U.S. and Europe Biostimulants Market Size, Share, and Industry Analysis, By Source (Microbial Biostimulants and Non-microbial Biostimulants), By Active Ingredients (Seaweed Extracts, Humic Substances, Vitamins & Amino Acids, Microbial Amendments, and Others), By Application (Foliar Treatment, Soil Treatment, and Seed Treatment), By Crop (Row Crops, Fruits & Vegetables, Turf & Ornamentals, and Others), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

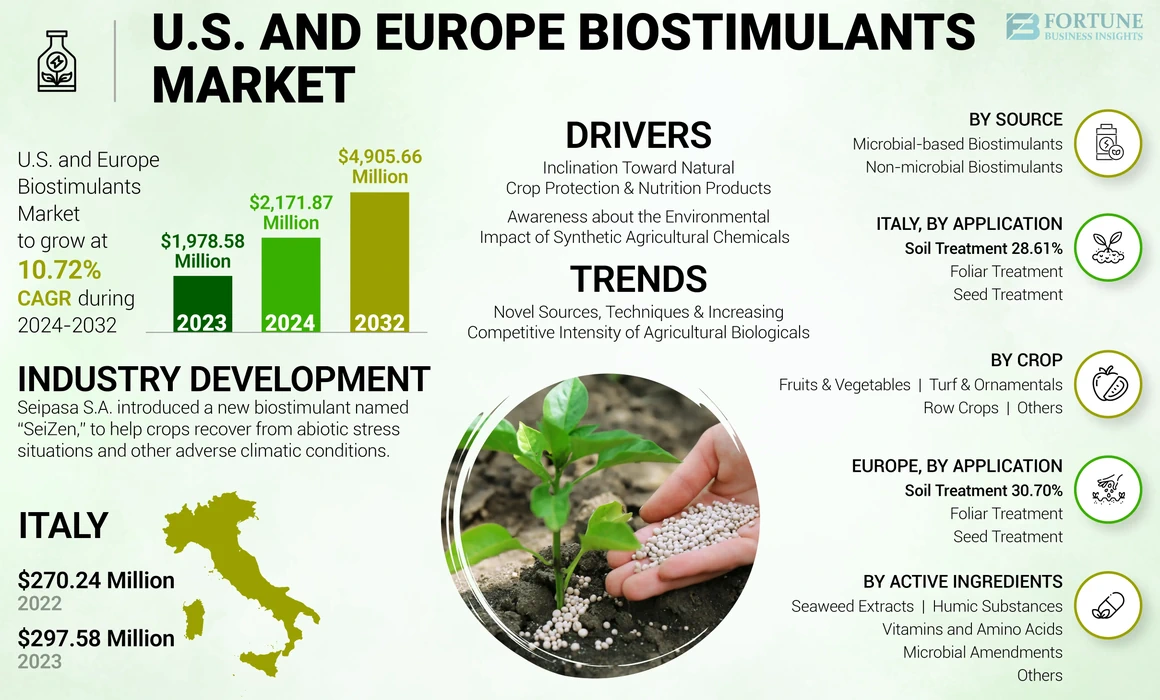

The U.S. and Europe biostimulants market size was valued at USD 1,978.58 million in 2023. The market is projected to grow from USD 2,171.87 million in 2024 to USD 4,905.66 million by 2032, exhibiting a growth at a CAGR of 10.72% during the forecast period.

Biostimulants are a class of products that are used to improve plant growth, health, and productivity. These products are derived from natural or synthetic sources and may contain various substances, including amino acids, humic acids, seaweed extracts, and beneficial microorganisms. Biostimulants work by enhancing nutrient uptake, increasing stress tolerance, and promoting root development, which ultimately leads to better plant growth and crop yields. These products are often used in sustainable agriculture as an alternative to synthetic fertilizers and pesticides. Seaweed extracts, humic substances, and microbial amendments are popular ingredients utilized for the development of biostimulants. Leading players in the market include Syngenta AG, Corteva, Inc., ADAMA Ltd., and Valent BioSciences, LLC.

Rising demand for organic foods and the surging government initiatives supporting the adoption of the product are pivotal factors contributing to the market growth.

