Coal Gasification Market Size, Share & Industry Analysis, By Feed Type (Slurry Feed Type and Dry Feed Type), By Gasifier (Fixed Bed, Fluidized Bed, and Entrained Bed), and By Application (Fertilizers, Electricity Generation, Hydrogen Production, Chemical, and Others), and Regional Forecast, 2026-2034

Coal Gasification Market Size

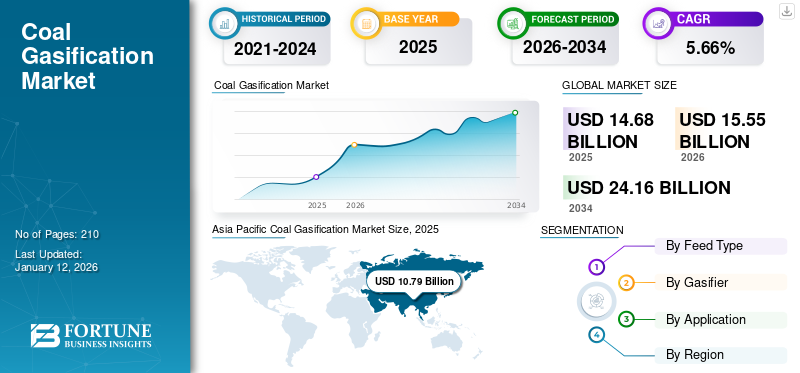

The global coal gasification market size was valued at USD 14.68 billion in 2025 and is projected to grow from USD 15.55 billion in 2026 to USD 24.16 billion by 2034, exhibiting a CAGR of 5.66% during the forecast period. Asia Pacific dominated the global market with a share of 73.51% in 2025. The Coal gasification market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.59 billion by 2032.

The coal gasification market is delivering outstanding deliverables in terms of fertilizers, chemicals, and hydrogen production globally, specifically in Asia Pacific. The growing number of methanol-infused fuels used in aviation and hybrid vehicles will also accelerate market growth in the future. Most coal is burned in traditional coal-fired power plants, but it can also be converted into gas, electricity, hydrogen, and other energy products. Coal gasification is a thermochemical procedure in which heat and pressure break down coal into its primary chemical constituents. The resulting synthesis gas consists mainly of carbon monoxide and hydrogen and sometimes other gaseous compounds. Syngas can be used for power generation, energy-efficient fuel cell technology, or as chemical "building blocks" for industrial purposes. Hydrogen can also be extracted to increase hydrogen conservation. These improvements are ongoing, and researchers continue to focus on improving the coal gasification technology to realize these and other potential future applications.

Global Coal Gasification Market Overview

Market Size:

- 2025 Value: USD 14.68 billion

- 2026 Value: USD 15.55 billion

- 2034 Forecast Value: USD 24.16 billion, with a CAGR of 5.66% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific held a 73.51% market share in 2025, led by large-scale coal-methanol and coal-chemical projects in China, India, Japan, and Indonesia.

- Fastest-Growing Market: The U.S. market is projected to reach USD 1.59 billion by 2032, driven by opportunities in electricity generation, hydrogen production, and chemicals despite competitive natural gas prices.

- Application Leader: The electricity generation segment led the market in 2024, benefiting from the wide availability of coal and advancements in cleaner, high-efficiency gasification technologies.

Industry Trends:

- Integrated Gasification Combined Cycle (IGCC) Growth: High-efficiency, low-emission IGCC plants are increasingly replacing traditional coal-fired power systems.

- Underground Coal Gasification (UCG): Growing adoption for hydrogen production and cleaner coal utilization, supported by pilot projects in China, Mongolia, and Australia.

- Versatile Output Applications: Rising use of syngas for fertilizers, chemicals, hydrogen, synthetic natural gas, and liquid fuels.

Driving Factors:

- Rising Hydrogen Demand: Coal gasification produces ~18% of global hydrogen, with China deriving ~62% of its hydrogen from this method.

- Environmental Efficiency Gains: IGCC plants can reduce CO₂, NOx, and SOx emissions while improving energy conversion efficiency.

- Technology Advancements: Integration with fuel cells, carbon capture, and synthetic fuel production enhances market viability.

