Data Center Rack Market Size, Share & Industry Analysis, By Rack Type (Cabinets/Enclosed Racks and Open Frame Racks), By Data Center Size (Small and Mid-sized Data Centers and Large Data Centers), By Rack Height (40U and Below, 41U up to 50U, and Above 51U), By Industry (BFSI, Retail, IT & Telecom, Government, Healthcare, and Others), and Regional Forecast Report, 2026-2034

Data Center Rack Market Overview

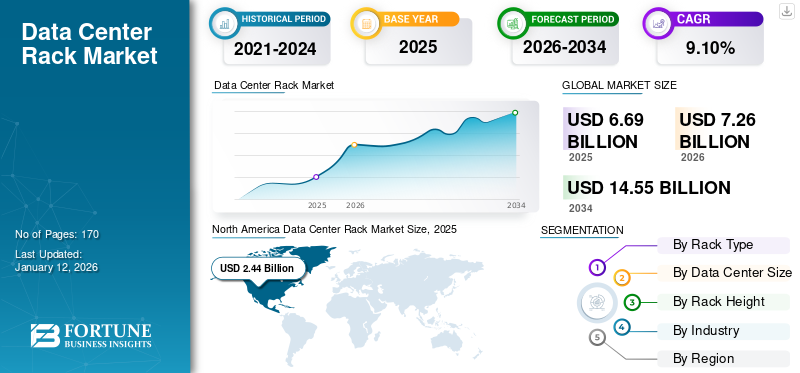

The global data center rack market size was valued at USD 6.69 billion in 2025 and is projected to grow from USD 7.26 billion in 2026 to USD 14.55 billion by 2034, exhibiting a CAGR of 9.10% during the forecast period. North America dominated the global market with a share of 36.40% in 2025.

Market Trends and Strategic Insights

- North America data center rack market held the largest share of 36.40% of the global market in 2025.

- By rack type, Cabinets/Enclosed racks segment is expected to hold the highest market share during the forecast period.

- Based on data center size, Large enterprises segment dominated the market in 2024.

- Based on rack height, 41U up to 50U segment dominated the market in 2024.

Market Size and Growth Forecast

- 2025 Market Size: USD 6.69 Billion

- 2026 Market Size: USD 7.26 Billion

- 2034 Projected Market Size: USD 14.55 Billion

- CAGR (2026–2034): 9.10%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

A data center rack is a frame used to store and arrange servers, computing equipment, networking devices, and other hardware in data centers or server rooms. These racks are made of metal and have vertical posts with holes for mounting, and come in different sizes and configurations, such as 23-inch racks, 19-inch racks, and more, based on industry standards. They offer a safe and orderly area for IT equipment such as servers, switches, routers, and storage devices. Additionally, they come with built-in features or can be fitted with a cooling system to ensure the right temperature for the enclosed equipment. These rack solutions are utilized in various sectors, including IT & telecom, BFSI, government, retail, and healthcare. A data center rack is mainly designed to store servers of various shapes and sizes, such as rack-mounted or blade servers. While their main purpose is to accommodate servers, some racks are also designed to hold other components, such as networking equipment, telecommunication equipment, cooling systems, and UPS.

The growth of the data center market is majorly attributed to the widespread adoption of cloud services by businesses and organizations, significant capital inflow by private equity firms, infrastructure funds, sovereign wealth, and other organizations into the data center ecosystem, and the rapid rollout of 5G across the world. 5G technology enables faster data transmission speeds and lower latency, driving the proliferation of data-intensive applications such as high-definition video streaming, augmented reality (AR), virtual reality (VR), and Internet of Things (IoT) devices. This surge in data traffic necessitates the expansion of data center infrastructure to handle the increased workload, leading to a higher demand for data racks to house servers, networking equipment, and storage devices.

To meet evolving businesses and customers’ requirements, market players such as Schneider Electric, Vertiv Group Corp., Eaton, nVent Electric plc, and Legrand are offering strategically cost-effective solutions that support a wide range of modern data center operations.

Impact of Reciprocal Tariffs

The reciprocal tariffs imposed by the U.S. government, precisely those targeting China and other trade allies, had a quantifiable impact on the market, owing to disrupting supply chains, affecting investment decisions, and increasing costs across the data center ecosystem.

Racks are principally constructed from steel or aluminum frames, and these materials often originate from countries such as China, Canada, and European countries, all subject to tariffs. As a result, steel-reliant products, such as racks, experienced cost inflation liable to the material origin and supplier.