MARKET DYNAMICS

Market Drivers

Growing Inclination Toward Natural Crop Protection and Nutrition Products Drives the Market’s Growth

Biostimulants are natural preparations to improve the vitality, health, and growth of plants. The U.S. and the Europe market is driven by the growing utilization of natural crop protection products. Food security and public health are intrinsically linked, prompting concerted efforts from all stakeholders in the agri-food industry to ensure sustainable food production. The major phytopharmaceutical companies in Europe and North America have intensified their R&D and production activities with regard to natural biostimulant products. The growing trend of organic farming is largely reliant on the efficient use of biostimulants across the U.S. and Europe. Moreover, the rising industrialization and modernization across Europe are resulting in the reduction of cultivable agricultural land. This has necessitated growers and farmers to utilize biostimulants to increase the quantity and quality of crops in both optimal and sub-optimal conditions.

Surging Awareness about the Environmental Impact of Synthetic Agricultural Chemicals Drives Product Adoption

The market is fueled by the growing awareness of the detrimental impact on the environment caused by synthetic plant protection products and chemical-based fertilizers. Farmers and cultivators are increasingly seeking eco-friendly and natural options to produce crops sustainably. Biostimulants offer a dual advantage of ensuring consistent returns on investments while ensuring the safety and sustainability of agricultural produce. The mismanagement of inorganic agricultural inputs, specifically synthetic substances, has led to increased amounts of greenhouse gases (GHGs) which include nitrous oxide (N2O), and methane (CH4). Thus, biostimulants can be widely used as it is eco-friendly in nature and are more specific to the target plant pests and crop growth.

Market Restraint

Regulatory Uncertainty in Biostimulants Sector Inhibits the Market’s Momentum

The restrictive and non-uniform regulatory scenario around the globe and the cumbersome approval process act as a barrier to market growth. There is still no single, accepted definition of biostimulants for legal, regulatory, or commercial purposes. The data requirements for biostimulant products are similar to synthetic chemicals, which doesn’t align with the nature and unique properties of stimulants of biological origin. Similarly, even though biostimulants have been commercially used for over 60 years, there is still an absence of well-established endpoints for risk assessments. Moreover, in certain markets, regulators and risk assessors lack the expertise to assess its effectiveness and provide reproducible outcomes. Thus, the factors mentioned above impede the U.S. and Europe biostimulants market share.

Market Challenge

Increasing Launches of Counterfeit Products is a Major Challenge

The biostimulants industry is experiencing the growing problem of counterfeit products across the U.S. and European regions. The rising proliferation of similar items from numerous competitors has hampered consumer loyalty and impacted the brand value of such products. As a result, this factor acts as a major challenge, and hamper the market growth.

Market Opportunity

Increasing Inclination Towards Organic Farming Paves Growth Opportunities

Organic farming is increasingly recognized as an ideal substitute to conventional techniques to reduce the overall harsh impact on environmental health. The promising growth of organic agriculture is expected to drive the future demand for biostimulants, reinforcing their role as natural plant growth promoters. The use of organic and natural biostimulant compounds in agriculture and forestry provides enormous opportunities for farmers to strengthen root and shoot development, better growth potential, and increase stress resistance. Moreover, the growing demand for organically cultivated foods is fueling up the demand for biostimulants in the U.S. and European markets. These products, derived from organic material containing bioactive substances and/or microorganisms, are proven to improve crop growth, making them an essential input for sustainable farming practices.

MARKET TRENDS

Novel Sources, Techniques, and Increasing Competitive Intensity of Agricultural Biologicals

The future growth of biostimulants is expected to be driven by the development of novel sources and techniques that enhance product availability. A well-structured and strengthened distribution framework will further guarantee the required level of product penetration of agricultural biostimulants. The biostimulants extracted from marine algae seaweed species are often regarded as promising bioresources and have a huge scope in crop production and promotion systems due to the presence of plant growth-stimulating compounds. There is a wide range of biostimulants being extracted from seaweed owing to its early seed germination, the establishment of plants, elevated resistance to biotic and abiotic stress, and improved crop performance and yields. Additionally, humic substances are gaining traction as an important source to extract biostimulants. They substances are gaining huge popularity among manufacturers as innovative and effective plant growth promoter products.

