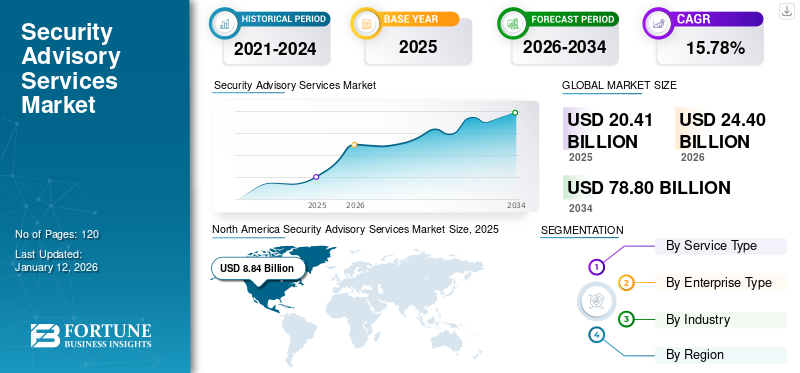

Security Advisory Services Market Size, Share & Industry Analysis, By Service Type (Vulnerability Management, Incident Response, Security Risk Management, Compliance Management, and CISO Advisory & Support), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, Healthcare, Government, Manufacturing, Energy & Utility, IT & Telecom, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global security advisory services market size was valued at USD 20.41 billion in 2025. The market is projected to grow from USD 24.4 billion in 2026 to USD 78.8 billion by 2034, exhibiting a CAGR of 15.78% during the forecast period. North America dominated the global market with a share of 43.34% in 2025.

Security advisory services includes security assessment services, web application penetration testing services, vulnerability scanning, infrastructure penetration testing, phishing & security awareness services. These services enable enterprises to meet and deploy security policies.

As the digital economy is growing, the number of digital crimes has also surged with it. The increasing number of online transactions and mobile interactions have created millions of attack opportunities for cybercriminals. According to industry experts, damage from cyberattacks will cost USD 10.5 trillion annually by 2025. In the wake of cyber-attacks and threats, organizations around the world spent USD 150 billion on cybersecurity in 2021. However, due to this, the demand for security advisory services will witness growth in the coming years.

COVID-19 IMPACT

Surge in Cyber Criminal Activities During Pandemic Propelled Market Growth

The COVID-19 pandemic caused an increase in both the likelihood and impact of cyber-attacks, as the organizations reacted rapidly to potentially major operational and financial challenges. Cybercriminals capitalized on the pandemic by sending phishing emails claiming to have important updates or encouraging donations, impersonating trustworthy organizations. In June 2020, the National Cyber Security Center reported 350 cases of cyber-attacks, due to increase in work from home policy during the pandemic.

The surge in remote work demands attention on cybersecurity as individuals working from home have more exposure to cyber risk. According to the Nuspire threat report, there were 1,620,910 Botnets events, 1,597,858 Malware events, and 26,156,165 exploitation events in the year 2020. Also, according to Hackmageddon, the total number of major attacks across the globe reported in the news was higher in almost every month of 2020. This surge in criminal activities led to increasing demand for various cybersecurity solutions and services among organizations, driving the market growth.

Security Advisory Services Market Trends

Rising Venture Deals across Cybersecurity Startups to Aid Market Growth

SMEs are often the most common size of business within a country, as they contribute up to 40% to the GDP in evolving economies. These businesses are least able to tackle cybersecurity attacks. Breach Investigations Report survey stated that 43% of cyberattacks target small businesses, and once an attack occurs, the financial fallout can be harmful to the business. On average, cybersecurity incidents cost businesses USD 200 million. This surges the need for cybersecurity awareness activities.

According to a GCI survey, 60% of countries have engaged in enhancing cyber awareness among SMEs, private sector companies, or government agencies in the past two years. Furthermore, venture deals in cybersecurity start-ups significantly increased in 2021. According to Momentum Cyber, a financial advisory firm for the security industry, cybersecurity start-ups raised a significant amount in venture capital for the year 2021. Nine M&A deals in 2021, including Auth0’s acquisition by Okta Proofpoint’s acquisition by Thoma Bravo and McAfee’s acquisition by TG, are valued at more than USD 1.0 billion.

Furthermore, according to Verizon, SMBs revealed a rising dependence on security service providers. Around 65% of small businesses reported that they currently obtain IT services from security services vendors, and 35% responded that they would invest in these services in the future.

