人工智能市场规模、份额和行业分析,按组件(硬件、软件、服务)、按部署(本地和云)、按企业类型(大型、中小型企业)、按功能(人力资源、营销和销售、产品/服务部署、服务运营、风险、供应链管理)、按技术(机器学习、自然语言处理、计算机视觉)、按行业(医疗保健、汽车、零售、BFSI、制造、农业) & 区域预测,2026 – 2034

人工智能市场规模及未来展望

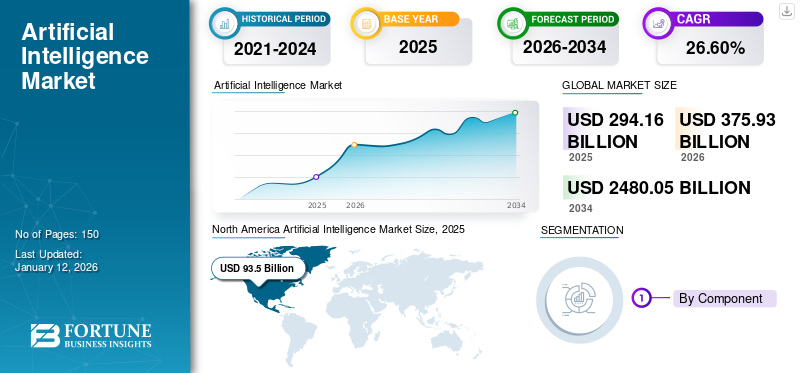

全球人工智能市场规模以美元计价294.16到 2025 年将达到 10 亿美元,预计将增长375.932026 年 10 亿美元2480.05到 2034 年将达到 10 亿美元,复合年增长率为26.60%在预测期内。北美占据全球市场的主导地位31.80%2025年。

使用机器来模拟人类智能过程被称为人工智能。它涉及开发智能软件和硬件来模仿人类的能力,例如学习和解决问题。许多公司正在转向人工智能来分析数据,以做出明智的决策,大约 35% 的企业集成了人工智能,十分之九的组织使用这项技术来保持市场领先地位。世界各国政府都在人工智能研发方面进行了大量投资,据高盛预测,到 2025 年,全球人工智能投资预计将达到 2000 亿美元左右。

下载免费样品 了解更多关于本报告的信息。

上图显示,2024年,美国资助的人工智能公司总数为2,049家,美国资助的人工智能公司为1,143家。这表明人们对该行业潜力的持续兴趣和乐观态度。展望未来,预计 2025 年将带来持续的创新、充满希望的融资机会和人工智能市场的进一步增长。

生成式人工智能对行业有何影响?

随着 ChatGPT 的推出,人工智能技术继续占据主导地位

生成式人工智能工具能够生成类似于人类书写的文本,涵盖广泛的任务,例如编写短篇小说、撰写学期论文和音乐、解决数学问题、编写基本程序以及执行翻译。 OpenAI 报告称,其人工智能工具 ChatGPT 在 2022 年 11 月发布后的五天内就吸引了超过 100 万用户。下面的统计数据说明了流行的在线服务达到相同用户数量所需的时间长度。相比之下,其他知名网络平台需要更长的时间才能达到100万用户的里程碑。

为了响应最近发布的人工智能工具,世界各地的主要科技公司一直在推出自己的人工智能驱动的聊天机器人。这些聊天机器人旨在与 ChatGPT 竞争并帮助这些组织保持在该行业的地位。响应 ChatGPT 的一些最新发布包括:

- 2023 年 2 月– 百度推出了自己的人工智能聊天机器人,英文名为 Ernie bot,中文名为文心一言。至此,百度在港股价上涨逾13%。

因此,ChatGPT 的到来促使企业积极参与和投资人工智能技术,以利用这些人工智能驱动的工具。对人工智能技术的推动一直推动着市场的增长。这种需求预计将在未来几年维持人工智能的领先地位。

生成式人工智能在全球各行业的扩张预计将在 2024 年继续。彭博资讯 (BI) 发布了一份报告,预测生成式人工智能市场在未来十年内将达到 1.3 万亿美元。此外,根据财富商业洞察,全球生成人工智能市场2023 年将达到 438.7 亿美元。目前,生成式人工智能正在利用基于 Transformer 的文本生成模型和基于扩散的图像生成模型。这些模型允许系统从现有数据中学习并生成与输入数据非常相似的大量信息。此外,chatGPT 和 LLM(大语言模型)等人工智能模型越来越多地应用于银行和金融服务、医疗保健以及旅游和酒店等领域,从而减少了人为干预。

互惠关税对人工智能产业有何影响?

人工智能融合了 GPU、服务器、传感器、摄像头和边缘计算芯片等先进组件。当美国对中国人工智能芯片加征关税或中国对美国制造的服务器进行报复等关税时,就会导致生产成本上升。正因为如此,企业在云计算、自主系统和人工智能研究实验室由于依赖专门的进口硬件而受到特别影响。制造成本的增加导致消费者的价格上涨。互惠关税可能会促使公司重新考虑其全球采购策略。 FPGA 板、高性能网络单元和人工智能服务器等关键人工智能组件可能需要从征收关税国家以外的替代供应商或制造厂采购。这些转变造成了运营复杂性,包括更长的交货时间、新供应商的重新资格认证、监管重新认证。互惠关税会影响公司经济高效地出口人工智能产品和服务的能力。依赖跨境人工智能部署的公司(云人工智能 API、智慧城市解决方案或企业人工智能套件)可能面临更高的合规成本,并且需要针对特定区域的部署或强制本地化。

“将塑造未来十年的主要人工智能市场趋势、突破和投资机会是什么?”

在量子人工智能、神经形态计算和下一代生成模型的突破性进步的推动下,人工智能市场正处于巨大转变的边缘。未来十年,我们将见证人工智能驱动的自动化、精准医疗、自主系统和道德领域的投资激增人工智能治理。但真正的游戏规则改变者在于行业融合——人工智能与生物技术、金融和物联网无缝交织,重塑整个生态系统。随着人工智能超越单纯的效率,进入创造力和自主决策领域,企业不仅必须采用而且必须预测这些颠覆。未来属于那些不仅跟上人工智能发展步伐而且积极塑造它的人。

市场动态

市场驱动因素

人类代理的人工智能援助将如何帮助扩大市场?

人工智能无疑为联络中心提供了客户体验聊天机器人,以协助常见查询并引导客户找到相关资源。到 2024 年,人工智能将通过充当代理助理来支持虚拟代理。一个例子是人工智能能够分析客户情绪并提供建议响应,以帮助人工客服提供改进的客户服务。此外,人工智能可以处理代理通常执行的一些重复性任务,例如对对话进行总结和分类以供将来参考。

人工智能为所有客户服务产品提供全面支持,处理基本任务以最大程度地减少代理请求。当需要人工代理时,人工智能可以提高其效率,改善所有接触点的客户互动。随着人工智能的进步,它将提供更强大的能力来协助人类代理。因此,人工智能辅助人类代理的采用正在推动全球人工智能市场份额的增长。

市场限制

人工智能工具的一次性采用是否会带来可能阻碍市场增长的挑战?

发展中国家人工智能人才的缺乏、人工智能工具一次性采用的挑战以及黑箱效应是市场的制约因素。公司已经升级了他们的解决方案,以通过更道德和可解释的人工智能模型来应对这些因素,从而消除黑匣子效应。黑匣子效应意味着人工智能算法有时会产生不易验证的结果。这些算法的结果可能存在难以发现的隐藏偏差。因此,对结果没有充分的解释。因此,用户在采用人工智能工具时往往缺乏信任和安全性。

此外,政府和企业一直在发展研究机构和教育中心,以克服全球人工智能人才的缺乏。因此,这些因素有望在未来几年加速该行业在全球范围内的增长。

市场机会

提供人工智能超级计算机作为服务能否为市场参与者带来利润丰厚的机会?

