Automotive Micro Motor Market Size, Share & Industry Analysis, By Vehicle Type (Hatchback/Sedan, SUV, Light Duty Truck, and Heavy Duty Truck), By Power Consumption (Less than 12V, 12V-23V, and More Than 24V), By Application (Power System (Windows, Seat & Steering), Wiper Motor, HVAC System, and Others), By Technology Type (Brushed Micro motor and Brushless Micro motor), By Component (Rotor, Stator, Magnet, and Others), and Regional Forecast, 2024 – 2032

KEY MARKET INSIGHTS

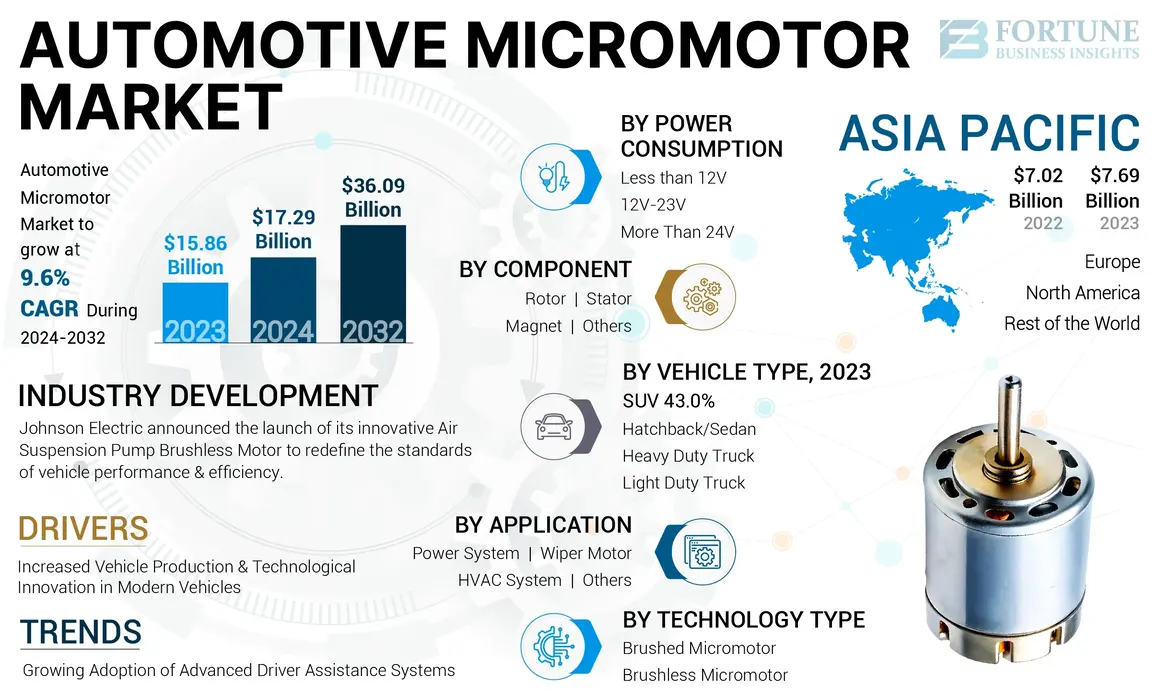

The global automotive micro motor market size was valued at USD 15.86 billion in 2023 and is projected to grow from USD 17.29 billion in 2024 and reach USD 36.09 billion by 2032, exhibiting a CAGR of 9.6% during the forecast period. Asia Pacific dominated the global market with a share of 48.48% in 2023. The Automotive Micromotor Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 4.66 Billion By 2032

The automotive micro motor market pertains to the sector of the automotive industry that specializes in small electric motors used in various vehicle applications. These micromotors are typically compact and lightweight, designed to convert electrical energy into mechanical energy, playing crucial roles in enhancing vehicle functionality and comfort.

Automotive micro motors are defined as small electromechanical devices that provide precise control and actuation in automotive systems. They are commonly utilized in applications such as, power windows, power mirrors, seat adjustments, wiper motors, and others. These motors are characterized by their high power-to-weight ratio, energy efficiency, and ability to operate at various voltage levels, typically ranging from 3V to over 48V. They can be found in both brushed and brushless configurations, with brushless motors gaining popularity due to their higher efficiency and longer lifespan. The market growth is attributed to the rising preference for luxury and technologically advanced vehicles. Consumers are increasingly opting for cars with premium functionalities, such as electric sunroofs, head-up displays, and advanced HVAC systems, all of which require micromotors for operation. The growing popularity of SUVs and the shift toward Electric Vehicles (EVs) are also contributing to market growth.

