Brain Health Supplements Market Size, Share & Industry Analysis, By Product Type (Nootropic Supplements {Dietary Supplements, Herbal Extracts, and Others}, and Vitamins and Minerals), By Dosage Form (Tablets, Capsules, and Others), By Application (Cognitive Function, Stress & Anxiety, and Others), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, Online Channels, and Others), and Regional Forecast, 2026-2034

Brain Health Supplements Market Size

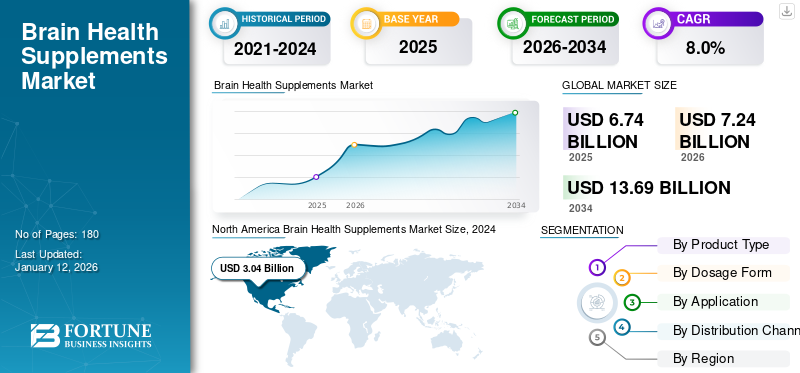

The global brain health supplements market size was USD 6.74 billion in 2025. The market is projected to grow from USD 7.24 billion in 2026 to USD 13.69 billion by 2034, exhibiting a CAGR of 8.00% during the forecast period. North America dominated the brain health supplements market with a market share of 48.86% in 2025.

Brain health supplements are a type of dietary supplement that helps in improving a person’s brain health and cognitive function. The increasing aging population, increasing number of people following restricted diets, and growing number of people navigating through certain medical conditions are expected to boost the demand for these supplements in the market.

- For instance, according to an article published by Frontiers Media S.A. in April 2023, most American adults are living with at least one-diet related chronic metabolic disease, among which hypertension is the most common, affecting half of the adult population, which accounts for 49.6%.

- According to a study published by the National Library of Medicine on the prevalence of Alzheimer’s disease at mild cognitive impairment and mild dementia stages, in 2022, 2.5 million people suffer from mild cognitive impairment in France, among which 1.65 million people fit for the criteria of cognitive impairment due to Alzheimer’s.

Moreover, the increasing focus of botanical extract manufacturers on the launch of new ingredients for advancing and supporting the efficacy of these supplements is expected to spur the growth of the brain health supplements market. For instance, in September 2023, Biotropics Malaysia Berhad launched BioKesum, a leaf extract supporting brain health, aiming to introduce its leaf extract to the global nutraceutical market.

However, the lack of evidence supporting that these supplements aid in improving brain health is constraining its growth in the global market. In addition, a lack of awareness about cognitive behavioral conditions and individual negligence toward its growing symptoms is restraining its market growth.

The COVID-19 pandemic positively impacted the market as it allowed people to share and open up about their experiences with mental illness, stress, anxiety, and mood fluctuations they deal with in their everyday lives through social media platforms. This increasing number of cases of mental illness contributed to the growing demand for these supplements in the market.

Moreover, the increased focus of the population during the pandemic toward improving their physical health and overall quality of life also contributed to the growing demand for these products in the market. This rising demand brought opportunities for brain health supplement manufacturers to collaborate with mental health influencers to promote their brain health supplement brands.

- For instance, in March 2021, Reckitt Benckiser Group plc collaborated with actress and neuroscientist Mayim Bialik to promote their brain health supplement brand Neuriva. The company also launched a campaign with the actress to educate and empower consumers on brain health.

