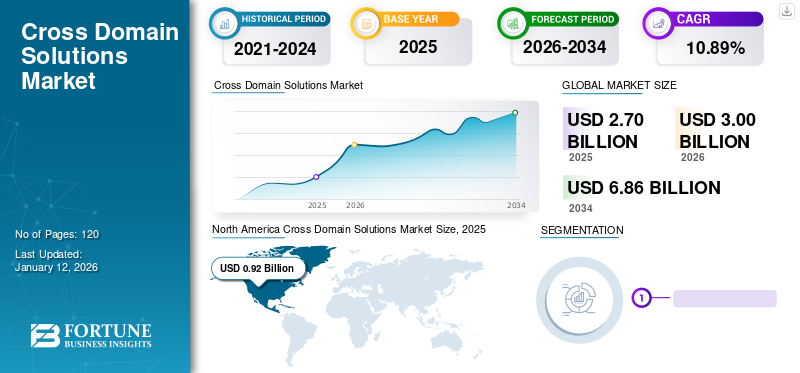

Cross Domain Solutions Market Size, Share & Industry Analysis, By Type (Access Solution and Transfer Solution), By Application (Aerospace and Defense, Law Enforcement and Security Agencies, and Critical Infrastructure), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global cross domain solutions market size was valued at USD 2.7 billion in 2025 and is projected to grow from USD 3 billion in 2026 to USD 6.86 billion by 2034, exhibiting a CAGR of 10.89% during the forecast period. North America dominated the global cross domain solutions market with a share of 34.09% in 2024. Additionally, the U.S. cross domain solutions market is projected to grow significantly, reaching an estimated value of USD 1,274.1 million by 2032.

Cross Domain Solutions (CDSs) are systems created to safeguard the sharing and transfer of information between multiple networks or domains. According to the Committee on National Security Systems (CNSS), CDS is a controlled interface that allows for the manual or automatic access and transfer of information across various security domains.

The market is driven by the ongoing and current threat of cyberattacks, the need to follow and abide by data privacy and governance requirements, and the demand of offering a secure hybrid work environment. As per analysts, spending on cybersecurity products and services continues to overtake growth in overall IT spending. Many instances of malware, ransomware, and other data breaches have been witnessed, and actions have been taken against them. Some include:

- May 2022: A national emergency was put out due to the Conti ransomware attack against many Costa Rican government bodies.

- August 2021: Saudi Aramco faced a data breach revealing critical data on more than 14,000 employees and the technical capabilities of the organization. The threat group, ZeroX, demanded a payment of USD 50.0 million.

Moreover, the outbreak of the coronavirus has presented fresh obstacles for businesses as they adjust to a new way of operating where remote work has become the standard. Companies are hastening their shift towards digitalization, and safeguarding against cyber threats has become a prominent worry. Prior to the pandemic, around 20% of cyberattacks employed malware or techniques that had not been encountered before. However, during the pandemic, this figure has increased to 35%, as stated by industry specialists. Thus, COVID-19 has opened up various growth prospects for market participants in the coming times.

IMPACT OF GENERATIVE AI

Generative AI to Aid Cross Domain Solutions with Adaptive Threat Detection by Continuously Learning Its Understanding of Cybersecurity Threats

Generative AI holds significant potential in influencing the field of cybersecurity. Just like its ability to learn and reproduce text patterns, GenAI can also gain insights from patterns in cyber threats or vulnerabilities and understand the documentation of security products. This enables analysts to query their security tools swiftly for enhanced responsiveness.

A GenAI model trained on extensive historical cybersecurity data can discern patterns and trends, enabling the prediction of future threats. Instead of reacting to threats in real time, cybersecurity professionals can utilize GenAI to anticipate and proactively address potential threats, optimizing the efficacy of existing security tools. This proactive approach, facilitated by generative AI, empowers enterprises in cybersecurity.

Additionally, GenAI can play a crucial role in securing systems by generating intricate passwords or encryption keys, adding a robust layer of defense against the common entry points of security breaches represented by weak or compromised credentials.

Cross Domain Solutions Market Trends

Rise in Technological Advancements to Set Trends in the Cross Domain Solutions Market

The rise of remote work has compelled companies, including those in traditional industries, to adopt Software as a Service (SaaS) and cloud tools for competitiveness and agility. Platforms, such as Zoom, Salesforce, and Slack have become crucial for facilitating efficient collaborations among remote knowledge workers. Public cloud hosting providers, such as AWS, Microsoft Azure and Google Cloud, have thrived in this environment.

- According to industry experts, the spending on cloud providers was USD 178 billion in 2022 from USD 141 billion in 2021. However, the shift to the cloud, while enabling modern software tools, has introduced significant cybersecurity challenges, marking a shift from traditional on-premise security.

The surge in technological advancements propels the cross domain solutions market growth by introducing increasingly complex and diverse systems. As emerging technologies, such as IoT, cloud computing, Artificial Intelligence (AI), and Machine Learning (ML) gain prominence, the need for seamless integration and secure communication across domains becomes critical. The continuous evolution of technology creates a dynamic landscape, continually driving the demand for adaptive solutions that can effectively bridge the gaps between diverse systems and domains.

Download Free sample to learn more about this report.

Cross Domain Solutions Market Growth Factors

Growing Investments and Government Initiatives to Propel Market Growth

Cybersecurity, online trust, online safety, and secure cyberspace are critical objectives and goals for any country aspiring to be a developed economy. A large number of cybersecurity initiatives are being undertaken as a strategy for creating secure cyberspace.

- January 2023: Carlyle, an investment firm, stated that it had invested around USD 55.0 million in Hack The Box, a cybersecurity upskilling and talent assessment platform.

- The November 2023 report of the European Union Agency for Cybersecurity (ENISA) stated that the investment in cybersecurity will continue to grow but also stressed the importance of vulnerability management. The report revealed a small increase of 0.4% of the IT budget for cybersecurity by EU operators.

These investments aim to enhance data protection, interoperability, and collaboration, leading to a higher adoption of CDS to meet stringent security requirements and facilitate efficient communication between government agencies and domains.

RESTRAINING FACTORS

High Operational Costs and Complex Multi-Design Likely to Hamper Market Growth

The complex multi-site design in CDS introduces intricacies related to connectivity, security, and data transfer among diverse locations. Managing the coordination and integration of information across multiple sites while ensuring strict security protocols poses a significant challenge. Also, integrating solutions across diverse domains with varying technologies and standards can be complex. Ensuring seamless interoperability is a constant challenge for these solutions.

A cross domain solution constitutes a sophisticated system of hardware, software, business processes, and operational policies. Consequently, organizations and integrators are likely to incur considerable financial and resource expenditures in the development, deployment, and support of a CDS. The operational costs associated with securely managing a CDS are anticipated to surpass the budget designated for other systems of comparable scale. Thus, the above factors are expected to hinder market growth in the coming years.

Cross Domain Solutions Market Segmentation Analysis

By Type Analysis

Transfer Solution Segment Dominated Owing to Rising Demand for Secure Data and Information Transfer through High-Security Domains

Based on type, the market is bifurcated into access solution and transfer solution.

The transfer solution segment held the largest market share in 2024. Cross domain data transfer solutions play a crucial role in safeguarding organizations against a wide range of attacks, both advanced and basic. High domains have stringent security measures in place to protect data during transfer. To prevent any unauthorized access or theft of sensitive information, a cross domain solution is employed to oversee the movement of data between low domains. The demand for CDS is mainly attributable to the rising spending on cybersecurity technology in the wake of constantly growing cyberattacks. The transfer solution segment is projected to dominate the market with a share of 56.14% in 2026.