Thus, rising investments in cybersecurity startups are expected to drive market expansion for security advisory services during the forecast period.

Download Free sample to learn more about this report.

Security Advisory Services Market Growth Factors

Rising Demand for Security as a Service among Enterprises Drives Market Growth

Security as a Service is gaining traction globally due to the ongoing adoption of cloud-based services among industries. In order to enhance productivity, enterprises are also gradually focusing on streamlining their business models by implementing cloud services. Moreover, for streamlining operations, SMEs do not have strict security measures to secure their files, networks, endpoints, and applications from cyber-attackers.

As SMEs highly adopt cloud services, it is estimated that there will be a huge opportunity for cloud-based service providers, which in turn will drive the global market size. As per Interpol reports, during the pandemic, around 59% of cyber-attacks reported were related to phishing, scams, and fraud. The report further suggests that this trend is expected to increase due to the economic downturn and shift in the business landscape following the pandemic. This tends to create opportunities for the market players.

RESTRAINING FACTORS

High Cost of Security Advisory Services to Hinder Market Expansion

Over the years, the frequency of cyber-attacks has increased, leading organizations to increase their investments in IT security to protect themselves from threats. However, several SMEs have budget constraints for cybersecurity, due to which there is a high frequency of cyber-attacks that hamper market growth. The cybersecurity investments by many enterprises do not fulfill their security needs. Therefore, cyber-attacks frequently occur in such enterprises. Hence, the high cost of security type of advisory services is a major factor hindering market expansion.

Security Advisory Services Market Segmentation Analysis

By Service Type Analysis

Budget Constraints Among Companies to Boost CISO Advisory & Support Segment Growth

By service, the market is segmented into compliance management with the share of 24.67% in 2026, incident response, security risk management, vulnerability management, and CISO advisory & support. Among these services, the CISO advisory & support segment is anticipated to witness the highest CAGR during the forecast period owing to budget constraints among enterprises. CISO helps enterprises form strategies and also monitors the processes that prevent cyber threats. It is one of the effective ways to manage risk and maintain the information security system.

The vulnerability management segment dominated the security advisory services market share in 2022 as this service helps enterprises automate the remediation of the vulnerabilities that frequently appear in the network. Vulnerability management minimizes the security team’s effort, mitigates the possibilities of cyber-attacks, and strengthens the security posture.

By Enterprise Type Analysis

Growing Security Concerns to Boost Large Enterprises Segment Growth

By enterprise type, the market is bifurcated into SMEs and large enterprises. The large enterprises segment dominated the market share of 56.58% in 2026 and is expected to grow with the highest CAGR during the forecast period, owing to growing security concerns. The potential financial loss, reputational harm to the brand, legal repercussions, and business interruption caused by security breaches. Large businesses use security advisory services to identify vulnerabilities, implement efficient security measures, and create incident response plans that minimize the effects of security incidents while preserving business continuity.

SMEs is estimated to witness steady growth during the forecast period as most of the SMEs invest less in cybersecurity due to a lack of awareness, lack of IT resources and budget constraints. As SMEs are investing in digitalization, the risk of cyber threats is increasing among SMEs. Hence, players in the market need to invest in marketing activities to spread awareness among SMEs regarding the importance of security services.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Healthcare Segment to Lead Due to the Rising Data Breaches in Healthcare Industry

Based on industry, the market is classified into BFSI, IT & telecom, healthcare, government, manufacturing, energy & utility, and others. The government segment is anticipated to grow at the highest CAGR with market share of 24.98% in 2026, due to the rising data breaches in the healthcare industry. In 2020, a cyber-attack in Germany led to the death of a patient due to delayed treatment. However, the segment’s growth is led by the increasing cyber threats and attacks, forcing organizations in the healthcare sector to invest heavily in security solutions.

The BFSI segment holds a maximum share, owing to the need for a secure, reliable, and cost-effective platform that offers protection against continuous threats of cybersecurity breaches in the industry. Due to the rising cyber threats, organizations in the BFSI sectors are widely adopting security services to enable convenient and secure finances.

REGIONAL INSIGHTS

The market is studied across the regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further classified into leading countries.