Download Free sample to learn more about this report.

Impact of COVID-19

The onset of the COVID-19 pandemic affected the economy of the U.S. and Europe as governments imposed lockdown measures and limited the movement of people. Industrial activities were paused, transnational travel was suspended, and only essential sectors such as medications and food were permitted to function. These actions significantly affected almost all industrial sectors, including fertilizer and biostimulant production, as factories faced supply chain interruptions and worker scarcities. Along with the different categories in the agri-input industry, fertilizers and biostimulant products production had observed interruptions and production decline during the initial phase of COVID-19. The several interruptions, including raw material scarcity, labor shortages, and government-mandated plant shutdowns, impacted the production slowdown. Uneven demand for biostimulants was also observed across the U.S. and Europe during this period. Therefore, crop enhancement input producers reframed their strategies, made well-informed tactical changes, and streamlined their productions to navigate the uneven demand. These efforts helped mitigate disruptions until the COVID-19 pandemic’s risk diminished and business dynamics began stabilizing, gradually returning to pre-pandemic stages.

SEGMENTATION ANALYSIS

By Source

Non-Microbial Biostimulants Segment Leads Due to Its Benefits

Based on source, the market is divided into microbial biostimulants and non-microbial biostimulants.

The non-microbial biostimulants segment dominates the market and generated the maximum market share in 2023. These biostimulants contain certain compounds that promote improved root growth and enhance plant health. Popular non-microbial-based biostimulants include algae extracts and protein hydrolysates. They play a vital role in improving produce quality and increasing plant’s tolerance to stress factors.

Microbial biostimulants exhibited the highest CAGR in both the U.S. and European markets and are anticipated to grow at a higher pace in the forecast period. These biostimulants are composed of microorganisms (plant-growth-promoting rhizobacteria) and assist in nitrogen fixation and reduce soil degradation.

By Active Ingredients

Seaweed Extracts Dominated Owing to Its Sustainable Approach

Depending on active ingredients, the U.S. and Europe biostimulants market is segmented into vitamins & amino acids, seaweed extracts, humic substances, microbial amendments, and others.

The seaweed extracts segment led the market in 2023, due to its several benefits. Seaweed extracts, when used as an ingredient in biostimulants, improve the growth of shoots and roots and help plants resist pathogens such as bacterial spots and fruit rot. Additionally, seaweed extracts can be used as a sustainable approach, as seaweed extract-enriched biostimulants can easily substitute inputs and reduce the use of chemical pesticides.

Microbial amendment witnessed the fastest CAGR and is predicted to witness significant growth in the forecast period. The use of such microbial amendment supports disease suppression in plants and enhances the quality of vegetable and fruit production.

By Application

Foliar Treatment Leads in the U.S. and Europe Due to Its Easy Application Technique

On the basis of application, the market is divided into foliar treatment, soil treatment, and seed treatment.

Out of all the categories, the foliar treatment category dominated the U.S. and Europe biostimulants market due to its easy application. Foliar treatment is primarily utilized for correcting nutrient deficiencies, as it can be sprayed easily onto the leaves for rapid absorption. As a result, this application method is highly used for better absorption, which leads to improved plant health.

In the U.S., seed treatment recorded the highest CAGR of 13.57% and is projected to witness massive growth in the coming years. This type of treatment can be collectively used with an Integrated Pest Management System to protect plants from insect and pest infection, making it a crucial method for enhancing crop resilience and yield.

In Europe, soil treatment secured the second position in the market and is expected to grow prominently in the future. Soil treatment helps in minimizing the pollutants from soil, which fuels the soil’s condition.

To know how our report can help streamline your business, Speak to Analyst

By Crop

Row Crops Dominated Due to their High Production

Based on crop, the market is segmented into row crops, fruits & vegetables, turf & ornamentals, and others.

