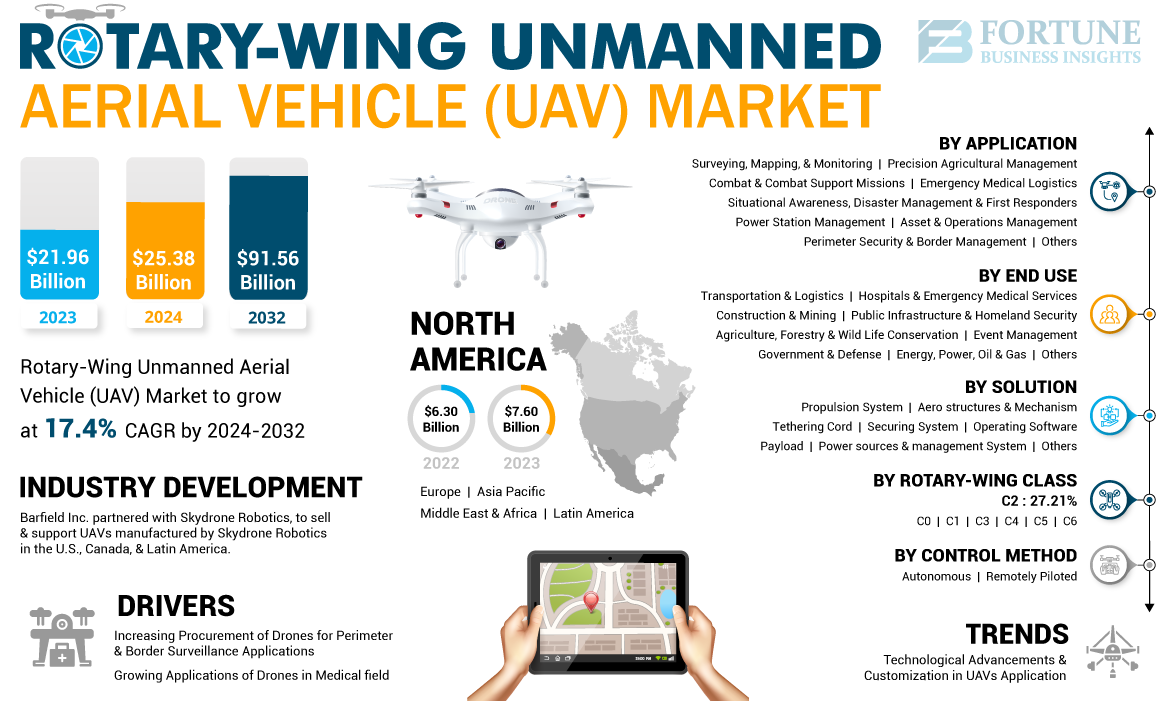

The global rotary-wing Unmanned Aerial Vehicle (UAV) market size was valued at USD 21.96 billion in 2023. The market is projected to grow from USD 25.38 billion in 2024 to USD 91.56 billion by 2032, exhibiting a CAGR of 17.4% during the forecast period. North America dominated the rotary-wing unmanned aerial vehicle (UAV) market with a market share of 34.61% in 2023.

A drone is an Unmanned Aerial Vehicle (UAV) that can be controlled or operated by onboard computers or by remote control from a specified distance. Rotary-wing UAVs generate vertical lift by rotating the rotor blades around the central mast, pushing air downward and taking the drone into the air.

Global Rotary-Wing Unmanned Aerial Vehicle (UAV) Market Overview

Market Size:

- 2023 Value: USD 21.96 billion

- 2024 Value: USD 25.38 billion

- 2032 Forecast Value: USD 91.56 billion, with a CAGR of 17.4% from 2024–2032

Market Share:

- North America held the highest share at 34.61% in 2023 due to strong military investment and established UAV developers

- The C2 class dominated in 2023 for its 4 kg payload and 120m altitude maintenance capacity

- Combat and combat support missions held the leading application share in 2023

- Government & Defense segment projected to hold 21% share in 2025

Key Country Highlights:

- China is projected to witness a strong CAGR of 18.7% during the forecast period

- Japan is expected to reach USD 1,177.5 million by 2025

- Europe is anticipated to grow at a CAGR of 17.3%, supported by companies like Parrot, Azure Drones, and AltiGATOR

Rotary-wing Unmanned Aerial Vehicle (UAV) consists of a series of single to 8 rotors that generate the thrust required. These UAVs are mainly used for in-place hovering activities. In addition, rotary-wing UAVs are relatively inexpensive and more maneuverable.

