Behavior Analytics Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Application (Advertising Campaign, Digital Marketing, Content Delivery, Brand Promotion, Threat Detection, and Others), By Industry (Retail, BFSI, Healthcare, Government, Media & Entertainment, Education, Food & Beverages, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

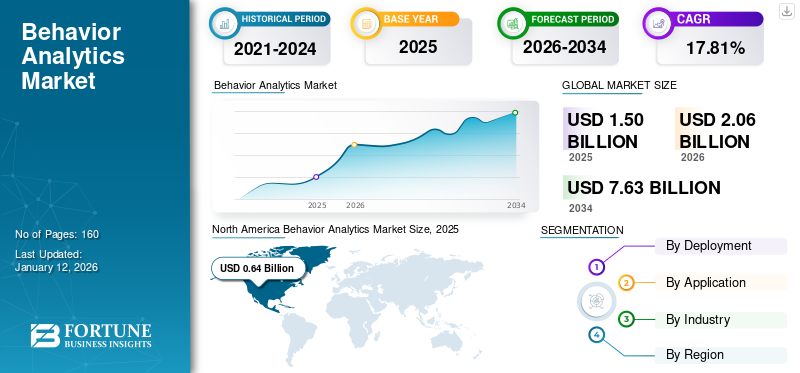

The global behavior analytics market size was valued at USD 1.5 billion in 2025 and is projected to grow from USD 2.06 billion in 2026 to USD 7.63 billion by 2034, exhibiting a CAGR of 17.81% during the forecast period. North America dominated the global market with a share of 42.98% in 2025.

Behavior analytics captures customers’ actions that help enterprises understand the market trends, provide recommendations as per preferences, and lower security threats by tracking unusual patterns. The rapid digital transformation across industries is likely to surge the demand for analytical tools. Companies are keen to understand customer preferences in advance to offer products per user’s choice. The tools support achieving maximum customer satisfaction, thus fueling sales revenue. Many organizations are collaborating and investing in security solutions that can help drive businesses. For instance,

- In July 2023, Silicom Ltd. announced a collaboration with AI chipmaker, Hailo, to integrate a product portfolio for various use cases. The companies are focusing on offering cost-effective solutions such as facial recognition, behavior analytics, human intrusion detection, and more to enhance decision making.

The COVID-19 pandemic surged the demand for behavior analytics exponentially to understand the changing trends and analyze future demand. The pandemic severely impacted customers' buying behavior for all products across industries. The enterprises invested in analytical tools to make future decisions and strategize product launches. As per the McKinsey and Oxford Economics report on Scenario A1, the U.S. customers’ disposable income is not expected to recover till the second quarter of 2024, thus likely impacting shopping and consumption trends.

Furthermore, the adoption of digital platforms and channels is increasing post-pandemic. Enterprises can draw vast information using tools to offer as per consumer requirements. The rising threats alert companies to constantly map user behavior to reduce fraud risk. Thus, rapidly changing preferences and growing threats are likely to boost the behavior analytics market growth.

Behavior Analytics Market Trends

Cybersecurity and Automation Capabilities of Generative AI to Boost Market Growth

Generative AI has significantly impacted behavior analytics, particularly in cybersecurity. AI has become a necessity in combating cyber threats by analyzing vast amounts of data, identifying patterns, and making real-time decisions. It enhances anomaly detection, improves predictive analysis, and enables proactive defense measures against evolving threats.

Generative AI, in particular, has the potential to transform cybersecurity by analyzing risk data to speed response times and augment security operations. It can create predictive models, generate simulated environments, and analyze large volumes of data to identify and respond to threats before they cause damage. The integration of AI into cyber security practices raised important considerations regarding ethics, privacy, and potential adversarial exploitation. Leveraging AI’s potential with responsible implementation to protect privacy and maintain ethical boundaries becomes crucial.

In July 2023, Swiggy, a food delivery platform, leveraged generative AI to personalize food images and descriptions based on user behavior, enhancing customer experiences. This initiative mirrored Zomato’s efforts in AI integration to improve customer-facing features.

Download Free sample to learn more about this report.

Behavior Analytics Market Growth Factors

Increasing Inside Frauds and Threats to Drive Market Growth

Cybersecurity threats and frauds have increased over the years with the rise in adoption of digitalization. As per the Federal Trade Commission, the online shopping category registered the second-highest fraud of 2.1 million reports in 2020. This factor is expected to surge the demand for behavior analytics.