Transformers have experienced substantial supply constraints, owing to a shortage of the particular electrical-grade steel essential for their production. As a result, transformers have become precarious trial items in the construction of new data centers, possibly delaying timelines.

Thus, these reciprocal tariffs can negatively impact the market with respect to supply chain disruptions, a surge in the cost of hardware, demand from end-users, and many other factors.

IMPACT OF GENERATIVE AI

Increased Computational Demand for Training and Deploying Generative AI Models to Fuel Market Growth

Generative AI-powered chatbots have been making waves since the launch of ChatGPT. ChatGPT is an AI chatbot that represents a major advancement in generative AI systems and has the potential to transform several industries. The growing adoption of generative AI applications is anticipated to increase demand for IT infrastructure. Generative AI has significantly impacted the architecture of AI clusters, needing a larger neural network and more hardware. This, in turn, results in the consumption of multiple megawatts of power, requiring denser server racks and cutting-edge cooling systems.

The energy required to train various AI models is contributing to high carbon emissions, prompting data center operators to prioritize more innovative and sustainable IT infrastructure to minimize their carbon footprint. Furthermore, due to the requirement for high computational power and storage capacity has driven the demand for specialized racks designed to support high-density computing and storage infrastructure, leading to increased sales of racks.

As hyperscalers (Google, Microsoft, AWS) enlarge their AI infrastructure, they are promptly augmenting data center capabilities worldwide, enhancing demand for large volumes of racks. Rise in hyperscale and colocation set-ups is further fast-tracking the bulk obtaining of modular, scalable rack systems that aid rapid deployment and reconfiguration. For instance,

- In January 2025, Microsoft released its plans to invest around USD 80 billion in the financial year 2025 on installing data centers to train AI (artificial intelligence) replicas and install AI and cloud-driven implementations. Investment in AI infrastructure has surged after OpenAI introduced ChatGPT in 2022, as organizations across industries seek to incorporate AI into their products and services.

Data Center Rack Market Trends

Rise in Adoption of High-Density and Modular Rack Designs to Propel Market Growth

Data center operators are increasingly adopting high-density racks to accommodate more computing power within smaller footprints. This trend is majorly driven by the need for energy efficiency and space optimization in hyperscale data centers. As per the "2022 Global Data Center Survey" by Uptime Institute, more than a third of data center operators stated that their rack densities have increased rapidly in the last three years. This shift is majorly driven by the rapid adoption of high-performance computing (HPC) applications in aerospace, seismic engineering, 3D modeling, research and development, simulation, Artificial Intelligence (AI), weather forecasting, big data analytics, and 3D film rendering.

- In March 2024, Eaton introduced new modular data center solutions to minimize the cost and time of installation for critical infrastructure. SmartRack modular data centers from Eaton aid customers in meeting growing computing requirements for machine learning, AI, and edge computing. The SmartRack modular data center's IT rack, service enclosures, and cooling generate an enhanced data center solution.

Traditional air cooling cannot dissipate the extreme heat generated by servers in a high-density rack, making it crucial for rack vendors to upgrade cooling technology systems. In high-density racks, liquid cooling solutions are mainly used to manage the heat generated by servers. These solutions use coolant to dissipate heat from servers and other hardware efficiently. Moreover, the racks used in data centers are becoming more modular, allowing for easy scalability. This approach simplifies the adoption or removal of equipment as needed, aligning with changing business requirements. Modular data center racks are equipped with efficient cable management solutions for reducing clutter and improving airflow. By minimizing obstructions and enhancing cooling efficiency, Innovations in cable management within racks help optimize data center performance.

MARKET DYNAMICS

Market Drivers

Increasing Number of Data Center Facilities across the Globe to Boost Market Growth

Data centers play an important role in efficiently managing vast amounts of data generated from digital services, Internet of Things (IoT) devices, social media, and online transactions. As a result, businesses and organizations require more data center capacity to store and process this data. As per Avendus Capital Private Limited, the data centre market in India is poised to reach around 1,700 MW capacity by 2025 at approximately 40% CAGR, attracting USD 5 billion in investments. The increasing demand for data storage and processing capacity fuels the construction of data centers, thereby driving the demand for racks to house server equipment.

Increasing concerns about energy consumption and environmental impact generated by data centers are another major factor contributing to the data center rack market growth. According to Vertiv Group Corp., data centers were responsible for about 3% of global electricity consumption in 2022 and are expected to reach 4% by 2030. This has led to the adoption of energy-efficient data center infrastructure, including racks designed to optimize airflow and cooling efficiency, thereby reducing operational costs and environmental footprint.

