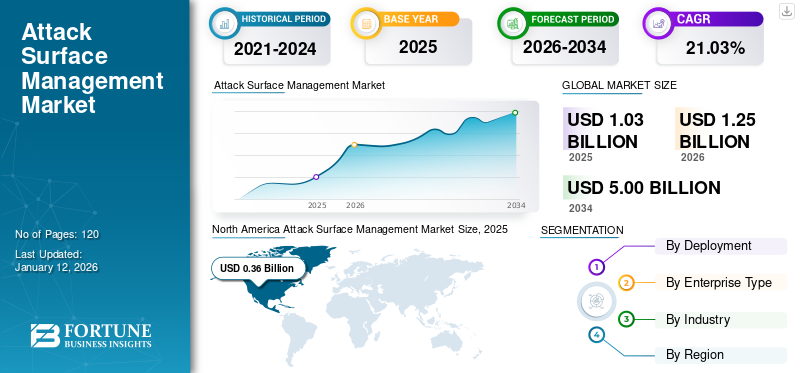

Attack Surface Management Market Size, Share & Industry Analysis, By Deployment (On-premise and Cloud), By Enterprise Type (Small and Mid-sized Enterprises (SMEs) and Large Enterprises), By Industry (IT & Telecom, BFSI, Retail and E-commerce, Healthcare, Manufacturing, Government, Aerospace & Defense, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global attack surface management market size was valued at USD 1.03 billion in 2025 and is projected to grow from USD 1.25 billion in 2026 to USD 5 billion by 2034, exhibiting a CAGR of 21.03% during the forecast period. North America dominated the global attack surface management market with a share of 34.97% in 2025.

Attack surface management involves the ongoing identification, monitoring, and control of both internal and external internet-connected assets to detect potential attack points and vulnerabilities. An organization's attack surface is constantly growing due to factors such as cloud usage and the rising number of connected devices. This makes it challenging for organizations to keep up with all their vulnerabilities and address them.

Organizations are witnessing significant growth in the market due to the rising awareness of the need to detect and address vulnerabilities in their digital health systems. With the shift toward digital transformation, cloud usage, and remote work, businesses are facing more intricate attack surfaces that are vulnerable to various cyber threats.

- With the world becoming more connected and dependent on digital technology, cybercrime is on the rise. A study found that in 2023, there was a significant increase in cyberattacks, with over 343 million people affected. Between 2021 and 2023, data breaches increased by 72%, surpassing the previous record.

The COVID-19 pandemic increased the use of attack surface management solutions. The pandemic and rise in remote work also raised the amount of external assets and targets security teams need to safeguard. In 2019, 38% of successful attacks were due to shadow IT, misconfigurations, and hidden internet exposures that could have been avoided with better visibility into the attack surface.

Moreover, according to a Trend Micro report, 43% of IT and business leaders believe that the attack surface is growing uncontrollably, with 73% expressing worry about the size of their digital attack surface. This increase in surface attacks has boosted the attack surface management market growth.

IMPACT OF GENERATIVE AI

Surging Investments by Enterprise in Cyber Defense Tools to Increase Demand for Generative AI Solutions

The increasing adoption of generative AI offers significant growth prospects for companies worldwide. Businesses are investing more in automation tools and cyber-attack response, particularly in AI and generative AI. The attack surface is expanding rapidly, leading to concerns about shadow AI and the potential risks associated with sharing sensitive data with insecure systems.

- March 2024: Tenable revealed new improvements to ExposureAI, the generative AI features and services in its Tenable One Exposure Management Platform. The latest updates allow users to efficiently outline important attack paths, interact with an AI assistant, and get precise guidance on how to reduce risk based on intelligence.

Attack Surface Management Market Trends

Convergence of Attack Surface Management with Other Security Capabilities to Propel Market Growth

Attack Surface Management (ASM) is trending toward merging with other security capabilities, such as Extended Detection and Response (XDR), to give a complete view of an organization's security. In the future, these functions may be more integrated, providing a unified platform for handling attack surfaces and addressing security threats.

Merging functions can make security operations more efficient by reducing the number of tools needed. This integration offers a broader perspective on security, helping to identify threats and weaknesses more effectively.

- In September 2023, CrowdStrike Holdings, Inc., a company that focuses on protecting endpoints, cloud workloads, identity, and data through cloud-based services, revealed that it will be purchasing Reposify Ltd. Reposify offers a platform for managing external attack surfaces. It scans the Internet for an organization's exposed assets to identify and remove potential risks from vulnerable and unknown assets before attackers can exploit them.

Download Free sample to learn more about this report.

Attack Surface Management Market Growth Factors

Expanding Digital Footprints of Companies to Boost Market Growth

As organizations embrace new opportunities and drive innovation, their digital presence grows, increasing the risk of cyberattacks. This includes websites, apps, cloud services, social media, and IoT devices. With this rapid growth, it becomes challenging for organizations to monitor all assets and detect vulnerabilities.