- Energy Security Goals: Nations with large coal reserves leverage gasification to diversify energy supply and reduce import dependency.

The COVID-19 pandemic had a negative impact on the development of coal gasification plants. The pandemic disrupted supply chains in various parts of the world and affected the production and marketing of raw materials used in process, mainly dry and slurried coal compounds.

Coal Gasification Market Trends

Focus on Producing Renewable Energy Sources to Augment Demand for Coal Gasification Process

Gasification is considered one of the most mature technologies used for the thermochemical production of gaseous fuels from carbon-based raw materials or fossil fuels. As an alternative to direct combustion, it allows the transformation of solid fuels into gaseous fuels with a higher calorific value. This reduces harmful emissions and also facilitates further transport and use. The raw material is usually treated at a high temperature (>700 °C) in a gasifier with steam and oxygen or air, where its incomplete combustion takes place in an oxygen-limited environment. The gasification product is fuel gas, which, subject to the raw material, contains a lot of synthesis gas (CO and H2), excluding carbon dioxide (CO2), methane (CH4), water vapor (H2O), and nitrogen. The product range includes hydrogen, Synthetic Natural Gas (SNG), liquid transportation fuels, kerosene, and chemicals. Gasification is, therefore, more versatile than direct combustion. It can be applied to different market segments and respond to market changes, providing an efficient path to a sustainable energy transition.

Download Free sample to learn more about this report.

Coal Gasification Market Growth Factors

Developments in IGCC Power Plants to Drive Market Growth

Advances in Integrated Gasification Combined Cycle (IGCC) power plants represent a state-of-the-art thermal power system that is expected to create excellent market opportunities. This is because IGCC power plants have high energy production efficiency and environmental protection levels as they integrate gasification with Gas Turbine Combined Cycle (GTCC) technology. Larger IGCC systems can improve power generation efficiency by approximately 15% while reducing CO2 emissions compared to conventional coal-fired power plants. This improved efficiency reduces nitrogen oxide, sulfur oxide, and dust emissions per kilowatt-hour of electricity generation.

For instance, in November 2021, an association of companies led by Mitsubishi Heavy Industries, Ltd. finished the construction of an Integrated Gasification Combined Cycle (IGCC) plant in the town of Hirono, in Fukushima Prefecture’s Futaba District. The new plant was officially handed over to the Hirono IGCC Power GK. The Hirono IGCC plant has a high-efficiency Gas Turbine Combined Cycle (GTCC) system integrating steam and gas turbines. Coal is gasified in a gasification furnace at high temperature and pressure. Sulfur, ash, and the likes are removed and separated, and the refined gas is utilized as fuel to drive the gas turbine. The power generation efficiency is 48%. This efficiency is comparatively higher than that of traditional coal-fired power generation, consequently leading to less carbon emissions.

Growing Demand for Underground Coal Gasification Process to Drive Market Growth

Underground Coal Gasification (UCG) technology is a coal development technology, an industrial process that converts coal into product gas using the thermal and chemical effects of coal for the clean development and utilization of coal. It adds a promising advantage in the field of underground coal gasification. This process involves burning coal on-site to create usable gas, which offers potential for a variety of applications, including power generation, steam generation, and chemical feedstock. UCG has demonstrated its capability through pilot projects and ongoing research, thereby creating a new approach to harness the potential of coal for power and hydrogen production. Integrating UCG with technologies, such as Solid Oxide Fuel Cells (SOFCs) promises efficient energy production and a carbon-neutral process.

For instance, in November 2021, NeuRizer had recognized two China sites for coal-to-hydrogen production. Insitu coal gasification developer NeuRizer and its Chinese companion Meijin Energy Investment picked out two locations in China and Mongolia for hydrogen production from underground coal. The companies believed that the sites were ideal for the utilization of NeuRizer’s underground gasification technology established at the former Leigh Creek coal fields in South Australia.

RESTRAINING FACTORS

High Costs Associated With Construction of Coal Gasification Plant to Hinder Market Progress

The high costs associated with the construction of a coal gasification plant will hamper the coal gasification market growth. Despite the use of traditional coal-fired power plants, the capacity of coal-fired thermochemical processes has not increased as expected due to the high capital and production costs associated with them. Integrated Gasification Combined Cycle (IGCC) coal-fired power plants are the key users of the power generation technology. The technology is expected to be 35% more expensive than traditional coal technology.