Governments and regulators across the world are closely monitoring the development of data centers to address sustainability concerns emerging from energy-intensive facilities and are imposing sustainability standards on newly built data centers. For instance,

- In January 2024, a new data center efficiency bill, HB 116, was presented in the Virginia House of Delegates, mandating data center operators to meet various energy efficiency conditions. As per the bill, the operators of data centers would only be eligible for sales and utilize tax exemptions if they achieve a power usage effectiveness score of 1.2 or less.

Such developments are anticipated to increase the demand for racks with optimal airflow management, thereby reducing environmental impact.

MARKET RESTRAINTS

Supply Chain Disruptions and High Initial Investment to Hamper Market Growth

Global supply chain disruptions caused by ongoing geopolitical instability, material shortages, macroeconomic volatility, manufacturing delays, and transportation bottlenecks are affecting the availability and cost of these racks. These challenges are anticipated to delay timely deployments and strain the procurement of rack components and accessories.

In addition, building and maintaining data center facilities, including racks, is expensive. This includes costs related to construction, cooling systems, electricity, and ongoing maintenance. Cost considerations can impact the decision to expand or upgrade rack infrastructure for some price-sensitive customers. High-density racks generate more heat, which requires robust cooling solutions, presenting a challenge in balancing power and cooling needs. Furthermore, incorporating new racks into existing data center facilities can be complex and time-consuming. Compatibility issues, interoperability challenges, and the requirement of skilled personnel to handle rack deployment and maintenance can pose restraints for organizations.

Market Opportunities

Increasing Demand for Hyperscaler Data Center Services Creates Lucrative Opportunities for Market Players

The rapid growth of data-intensive applications, including generative AI, cloud computing, and real-time analytics, is pushing organizations to expand their IT infrastructure. This is creating strong demand for high-density, scalable, and secure data center rack solutions.

As enterprises and hyperscaler providers continue scaling operations to handle AI training and inference workloads, the need for reliable rack systems—optimized for heat dissipation, cable management, and power distribution—has become increasingly critical.

Edge computing is also gaining traction, especially in manufacturing, telecom, and retail sectors. Compact and ruggedized rack solutions are increasingly being deployed in edge data centers to support real-time data processing closer to the source. For instance,

- June 2024: Equinix, Inc., introduced its fourth data center in Osaka, Japan. In addition, the company also invested over USD 160 million with the objective of expanding its data center presence in Australia. With this, the company anticipates meeting rising AI-related demand.

Additionally, modular and preconfigured rack solutions are gaining popularity due to their ability to reduce deployment times and adapt to evolving IT loads. This trend benefits rack manufacturers offering customizable and future-ready designs.

SEGMENTATION ANALYSIS

By Rack Type

Growing Importance of Physical Security of the Equipment to Augment Cabinets/Enclosed Racks Segment Growth

Based on rack type, the market is segmented into cabinets/enclosed racks and open frame racks.

The cabinets/enclosed racks segment is expected to hold the highest data center rack market with a share of 61.91% in 2026. The locked enclosures of these racks ensure physical security for the equipment. With the rise of generative AI and the urgent need to expand AI workloads, numerous users quickly looked for new IT infrastructure. Amazon Web Services (AWS), Microsoft, and Google are currently delivering large amounts of computing power to customer sites, such as private data centers, central offices, and on-premises locations within businesses. This allows enterprises to create and operate cloud-based applications within their own facilities, utilizing the platform of leading service providers.

The open frame racks segment is predicted to record the highest CAGR during the forecast period due to the numerous advantages they offer, such as easy access to IT equipment and cabling, ease of installation, and cost-effectiveness. Open frame racks are inexpensive compared to enclosed server racks. The open frame racks are easier to ship, enabling customers to save money while buying, transporting, and installing them.

By Data Center Size

Large Enterprises Segment Dominated the Market Owing to the Proliferation of Digital Technologies

Based on data center size, the market is divided into small and medium-sized enterprises and large enterprises.

The large enterprises segment dominated the market with a share of 54.46% in 2026 due to the increasing demand for data storage and processing capacity across the world. This rapid proliferation of digital services, cloud computing, IoT, and big data analytics has fueled the construction of large data centers, thereby driving the demand for racks to house server equipment.