- For instance, the Guacamaya is a group of hacktivists that claim environmental protection in South America. They engage in the act of stealing and releasing data from industrial companies and government agencies. These hacktivists have exposed more than 20 TB of stolen data since 2022. As a result, there is an anticipated increase in the need for cross domain solutions in the foreseeable future.

The access solution segment is estimated to grow with the highest CAGR over the forecast period, owing to the rising need to provide decision-makers with access to real-time and accurate information from multiple sources. According to industry experts, Artificial Intelligence (AI) and Machine Learning (ML) (20%), cloud technology (19%), and user identity and access management (15%) will have the greatest impact on their cyber risk strategies by 2025.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Significance and Reliance on Timely Sharing of Crucial Information Boosted Aerospace and Defense Segment Growth

Based on application, the market is segmented into aerospace and defense, law enforcement and security agencies, and critical infrastructure.

The aerospace and defense segment held the major market share in 2024. The sector is experiencing growth due to the increasing significance and reliance on the timely sharing of crucial information. The need for sustainability, product advancements, and defense during wartime will drive rapid technological progress in the industry. The aerospace and defense segment is expected to lead the market, contributing 42.26% globally in 2026.

- For instance, Canada revealed its plan in June 2023 to allocate approximately USD 265 million toward supporting initiatives aimed at enhancing the environmental sustainability of the aerospace sector. The main areas of focus will include hybrid and alternative propulsion, aircraft systems, the adoption of alternative fuels, and the development of aircraft support infrastructure.

The critical infrastructure segment is likely to grow with a highest CAGR over the forecast period. As critical infrastructure sectors, such as energy, transportation, and healthcare, increasingly rely on interconnected technologies, there is a growing need for cross domain solutions to safeguard sensitive information and facilitate secure communication across domains.

- Cyberattacks on critical infrastructure worldwide have doubled, according to the Microsoft Digital Defense Report 2022. Microsoft detected that these attacks accounted for 40% of all nation-state attacks compared to the previous 20%. As a result, there will be an increased need for cross domain solutions in critical infrastructure in the future.

REGIONAL INSIGHTS

The global market scope is classified across five regions, namely North America, South America, Europe, Middle East & Africa, and Asia Pacific.

North America

North America Cross Domain Solutions Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

In 2024, the market in North America held the highest cross domain solutions market share. The aerospace industry landscape in the region is anticipated to be influenced by ongoing technological progress in 2024. The Aerospace Industries Association’s Vision for 2050 highlights several significant advancements, including artificial intelligence, immersive technologies, and additive manufacturing, which will have a profound impact on aerospace and defense trends in the coming years. The U.S. market is estimated to reach USD 0.72 billion by 2026.

Furthermore, the majority of cross domain technology and high assurance guards are created by American companies in collaboration with U.S. government agencies responsible for security, military, and intelligence.

- In January 2022, the White House released the National Security Memorandum/NSM-8, aiming to enhance the cybersecurity of systems related to the Department of Defense, the Intelligence Community, and National Security.

Asia Pacific

Asia Pacific is anticipated to have the highest CAGR growth in the market over the forecast period. The growth is mainly due to the continually evolving sectors, such as aerospace and defense, government, and critical infrastructure. Several businesses in this region are concentrating on creating and releasing innovative cybersecurity solutions to meet the increasing need for security solutions and services. Due to increasing investments by key players, governments, and foreign investors in various smart city projects, blockchain projects, and other projects, the growth of the market in countries, such as Japan, India, China, Korea, and others is expected to experience an exceptional CAGR during the forecast period. The Japan market is forecast to reach USD 0.14 billion by 2026. The China market is poised to reach USD 0.15 billion by 2026. The India market is set to reach USD 0.14 billion by 2026.

Europe

Furthermore, the growth of Industry 4.0 and IoT is fueling the European market share. The Ministry for Economic Affairs and Energy (BMWi) and Industry 4.0, a government-led initiative, emphasize the importance of product interconnection, digitization, business models, and value chain. As a result, cross domain technology is expected to play a significant role in smart manufacturing factories in Europe. The UK market is expected to reach USD 0.14 billion by 2026. The Germany market is anticipated to reach USD 0.15 billion by 2026.

