Vietnam Water Purifier Market Size, Share & Industry Analysis, By Product Type (RO Filters, UV Filters, Gravity Filters, and Others), By Application (Residential, Light Commercial, and Commercial), and Forecast, 2024-2032

KEY MARKET INSIGHTS

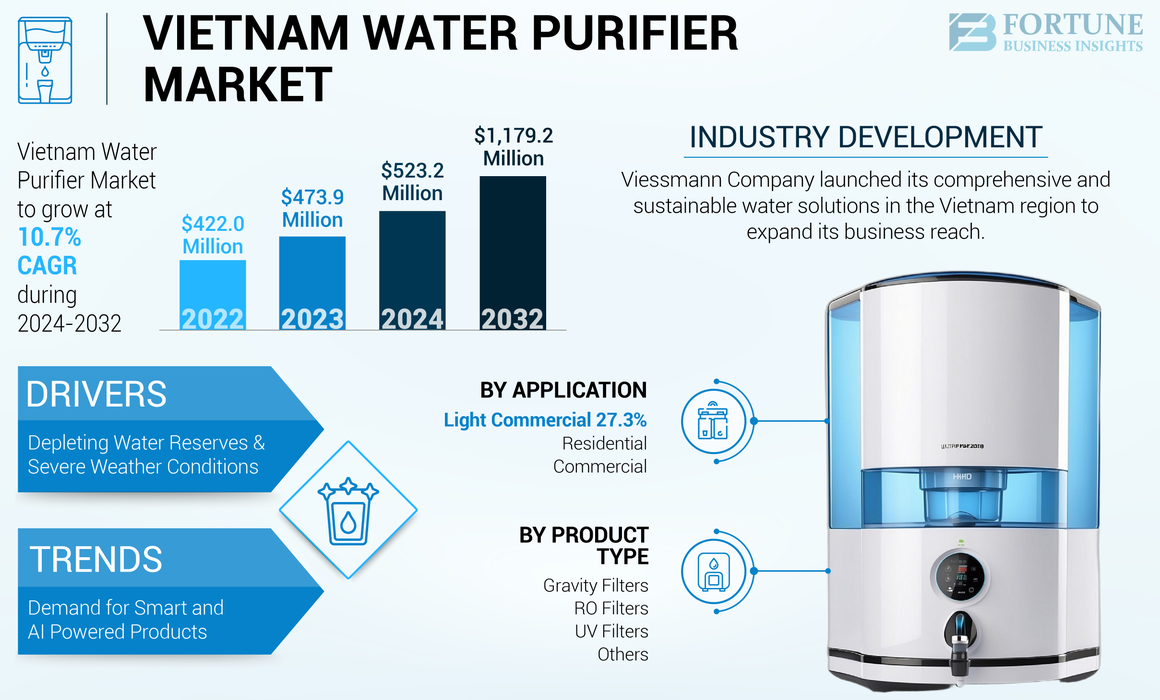

Vietnam water purifier market size was valued at USD 473.9 million in 2023 and is expected to grow from USD 523.2 million in 2024 to USD 1,179.2 million by 2032 at a CAGR of 10.7% during the forecast period.

Water purifiers are systems/appliances used to purify water for drinking and household consumption. These systems are equipped with different types of water filters depending on which categorized them into different groups such as reverse osmosis (RO) filters, ultraviolet (UV) filters, and others. Water purification systems provide safe and clean drinking water with a better taste and offer several health benefits. Growing demand for clean water free from various kinds of toxic chemicals and heavy minerals is set to drive product demand. As people are becoming more conscious of how the quality of their water affects their health, the demand for the product will rise in the forthcoming years.

Major companies such as Sunhouse, Kangaroo, and Sanofi are driving market growth by bringing innovative products such as smart water purifiers and IoT-enabled products. Such efforts taken by market players will increase the product’s penetration during the forecast period.

