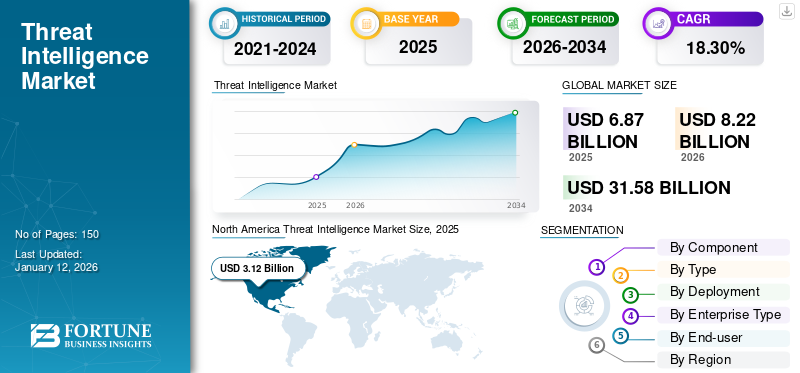

Threat Intelligence Market Size, Share & Industry Analysis, By Component (Solutions, Services), By Type (Strategic, Tactical, Operational), By Deployment (Cloud, On-Premise), By Enterprise Type (SMEs, Large Enterprise), By End-user (BFSI, IT & Telecom, Manufacturing, Healthcare, Energy & Utilities, Retail, Others), and Regional Forecast, 2026-2034

Threat Intelligence Market Size

The global threat intelligence market size was valued at USD 6.87 billion in 2025 and is projected to grow from USD 8.22 billion in 2026 to USD 31.58 billion by 2034, exhibiting a CAGR of 18.30% during the forecast period. North America dominated the global market with a share of 44.70% in 2025.

Threat intelligence refers to the procedure of recognizing and analyzing cyber threats. It is the process of collecting data on a prospective threat or collecting, handling, and analyzing that data to understand threats better. These platforms centralize the collection of threat data from numerous data sources and formats. These are designed to aggregate the data in one place and present it in an understandable and usable form.

Threat intelligence is an essential part of the cybersecurity network. A cyber threat intelligence solution can help avoid data loss with its well-organized CTI program, where enterprises can identify cyber threats by preventing data breaches from leaking sensitive information. Other benefits of threat intelligence solutions include informed decision-making, automated responses, performance metrics, granular threat visibility, and many more.

The COVID-19 pandemic positively impacted the market, with government agencies worldwide developing implementations of new strategies to support the cyber concerns expressed by the organizations. Due to COVID-19, many organizations are going through stages of response, recovery, and renewal. By building business resilience and enabling agility, an organization can sustain the COVID-19 crisis and adapt to the new normal.

Threat Intelligence Market Trends

Rising Implementation of Artificial Intelligence (AI) in Security Solutions to Aid Market Growth

Artificial intelligence (AI) has the potential to transform cybersecurity significantly.

Threat intelligence provides contextual and actionable advice on cyber threats targeting the organization. Integrating AI into this intelligence provides deeper insight and ensures scalability as attack volumes increase. It has become an important information security technology as AI quickly analyzes loads of events to identify threats, from malware exploiting zero-day vulnerabilities to identifying dangerous behaviors that could lead to attacks.

Implementation of AI in threat intelligence helps enterprises improve threat detection, automate processes, minimize human error, accelerate troubleshooting, and provide enhanced user experience. The major types of artificial intelligence that help in threat intelligence include generative AI, machine learning, and deep learning.

Due to the above factors, security leaders are investing in AI. According to a 2020 survey conducted by Centrify:

- 64% of security leaders believe that AI lowers the cost of detecting and responding to breaches.

- 69% of enterprises see AI as a necessary investment for responding to cyber-attacks.

- 51% of executives see cyber threat detection as the primary use case for AI.

The AI built-in security characteristic is one of the key factors impelling the market growth.

Download Free sample to learn more about this report.

Threat Intelligence Market Growth Factors

Rising Digital Technologies in Data Security Owing to Increased Cyber Attacks to Drive the Market Growth

Cybercrime has been rising for years and shows no sign of slowing down. The pandemic has led to an increase in working-from-home situations, resulting in increased cyberattack rates. Organizations are adopting a work-from-home model, which is raising concerns about corporate security.

On an average, a new company falls victim to ransomware every 10 seconds worldwide. Harris Federation, Channel Nine, Florida Water System, CAN Financial, Bombardier, Acer, Microsoft Exchange, and Sierra Wireless are some companies that faced major cyberattacks in 2021.

Besides, the advent of cloud computing and cybersecurity have pushed the boundaries from single networks to distributed networks. Threat intelligence solutions provide insight into attacks as they occur. Therefore, organizations' increasing use of threat intelligence programs to analyze global cyberattacks and threat data is expected to boost market growth.