INDUSTRY ANALYSIS

The world was faced with the COVID-19 pandemic in early 2020. Despite the implementation of social distancing measures and other restrictions, the helicopter-like UAV drones market managed to survive during this time. Due to travel restrictions, self-operating rotary-wing Unmanned Aerial Vehicle (UAV) or drones were employed to deliver essential items including groceries, medications, and more directly to people's doors. Eighteen countries, including the U.S., U.K., Singapore, China, Ghana, Chile, and others, began utilizing drones for the delivery of these goods. Many operators of UAVs and drones took advantage of this opportunity and expanded into new territories.

The healthcare industry experienced the most significant impact from the UAV and drone market during the COVID-19. Drones were valuable in delivering medical supplies while complying with safety measures and avoiding human interaction due to travel restrictions and social distancing guidelines. Throughout this period, existing drone technology underwent numerous enhancements, including increased payload capacity, higher speed, extended battery life, improved stabilization, and other improvements. Drones played a crucial part in collecting test samples from residences, transporting vaccines and other necessities, identifying high-risk disease transmission areas, and carrying out various tasks. Many countries utilized these technologies.

- For instance, in October 2020, UPS, an American logistics company, initiated drone deliveries to transport medical supplies, PPE kits, and medications. The drone systems facilitated the quick delivery of time-critical medical supplies and PPE between the main health system campus and its other facilities.

- UAVs played a vital role in humanitarian missions by identifying heavily impacted areas and efficiently delivering aid. Additionally, they were valuable in overseeing natural disaster scenarios, such as floods, and directing rescue teams to individuals requiring assistance.

- For instance, in July 2020, remotely controlled drones are set to assist in search and rescue operations for the first time in the U.K, as announced. The drones, known as Baby Shark and previously tested in Gwynedd, will provide support for HM Coast Guard operations across North Wales.

RUSSIA-UKRAINE WAR IMPACT

Evolving Battlefield Dynamics to Boost UAV Utilization

The Russia and Ukraine war began in early 2022 and both sides have heavily invested in their military, with a particular focus on electronic equipment rather than traditional firepower. This shift toward electronic warfare has led to a significant increase in the use of drones and rotary-wing Unmanned Aerial Vehicle (UAV) on the battlefield, providing improved Intelligence, Surveillance, Reconnaissance (ISR), and communication capabilities. Both countries have escalated their deployment of drones to enhance their offensive potential while prioritizing the safety of their personnel.

- For instance, in June 2023, A British company focused on defense matters, the Royal United Services Institute (RUSI), released a report indicating that the Ukrainian military was reportedly losing more than 10,000 drones monthly, which equates to over 300 drones lost in a day.

Russia and Ukraine are not the only places with a high demand for rotary-wing Unmanned Aerial Vehicle (UAV). NATO nations such as the U.S. and U.K. sending military supplies to Ukraine has also led to increased drone production in those regions. In the Middle East, Iran and Turkey are supplying drones that see regular use on the battlefield. The ongoing war has brought attention to the effectiveness and dependability of UAVs, causing both sides to amass drones for strategic benefits. Ukraine primarily gets its drones from the U.S. and Turkey. The Turkish Bayraktar B2 drone has been widely used in Ukraine's counter-offensives, while kamikaze drones provided by the U.S. have been successful in dislodging soldiers from hazardous areas.

Russia has begun bringing in kamikaze drones from Iran and combining them with its own collection of domestic drones. Both countries have been utilizing civil commercial drones such as the DJI Mavic drones manufactured in China. This widespread use of drones has resulted in a growing need in Europe, as well as in North America and Asia Pacific. The rising intricacy of electronic warfare is also supporting the progression of rotary-wing Unmanned Aerial Vehicle (UAV) technology.

- For instance, in March 2023, Ukraine revealed the acquisition of more than 300 DJI Mavic 3T UAVs that have been deployed on the front lines. These rotary-wing Unmanned Aerial Vehicle (UAV) are equipped with thermal and zoom capabilities, making them well-suited for collecting intelligence in high-risk situations. Official Russian customs data provided by third-party data providers has shown that the Chinese government has supplied drones valued at over USD 12 million to Russia since the war began. The shipments included a combination of DJI drones and various models from smaller companies.

The expansion of drone availability has led to an increase in research and development efforts, making the production of drones and UAVs more affordable and accessible. The conflict has emphasized the necessity for uncomplicated, effective, and quickly produced drones to address diminishing supplies, signifying a change in the development of drone technology.