Impact of COVID-19:

Though the COVID-19 pandemic brought various challenges to the market but it also fueled the importance of water purification systems among consumers. During the challenging period of the COVID-19 pandemic, Vietnamese individuals prioritized spending additional time with their families and enhancing their home lives. As a result, there was a growing inclination to upgrade and enhance their living spaces. Consequently, there was a noticeable rise in the desire and expenditure on consumer electronics and appliances, which led to a high demand for water purification systems in commercial spaces, hotels, and restaurants.

Market Dynamics

DRIVING FACTORS

Depleting Water Reserves and Severe Weather Conditions to Drive Market Growth

In recent years, Vietnam has made significant progress in both social and economic development, positioning itself to emerge as a key player in global manufacturing. However, rapid urbanization has had a severe impact on the environment, pushing the country to become one of the top 10 most vulnerable countries to climate change. As a result, Vietnam is increasingly susceptible to water scarcity due to its harsh and erratic climate patterns in the coming years. A recent report by the World Bank described Vietnam's water situation as "too much, too little, too dirty," highlighting the country's struggles with floods and landslides caused by excessive rainfall and the geological landscape's inability to hold water during the wet season. The nation has also experienced prolonged droughts that have affected large areas of farmland. Moreover, Vietnam's water sources, both on the surface and underground, have been heavily contaminated by industrial activities and the continuous buildup of untreated waste.

Rising fear of water scarcity will likely push people toward water filtration products, as they provide a safer and more convenient solution. Therefore, dwindling water reserves and the aforementioned severe weather conditions are set to fuel the demand for water purifiers in Vietnam during the forecast period. In addition, rapid urbanization has polluted domestic water reserves and growing public awareness of waterborne diseases will further propel the Vietnam water purifier market growth.

RESTRAINING FACTORS

High Initial Cost and Negative Environmental Concerns May Slow Down Product’s Adoption

Cost is a major factor limiting the adoption of water purification systems, especially in low-income and rural areas. Advanced purification solutions such as real-time monitoring, advanced filtration, and smart connectivity, are expensive to purchase, acting as a barrier for many consumers. Additionally, filters and membranes need to be replaced regularly, which can strain household budgets. In rural areas, a lack of reliable electricity and deficiencies in water storage and distribution systems can further reduce the effectiveness of such products.

Some water purification technologies, such as reverse osmosis (RO) systems, can waste a significant amount of water. Water purification systems can be more energy-intensive than other water treatment methods and produce a significant amount of waste in terms of water dispensed while purification. Moreover, components such as UV filters are non-biodegradable, which can end up in soil, water, and organisms, making them toxic. Therefore, high initial cost and environmental concerns may slow down the product’s adoption. Some water purification technologies, like reverse osmosis, waste significant water and energy, and produce non-biodegradable waste, limiting their adoption.

MARKET OPPORTUNITIES

Supportive Government Initiatives to Create Remunerative Opportunities in the Market

The Vietnamese government has recognized the importance of providing clean and safe drinking water for its citizens. In response, in 2022, the government endorsed Conclusion 36 on “Ensuring Water Security and Safety of Dams and Reservoirs by 2030, with a vision to 2045,” focusing on key elements for transitioning to a clean, resilient, and inclusive economy. To support the growing product demand, the government has established water quality standards and safety regulations to encourage consumers to use water purifiers. Additionally, the government has promoted public health and environmental protection to support market expansion. Such government initiatives and policies are set to create remunerative opportunities in the market.

MARKET CHALLENGES

Fragmented Market and Strict Regulations to Present Various Challenges

The water purifier market in Vietnam is fragmented, with many small players and established brands. This competition can lead to price wars and pressure on profit margins. Additionally, regulatory and safety standards can be challenging for manufacturers to meet. For example, the National Green Tribunal has banned RO purifiers in areas with TDS levels below 500 mg/L. Manufacturers are also under pressure to develop eco-friendly products with sustainable materials and energy-efficient technologies.

In addition, a major chunk of the population still relies on traditional water purification methods such as boiling, filtering, and chlorination. Though people in urban areas are becoming more aware of water purification techniques, the majority still rely on traditional methods, posing a challenge for market players.

VIETNAM WATER PURIFIER MARKET TRENDS

Growing Demand for Smart and AI Powered Products to Fuel Market Growth

Focusing on product innovation has become the primary strategic approach, impacting the water purifier industry in various ways. Purifiers with smart features allow consumers to monitor water usage, adjust settings, and send maintenance alerts. These products are becoming more popular as people's standard of living and spending capacity improve. Increasing awareness about health issues linked to waterborne illnesses is driving up the need for intelligent water purification systems. Moreover, technological progress, such as the incorporation of artificial intelligence (AI), the Internet of Things (IoT), and other sophisticated technologies in water purification systems, is also accelerating the expansion of the market. Current RO purifiers are integrated with many advanced technologies that enhance user experience and bring many great health benefits. Therefore, the trend toward smart and AI-powered purifiers is set to create remunerative opportunities in the market. In addition, growing demand for multi-stage filtration and portable water purifiers is likely to create additional opportunities in the market. Portable water purifiers help reduce the use of single-use plastic bottles and also provide clean filtered water that can positively impact human health.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product Type

RO Segment Held the Largest Share Owing to its High Filtration Capability

Based on product type, the market is segmented into RO filters, UV filters, gravity filters, and others.

The RO segment held the largest Vietnam water purifier market share in 2023. In RO purification technology, water molecules can pass through the pores of the membrane, while larger particles, ions, and molecules are blocked. This process removes harmful contaminants such as bacteria, viruses, dissolved salts, and heavy metals. RO purifiers can also convert hard water into soft water, which makes them ideal for purification technologies in the water purification segment.

In UV water filtration systems, ultraviolet light eliminates harmful bacteria from the water, thoroughly disinfecting it of pathogens. UV based purifier is beneficial for health as it eradicates all dangerous microbes found in the water without altering its taste. The efficacy of UV filters to offer disinfected, pure water will drive moderate growth in the UV filter segment during the forecast period.

Gravity filters are non-electric devices that use gravity to purify water by passing it from a higher container to a lower one. These systems use microfilters and sediment carbon to remove impurities from water. While they are effective for basic filtration, they are not as efficient as electronic purification systems and are less suitable for water with high levels of contamination or harmful chemicals. This limits their adoption in areas where high purity is prioritized. As a result, the demand for gravity filters is expected to remain stagnant in the foreseen period.

By Application

Residential Segment Held the Majority Share Owing to High Demand for Clean Water

Based on application, the market is classified into residential, light commercial, and commercial.

The residential segment accounted for the major share of the Vietnam market in 2023 and is set to maintain its dominance throughout the assessment period. The anticipated demand is attributed to increasing urbanization, industrialization, and growing concerns over water contamination. The growth in disposable income and awareness of waterborne diseases further contribute to the demand for water purifiers in residential settings.

A secure work environment provides workers with the highest quality working conditions, including adequate water, sanitation, and cleanliness amenities. A study conducted in 2022, supported by HSBC, showed that businesses that intentionally allocate resources to meet the water, sanitation, and hygiene requirements of their staff are more successful. Furthermore, the presence of proper sanitation and hygiene amenities enhances the well-being, efficiency, and spirit of the employees, leading to better financial performance and reduced operational expenses. As a result, demand from the light commercial application segment is set to grow significantly during the forecast period.

The commercial segment is estimated to experience moderate growth till 2032. The demand is anticipated to be driven by the growing need for commercial water purification applications, rising industrialization, urban development, and stricter government regulations on water quality standards. Commercial establishments such as offices, hotels, restaurants, hospitals, and educational institutions are increasingly adopting water purification systems to ensure clean and safe drinking water for employees, customers, and guests. Vietnam’s rapid economic development, along with the growing importance of corporate social responsibility (CSR) and health consciousness, is contributing to the segment's expansion.

To know how our report can help streamline your business, Speak to Analyst

VIETNAM WATER PURIFIER COUNTRY OUTLOOK

Vietnam market is projected to grow significantly during the forecast period. The anticipated demand is attributed to increasing urbanization, industrialization, and concerns over water pollution. The country’s population, over 100 million, is predominantly young and rapidly urbanizing, leading to rising demand for clean, safe drinking water. Rise in disposable income and increasing awareness of waterborne diseases further contribute to the demand for water purifiers in residential settings.

In addition, decreasing confidence in tap water is another factor driving the adoption of water purifiers. Vietnam’s water supply is affected by pollution from industrial waste, agricultural runoff, and contamination of surface water resources, necessitating the high need for purification before consumption. Water purifiers make water safe to drink by removing a wide range of contaminants such as impurities, biological contaminants, and minerals. They help prevent waterborne diseases such as cholera, typhoid, diarrhea, and cancer. Water purifiers use various methods to treat water, such as reverse osmosis, distillation, UV treatment, and others.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players are Adopting Product Innovation Strategies to Attract New Customers’

Sunhouse, Karofi Group Joint Stock Company, Kangaroo, Culligan International, and Daikiosan are identified as key manufacturers in the Vietnam water purifier market study. Players operating in the market have adopted both organic and inorganic expansion strategies to capitalize on the growing market potential. Domestic players are primarily focusing on creating innovative products to attract new customers and retain their existing customer base through high-quality after-sales service. International market players are acquiring and forming joint ventures with smaller local players to enhance their market stance in the domestic market.

LIST OF KEY PLAYERS PROFILED:

- Sunhouse (Vietnam)

- Karofi Group Joint Stock Company (Vietnam)

- Kangaroo (Vietnam)

- Culligan International (U.S.)

- Daikiosan (Vietnam)

- BWT (Germany)

- China Ecotek Vietnam Co., Ltd (Vietnam)

- Pure it by Unilever (U.K.)

- AO Smith (U.S.)

- Panasonic Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: AO Smith Corporation signed an agreement to acquire Unilever's water purification business, Pureit. The addition of Pureit would strengthen the company’s position as a global supplier of premium water treatment products and double its market penetration in South Asia. The acquisition would also support the company’s corporate strategy by enhancing its premium product portfolio and distribution capabilities.

- November 2023: Panasonic Manufacturing Malaysia Berhad (PMMA) introduced its inaugural Reverse Osmosis Water Purifier (ROWP) to the Vietnamese market. This purifier is offered in three unique models: Premium, Mid, and Standard, each distinguished by their own designs and features to meet various requirements and tastes. To sum up, the Panasonic ROWP boasts an appealing look, is built to last, and delivers water of the highest quality to its users.

- October 2023: Viessmann Company launched its comprehensive and sustainable water solutions in the Vietnam region to expand its business reach. The company introduces two product categories namely Vitowell water heaters and Vitopure water purifiers to tap into regional opportunities.

REPORT COVERAGE

The research report provides a detailed market analysis, focusing on crucial aspects such as leading companies, product type, and application. In addition, it provides quantitative data regarding market size, analysis, research methodology, and insights into market trends. The report also highlights vital industry developments and the competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors that have contributed to the market's growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 10.7% during 2024-2032 |

|

Segmentation |

By Product Type

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says that the Vietnam market size was USD 473.9 million in 2023 and is projected to reach USD 1,179.2 million by 2032.

Growing at a CAGR of 10.7%, the market is expected to exhibit rapid growth during the forecast period.

By application, the residential segment dominated the market in 2023.

Depleting water reserves and severe weather conditions are key factors driving market growth.

Sunhouse, Kangaroo, Karofi Group Joint Stock Company, and AO Smith are the top players in the market.

Growing demand for smart and IoT-enabled water purifiers is set to create lucrative opportunities in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us