The COVID-19 pandemic had a significant impact on the market, affecting various aspects of production, supply chains, and consumer demand. The pandemic led to widespread disruptions in global supply chains due to lockdowns, travel restrictions, and reduced manufacturing capacities. These disruptions affected the availability of raw materials and components necessary for micromotor production. As a result, manufacturers faced production bottlenecks and delays in the delivery of final products, which hindered growth in the automotive sector and related industries.

Automotive Micro Motor Market Trends

Rising Adoption of Advanced Driver Assistance Systems (ADAS) to Drive Market Growth

The growing popularity of Advanced Driver Assistance Systems (ADAS) is indeed a key trend shaping the market. ADAS technologies, such as lane-keeping assist, collision avoidance, adaptive cruise control, and automated parking systems, require a range of micromotors to function effectively.

The automotive micro motor market is witnessing a significant shift driven by evolving vehicle preferences and technological advancements across different vehicle types. The rising demand for SUVs, which accounted for a substantial portion of global passenger car sales, is accelerating the adoption of micro motors for various comfort and convenience features, including advanced seating adjustments, electronic tailgates, and adaptive lighting systems. In the power consumption segment, the increasing electrification of vehicle components is driving demand for 12V-23V micro motors, which are widely used in power windows, HVAC systems, and electronic steering mechanisms. Additionally, the growing penetration of more than 24V micro motors in commercial and heavy-duty vehicles is attributed to the rising integration of automated functionalities, such as electronically controlled braking and advanced suspension systems, to enhance safety and efficiency.

ADAS systems depend on the precise movement of sensors, cameras, and radar systems. Micromotors play a critical role in adjusting the position of these components to ensure accurate detection of surroundings and obstacles. As vehicle safety standards evolve and the adoption of ADAS becomes more widespread, manufacturers are increasingly integrating micromotors in safety-critical systems that provide features such as automated braking, steering assistance, and even emergency interventions.

In August 2024, Jaguar Land Rover (JLR) announced an initiative aimed at enhancing driver awareness regarding critical Advanced Driving Assistance Systems (ADAS). The company's forthcoming electric vehicles will be developed on the NVIDIA DRIVE software-defined platform, which will provide a comprehensive array of active safety features, automated driving capabilities, and parking systems alongside various driver assistance technologies. Additionally, the system will incorporate artificial intelligence features that will monitor drivers and occupants, as well as offer advanced visualization of the vehicle's surroundings.

Technological advancements are also reshaping the industry, with brushless micro motors witnessing rapid growth due to their superior efficiency, lower maintenance requirements, and enhanced durability compared to brushed alternatives. Automakers are increasingly adopting brushless micro motors for high-end applications, including ADAS and electronic throttle controls, to meet evolving performance standards. Furthermore, in the component segment, the development of high-performance stators and magnets is enhancing the power efficiency and reliability of automotive micro motors. Manufacturers are focusing on advanced materials and innovative designs to optimize weight, power output, and thermal management, ensuring seamless integration into modern automotive architectures. As industry players continue to prioritize innovation and energy efficiency, the automotive micro motor market is poised for steady expansion, driven by advancements across all key segments

Download Free sample to learn more about this report.

Automotive Micro Motor Market Growth Factors

Increased Vehicle Production and Technological Innovation in Modern Vehicles Propel Market Growth

The global automotive industry is steadily recovering from disruptions caused by the pandemic and economic downturns. This resurgence in vehicle production, especially in Asia Pacific, North America, and Europe, is driving the demand for micromotors, which are integral components of both electric and conventional vehicles. In emerging economies such as India, China, and Brazil, rising disposable incomes and urbanization are boosting vehicle ownership. These vehicles come with a variety of electronic and comfort features powered by micromotors, further fueling demand for the automotive micrometer market.

For instance, Asia Pacific sold an estimated 42.6 million passenger cars in 2023, up from an estimated 37.5 million in 2022. The region sold about eight million commercial vehicles in 2023, up from about seven million in 2022. This increasing production directly drives the demand for the market. Modern vehicles, from budget models to luxury cars, are incorporating more electronic components, such as power seats, windows, and mirrors, all of which require micromotors. This trend is driving the demand for micromotors as part of standard and advanced vehicle features.

For instance, in October 2023, Volkswagen announced a new program called 'Volksfest 2023', under which special offers and benefits are offered across all its dealerships for the given festive season. As part of the program, the two VW cars were offered with first-in-segment electric adjustments for both driver and front passenger seats; such development drives market growth.

RESTRAINING FACTORS

Higher Development & Manufacturing Cost May Restrain Market Growth

Developing advanced micromotors, especially those that are energy-efficient and compact, requires significant investment in research and development. This can drive up the overall cost of the final product, making it more expensive for manufacturers and, ultimately, for consumers. The manufacturing of micromotors often involves advanced materials and technologies, which can be expensive. For example, precision engineering, miniaturization, and the use of specialized composites can have added to production costs. Thus, the impact of pricing and manufacturing costs restrains the automotive micro motor market growth.