The major players operating in the market witnessed revenue growth due to increased sales of their brain health supplements. For instance, the health business segment of Reckitt Benckiser Group plc generated a revenue of USD 5,142.0 million in 2020 and witnessed a growth of 9.6% compared to USD 4,691.9 million in 2020. The revenue growth was due to increased Neuriva sales.

Global Brain Health Supplements Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 6.74 billion

- 2026 Market Size: USD 7.24 billion

- 2034 Forecast Market Size: USD 13.69 billion

- CAGR: 8.00% from 2026–2034

Market Share:

- North America dominated the brain health supplements market with a 48.86% share in 2025, driven by the rising prevalence of cognitive disorders, higher diagnosis rates, and a growing focus on mental wellness among the elderly population.

- By product type, Vitamins & Minerals held the largest market share in 2024, supported by the increasing interest of both aging populations and younger consumers in maintaining brain health through essential nutrients.

Key Country Highlights:

- United States: Market growth is fueled by increasing consumer focus on brain health, strategic collaborations with mental health influencers, and the rising adoption of innovative dietary ingredients.

- Europe: Players are emphasizing technologically advanced products that enable consumers to monitor their cognitive performance, supported by partnerships between tech firms and supplement manufacturers.

- China: Companies are strategically expanding into untapped markets, leveraging e-commerce platforms to penetrate independent pharmacies and enhance product visibility among consumers.

- Japan: Focus on promoting sports nutrition products infused with cognitive-enhancing ingredients to support athletes' brain function, alongside rising consumer interest in holistic mental wellness.

Brain Health Supplements Market Trends

Growing Focus of Manufacturers on Including New Dietary Ingredients in Their Brain Health Supplement Products

There are an ample number of supplements that aid in improving brain health and also assist in reducing the risk of neurodegenerative diseases such as Alzheimer’s and dementia. Though brain health has a wide range of applications and success in preventing certain diseases, the safety and efficacy of many of these supplements are conflicting. The marketed brain health supplements may include ingredients not listed on the nutrition label or contain the content in different amounts. Moreover, individuals are also at risk of experiencing side effects due to overconsumption.

Therefore, to avoid this situation, many researchers are focusing on developing new extracts and ingredients that are safe for consumption and more effective for the population. Manufacturers are also focusing on getting it approved by regulatory authorities to obtain marketing authorization.

- For instance, in August 2023, AKER BIOMARINE, a biotech innovator, received a new dietary ingredient status for LYSOVETA from the U.S. FDA. LYSOVETA is a brain health ingredient for improving cognitive decline during aging. This approval allowed the company to market its product to the general adult population.

Therefore, introducing new ingredients to meet the growth of these products will majorly contribute to the brain health supplements market growth.

Also, the rising partnerships and collaborations among market players and research organizations to develop innovative and more effective supplements for the conditions are expected to support the shifting preference of consumers, healthcare professionals, professional athletes, and sports teams toward these novel supplements.

- For instance, in April 2021, Onegevity, a division of Thorne HealthTech engaged in offering B2B solutions for clinical research organizations and nutritional supplement industries, collaborated with EmbodyBio to advance brain health by developing treatments for neurological diseases.

Download Free sample to learn more about this report.

Brain Health Supplements Market Growth Factors

Increasing Number of Entrants with Launch of New Product Portfolio Anticipates Market Growth

The growing focus of young individuals on normalizing and prioritizing conversations related to mental health has extended support to people suffering from different mental illnesses. The support has led to a significant shift in people's understanding of mental health and has reduced the stigma associated with mental illness, encouraging many people to seek treatment.

The increasing preference toward incorporating naturally sourced ingredients into dietary habits is augmenting the growing demand for supplements containing natural components. This growing demand for these supplements, including natural ingredients, has allowed many investors to enter the market.

- For instance, in August 2023, Genuine Health, a provider of natural and science-based supplements, revealed its product portfolio formulated with saffron. These products are designed to support natural brain functions and long-term benefits to the brain.