Middle East & Africa

Middle East & African countries are expected to showcase strong in the adoption of cross domain and other cyber security technologies. Cyber-attacks on Qatar's RasGas and Saudi Aramco have compelled Middle Eastern oil and gas firms to tighten their computer system security measures to avoid security breaches and safeguard their assets.

List of Key Companies in Cross Domain Solutions Market

Launching New Cross Domain Solutions with Enhanced Features to Cater to End Users’ Evolving Requirements

Key players operating in the market, such as Lockheed Martin Corporation, BAE Systems plc, Forcepoint, OPSWAT Inc., Infodas GmbH, and others, are launching several new products that are focused on catering to specific types of end users. These players integrate existing products with new technologies with the aim of catering to customers’ evolving requirements.

List of Key companies profiled:

- Lockheed Martin Corporation (U.S.)

- BAE Systems plc (U.K.)

- Owl Cyber Defense (U.S.)

- Advenica AB (Sweden)

- Forcepoint (U.S.)

- Infodas GmbH (Germany)

- 4Secure Ltd. (U.K.)

- OPSWAT Inc. (U.S.)

- General Dynamics Corporation (U.S.)

- Raytheon Technologies Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2023 – Forecepoint’s global governments and critical infrastructure business segment partnered with Microsoft with the aim to integrate its cross domain technology with Azure’s cloud service solutions. Through this partnership, the intelligence community and warfighters are expected to access the information as per the scale and velocity requirements of a mission.

- August 2023 – Owl Cyber Defense completed the acquisition of Big Bad Wolf Security, which identifies as a technology company dedicated to providing cloud infrastructure security for commercial and government applications. With this acquisition, the company expects to combine the skilled workforce of BBWS’s cyber security innovators with specific capabilities in CDS and cloud security to the Owl family.

- July 2023 – Insta, a Finnish high-tech business, collaborated with Lockheed Martin Corporation with the objective of providing its end users with enhanced gateway and security solutions. This collaboration is among the first agreements under indirect industrial cooperation in Finland's acquisition of the 5th Generation F-35. Under this collaboration, companies expect to develop a bi-directional network security & gateway solution, a Cross Domain Solution, which will be used for demanding military operations, further enabling cooperation across several security-level networks.

- July 2023 – Becrypt introduced APP-XD, a high-assurance cross domain solution. It allows secure connectivity of services over high-threat networks through standard APIs. APP-XD provides a novel approach for critical national infrastructure organizations to safeguard their most vital services while promoting infrastructure modernization.

- November 2022 – Owl Cyber Defense introduced V3CDS, its first multi-domain cross-domain solution. It is an adaptable, scalable transfer CDS focused on video teleconferencing, voice, structured data, full motion video streaming and collaboration capabilities across up to 12 or more domains.

REPORT COVERAGE

An Infographic Representation of Cross Domain Solutions Market

To get information on various segments, share your queries with us

The research report includes prominent regions across the globe to get a better knowledge of the industry. Furthermore, it provides insights into the most recent industry trends and an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes on the market’s drivers and restrictions, allowing the reader to obtain a thorough understanding of the industry.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 10.89% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the cross domain solutions market was valued at USD 2.7 billion in 2025.

Fortune Business Insights says that the market is expected to reach USD 6.86 billion by 2034.

A CAGR of 10.89% will be observed in the market during the forecast period of 2026-2034.

By application, the critical infrastructure segment is expected to showcase the highest CAGR during the forecast period.

Growing investments and government initiatives to propel the CDS demand and accelerate market growth.

Lockheed Martin Corporation, BAE Systems plc, Owl Cyber Defense, Forcepoint, General Dynamics Corporation, and others, are the top players in the market.

Asia Pacific is expected to record the highest CAGR during the forecast period.

By type, the access segment is expected to grow with a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic