Transosteal Dental Implants Market Size, Share & Industry Analysis, By Material (Titanium, Zirconium, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

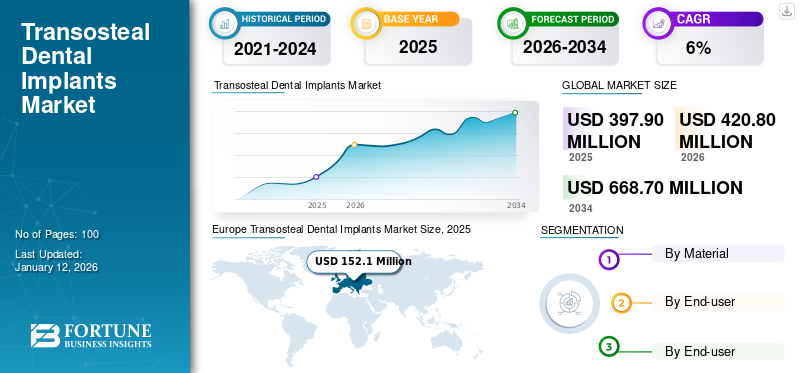

The global transosteal dental implants market size was valued at USD 397.9 million in 2025. The market is projected to grow from USD 420.8 million in 2026 to USD 668.7 million by 2034, exhibiting a CAGR of 6.00% during the forecast period. Europe dominated the transosteal dental implants market with a market share of 38.20% in 2025.

The transosteal dental implant is a biocompatible device that involves a threaded post penetrating both the top and bottom cortical bone plates of the mandibular region. This implant extends through the oral mucosa to provide support and attachment for the prosthesis. It typically consists of long screws that pass through the bone, requiring an incision under the chin that goes through the entire jawbone and emerges at the bottom of the chin to secure the top and bottom pressure plates for the prosthesis.

This type of implant provides good primary stability for the prosthesis by anchoring a base plate at the bottom of the jawbone with screws that pass through the bone and exit the oral cavity to support the upper edge of the denture restoration. Furthermore, transosteal dental implants are used in individuals who do not have enough bone in their jaws to support endosteal and subperiosteal dental implants.

In addition, jaw deformities due to trauma and mandibulectomy increase the chances of total and partial mandible construction, thereby increasing the demand for these implants.

Overall, the market is anticipated to witness growth over the projected years due to the rise in accidental and oral cancer-associated jaw deformities, leading to demand for cosmetic dentistry and advancements in surgical techniques, leading to a demand for these implants.

Furthermore, there were disruptions in the transosteal implants market due to supply chain disruptions and reduced dental procedures during the COVID-19 pandemic. However, in 2021, the market recovered from the resumption of normal operations in dental practices and restoring patient confidence in elective procedures.

Global Transosteal Dental Implants Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 397.9 million

- 2026 Market Size: USD 420.8 million

- 2034 Forecast Market Size: USD 668.7 million

- CAGR: 6.00% from 2026–2034

Market Share:

- Region: Europe dominated the market with a 38.20% share in 2025. This leadership is driven by a significant elderly population prone to oral diseases, the presence of major industry manufacturers, and robust insurance coverage for dental procedures in key European nations.

- By Material: The titanium segment held the largest market share. Titanium is the preferred material due to its high biocompatibility, strength, non-toxic nature, and excellent corrosion resistance, which facilitates better osseointegration.

Key Country Highlights:

- Japan: Demand is spurred by a rapidly aging population and a high cultural value placed on aesthetic dentistry. The country's strong focus on technological innovation in the dental sector, including advancements in digital dentistry and CAD/CAM technologies, further propels the market.

- United States: Market growth is driven by the increasing prevalence of dental disorders, such as edentulism and oral cancers that may require jaw reconstruction. The adoption of advanced technologies like computer-guided implant surgery and a rise in cosmetic dental procedures also contribute significantly.

- China: The market is expanding due to rising disposable incomes, greater awareness of oral health, and an increasing number of dental professionals. Strategic investments in research and the local presence of companies with advanced additive manufacturing capabilities are expected to increase the adoption of these implants.