超级计算提供了类似于计算机的强大处理能力高性能计算 (HPC)。然而,与可用于支持多个应用程序的 HPC 服务器不同,超级计算机仅由一台可定制以执行专用任务的计算机组成。这场大流行激增了对超级计算机集群的需求,这有助于研究人员开发各种药物,并使政府和其他组织能够成功完成与大流行相关的举措。

微软和惠普企业(HPE)等超大规模企业正在致力于开发和投资这个利润丰厚的市场,以获取最大的份额。这些投资和技术专长帮助这些供应商将自己定位为市场领导者。例如,微软Azure发布了由NVIDIA A100 Tensor Core GPU驱动的高精度公共云超级计算机服务。该公司加入了 AWS、Oracle 和 Google 的行列,基于 NVIDIA 的平台推出了类似的超级计算即服务产品。

- 2023 年 2 月 - IBM 在云端构建了一台 AI 超级计算机,用于训练公司的大规模 AI 模型。

- 2022 年 1 月 - Meta 建造了一台专门用于训练机器学习系统的“AI 超级计算机”。

因此,作为服务提供的人工智能超级计算机的日益普及预计将为人工智能市场上的主要供应商创造利润丰厚的机会。

人工智能市场趋势

量子人工智能将如何影响市场?

使用量子计算人工智能的原理被称为量子人工智能。这种形式的人工智能由于其增强人工智能算法的能力而变得越来越流行。量子人工智能有潜力通过快速解决传统计算机难以解决的复杂问题来推动材料科学、复杂系统优化和加密等领域的进步。量子人工智能的主要优势之一是它能够通过有效处理大型数据集和执行目前不可行的计算来显着改进机器学习模型。随着量子人工智能的不断发展,它将促进以前受传统处理能力限制的领域的创新和进步。这种类型的人工智能有望彻底改变各个行业。例如,

- 量子人工智能有潜力加快药物发现领域潜在治疗药物新分子的识别。凭借其以极高的精度模拟复杂化学反应的能力,它可能会在治疗难以解决的疾病方面带来重大进展。对人类健康的潜在影响可能是革命性的。

- 在金融领域,量子人工智能有潜力彻底改变风险评估和投资组合管理。通过分析详细的市场数据并同时考虑无数变量,它可以提供有价值的见解,为投资者提供巨大的优势。它或许能够以一定的精度预测市场模式,从而使当今的顶级算法仅仅是猜测。

下载免费样品 了解更多关于本报告的信息。

量子人工智能有潜力通过提高气候变化及其影响预测的准确性来增强气候建模,这对于制定有效的缓解策略至关重要。在领域网络安全量子人工智能既可能带来重大风险(例如可能损害当前的加密方法),也可能带来机遇(例如创建新的抗量子加密)。量子人工智能的变革能力几乎对每个行业都有影响。在制造业中,它有潜力将供应链和生产流程增强到目前难以想象的程度。在交通运输领域,它有可能改变交通管理和自动驾驶汽车技术。在能源领域,它可以加速开发新的、更有效的可再生能源技术。

大型科技公司和初创公司都在这一领域进行了大量投资,世界各地的政府都在推出支持量子研究和开发的举措。此外,玩家们正在合作加速这种人工智能形式的发展。例如,

- 2024 年 7 月,Zapata 与 D-Wave 建立合作伙伴关系,以增强量子 AI 的融合。此次合作的目的是加快 D-Wave Leap 云平台上组合量子和生成 AI 解决方案的开发和实施。

因此,量子人工智能的普及将创造人工智能市场增长机会。

市场是如何细分的?细分分析的主要见解是什么?

通过组件洞察

多个行业越来越多地采用人工智能会促进人工智能软件的增长吗?

根据组件,市场分为硬件、软件和服务。

该软件占据了市场份额44.94%到2026年,由于人工智能软件在整个人工智能工作流程中发挥着关键作用,对人工智能解决方案的需求不断增加。现在可以访问各种端到端人工智能软件平台,提供简化非数据科学家模型训练的工具。这减少了对招聘专家的依赖,并加快了开发和上市时间。此外,还采用大量软件工具来利用硬件功能并增强资源管理和代码效率,从而提高软件应用程序的整体性能。

据估计,在预测期内,服务将以最高的复合年增长率增长,因为越来越多的企业采用人工智能,他们寻求外部专业知识来进行部署、定制、培训和维护,这正在推动对人工智能服务的需求。 IBM、埃森哲、普华永道、TCS 和凯捷报告称,从 2022 年到 2024 年,人工智能咨询服务的需求将增长 2-3 倍。

通过部署见解

组织中不断增长的云采用是否刺激了对基于云的部署的需求?

根据部署,市场分为云和本地。

到 2026 年,云将主导市场。云细分市场占71.64%到 2025 年,市场份额预计将达到 30.70% 的复合年增长率。 AI不断发展;例如,生成式人工智能的持续趋势推动企业投资和开发人工智能工具。这表明全球对云解决方案的需求不断增长。此外,疫情期间云计算技术的采用激增进一步推动了云部署的增加。

预计未来几年内部部署将显着增长。本地解决方案可确保数据保留在特定地理区域内,这对于在具有严格数据主权法的司法管辖区运营的公司至关重要。

按企业类型洞察

“人工智能的采用主要是由寻求提高生产力的大型企业推动的吗?”

根据企业类型,市场分为大型企业和中小企业。

大型企业将在 2024 年占据大量市场份额。IBM 报告称,约 42% 的大型企业已在其业务运营中实施人工智能,而这些组织中 59% 的 IT 专业人员已确认积极部署人工智能。大型企业板块持有58.99%2026 年的市场份额。

预计中小企业在预测期内复合年增长率最高,达 32.10%。利用人工智能技术可以增强中小企业在多个领域的创新和绩效,包括财务管理、销售和营销、人力资本管理和产品开发。 SAP 的一项研究表明,通过采用人工智能,中小企业的收入预计可以增加 6-10%。

按功能洞察

服务运营是否因其日益普及而占据市场主导地位?

根据功能,市场分为人力资源、营销和销售、产品/服务部署、服务运营、风险、供应链管理等。

2024年,服务运营将主导市场。人工智能最大限度地减少服务管理工作,并通过更快地解决问题来进一步增强客户服务。根据 BMC 最近的一项调查,69% 的企业正在其 IT 服务管理和 IT 运营管理流程中实施人工智能等先进技术,称为 ServiceOps。将人工智能集成到他们的服务中的原因是为了提高运营效率。服务运营账户20.86%2026 年的市场份额。

预测期内,风险预计将以最高复合年增长率 32.40% 增长。现代企业面临着多维风险,例如欺诈、数据泄露、违规、气候相关影响和供应链中断。传统的风险管理系统是静态的、反应性的,而人工智能则可以实现实时和预测性的风险情报。

供应链管理,营销/销售职能一直在加速采用人工智能。这些业务部门一直在利用人工智能来充分利用技术并增强客户体验。因此,在未来几年,这些细分市场预计将呈现出可观的增长率。

通过技术洞察

机器学习是否因其在准确性和精度方面的广泛应用而处于领先地位?

按技术划分,市场分为机器学习、自然语言处理、计算机视觉、机器人技术和自动化、专家系统。

到2025年,机器学习领域将占40.00%的份额,预计在预测期内将创下32.60%的最高复合年增长率,因为该技术能够提高各种任务的准确性和精确度。它还可以处理大量数据并识别人类可能忽视的模式。通过识别趋势、相关性和异常,机器学习可以帮助企业和组织做出数据驱动的决策。据财富商业洞察预测,到 2025 年,全球机器学习市场价值预计将达到 500 亿美元左右。

预计自然语言处理在预测期内将显着增长。借助 NLP 技术,例如交互式语音应答 (IVR)、虚拟助理、实时翻译和聊天机器人,各种业务运营的效率正在不断提高。当人工智能直接与客户交互时,自然语言处理有助于无缝收集数据。此外,它还构建了海量数据同步的敏捷性,有助于优化运营成本,并有助于提高企业生产力。技术进步带来了巨大的准确性并提高了工业生产力。

通过行业洞察

了解我们的报告如何帮助优化您的业务, 与分析师交流

“不断增加的金融欺诈是否正在推动 BFSI 行业获得最大的市场份额?”

根据行业,市场分为医疗保健、汽车、零售、BFSI、制造业、农业、政府和公共部门、IT 和电信、能源与公用事业以及教育。

BFSI 在 2024 年占据市场主导地位,人工智能实现个性化财务建议、聊天机器人和全渠道支持正在提高客户参与度和满意度。人工智能在金融机构中的实施被用来开发创新解决方案,解决传统的金融准入障碍,让更多的人和小企业参与正规的金融体系。据行业专家称,到 2030 年,人工智能仅通过银行业就可以为海湾合作委员会 GDP 贡献 13.6%,这表明效率显着提高。到 2025 年,BFSI 细分市场将占据 18.90% 的市场份额。

由于专门针对该行业的人工智能应用的不断发展,预计医疗保健行业在预测期内将创下36.50%的最高复合年增长率。医疗机构正在利用人工智能来提高从管理任务到患者护理等各种流程的效率。根据 IBM 的一项研究,大约 64% 的患者愿意使用 AI 24/7 获取支持护士提供的答案。人工智能还可以用来检测患者自行用药的错误。例如,根据 Nature Medicine 的研究,高达 70% 的患者没有遵守规定的胰岛素剂量。人工智能驱动的工具,很像患者环境中的 Wi-Fi 路由器,可以用来识别患者使用胰岛素笔或吸入器的方式中的错误。

人工智能市场区域展望

对北美、南美、欧洲、中东和非洲以及亚太地区的市场进行了地理研究,并且对每个地区进行了跨国家的进一步研究。

北美

North America Artificial Intelligence Market Size, 2025 (USD Billion)

获取本市场区域分析的更多信息, 下载免费样品

由于 IBM 公司、微软公司等超大规模企业的存在,北美在市场上占据主导地位。最近持续的生成式人工智能趋势促使这些超级缩放器升级其人工智能技术并开发解决方案来满足不断变化的用户需求。 2023年,美国初创企业约25%的投资流向了人工智能相关公司。此外,北美在人工智能技术创新中发挥着至关重要的作用。由于上述原因,该地区在市场上占据主导地位。

预计美国人工智能产业在预测期内将出现强劲增长。该国的市场规模预计将达到美元82.63到2026年将达到10亿美元。美国有许多新投资的人工智能公司。根据《2022年人工智能指数报告》,全球有1392家人工智能公司获得了超过150万美元的融资,其中美国占542家。此外,大约 73% 的美国公司在其业务的某些方面使用人工智能。近年来,生成式人工智能在美国取得了显着的增长和投资,根据财富商业洞察,美国的生成式人工智能市场达到了82.63到 2026 年,这一数字将达到 10 亿美元。根据 Skynova 2023 年的一项调查,近 80% 的美国小企业主对其人工智能部署持乐观态度。此外,美国受访者被问及他们用于销售、营销和其他用例的人工智能工具,其回答以下面的表格格式提供。

亚太地区

亚太地区市场规模估计为美元112.16由于人工智能(AI)投资的增加,预计到 2026 年将实现 34.70% 的复合年增长率,达到第二高的复合年增长率。预计到 2030 年,人工智能将为该地区的 GDP 带来 3 万亿美元的收入。Google.org 和亚洲开发银行于 2024 年 5 月推出了 1500 万美元的人工智能机会基金,为亚洲劳动力提供不断变化的工作环境所需的基本人工智能知识和工具,从而确保该地区更多的人,特别是那些来自需求未满足的社区的人,能够获得人工智能带来的工作和角色。

中国市场预计将冲击美元37.16亿美元,其次是印度,价值重要美元18.08十亿和日本展示的价值美元20.9到2026年,该地区国家将重点推出与人工智能安全相关的举措,并重点提升其人工智能能力。 2025 年 2 月,印度和韩国将加强人工智能能力,同时注重加强主权和深化合作。印度宣布计划为人工智能开发提供 18,000 个基于 GPU 的高端计算设施,而在韩国,总统人工智能委员会会议概述了开发世界级大语言模型 (LLM) 的项目。

欧洲

预计欧洲将展现出巨大的美元市场规模81.97到2026年,其规模将达到10亿美元,因为其拥有大量丰富的公共数据和工业数据,这为人工智能的发展提供了潜力。 2025年2月,欧盟委员会启动了耗资2250亿美元的“人工智能大陆行动计划”倡议,将欧洲置于人工智能革命的前沿。在该计划中,将为人工智能初创公司、研究机构、新兴技术和超级工厂提供约255.1亿美元,这些公司将专门训练超大型人工智能模型。每个工厂将拥有约10万颗尖端人工智能芯片,大约是目前正在设立的人工智能工厂的四倍。

英国市场预计以美元计价19.38十亿美元,德国以美元领先14.96到2026年,法国市场规模将达到121.2亿美元。到2025年,法国市场规模将达到121.2亿美元。

中东和非洲

中东和非洲预计将以美元计价增长46.71到2026年将达到10亿美元。2025年5月,思科针对海湾地区人工智能革命的各个阶段推出了一系列战略举措。这些举措使思科处于这一转型的最前沿,与合作伙伴合作提供世界一流且值得信赖的技术。海湾合作委员会国家预计 2025 年市场规模将达到 156 亿美元。

南美洲

南美市场可能在预测期内实现稳定增长。全球参与者和当地投资者正在为南美洲的人工智能初创公司和数字创新中心提供资金。据拉美私募股权与风险投资协会统计,2023年拉美地区人工智能创业资金达到25亿美元,较上年增长40%。

竞争格局

主要行业参与者

市场参与者选择并购策略来扩大其影响力

人工智能市场领导者正在升级其现有的人工智能解决方案,以满足不断变化的用户需求。随着近年来生成式人工智能工具的发展趋势,企业正在利用人工智能技术升级其产品组合。除了现有的人工智能增强功能之外,人工智能市场的主要参与者正在寻求相关的合作伙伴关系和收购,以便为客户提供先进和增强的服务。参与者正在采用这一策略,将自己最好的概念和能力与收购的合作伙伴的专业知识和市场上可用的技术相结合。

主要研究公司名单:

- 微软公司(美国)

- com, Inc.(美国)

- IBM公司(美国)

- Alphabet Inc.(谷歌有限责任公司)(新加坡)

- com公司(我们。)

- 百度公司(中国)

- 英伟达公司(S.)

- 艾(美国)

- 甲骨文公司(S.)

- 惠普企业发展有限公司(S.)

- 思科(美国)

- 阿里云(中国)

- 华为(中国)

- 阿皮尔(台湾)

- 伽玛雅(瑞士)

- 海洛(以色列)

- Lumen5(加拿大)

- Graphcore(英国)

- OpenAI(美国)

……还有更多

最新的关键行业发展是什么?