Enterprises are significantly investing in tools to understand the pattern that can track miscellaneous activities. Behavioral analytics software monitors activities such as the speed of information entered, information of multiple taps, number of password re-entries, and more. According to security analytics, a change in behavior patterns is the early sign of brewing fraud activity and is also an early step to lower risk. Thus, along with cybersecurity protection on all channels, companies monitor employees and customers from the inside to reduce fraud risk. The software helps in separating fraudsters from genuine customers and employees. The aforementioned factors are anticipated to drive the market growth.

RESTRAINING FACTORS

Stringent Data Protection Laws to Hamper Market Growth

The rules for protecting customers’ personal and sensitive data are growing stringently across the globe. The companies need to use these customer data with higher precaution and only after taking the customer's permission. However, several companies violate the protection rules to establish their hold on the market. Thus, in many countries, governments have taken strong actions against such companies to reduce data misuse. For instance, in September 2022, the government of South Korea imposed Personal Information Protection Commission (PIPC) regulation on Meta LLC and Google LLC for collecting customer data without their consent. Thus, such a rise in rules against the collection and usage of data is likely to hinder the behavior analytics market share expansion.

Behavior Analytics Market Segmentation Analysis

By Deployment Analysis

Data Security to Boost On-premises Solution Demand

Based on deployment, the market is split into cloud and on-premises.

The on-premises segment is expected to gain maximum segment with a share of 52.00% in 2026 during the forecast period. The data safety of in-house storage is surging the demand for on-premises solutions.

The cloud segment is anticipated to gain rapid growth rate owing to the scalability of storage and warehouse. Similarly, as the business grows, the demand for storage capacity and on-demand services is expected to grow. Thus, the ease of burden of setup and maintenance will fuel the cloud segment growth.

By Application Analysis

Growing Adoption Digital Platform to Boost Digital Marketing Share

Based on application, the market is segmented into advertising campaign, digital marketing, content delivery, brand promotion, threat detection, and others (customer engagement).

The digital marketing segment is expected to gain maximum segment with contribution of 23.45% globally in 2026. As the adoption of e-commerce and online shopping grows drastically, there is an increase in data generation. The generated data helps digital marketers analyze consumer behavior trends and target new strategies.

The threat detection segment is anticipated to grow rapidly during the forecast period. Threat detection tools send alerts when a minor change is detected in a customer’s behavior. According to the Cost of Insider Threat Report 2020, cybercrime costs are expected to increase by 15% year-on-year in the next four years. Thus, with the growing anomalies, organizations are investing in such analytics tools to lower fraud.

The content delivery segment is estimated to showcase significant growth during the forecast period. The brands offer content based on customers’ preferences that were recorded earlier for analysis. OTT platforms such as Amazon Prime and Netflix analyze user and entity behavior analytics to understand customer needs, and thus recommend content. The demand for these analytics is gaining traction in other industry applications and thus driving the market growth.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Numbers of Online Shoppers to Fuel Retail Market Share

By industry, the market is categorized into retail, BFSI, healthcare, government, media & entertainment, education, food & beverages, and others (energy & utility, travel & tourism).

The retail segment to gain dominant market share owing to the rise in e-commerce and online shopping trends. The generation of customer insights is exponential in the retail industry, and thus the demand for analytical tools is growing.

Similarly, the media & entertainment segment is witnessing considerable growth with the rise in online content streaming.

The BFSI segment is expected to grow rapidly during the forecast period with a share of 19.57% in 2026. Access to 360-degree insights enables banking and financial institutes to provide a personalized experience. It helps recommend suitable services, reduce threats, and enhance the banking experience.

The education segment is also significantly investing in analytical tools to understand student’s requirements and provide personalized supper. The healthcare industry is growing steadily with the rapid digital transformation and patients’ data.

REGIONAL INSIGHTS

North America

North America Behavior Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America to gain dominant revenue share during the forecast period. Europe dominated the global market in 2025, with a market size of USD 0.64 billion. The rapidly growing digitalization across businesses and the presence of customers on various digital platforms is driving market growth. As per The Digital 2023 USA report, 72.5% of the total population in the U.S. are social media platform users. Thus, the exponential growth in digital solutions fuels the region's demand. The U.S. market is projected to reach USD 0.59 billion by 2026.

Asia Pacific

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific to gain a rapid growth rate during the forecast period. The increasing population in India and China is anticipated to drive the demand for solutions to understand the changing trends of the markets. With a huge customer presence, various companies are investing in these countries. In 2022, India witnessed a 10% rise in Foreign Direct Investment, with China at 5% and Singapore at 8%. Similarly, other Asian countries such as South Korea, Japan, and Singapore contribute to the digital transformation, thus likely to propel market growth. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.11 billion by 2026, and the India market is projected to reach USD 0.08 billion by 2026.

Europe

Europe to gain significant market share owing to the increasing number of businesses and enterprises. Also, the financing programs in European countries are driving small & medium enterprise's IT funds, thus likely to boost market share. The UK market is projected to reach USD 0.06 billion by 2026, and the Germany market is projected to reach USD 0.09 billion by 2026.

Middle East & Africa

The Middle East & Africa to grow significantly during the forecast period. The growing digitalization in gaming and entertainment, healthcare, retail, and more industries is expected to drive the demand. Similarly, South America's rising internet penetration and smartphone access are estimated to propel market growth during the forecast period.

Key Industry Players

Advanced Offering by Key Players to Propel Revenue Share

Key market players are keen on offering advanced solutions for businesses to understand customer requirements by analyzing their behavior. The solutions market players offer to increase enterprise credibility through enhanced user experience. Companies across industries invest in the solution to reduce fraud threats, boost customer relationships, and monitor the workforce.

- April 2023: IBM Corporation launched QRadar Security Suite to enhance the speed of threat detection using anomalies in behavior. Real-time detection uses threat intelligence, user behavior analytics, and artificial intelligence.

- May 2023: Remark Holdings, Inc., an AI-based video analytics provider, announced a collaboration with the core partner of Cisco Systems, Inc., WaitTime, to integrate crowd-behavior analytics solutions. The solution provides live and personal insights that help deepen the relationship with the users.

List of Top Behavior Analytics Companies:

- Oracle Corporation (U.S.)

- Adobe Inc. (U.S.)

- IBM Corporation (U.S.)

- Splunk Inc. (U.S.)

- Heap Inc. (U.S.)

- LogSentinel B.V. (Netherlands)

- Altamira.ai (U.S.)

- Hotjar Ltd. (Malta)

- TIBCO Software Inc. (U.S.)

- Niara Inc. (HP Inc.) (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: NEC APAC partnered with Securonix, Inc. to enhance NEC’s cyber defense services in Southeast Asia, focusing on its Managed Services Business Unit. This collaboration aimed to enhance the company’s technological innovations, specifically focusing on enhancing capabilities, including behavior analytics, to address the growing cyber threats.

- December 2023: M2P Fintech acquired Goals101, a transaction behavior intelligence company, for approximately USD 30 million. This acquisition integrated Goals101’s platform, which utilizes machine learning and AI to analyze consumer transaction patterns, into the company’s financial services suite.

- October 2023: NoBroker launched CallZen.AI, offering conversational insights from multiple Indian languages across chat, meetings, and calls. This AI-powered platform included features such as behavior analytics and semantic analysis, catering to several sectors with a freemium model.

- September 2023: Adsquare launched a new platform with enhanced user interface and location analytics, augmenting location data for businesses. The platform offered in-depth footfall metrics, including unique visitors and their visits and behavior analytics, empowering businesses to gain insights into customer engagement trends.

- August 2023: Exabeam expanded its partnership with Google Cloud to develop generative AI models for its New-Scale SIEM product portfolio, aiming to enhance security operations with advanced AI and behavior analytics. The collaboration leveraged Google Cloud’s innovative AI capabilities to accelerate the design of AI-based security enhancements.

- March 2023: Viisights, Inc. launched viisights IQ at ISC West 2023, introducing an auto-learning technology that enhanced their behavior recognition video analytics. This innovation aimed to reduce false alarms, improve efficiency, and increase event precision capabilities.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.81% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 7.63 billion by 2034.

In 2025, the market was valued at USD 1.5 billion.

The market is projected to grow at a CAGR of 17.81% during the forecast period.

The retail segment is expected to lead the market.

The increasing inside frauds and threats to drive market growth.

Oracle Corporation, Adobe Inc., IBM Corporation, Splunk Inc., Heap Inc. LogSentinel B.V., Altamira.ai are the top players in the market.

North America is expected to hold the highest market share.

By deployment, the cloud segment is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us