- Europe: The market is propelled by its large geriatric population and a strong, growing demand for cosmetic dentistry. Technological advancements, particularly the use of 3D printing for creating more precise and customized implants, alongside favorable healthcare frameworks in some countries, are key growth drivers.

Transosteal Dental Implants Market Trends

Additive Manufacturing is Anticipated to Revolutionize the Market

Additive manufacturing, also known as 3D printing, has revolutionized the field of dentistry and has been used in the fabrication of various dental products, including dental implants. One specific type of dental implant that can benefit from additive manufacturing is the transosteal dental implant.

The process involves creating a 3D model of the patient's jawbone and then using a 3D printer to create the implant accordingly. This allows for a more precise fit and better integration with the jawbone, resulting in improved stability and longevity of these implants.

- In February 2023, Carbon, a 3D printing company, is expanding its offerings to equip dental labs with time-saving and cost-reduction solutions. Such expansion of 3D printers in dental labs is expected to increase the demand for transosteal implants.

Direct Metal Laser Sintering (DMLS) method in additive manufacturing allows for the production of customized titanium root analog implants with intricate surface designs, including porous structures, textured surfaces, and bioactive coatings. This customization can result in better fit, function, and aesthetics of the implants, improving patient outcomes.

Download Free sample to learn more about this report.

Transosteal Dental Implants Market Growth Factors

Rising Number of Jaw Reconstruction Surgeries to Boost the Market Growth

Mandible deformities can result from various factors, such as injuries, congenital issues, infections, developmental flaws, cysts, tumors, or head and neck cancers. The mandible deformities often require jaw reconstruction surgeries to improve both the functional and aesthetic aspects of the jaw.

These jaw reconstruction surgeries require a full denture that is supported by transosteal dental implants. These implants consist of a horizontal support beam connected to metal rods that are implanted through drilled holes in the jawbone, with a metal plate secured underneath the jawbone for added stability. The increasing prevalence of mandible deformities is anticipated to create a greater demand for these as a solution for reconstructing and stabilizing the jaw structure, and market growth is expected in the coming years.

- According to the article published in ACTA ODONTOLOGICA SCANDINAVICA in February 2023, approximately 2% of the population in the U.S. have a malocclusion or mandible deformity that might benefit from jaw reconstruction surgery. Such high prevalence can increase jaw reconstruction surgeries, and the adoption of these is anticipated to grow during the forecast period.

Increasing Prevalence of Disease Related to Oral Health to Boost Market Growth

Mandibulectomy, or the removal of the jaw, is one of the dental treatment approaches used to manage advanced mandible invasive oral cancer. The prevalence of mandibulectomy has increased in recent years due to various factors, such as bisphosphonate-related necrosis of the mandible, infectious etiologies, including osteomyelitis, osteoradionecrosis, and benign or malignant neoplastic processes involving the jaw.

Mandibulectomy is performed when the malignant tumors invade the mandible or benign tumors destroy the mandibular integrity. The procedure can involve full-thickness or partial-thickness resection of the mandible, depending on the need to maintain the mandibular continuity.

Successful outcomes of mandibulectomy require mandible reconstruction and implantation to place the artificial teeth. The market growth for transosteal implants is anticipated to increase due to the increasing number of oral cancer and mandible removal surgeries for cancer maintenance.

- According to the article published by the NCBI in August 2023, oral cavity squamous cell carcinoma affects around 300,000 individuals every year.

Such a high prevalence of mandible invasion of this cancer is anticipated to increase the number of jaw removal surgeries, thereby increasing the adoption of transosteal dental implants during the forecast period.

RESTRAINING FACTORS

Complexity and High Failure Rate of Transosteal Dental Implants to Hamper the Market Growth

Transosteal dental implants are used in cases where there is limited bone structure to support a traditional implant or when there is significant bone loss in the jaw. The placement requires a complex surgical procedure, as it involves both intraoral and extraoral approaches to insert directly through the jawbone. Additionally, the highly invasive nature requires a longer recovery time than other implants. Moreover, an individual patient's jawbone structure does not integrate these implants. Therefore, these implants have a minimal success rate compared to other type of implants. Altogether, the market growth is anticipated to be hampered by these factors.

These implants and surgeries are usually more expensive than endosteal and subperiosteal implants due to their complex nature.

- For instance, MyraDental, a dental clinic, reported that the cost of these implants can cost around USD 5,200 to 13,000 per arch.

The complexity and invasiveness of transosteal implants have led to their limited use in modern dentistry, with endosteal implants being the more commonly preferred option due to their predictability and success rates. Furthermore, the high cost of dental implants is another factor hampering the market growth during the forecast period.

Transosteal Dental Implants Market Segmentation Analysis

By Material Analysis

Titanium Implants Dominated the Market Due to Stability and Biocompatibility

Based on material, the market is classified into titanium, zirconium, and others.

The titanium segment dominated the market in 73.67% 2026. The non-toxic and biocompatible nature of titanium compared to other materials, such as chromium-cobalt and stainless steel, increases the adoption of titanium over other implant materials. Furthermore, titanium is one of the most studied materials for its biocompatibility, high resistance against corrosion, and stability, making it widely popular among dentists and patients. Moreover, other advantages include titanium's ability to bond with bone tissue and act as a substitute for tooth roots to stimulate the surrounding tissue growth and the ability to prevent bone loss around the implants, which are anticipated to propel the segment growth in the near future.

On the other hand, zirconium is expected to grow considerably during the forecast period. Zirconium dental implants are emerging as an advanced material over traditional implants. The rising demand for aesthetic dental procedures, advancements in dental implant technology, and growing awareness about oral health are driving the demand for zirconium dental implants.

Additionally, an increasing number of studies demonstrating that zirconia implants can integrate well with bone and promote faster healing are further anticipated to increase the adoption of zirconia implants.

- For instance, an article published in Frontiers in Dental Medicine in August 2021 stated that zirconia can be a good candidate material for dental implants due to its good mechanical, esthetic, and biocompatible performance.

The others segment, including polyether ether ketone (PEEK), is anticipated to witness growth during the forecast period. Initiatives to combine these materials with others that offer better mechanical strength are anticipated to drive the market.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Were Dominant Due to Their Widespread Presence

Based on end-user, the market is segmented into solo practices, DSO/group practices, and others.

The solo practices held the dominant global transosteal dental implants market share in 58.15% 2026. The dominance of the segment is attributed to the advantages associated with this mode of practice. A tailored patient experience and strong relationships between patients and practitioners are the key advantages of these practices. Moreover, a huge number of dentists who use this mode of practice globally, is expected to increase the number of transosteal dental implant procedures in these facilities, thereby propelling segmental growth.

The DSO/group practices segment is expected to exhibit significant growth in the near future. The rapid growth of the segment can be attributed to the transition from solo practices to DSO/group in the developed nations. According to a study published in Dental Tribune International in June 2023, there has been a shift in the dental industry in the U.S. as more dentists are choosing to join larger corporate clinics. This market trend is increasing the number of patients visiting DSO/group practices, and the market is anticipated to grow in the coming years.

The others segment, including hospital and community health centers, are expected to grow during the forecast period. The rising partnerships among manufacturers and hospitals to support dentists are also augmenting the segment’s growth.

REGIONAL INSIGHTS

Based on geography, the market for transosteal dental implants is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe Transosteal Dental Implants Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe

Europe held the largest transosteal dental implants market share in 2025, generating a revenue of USD 152.1 million. The growth can be attributed to the increasing elderly population at risk of oral disease and the presence of major players. Furthermore, comprehensive insurance coverage for dental procedures in some of the countries in Europe increases the demand for these dental procedures. The U.K. market is projected to reach USD 7.5 billion by 2026, while the Germany market is projected to reach USD 33.9 billion by 2026.

Moreover, continuous advancements in the region for 3D printing technology, including new materials and printing techniques, are enabling the production of more complex and advanced transosteal implants, which is expected to boost the adoption of transosteal dental implants during the forecast period. Additionally, the large number of implant procedures performed in countries, such as Spain and Russia, is expected to increase the regional market growth during the forecast period.

North America

North America held the second-largest revenue in 2024. The transosteal dental implant market growth is influenced by various factors, including the increasing prevalence of dental disorders and technological advancements, such as computer-guided implant surgery for improved accuracy. Moreover, the high prevalence of tooth loss and oral cancers is increasing the demand for tumor removal and jaw reconstruction surgeries, resulting in the increased adoption of transosteal dental implants in the region. The U.S. market is projected to reach USD 129.5 billion by 2026.

- According to the National Institute of Dental and Craniofacial Research, around 54,000 new oral cancer cases were diagnosed in the U.S. in 2022. It is roughly around three percent of all cancers diagnosed annually in the U.S. The high prevalence of these cancers often results in tumor removal surgeries and is anticipated to increase demand along with jaw reconstruction surgeries.

Asia Pacific

The Asia Pacific region is anticipated to grow at a faster rate in the global market. The region's market expansion can be attributed to the rising adoption of transosteal dental implants, a growing number of dental practitioners, increasing disposable incomes, and rising awareness of dental health in countries, such as China and India. Additionally, an increase in the investment in research and development activities in the region is contributing to this growth. Moreover, the presence of various regional players with additive manufacturing ability is anticipated to increase the adoption of these implants in the near future. The Japan market is projected to reach USD 7.5 billion by 2026, the China market is projected to reach USD 19.5 billion by 2026, and the India market is projected to reach USD 5.3 billion by 2026.

The Latin America and the Middle East & Africa markets are expected to experience substantial growth, driven by the rise in dental tourism and increasing healthcare expenditures in the region. Furthermore, the increasing prevalence of advanced dental disorders is expected to boost the growth of the region's market.

List of Key Companies in Transosteal Dental Implants Market

KLS Martin Group., CRANIOTECH, and Other Players Dominated Due to Strong Additive Manufacturing Ability

Market players, such as KLS Martin Group, Xilloc Medical Int B.V., and CRANIOTECH, are constantly investing in research and development initiatives to introduce innovative technologies that improve the design and functionality of these dental implants. Also, the strategic partnerships and collaborations to expand their market presence and enhance their product offerings are the key factors anticipated to contribute to the growth of these companies in the region.

Other players, including the regional key players, such as GPC Medical Ltd. and INCREDIBLE AM PVT LTD., are focused on expanding their collaborations with dentists and DSOs to expand their product offerings in the region. Furthermore, initiatives, such as the increase in the adoption of additive manufacturing in their laboratories, are also expected to increase their share in the market.

Very few global players in the market enable the regional players to grow significantly across regions.

LIST OF KEY COMPANIES PROFILED:

- Xilloc Medical Int B.V. (Netherlands)

- CRANIOTECH (South Africa)

- INCREDIBLE AM PVT LTD. (India)

- KLS Martin Group (Germany)

- GPC Medical Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- November 2023 - Axtra3D has partnered with Oqton and 3D Systems to allow dental customers to use their materials and software offerings to design dental restorative solutions, such as transosteal implants, alongside its Hybrid Photosynthesis 3D printing technology.

- June 2023- KLS Martin Group opened new office building in Mühlheim to expand its implant business.

- February 2023 – Structo announced a new line of dental 3D printers to provide better efficiency and unit economics for dental and orthodontic laboratories to provide restorative solutions, such as transosteal implants.

- July 2020 – KLS Martin Group opened new plant in Germany for the production of implants. The new plant is construted with an aim to increase the efforts for new products launches

- October 2019 – KLS Martin Group opened a new training center in Jacksonville, Florida to offer training and education to the craniomaxillofacial surgeons in the region.

REPORT COVERAGE

An Infographic Representation of Transosteal Dental Implants Market

To get information on various segments, share your queries with us

The global transosteal dental implants market report provides an in-depth industry analysis. The report focuses on market segments, material, and end-user. Besides, it offers the global transosteal dental implants market forecast in relation to the current market dynamics, the impact of COVID-19, and the latest market trends. Furthermore, the report provides regional insights, key drivers and the factors affecting the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.00% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Material

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 397.9 million in 2025 and is projected to reach USD 668.7 million by 2034.

In 2025, the market value stood at USD 152.1 million.

The market will exhibit a steady CAGR of 6.00% during the forecast period.

Currently, the titanium segment was leading the market in terms of material.

Rising number of jaw reconstruction surgeries and increasing prevalence of oral cancer removal surgeries, and surge in cosmetic dentistry.

Xilloc Medical Int B.V., CRANIOTECH, KLS Martin Group are the major players in the market.

Europe dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic