汽车软件市场规模、份额和行业分析,按类型(应用软件、中间件和操作系统)、按应用(ADAS 和安全、信息娱乐和仪表组、发动机管理和动力总成等)、按车辆类型(乘用车和商用车)以及区域预测,2026 年至 2034 年

主要市场见解

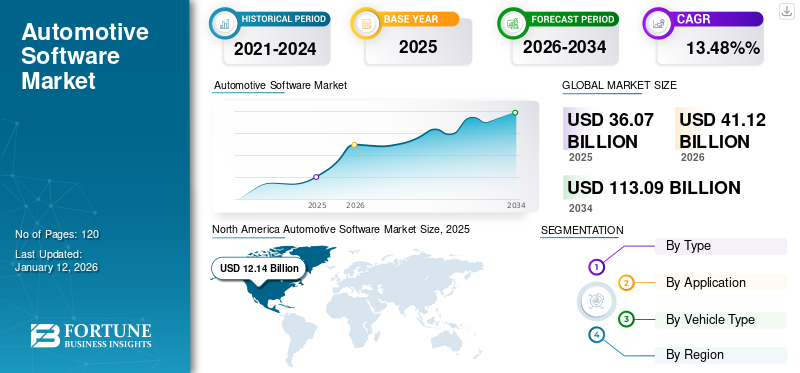

2025年全球汽车软件市场规模达360.7亿美元,预计将增长41.122026 年 10 亿美元113.09到 2034 年将达到 10 亿美元,复合年增长率为13.48% 在预测期内。北美主导汽车软件市场,市场份额为 33.65%2025年。

软件与汽车系统的集成度不断提高、技术进步以及对互联、自主和互联的需求不断增长,推动了市场的发展。 电动汽车。此外,对配备连接功能的车辆的需求不断增长,这些功能允许车辆、基础设施和云服务之间进行实时通信和数据交换。预计这些因素将在预测期内推动汽车软件市场向前发展。

此外,共享移动服务和车队管理平台的激增正在推动对先进汽车软件解决方案的需求。随着网约车和汽车共享模式的扩展,车队运营商将需要智能车辆跟踪、预测性维护和驾驶员行为分析,从而推动汽车生态系统中的软件发展。

全球汽车软件市场概览

市场规模:

- 2025 年价值:360.7 亿美元

- 2026 年价值:美元41.12十亿

- 2034 年预测值:美元113.09亿元,复合年增长率为13.48%2026年至2034年

市场份额:

- 区域负责人:北美举办了33.65受特斯拉、通用汽车和 Waymo 等主要厂商支持的联网和自动驾驶汽车的广泛采用的推动,到 2025 年,市场份额将达到 %。

- 增长最快的地区:在快速电气化、不断扩大的电动汽车基础设施以及中国、日本和韩国强有力的政府举措的推动下,亚太地区是增长最快的地区。

- 最终用户领导者:在物联网和车联网 (V2X) 技术增强安全性、连接性和用户体验的推动下,乘用车细分市场将在 2024 年引领市场。

行业趋势:

- 转向软件定义车辆 (SDV):过渡到支持 OTA 的、以软件为中心的车辆。

- 生成式人工智能的集成:加快设计和预测性维护效率。

- 联网和自动驾驶车辆:提高安全性、移动性和车内智能。

驱动因素:

- 联网汽车采用率不断上升:促进实时数据集成。

- 人工智能和机器学习进步:为自主和智能系统提供动力。

- 电动汽车扩展:驱动电池和能源优化。

- 车队管理需求增长:加强预测和远程信息处理操作。

- 政府和监管支持:促进安全和排放合规。

汽车软件是指用于车辆设计、制造、操作和维护的广泛软件解决方案。这些解决方案专为嵌入式系统、车辆管理系统、信息娱乐、安全和安保系统、远程信息处理、自动驾驶等汽车应用量身定制。这些解决方案可以帮助汽车制造商、供应商和服务提供商提高车辆性能、安全性、用户体验和整体效率。

COVID-19 大流行对世界各地的多个行业产生了负面影响。疫情对全球供应链造成了严重破坏,影响了汽车软件系统所需硬件组件的可用性。这些中断导致了生产和开发周期的延迟。然而,疫情加速了汽车行业向数字化的转型,重点是改善在线销售、远程诊断和无线(OTA)软件更新。

工作范围包括 BlackBerry Limited、KPIT Technologies Ltd、MONTAVISTA SOFTWARE, LLC.、Microsoft、Intellias、HARMAN International 等公司提供的解决方案。

生成式人工智能的影响

对过程自动化和质量控制的需求不断增长预计将推动市场增长。

生成式人工智能技术根据以前学习的模式和数据创建新的内容和解决方案。该软件对包括汽车行业在内的多个行业产生了重大影响。生成式人工智能可以快速生成和评估车辆部件的多个设计选项,从而加快迭代和细化过程。人工智能算法可以优化空气动力学、减轻重量和材料使用的设计,从而提高车辆效率和性能。

生成式人工智能还可以优化制造流程,确定最有效的组件组装方法,同时减少浪费。人工智能驱动的视觉系统可以实时检测缺陷和异常,从而提高生产质量标准。此外,生成式人工智能可以提高高级驾驶员的准确性和鲁棒性。

例如,

- 2024年5月, KPIT Technologies 与多家美国汽车制造商建立了合作伙伴关系。通过此次合作,该公司旨在推出嵌入汽车的专有生成式人工智能技术。

生成式人工智能越来越多地用于通过根据用户偏好定制信息娱乐、语音助手和气候控制系统来改善车内体验。人工智能驱动的行为学习模型使车辆系统能够动态适应驾驶员的习惯,确保舒适性和安全性。这种转变使 OEM 能够提供差异化且直观的用户体验。

汽车软件市场趋势

向软件定义车辆 (SDV) 的转变正在推动市场增长。

车辆越来越多地由其软件功能而不是硬件来定义。这种转变允许通过无线 (OTA) 软件更新进行持续更新和增强。汽车制造商正在采用模块化软件架构,以便更轻松地更新和集成新功能。随着车辆的互联程度越来越高,实施稳健的技术至关重要 网络安全防止黑客攻击和数据泄露的措施。

欧洲、北美和亚洲的监管机构需要车辆软件来进行合规报告、排放监测和实时诊断。这些不断变化的监管要求正在推动汽车制造商和一级供应商大力投资下一代软件平台,以确保合规性并提供报告透明度。

另一个不断增长的趋势是使用 AUTOSAR Adaptive 和 ROS2 等开源软件框架,它可以加快汽车软件平台的开发和标准化。这些框架因其模块化、可扩展性和缩短上市时间的优势而受到 OEM 和初创公司的青睐。

此外,市场参与者越来越注重将可持续性和环保解决方案融入自动驾驶汽车中。这包括开发优化车辆性能的软件,以减少排放并提高燃油效率。生态驾驶模式等功能可帮助驾驶员减少对环境的影响。随着行业不断创新,软件将在定义车辆功能和增强整体驾驶体验方面发挥越来越重要的作用。预计这些进步将在预测期内推动市场增长。

下载免费样品 了解更多关于本报告的信息。

汽车软件市场增长因素

车辆技术的不断进步推动了市场的增长。

人工智能(AI)和机器学习(ML)融入汽车软件可实现自动驾驶、预测性维护和个性化用户体验等高级功能。先进的软件在车道保持辅助、自适应巡航控制和自动紧急制动等先进 ADAS 功能的开发中发挥着重要作用。

云和边缘计算日益集成到汽车架构中,提高了处理速度、数据安全性和系统可扩展性。云平台可实现软件更新、分析和远程诊断的集中管理,而边缘计算可加快关键 ADAS 功能的响应时间,从而形成支持实时车辆智能的无缝混合基础设施。

此外,车辆中物联网设备的激增实现了实时数据交换和连接,从而改善了实时导航、车辆诊断和远程控制等功能。此外,车队管理、基于使用情况的保险和车辆跟踪对远程信息处理系统的需求不断增长,推动了对强大的汽车软件解决方案的需求。这些因素将塑造市场的未来,从而实现持续增长和发展。

例如,

- 根据行业调查报告,预计到 2030 年,全球道路上行驶的车辆将有 12% 实现完全自动驾驶。

制约因素

数据隐私和安全问题可能会阻碍市场增长。

汽车软件经常在安全关键环境中运行,其中的故障可能会造成严重后果。确保高可靠性和故障安全运行至关重要,需要进行广泛的测试和验证。即使是很小的安全缺陷也可能导致重大安全问题或召回,从而降低消费者的信任并增加汽车制造商的成本。

跨原始设备制造商和地区的汽车软件平台缺乏全球标准化,使开发变得复杂,导致互操作性问题,并增加认证成本。这种分散的生态系统使可扩展性和统一合规性变得复杂,特别是当车辆在具有不同监管环境的跨境环境中更频繁地运行时。

此外,该软件经常收集和处理大量个人数据,引发了数据隐私和安全方面的问题。确保遵守《通用数据保护条例》(GDPR) 和《中央消费者保护局》(CCPA) 等数据隐私法至关重要。通过安全地管理和透明地披露数据使用情况来维持消费者的信任是该行业持续面临的挑战。预计这些因素将减缓市场增长。

汽车软件市场细分分析

按类型分析

应用软件细分市场领先的原因 对自动驾驶能力的需求不断增长

根据类型,市场分为应用软件、中间件和操作系统。

应用软件占据最大市场份额50.97%到 2026 年,因为它对于自动驾驶系统的开发和运营至关重要,该系统允许车辆在没有人工干预的情况下导航和做出决策。使用软件应用程序组合来自多个传感器(激光雷达、摄像机和雷达)的数据可以提高自主系统的准确性和可靠性。

由于汽车操作系统有效地将系统资源(CPU、内存和I/O)分配给各种应用程序,确保峰值性能,因此预计操作系统在预测期内将以最快的复合年增长率增长。操作系统通过优先考虑安全和实时处理等关键功能而不是非关键任务来安排任务。预计这些因素将在未来几年加速市场增长。

中间件越来越受欢迎,因为它充当操作系统和应用程序层之间的通信链路,确保数据流顺畅、系统模块化以及各种电子控制单元 (ECU) 之间的互操作性。随着车辆架构变得越来越复杂,汽车制造商越来越多地转向中间件以实现更快的集成和敏捷的软件开发。

了解我们的报告如何帮助优化您的业务, 与分析师交流

按应用分析

ADAS 和安全领域主导市场的原因是 更加注重增强安全性

根据应用,市场分为高级驾驶辅助系统和安全、信息娱乐和仪表组、发动机管理和动力总成以及其他(远程信息处理和连接)。

ADAS 和安全市场份额最大34.50%到 2026 年,汽车软件将为车道保持辅助、自适应巡航控制、自动紧急制动和盲点检测等关键 ADAS 功能提供支持,从而显着提高车辆安全性。

此外,该软件还可以进行实时数据处理和决策,以避免碰撞,从而保护乘客和行人。随着技术的进步,应用软件在汽车行业中的重要性和影响力预计将增加,从而导致车辆性能和用户满意度的进一步创新和提高。

信息娱乐和仪表组预计在预测期内将以最快的复合年增长率增长,因为它们已成为汽车的重要特征。随着技术的进步,模拟仪表和刻度盘让位于数字仪表组。它显示重要的车辆信息,例如速度、发动机状态和燃油油位。此外,现代信息娱乐系统与智能手机集成,支持语音命令,并提供各种服务来改善驾驶体验。

豪华车和下一代汽车对 AR/VR 驱动的导航系统、驾驶员警报和沉浸式娱乐的需求不断增长,正在推动信息娱乐行业的创新。 OEM 正在投资人机界面 (HMI) 软件来创建交互式仪表板,从而提高用户参与度和品牌价值。

按车型分析

乘用车细分市场领先的原因是 物联网和 V2X 技术的不断融合

根据车辆类型,市场分为乘用车和商用车。

2026年,乘用车占据最大市场份额,达74.44%。物联网设备和 V2X(车对万物)通信技术的集成使车辆能够相互通信、与交通基础设施和云通信。这种连接可实现实时数据交换和更好的流量管理。此外,许多乘用车现在都配备了自动驾驶和自动停车等半自动功能。这些功能使用先进的软件算法来提高驾驶员的便利性和安全性。

电动轻型商用车 (e-LCV) 在物流和最后一英里交付业务中的使用不断增加,对路线优化、电池健康监控和车队效率分析等软件的需求不断增加。车队经理越来越多地将这些数字功能视为关键的成本削减工具。

随着远程信息处理软件的进步使得实时车辆诊断、远程监控和基于使用的保险等功能更加普遍,商用车预计在未来几年将以最快的复合年增长率增长。汽车软件对于商用车运营商跟踪并确保遵守安全、排放和驾驶时间法规至关重要,所有这些对于全球许多地区都很重要。

区域见解

从地理上看,我们对北美、南美、欧洲、中东和非洲以及亚太地区的市场进行了研究。

[vONwzj68 月]

北美

北美以美元估值主导市场12.142025 年 10 亿美元13.72026 年将达到 10 亿。在特斯拉等公司和监管激励措施的推动下,该地区,尤其是美国和加拿大,电动汽车的采用率正在显着增长。预计到 2026 年,美国市场将达到 97 亿美元。

用于管理电池性能、能源效率和充电基础设施的先进软件对于不断增长的电动汽车市场至关重要。 Waymo、通用汽车、特斯拉等北美主要汽车制造商和科技公司都在大力投资自动驾驶技术的开发。

此外,该地区科技巨头和汽车原始设备制造商之间正在加强合作,开发云原生软件定义汽车。对移动即服务(MaaS)平台和数据货币化框架的战略投资正在推动市场增长。

例如,

- 美国国家公路交通安全管理局 (NHTSA) 和其他监管机构鼓励或强制纳入某些 ADAS 功能,以改善道路安全。

亚太地区

预计亚太地区在预测期内将以最快的复合年增长率增长。中国、日本和韩国在电动汽车市场处于领先地位,在技术和基础设施方面进行了大量投资。本地软件开发中心的发展、政府支持的电动汽车补贴以及与全球原始设备制造商的战略联盟都为亚太地区创新驱动的汽车软件开发生态系统做出了贡献。日本市场预计到2026年将达到20.7亿美元,中国市场预计到2026年将达到22.6亿美元,印度市场预计到2026年将达到15.8亿美元。

先进的电池管理系统对于优化电池性能并确保电动汽车的安全和效率至关重要。此外,该地区对先进的信息娱乐系统有很高的需求,可以与智能手机、互联网连接和复杂的用户界面。联网车辆提供实时导航、交通信息和远程诊断,增强整体驾驶体验。例如,

- 2024年4月,中国技术提供商华为推出了一款新颖的智能驾驶汽车软件。通过推出该软件,该公司旨在扩大其在电动汽车行业的业务。

欧洲

预计欧洲未来几年将以显着的复合年增长率增长。自适应巡航控制、车道保持辅助、自动紧急制动、停车辅助等ADAS功能在欧洲车辆中广泛采用。欧盟 (EU) 制定了严格的安全法规,例如通用安全法规 (GSR),要求新车配备某些 ADAS 功能,以增强道路安全。英国市场预计到2026年将达到22.4亿美元,德国市场预计到2026年将达到23.8亿美元。

城市地区移动即服务 (MaaS) 的兴起,加上数字化的广泛采用,正在推动对可扩展汽车软件平台的需求。欧洲对数据治理和网络安全的高度重视鼓励原始设备制造商使用强大、合规的软件架构。 此外,欧洲车辆正在集成先进的人机界面(HMI),包括触摸屏、语音控制和增强现实显示器,以增强用户体验。

中东、非洲和南美洲

预计中东和非洲在预测期内将出现显着增长。该地区的许多汽车制造商正在采用无线更新功能,允许远程软件更新、功能添加和解决安全漏洞,而无需亲自访问。

此外,该地区日益重视智慧城市计划和智能交通管理系统,为 V2X 和远程信息处理软件提供商创造了新的机遇。海湾国家的高档汽车需求也推动了豪华车领域的软件创新。

在南美洲,随着汽车制造商加大对自动驾驶技术的投资,该市场正在稳步增长。许多试点计划和测试举措正在进行中,特别是在巴西和阿根廷,为更广泛采用铺平了道路自动驾驶汽车。

政府对交通网络数字化和物流现代化的举措增加了人们对联网商用车的兴趣,从而导致对适合区域运营条件的汽车软件解决方案的需求更大。

主要行业参与者

领先组织正在联手扩大其全球足迹

领先公司专注于通过展示特定行业的服务来巩固其市场地位。这些公司正在与国内企业实施收购和兼并战略,以巩固自己的地位。老牌公司正在推出尖端解决方案来扩大客户群。此外,用于推出技术先进产品的研发资本支出的增加预计将促进市场扩张。此外,知名公司正在部署战略,以在竞争激烈的市场中保持相对于其他公司的优势。

顶级汽车软件公司名单:

- 黑莓有限公司(加拿大)

- KPIT 技术有限公司(印度)

- 谷歌有限责任公司(美国)

- Airbiquity Inc(美国)

- 风河系统公司(我们。)

- 微软(美国)

- 蒙塔维斯塔软件有限责任公司。 (我们。)

- 罗伯特·博世有限公司(德国)

- 因泰利亚斯(我们。)

- 哈曼国际(美国)

主要行业发展:

- 2024 年 4 月:塔塔汽车公司选择 HARMAN Ignite Store 作为其车载应用程序商店,帮助客户在全球范围内轻松、安全地访问应用程序。

- 2024 年 3 月:法雷奥与 SDVerse 汽车软件市场、通用汽车、麦格纳和 Wipro 合作开发了一个用于销售和购买汽车软件的 B2B 销售平台。

- 2024 年 3 月: Arm 推出了最先进的 Arm 汽车增强型 (AE) 处理器以及新颖的虚拟平台,可将汽车开发周期缩短长达两年。

- 2024 年 1 月:现代摩比斯 选择风河来推动其软件定义汽车的开发,旨在利用风河 Linux 和 VxWorks 实时操作系统来加强其汽车软件业务。

- 2023 年 10 月:合众新能源汽车有限公司与风河公司合作打造合众汽车智能安全车辆平台,为消费者和汽车制造商提供新的可能。

报告范围

该报告对市场进行了详细分析,重点关注领先企业、产品/服务类型、产品领先应用等关键方面。此外,该报告还提供了对市场趋势的洞察,并重点介绍了行业的关键发展。除了上述因素外,报告还涵盖了近年来促进市场增长的几个因素。

定制请求 获取广泛的市场洞察。

报告范围和细分

|

属性 |

细节 |

|

学习期限 |

2021-2034 |

|

基准年 |

2025年 |

|

预计年份 |

2026年 |

|

预测期 |

2026-2034 |

|

历史时期 |

2021-2024 |

|

增长率 |

复合年增长率13.48%从2026年到2034年 |

|

单元 |

价值(十亿美元) |

|

分割 |

按类型

按申请

按车型分类

按地区

|

常见问题

预计到 2034 年,市场规模将达到 1130.9 亿美元。

2025年,市场估值为360.7亿美元。

预计该市场在预测期内将以 13.48% 的复合年增长率增长。

从车型来看,2023年乘用车将引领市场。

汽车技术进步的不断采用是推动市场增长的关键因素。

BlackBerry Limited、KPIT Technologies Ltd、MONTAVISTA SOFTWARE, LLC.、微软、Intellias 和 HARMAN International 是市场上的顶级参与者。

北美在汽车软件市场占据主导地位,2025 年市场份额为 33.65%。

从应用来看,信息娱乐和仪表组预计在预测期内将以最高复合年增长率增长。

与我们的专家联系 与专家交谈