In addition, an increasing number of contract and private label manufacturers are also easing the entry of players willing to enter the brain health supplement market. These contract manufacturers make products readily available to the new entrant at a cost-effective price. This growing demand for private label products grabbed the attention of many private investment firms to enter into the contract manufacturing business to produce a varied range of supplements.

- For instance, In March 2021, Cornell Capital, a private investment firm, acquired Innovations in Nutrition Wellness (INW). The company supports the fast-growing nutrition industry by providing manufacturing and marketing solutions.

Thus, these factors, coupled with the increasing focus of the market players on developing and introducing novel brain health supplement products, are expected to boost the demand for these products.

Growing Adoption of Brain Health Supplements in the Sports Industry to Propel Market Demand

Exercise and nutrition are the most potent means of influencing the brain. The brain requires an ample amount of energy to maintain its optimal function. To maintain this optimal function, young athletes must eat enough beneficial nutrients to fuel their bodies and brain. For instance, according to an article by TrueSport in November 2021, the brain uses 20% of the body’s energy.

Therefore, fueling it can make an athlete's brain think faster and sharper on the field. However, in case of a deficit of nutrients, an athlete may experience brain fog and struggle to pay attention to their game. Considering this, many players include sports nutrition products consisting of nootropic elements linked to an individual's mental and physical health, contributing to the brain health supplement market growth. These nootropic ingredients aid in boosting cognitive function, ultimately improving athletic performance.

This growing demand for brain health supplement products from the sports industry has led manufacturers to market their products to athletic enthusiasts. For instance, in June 2023, USA Track & Field collaborated with Prevagen as an official brain health supplement partner. The collaboration aims to support aging adult athletes by promoting their product for cognitive function.

Moreover, the rising awareness of mental health disorders among the growing population, along with their growing focus on maintaining their physical and mental health, augment the growth of the market. For instance, according to the data published by Nutritional Outlook in January 2022, the sales of cognitive health supplements aiding in improving brain functioning increased by 19.0% in the U.S.

Thus, the increasing adoption of these supplements by young individuals and sports enthusiasts contributes to the growing demand for the product and spurs market growth.

RESTRAINING FACTORS

High Cost of Biologics and Overall Treatment Cost Limiting the Adoption of the Product

There is a growing presence of numerous brain health supplements in the market, each of which assures increased brain power. These supplements commonly contain compounds such as choline and huperzine A. They are primarily responsible for raising levels of acetylcholine, a chemical that plays an essential role in memory and understanding.

According to a pressbook (PB), some research studies have proven that these supplements aid in improving memory of individuals with dementia or Alzheimer's. Some researchers have mentioned that individuals consuming supplements containing omega-3 fatty acids have better cognitive function. For instance, an article published by Apollo Pharmacy in September 2023 stated that incorporating omega-3 fatty acids in one's diet positively impacts cognitive function, such as memory, mood, and overall mental well-being.

However, several other studies state that these products have potential side effects and have minimal scientific proof of their efficiency. For instance, according to an article published by Nuvance Health in May 2022, over-the-counter (OTC) supplements claiming to improve cognitive abnormalities may contain unapproved pharmaceutical drugs. Also, according to a study published by Slfox in March 2023, there is limited clinical proof of the efficiency of several mind supplements for brain health.

In addition, a lack of awareness among the general population and limited knowledge of pharmacists about using these supplements to maintain an individual’s physical, emotional, and mental well-being restricts its market growth. For instance, according to a study published by MJH Life Sciences on Pharmacists Eager for More Brain Health Supplement Information in November 2021, 99% of the pharmacists asked for more clinical information, and only 6% were upto date on brain health supplements.

Moreover, the higher cost associated with these supplements for brain health restricts growing adoption in low-income countries.

Brain Health Supplements Market Segmentation Analysis

By Product Type Analysis

Nootropic Supplements are Poised for Rapid Growth Fueled by Cognitive Enhancement Benefits

On the basis of product type, the market is segmented into nootropic supplements and vitamins & minerals.

