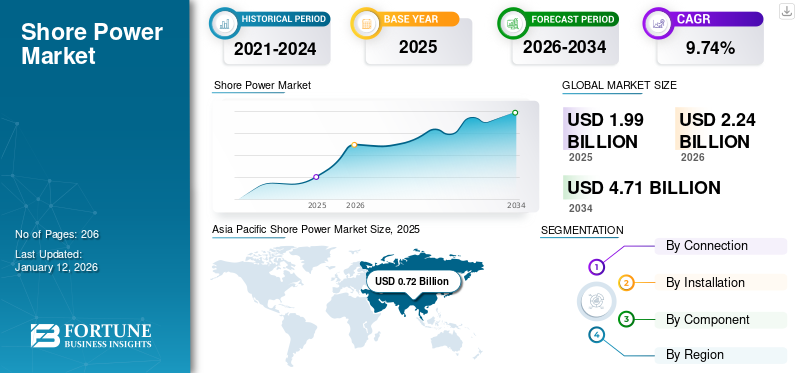

Shore Power Market Size, Share & Industry Analysis, By Connection (Shoreside and Shipside {Passenger Vessel, Merchant Vessel, Offshore Support Vessel, and Specialized Vessel}), By Installation (New Installation and Retrofit), By Component (Transformer, Switchgear, Cables and Accessories, Static Frequency Converter, and Others), and Regional Forecast, 2026-2034

Shore Power Market Size

The global shore power market size was valued at USD 1.99 billion in 2025. The market is projected to grow from USD 2.24 billion in 2026 to USD 4.71billion by 2034, exhibiting a CAGR of 9.74% during the forecast period. Asia Pacific dominated the shore power industry with a market share of 36.42% in 2025. The Shore power market in the U.S. is projected to grow significantly, reaching an estimated value of USD 583.02 million by 2032.

The ships docked at port require power for various purposes such as lighting, maintaining heating and cooling systems, and running other essential functions, primarily provided by the ship's diesel-powered auxiliary engines. Shore power, referred to as cold-ironing or alternative marine power, provides electrical power from the shore to docked ships, enabling the shutdown of their auxiliary engines and eliminating the need for diesel fuel consumption, further contributing to the reduction of air emissions and improving local air quality. Moreover, by providing ship operators with an alternative to utilizing diesel auxiliary engines during docking, shore power technology helps reduce fuel expenses for ship owners.

The COVID-19 pandemic led to a significant reduction in global shipping activity, particularly during the early months of the outbreak. As ships reduced their voyages or were idled, the need for shore power connections in ports decreased. The COVID-19 pandemic caused disruptions in the global supply chain, affecting shore-power equipment and infrastructure production and delivery, delaying some shore-power projects.

The COVID-19 pandemic disrupted the market by affecting shipping activity, supply chains, financial priorities, and regulatory processes. However, it also highlighted the importance of environmental sustainability and the need for resilient, cleaner, and more efficient port operations.

Shore Power Market Trends

Growing Port Infrastructure to Enhance the Market Expansion

Rising port infrastructure amid increasing trade volumes of cargos across the nations led to an increase in the construction of additional ports across the globe. The governments of growing economies and developed nations have been making investments for the expansion of the old ports and the establishment of new ports. For instance, Sudan entered into a USD 6 billion contract with a coalition headed by the AD Ports Group from the UAE and Invictus Investment for establishing a fresh port and economic zone in the Red Sea. The investment in the modernization and expansion projects, leads to a surge in integrating shore power systems to accommodate docked vessels. This trend is further favored by environmental regulations, aimed at reducing emissions from maritime activities as well as growing awareness of the economic and environmental benefits of shore power.

Download Free sample to learn more about this report.

Shore Power Market Growth Factors

Ongoing Advancements in Technology to Drive Market Demand

Ongoing advancements in shore power technology are crucial in driving market demand. These advancements make shore-power solutions more attractive, efficient, and environmentally friendly, leading to increased adoption in the maritime industry. Technological improvements have made these systems more energy-efficient, reducing electricity losses during transmission. This increased efficiency translates into cost savings for both port operators and ship owners.