According to Endpoint security research at Tanium, 75% of organizations use threat intelligence on an ongoing and frequent basis. Thus, rising cyber-attacks are contributing to the growth of the global market.

RESTRAINING FACTORS

Lack of Skills and Trained Security Analysts to Create Challenges for Industry Expansion

The biggest obstacle to securing industry infrastructure is the lack of security professionals. Janet Manfra, deputy director of CISA, said talent shortages in public and private sectors could create national security risks. Countries such as Japan and the U.K. struggle to find qualified cybersecurity professionals.

Despite the ever-expanding digital marketplace, the shortage of security professionals managing critical infrastructure is growing. This leads to the search for trained and skilled security professionals to operate threat intelligence solutions effectively.

According to the Vulcan Cyber Survey, 73% of managers stated that a lack of skills to control threat intelligence is a key problem.

The lack of trained security analysts creates a challenge for market players.

Threat Intelligence Market Segmentation Analysis

By Component Analysis

Rising Need for Advanced Threat Management Solutions to Boost Market Growth

Based on component, the market is analyzed into solutions and services.

The solutions segment accounted for the highest market revenue share, with over 53.85% of the market share in 2026. Operational security teams can save time and increase effectiveness with real-time insights from threat intelligence solutions. The increasing adoption of solutions such as security information and event management, security and vulnerability management, log management, incident forensics, identity and access management, risk and compliance management, and user and entity behavior analytics positively impact the market.

The rising need for advanced threat management services, professional training, and support services among enterprises worldwide will help the growth of threat intelligence services with the highest CAGR from 2025 to 2032. Such managed and professional services enable enterprises to understand the global threat landscape better, predict attackers’ subsequent moves, and take quick action to prevent attacks.

By Type Analysis

Increased Need for Data on Incoming Attacks to Propel the Operational Segment Growth

By type, the market is categorized into strategic, tactical, and operational.

The operational segment held the largest market share with a share of 35.05% in 2026. This is on account of the increased need for information on specific incoming attacks by cybercriminals. The operational segment offers information about the nature of the attack, the capabilities and identity of the attacker, and indications of when the attack will hit the organization.

The tactical type of threat intelligence is anticipated to record the highest CAGR during the forecast period. This type of threat intelligence offers security squads enhanced insights regarding how cybercriminals attack. They provide security teams with information about the tools that are used to take off attacks, intensify privileges, and settle systems and data. Thus, it is used more by security teams and squads to prevent attacks.

By Deployment Analysis

Rising Adoption of Cloud-Based Security Owing to Security Concerns to Boost the Market Growth

By deployment, the market is categorized into cloud and on-premise.

The cloud segment held the highest market with a share of 65.67% in 2026 and is predicted to record a leading CAGR during the forecast period. With the integration of cloud and threat intelligence, organizations can minimize attack surface by leveraging the global threat community and blocking cyber threats to detect unidentified threats and ultimately stop them before occurring. The cloud segment plays a significant role in opposing rising cyber threats. Thus, the adoption of cloud-based threat intelligence tools has witnessed an enormous rise over the last few years. On the other hand, the on-premise segment will grow at a considerable CAGR during the forecast period of 2025-2032.

By Enterprise Type Analysis

Large Enterprises Segment to Gain Traction Due to Availability of Various Opportunities

By enterprise type, the market is categorized into SMEs and large enterprises.

The large enterprises segment accounted for the highest market with a share of 52.93% in 2026. Large companies can reduce the cost of the business in a large-scale business economy while maximizing their profit margins. This major advantage of a large business economy is creating opportunities and paving the growth of large enterprises.

Furthermore, the SMEs segment will register the highest CAGR during the forecast period of 2026-2034. This is attributed to the fact that small and medium-sized enterprises are often victims of cyberattacks. According to the Government Information Security Breaches Survey 2021, 74% of small businesses had experienced a breach over the past year, an increase of 60% compared to the previous year. To overcome security issues, SMEs are increasing the adoption of threat intelligence solutions & services, which will help to grow market revenue in the upcoming year.

By End-user Analysis

Advanced Benefits of Threat Intelligence in IT and Telecom to Fuel Market Progress

By end-user, the market is categorized into BFSI, IT & telecom, manufacturing, healthcare, energy & utilities, retail, and others (education, government, and others).

The IT & telecom segment holds the highest market share. It is anticipated to register a leading CAGR during the forecast period owing to rising security incidents in the telecommunication industry. In telecommunications, threat intelligence solutions offer a variety of benefits, such as proactive threat detection, enhanced incident response, informed security investments, and many others. Such benefits will contribute to the market’s growth in IT and telecom sectors. According to PwC’s Global State of Information Security Survey, IT security incidents in the telecom sector increased by 45% compared to the previous year (2020).

The BFSI segment held a significant market share in 2024. The BFSI industry is one of the major segments facing multiple cyberattacks and data breaches. Cybercriminals have an extremely profitable operating model with incredible returns, including relatively low risk and detectability.

