U.S. Sterilization Equipment Market Size, Share & Industry Analysis, By Product Type (Thermal Sterilizers {Dry-heat Sterilizers and Moist-heat Sterilizers}, Chemical/Gas Sterilizers {Hydrogen Peroxide Sterilizers, Ethylene Oxide Sterilizers, Nitrogen Dioxide Sterilizers, and Others}, and Others), By End-user (Hospital & Specialty Clinic, Pharmaceutical & Medical Device Manufacturers, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

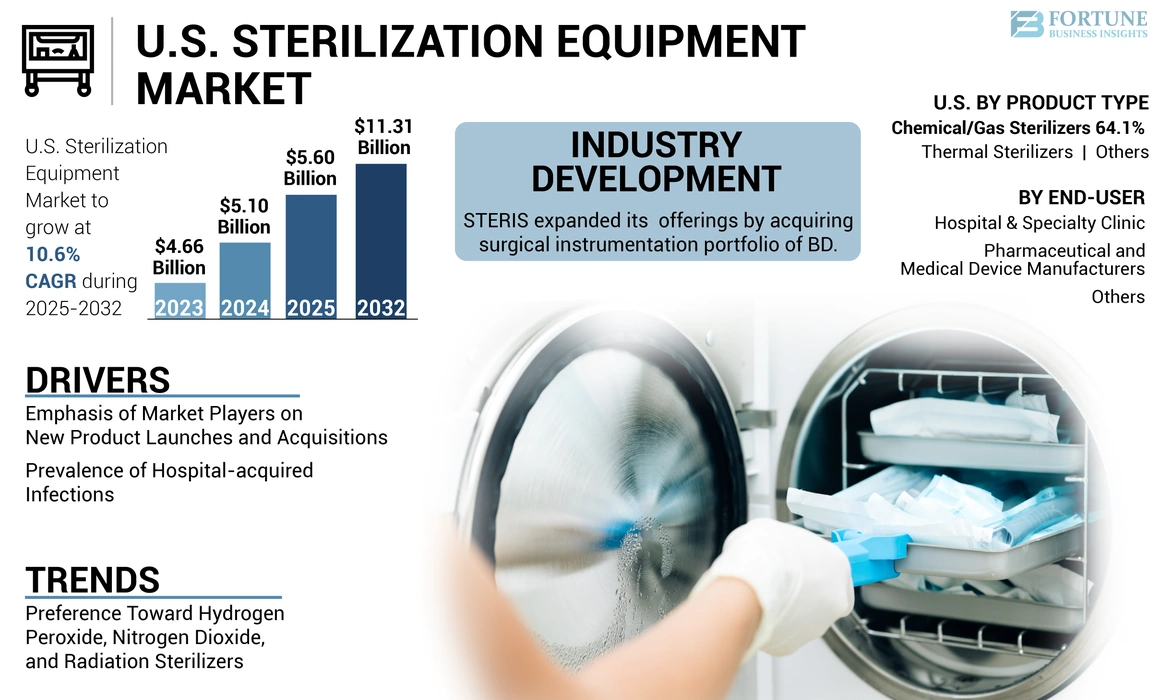

The U.S. sterilization equipment market size was valued at USD 5.10 billion in 2024. The market is projected to grow from USD 5.60 billion in 2025 to USD 11.31 billion by 2032, exhibiting a CAGR of 10.6% during the forecast period.

Sterilization equipment, such as heat sterilizers, ethylene oxide sterilizers, radiation sterilizers, and others, are used to sterilize medical devices in hospitals and manufacturing equipment in pharmaceutical, biotechnology, and medical device companies. This is done to prevent any contamination or hospital-acquired infections, such as catheter-associated urinary tract infections, central line-associated bloodstream infections (CLABSI), and others.

The increasing prevalence of hospital-acquired infections and the increasing focus of pharmaceutical companies on R&D for therapeutic development is anticipated to fuel the market growth during the forecast period.