North America Security Advisory Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 8.84 billion in 2025 and USD 10.38 billion in 2026. North America generated maximum revenue in 2022, owing to the increasing diversity, volume, and sophistication of cyber threats. The market is witnessing growth in the region as the number of teleworkers has increased exponentially. Prior to the COVID-19 outbreak, around 47% of U.S. workers had never worked remotely. Post-COVID-19, 44% of employees are working remotely five or more days a week, and 67% of cyberattacks target remote workers, placing businesses at risk. However, enterprises are adopting these advisory services to protect their data and critical information from cybercriminals. The U.S. market is projected to reach USD 8.49 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow with the highest CAGR during the forecast period owing to the rapid digitalization among enterprises and increasing instances of advanced attacks. As per IBM’s X-Force Threat Intelligence Index 2021, Asia accounted for around 25% of global cyberattacks, with India ranking in second position, making Asia Pacific an attractive target for cybercriminals. According to IBM’s index, server access was the most common attack type in Asia, accounting for a fifth of all cyberattacks. With the increase in cyberattacks, a lack of comprehensive cybersecurity policies, and changing data protection legislation, the security services space in the region could see a surge in the coming years, with enterprises trying to understand the risk. The Japan market is projected to reach USD 0.64 billion by 2026, the China market is projected to reach USD 1.51 billion by 2026, and the India market is projected to reach USD 1.34 billion by 2026.

Europe

Europe is witnessing substantial growth as enterprises are investing in security services due to changing government policies and regulations related to data security. Cyber threats present a major obstacle in Europe‘s path to prosperity, and only 32% of businesses have a cybersecurity strategy. Therefore, organizations in various industries are focusing on investing more in security advisory services, further propelling the market demand in the region. The UK market is projected to reach USD 0.87 billion by 2026, and the Germany market is projected to reach USD 0.64 billion by 2026.

South America and the Middle East & Africa

South America and the Middle East & Africa are experiencing significant growth as the digital transformation has expanded access to financial, health, and education services for people across the countries in the regions. The digital transformation is increasing privacy and cybersecurity concerns. Furthermore, due to security concerns, governments and businesses are ensuring adequate protection by adopting security services. This creates opportunities for security advisory services players to enhance their customer base and service offerings.

Key Industry Players

Major Players Focus on New Product Launches to Strengthen Market Position and Drive Market Growth

Key players, such as Cisco, Deloitte, DXC Technologies, and others operating in this market, are actively innovating advanced services to cater to customer demands. Furthermore, these market players proactively pursue partnerships, collaboration, and mergers and acquisitions to boost their security type of advisory services.

List of Top Security Advisory Services Companies

- Cisco (U.S.)

- DXC Technologies (U.S.)

- KPMG (U.K.)

- PwC (U.K.)

- EY (U.K.)

- Deloitte (U.S.)

- NTT Security (Japan)

- Sage Data Security (U.S.)

- Verizon (U.S.)

- TCS (India)

KEY INDUSTRY DEVELOPMENTS

- November 2023: PwC U.K. entered into a strategic alliance with Wiz. The alliance combines PwC’s Cyber Risk and Advisory Services with Wiz’s Cloud Native Application Protection Platform for customers.

- November 2023: TCS entered into collaboration with Amazon Security Lake and introduced the Cyber Insight Platform. Through this collaboration, TCS extended its cybersecurity portfolio with a range of services, including advisory services, vulnerability management, and others.

- June 2023: Coalfire entered into collaboration with AWS to help customers quickly enter and scale new business opportunities. The collaboration aims to make Coalfire’s advisory services and penetration testing services available to AWS.

- September 2022: KPMG India entered into a partnership with CyberArk to combine KPMG’s advisory services with CyberArk Identity Security Platform to help clients safeguard against insider and external cyber threats.

- June 2022: DXC Technology introduced a new advisory service to assist Australian state government agencies. This advisory service provides a shared platform for government agencies to come together and learn, exchange, and improve their experiences.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights the competitive landscape. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.78% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 78.8 billion by 2034.

In 2025, the market was valued at USD 20.41 billion.

The market is projected to grow at a CAGR of 15.78% during the forecast period.

The vulnerability management type segment is expected to lead the market.

Increasing cyber threats are expected to boost market growth.

Cisco, DXC Technology, TCS, and Deloitte are the top players in the market.

North America dominated the global market with a share of 43.34% in 2025.

By industry, the healthcare industry is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us