The nootropic supplement segment is projected to grow at the highest CAGR during the forecast period due to its range of benefits and essential role in optimizing brain function. The preferential shift of patients toward adopting nootropic supplements due to the incorporation of high-quality ingredients, supported by scientific research and evidence along with their safety profile, majorly contributes to its growth. Moreover, its increasing range of products for treating various cognitive functions, anxiety reduction, and mental health boosting, anticipates its market growth. For instance, in May 2023, Nature’s Way, a manufacturer of vitamins and supplements, launched Brain Fuel, a gummy supplement for adults' short-term memory, focus, and concentration.

In addition, an increasing number of new entrants in the industry are focused on raising capital from different capital firms to expand their manufacturing and marketing capabilities, which augments market growth. For instance, in May 2023, Thesis, a nootropic supplement start-up, raised funding of USD 8.4 million. The company has planned to use this funding to expand its team and product portfolio.

The vitamins & minerals segment led the market accounting for 79.05% market share in 2026. The growing interest of the aging population and younger people in maintaining healthcare is anticipating the segment's growth. Maintaining proper nutrition during pregnancy to deliver infants with well-developed brain functions also contributes to their growing demand. For instance, based on an article published by ACKO Technology & Services Pvt Ltd in March 2023, Zinc and Magnesium play a particular role in memory enhancement and concentration of the human brain and are essential minerals for cognitive functioning.

Therefore, the growing affirmation of the aging population and youngsters toward maintaining their mental healthcare is contributing to the growing demand for brain health supplements in the market.

To know how our report can help streamline your business, Speak to Analyst

By Dosage Form Analysis

Capsules Segment Leads Market with Diverse Dosing Options and Clean Label Appeal

On the basis of dosage form, the market is segmented into tablets, capsules, and others.

The Capsules segment dominated the market accounting for 69.40% market share in 2026, providing manufacturers with several dosing options. Several ingredients can be encapsulated with the minimum excipient, aiding companies in marketing their products to consumers with clean label status. Moreover, capsules incorporate a wide range of filling materials, such as granules, pellets, and liquids, making it one of the preferred choices among manufacturers.

- For instance, according to a press release by Akums Drugs and Pharmaceuticals Ltd. in June 2023, capsules are small and easy to swallow, which makes them one of the preferred dosages for many consumers.

The tablets segment is estimated to grow at a significant CAGR during the forecast period. The compressed form of powdered ingredients aids in the eventual absorption of drugs into the bloodstream, making it one of the preferred dosage choices among practitioners. The tablet’s ability to hold the pill together and improve its taste, texture, and appearance also anticipates its market growth. Moreover, the low cost associated with tablet manufacturing makes it one of the preferred choices among manufacturers and affordable to consumers.

- For instance, according to a press release by Divi’s Nutraceuticals in January 2023, tablets dominate the dietary supplement market and are the most commonly used dosage form for taking vitamins.

By Application Analysis

Cognitive Function Segment Set for Optimal Growth Amid Rising Neurological Disorders

On the basis of application, the market is segmented into cognitive function, stress & anxiety, and others.

The cognitive function segment is projected to grow at a highest growth rate during the forecast period. The rising prevalence of cognitive impairment cases majorly augments the segment's growth. Moreover, the growing number of the aging population and people suffering from chronic conditions such as Parkinson’s disease and heart and stroke disease also anticipates the segment’s growth. These increasing numbers of cases put these patients at risk of developing neurological conditions such as Alzheimer’s and dementia.

- For instance, based on an article published by Columbia University in October 2022, the rate of dementia and mild cognitive impairment rose sharply by 3% among people within the age group of 65 and 69. It also increased among people aged 90 and above by 35%.