Advances in frequency conversion technology have resulted in more flexible and adaptable systems. They can accommodate ships with various electrical systems, voltage requirements, and frequency standards. Integrating digital control and automation features streamlines the connection and disconnection process, improving safety, efficiency, and ease of use for ship crews and port personnel.

Technological advancements enable remote monitoring and management of shore-power systems. This real-time oversight enhances operational efficiency and facilitates rapid diagnostics and issue resolution. Smart shore-power systems can effectively help manage power distribution, ensuring an even load and preventing overloads. This contributes to grid stability and reduces the risk of disruptions.

Reduction in Low-Frequency Noise and Operational Costs at Ports to Spur Product Demand

Marine power, used in ships docked to the shoreside for electricity, is helpful in reducing the noise created by ships while at shore. Shoreside electricity powers the onboard electrical systems in the vessel, including cargo pumps, ventilators, communication devices, lights, and others, without turning on the auxiliary engine. This helps reduce low-frequency noise and vibration, enabling the crew to save the ship's fuel requirement for diesel engines. Furthermore, it is cost-effective and quickly aligns with shipping companies looking to achieve emission targets.

For instance, in May 2023, the Netherlands Ministry of Infrastructure shared plans to allocate USD 153.10 million to build shore-power facilities at ports around the country, with the initial phase at the Port of Rotterdam. Building shore-power plants benefits the environment, reduces noise pollution, and can create nitrogen space in the port for climate projects.

Shore-power is mainly provided on the shoreside of many international ports worldwide. The tariffs on electricity provided by these ports vary in different countries. Additionally, the cost of electricity also differs. With the use of shore-power, the cost of power decreases as engines are shut off, and in many cases, ships adapting to shore-power are given priority. Furthermore, the relative fuel price is high at many ports, increasing the operational cost. This operational cost can be reduced by using shore-power installations.

For a ship with many regular calls to only a few ports, a retrofit investment to connect shore-power is more likely to produce reliable returns than if its port calls are scattered and unpredictable. Similarly, ports with traffic concentrated on a few vessels are more likely to see positive commercial benefits from providing shore-side energy than ports with many infrequent users, whose implementation is unlikely to be profitable. The reduction of operational costs is the major factor for the development of this market. Hence, regulations for reducing noise and port operational costs will increase product demand over the forecast period.

RESTRAINING FACTORS

High Cost of Installation and Maintenance of Shore Power System Creates Hindrance in Market Expansion

The price of shore power systems involves fixed investment and operating cost expenses. Fixed investments encompass coastal and ship investments in onshore energy infrastructure, including high-voltage electricity, transformers, switchboards and control panels, power distribution systems, cable reel systems, and frequency converters. The two most significant expenses related to beach infrastructure are frequency conversion equipment and high-voltage power supply, constituting about half of all capital investments. Shipping costs may range from USD 300,000 to USD 2 million, depending on vessel type, size, and the need for an internal transformer.

There is also a notable difference between modernization and new projects: retrofitting sometimes costs up to twice as much as additional costs for new construction investments. Operating costs are mainly related to electricity costs and taxes, both of which vary by region. Sweden reduces taxes on electricity used by terrestrial power systems. However, some electricity providers also charge subscription fees.

For instance, in 2019, the Northwest Seaport Alliance (NWSA) initiated the installation of a shore-power system at Seattle and Tacoma with an estimated cost of USD 33 million. This figure included USD 5.6 million for the T-18 terminal, however in 2023, the cost has reached USD 28 million with a completion date in 2030. Similarly, in Europe, Enova SF and NOx Fund are state-funded entities dedicated to deploying technologies such as shore-power and electric vehicle charging facilities in Norwegian ports. Enova SF has invested more than USD 64.55 million in more than 100 projects in various Norwegian ports. Hence, the rising year-on-year cost of installation of systems across the globe creates a hindrance in the shore power market growth.

Shore Power Market Segmentation Analysis

By Connection Analysis

Shoreside Segment to Dominate due to the ongoing Advancements in Shore Power Technology

Based on connection, the market is segmented into shoreside and shipside, which is further segmented into passenger vessels, merchant vessels, offshore support vessels, and specialized vessels.