Small and medium-sized enterprises are expected to grow with the highest CAGR during the forecast period, as they are cost-effective, flexible, and scalable, making it easier to adapt to a rapidly changing business landscape. In addition, they are easy to install and maintain. Their simplified operations, with less complexity in infrastructure, networking, and equipment management, further contribute to their growth.

By Rack Height

41U up to 50U Rack Segment Dominated the Market Owing to its Ability to Provide High Security to Data Center Equipment

Based on rack height, the market is divided into 40U and below, 41U up to 50U, and above 51U.

41U up to 50U dominated the market with a share of 52.72% in 2026, as 43U racks come with advanced locking mechanisms and other security features to safeguard the equipment from unauthorized access, adding an extra layer of physical security. Furthermore, enterprises can gain higher equipment density and consolidation using a 43U rack, minimizing the need for additional rack units and optimizing space usage.

40U and below racks are anticipated to expand at the highest CAGR, as they are more space-efficient and highly suitable for settings with limited available floor space, including small server rooms or office closets. In addition, smaller racks are more inexpensive than larger ones, and they need less physical space, which results in lower construction and operational costs.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Increasing Dependence on E-commerce Platforms Propelled the Retail Segment Growth

By industry, the market is categorized into BFSI, retail, IT & telecom, government, healthcare, and others (education and media & entertainment).

The retail segment dominated the market in 2024, as retailers with online stores and e-commerce platforms depend on these racks for hosting their websites, managing databases, and facilitating online shopping applications. Moreover, these racks aid in efficiently monitoring and controlling inventory levels.

The healthcare segment is anticipated to grow at the highest CAGR during the coming years. The healthcare sector's growing focus on digital technologies leads to a significant increase in data, ranging from electronic health records (EHRs) to medical imaging. These storage systems ensure the safekeeping and organization of this sensitive information. As a result, the rapid adoption of digital technologies in healthcare is expected to drive market growth in the foreseeable future.

DATA CENTER RACK MARKET REGIONAL OUTLOOK

Geographically, the market is studied across five major regions, including North America, South America, Europe, the Middle East & Africa, and the Asia Pacific. They are further categorized into countries.

North America Data Center Rack Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.44 billion in 2025 and USD 2.59 billion in 2026. The growth in this region can be attributed to the rapid adoption of data centers, the surge in the adoption of AI applications across various sectors, and strong technology investment bolstered by government funding and support. The regional growth can also be attributed to the presence of well-established IT software and hardware providers such as HPE, Dell Inc., and Vertiv Group Corp.

Download Free sample to learn more about this report.

The U.S. has maintained its dominant position in the region due to the robust investment in AI research. As per the new report by Stanford University, the U.S. government's spending on AI contracts reached around USD 3.3 billion in 2022. Furthermore, the U.S. hosts the highest number of data centers globally. In the U.S., Northern Virginia is currently the largest data center market in the world, with over 275 facilities. Additionally, Dallas/Ft. Worth, Chicago, and Silicon Valley are witnessing significant construction activity. These advancements are expected to drive market expansion in the coming years. The U.S. market is projected to reach USD 1.69 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

The Asia Pacific market is anticipated to show the highest growth rate due to the increasing demand for data storage and processing capacity. The proliferation of digital services, cloud computing, IoT, and big data analytics fuels the construction of data centers, thereby driving the demand for racks to house server equipment. The rollout of 5G networks and the expansion of telecommunications services across the region further augment market growth in the region. In 2019, South Korea became the first country across the globe to roll out a nationwide 5G network, followed by Australia, China, the Philippines, and New Zealand. The Japan market is projected to reach USD 0.38 billion by 2026. The China market is projected to reach USD 0.47 billion by 2026. The India market is projected to reach USD 0.32 billion by 2026.

The market in Europe is primarily fueled by robust AI and ML investments, the presence of high-quality digital infrastructure, and the rapid adoption of HPC. Many companies in the region are investing in data center facilities to support digital government initiatives, public services, and data analytics. The UK market is projected to reach USD 0.31 billion by 2026. The Germany market is projected to reach USD 0.3 billion by 2026. For instance,

- In January 2024, Alphabet Inc. (Google) announced an investment of USD 1 billion in the U.K. for a new data center, aimed at addressing the rising demand for internet services in the country.

In South America, the adoption of cloud-based solutions is expected to augment market growth. Brazil is anticipated to maintain its dominant position on account of the rapid adoption of Industry 4.0 technologies in the manufacturing sector, requiring racks to support automation, IoT devices, and data analytics in production environments.