The stress and anxiety segment led the market accounting for 45.43% market share in 2026, as the increased burden of responsibilities, uncertainty, and stressful life events are some of the significant causes of stress and anxiety among individuals. The feeling of isolation and burnout can cause low motivation and lead to several other severe physical conditions. The other reason for anxiety is continuous work-related stress caused by factors such as heavy workloads and tight deadlines. For instance, according to the statistics released by Healthdirect Australia in June 2023, anxiety disorder is the most common mental health condition in Australia, and it affects 1 in 4 Australians at some time. This rising prevalence of anxiety and stressful conditions is contributing to the growing demand for these supplements among youngsters for the management of the condition and contributing to the segment’s growth.

By Distribution Channel Analysis

Online Channel Emerges as Fastest Growing Segment Fueled by Convenience and Accessibility

On the basis of distribution channels, the market is segmented into hospital pharmacies, drug stores & retail pharmacies, online channels, and others. The hospital pharmacies segment will account for 43.75% market share in 2026.

The online channel segment is expected to grow at the highest CAGR during the forecast period. The flexibility of creating a product listing and the fast and easy process of buying products through online platforms have contributed to the increasing number of consumers buying products online. These factors have led many manufacturers to market and sell their products through online platforms. Moreover, the increasing number of digital users and the ease of procurement of medications and supplements through online platforms contribute to the segment's growth in developed and developing countries.

- For instance, according to an article published by Supplements101 in December 2021, the online sales of supplements accounted for the fourth largest revenues in total online sales by witnessing a 40% increase.

The drug store & retail pharmacies segment is projected to grow at a significant CAGR. The growing focus of brain health supplement manufacturers on collaboration with established retail and online distributors for penetration of their products in various markets is propelling the segment’s growth. For instance, in January 2022, Blackmores, a producer of brain health supplements and other dietary products, collaborated with Natural Health to distribute its multivitamin products in India.

On the other hand, the hospital pharmacies segment is expected to grow owing to the rising prevalence of Alzheimer's and dementia and the increasing number of patients admitted to hospitals for treatment. For instance, according to a journal published by the National Library of Medicine in December 2022, the number of persons who have Alzheimer’s disease is projected to rise by 14% in 2025.

REGIONAL INSIGHTS

Regionally, the market is studied across North America, Europe, Asia Pacific, and the rest of the world.

North America Brain Health Supplements Market Size, 2024(USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America held the dominant share in 2026 valuing at USD 1.29 billion and also took the leading share in 2025 with USD 1.22 billion. The U.S. market is projected to reach USD 2.6 billion by 2026, owing to the growing prevalence of various cognitive disorders and higher diagnosis and treatment rates of neurological diseases. Moreover, the growing focus of the elderly population on maintaining their mental healthcare is further augmenting the market growth in the region. For instance, according to a study published in Nuvance Health in May 2022, adults aged 50 and above spend more than USD 93.0 million monthly on supplements marketed for brain health. The American Association of Retired Persons conducted the study.

In addition, the conducive environment for researching and developing various innovative ingredients for developing brain health supplement products contributes to the market's growth.

- For instance, in February 2023, Kyowa Hakko, an international health ingredients manufacturer, launched Hydrate, a sports drink featuring Cognizin (Citicoline). The product is a blend of electrolytes, essential vitamins, and minerals that athletes can use for hydration.

Europe accounts for a substantial share of the market as brain health supplement manufacturers increasingly focus on providing their customers with technologically advanced products to keep track of their cognitive performance. For instance, in March 2023, Cognetivity Neurosciences Ltd., a tech company, collaborated with Conka, a U.K.-based provider of natural brain health supplements. The collaboration aims to provide Conka’s customers with Cognetivity’s brain health assessment technology for accurately measuring changes in their cognitive performance.

The UK market is projected to reach USD 0.49 billion by 2026, and the Germany market is projected to reach USD 0.35 billion by 2026.