For instance, based on industry studies, almost 70% of organizations have acknowledged facing at least one cyber-attack that originated from an unknown, unmanaged, or poorly managed internet-facing asset. Moreover, organizations with a higher number of IT assets and, therefore, larger attack surfaces were nearly twice as prone to multiple cyber-attacks.

RESTRAINING FACTORS

Integration and Complexity of Environment Likely to Hamper Market Growth

One of the primary difficulties in the market is the requirement for ASM to easily work with current cybersecurity tools, such as SIEM platforms, endpoint protection systems, and vulnerability scanners. However, merging different systems can be difficult and take a lot of time, especially if they have different protocols, data formats, or APIs.

Integrating attack surface management solutions into existing infrastructure can lead to compatibility issues, data silos, and interoperability challenges for organizations. Managing the attack surface in diverse IT environments, including cloud infrastructure, legacy systems, third-party applications, and IoT devices, can be difficult and may impact the global market growth.

Attack Surface Management Market Segmentation Analysis

By Deployment Analysis

Rise in Adoption of Cloud-based Solutions Owing to its Ease of Use to Boost Market Expansion

By deployment, the market has been classified into on-premise and cloud. Cloud deployment dominated the attack surface management market with a share of 58.09% in 2026 and is expected to witness the highest growth rate during the forecast period. Cloud-based attack surface management helps organizations to efficiently handle their attack surface using cloud computing advantages. It offers cost savings with subscription plans, scalability for evolving IT setups, accessibility from any internet-connected location, and quick deployment without complex hardware configurations.

- In June 2023, Palo Alto Networks introduced Cortex Xpanse Expander, a cloud-based tool for managing attack surfaces. It assists organizations in identifying and resolving both known and unknown risks associated with their internet connections. Expander conducts regular automated scans to map out the entire Internet, uncovering all connected assets, misconfigurations, and exposed services.

The on-premises segment held a decent market share in 2024. This deployment model provides customers with flexibility, as transactions are only done once. Costs are relatively lower compared to cloud expenditures. Some sectors, such as healthcare, banking, or government, have strict rules and concerns about data confidentiality and security. Organizations can have complete control over their data and reduce the risk of data breaches or unauthorized access by using on-premises attack surface management.

By Enterprise Type Analysis

Large Enterprises to Gain Momentum Owing to More Complex and Vulnerable IT Environment

Based on enterprise type, the market is categorized into Small and Mid-sized Enterprises (SMEs) and large enterprises. The large enterprises accounted for the largest market with a contribution of 58.12% globally in 2026. HackerOne's 2022 Attack Resistance report found that 33% of big business security teams see less than 75% of their attack surface, and nearly 20% think that over 50% is unknown or not visible. With the attack surface getting more complex, large enterprises are using more security tools.

It is projected that SMEs are likely to experience the highest growth rate in the coming years. Small businesses are being targeted more by cybercriminals because they are easy to attack due to lack of funds for strong online security. This means that small businesses need to start using ASM solutions sooner rather than later.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Importance of IT and Network Security Protection by IT & Telecom Sector to Augment Demand for Attack Surface Management

Based on industry, the market is segmented into IT & telecom, BFSI, retail and e-commerce, healthcare, manufacturing, government, aerospace & defense, and others. The IT & telecom sector is likely to record the highest CAGR over the forecast period. The IT & telecom sector is becoming more linked to the Internet, leading to a larger attack surface that can be reached from the public Internet. This has made information, such as IP addresses, open ports, and network details, more available to anyone online. Consequently, the number of entry points for attackers has risen, highlighting the importance of mapping out the attack surface of telecommunication networks.

The BFSI segment held the major market with a share of 23.54% in 2026. The finance industry is at risk of cyber threats due to handling sensitive data, requiring strong ASM. According to IBM, the average cost of data breaches in the finance industry globally was USD 5.97 million in 2022, up from USD 5.72 million in 2021. Banking institutions are focused on using advanced technologies to protect themselves from cyber-attacks, ensuring secure IT processes and systems, protecting customer information, and complying with government regulations. This is expected to drive demand for attack surface management solutions by finance firms in the coming years.

REGIONAL INSIGHTS

The global market scope is classified across five regions, namely North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Attack Surface Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2026, North America held the highest share of the global market. North America dominated the global market in 2025, with a market size of USD 0.36 billion. The region’s market is projected to grow rapidly as the analysis of attack surfaces increases, allowing for better identification of risks and weaknesses. This enables efficient problem-solving. The U.S. is a top target for cyberattacks because of its advanced digital infrastructure. Additionally, the region's many major companies in key sectors such as finance, healthcare, and defense are at risk, highlighting the importance of stronger security measures. The U.S. market is projected to reach USD 0.34 billion by 2026.

- In April 2024, Rapid7 announced a significant update to its vulnerability management solution, InsightVM. The update enhanced its integration with major cloud platforms, such as AWS, Azure, and Google Cloud, to bolster security for cloud-based applications and provide more streamlined, comprehensive protection across diverse cloud environments.

Asia Pacific

Asia Pacific is expected to experience the highest CAGR over the analysis period. The region is quickly changing digitally as more businesses and governments are using digital technologies. This makes it a good place for security and vulnerability management solutions. A survey found that almost 20% of companies in this region had over six security breaches in the past few years. Major industry players are focusing on improving their defenses because of the rise in cyberattacks in the area. The governments of these countries are also paying attention to this issue. The Japan market is projected to reach USD 0.06 billion by 2026, the China market is projected to reach USD 0.07 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

- In March 2022, The Australian government released its 2022-23 federal budget, allocating USD 6.39 billion to enhance cybersecurity and intelligence. The funds were utilized through the REDSPICE program, focusing on resilience, effects, defense, space, intelligence, cyber, and enablers.

Europe

Moreover, Europe’s market share is being driven by the expansion of Industry 4.0 and IoT. European companies are increasingly using risk-focused methods for cybersecurity. The increase in complex cyber dangers, such as ransomware and APTs, is pushing European businesses to improve their security with attack surface management tools. The UK market is projected to reach USD 0.07 billion by 2026, and the Germany market is projected to reach USD 0.08 billion by 2026.

Middle East & Africa

The Middle East & Africa is experiencing continuous growth in the use of attack surface management. A recent Microsoft report revealed that the main security concern for organizations in the UAE and Qatar is the increasing number of ransomware attacks. In 2023, 40% of UAE-based organizations affected by ransomware had to close down, resulting in a total loss of USD 1.4 million. This situation is leading to the rise of attack surface management in the region. Additionally, the market in South America is heavily influenced by the growing adoption of technology, investment in security, and widespread acceptance of cloud technology.

KEY INDUSTRY PLAYERS

Companies Focus on Acquisitions and Partnerships to Gain Competitive Edge

Major players in the attack surface management market include Microsoft, Google, Palo Alto Networks, Cisco Systems, Trend Micro, and IBM. They are focused on introducing new products, forming partnerships, and engaging in mergers and acquisitions to grow their businesses and reach new markets. For instance,

- In June 2022, IBM acquired Randori, a Boston-based company that focuses on attack surface management and offensive cyber security solutions. Randori's technology identifies and prioritizes vulnerable external assets, supporting IBM's Hybrid Cloud strategy and enhancing its AI-driven cybersecurity services. This purchase shows IBM's commitment to enhancing cyber security defenses against increasing cyber threats.

List of Top Attack Surface Management Companies:

- Palo Alto Networks (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Google Cloud (U.S.)

- Trend Micro Inc. (Japan)

- IONIX Inc. (Israel)

- Cyberint (Israel)

- Qualys, Inc. (U.S.)

- Tenable Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2024 – Bugcrowd, a crowdsourcing security company, acquired Informer, a company that offers external attack surface management services. Bugcrowd believes that adding Informer will strengthen its platform by automating the detection of vulnerable assets. Informer combines ongoing asset discovery with penetration testing in a single platform.

- May 2024 – Edgio introduced its new Attack Surface Management (ASM) solution. ASM, combined with Edgio’s comprehensive managed security services and web security solutions, delivers the edge-enabled continuous web application threat management service.

- November 2023 – Palo Alto Networks acquired Talon Cyber Security for its Enterprise Browser tech. When combined with Prisma SASE, this system protects business apps on all devices, ensuring seamless user experiences and privacy. After the purchase, Talon's founders stayed on to lead their teams within Palo Alto Networks.

- November 2023 – Trend Micro is adding Attack Surface Risk Management (ASRM) features to the Trend Vision One cybersecurity platform. With ASRM capabilities, organizations can monitor their cloud attack surfaces in real-time and access inventories of both internal and external cloud assets.

- December 2022 – Palo Alto Networks introduced Cortex Xpanse Active Attack Surface Management, providing automated solutions to rapidly identify and address internet-related vulnerabilities. Through its active discovery, learning, and response capabilities, Xpanse enables security teams to proactively defend against cyber threats and ensure effective risk management.

REPORT COVERAGE

The research report includes an analysis of prominent regions to get a better knowledge of the industry. Additionally, it provides insights into the most recent industry trends and an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes on the market’s drivers and restrictions, allowing the reader to obtain a thorough understanding of the industry.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 21.03% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 1.03 billion in 2025.

Fortune Business Insights says that the market is expected to record a valuation of USD 5 billion by 2034.

The market is projected to record a CAGR of 21.03% during the forecast period of 2026-2034.

By enterprise type, the large enterprises segment dominated the market share in 2025.

Expanding the digital footprints of companies is expected to boost market growth.

Microsoft, Google, Palo Alto Networks, Cisco Systems, Trend Micro, and IBM, among others, are the top players in the market.

Asia Pacific is expected to record the highest CAGR.

By industry, the IT & telecom sector is likely to register the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us