The shoreside segment is projected to lead the market share. There is an increasing focus on reducing air pollution and greenhouse gas emissions from ships while they are docked in ports. Many regulatory bodies and international agreements, such as MARPOL Annex VI, require vessels to limit their emissions when at berth. This has led to a higher demand for shore power solutions, which are more environmentally friendly than shipboard power generation. The systems are generally more energy-efficient and produce fewer emissions compared to onboard ship generators.

Ports and shipping companies are recognizing the economic and environmental benefits of using shore-power. Thus, all these factors dominate the shoreside segment. Collaboration within the maritime industry, involving port authorities, shipping companies, and technology providers, can foster the development and implementation of shore-power solutions. Joint efforts and shared best practices may contribute to the increasing adoption of shore-power on the shore side.

Shipside segment is the second leading segment in this market. Shore power provides a significant opportunity by replacing fossil fuels with cleaner grid electricity. Public and industry awareness of the environmental impact of port operations is rising, driving demand for cleaner solutions like shore power. Thus, all these factors is expected to drive the shipside segment demand.

By Installation Analysis

New Installation Segment Held the Largest Market Share in due to Surge in the Number of New Shore Power Installations

Based on installation, the global market is segmented into new installation and retrofit.

The new installation segment is the dominant segment in the global market. The installation of new shore-power systems is rapidly increasing in China and Western European countries due to the rise in the requirement for shipping lines and the binding of regulations to curb GHG emissions. For instance, Hareid Group's marine division launched its HG Shore Power solution in 2021, and several units are already in use in shipyards and ports on the west coast of Norway. The solutions are offered in two power classes: 550 and 1000 kVA. The compact tanks are insulated and have heating and ventilation systems in addition to ABB ACS880 Multidrives.

Some governments and organizations offer financial incentives to encourage ports and ships to adopt shore power solutions. These incentives can help offset the upfront costs of retrofitting. While new installations still dominate the market, the retrofit segment is expected to see continued growth in the coming years due to these factors.

By Component Analysis

To know how our report can help streamline your business, Speak to Analyst

Static Frequency Converter Segment Leads with its Advanced Control Systems

Based on component, the global market is segmented into transformer, switchgear, cable and accessories, static frequency converter, and others.

The static frequency converter segment is the largest segment in the market. The dominance of the segment can be influenced by various factors, including technological advancements, regulatory requirements, and market demand. As more ports and shipping companies adopt shore-power solutions to reduce emissions and comply with environmental regulations, the demand for reliable and efficient frequency converters is likely to increase. Shore power is often adopted as a part of sustainability initiatives in the maritime industry.

Transformer is the second leading segment in this market. Transformers cater to various applications within this market. They are used in both new installations and retrofits, catering to different ship sizes and power demands. This versatility increases their overall market share.

REGIONAL INSIGHTS

Based on region, the global market is segmented into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific Shore Power Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 0.72 billion in 2025 and USD 0.82 billion in 2026. Asia Pacific holds the largest shore power market share globally. The region is experiencing robust economic growth and urbanization, leading to an increased demand for energy. Shore-power can help reduce emissions and dependence on fossil fuels in ports. Some of the world's busiest ports are located in Asia Pacific, dealing with a significant volume of container traffic and maritime activities. Ports in the region are seeking solutions to reduce emissions and comply with local and international environmental regulations, making shore-power an essential consideration. Air quality and environmental concerns in many Asian cities further emphasize the need for solutions such as shore-power installations to mitigate pollution and improve local environmental conditions. Governments in the Asia Pacific region are increasingly supporting clean energy initiatives, including shore-power, through subsidies, incentives, and regulations. The region's technological advancements in various industries, including energy and maritime, make the implementation of shore-power solutions more accessible and cost-effective.

North America

Ports in North America are undergoing modernization and expansion to accommodate larger vessels and increase capacity. As part of these developments, ports may incorporate shore-power infrastructure to enhance their environmental performance and attract environmentally conscious shipping companies. All these factors contribute to driving market growth in the region.

