3D Mapping & 3D Modeling Market Size, Share & Industry Analysis, By Type (3D Mapping and 3D Modeling), By Deployment (On-premise and Cloud), By Application (Projection Mapping, Maps and Navigation, Texture Mapping, and Others), By End-use Industry (AEC (Architecture, Engineering, and Construction), Automotive, Manufacturing, Healthcare, Oil and Gas, Media and Entertainment, Transportation and Logistics, and Others), and Regional Forecast, 2026-2034

3D Mapping & 3D Modeling Market Size

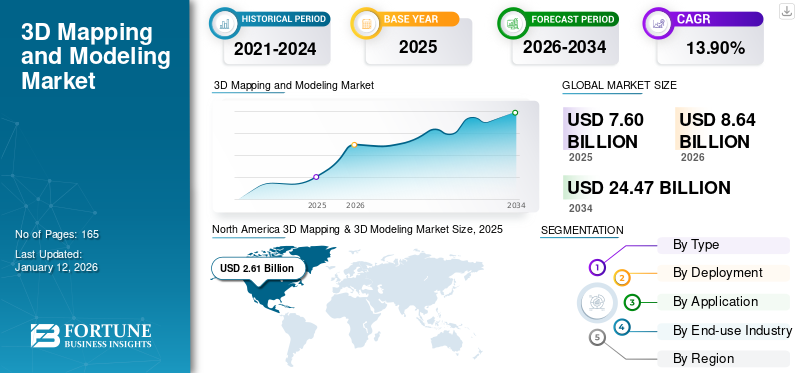

The 3D mapping & 3D modeling market size was valued at USD 7.6 billion in 2025 and is projected to grow from USD 8.64 billion in 2026 to USD 24.47 billion by 2034, exhibiting a CAGR of 13.90% during the forecast period. North America dominated the global market with a share of 34.30% in 2024. Additionally, the U.S. 3D mapping and modeling market is predicted to grow significantly, reaching an estimated value of USD 5,038.1 million by 2032.

3D modeling involves using specialized software to create a three-dimensional representation of an object. This is done by manipulating the edges, vertices, and polygons in a simulated 3D space. On the other hand, 3D mapping technology uses machine learning algorithms to profile objects and generate a 3D view that can be mapped into the real world. It maps objects in the x, y, and z axes, giving them a three-dimensional representation.

Global 3D Mapping & 3D Modeling Market Overview

Market Size:

- 2025 Value: USD 7.6 billion

- 2026 Value: USD 8.64 billion

- 2034 Forecast Value: USD 24.47 billion

- CAGR: 13.90% (2026–2034)

Market Share:

- Regional Leader: North America accounted for around 34.30% market share in 2025.

- Fastest-Growing Region: Asia Pacific is projected to record the highest growth rate during the forecast period.

Industry Trends:

- Increasing use of LiDAR and photogrammetry technologies for high-accuracy 3D data capture in construction, urban planning, and smart city projects.

- Growing adoption of 3D mapping and modeling in architecture, engineering, construction, and gaming for immersive design and visualization.

- Rising preference for cloud-based deployment due to scalability and collaborative workflow benefits.

Driving Factors:

- Need for early detection of project issues through virtual simulation to save time and reduce costs.

- Expanding applications in smart city development, infrastructure projects, and healthcare for advanced 3D navigation and visualization.

- Increasing demand for precise 3D mapping solutions in medical diagnostics and complex procedures.

The market is expected to grow due to the rising use of 3D mapping and modeling, which helps in identify the problems in projects before construction, thereby saving time and money. The market will also be driven by the increasing adoption of these technologies in emerging economies and their application in healthcare for better understanding of the human body.

- In the first half of 2023, digital health startups in the U.S. raised a total of USD 6.1 billion through 244 deals. On average, each deal amounted to USD 24.8 million.

3D mapping and modeling software experienced a rise in consumer interest during the COVID-19 pandemic. Industries, such as e-commerce, logistics, online education, food delivery, healthcare, and more witnessed notable growth as they utilized 3D mapping & 3D modeling solutions to improve their customer-facing applications.

ESRI (Environmental Systems Research Institute Inc.) used mathematical modeling and spatial analytics to calculate and show COVID-19 forecasts. This helped policymakers understand the effects of their decisions and use smart maps to explore different scenarios for response and recovery efforts. Additionally, the geospatial private sector will keep developing advanced tools, such as 3D models to address the unique requirements and difficulties of urban areas.

3D Mapping & 3D Modeling Market Trends

Rapid Adoption of LiDAR and Photogrammetry Technologies to Expand Market Growth

The use of LiDAR and photogrammetry technologies in 3D mapping & 3D modeling has greatly enhanced their accuracy and efficiency in different industries. These technologies, including LiDAR, aerial imagery, and satellite images, have played a crucial role in capturing field data for creating high-definition 2D and 3D maps. They find applications in mining, agriculture, engineering, construction & infrastructure, insurance, urban & smart city solutions, as well as oil & gas upstream and midstream sectors.

LiDAR applications have been greatly expanded, thanks to the advancements in drone technology and relaxation of regulations. This has led to new opportunities for the use of LiDAR in the U.S., Australia, and other countries. For instance,

- In July 2023, GeoCue, a global leader in geospatial solutions for LiDAR mapping hardware and software, unveiled three TrueView 3D imaging systems. These systems, namely TV625, TV680, and TV680LR, offer unparalleled accuracy and advanced features, revolutionizing the field of aerial imaging technology.

Download Free sample to learn more about this report.

3D Mapping & 3D Modeling Market Growth Factors

Increasing Adoption of 3D Modeling Across Architecture & Construction, and Gaming Industries to Accelerate Market Growth

Architects have been increasingly relying on emerging technologies, such as 3D modeling to overcome the limitations of traditional methods and bring their innovative ideas to work in real-time.

3D modeling helps architects develop detailed virtual models of building spaces. It allows them to evaluate and visualize various aspects of a project, such as materials, lighting, proportions, and composition, even before the physical construction starts. This helps them captivate their end users as they are able to visualize their desired building structure.

Augmented Reality (AR) and Virtual Reality (VR) are important trends in 3D modeling in architecture. VR allows architects and clients to interact with virtual models, providing an immersive experience. By using VR headsets, users can walk through the virtual building, helping them assess the proportions, scale, and architectural details. This realistic understanding of the future project helps customers in making informed decisions.

RESTRAINING FACTORS

Lack of Awareness, Skilled Professionals, and Use of Unlicensed Software to Hinder Market Growth

The restraining factors of the market include a lack of awareness of the capabilities of 3D technologies across several industries, lack of skilled professionals, use of unlicensed tools, and discrepancies in the functioning of 3D mapping & 3D modeling solutions.

Several market players rely on Architectural Engineering and Construction (AEC) and the automotive industries for the growth of their sales. This reliance is due to the interactive 3D and 2D technologies being in the developing phase in industries beyond gaming and AEC. Other industries are yet to implement 3D technology at its complete potential. Moreover, the uncertainty of whether these industries will implement this technology as expected or how rapidly it will develop can hinder the adoption of 3D creation tools across these industries.

Another major factor hampering the adoption of 3D creation tools is the lack of interoperability and certain software showcasing error-prone programming. In addition, there are certain procedures in developing 3D models that are heavily dependent on expert manuals despite increased digitization.

3D Mapping & 3D Modeling Market Segmentation Analysis

By Type Analysis

Demand for Immersive Content Emerges As Driving Force for Using 3D Modeling in Various Industries

Based on type, the market is bifurcated into 3D mapping and 3D modeling.

The 3D modeling solution segment held the largest market share in 2026, accounting for 59.07% of the total market share. It serves in various industries, such as architecture, engineering, construction, gaming, entertainment, and healthcare. These applications makes accounts for a broad customer base for the tool. Moreover, the growing demand for immersive content in many industries will also drive the segment’s growth. The attractiveness of 3D modeling enhances its market position as it is valuable for design, simulation, and presentations.

- In May 2022, Ecopia AI announced the expansion of its partnership with Airbus to merge its 3D vector mapping and modeling abilities with Airbus' vast collection of satellite images from around the world. The objective of this collaboration is to generate extremely accurate 3D maps of the actual environment quickly.

The 3D mapping solution segment is expected to witness the highest CAGR over the forecast period. Governments and organizations around the world are increasingly relying on 3D mapping for geospatial applications, such as urban planning, Geographic Information System (GIS), and environmental monitoring.

Furthermore, the global efforts to develop more smart cities are driving substantial investments in spatial mapping to improve the effectiveness and control of infrastructure and utilities. Real-time 3D mapping data is also greatly advantageous for disaster management as it assists in evaluating terrains and facilitating disaster response operations.

By Deployment Analysis

Use of Cloud-based 3D Mapping & 3D Modeling Increased Due to Adoption of Cloud Software in Tech Industry

Based on deployment, the market is bifurcated into on-premise and cloud.

The cloud deployment segment dominated the 3D mapping & 3D modeling market in 2026, accounting for 58.72% of the total market share and is expected to continue its strong growth in the coming years. Cloud-based software is becoming more prevalent in the tech industry, thereby benefiting various sectors. The market for cloud-based solutions has doubled in the last three years.

- In the next few years, more than half of all companies' spending will be focused on SaaS-based applications, as stated in the PTC CAD Software Trends 2023 report. These companies are increasing their investments in the cloud and SaaS, and they anticipate software vendors to take advantage of the cloud and SaaS capabilities.