For instance, according to IRENA, gasification technologies, comprising fluidized bed and fixed bed solutions, incurred installed capital costs of approximately USD 2,000 - USD 6,700/kW.

Coal Gasification Market Segmentation Analysis

By Feed Type Analysis

Slurry Feed Segment Dominates with its Rising Trend in Coal Gasification Technology

Based on feed type, the market is divided into slurry feed and dry feed. The slurry feed type segment dominates the market. Slurry feed is an accompanying flow gasification process that aims to produce synthesis gas at high temperatures and pressure with coal slurry as feedstock and oxygen or air as gasification agent. The main components of synthetic gas are carbon monoxide, carbon dioxide, and hydrogen. Coal slurry feed-type pressure gasification with an advanced air flow bed reactor has become one of the main trends of coal gasification technology and has also received increasing attention in the development of modern coal chemical technology. As the demand for gas fuel increases in the market, the supply of coal to the slurry increases. The slurry coal feed segment is expected to lead the market, contributing 72.65% globally in 2026.

In a dry feed system, coke or coal is pulverized and dried together with the melt in a roller, and it consists of a hot gas drying circuit similar to conventional coal-pulverized power plants.

By Gasifier Analysis

Fixed Beds are Cost-Friendly and Easy To Maintain, Which Helps Increase Their Market Share

Based on gasifier, the market is segmented into fixed bed, fluidized bed, and entrained bed. The fixed bed segment is dominating the market share as they are easy to construct and operate and have high carbon conversion with solid residence time, low ash carryover, and low gas velocity. This type of gasifier has a bed of solid fuel particles through which the gasifier and gas travel either up or down. This is the simplest type of carburetor, which usually consists of a cylindrical space for a fuel supply device, an ash removal device, and a gas outlet. The fixed bed segment will account for 56.58% market share in 2026.

Fluidized bed gasifiers suspend feedstock particles in an oxygen-rich gas so that the bed inside the gasifier acts as a liquid. These carburetors use back-mixing and effectively mix the pre-charged carbon particles with the carbon particles already gassed.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Coal Gasification as an Electricity-Generation Technology is Gaining Popularity Due to the Ready Global Availability of Coal

Based on application, the market is classified into fertilizers, electricity generation, hydrogen production, chemicals, and others. The electricity generation segment dominates the market and held the largest coal gasification market share in 2023 as coal gasification is an age-old, convenient method used in electricity production. Coal is available in most countries, and with growing improvements in environment-friendly technologies, electricity generation is leading the market. The electricity generation segment is anticipated to hold a dominant market share of 39.76% in 2026.

With the growing demand for hydrogen in the energy market, coal gasification currently produces about 18% of the world's total hydrogen. It is the second-largest and most cost-effective way of producing hydrogen. In China, the situation is entirely different. There, gasification is the primary production method, delivering 62% of the country’s hydrogen. The most significant climate impact is considered to be the production of hydrogen by gasification of coal as, during the process, 18-20 kg of CO2 emissions are produced per 1 kg of H2, while 8-12 kg emissions are emitted per 1 kg of H2 while reforming methane with steam.

REGIONAL INSIGHTS

The global market has been analyzed in five key regions - North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Coal Gasification Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the global market with mainly China, India, Australia, Japan, and Indonesia actively engaged in several gasification of coal projects due to their significant coal reserves. Several coal-methanol projects and coal-chemical projects have been implemented in China. For instance, China and Indonesia signed a memorandum of intent in October 2021 to carry out a feasibility study for a USD 560 million coal and methanol plant. The Japan market is forecast to reach USD 0.28 billion by 2026, the China market is set to reach USD 7.68 billion by 2026, and the India market is likely to reach USD 1.7 billion by 2026.

North America

In North America, natural gas prices in the U.S. dropped after the shale oil and gas revolution, which meant that the cost of producing electricity with natural gas was lower than with coal. With abundant oil and gas reserves in the U.S., sufficient oil and gas production, and falling expenses for renewable energy sources, such as wind and solar power, the U.S. is likely to gasify coal for electricity or chemical output in the future as natural gas offers plenty of cheaper and technically established alternatives to the same. The U.S. market is estimated to reach USD 1.3 billion by 2026.

Rest of The World

In the Middle East & Africa, gasification is on the rise, with increasing demand for hydrogen as fuel in the UAE and Saudi Arabia.

In the case of Europe, many countries had stopped the operation of coal plants of gasification due to the emission of harmful gases. Still, as the war situation gets worse in Ukraine, the domestic need for energy has compelled these countries to reopen the gasification plants. The UK market is expected to reach USD 0.05 billion by 2026.

In Latin America, coal gasification plants are at a nascent stage and need more investments for the growth of the market.

KEY INDUSTRY PLAYERS

Air Product’s Prominence is Led by Wide Application of Its Coal Gasification Technology

Air Product’s coal gasification technology can be customized to cater to various requirements, such as offering an alternative feedstock for producing chemicals, lubricants & synthetic liquid fuels. It can also be used to generate power with less emissions than from burning coal or even natural gas, with the option of high-pressure carbon capture and storage.

Air Product has invested in gasification of coal and announced financial closure and the transfer of another group of assets through a USD 12 billion gasification and power joint venture (JV) with Aramco, ACWA Power, and Air Product Qudra in Jazan Economic City ("Jazan"), Saudi Arabia. The joint venture's purchase of this second group of assets from Jazan follows the successful acquisitions and project financings for the first asset group, which were completed at the end of October 2021.

LIST OF TOP COAL GASIFICATION COMPANIES:

- Air Liquide (France)

- Mitsubishi Heavy Industries Inc. (Japan)

- Air Product (U.S.)

- Sedin Engineering (Indonesia)

- Coal India (India)

- McDermott International (U.S.)

- Dakota Gasification Company (U.S.)

- Jindal Steel and Power Ltd. (India)

- NeuRizer (Australia)

- ONGC (India)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Pennsylvania-based Air Products and Chemicals announced plans to invest USD 15 billion in coal gasification projects in Indonesia. This was one of the biggest overseas coal investments by a U.S. company in late 2021. Less than a year and a half later, in March 2023, Air Products announced that it was closing all of its coal projects in Indonesia, which made up the majority of its non-Chinese gasification of coal portfolio.

- April 2022: Jindal Steel Plant Ltd. planned to set up a coal gasification plant - the second in the industry - at its Raigarh plant in Chhattisgarh. The company already uses this technology to produce steel at its Anguli plant in Odisha. Commissioned in 2018, the plant, with an annual production capacity of 2 million tons, is India's first and only plant to produce steel from Swadeshi coal using the gasification technology.

- June 2021: Mitsubishi Power's gasification technology helped provide Woody Biomass with sustainable jet fuel for scheduled flights. In a project commissioned by NEDO, JERA, TOYO, and JAXA collaborated to create a robust fuel production method. The aim was to increase the use of sustainable jet fuel and contribute to the achievement of the goal of carbon neutrality in 2050.

- April 2021: A consortium led by Mitsubishi Power, a subsidiary of the Mitsubishi Heavy Industries (MHI) group, completed the construction of an Integrated Gasification Combined Cycle (IGCC) plant in Fukushima Iwaki. This was followed by a formal handover to the company client, Nakoso IGCC Power GK. The new facility, a high-efficiency, clean commercial power plant that uses the world's most advanced gasification technologies for coal, began operations in April.

- February 2021: GE partnered with Tianjin Junliang Chen Power Plant. GE supplied power generation equipment for a new Combined Heat and Power (CHP) gas-fired power plant that replaced an old coal-fired power plant.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, feed and gasifier types, and leading product applications. Besides, it offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.66% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Feed Type

|

|

By Gasifier

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights study shows that the global market was valued at USD 14.68 billion in 2025.

The global market is projected to record a CAGR of 5.66% during the forecast period.

The market size of Asia Pacific was valued at USD 10.79 billion in 2025.

Based on application, the electricity generation application segment holds a dominating share of the global market.

The global market size is expected to reach a valuation of USD 24.16 billion by 2034.

The developments in IGCC power plants and the growing demand for the UCG process drive market growth.

Shell, Air Product, Air Liquide, and Mitsubishi, among many others, are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us