Amongst all, the row crops lead the market, due to their wide production. Row crops are mainly planted in rows and are cultivated at a broader scale. Some of the row crops include potato, flax, field peas, and wheat. As row crops are highly susceptible to bacterial infections and root rot, biostimulants are proven to be beneficial for promoting their healthy growth.

Fruits & vegetables ranked second in the market and observed the highest CAGR. The increasing cultivation of these crops and the rising consumer demand for natural and healthy products contribute to the growth of this segment, ultimately driving the increased use of biostimulants.

U.S. and Europe Biostimulants Market Regional Outlook

On the basis of regions/countries, the market is segmented into the U.S. and Europe.

Europe is the leading market for biostimulants, with countries including Spain, Italy, Germany, and France acting as hotspots for biological products. The growth of the market in this region is attributed to the surging demand to boost the production of food crops such as oilseeds and sugarcane, which have applications in food, fuel, and industrial sectors. While the product was initially used in more profitable production such as wine growing, horticulture, and fruit farming, their use is also expanding to herbaceous field crops. Today, consumers are more inclined toward clean-label products produced using organic substances and processes. Thus, biostimulants are an ideal choice for the future of the agriculture industry in terms of contributing to organic practices.

Among European countries, Italy leads in the market and accounted for USD 297.58 million in 2023 driven by the rising focus on improving soil fertility and farm productivity. The efforts undertaken by the Italian government to increase the arable land and reduce the environmental impact of chemical fertilizers will also create lucrative opportunities for the biostimulants market. Additionally, the well-defined regulatory framework, makes it easier for companies to introduce new products into the market.

To know how our report can help streamline your business, Speak to Analyst

The rest of Europe, which includes countries such as Poland, Belgium, Netherlands, Austria, and others, is also a significant market by generating a strong market share in 2023. The presence of a large number of market players and new launches of biostimulants across these countries are key factors contributing to this growth. Unlike some other European countries, these nations are adopting modern agricultural methods with innovations in farming practices that help to boost agricultural efficiency and minimize the loss of natural resources. Thus, the application of biostimulants is also fueling in the countries.

France has emerged as one of the dominant agriculture centers in Europe for centuries with about 730,000 farms engaged in agriculture or related sectors. The adoption of precision farming technologies in France has been growing due to factors such as the need for sustainable farming and increased governmental support. As a result, these factors are likely to drive the use of biostimulants in the country.

In Spain, a movement for sustainable agriculture has evolved, supporting agricultural processes that lessen social and environmental concerns to feed the region’s expanding population. Although biostimulants are still relatively new to the market, the growing governmental support and widespread awareness are propelling significant growth in Spain’s biostimulants sector in the European market.

In the U.K., the role of biostimulants is expanding, with the country holding a strong market share across the world. Every year, the country faces extreme weather fluctuations, which negatively impacts crops in agriculture and horticulture. As a result, there is a growing shift among U.K. farmers toward adopting biostimulants to minimize ecological footprints, safeguard food provision, and provide options for adapting to climate change, ensuring their livelihood.

Ukraine and Romania have observed minimal usage of biostimulants, primarily due to the Russia-Ukraine war, which has hampered the growth in both countries.

The U.S. market is also recognized as one of the prominent leaders in the biostimulants industry owing to the presence of a large number of consumers and growers. Currently, the growth in the biostimulants section is mainly achieved by the favorable regulatory structure and the need for enhanced yield. As the country’s population (approx. 332 million) grows, there is an increased demand for food, making agriculture and the use of biostimulants more important to nation.

COMPETITIVE LANDSCAPE

Key Industry Players

To know how our report can help streamline your business, Speak to Analyst

Leading Market Players Are Concentrating on Product Launches and Base Expansion to Increase their Revenue Generation

Active players in the U.S. and Europe biostimulants market include Syngenta AG, ADAMA Ltd., Hello Nature, Inc., Gowan Group, and others. In today’s market, consumers are seeking clean-label products that are devoid of harmful chemicals. This demand necessitated the farmers/growers to produce high-quality crops which are safe for consumption. Also, the active players in the market are trying to strengthen their universal footprints, in several countries, which further improves the awareness, and usage of biostimulants. As a result, this factor enhances the usage of biostimulants in the market.