The threats to these attacks range from Trojans, ATM malware, ransomware, data breaches, mobile banking malware, data theft, interference with organizations, and tax breaches. Additionally, with the proliferation of technologies and digital channels, mobile banking and Internet banking have become customers' preferred choices for banking services. Banks should leverage advanced authentication and access control processes, including threat intelligence strategies.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The market is divided geographically into key regions, such as North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America

North America Threat Intelligence Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The North America market held the largest threat intelligence market with a size of 3.12 billion in 2025. Increased adoption of IoT devices by a large number of global financial institutions and internet users due to the high availability of suitable infrastructure is expected to drive market growth in the North America region. Government agencies and private companies in the region are investing in research & development to deploy advanced solutions. The U.S. Department of Homeland Security (DHS) Infrastructure Security Agency (CISA) and Cybersecurity reported a surge in phishing and malware using COVID-19 decoys and new domain names containing language related to coronavirus. The U.S. market is projected to reach USD 1.9 billion by 2026.

Asia Pacific

Asia Pacific is estimated to record the highest CAGR during the forecast period. The region represents significant economies such as India, South Korea, Japan, China, and Oceania and is expected to see high growth in the market. The region is a mixture of developing and developed countries and has the largest presence of SMEs. The rise of cyberattacks has made critical data stored by businesses more vulnerable. These cyberattacks negatively affect product sales. Therefore, Asia Pacific businesses and governments have started investing in threat intelligence solutions related to these statistics. The Japan market is projected to reach USD 0.36 billion by 2026, the China market is projected to reach USD 0.35 billion by 2026, and the India market is projected to reach USD 0.32 billion by 2026.

Europe

An increase in sophisticated threats and the need to comply with government data security regulations are contributing to the expansion of the Europe market. Nations such as the United Arab Emirates (UAE), Bahrain, Qatar, Oman, and others are strongly moving toward digitization in the security and observation area, which is projected to increase the growth of the market. The UK market is projected to reach USD 0.33 billion by 2026, while the Germany market is projected to reach USD 0.34 billion by 2026. Further, South America and the Middle East & Africa markets are also growing at a considerable CAGR during the forecast period.

Key Industry Players

Strategic Partnerships and Product Launch to Boost Market Expansion of Key Players

Key players enter into strategic partnerships with other technology providers. Major players are adopting this strategy to integrate threat intelligence with new technologies to increase revenue streams. Through business strategy, companies gain expertise and expand their business by reaching a large customer base.

List of Top Threat Intelligence Companies:

- CrowdStrike, Inc. (U.S.)

- AO Kaspersky Lab. (Russia)

- IBM Corporation (U.S.)

- Vmware, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Dell, Inc. (U.S.)

- Fortinet, Inc. (U.S.)

- Anomali, Inc. (U.S.)

- Check Point Software Technologies (Israel)

- Huawei Technologies (China)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Check Point announced the launch of Quantum Force Gateway Series, an AI-driven cloud-based security solution. Quantum Force unveiled new standards with threat prevention, improved efficiency, and seamless management for the digital stage, equipping enterprises of all types with next-generation firewall mechanisms.

- October 2023: CrowdStrike, in collaboration with Box, announced its intention to combat cyber threats and secure content in the cloud. The collaboration aimed to help enterprises of all types protect their data in the cloud and prevent data-related breaches. The partnership comprised a new integration between Box’s secure content management and partnership competencies with CrowdStrike’s modern, AI-driven security CrowdStrike Falcon platform for real-time access control and threat prevention.

- April 2023: VMware unveiled new proficiencies that provide robust lateral security over multi-cloud ecosystems so that users can better identify threats and prevent them. VMware Contexa is a threat intelligence cloud that empowers VMware’s suite of security solutions.

- February 2023: Kaspersky introduced a new range of threat intelligence services, which comprises a variety of enhanced feeds that give better insights into cyber-attackers’ behavior, techniques, tactics, and processes, irrespective of the region or language.

- October 2022: BlackBerry Limited announced the launch of its unique Cyberthreat Intelligence (CTI) solution at the BlackBerry Security Summit. This is designed to help organizations detect and respond to cyberattacks. The solution provides threat intelligence that details the latest threat actors, cyberattacks, and malicious campaigns.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding of the market. Furthermore, the report provides insights into the latest industry and threat intelligence market trends and analyzes technologies deployed rapidly at the global level. It further highlights some growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Type

By Deployment

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 31.58 billion by 2034.

In 2025, the market value stood at USD 6.87 billion.

The market is projected to record a CAGR of 18.30% during the forecast period of 2026-2034.

The IT & telecom end-user segment is anticipated to record a leading CAGR during the forecast period.

North America dominated the global market with a share of 44.70% in 2025.

Asia Pacific is expected to record the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us