Automotive Micro Motor Market Segmentation Analysis

By Vehicle Type Analysis

Increasing Advanced Features Create High Demand for SUVs Among Consumers

The market is categorized by vehicle type into hatchback/sedan, SUV, light duty truck, and heavy duty truck. The SUV segment holds the largest market share. This growth can be attributed to the increasing popularity of SUVs and the incorporation of advanced technological features. These cutting-edge features necessitate the use of sophisticated micromotors for seamless operation and enhanced efficiency, thereby fueling market growth throughout the forecast period. For instance, in 2023, SUVs sold 36.72 million units, a 16% increase from 2022. SUVs accounted for nearly 47% of all global passenger car sales in 2023. China and the U.S.-Canada remained the largest markets for SUVs, accounting for 54% of the global total.

The hatchback/sedan segment accounts for the second-largest share of the market, with its growth primarily driven by the increasing number of new hatchback launches featuring advanced technologies. For example, in April 2024, BYD introduced the BYD SEAGULL, a new pure electric vehicle in Colombia. This compact electric hatchback boasts high aesthetic appeal, state-of-the-art electric technology, and exceptional cost-effectiveness, positioning it as a preferred choice for urban youth in Colombia. Such developments are expected to propel market growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Power Consumption Type Analysis

Advancement of Automotive Technologies to Boost 12V-23V Segment Growth

Based on power consumption, the market is classified into less than 12V, 12V-23V, and more than 24V. The 12V-23V represents the largest segment of the market. The advancement of automotive technologies, including the integration of Advanced Driver Assistance Systems (ADAS), power electronics, and others, has further propelled the demand for 12V-24V micro motors. These systems require reliable and efficient motors to function effectively, thereby increasing their market share.

The more than 24V segment held the second-largest market share in 2023. The segment’s growth is attributed to growing consumer expectations for enhanced vehicle features, which often necessitates the use of various electronic systems powered by more than 24V micromotors. This trend is particularly evident in luxury and premium vehicles, where automation and comfort features are prioritized.

By Application Type Analysis

Rising Adoption of Luxury Vehicles to Fuel Segment Growth

Based on application, the market is categorized into power system (windows, seat & steering), wiper motor, HVAC system, and others. The power system segment holds the maximum share of the market. The luxury car market is expanding rapidly, with consumers willing to invest in vehicles that offer enhanced comfort and technology features. The power system (window, seat & steering) are a fundamental feature in luxury vehicles, further reinforcing their leading position in the market.

For instance, luxury car sales in India in 2023 were up by 20% year-on-year compared to 2022. According to BMW's annual report, China held the highest share of 32.3% in global automotive sales in 2023. Similarly, China was the largest single market for Audi in 2023. The company delivered a total of 729,042 vehicles (2022: 642,548 vehicles) in China, 13% more than the previous year.

The wiper motor segment holds the second-largest automotive micro motor market share by application. The segment’s growth is credited to the rise in vehicle production directly correlates with the demand for wiper motors. As more vehicles are manufactured and sold, the need for reliable wiper systems becomes more pronounced, contributing to the market's growth.

By Technology Type Analysis

Brushed Micromotor is the Leading Technology Due to its Widespread Usage and Ease of Control

Based on technology type, the market is categorized into brushed micromotor and brushless micromotor. The brushed micromotor segment holds the maximum market share. Brushed micromotors are utilized in various essential automotive functions, which drives consistent demand. Their applications range from basic functionalities to more advanced systems, ensuring a broad market base. Brushed motors provide straightforward speed control due to their mechanical commutation system. This feature is particularly beneficial in automotive applications that require precise motor regulation, enhancing their appeal.

The brushless motor segment holds the second-largest market share and its growth is credited to its higher efficiency and longer lifespan. Brushless micromotors are known for their superior energy efficiency compared to brushed motors. They convert a higher percentage of electrical energy into mechanical energy, resulting in lower power consumption and longer operational times. This is increasingly important in modern vehicles that prioritize fuel efficiency and sustainability. Brushless motors typically have a lifespan exceeding 10,000 hours of operation. This longevity reduces the need for replacements and maintenance, making them more appealing for automotive applications where reliability is critical.

By Component Type Analysis

Development of Permanent Magnets to Drive Component Segment Growth

Based on component, the market is categorized into rotor, stator, magnet, and others. The magnet segment holds the maximum share of the market and is anticipated to dominate with the highest CAGR over the forecast period. Continuous innovations in magnet materials and motor design are enhancing the performance and cost-effectiveness of permanent magnet motors over time. As manufacturers develop more efficient and cost-competitive designs, the adoption of permanent magnet motors in various automotive applications is expected to increase significantly.

The motor stator segment accounted for a considerable market share in 2023. The stator is basically a stationary part of the EV motor. It produces a magnetic field that drives the rotating armature. Due to this, the stator plays a crucial role in the EV motor.

REGIONAL INSIGHTS

The market is analyzed across Europe, Asia Pacific, North America, and the rest of the world.

Asia Pacific Automotive Micromotor Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific’s market was valued at USD 7.69 billion in 2023 and is projected to maintain its leadership position during the forecast period with the fastest-growing CAGR. The soaring electric vehicle sales and vehicles in use drive the demand for automotive micro motors in the region. The presence of a robust manufacturing sector in emerging economies of the region, including India, China, Japan, South Korea, and others, further contributes to market expansion.

The European region accounts for the second-largest market share as it is an early adopter of new energy vehicles and the second-largest manufacturing hub for vehicles globally. The region comprises numerous leading automotive manufacturers, technology firms, and research institutions that drive innovation in electric mobility and sensor technologies.

The surge in the use of electric/ICE vehicles for commercial transportation in the North American region drives the demand for automotive micro motors. Technological improvements and higher vehicle sales, particularly in the commercial vehicle (light and heavy commercial) sector, are slated to accelerate the demand for the product to ensure the efficient working of modern automobiles.

The rest of the world captures a substantial share of the market, with numerous companies focusing on reducing their carbon footprint, resulting in increasing adoption of electric fleets.

KEY INDUSTRY PLAYERS

Companies Focus on Expanding Sales Networks and Product Portfolio to Enhance Their Position

Key players in this market include Denso, Nidec, and Mitsuba. The automotive micro motor manufacturers focus on expanding their product portfolio and sales networks and partnerships. Denso Corporation is one of the leading automotive micro motor manufacturers. The company focuses on research and development activities to create high-quality new products with improved capabilities. It develops, manufactures, and distributes tool and equipment solutions across the globe.

List of Top Automotive Micro Motor Companies:

- Robert Bosch GmbH (Germany)

- Constar MicroMotor (China)

- Buhler Group (Switzerland)

- Johnson Electric Holdings Limited (China)

- NIDEC CORPORATION (Japan)

- Brose Fahrzeugteile GmbH & Co. KG (Germany)

- Mitsuba Corp. (Japan)

- MABUCHI MOTOR CO., LTD (Japan)

- Valeo SA (France)

- Denso Corporation (Japan)

- Maxon (Germany)

KEY INDUSTRY DEVELOPMENTS:

- August 2024: Johnson Electric announced the launch of its innovative Air Suspension Pump Brushless Motor. This cutting-edge product is set to redefine the standards of vehicle performance and efficiency. The motor is ideal for manufacturers seeking to enhance their vehicle's air suspension system with a reliable and efficient motor.

- March 2024: Nidec Corporation announced that the company had developed a new air suspension motor for automobiles. Nidec Motor (Dalian) has developed this latest air suspension motor. Compact, durable, and highly responsive during start-up, this product drives the air compressor, the component that supplies the air tank with compressed air.

- November 2023: Portescap launched the 60ECF brushless DC slotted flat motor, enhancing its flat motor range. This motor features a body length of 38.2mm and an outer rotor slotted design, which improves heat management and delivers a torque of up to 298 mNm. It is particularly suited for applications in aerospace, robotics, and industrial automation.

- April 2023: Honda recognized Mitsuba Corporation, a manufacturer specializing in motors and micromotors, for its outstanding quality and timely delivery during 2022. Honda acknowledged that Mitsuba Corporation played a crucial role as a supplier in 2022, enabling the automaker to concentrate on increasing its manufacturing capacity.

- August 2022: Johnson Electric introduced its steering wheel adjuster motor for a more comfortable long-drive experience, allowing drivers to ingress and egress with ease. Johnson Electric developed an automatic steering column adjuster motor to achieve precise linear and height adjustment. Its “intelligent mode,” which features “welcome mode” and “one-button switching mode,” helps the driver achieve the most comfortable driving posture.

REPORT COVERAGE

The automotive micromotor market research report provides a detailed analysis and focuses on key aspects such as leading market participants, competitive landscape, and type. Besides this, it includes insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that have contributed to the market's growth in recent years.

To gain extensive insights into the market, Download for Customization

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 9.6% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vehicle Type

|

|

By Power Consumption

|

|

|

By Application

|

|

|

By Technology Type

|

|

|

By Component

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 15.86 billion in 2023.

The market is poised to grow at a CAGR of 9.6% during the forecast period of 2024-2032.

By vehicle type, the SUV segment captures the largest share due to the high production volume of SUVs globally.

The market size of Asia Pacific was valued at USD 7.69 billion in 2023.

Denso, Nidec, and Mitsuba are some of the top players in the market.

In 2023, Asia Pacific held the largest share of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us