- For instance, as per the research study published by the National Center for Biotechnology Information (NCBI) in May 2023, around 32,797 non-ventilator-associated hospital-acquired pneumonia (NV-HAP) events per 100 hospitalizations were observed among the 6,022,185 hospital admissions recorded in 284 hospitals in the U.S. Moreover, patients suffering from NV-HAP also experienced other comorbidities such as congestive heart failure, neurologic conditions, chronic lung disease, and others.

The market experienced slow growth in 2020 due to the sudden outbreak of the COVID-19 pandemic. Market players were not able to fulfill the demand for sterilization devices in the first half of 2020 due to lockdown restrictions. However, in the third quarter of 2020, when the lockdown restrictions were reduced, the market experienced significant growth.

U.S. Sterilization Equipment Market Trends

Shift in Preference Toward Hydrogen Peroxide, Nitrogen Dioxide, and Radiation Sterilizers

Thermal sterilization and ethylene oxide sterilization are the most commonly used sterilization methods. However, there are certain limitations associated with these sterilizers that have been limiting their adoption. For instance, sterilization through thermal sterilizers is very slow. Because of this, many objects cannot withstand high temperatures for a longer duration. Moreover, these sterilizers are sometimes not completely efficient in killing microorganisms.

Furthermore, ethylene dioxide sterilizers are the potential cause of cancer due to ethylene oxide (EtO) emissions.

- In March 2024, the U.S. Environmental Protection Agency (EPA) announced amendments to Clean Air Act standards for ethylene oxide (EtO) to address this. These amendments set compliance timelines for the facilities using larger amounts of EtO, as they pose a greater risk than other facilities.

Due to such factors, the healthcare industry has been shifting its preference toward alternate options for these sterilizers, such as hydrogen peroxide sterilizers, radiation sterilizers, and others. These sterilization equipment are more efficient than thermal and ethylene oxide sterilizers.

Furthermore, in order to fulfill the increasing demand for alternatives to ethylene oxide and thermal sterilizers, market players have increased their focus on expanding their production capacity.

- For instance, in April 2024, Noxilizer, Inc. announced the availability of its new facility in the U.S. to manufacture its nitrogen dioxide sterilizer.

Download Free sample to learn more about this report.

U.S. Sterilization Equipment Market Growth Factors

Increasing Prevalence of Hospital-acquired Infections Has been Fueling the Demand for Sterilization Equipment

The number of surgeries being conducted in the U.S. has been growing significantly. Factors such as the rising geriatric population and increasing adoption of sedentary lifestyles have been fueling the prevalence of health issues that can require surgeries as a part of the treatment process.

- For instance, according to the study published by the National Center for Biotechnology Information (NCBI) in 2021, 13 billion surgical procedures were conducted in the U.S. from January 2019 to January 2021.

Moreover, according to the data published by the University of Alabama at Birmingham in 2021, around 350,000 Cardiac Bypass Surgeries (CABG) are performed annually in the U.S.

Sterilization of medical equipment being utilized in surgical procedures is necessary after every surgery to prevent the spread of any infection. Therefore, the growing number of surgical procedures has been increasing the demand for the sterilization process, thereby fueling the U.S. sterilization equipment market growth.

Increasing Emphasis of Market Players on New Product Launches and Acquisitions to Enhance Product Offerings Has Been Boosting the Market Growth

The growing prevalence of hospital-acquired infections, such as catheter-associated urinary tract infections, non-ventilator-associated hospital-acquired pneumonia (NV-HAP), and others, has been fueling the demand for efficient sterilization devices in the country.

The market players have increased their focus on the development and approval of advanced products to fulfill the increasing demand for effective equipment.

- In June 2024, Getinge launched Poladus 150, a vaporized hydrogen peroxide (VHP) low-temp sterilizer. It operates at temperatures up to 55°C. With this launch, the company strengthened its product portfolio for sterilization equipment.

Moreover, the market players have also increased their focus on acquiring other players to enhance their product offerings and strengthen their position in the market.

- For instance, in March 2023, Getinge acquired Ultra Clean Systems, a sterilization firm based in Florida, U.S. With this acquisition, the company aimed to strengthen its position in the U.S. sterilization equipment market.

The increasing focus of the market players on new product launches and the acquisition of other companies in order to expand their product offerings in the country has been fueling the availability of advanced products in the U.S. market. This factor is responsible for increased sales of the advanced products in the market, thereby impelling the U.S. market growth.

RESTRAINING FACTORS

Risk Associated with Inappropriate Sterilization Processes and High Cost Associated of the Equipment Limits the Market Growth

The increasing prevalence of hospital-acquired infections has been fueling the demand for sterilization. However, improper sterilization can increase the chances of hospital-acquired infections. Sometimes, it is not possible to disinfect all the parts of a medical device. Reprocessing equipment without following the Instruction For Use (IFU) manual can also lead to inappropriate sterilization.

Moreover, adherence to multidrug-resistant (MDR) bacteria in medical devices can also cause patient infections. Usually, MDR adheres to the flexible part of the medical device. This could be due to inappropriate reprocessing or previous patients' use.

Furthermore, the high cost associated with sterilization equipment also limits the adoption of these devices in the healthcare industry. For instance, a 60-liter top loader autoclave can cost around USD 18,000 to USD 40,000, and a 150-liter top loader can cost between USD 27,000 to USD 46,000. Similarly, a 60-liter benchtop autoclave can cost around USD 22,000 and a 150-liter front-loading autoclave can cost between USD 32,000.0 and USD 52,000.0.

Therefore, due to the limitations associated with improper sterilization procedures and the high cost associated with the devices, customers prefer disposable items such as gloves, single-use scopes, and others. This reduces the use of sterilizers at healthcare facilities, thereby limiting the market growth.

U.S. Sterilization Equipment Market Segmentation Analysis

By Product Type Analysis

Advantages of Chemical/Gas Sterilizers Over Other Sterilizers is Responsible for the Segment's Dominance

Based on product type, the U.S. market for sterilization equipment is segmented into thermal sterilizers, chemical/gas sterilizers, and others.

The chemical/gas sterilizers segment dominated the market in 2024 by accounting for the maximum U.S. sterilization equipment market share. In addition, the segment is expected to grow at the fastest CAGR during the forecast period. The segment's dominance is attributed to the various advantages associated with the use of these sterilizers. For instance, these sterilizers can effectively inactivate a wide variety of microorganisms in less time compared to heat sterilizers. Similarly, the strong presence of companies such as Steris and 3M that emphasize new advanced product launches is also fueling the segment's growth.

Moreover, the others segment is expected to grow at a substantial CAGR during the forecast period. The segment's growth is attributed to the increasing demand for radiation sterilization. Radiation sterilization is mostly used in sterilizing single-use medical devices such as surgical gloves and injections. Therefore, the growing consumption of these devices in hospitals, research institutes, clinics, and others has been fueling the demand for radiation sterilization.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Rising Prevalence of Hospital-acquired Infections is Responsible for Increased Demand for Sterilizers in Hospital & Specialty Clinic Settings

Based on end-user, the U.S. market for sterilization equipment is segmented into hospital & specialty clinic, pharmaceutical & medical device manufacturers, and others.

The hospital & specialty clinic segment dominated the market in 2024 and is expected to grow at the fastest CAGR during the forecast period. The increasing prevalence of hospital-acquired infections has been fueling the adoption of sterilizers in this sector.

- For instance, as per the data published by the Centers for Disease Control and Prevention (CDC) in January 2024, around 30,100 central line-associated bloodstream infections (CLABSI) occur in intensive care units and wards in the U.S. every year.