Asia Pacific is expected to grow at a significant CAGR during the forecast period as key players focus on marketing their products in untapped regions. Many players have started marketing their products at discounted rates through online channels to mark their presence. For instance, in January 2022, Blackmores, a natural health and dietary supplements company, collaborated with Udaan, an e-commerce platform in India, to distribute their premium multivitamin products to independent pharmacies nationwide.

The Japan market is projected to reach USD 0.48 billion by 2026, the China market is projected to reach USD 0.24 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

The rest of the world's market is expected to grow during the forecast period with improving healthcare infrastructure, growing collaboration, and partnerships of key companies with established distributors to improve the penetration of these supplements. Moreover, the increasing awareness regarding neurological diseases contributes to its increasing adoption in the market. For instance, in February 2020, Biovital Ltda. collaborated with BioActor B.V. to distribute BRAINBERRY, BioActor’s proprietary brain fitness ingredient, for the compounding pharmacy market in Brazil.

List of Key Companies in Brain Health Supplements Market

Emphasis on New Product Launches and Collaborative Ventures Reinforce Industry Presence

The fragmented market comprises many players with a wide range of product portfolios. The increasing sales of its newly launched brain health supplement, Neuriva, contribute to its growing market share. Their continuous focus on improving its sales team and strategies is one of the factors contributing to its increasing market share.

- In 2022, more than 3,000 company employees completed their sales competency learning, which aimed to update their commercial operating model. The company was also awarded the Overall Supplier of the Year 2022 by Woolworths in Australia. The Brazilian Association of Cash and Carry Retailers also named it the Supplier of the Year.

Natrol, LLC. focuses on launching new products to cater to the population's rising demand. Moreover, their growing emphasis on collaboration with competitor players to expand their product portfolio is expected to contribute to the company’s market hold. For instance, in September 2021, Natrol, LLC., launched MelatoninMax, a drug-free sleep aid brand that helps individuals fall asleep faster.

Moreover, the increasing number of private label manufacturers also brings opportunities for new entrants to introduce their products and contributes to the market's growth.

LIST OF KEY COMPANIES PROFILED:

- Alternascript (U.S.)

- Natrol, LLC. (U.S.)

- Procera Health (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

- NEUROHACKER COLLECTIVE, LLC (U.S.)

- SOMA Analytics (U.K.)

- Onnit Labs, Inc. (U.S.)

- Natural Factors USA (U.S.)

- Xtend-Life (New Zealand)

KEY INDUSTRY DEVELOPMENTS

- February 2024: EyePromise, a supplement brand specializing in supplements supporting eye health, announced the launch of BrainPromise, a formula featuring essential vitamins, minerals, and the carotenoids lutein and zeaxanthin.

- September 2023: Natrol, LLC., is launching Soothing Night, a sleep-aid supplement without melatonin to promote longer and better sleep.

- August 2023: Natrol, LLC., collaborated with Being Frenshe to promote their sleep support products and aid individuals in their healthy sleep routine.

- September 2022: Fonterra, one of the leading producers of dairy products, is diversifying its business with the launch of BioKodeLab, a supplement brand indicated for improving cognitive performance.

- December 2020: New Mountain Capital acquired Natrol, LLC., a manufacturer of vitamins and minerals supplements, to mark its presence in the supplements market.

REPORT COVERAGE

The brain health supplements market report covers a detailed analysis and overview. The report focuses on key aspects such as competitive landscape, drug class, dosage form, disease indication, distribution channel, and region. Besides this, it offers market insights such as drivers, trends, dynamics, the impact of COVID-19, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.00% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Dosage Form

|

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 7.24 billion in 2026 and is projected to reach USD 13.69 billion by 2034.

In 2025, the North America market value stood at USD 3.29 billion.

The market will exhibit steady growth at a CAGR of 8.0% during the forecast period.

Currently, vitamins & minerals supplements segment led by product type and will lead the market during the forecast period.

The increasing number of entrants with the launch of new product portfolios are the key drivers of the market.

Alternascript, Natrol, LLC., Procera Health, and Reckitt Benckiser Group PLC are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us