European shore power market is flourishing due to a combination of regulations, environmental concerns, economic benefits, technological advancements, and industry dynamics. With continued support and development, shore power is likely to become an increasingly prevalent solution for a cleaner and more sustainable European maritime sector. All these factors to drive the market demand in the Europe region.

Key Industry Players

Eaton's Strategic Expansion Bolsters Data Center Power Solutions through the Acquisition of Power Distribution, Inc. (PDI)

Eaton's involvement in the acquisition of Power Distribution, Inc. (PDI) is aimed at expanding its range of data center power distribution and monitoring solutions. The company provides sustainable solutions that help consumers manage hydraulic, electrical, and mechanical power more accurately and effectively.

In February 2020, the Power Management Company acquired Power Distribution, Inc., a major supplier of mission-critical power distribution, power monitoring services, and equipment for data centers and commercial and industrial consumers. The company reported sales of USD 125 million in 2019. PDI is a global supplier of power distribution and monitoring solutions for data centers and other critical electrical systems. PDI has operational facilities in California and Virginia and employs around 450 people.

List of Top Shore Power Companies:

- ABB (Switzerland)

- Wartsila (Finland)

- Siemens (Germany)

- Schneider Electric SE (France)

- Cavotec (Switzerland)

- ESL Power Systems, Inc. (U.S.)

- SmartPlug System (U.S.)

- Cochran Marine LLC (U.S.)

- Blueday Technology (Norway)

- VINCI Energies SA (France)

- Igus Inc. (Germany)

- Nidec Industrial Solutions (Italy)

- Power Systems International (U.K.)

- Hitachi Energy Ltd. (Switzerland)

- Ensmart Power Ltd (U.K.)

- Jinan Xinyuhua Energy Technology Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: ABB signed an agreement with Finnish shipbuilder Meyer Turku to supply two new Finnish multipurpose patrol vessels with an integrated power and propulsion package, including two Azipod thrusters and an Onboard DC Grid™ electrical system. The 98-meter vessels to be delivered in 2025 and 2026 will replace the departing Tursas and Uisko patrol vessels.

- January 2023: Port of San Diego, in collaboration with Cochran Marine LLC, completed a project worth USD 4.4 million with equipment purchase and for construction management, coordination, testing, and commissioning. The mobile cable positioning device can be used with any shoreside electric power system, not just Cochran Marine installations.

- September 2022: Wartsila Corporation signed a contract to supply an integrated hybrid propulsion system for two new hybrid ro-ro vessels. The ships would be built at China Merchants Jinling Shipyard (Weihai) Co., Ltd. for the Swedish shipping company Stena RoRo. The ships are the world's first methanol-powered hybrid ro-ro ships and would operate on Stena Line's Irish Sea system.

- May 2022: Siemens announced the construction of two new SIHARBOR in Kiel, which will be Europe’s largest shore-power connections and will be operating by the end of year 2023. These two shore power systems supply sustainable power through local power grid systems. Supplying green onshore power saves 12,000 metric tons of CO2 per year. An additional benefit is an end to noise emissions and vibration caused by the ships’ diesel generators.

- July 2021: Cavotec was awarded three orders for its innovative shore-power connection systems by global marine equipment manufacturer Samsung Heavy Industries, which is a supplier of clean-tech systems that are playing a key role in the modernization and de-carbonization of the world’s ports. The total financial value of these orders is USD 3.2 million.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the development of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.74% from 2026 to 2034 |

|

Value |

Value (USD Billion) |

|

Segmentation |

By Connection

|

|

By Installation

|

|

|

By Component

|

|

|

By Country

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 1.99 billion in 2025.

The market is likely to grow at a CAGR of 9.74% over the forecast period (2026-2034).

The global market size is expected to reach USD 4.71 billion by 2034.

Based on connection, the shoreside segment is expected to lead the market.

The market size of Asia Pacific stood at USD 0.72 billion in 2025.

Reduction in low-frequency noise and operational costs at ports is a key factor driving the market development.

Some of the top players in the market are ABB, Wartsila, Siemens, Cavotec, Igus Inc., Hitachi Energy Ltd., and others.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us