Rotary-Wing Unmanned Aerial Vehicle (UAV) Market Trends

Technological Advancements and Customization in UAVs Application to Boost Market Growth

Earlier, rotary-wing Unmanned Aerial Vehicle (UAV) were micro and mini versions of today’s products, and they have since undergone tremendous technological upgrades to keep up with the advancements around the world. Present-day UAVs and drones have a better range, better stabilization, better reliability, and have a wide range of sensors customizable to the needs of the operator. Even today, firms are focused on upgrading the existing technology, while trying to minimize the cost of buying and maintaining a UAV. Drones equipped with newer and better cameras and upgraded sensors find applications in film-making and videography industries.

Thermal and various other detection sensors are being used for land surveillance, discovering new mining sites and areas for construction. Improved thrust in drones is making them popular among firms for delivery purposes. Many such improvements are benefitting rotary-wing Unmanned Aerial Vehicle (UAV) market growth. Additionally, from manufacturing to UAV implementation, various emerging technologies such as 3D printing, machine learning, Internet of Things, Augmented Reality, Virtual Reality, Extended Reality (XR), are readily adopted for regular operations. Numerous applications involve customization and additional software or application installment on rotary-wing Unmanned Aerial Vehicle (UAV) for better functioning, expected to gain traction in the forecast period.

- North America witnessed rotary-wing Unmanned Aerial Vehicle (UAV) market growth from USD 6.30 Billion in 2022 to USD 7.60 Billion in 2023.

- In June 2023, UVAOS unveiled the deployment of drones for aerial photography and prospective surveys aimed at collecting data for pipeline constructions. The technology has been deployed for use in Northern Europe.

Download Free sample to learn more about this report.

Rotary-Wing Unmanned Aerial Vehicle (UAV) Market Growth Factors

Increasing Procurement of Drones for Perimeter and Border Surveillance Applications to Accentuate Rotary-wing UAV Market

Increased surveillance is one of the key benefits of deploying drones for personal security. They can effectively monitor large areas of external properties, including businesses, real estate, government facilities or any other location requiring enhanced security. Rotary-wing Unmanned Aerial Vehicle (UAV) provide widespread coverage compared to video surveillance capabilities, making them especially useful for any large facility with multiple entrances. They provide many monitoring and security benefits, such as HD records of anyone entering the property, capturing images of unauthorized or suspicious individuals, vehicles, and license plates. They can also automatically provide real-time alerts to security and law enforcement agencies in the event of suspicious activity driving the market growth.

Additionally, they help eliminate blind spots on a property and are easily equipped with sensors, including thermal imaging and night vision lenses, ensuring asset protection even at night. As drone technology continues to develop, their usefulness and applications will continue to expand. Border surveillance and security have become major global concerns due to increasing cross-border tension. The advent of rotary-wing Unmanned Aerial Vehicle (UAV) has revolutionized the surveillance domain, offering a comprehensive and effective solution for border protection and monitoring without costing the lives of soldiers.

- For instance, in March 2023, the Belgian Armed Forces unveiled the procurement of additional ANAFI USA rotary-wing unmanned aerial vehicles from Parrot. These micro-drones are intended for surveillance applications, enhancing border security measures.

Growing Applications of Drones in Medical field to drive Market Growth

In recent years, many healthcare providers are turning to rotary unmanned aerial vehicles to streamline emergency response operations, profoundly impacting the healthcare sector. By using drones, healthcare providers expand their reach into local communities and are able to save more lives. Medical drones, a type of rotary-wing Unmanned Aerial Vehicle (UAV), are utilized by healthcare personnel and NGOs to deliver essential supplies and care in emergency situations.

- For example, medical emergencies such as cardiac arrest and serious abrasions demand immediate help. However, it can take several minutes for nearby medical teams to reach those in need, sometimes resulting in late arrivals beyond their control, and leading to permanent damage or even death.

Additionally, to transfer personnel and equipment, drones are regularly being used to transfer various other medical components such as vital organs, surgical equipment, blood, and vaccinations. For instance, in February 2022, a rotary wing UAV delivered vital organ-lungs to a hospital in Toronto, Canada. During the COVID-19 pandemic, rotary wing UAVs were primarily used to transport medicines, necessity items, and vaccines to remote areas using rotary-wing Unmanned Aerial Vehicle (UAV).

Since the first few minutes are crucial in an emergency, medical teams are constantly seeking ways to reach patients faster. Air ambulances, small devices capable of carrying life-saving technologies such as medications, CPR kits, and even Automated External Defibrillators (AEDs), play a crucial role in facilitating rapid response care. These air ambulances and medical drones are thereby used to transfer personnel or material for medical use. Furthermore, these rotary-wing unmanned aerial vehicles are increasingly being used in search and rescue and humanitarian aid as well, which, in turn, is growing the market and application of air ambulance and medical drones worldwide.

RESTRAINING FACTORS

Stringent Government Rules and Regulations for Rotary-Wing UAVs to Hamper Market Growth

Regulations for rotary-wing Unmanned Aerial Vehicle (UAV) differ by country, affecting their use for commercial and military purposes. National security concerns have led to the implementation of rules governing factors such as UAV weight, flight altitude, permitted operation areas, and more. Manufacturers must ensure compliance with these regulations and production guidelines, limiting the availability of UAVs for commercial use. In several countries, operators of rotary-wing unmanned aerial vehicles are often mandated to maintain visual contact with the drone and obtain a license.

- For instance, in June 2023, The Interim Regulation for Managing Uncrewed Aerial Flights was introduced by the Chinese government. It mandates the registration of drones regardless of their size, and deems activities such as using drones for land surveying or non-Chinese individuals piloting drones as punishable offenses.

The rise in geopolitical tensions around the world is contributing to the decreased growth of the market. Many UAVs and drones used for commercial purposes are built with cameras, leaving them vulnerable to cyber-attacks. These features also create worries about potential monitoring through the system, presenting a threat to national security. Consequently, several countries have imposed limitations on goods from specific manufacturers or countries, resulting in a slowdown in market expansion.

- For instance, in May 2023, DJI, a Chinese company, was banned from using its drones in two U.S. states. This action stemmed from the company's blacklisting by the U.S. Department of Defense and other agencies over concerns of potential data leaks through the drones' network.

Rotary-Wing Unmanned Aerial Vehicle (UAV) Market Segmentation Analysis

By Rotary-Wing Class Analysis

Operational Flexibility with Altitude Maintenance Places C2 Rotary-Wing at the Apex

By rotary-wing class, the market is classified into C0, C1, C2, C3, C4, C5, and C6. The C2 segment dominated in 2023. Under the C2 segment, the rotary-wing unmanned aerial vehicle can carry a maximum weight of 4 Kgs and maintain an altitude of 120m above ground. Due to its load carrying capacity, the C2 segment has high demand in military operations.

- The C2 segment is expected to hold a 27.21% share in 2023.

The C4 segment is anticipated to witness the fastest growth during the forecast period. Under the C4 segment, the rotary-wing unmanned aerial vehicle can carry a maximum weight of 25 Kgs and maintain an altitude of 120m above ground and a horizontal distance of 150m from ground obstacles.

To know how our report can help streamline your business, Speak to Analyst

By Control Method Analysis

Remotely Piloted Drones Dominate Fueled by their Several Applications and High Demand

Based on control method, the market is classified into autonomous and remotely piloted. The remotely piloted segment dominated the market in 2023. The segment is experiencing significant growth driven by military applications, advancements in technology, and increasing commercial adoption. UAVs are capable of long-distance flight at low-altitude. Remotely operated UAVs have become increasingly popular in recent years in many countries due to the increasing demand for drone technology and its wide range of applications.

Autonomous is poised to be the fastest growing segment in 2024-2032 period. It includes the CDS (Command and Data System) and FPS (Flight Planning System), where the flight path and flight radius are established before the operation. The UAV has full control without any input from the ground operator. Mission-Based High Payload Platform (MBHPP) UAVs are mission based high payload UAVs designed for mission specific applications in the U.S., China, Russia, and Israel. The autonomous segment is projected to generate USD 2,788.1 million in revenue by 2025.

By Solution Analysis

Aero structures & Mechanism Holds Leading Position Owing to Increasing Concerns of Securing System in UAVs to Support Safety

Based on solution, the market is segmented into aero structures & mechanism, securing system, operating software, tethering cord, power sources & management system, payload, propulsion system, and others. Aero structures & mechanism dominated and held the maximum share in 2023. High-tech companies are expected to contribute to technological innovation in the aeronautical structure & mechanics of UAVs, resulting in a smooth development cycle and significant improvements in UAV performance.

Securing systems is going to be the fastest-growing segment during the forecast period. The rising significance of payload, range, and endurance of a rotary-wing Unmanned Aerial Vehicle (UAV) are top priorities for OEMs and operators, coupled with the emergence of cyber-attacks on UAV will bring about significant changes in the competitive environment. To address this challenge, securing systems plays an important role and is expected to gain high demand in the forecast period.

By Application Analysis

Specialized UAV’s Designed for High Payload Capacities and Specific Mission Applications for Combat Support Catalyze the Market Growth

The application segment is segmented into perimeter security & border management, combat and combat support missions, situational awareness, disaster management & first responders, surveying, mapping, & monitoring, precision agricultural management, power station management, asset & operations management, emergency medical logistics, and others.

Combat and combat support missions dominated the segment in 2023, the growth of drones in combat and combat support missions is significant, reflecting their evolving role in modern military operations. This sector is experiencing rapid advancements and increasing adoption across various military applications.

Emergency medical logistics emerges as the fastest-growing segment in 2024-2032. The use of drone technology in emergency medicine is one of its most promising applications, where a rapid response is necessary to enhance patient care. During the pandemic, medical drones have become more popular globally. They are used to transport Personal Protective Equipment (PPE), COVID tests, laboratory samples, and vaccines where direct human-to-human contact is prohibited for infection control.

By End-User Analysis

Growing Demand for UAVs in Defense Sector for Combat & Surveillance Supports Government & Defense Segment’s Growth

The end-user segment is categorized into government & defense, energy, power, oil & gas, construction & mining, agriculture, forestry & wild life conservation, public infrastructure & homeland security, hospitals & emergency medical services, transportation & logistics, event management, and others.

Government & Defense segment dominated the market in 2023. Military UAVs are expected to remain popular in the coming years as defense and security communities continue to utilize UAVs for surveying, mapping, transportation, combat, and surveillance. The government & defense segment is expected to hold a 21% share in 2025.

Hospitals & emergency medical services is the fastest growing segment during the forecast period. The COVID-19 pandemic also led governments and Original Equipment Manufacturers (OEMs) to adopt and implement flexible rules, approvals, trials, and trial flights for medical purposes. As a result, many countries began to experiment and test UAV performance.

REGIONAL INSIGHTS

Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. The rotary-wing Unmanned Aerial Vehicle (UAV) market share is estimated to be dominated by North America, followed by Asia Pacific and Europe.

North America Rotary-Wing Unmanned Aerial Vehicle (UAV) Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is projected to hold the largest market share as majority of the UAV developers are located in this region. The growth of the UAV market in North America can be attributed to a number of factors, including the increase in military spending by the Air force, resulting in an increase in UAV demand in the U.S. Additionally, the market in Canada is expected to grow as a result of an increase in Canadian exports and an upturn in the economy of drone industry.

Asia Pacific is projected to witness the fastest-growth over the forecast period due to China’s expected dominance in the market. Heavy-duty Unmanned Aerial Vehicles (UAVs) are in high demand in commercial and defense applications, such as combat, cargo and more.

- The rotary-wing unmanned aerial vehicle market in Japan is expected to reach USD 1,177.5 million by 2025.

- China is projected to witness a strong CAGR of 18.7% during the forecast period.

The European UAV market is divided into a number of segments and is dominated by a few players. Some of the leading drone manufacturers in the European UAV market include: Azure Drones SAS, Parrot Drones, Terra Drone, Onyx Scan advanced liDAR Systems, and AltiGATOR unmanned Solutions. These manufacturers are spending a lot of money to upgrade their technology and add new features to their drones to support various commercial applications.

- Europe is anticipated to grow at a CAGR of 17.3% during the forecast period.

In the Middle East, the UAV market is highly segmented, with major players including SZ DJI Technology Co. Ltd Parrot SA AeroVironment Inc. BlueBird Aero Systems Ltd Terra Drone Corporation. Technology development in the Middle East UAV market is mainly based on cooperation between UAV manufacturers and UAV solutions companies for a long term agreement. UAV service providers are seeking to expand their revenue by diversifying their solution portfolio to cater to the unique needs of the end-users in the region, such as construction, infrastructure management, security and surveillance.

Even though Latin America is one of the least developed UAV markets globally, it has a lot of potential for growth. The U.S. is influencing military procurement in Latin America through several bilateral initiatives, such as Plan Colombia and the Merida Initiative, which are expected to generate more contracts for U.S.-based companies. Local manufacturers can compete with major foreign players by upgrading products with state-of-the-art technologies, boosting their regional presence.

KEY INDUSTRY PLAYERS

Growth of Advance Technology by Key Players to Propel Market Growth

The rotary-wing UAV market is highly fragmented, with many manufacturing companies dominating the market. The top companies have a strong product portfolio and strong distribution networks in both developed and emerging countries and new market participants entering into the market. Currently, the leading players in the market are DJI (China) Parrot (Switzerland), Elbit Systems (Israel), Yuneec (China). These companies accounted for most of the global rotary-wing UAV market rank in 2023. However, since there are no stringent entry barriers in the market, domestic players will continue to dominate in the global market.

List of Top Rotary-Wing Unmanned Aerial Vehicle (UAV) Companies:

- AeroVironment Inc. (U.S.)

- Autel Robotics USA LLC (China)

- AIrobotics Inc. (Ondas Holdings Inc.) (U.S.)

- American Robotics Inc. (Ondas Holdings Inc.) (U.S.)

- Asylon Inc. (U.S.)

- Azur Drones S.A.S. (France)

- BAE Systems plc (U.K.)

- Elbit Systems Ltd. (Israel)

- Fotokite AG (Switzerland)

- H3Dyamics LLC (France)

- Shenzhen HEISHA Technology Co. Ltd. (China)

- Israel Aerospace Industries Ltd. (Israel)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Parrot Drone S.A.S. (France)

- SZ DJI Technology Co. Ltd. (China)

- Teledyne Technologies Inc. (U.S.)

- Textron Systems Corporation (U.S.)

- Tonner Drones S.A. (France)

- Yuneec International Co. Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 –During the Unmanned Systems Exhibition and Conference (UMEX) 2024 in Abu Dhabi from 23 to 25 January, the Edge Group of the United Arab Emirates (UAE) secured a deal to deliver 200 HT-100 and HT-750 unmanned helicopters to the Ministry of Defence (MoD) of the nation.

- August 2024 –Rotor Technologies, Inc. is introducing two new unmanned aerial vehicles (UAVs) for the 2025 model year, namely Airtruck, a utility UAV capable of carrying more than 1,000 lbs of payload, and Sprayhawk, an agricultural UAV equipped with a 110-gallon capacity. Both aircraft will be available at an introductory price lower than USD 1,000,000.

- July 2023 - IoTechWorld avigation Pvt Ltd, a leading agri-drone manufacturer, declared that it has won a large contract from IFFCO, a cooperative major, to supply 500 drones for the spraying of nano liquid urea, and DAP.

- June 2023 - Barfield Inc. entered into a partnership agreement with UAV manufacturer, Skydrone Robotics, to sell and support UAVs manufactured by Skydrone Robotics in the U.S., Canada, and Latin America.

- June 2023 - The U.S. Department of Defense awarded a contract to AeroVironment to develop its high-altitude solar-powered UAV. AeroVironment plans to deploy a network of high-altitude long-range UAVs to support global internet connectivity. The fixed-wing aircraft is expected to fly at an altitude of approximately 65,000 ft, or 19,812 m, and will carry sensors.

- March 2023 - An Indian company is in talks to supply Indian-made drones to Australia’s Navy. The drone company was supported by the Indian Navy in developing its products, including its human-carrying ‘Varuna’ drone that was presented to India’s Prime Minister at an event.

- May 2022 - FLIR Defense, a wholly-owned subsidiary of Intel Corporation, secured an additional USD 14 million order to supply its Black hornet 3 PRS (Personal Reconnaissance and Navigation Systems) to the U.S. Army.

REPORT COVERAGE

The market research report gives an in-depth analysis of the market by identifying the leading companies in the market, product types, and leading applications. The report also provides market trends and key developments in the market. In addition to the factors mentioned above, the report also includes several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 17.4% from 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Rotary-Wing Class

|

|

By Control Method

|

|

|

By Solution

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market value stood at USD 21.96 billion in 2023 and is projected to reach USD 91.56 billion by 2032.

Growing at a CAGR of 17.4%, the market will exhibit steady growth in the forecast period (2024-2032).

The remotely piloted segment led the global market in 2023.

SZ DJI Technology Co. Ltd., Elbit Systems Ltd., American Robotics Inc. (Ondas Holdings Inc.), Asylon Inc. (U.S.), Azur Drones S.A.S. (France), BAE Systems plc (U.K.) and AeroVironment Inc. are some of the leading OEMs in the market.

North America is projected to capture the largest share of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us