U.S. Behavioral Health Market Size, Share & Industry Analysis, By Type (Behavioral & Mental Health, Substance Abuse, Eating Disorders, Trauma/PTSD, and Others), By Payor (Public Health Insurance and Private Health Insurance/Out-of-pocket), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

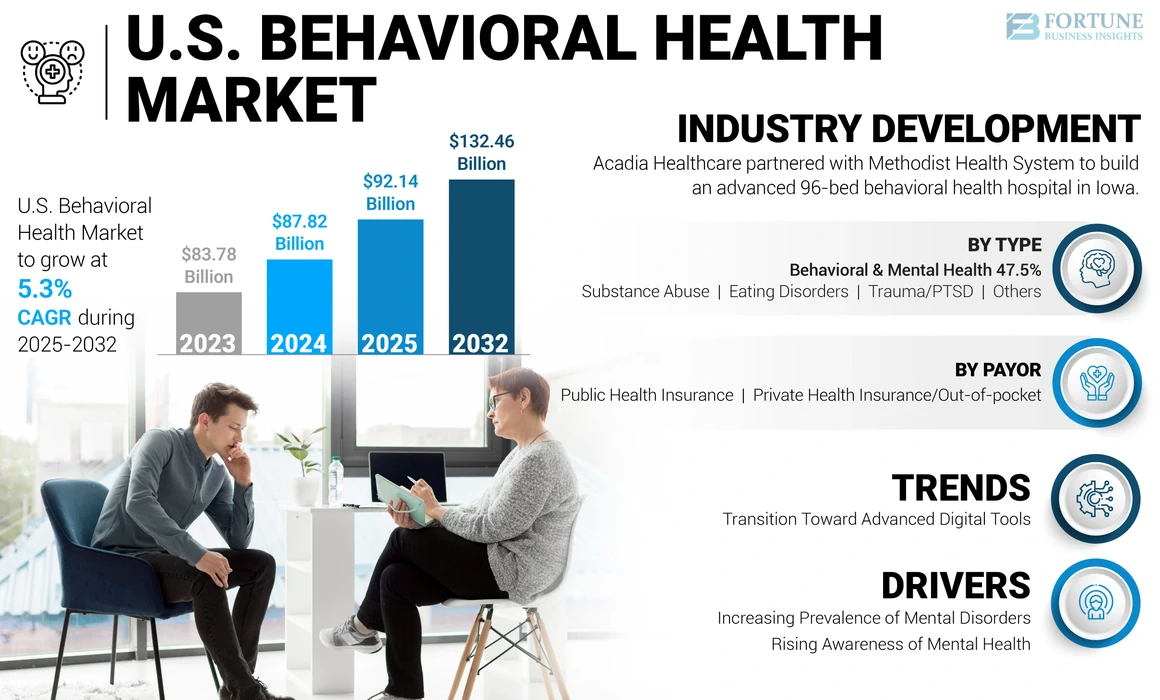

The U.S. behavioral health market size was valued at USD 87.82 billion in 2024. It is projected to grow from USD 92.14 billion in 2025 to USD 132.46 billion by 2032, exhibiting a CAGR of 5.3% during the forecast period.

Behavioral health services are focused on the daily habits, behavior, and actions of an individual, which can impact the mental health of a patient. Physical & mental health disorders, such as mental illness, anxiety, depression, substance use disorders, post-traumatic stress disorder, and eating disorders, are the primary reasons for distress and disability among the population in the country. The rising demand for treating these disorders is set to augment the market size over the coming years.

- For instance, according to the Centers for Disease Control and Prevention's 2022 data, the percentage of adults receiving treatment for mental health increased from 19.2% in 2019 to 21.6% in 2021.

The U.S. market is expected to grow substantially during the forecast period. The increasing prevalence of behavioral health issues, improved access to care, rising awareness of mental health among the population, and acquisitions and partnerships by market players are expected to fuel the market growth.

- For instance, in November 2021, BHG Holdings, LLC., acquired Valhalla Place, the premier provider of addiction and mental health services in the Twin Cities.

In addition, the implementation of favorable policies on both the federal and state levels and a shift in the trend of the adoption of telehealth-based treatments are expected to drive the market growth. Furthermore, the government's focus on promoting virtual care services by introducing awareness campaigns about these therapies is expected to support market growth.

- For instance, in February 2022, the U.S. Department of Health & Human Services awarded USD 55.0 million to 29 HRSA-funded health centers to increase access to care and quality for underserved populations through virtual care such as telehealth, health information technology platforms, and others.

The COVID-19 pandemic influenced the dynamics of the healthcare sector globally. During the pandemic period, behavioral healthcare services emerged as both a challenging and an opportunity. The demand for these services surged during the pandemic as the prevalence of depression, anxiety, and stress rose significantly. In addition, the disruption of the supply chain for medications and medical supplies and the reduction in inpatient hospital treatment boosted the adoption of virtual health and telehealth. According to the Commonwealth Fund, there was a 56% increase in the use of telemedicine for specialties such as behavioral health in December 2020 as compared to March 2020. In 2021, the market witnessed substantial growth as restrictions related to the pandemic were lifted and healthcare activities resumed to their normal pace.

U.S. Behavioral Health Market Trends

Transition Toward Advanced Digital Tools Due to Their Increasing Advantages and Applications

The U.S. is witnessing a significant shift in customer preferences toward digital tools. Various factors, such as cost savings, convenience, and enhanced patient tracking, are driving this shift in customer preferences. The increasing demand and rising awareness among individuals have prompted both established companies and new players in the market to develop and introduce advanced digital tools to meet the needs of patients seeking mental health treatments in the U.S., thereby driving market expansion.

- For instance, in July 2023, Universal Health Services, Inc. announced the addition of Oracle's Electronic Health Record (EHR) across its broad network of behavioral health facilities in the U.S.

Download Free sample to learn more about this report.

The proliferation of digital counseling platforms, mobile apps, virtual reality therapies, digital biomarkers, and AI-driven insights for mental health are being witnessed in the market to prevent, diagnose, and treat behavioral disorders. These factors have shifted customer preference from conventional treatment to digital tools.

United States Behavioral Health Market Growth Factors

Increasing Prevalence of Mental Disorders to Aid Market Growth

Over the years, an increasing number of trauma, substance abuse, and poor nutrition cases have resulted in depression, anxiety, and eating disorders. This has led to an increase in the number of people suffering from functional impairment while managing assignments and prioritizing tasks. Thus, the rising prevalence of mental illness in the country leads to an increased demand for treatment services.

- For instance, according to the Substance Abuse and Mental Health Services Administration (SAMHSA), in 2022, almost 1 in 4 adults aged 18 or older had any mental illness (AMI), which is 59.3 million of the adult population.

Furthermore, an increase in the number of patients suffering from mental illnesses, such as anxiety, depression, and Post-Traumatic Stress Disorder (PTSD), is leading to growing cases of substance abuse, which is considered one of the major behavioral disorders.

- According to SAMHSA, in 2022, 48.7 million people aged 12 or older (or 17.3%) had a substance use disorder. Similarly, in September 2022, the American Addiction Centers reported that people seeking treatment for post-traumatic stress disorder are 14 times more likely to be diagnosed with a substance abuse disorder.

The increasing prevalence of mental illness and substance abuse disorder has led to a rise in demand for these services in the country, propelling the U.S. behavioral health market growth.

Rising Awareness of Mental Health Among the Population to Foster Market Growth

The U.S. has observed a significant increase in awareness and literacy around mental health due to public figures sharing their experience and various media sources such as TV shows, podcasts, and social media. This has led to more open discussions and a greater understanding of mental health issues. The COVID-19 pandemic, ongoing racial tensions, and social justice movements have also highlighted the importance of mental health.

This, along with the higher prevalence and impact of mental health disorders, has resulted in more individuals seeking treatment for their mental health concerns. Initiatives, including those by SAMHSA and the American Institutes for Research, such as Mental Health Awareness Month in May, are expected to increase awareness among the population further. For instance, SAMHSA has recognized every May as Mental Health Awareness Month to boost awareness. The increasing awareness of mental health conditions among the population in the U.S. is expected to boost the market for mental health services and treatments.

RESTRAINING FACTORS

Shortage of Mental Health Professionals and High Cost of Treatment May Hinder Market Growth

In the U.S., there is a significant increase in opioid addiction and mental health issues, resulting in a growing demand for these services. This surge in demand has caused a shortage of trained professionals, such as psychiatrists, psychologists, counselors, and marriage and family therapists. Furthermore, the uneven distribution of these professionals has further compounded the issue, making it difficult for individuals to access the services they need.

- As of December 2023, 169.0 million people in the U.S. were residing in a mental health professional shortage area, representing half of the country's population. In addition, the 2022 National Survey on Drug Use and Health (NSDUH) revealed that around 7.6 million adults with mental illness did not receive mental health services in 2021. This lack of mental health professionals and unmet needs can hinder the adoption of these treatments and impede market growth in this sector.

Another factor restraining the market growth is the high cost of treatment. Although the Affordable Care Act requires medical insurers to cover behavioral and mental healthcare, the cost of therapy still limits access to mental health services. In the U.S., a lack of financial resources prevents many individuals from seeking professional help or may lead to inadequate treatment.

- For instance, in 2022, according to data published by Mental Health America, 11.1% of Americans with a mental illness were found to have no insurance policies. It was also stated that 8.1% of children had private insurance for various diseases except mental health services, totaling 950,000 youth.

Such limited reimbursement policies available to patients located in rural locations limit the growth of the overall market.

U.S. Behavioral Health Market Segmentation Analysis

By Type Analysis

Rising Patient Count for Mental Illness to Drive Behavioral & Mental Health’s Growth

Based on type, the market is segmented into behavioral & mental health, substance abuse, eating disorders, trauma/PTSD, and others.

The behavioral & mental health segment dominated the market in 2023 and is expected to grow at a higher CAGR during the forecast period. The rising prevalence of depression and anxiety disorders in the U.S. has resulted in a higher demand for behavioral and mental health services. This has led to an increase in inpatient admissions and outpatient hospital visits, driving growth in the segment.

- For instance, according to Mental Health America, Inc., 15.08% of youth (aged 12-17) reported suffering from at least one Major Depressive Episode (MDE) in New York in 2021.

The substance abuse segment is projected to register a substantial CAGR over the forecast period. The growth of the segment can be attributed to the rising number of illicit drug users in the country, leading to a strong demand for treatment among patients suffering from substance abuse disorders.

- For instance, according to the Mental Health America, Inc. report, 15.35% of adults in the U.S. reported to have a substance use disorder in 2024. This high prevalence is expected to drive market growth significantly in the coming years.

The others segment, including obsessive-compulsive disorder, emotional disorders, among others, are also likely to have a significant share of the market during the forecast period. The rising awareness among the population regarding these conditions is expected to drive the segment growth in the near future.

To know how our report can help streamline your business, Speak to Analyst

By Payor Analysis

Public Health Insurance Holds Leading Position Owing to Significant Surge in Adoption

Based on payor, the market is segmented into public health insurance and private health insurance/out-of-pocket.

The public health insurance segment accounted for the largest share of the market in 2024. This is due to the increasing demand for behavioral therapies, which leads to a high uptake of insurance under Medicare and Medicaid. Additionally, factors such as affordable insurance plans, lower premiums, and others are driving the growth of this segment.

- For instance, in 2023, Medicaid accounted for 54.0% of the revenue generated by Acadia Healthcare.

The private health insurance/out-of-pocket segment held a substantial share of the market in 2023. Strategic initiatives undertaken by insurers, such as launching integrated care management and outreach programs, significantly contribute toward the segment growth. In addition, rising incidence of substance abuse disorder and growth in the awareness regarding behavioral health are expected to increase the out-of-pocket expenses during the forecast period.

- For instance, in May 2024, Anthem Insurance Companies, Inc. collaborated with InStride Health to expand its insurance network. InStride Health is a specialty pediatric anxiety and Obsessive-Compulsive Disorder (OCD) treatment provider in the U.S. Hence, the aforementioned factors, combined with partnerships with hospitals, are set to fuel the growth of the segment during the forecast period.

KEY INDUSTRY PLAYERS

Expansion of Related Health Facilities in the U.S. to Lead to Intense Competition Among Industry Players

The United States behavioral health market share is fragmented, with a large number of companies providing substance abuse and eating disorders services. Among key players, Universal Health Services represents a significant share of the market owing to its expanded presence across states with several facilities.

- For instance, in January 2024, Acadia Healthcare partnered with Ascension to expand the number of inpatient behavioral beds available in Austin to expand its services in Texas. Moreover, in July 2023, Acadia Healthcare opened the first of its two hospitals built in collaboration with Geisinger Behavioral Health Center Northeast in Pennsylvania.

Acadia Healthcare is recognized as one of the key providers of behavioral healthcare services as it currently has 253 facilities, including primary care, emergency departments, and outpatient facilities across 38 states in the U.S. The adoption of telehealth technology and its emphasis on acquisitions and partnerships to offer services to a wider segment of the population are expected to enhance the growth potential of the U.S. market in the coming years. In addition to these behavioral health systems, BHG Holdings, LLC., American Addiction Centers, and Uprise Health are concentrating on expanding their footprint in the U.S. market by broadening their facilities and introducing new services in the country.

- For instance, in October 2021, Integrated Behavioral Health rebranded to Uprise Health and announced the expansion of its services in order to address accelerating mental health needs of patients.

LIST OF TOP BEHAVIORAL HEALTH COMPANIES IN U.S./ LIST OF TOP BEHAVIORAL HEALTH COMPANIES:

- Universal Health Services, Inc. (U.S.)

- BHG Holdings, LLC. (U.S.)

- Acadia Healthcare (U.S.)

- American Addiction Centers (U.S.)

- CuraLinc Healthcare (U.S.)

- BEHAVIORAL HEALTH SYSTEMS, INC. (U.S.)

- North Range Behavioral Health (U.S.)

- Uprise Health (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: BHG Holdings, LLC., partnered with Sonara Health, Inc. to make Sonara's remote dosing application available to three opioid treatment programs in South Carolina.

- July 2023: Acadia Healthcare partnered with Methodist Health System to build an advanced 96-bed behavioral health hospital in Council Bluffs, Iowa. This joint venture was formed to expand Acadia Healthcare's acute service line into a new U.S. state.

- February 2023: Universal Health Services, Inc., in partnership with Lehigh Valley Health Network (LVHN), announced plans to build a new 144-bed behavioral health hospital on Macada Road in Hanover Township, Pennsylvania.

- March 2021: Integrated Behavioral Health acquired Uprise, a digital health platform delivering personalized care through self-guided modules, live coaching, and in-person therapy sessions.

- April 2020: Psious launched its virtual reality based-teletherapy solution that allows therapists from all over the world to conduct remote therapy sessions with virtual environments. This solution offers the freedom of teletherapy and helps increase the therapeutic possibilities for mental health professionals.

REPORT COVERAGE

The market research report provides a detailed analysis of the industry. It focuses on key aspects such as regulatory and reimbursement scenarios in the U.S., statistics related to mental health, opioid addiction, and adoption of telehealth technology, key industry developments, such as mergers, acquisitions, and partnerships, and the impact of COVID-19 on the market. Besides this, the report also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.3% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Payor

|

Frequently Asked Questions

The U.S. behavioral health market is expected to grow from USD 92.14 billion in 2025 to USD 132.46 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.3% during the forecast period.

Registering a CAGR of 5.3%, the market is poised to exhibit steady growth during the forecast period (2025-2032).

By type, the behavioral & mental health segment dominated the market in 2024.

Increasing prevalence of mental health disorders such as depression, anxiety, and substance use disorders. Improved access to behavioral health care services. Rising awareness and destigmatization of mental health issues. Strategic acquisitions and partnerships by key market players. Implementation of favorable federal and state policies promoting telehealth-based treatments.

Universal Health Services Inc., Acadia Healthcare, and Behavioural Health Group Inc. are some of the leading companies in the U.S. market.

The introduction of telehealth services and the establishment of advanced facilities are expected to drive the adoption of these services in the U.S.

Enhancing access to care, especially in underserved areas. Providing cost-effective and convenient treatment options. Facilitating continuous patient monitoring and follow-up. Encouraging the integration of digital tools in behavioral health services.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us