The Middle East & African countries are increasingly adopting digital technologies. Gulf Cooperation Council (GCC) nations are increasingly spending on high-tech as part of economic transformation strategies. All these factors are expected to offer ample growth opportunities to market players in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focused on Innovation to Boost their Product Portfolio

Key players are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships. For instance, in May 2023, nVent Electric plc launched RDHX PRO rear door coolers (RDC) for cooling high-density racks up to 78kW. This innovation meets the growing demand for the increasing use of AI-based applications, higher energy efficiency and sustainability, and the requirement for data center space utilization.

Major Players in the Data Center Rack Market

To know how our report can help streamline your business, Speak to Analyst

The global market is dominated by the top players such as Schneider Electric SE, Vertiv Group Corp., and Eaton Corporation plc, accounting for around 53% - 55% of the market share.

List of Top Data Center Rack Market Companies Studied

- Schneider Electric SE (France)

- Vertiv Group Corp. (U.S.)

- Eaton Corporation plc (Ireland)

- Cyber Power Systems, Inc. (Taiwan)

- Legrand S.A. (France)

- nVent Electric plc (U.K.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Rittal GmbH & Co. KG (Germany)

- Dell Technologies Inc. (U.S.)

- FUJITSU Limited (Japan)

- Delta Electronics (Taiwan)

- Black Box Corporation (U.S.)

- Lenovo (U.S.)

- Suntech IT (China)

- Equinix, Inc. (U.S.)

- Great Lakes Data Racks & Cabinets (U.S.)

- AMCO Enclosures (U.S.)

- Kendall Howard LLC (U.S.)

- Many more.

KEY INDUSTRY DEVELOPMENTS

- June 2025: Schneider Electric announced the launch of data center solutions to meet the difficulties of high-density AI (artificial intelligence) and fast-tracked compute implementations. New rack systems and rack PDUs (Power Distribution Units) are developed for weight support and increased size, featuring direct-to-chip liquid cooling.

- July 2025: Vertiv announced the acquisition Great Lakes Data Racks & Cabinets group of enterprises (combinely “Great Lakes”) for USD 200 million. The incorporation of Great Lakes’ expertise with Vertiv's current offering is expected to offer substantial customer benefits through combined infrastructure sourcing and pre-engineered solutions.

- August 2023: Cyber Power Systems, Inc. redesigned their server racks and rack accessories to lighter and smaller models. The new server racks include CR42U11001, a 42U freestanding server rack, and three wall-mount rack models in various sizes from 6U to 12U.

- March 2023: Vertiv Group Corp. launched the Intelligent Fingerprint Rack Access Control System (iFACS) in India. iFACS helps to secure racks housing equipment, assets, and enterprise data.

- February 2023: Eaton added Rittal GmbH & Co. KG, a manufacturer of enclosures, to its xModular partner program to augment innovations within the modular data center space.

- May 2022: Legrand unveiled a new Nexpand configure-to-order cabinet series for data centers. Nexpand cabinets feature solid doors and electronic temper-proof locks, with a superior cable management system. Nexpand offers the scalability and sustainable architecture required to support the rise in Internet-of-Things (IoT) connectivity, 5G services, edge computing, and Artificial Intelligence (AI) applications.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The worldwide investment set-up for data centres has been on the rise in the past years, with the market being highly dominated by U.S.-based companies, predominantly private equity firms. This investment growth replicates the critical role of data centre racks play in the present digital economy. These large-scale operatives considerably shape the sector’s direction and economic landscape. Foremost institutional investors and private equity firms show substantial interest in the data centre-related assets. Their involvement specifies assurance in data center investments' long-term feasibility and probable returns.

REPORT COVERAGE

The report offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments in the market. It also elaborates on market dynamics, emerging trends, and the competitive landscape. The report offers key insights, such as the implementation of automation in specific market segments, recent industry developments, such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro & microeconomic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 9.10% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Rack Type

By Data Center Size

By Rack Height

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is predicted to reach USD 14.55 billion by 2034.

In 2025, the market value stood at USD 7.26 billion.

The market is projected to record a CAGR of 9.10% during the forecast period of 2026 – 2034.

By rack type, cabinets/enclosed rack is expected to capture the highest market share and lead the market.

Increasing the number of data center facilities globally is a key factor driving market growth.

Some of the top players in the market are Schneider Electric SE, Vertiv Group Corp., Eaton Corporation plc, and others.

Asia Pacific is expected to show the highest growth rate due to the rapid 5G rollout and data center expansion in the region.

By industry, the healthcare segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us