As the cloud becomes more popular in the tech industry, 3D mapping & 3D modeling solution providers are also adopting the same. They are shifting from on-premise solutions to Software-as-a-Service (SaaS), which caters to organizations that prioritizes the cloud. According to industry forecasts, cloud technologies will make up for 37% of the digital transformation and IT spending in 2026, compared to 27% in 2021. This shift is driven by the increasing prevalence of the remote work culture, highlighting the important role of the cloud in the market.

By Application Analysis

Growing Integration of Projection Mapping with Virtual Reality for Multi-dimensional Experience Drives Product Demand

Based on application, the market is segmented into projection mapping, maps & navigation, texture mapping, and others (virtualization).

The projection mapping segment was the leading revenue contributor in 2026, accounting for 32.36% of the total market share. 3D projection mapping is the process of projecting digital content onto physical objects and surfaces, bringing static environments to life. The market growth is being driven by the increasing need for projection systems in festive occasions, mega sports events, and the hospitality industry to create immersive visual spectacles. 3D projection mapping enhances the immersive capabilities of both technologies when combined with virtual reality, thereby providing a dynamic and multi-dimensional experience that deeply engages customers.

The maps & navigation application segment is expected to register the highest CAGR during the forecast period. The segment’s growth can be attributed to various factors, such as the increasing consumer demand for advanced navigation solutions, especially on smartphones and GPS-enabled devices. High-precision 3D maps are crucial for the safe navigation of autonomous vehicles, such as self-driving cars and delivery drones. Urban planners also rely on detailed 3D maps to optimize city development and implement smart initiatives in the face of rapid urbanization. Additionally, 3D mapping plays a vital role in logistics and e-commerce by facilitating efficient route planning and delivery optimization, which ultimately reduces costs and minimizes environmental impact.

- In January 2023, Luminar successfully acquired the HD mapping startup Civil Maps. This acquisition will greatly benefit Luminar by granting it access to Civil Maps' advanced technology, specifically in the areas of high-definition mapping and localization.

By End-use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Demand for Detailed Visualization and Cloud Collaboration Practices in Healthcare Sector to Boost Product Use

By end-use industry, the market is divided into AEC (architecture, engineering & construction), automotive, manufacturing, healthcare, oil & gas, media & entertainment, transportation & logistics, and others (education).

The healthcare industry is projected to experience the highest growth in the adoption of 3D mapping & 3D modeling solutions. Spatial mapping and Geographic Information Systems (GIS) are being used for different purposes in the healthcare sector. 3D navigation mapping systems have ushered in a new era of precision and safety in cardiac electrophysiology. In addition, 3D mapping and modeling solutions provide real-time guidance, allowing physicians to position catheters and monitor their movement within the heart precisely.

The AEC industry segment is leading the market share at present. The segment’s growth is due to the wide range of uses of 3D mapping and modelling solutions, such as visualizing complex projects, collaborating effectively, saving time & money, and considering sustainability. 3D modeling plays a crucial role in accurate planning, minimizing mistakes, and meeting strict regulations. Additionally, the increase in construction projects in developing nations, such as China, India, South Africa, Brazil, and South Korea, fueled by urbanization and infrastructure development, will greatly contribute to the segment’s expansion.

REGIONAL INSIGHTS

The market scope is classified across five regions, namely North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America 3D Mapping & 3D Modeling Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America held the highest market share, with the market valued at USD 2.61 billion in 2025 and increasing to USD 2.91 billion in 2026. This region is a major centre for the market due to its strong technology infrastructure and increasing need for spatial data solutions. Various industries, such as urban planning, construction, and entertainment are embracing spatial mapping and modeling technologies for purposes, such as city planning, architectural design, and virtual reality experiences. The US market is projected to reach USD 2.22 million by 2026.

- In October 2023, the U.S. Army funded two small businesses to create software for three-dimensional modeling. This software will be used to map and evaluate infrastructure as part of the Dynamic Enhance Environment Perception – Building Information Models project. The Army Small Business Innovation Research Program's initiative has improved the Army's ability to create real-time 3D maps and models. These solutions will enhance soldiers' awareness in remote and underground areas.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is anticipated to record the highest CAGR in this market. This growth can be attributed to the increasing demand for 3D imaging sensors, modeling, and visualization software tools in various industries, such as healthcare, manufacturing, construction, and media & entertainment. Small and medium-sized companies, as well as government agencies in the region are also driving the demand for 3D mapping and modeling solutions for marketing purposes. The regional market’s expansion is further fueled by the adoption of cloud and IoT technologies, as well as the growing use of the Internet. The Japan market is projected to reach USD 0.43 million by 2026, the China market is projected to reach USD 0.44 million by 2026, and the India market is projected to reach USD 0.36 million by 2026.