List of Key U.S. and Europe Biostimulants Market Companies Profiled:

- Syngenta AG (Switzerland)

- ADAMA Ltd. (Israel)

- Bio (Belgium)

- SEIPASA S.A. (Spain)

- Gowan Group (U.S.)

- Hello Nature, Inc. (Italy)

- Valent Biosciences LLC (Sumitomo Chemical) (U.S.)

- Novozymes A/S (Denmark)

- Corteva, Inc. (U.S.)

- Aminocore (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

April 2024: Hello Nature, Inc., an Italian firm, received industry certification from TFI for its PSP 5-0-0 technology. It is committed to maintaining efficacy, safety, and composition standards that benefit farmers. The certification program helped the company to increase consumer trust in its biostimulant product range and ultimately leads to higher product sales.

March 2024: UPM Biochemicals GmbH, a Germany-based company, launched a new range of bio-based plant stimulants, UPM Solargo, across the European market. This launch marks the company’s entry into one of the profitable and biggest agrochemicals industries via sustainable substitute.

January 2024: Novozymes AS, a pioneer in biological solutions located in Denmark, completed its merger with Chr. Hansen, forming a leading global biosolution manufacturing company in the European market. The combined entity will be known by the “Novonesis,” which provides solutions to the major crop problems faced globally.

May 2023: Seipasa S.A., a Spanish botanical-based solutions firm, launched a new biostimulant named “SeiZen,” a liquid biostimulant that helps crops recover from abiotic stress situations and other adverse climatic conditions. It works by reducing oxidative damage and mitigating the effects of abiotic stress by blocking the excess of ethylene.

January 2023: Valent BioSciences LLC, a subsidiary of Sumitomo Chemicals, acquired FBSciences, one of the leading manufacturers of biostimulants in the U.S. This acquisition helped the company to expand their product portfolio and provide integrated biorational solutions, including biostimulants, to farmers.

Investment Analysis and Opportunities

The market report provides comprehensive investment analysis and opportunities aimed at providing investors and business leaders with actionable insights. The report highlights the various opportunities that have the potential for investments, including new product launches, technological advancements, mergers & acquisitions, and geographic expansions.

REPORT COVERAGE

The U.S. and Europe biostimulants market report includes quantitative and qualitative insights. It offers a detailed analysis of the market sizing and growth rates for all possible market segments. Key insights presented in the report include an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory environment in critical countries, and the latest market trends.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 10.72% from 2024 to 2032 |

|

Segmentation |

By Source · Microbial-based Biostimulants · Non-microbial Biostimulants |

|

By Active Ingredients · Seaweed Extracts · Humic Substances · Vitamins & Amino Acids · Microbial Amendments · Others |

|

|

By Application · Foliar Treatment · Soil Treatment · Seed Treatment |

|

|

By Crop · Row Crops · Fruits & Vegetables · Turf & Ornamentals · Others |

|

|

By Region/Country · U.S. (By Source, Active Ingredients, Application, and Crop) · Europe (By Source, Active Ingredients, Application, and Crop) o Spain (By Source, Active Ingredients, Application, and Crop) o Italy (By Source, Active Ingredients, Application, and Crop) o France (By Source, Active Ingredients, Application, and Crop) o Germany (By Source, Active Ingredients, Application, and Crop) o U.K. (By Source, Active Ingredients, Application, and Crop) o Romania (By Source, Active Ingredients, Application, and Crop) o Ukraine (By Source, Active Ingredients, Application, and Crop) o Rest of Europe (By Source, Active Ingredients, Application, and Crop) |

Frequently Asked Questions

Fortune Business Insights says that the U.S. and Europe market size was valued at 1,978.58 million in 2023.

The market is expected to grow at a CAGR of 10.72% during the forecast period.

The microbial-based biostimulants segment led the market.

Growing inclination toward natural crop protection & nutrition products and surging awareness about the environmental impact of synthetic agricultural chemicals are the key factor driving product adoption.

Syngenta AG, ADAMA Ltd., and Gowan Group are few of the top players in the market.

Italy held the highest share of the market throughout the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us