Moreover, the increased government initiatives in the country to control the spread of infection in hospitals are anticipated to boost the growth of the segment.

- For instance, in the U.S., the Health and Human Services (HHS) Steering Committee was established in 2008. The aim was to control the increasing burden of hospital-acquired infection.

Furthermore, the pharmaceutical & medical device manufacturers segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is attributed to the increased focus of the pharmaceutical and biotechnology companies on new biologics approval and commercialization.

- For instance, according to data published by the National Center for Biotechnology Information (NCBI) in May 2023, the U.S. Food and Drug Administration approved around 15 biologics in 2022 from 7 biologics in 2016. The approved biologics in 2022 included nine monoclonal antibodies.

KEY INDUSTRY PLAYERS

Increasing Focus of Market Players on the Expansion of their Product Portfolio is Responsible for their Growth in the Market

Market players such as STERIS, Getinge, and 3M are among the significant players in the U.S. sterilization equipment market. These players' growth is attributed to their increasing focus on strengthening their sterilizer product portfolio.

- In June 2024, STERIS completed the expansion of its existing facility, Illinois gamma processing facility to include X-ray processing.

Other market players, such as Andersen Sterilization, MMM Group, ASP (Fortive), and others, have been focusing on new product launches to enhance the efficiency of their sterilizers.

- For instance, in April 2022, Andersen Sterilizers introduced Anprolene AN75, an ethylene oxide sterilizer, in the U.S. market. This new product is the most significant upgrade to the Anprolene system since its introduction in the 1960s.

LIST OF TOP STERILIZATION EQUIPMENT COMPANIES IN U.S./ LIST OF TOP STERILIZATION EQUIPMENT COMPANIES:

- STERIS (U.S.)

- Getinge AB (Sweden)

- ASP (Fortive) (U.S.)

- 3M (U.S.)

- Cardinal Health (U.S.)

- Stryker (U.S.)

- MMM Group (Germany)

- MATACHANA (Spain)

- Andersen Sterilizers (U.S.)

- Noxilizer Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – MATACHANA introduced a new format of integrating chemical indicators to maximize environmental sustainability in the sterilization sector.

- November 2023 – Getinge announced the acquisition of Healthmark Industries Co. Inc., a provider of infection control consumables, for nearly USD 320.0 million. This strategic step enhanced Getinge's presence within sterile reprocessing in the U.S. and facilitated a global expansion for Healthmark Industries Co. Inc.

- August 2023 – Andersen Sterilizers and Andersen Scientific (sister company of Andersen Sterilizers) received the first master file from the Food and Drug Administration (FDA) 510(k) in the Ethylene Oxide (EO) Sterility Change Master File Pilot Program.

- June 2023 – STERIS expanded its offerings by acquiring surgical instrumentation, laparoscopic instrumentation, and sterilization container portfolios of BD, a medical technology company with an aim to strengthen its product portfolio.

- September 2020 – Steris and the Association for the Advancement of Medical Instrumentation (AAMI) and medical industry leaders collaborated to develop a free publication to discuss best practices and strategies for sterilization of medical devices and packaging.

REPORT COVERAGE

The U.S. sterilization equipment market report provides a detailed competitive landscape. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. In addition, it focuses on key points, such as new solution launches in the market. Furthermore, the report covers a regional analysis of different segments, profiles of key market players, market trends, and the impact of the COVID-19 pandemic on the market. The report consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.6% from 2025-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By End-user

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market stood at USD 5.10 billion in 2024 and is projected to reach USD 11.31 billion by 2032.

The market is predicted to exhibit a CAGR of 10.6% during the forecast period of 2025-2032.

By product type, the chemical/gas sterilizers segment led the market in 2024.

The rising prevalence of hospital-acquired infection, surgical procedures, and increasing investment in R&D by pharmaceutical and biotechnological companies to develop novel biologics have fueled the market growth.

STERIS, Getinge, and 3M are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us