In Europe, the field of 3D modeling has experienced significant expansion and advancement in recent years. According to a survey by SAP SE, about 70% of organizations in the U.K. planned to adopt new technologies to help them overcome various manufacturing and designing challenges. The continuous progress in technology, coupled with the rising desire for immersive experiences, has paved the way for a promising future for 3D mapping & 3D modeling solutions in the region. The UK market is projected to reach USD 0.53 million by 2026, while the Germany market is projected to reach USD 0.52 million by 2026.

The Middle East is also experiencing growth in the global market due to huge investments in the construction industry and infrastructure development projects in countries, such as Saudi Arabia and the U.A.E. According to the latest industry survey in the Middle East, the adoption of technology in the construction industry passed the 50% mark for the first time in 2022. This is, in turn, further driving the 3D mapping and 3D modeling market growth in the region.

Moreover, rising investments in digital transformation initiatives in South American countries, such as Brazil and Argentina is driving the market growth in the region. In April 2021, the Inter-American Development Bank (IDB) provided around USD 1 billion of funding to Brazil to adopt the digital transformation strategy. The investment was made to adopt various advanced technologies, such as cloud computing, AI, and machine learning.

Key Industry Players

Product Enhancements and Strategic Partnerships by Major Players Will Help Them Gain Competitive Edge

Leading market players, such as Dassault Systèmes, Autodesk Inc., ESRI, PTC, Bentley Systems, and others are implementing various commercial plans and strategies. Upgrading solutions with innovative mechanisms is one of the substantial approaches taken by these companies. Likewise, many prominent players are intentionally collaborating and forming alliances with other firms to achieve global expansion.

List of Top 3D Mapping & 3D Modeling Companies:

- Autodesk Inc. (U.S.)

- ESRI Inc. (U.S.)

- Bentley Systems Inc. (U.S.)

- Trimble Inc. (U.S.)

- CyberCity 3D, Inc. (U.S.)

- Foundry Visionmongers Limited (U.K.)

- PTC (U.S.)

- Spatial Corp. (Dassault Systèmes) (U.S.)

- Adobe (U.S.)

- Golden Software (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2023 – Ecopia AI (Ecopia) and Nearmap joined forces to create innovative 3D mapping products in over 1,800 urban areas in North America. By working together, Ecopia's AI-powered mapping technology will gather accurate map data from Nearmap's stereo and oblique imagery, covering more than 1 million square kilometres.

- July 2023 – CAPE Analytics, a company that uses artificial intelligence (AI) to provide property intelligence based on location, announced a collaboration with Intermap Technologies. Intermap Technologies is a firm that specializes in 3D geospatial products and intelligence solutions. Through its suite of software applications, CAPE plans to incorporate Intermap's Digital Surface Models (DSMs) across the country to enhance property and parcel attributes.

- March 2023 – Adobe announced that it had entered a strategic partnership with Autodesk and Epic Games during its Substance Day keynote at the GDC 2023. With this partnership, the company aims to provide its game developers with a rich tool set and multi-platform standards for 3D material models.

- February 2023 – Esri Inc. launched ArcGIS reality software for capturing the world in 3D. This new extension of Esri's desktop GIS software, called ArcGIS Reality for ArcGIS Pro, enables users to input images from crewed aircraft or drones to create 3D outputs for reality mapping.

- September 2022 – Bentley Systems, Inc. and Genesys International, a provider of geospatial content and advanced mapping services, revealed that Genesys' 3D City Digital Twin Solution for Urban India will be supported by OpenCities 365, Bentley's infrastructure digital twin solution for cities and campuses. The extensive mapping and surveying initiative has already commenced and will cover a significant portion of urban India.

REPORT COVERAGE

The research report includes information on prominent regions across the globe to get a better knowledge of the market. Furthermore, it provides insights into the most recent industry trends and an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes on the market’s drivers and restraints, allowing the reader to obtain a thorough understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 13.90% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type, Deployment, Application, End-use Industry, and Region |

|

Segmentation |

By Type

By Deployment

By Application

By End-use Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at 7.6 billion in 2025.

Fortune Business Insights says that the market value is expected to reach USD 24.47 billion by 2034.

A CAGR of 13.90% will be observed in the market during the forecast period of 2026-2034.

By application, the maps & navigation segment is expected to showcase the highest CAGR during the forecast period.

Increasing adoption of 3D modeling software across the architecture & construction and gaming industries will accelerate the market growth.

Autodesk Inc., ESRI Inc., Bentley Systems Inc., Trimble Inc., and CyberCity 3D, Inc., among others, are the top players in the market.

Asia Pacific is expected to record the highest CAGR.

By end-use industry, the healthcare industry segment is expected to record a leading CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us