- 2025 年 5 月 –OpenAI 推出了 Codex,这是一款新开发的人工智能驱动的编码助手,现在某些 ChatGPT 订阅者可以作为研究预览版使用。该版本代表了该公司的一项重大成就,表明其目标是改变软件开发人员在日常任务中使用人工智能的方式。

- 2025 年 5 月 –惠普在 2025 年 Computex 期间推出了其最新产品 OmniBook 5 系列人工智能 PC。这些最先进的机器配备了 Snapdragon X 和 Snapdragon X Plus 处理器,其中包括专用神经处理单元 (NPU),可实现高达每秒 45 兆次运算 (TOPS) 的卓越计算性能。

- 2025 年 5 月 –Oracle 透露,NVIDIA AI Enterprise 是一款全面的云原生软件解决方案,旨在增强数据科学并简化可用于生产的 AI 的创建和实施,可在 Oracle 云基础设施 (OCI) 上访问。

- 2025 年 5 月 –OpenAI 计划协助在阿拉伯联合酋长国建设一个大型新数据中心,该数据中心有可能成为全球最大的数据中心之一,标志着公司在中东的大量投资以及公司全球人工智能基础设施目标的大幅提高。

- 2025 年 5 月 –NVIDIA 推出了 DGX Cloud Lepton,这是一款专注于 AI 的基于云的软件解决方案,可简化 AI 工厂向全球寻求高性能计算访问的开发人员租赁硬件的流程。

影响AI市场投资分析及机会的关键因素有哪些?

几家小型公司正在筹集资金来加速和增强其人工智能生态系统。与非人工智能初创企业相比,人工智能初创企业的估值要高得多,而且随着它们的发展,这种差距不断扩大。在B轮融资阶段,人工智能初创公司的估值比非人工智能初创公司高出60%。 2023 年,人工智能的融资大幅增长,仅对生成式人工智能的投资就达到 252 亿美元,比 2022 年增长了近八倍。专注于人工智能的初创企业通过 2024 年第一季度的 1,166 笔交易筹集了 122 亿美元,比 2023 年第四季度投资 1,072 笔交易的 117 亿美元小幅增长了 4%。 2024年,人工智能公司获得了47亿美元的风险投资,占2月份风险投资总额的20%以上。

报告范围

人工智能市场研究报告提供了详细的市场分析。它重点关注关键点,例如领先公司、产品和应用程序。除此之外,它还提供了对最新市场趋势的了解并突出了关键的行业发展。除了上述因素外,报告还包含了近年来推动市场增长的几个因素。

定制请求 获取广泛的市场洞察。

报告范围和细分

|

属性 |

细节 |

|

学习期限 |

2021-2034 |

|

基准年 |

2025年 |

|

预计年份 |

2026年 |

|

预测期 |

2026-2034 |

|

历史时期 |

2021-2024 |

|

增长率 |

复合年增长率26.60%从2026年到2034年 |

|

单元 |

价值(十亿美元) |

|

分割 |

按组件

按部署

按企业类型

按技术

按功能分类

按行业分类

按地区

|

|

报告中介绍的公司 |

甲骨文公司(美国)、微软公司(美国)、亚马逊公司(美国)、Alphabet Inc.(美国)、Salesforce.com, Inc.(我们。),百度公司(中国)、NVIDIA 公司(美国)、H2O.ai(美国)、HPE(美国)等。 |

常见问题

预计到 2034 年,市场估值将达到 24800.5 亿美元。

2025年,市场估值为2941.6亿美元。

预计人工智能市场在预测期内复合年增长率为26.60%。

软件部门预计将在市场份额方面领先。

越来越多地采用人工智能辅助人类代理将促进市场增长。

甲骨文公司、微软公司、亚马逊公司、Alphabet公司、Salesforce.com公司、百度公司、NVIDIA公司、H2O.ai和HPE是市场上的顶级参与者。

预计北美将占据最高的市场份额。

预计医疗保健行业在预测期内将创下最高复合年增长率。

与我们的专家联系 与专家交谈